28f3ccbceb624b329e30274334f61a93.ppt

- Количество слайдов: 27

An Environmental SAM and SAM-based CGE Modelling for Environmental Policy Problems Noritoshi Ariyoshi Faculty of Environmental Studies Nagasaki University Itsuo Sakuma School of Economics Senshu University Akihiko Taniguchi Graduate School of Economics Senshu University International Workshop for Interactive Analysis on Economy and Environment Cabinet Office, the Government of Japan 4 th March 2006

CONTENTS l 1. Introduction 2. A general explanation of Japanese NAMEA (Hybrid Accounts) 3. From NAMEA to a SEEA-type SAM with monetary valuation of environmental pressures 4. A CGE analysis l 5. Concluding remarks l l l

1. Introduction l l The purpose of this paper is twofold. Concerning (1) Data aspects, we attempt to Construct a DATA ENVIRONMENTAL SAM from Japanese NAMEA(*) compiled by ESRI. DATA ENVIRONMENTAL SAM is a SEEA-ver. IV. 2 type SAM(**), which includes monetary valuation of environmental pressures, in particular, the estimation of imputed environmental cost. (*)”NAMEA” is an acronym for National Accounting Matrix Including Environmental Accounts. (**)”SEEA” is an acronym for System for Integrated Environmental and Economic Accounting.

1. Introduction(continued) l l Concerning (2) Modelling aspects, we attempt to Conduct SAM-based CGE analyses. To do this, MODEL ENVIRONMENTAL SAM will be created to accommodate a specific general equilibrium modelling structure. Using this SAM as a base equilibrium data, various simulation (comparative static analyses) will be conducted so as to evaluate policy changes etc. involved.

Introduction (continued) l NAMEA l DATA ENVIRONMENTAL SAM l MODEL ENVIRONMENTAL SAM l ENVIRONMENTAL CGE ANALYSIS

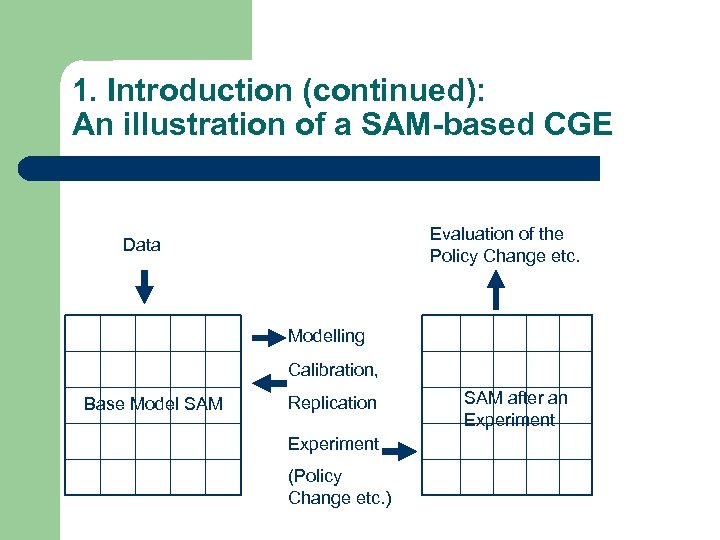

1. Introduction (continued): An illustration of a SAM-based CGE Evaluation of the Policy Change etc. Data Modelling Calibration, Base Model SAM Replication Experiment (Policy Change etc. ) SAM after an Experiment

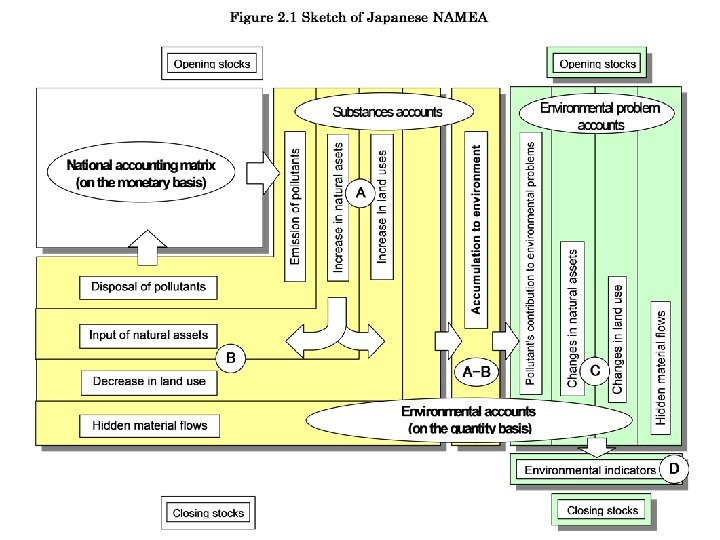

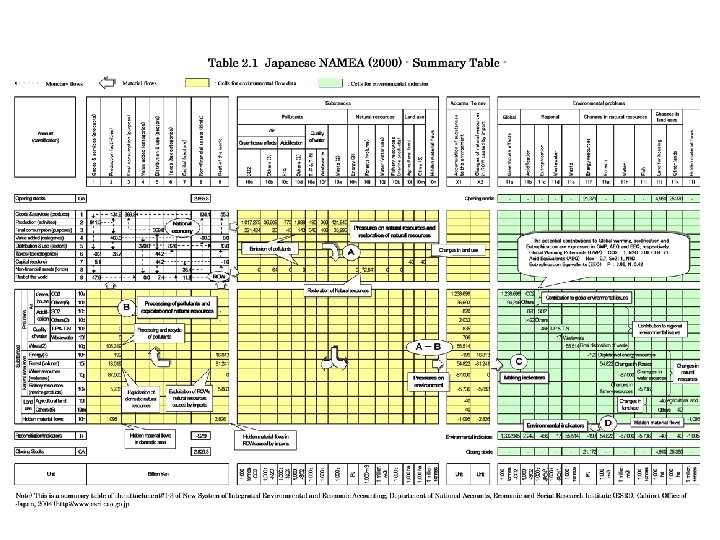

2. A General Explanation of Japanese NAMEA (Hybrid Accounts) 1) It is based on the original NAMEA* by the Netherlands, and estimates for 90, 95, and 00 2) Twofold parallel structure: national accounting matrix (NAM) at monetary term and environmental accounts (EA) at physical term. 3) Twofold structure of EA : substance accounts and environmental problem accounts.

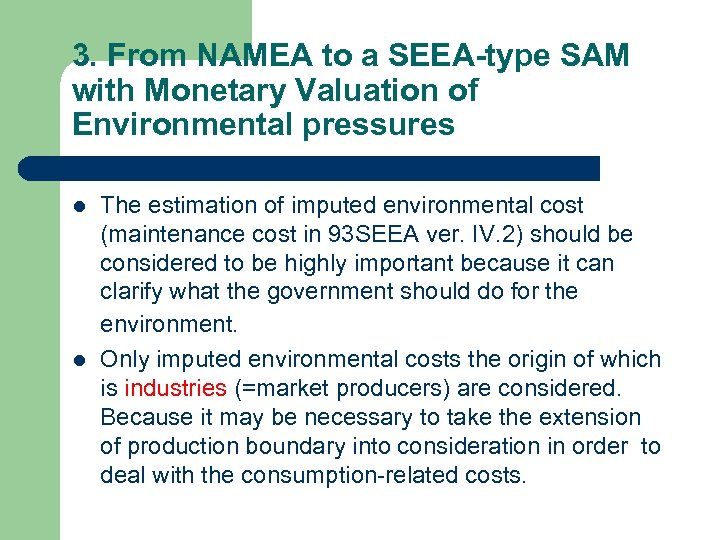

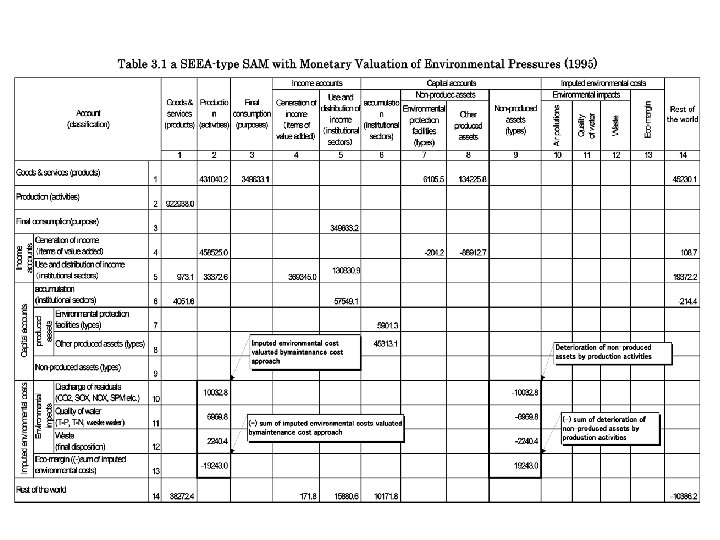

3. From NAMEA to a SEEA-type SAM with Monetary Valuation of Environmental pressures l l The estimation of imputed environmental cost (maintenance cost in 93 SEEA ver. IV. 2) should be considered to be highly important because it can clarify what the government should do for the environment. Only imputed environmental costs the origin of which is industries (=market producers) are considered. Because it may be necessary to take the extension of production boundary into consideration in order to deal with the consumption-related costs.

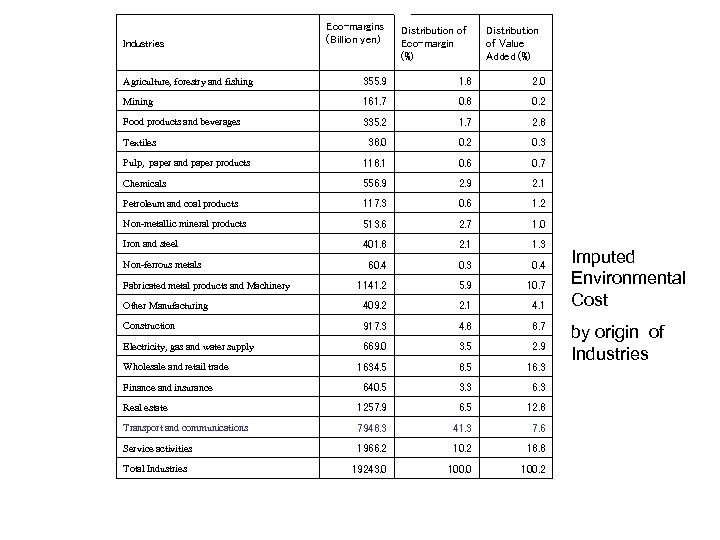

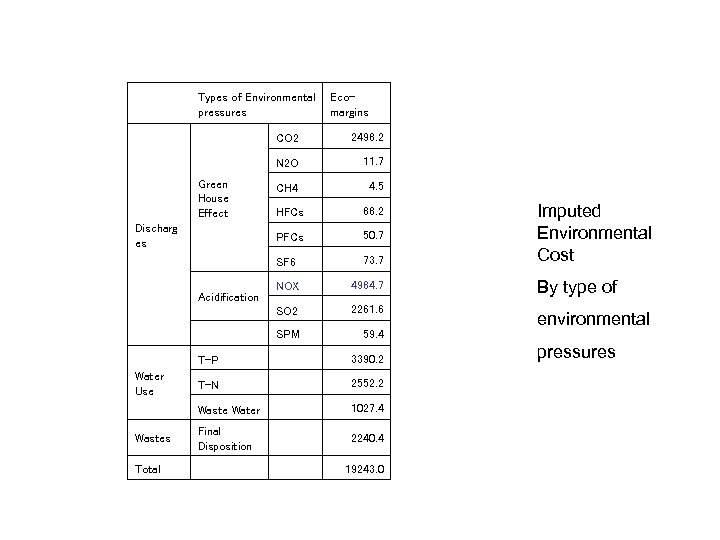

The Estimation of Imputed Environmental Cost l l l Except for CO 2 , the assumption of “zero-emission” is posited in order to calculate imputed environmental cost about each environmental pressure category. Concerning CO 2 , the emission level 6% below that in 1990 is assumed according to the Kyoto Protocol. Two summary tables are on two slides below, giving imputed environmental cost by sources and by environmental pressure types.

Industries Eco-margins (Billion yen) Distribution of Eco-margin (%) Distribution of Value Added (%) Agriculture, forestry and fishing 355. 9 1. 8 2. 0 Mining 161. 7 0. 8 0. 2 Food products and beverages 335. 2 1. 7 2. 8 38. 0 0. 2 0. 3 Pulp, paper and paper products 118. 1 0. 6 0. 7 Chemicals 556. 9 2. 1 Petroleum and coal products 117. 3 0. 6 1. 2 Non-metallic mineral products 513. 6 2. 7 1. 0 Iron and steel 401. 8 2. 1 1. 3 60. 4 0. 3 0. 4 1141. 2 5. 9 10. 7 Other Manufacturing 409. 2 2. 1 4. 1 Construction 917. 3 4. 8 8. 7 Electricity, gas and water supply 669. 0 3. 5 2. 9 1634. 5 8. 5 16. 3 640. 5 3. 3 6. 3 Real estate 1257. 9 6. 5 12. 8 Transport and communications 7948. 3 41. 3 7. 6 Service activities 1966. 2 10. 2 18. 8 Total Industries 19243. 0 100. 2 Textiles Non-ferrous metals Fabricated metal products and Machinery Wholesale and retail trade Finance and insurance Imputed Environmental Cost by origin of Industries

Types of Environmental pressures Ecomargins CO 2 2498. 2 N 2 O 11. 7 CH 4 4. 5 HFCs 88. 2 PFCs 50. 7 SF 6 73. 7 NOX 4984. 7 By type of SO 2 2261. 6 SPM 59. 4 environmental T-P 3390. 2 T-N 2552. 2 Waste Water 1027. 4 Wastes Final Disposition Total Green House Effect Discharg es Acidification Water Use 2240. 4 19243. 0 Imputed Environmental Cost pressures

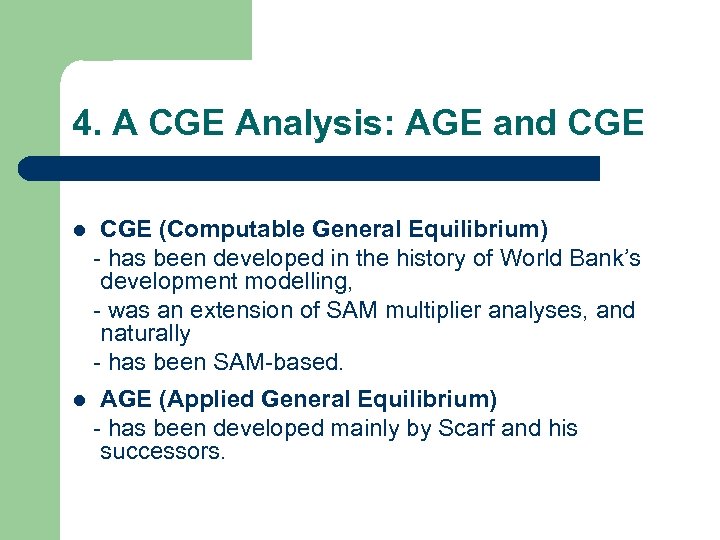

4. A CGE Analysis: AGE and CGE l CGE (Computable General Equilibrium) - has been developed in the history of World Bank’s development modelling, - was an extension of SAM multiplier analyses, and naturally - has been SAM-based. l AGE (Applied General Equilibrium) - has been developed mainly by Scarf and his successors.

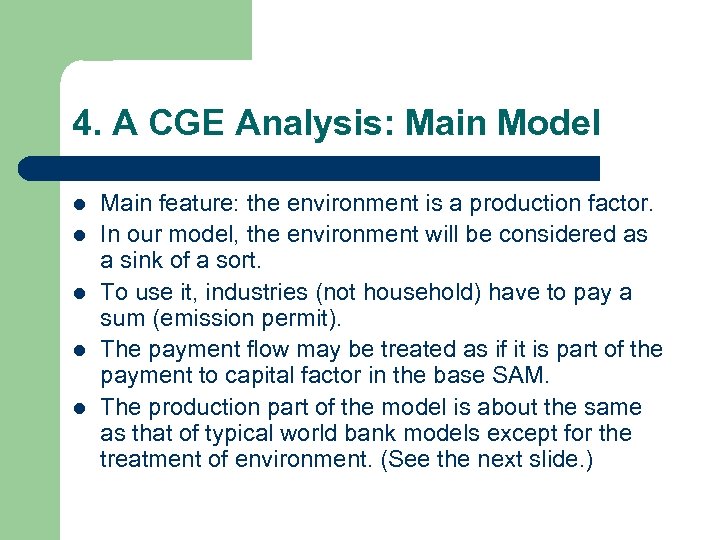

4. A CGE Analysis: Main Model l l Main feature: the environment is a production factor. In our model, the environment will be considered as a sink of a sort. To use it, industries (not household) have to pay a sum (emission permit). The payment flow may be treated as if it is part of the payment to capital factor in the base SAM. The production part of the model is about the same as that of typical world bank models except for the treatment of environment. (See the next slide. )

COBB DOUGLAS CAP LAB CES MIXED PROD. FACTOR DOM. PROD. Production Part of the Model ECOMARGIN LEONTIEF INT. INPUT DOM. GOOD S. 1 CES EXPORTS CET DOM. GOOD S 2 IMPORTS COMPOSITE GOODS

A thought behind the treatment l l The domestic equilibrium price of the permit will be determined at the level of imputed environmental cost, estimated according to the concept of “maintenance cost. ” Because firms do not pay for the permit if they can reduce the emission by spending actual environmental protection cost which equals to maintenance cost and is less than the permit value.

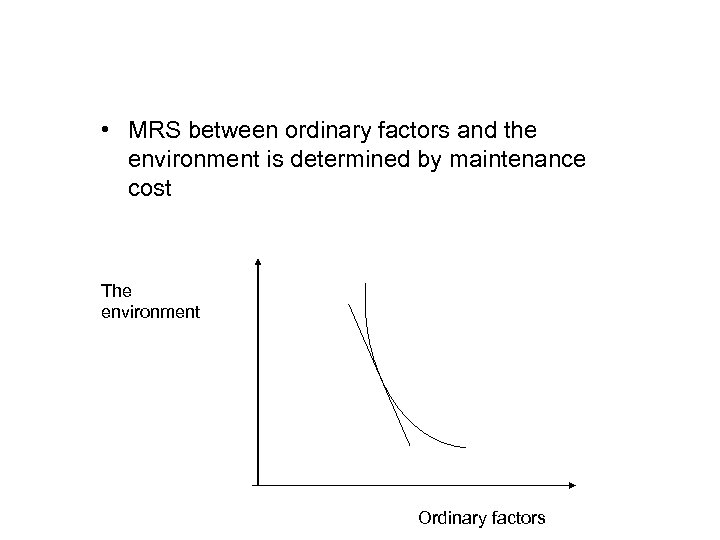

• MRS between ordinary factors and the environment is determined by maintenance cost The environment Ordinary factors

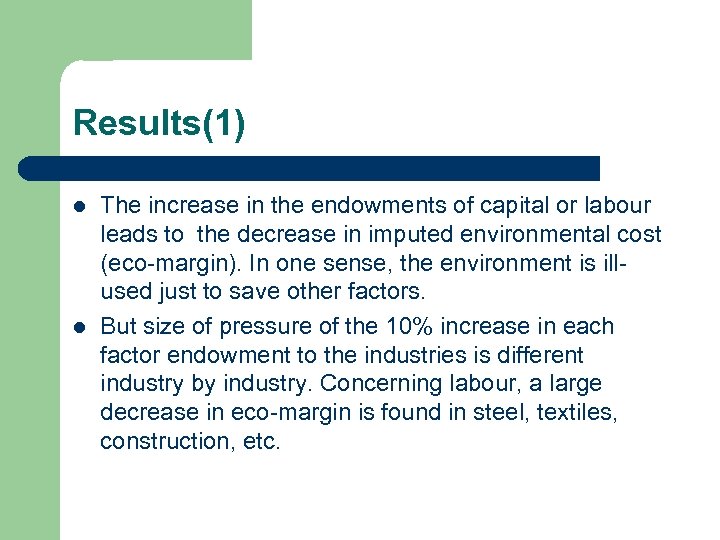

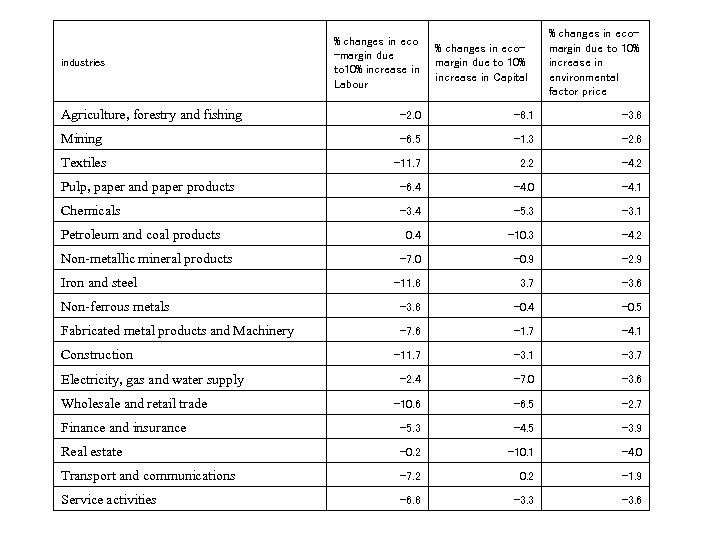

Results(1) l l The increase in the endowments of capital or labour leads to the decrease in imputed environmental cost (eco-margin). In one sense, the environment is illused just to save other factors. But size of pressure of the 10% increase in each factor endowment to the industries is different industry by industry. Concerning labour, a large decrease in eco-margin is found in steel, textiles, construction, etc.

Results(2) Concerning 10% increase in capital , a large decrease in eco-margin is found in Petroleum and coal products, etc. l The 10% increase in labour endowment has a larger effect on the reduction of eco-margin than the same proportional increase in capital endowment. (7. 6% vs 3. 1%) l

Results(3) l l The 10% increase in indirect tax rate will reduce eco-margins of all industries, by 0. 9% -1. 4%. The 10% increase in the price of environment (tradable permit) will reduce eco -margins by 0. 5%-4. 2%.

industries % changes in eco -margin due to 10% increase in Labour % changes in ecomargin due to 10% increase in Capital % changes in ecomargin due to 10% increase in environmental factor price Agriculture, forestry and fishing -2. 0 -8. 1 -3. 8 Mining -6. 5 -1. 3 -2. 8 Textiles -11. 7 2. 2 -4. 2 Pulp, paper and paper products -6. 4 -4. 0 -4. 1 Chemicals -3. 4 -5. 3 -3. 1 0. 4 -10. 3 -4. 2 -7. 0 -0. 9 -2. 9 -11. 8 3. 7 -3. 6 Non-ferrous metals -3. 8 -0. 4 -0. 5 Fabricated metal products and Machinery -7. 6 -1. 7 -4. 1 -11. 7 -3. 1 -3. 7 -2. 4 -7. 0 -3. 6 -10. 6 -6. 5 -2. 7 Finance and insurance -5. 3 -4. 5 -3. 9 Real estate -0. 2 -10. 1 -4. 0 Transport and communications -7. 2 0. 2 -1. 9 Service activities -6. 8 -3. 3 -3. 6 Petroleum and coal products Non-metallic mineral products Iron and steel Construction Electricity, gas and water supply Wholesale and retail trade

A Model for an Ordinary Economy l l l In addition to the main model, an alternative model is formulated to analyse an ordinary or actual economy without environmental imputation. Policy makers may be inclined to think that it is necessary to introduce direct rather than indirect regulation measures in order to reduce the imputed environmental cost known quite immediately to zero. In other words, the imputed cost in the main model needs to be borne actually by the producers of the alternative model. Thus, they must spend some additional cost for the environmental protection instead of discharging residuals.

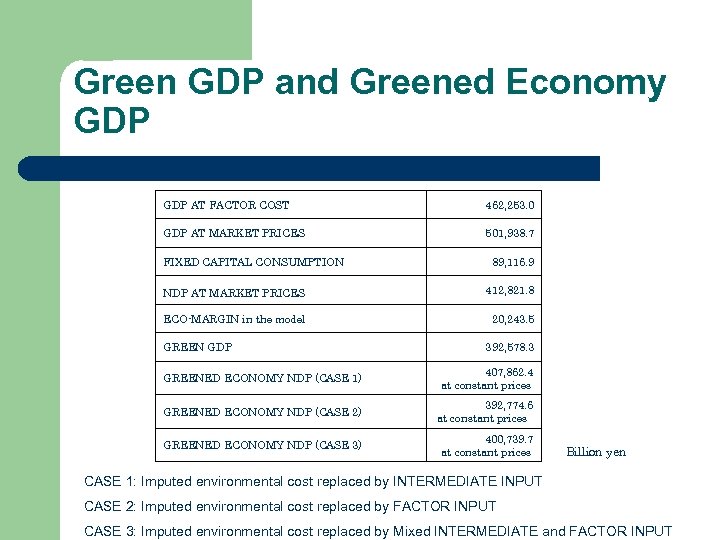

Greened Economy GDP l l On this assumption, the working of the economy will be simulated. Additionally, “greened economy GDP(NDP)” will be calculated although “greened economy SAM” may be a more meaningful concept. The concept of “green GDP” is criticised in that it does not take it into account that incurring additional cost (maintenance cost) could lead to various percussions and repercussions, so the concept does not reflect the real situation. Greened economy NDP may be equal to or greater than green GDP depending on the assumptions made.

Green GDP and Greened Economy GDP AT FACTOR COST 462, 253. 0 GDP AT MARKET PRICES 501, 938. 7 FIXED CAPITAL CONSUMPTION 89, 116. 9 NDP AT MARKET PRICES 412, 821. 8 ECO-MARGIN in the model 20, 243. 5 GREEN GDP 392, 578. 3 GREENED ECONOMY NDP (CASE 1) 407, 862. 4 at constant prices GREENED ECONOMY NDP (CASE 2) 392, 774. 6 at constant prices GREENED ECONOMY NDP (CASE 3) 400, 739. 7 at constant prices Billion yen CASE 1: Imputed environmental cost replaced by INTERMEDIATE INPUT CASE 2: Imputed environmental cost replaced by FACTOR INPUT CASE 3: Imputed environmental cost replaced by Mixed INTERMEDIATE and FACTOR INPUT

Concluding Remarks l l l A controversial problem over “direct” vs. “indirect” regulations will be spotlighted by this sort of modelling. Whether any switch of techniques as well as shift in industrial structure is triggered by the policy change may be the key to the problem. More disaggregated treatment about environmental pressure categories may be necessary.

28f3ccbceb624b329e30274334f61a93.ppt