An Impact of Institutional Environment on the Czech Banking Sector Petr Budinský Vice-rector VŠFS Conference Human Capital & Financial Management Prague, September 2012

An Impact of Institutional Environment on the Czech Banking Sector Petr Budinský Vice-rector VŠFS Conference Human Capital & Financial Management Prague, September 2012

SOLUTION OF DEBT CRISIS • Political Union • Fiscal Union • Banking Union

SOLUTION OF DEBT CRISIS • Political Union • Fiscal Union • Banking Union

ECB • • Decrease of interest rates LTRO 1 trln EUR Unlimited buy-out of bonds Banking union - 1 regulator - sharing risks

ECB • • Decrease of interest rates LTRO 1 trln EUR Unlimited buy-out of bonds Banking union - 1 regulator - sharing risks

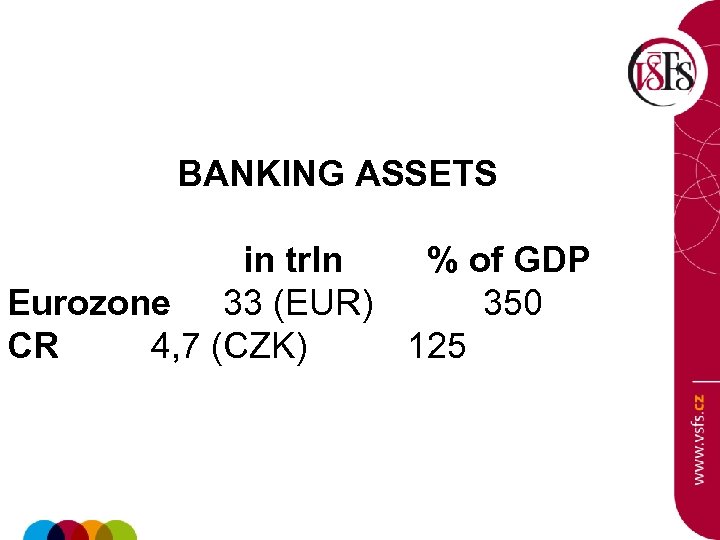

BANKING ASSETS in trln % of GDP Eurozone 33 (EUR) 350 CR 4, 7 (CZK) 125

BANKING ASSETS in trln % of GDP Eurozone 33 (EUR) 350 CR 4, 7 (CZK) 125

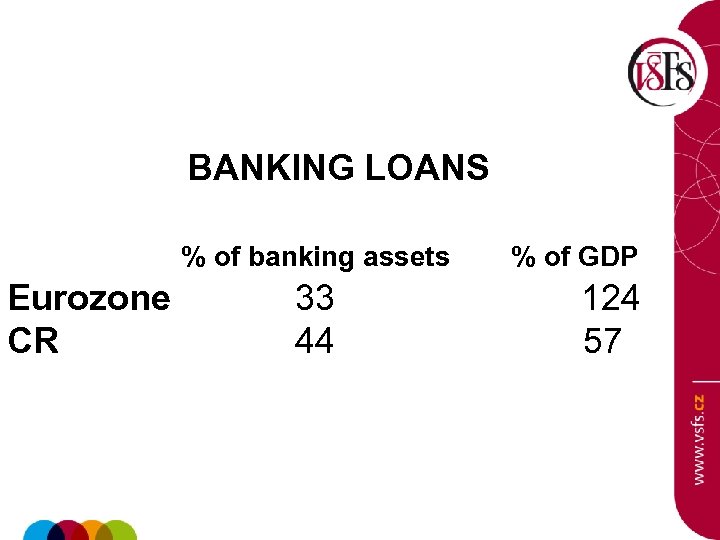

BANKING LOANS % of banking assets Eurozone CR 33 44 % of GDP 124 57

BANKING LOANS % of banking assets Eurozone CR 33 44 % of GDP 124 57

BANKS • • • Worsening of loans Holding of bonds Losing deposits Capital requirements Fundings problems

BANKS • • • Worsening of loans Holding of bonds Losing deposits Capital requirements Fundings problems

DELEVERAGING + … Restructuring of assets Capital increase - … Restricting new loans

DELEVERAGING + … Restructuring of assets Capital increase - … Restricting new loans

BANKS BEHAVIOUR • Bonds purchases • Stricter conditions for granting of loans • Lower demand for loans

BANKS BEHAVIOUR • Bonds purchases • Stricter conditions for granting of loans • Lower demand for loans

CNB EXPOSURE (in BLN´s of CZK) 2009 2010 2011 GERMANY 124 216, 7 283, 4 ITALY 54, 1 17, 9 4, 8 IRELAND 13, 8 5, 8 0, 5 SPAIN 60, 6 11, 1 6, 7 GREECE 14, 8 0, 1 0

CNB EXPOSURE (in BLN´s of CZK) 2009 2010 2011 GERMANY 124 216, 7 283, 4 ITALY 54, 1 17, 9 4, 8 IRELAND 13, 8 5, 8 0, 5 SPAIN 60, 6 11, 1 6, 7 GREECE 14, 8 0, 1 0

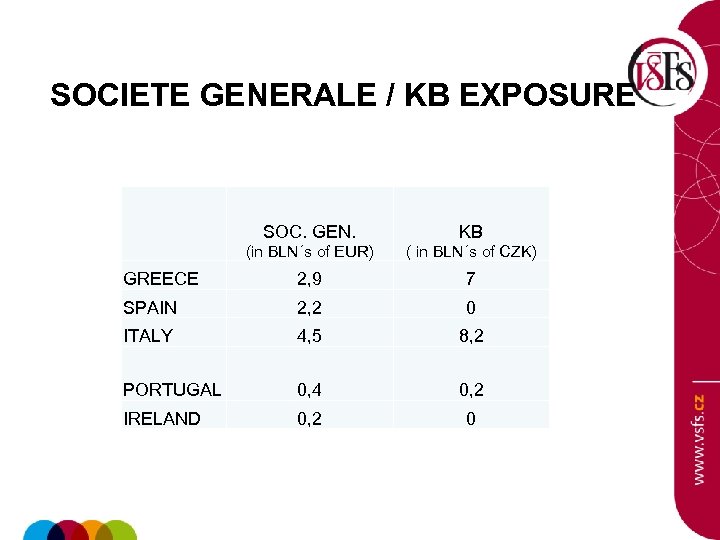

SOCIETE GENERALE / KB EXPOSURE SOC. GEN. KB (in BLN´s of EUR) ( in BLN´s of CZK) GREECE 2, 9 7 SPAIN 2, 2 0 ITALY 4, 5 8, 2 PORTUGAL 0, 4 0, 2 IRELAND 0, 2 0

SOCIETE GENERALE / KB EXPOSURE SOC. GEN. KB (in BLN´s of EUR) ( in BLN´s of CZK) GREECE 2, 9 7 SPAIN 2, 2 0 ITALY 4, 5 8, 2 PORTUGAL 0, 4 0, 2 IRELAND 0, 2 0

KBC / CSOB EXPOSURE KBC CSOB (in BLN´s FOND) (in BLN´s of CZK) GREECE 0, 5 3, 06 SPAIN 2, 2 0, 57 ITALY 6, 1 1, 99 PORTUGAL 0, 4 0 IRELAND 0, 3 0

KBC / CSOB EXPOSURE KBC CSOB (in BLN´s FOND) (in BLN´s of CZK) GREECE 0, 5 3, 06 SPAIN 2, 2 0, 57 ITALY 6, 1 1, 99 PORTUGAL 0, 4 0 IRELAND 0, 3 0