752682a17bc64033274019aeb6dee0bc.ppt

- Количество слайдов: 25

An Early Agent-Based Stock Market: Replication & Participation László Gulyás (gulyas@sztaki. hu) Computer and Automation Research Institute Hungarian Academy of Sciences Balázs Adamcsek AITIA, Inc. Budapest, Hungary Árpád Kiss AITIA, Inc. Budapest, Hungary Loránd Eötvös University, Budapest May 29, 2003. NEU 2003, Venice, Italy 1

Overview n Motivation for… n n n Agent-Based Modeling Experimental Economics Participatory Simulation The Early Santa Fe Artificial Stock Market Results: n n Replication Participatory Experiments May 29, 2003. NEU 2003, Venice, Italy 2

Agent-Based Modeling (ABM) n n A form of computational modeling. Aiming at creating complex (social) behavior “from the bottom up”. n n Complex interactions of A high number of (Complex) individuals. A generative and mostly theoretical approach: n n Computational “thought experiments”, Existence proofs, etc. May 29, 2003. NEU 2003, Venice, Italy 3

Experimental Economics n Controlled laboratory experiments with human subjects. n n Typical tools: n n n The effect of human cognition on economic behavior. Learning and adaptation. Social traps, etc. Observation (Videotaping) Questionnaires, etc. An experimental approach. May 29, 2003. NEU 2003, Venice, Italy 4

Participatory Simulation (PS) n n A computer simulation, in which human subjects also take part. Agent-based simulations are well suited: n n n Individuals are explicitly modeled, with Strict Agent-Environment and Agent-Agent boundaries. Bridges theoretical and experimental approaches. Can help both of them: n n Testing assumptions and results of an ABM. Generating specific scenarios (e. g. , crowd behavior) for laboratory experiments. May 29, 2003. NEU 2003, Venice, Italy 5

Summary of the project n Replication of a famous ABM in finance. n n Conversion to a PS. n n Replication of results is a most important step in science! Partly as a demonstration of our General-Purpose Participatory Architecture for Re. Past (GPPAR). Initial Experiments, testing: n n n Original results’ sensitivity to human trading strategies. Human versus computational economic performance. The effect of human learning between runs. May 29, 2003. NEU 2003, Venice, Italy 6

The Santa Fe Artificial Stock Market 1/2 n n A prominent model of agent-based finance (Arthur, Holland, Le. Baron, Palmer and Tayler, 1994. ) A minimalist model of two assets: n n n “Money”: fixed, risk-free, infinite supply, fixed interest. “Stock”: unknown, risky behavior, finite supply, varying dividend. Artificial traders n n Developing trading strategies. In an attempt to maximize their wealth. May 29, 2003. NEU 2003, Venice, Italy 7

The Santa Fe Artificial Stock Market 2/2 n Two distinct behavioral regimes: n One: • Consistent with Rational Expectations Equilibrium. • Price follows fundamental value of stock. • Trading volume is low. n The other: • “Chaotic” market behavior. • “Crashes” and “bubbles”: price oscillates around fundamental value. • Trading volume shows wild oscillations. • Appears to be “in accordance” with actual market behavior. May 29, 2003. NEU 2003, Venice, Italy 8

The Early SFI-ASM 1/4 The most known version of the SFIASM was published in 1997, after several years of work. n However, a first, simpler design was published in 1994. It has n Less realistic market mechanisms. n Simpler trading strategies for agents. n n We were working with the early version. May 29, 2003. NEU 2003, Venice, Italy 9

The Early SFI-ASM 2/4 n Dividend: n n Possible Actions: n n n A stochastic (Ohrnstein-Uhlenbeck) process. Selling/Buying one share, Or holding. Market Clearing: n n A rationing scheme (agents may only get a fraction of their bids). May yield fractional shares. May 29, 2003. NEU 2003, Venice, Italy 10

The Early SFI-ASM 3/4 n Agents: n 60 ‘trading rules’: • Specifying actions (buy, sell, hold) based on market indicators: • Price > Fundamental Value, or • Price < 100 -period Moving Average, etc. • Reinforced if their ‘advice’ would have yielded profit. n A Genetic Algorithm • Activated in Poisson-distributed intervals (individually for each agent). • Replaces 10 -20% of weakest the rules. May 29, 2003. NEU 2003, Venice, Italy 11

The Early SFI-ASM 4/4 n n Trading rules: (condition, action, strength) Action: n n Condition: n n n Buy, Sell, Hold Ternary string: 110*1***0 Matching the binary (true/false) string of market indicators. A classifier system. May 29, 2003. NEU 2003, Venice, Italy 12

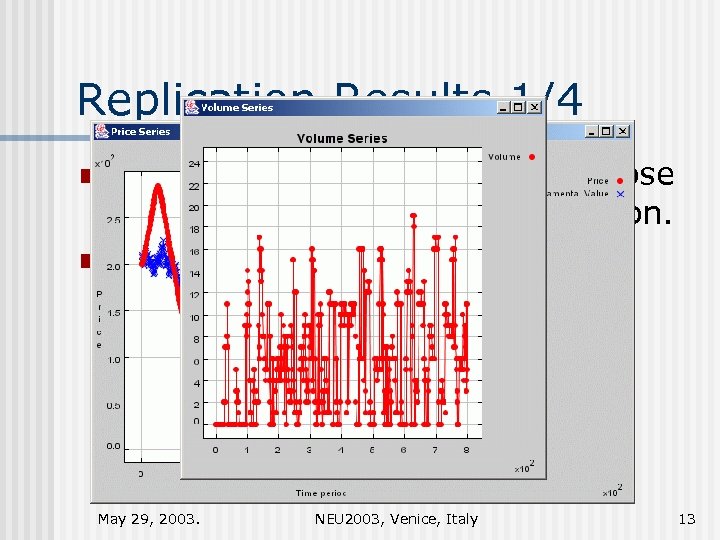

Replication Results 1/4 Our implementation confirms those reported in the original publication. n The interesting case is that of a complex system, which yields n Market volatility and high volume. n Agents’ strategies grow diverse. n May 29, 2003. NEU 2003, Venice, Italy 13

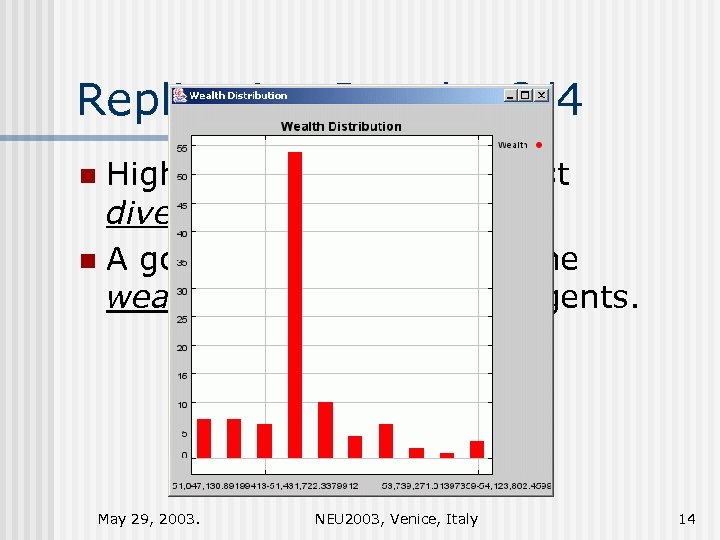

Replication Results 2/4 High trading volume suggest diverse agents. n A good measure of this is the wealth distribution of the agents. n May 29, 2003. NEU 2003, Venice, Italy 14

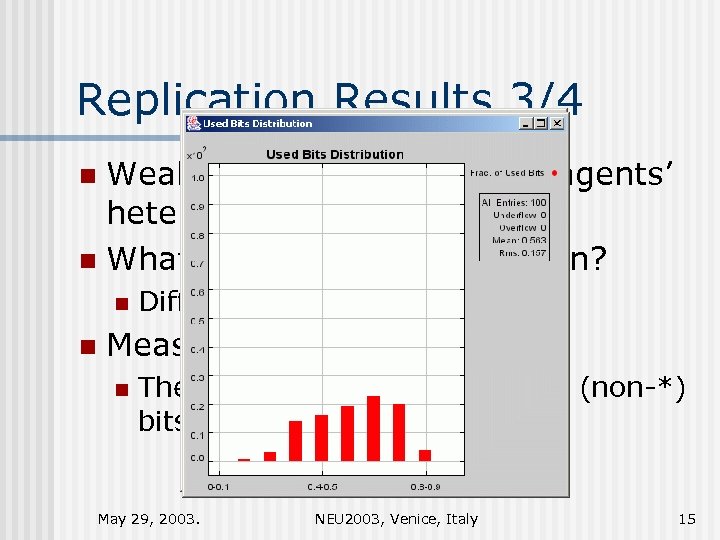

Replication Results 3/4 Wealth is only a sign of the agents’ heterogeneity. n What is the underlying reason? n n n Different trading strategies. Measure: n The average number of “used” (non-*) bits in the rule set. May 29, 2003. NEU 2003, Venice, Italy 15

Replication Results 4/4 n Concluding remarks: n n n The agent community learned to ‘manipulate’ price in such a way that it follows FV. (Subject to a certain range of error. ) Agents “self-organize” (i. e. , mutually adapt) to achieve this. However, heterogeneity suggests that some learned to be smart, while others learned to “sacrifice” their wealth. May 29, 2003. NEU 2003, Venice, Italy 16

Participatory ASM: Questions n n Can agents adapt to external trading strategies, just as well as they did to those developed by fellow agents? Would the apparently complex market behavior appear so to human players? Or would they easily learn to control the market? Will computational agents outperform humans, particularly in a fast game? What effect would human learning between sessions play on the outcome? May 29, 2003. NEU 2003, Venice, Italy 17

Participatory ASM: Implementation, Design n The illusion of a ‘real market’: n n A fast, ‘real-time’ game. Based on the General-Purpose Participatory Architecture for Re. Past (GPPAR). Can be used to transform arbitrary ABMs to participatory simulation. n Networked execution. n Extensive logging: the possibility of “replay”. n May 29, 2003. NEU 2003, Venice, Italy 18

Participatory ASM: Experimental Settings Inexperienced subjects (CS students and office workers). n Not allowed to communicate. n “Open-ended” runs, stopped by the experimenter without prior notice. n 3 -4 runs person. n Questionnaire after the session. n May 29, 2003. NEU 2003, Venice, Italy 19

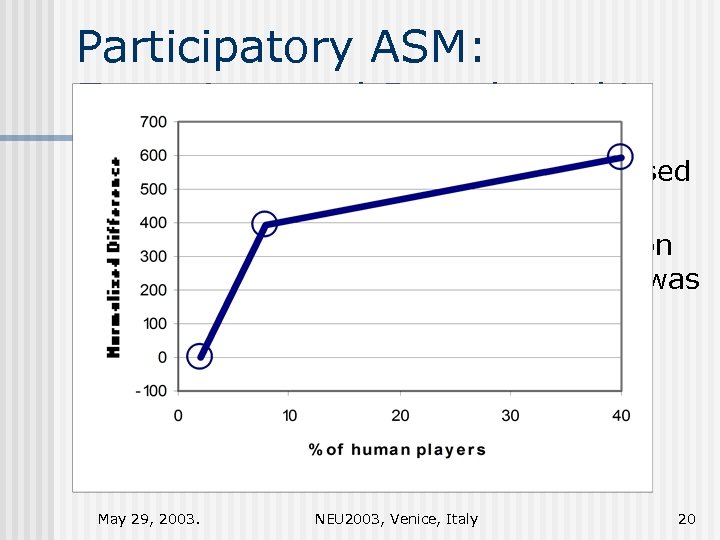

Participatory ASM: Experimental Results 1/4 n n n The presence of human traders increased market volatility. The higher percentage of the population was human, the higher the difference was w. r. t. the performance of the fully computational population. However, this may also be an effect of human learning. May 29, 2003. NEU 2003, Venice, Italy 20

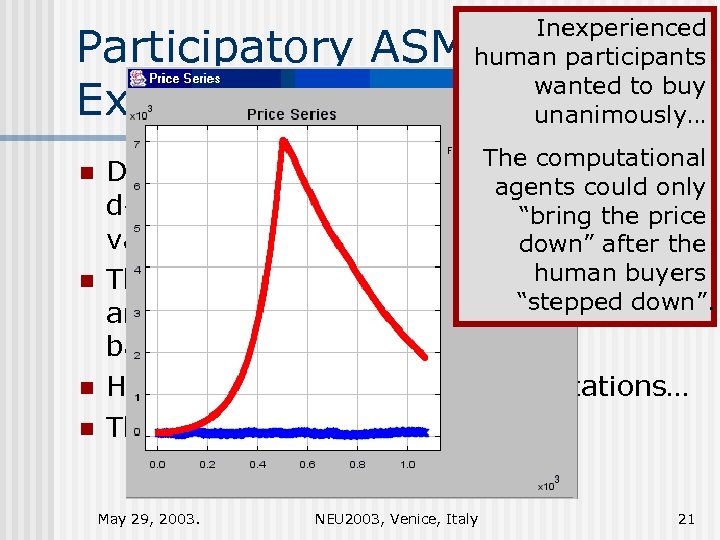

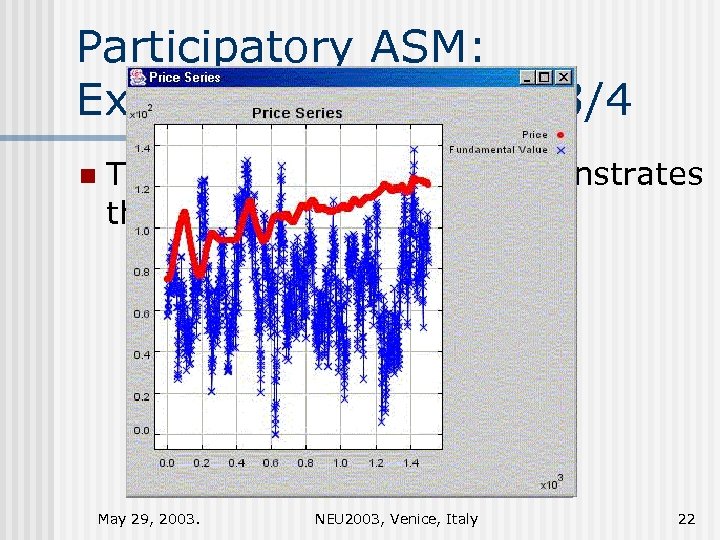

Inexperienced human participants wanted to buy unanimously… Participatory ASM: Experimental Results 2/4 The computational n Despite the increased level of market agents could only deviations, price followed fundamentalprice “bring the value. down” after the human buyers n This suggests that computational agents “stepped down”. n n are able to adapt and ‘keep’ the market in balance. However, their ability has its limitations… The lesson of the initial runs: May 29, 2003. NEU 2003, Venice, Italy 21

Participatory ASM: Experimental Results 3/4 n This initial mishap also demonstrates the effect of human learning. May 29, 2003. NEU 2003, Venice, Italy 22

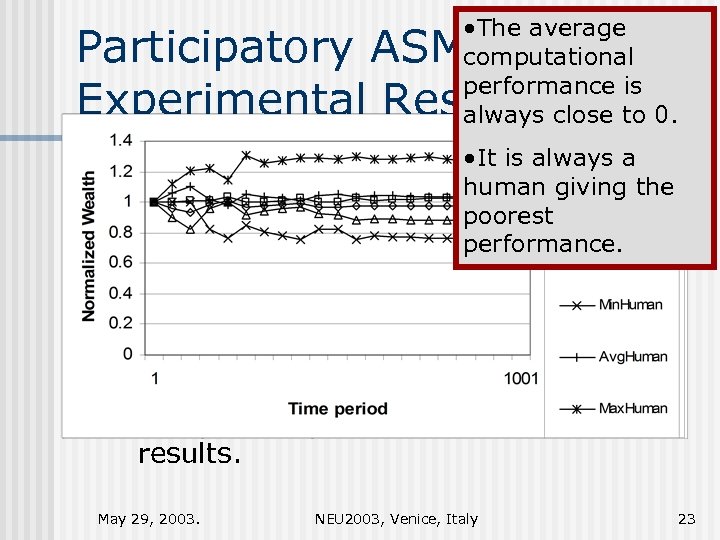

• The average computational performance is always close to 0. Participatory ASM: Experimental Results 4/4 • It is always a n Human learning is also obvious in human giving the relative performance of human poorest participants and computational performance. agents. n Notes: The notion of base wealth: the wealth of an agent that did nothing. n The path-dependent nature of the results. n May 29, 2003. NEU 2003, Venice, Italy 23

Participatory ASM: Trading Strategies n Humans initially applied technical trading strategies, but gradually discovered fundamental strategies. n The winning human’s strategy was: • Buy if price < FV, sell otherwise. n The experiments confirmed that technical trading leads to market deviations. May 29, 2003. NEU 2003, Venice, Italy 24

Conclusions We have introduced Agent-Based Modeling and Participatory Simulation. n We have argued for the use of PS to test ABMs and to help setting up laboratory experiments. n We have demonstrated the applicability of the concept. n May 29, 2003. NEU 2003, Venice, Italy 25

752682a17bc64033274019aeb6dee0bc.ppt