9c04cab90f6b30dca6c4fd01d9232490.ppt

- Количество слайдов: 17

An Assessment on Graham’s Approach for Stock Selection: The Case of Turkey Society for Economic Measurement Conference July 22 -24, 2015 Nuray Terzi Marmara University, Istanbul, Turkey

An Assessment on Graham’s Approach for Stock Selection: The Case of Turkey Society for Economic Measurement Conference July 22 -24, 2015 Nuray Terzi Marmara University, Istanbul, Turkey

The aim of this presentation • Examine the profitability of stock selection criteria of Benjamin Graham in Turkey’s capital market

The aim of this presentation • Examine the profitability of stock selection criteria of Benjamin Graham in Turkey’s capital market

The plan of this presentation • Focus literature review • Explain data and methodology • Give results and conclusion

The plan of this presentation • Focus literature review • Explain data and methodology • Give results and conclusion

Graham’s approach • Focus on the concept of an intrinsic value that is justified by a firm’s assets, earnings, dividends, and financial strength • Companies have an intrinsic value which the market doesn’t necessary reflect in their stock prices. • Focusing on this value can prevent an investor from being misled by the misjudgments often made by the market during periods of uncertainty

Graham’s approach • Focus on the concept of an intrinsic value that is justified by a firm’s assets, earnings, dividends, and financial strength • Companies have an intrinsic value which the market doesn’t necessary reflect in their stock prices. • Focusing on this value can prevent an investor from being misled by the misjudgments often made by the market during periods of uncertainty

Graham’s Approach-Value investing • The prices of financial securities are subject to erratic and significant movements. • The value of the security may not be reflected in its current market price. • The time to buy financial securities is when they are selling significantly below their intrinsic value or what they are really worth based on assets of the company.

Graham’s Approach-Value investing • The prices of financial securities are subject to erratic and significant movements. • The value of the security may not be reflected in its current market price. • The time to buy financial securities is when they are selling significantly below their intrinsic value or what they are really worth based on assets of the company.

Literature… • • • Oppenheimer and Schlarbaum, (1981) Klerck and Maritz (1997) Xiao and Arnold (2008) Balik and Mehran (2008) Chang (2011) Singh and Kaur (2014)

Literature… • • • Oppenheimer and Schlarbaum, (1981) Klerck and Maritz (1997) Xiao and Arnold (2008) Balik and Mehran (2008) Chang (2011) Singh and Kaur (2014)

Data • Universe of the study comprises of the stocks listed at Istanbul Stock Exchange • The data were both provided by Queen Stocks Professional Program. • The study is conducted over the period of nine years that is 2005 -2014.

Data • Universe of the study comprises of the stocks listed at Istanbul Stock Exchange • The data were both provided by Queen Stocks Professional Program. • The study is conducted over the period of nine years that is 2005 -2014.

Methodology • In the first stage of study, it was selected the stocks as modified Graham criteria. • Secondly, the portfolio performance was calculated by using analytical tools. • Finally, the portfolio performance was compared by an index performance.

Methodology • In the first stage of study, it was selected the stocks as modified Graham criteria. • Secondly, the portfolio performance was calculated by using analytical tools. • Finally, the portfolio performance was compared by an index performance.

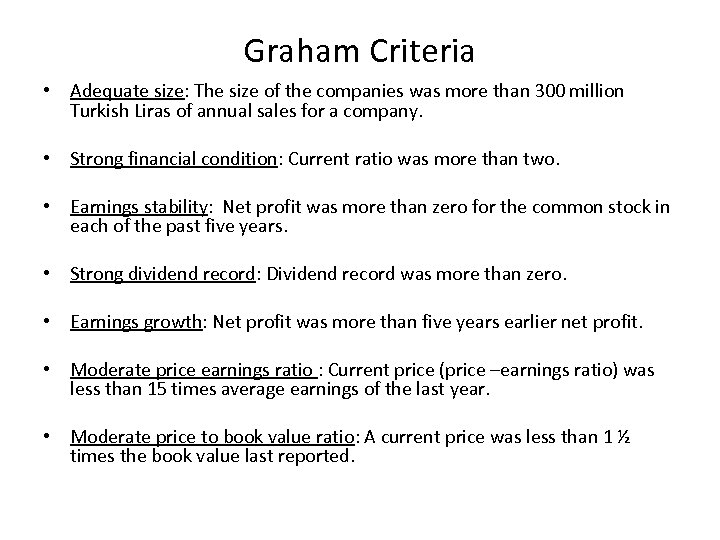

Graham Criteria • Adequate size: The size of the companies was more than 300 million Turkish Liras of annual sales for a company. • Strong financial condition: Current ratio was more than two. • Earnings stability: Net profit was more than zero for the common stock in each of the past five years. • Strong dividend record: Dividend record was more than zero. • Earnings growth: Net profit was more than five years earlier net profit. • Moderate price earnings ratio : Current price (price –earnings ratio) was less than 15 times average earnings of the last year. • Moderate price to book value ratio: A current price was less than 1 ½ times the book value last reported.

Graham Criteria • Adequate size: The size of the companies was more than 300 million Turkish Liras of annual sales for a company. • Strong financial condition: Current ratio was more than two. • Earnings stability: Net profit was more than zero for the common stock in each of the past five years. • Strong dividend record: Dividend record was more than zero. • Earnings growth: Net profit was more than five years earlier net profit. • Moderate price earnings ratio : Current price (price –earnings ratio) was less than 15 times average earnings of the last year. • Moderate price to book value ratio: A current price was less than 1 ½ times the book value last reported.

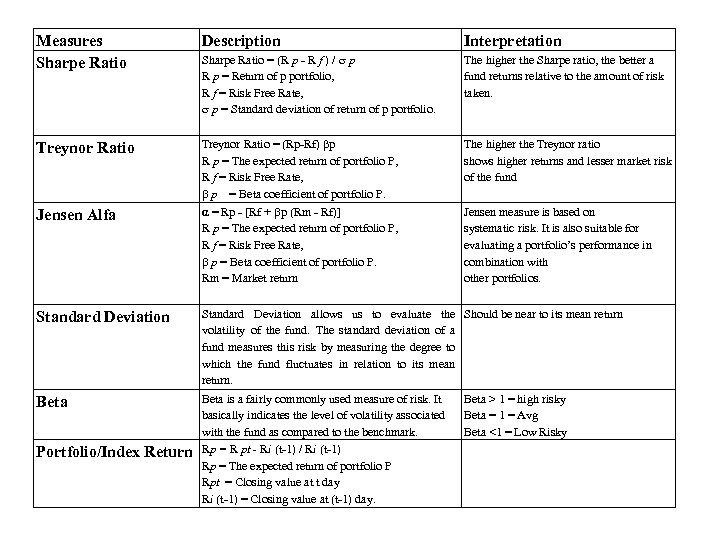

Measures Sharpe Ratio Description Interpretation Sharpe Ratio = (R p - R f ) / s p R p = Return of p portfolio, R f = Risk Free Rate, s p = Standard deviation of return of p portfolio. The higher the Sharpe ratio, the better a fund returns relative to the amount of risk taken. Treynor Ratio = (Rp-Rf) βp R p = The expected return of portfolio P, R f = Risk Free Rate, b p = Beta coefficient of portfolio P. α = Rp - [Rf + bp (Rm - Rf)] R p = The expected return of portfolio P, R f = Risk Free Rate, b p = Beta coefficient of portfolio P. Rm = Market return The higher the Treynor ratio shows higher returns and lesser market risk of the fund Jensen Alfa Jensen measure is based on systematic risk. It is also suitable for evaluating a portfolio’s performance in combination with other portfolios. Standard Deviation allows us to evaluate the Should be near to its mean return volatility of the fund. The standard deviation of a fund measures this risk by measuring the degree to which the fund fluctuates in relation to its mean return. Beta is a fairly commonly used measure of risk. It basically indicates the level of volatility associated with the fund as compared to the benchmark. Rp = R pt - Ri (t-1) / Ri (t-1) Rp = The expected return of portfolio P Rpt = Closing value at t day Ri (t-1) = Closing value at (t-1) day. Portfolio/Index Return Beta > 1 = high risky Beta = 1 = Avg Beta <1 = Low Risky

Measures Sharpe Ratio Description Interpretation Sharpe Ratio = (R p - R f ) / s p R p = Return of p portfolio, R f = Risk Free Rate, s p = Standard deviation of return of p portfolio. The higher the Sharpe ratio, the better a fund returns relative to the amount of risk taken. Treynor Ratio = (Rp-Rf) βp R p = The expected return of portfolio P, R f = Risk Free Rate, b p = Beta coefficient of portfolio P. α = Rp - [Rf + bp (Rm - Rf)] R p = The expected return of portfolio P, R f = Risk Free Rate, b p = Beta coefficient of portfolio P. Rm = Market return The higher the Treynor ratio shows higher returns and lesser market risk of the fund Jensen Alfa Jensen measure is based on systematic risk. It is also suitable for evaluating a portfolio’s performance in combination with other portfolios. Standard Deviation allows us to evaluate the Should be near to its mean return volatility of the fund. The standard deviation of a fund measures this risk by measuring the degree to which the fund fluctuates in relation to its mean return. Beta is a fairly commonly used measure of risk. It basically indicates the level of volatility associated with the fund as compared to the benchmark. Rp = R pt - Ri (t-1) / Ri (t-1) Rp = The expected return of portfolio P Rpt = Closing value at t day Ri (t-1) = Closing value at (t-1) day. Portfolio/Index Return Beta > 1 = high risky Beta = 1 = Avg Beta <1 = Low Risky

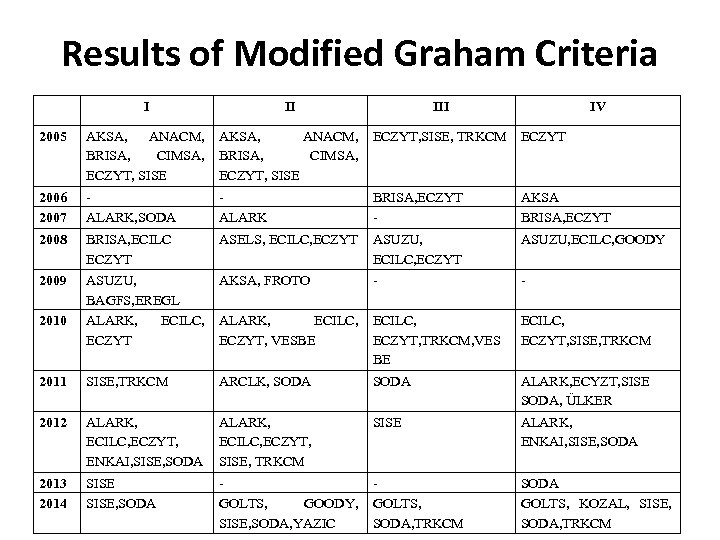

Results of Modified Graham Criteria I II 2005 AKSA, ANACM, BRISA, CIMSA, ECZYT, SISE, TRKCM ECZYT 2006 2007 ALARK, SODA ALARK BRISA, ECZYT - AKSA BRISA, ECZYT 2008 BRISA, ECILC ECZYT ASELS, ECILC, ECZYT ASUZU, ECILC, GOODY 2009 ASUZU, BAGFS, EREGL ALARK, ECILC, ECZYT AKSA, FROTO - - ALARK, ECILC, ECZYT, VESBE ECILC, ECZYT, TRKCM, VES BE ECILC, ECZYT, SISE, TRKCM 2011 SISE, TRKCM ARCLK, SODA ALARK, ECYZT, SISE SODA, ÜLKER 2012 ALARK, ECILC, ECZYT, ENKAI, SISE, SODA ALARK, ECILC, ECZYT, SISE, TRKCM SISE ALARK, ENKAI, SISE, SODA 2013 2014 SISE, SODA GOLTS, GOODY, SISE, SODA, YAZIC GOLTS, SODA, TRKCM SODA GOLTS, KOZAL, SISE, SODA, TRKCM 2010 III IV

Results of Modified Graham Criteria I II 2005 AKSA, ANACM, BRISA, CIMSA, ECZYT, SISE, TRKCM ECZYT 2006 2007 ALARK, SODA ALARK BRISA, ECZYT - AKSA BRISA, ECZYT 2008 BRISA, ECILC ECZYT ASELS, ECILC, ECZYT ASUZU, ECILC, GOODY 2009 ASUZU, BAGFS, EREGL ALARK, ECILC, ECZYT AKSA, FROTO - - ALARK, ECILC, ECZYT, VESBE ECILC, ECZYT, TRKCM, VES BE ECILC, ECZYT, SISE, TRKCM 2011 SISE, TRKCM ARCLK, SODA ALARK, ECYZT, SISE SODA, ÜLKER 2012 ALARK, ECILC, ECZYT, ENKAI, SISE, SODA ALARK, ECILC, ECZYT, SISE, TRKCM SISE ALARK, ENKAI, SISE, SODA 2013 2014 SISE, SODA GOLTS, GOODY, SISE, SODA, YAZIC GOLTS, SODA, TRKCM SODA GOLTS, KOZAL, SISE, SODA, TRKCM 2010 III IV

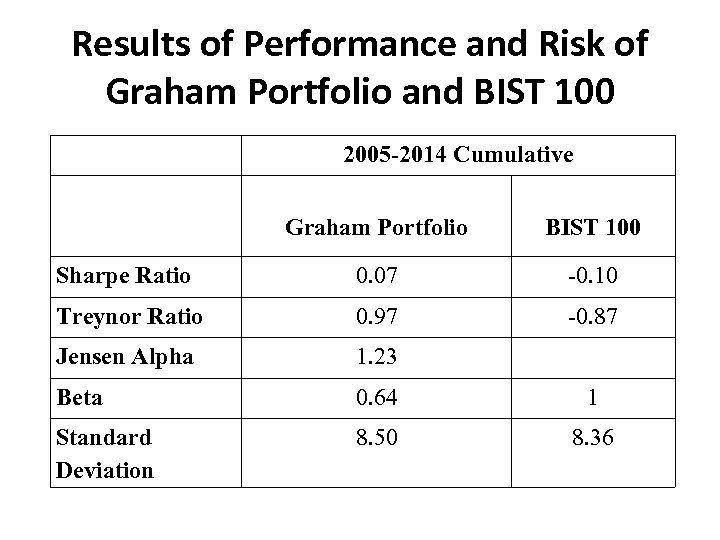

Results of Performance and Risk of Graham Portfolio and BIST 100 2005 -2014 Cumulative Graham Portfolio BIST 100 Sharpe Ratio 0. 07 -0. 10 Treynor Ratio 0. 97 -0. 87 Jensen Alpha 1. 23 Beta 0. 64 1 Standard Deviation 8. 50 8. 36

Results of Performance and Risk of Graham Portfolio and BIST 100 2005 -2014 Cumulative Graham Portfolio BIST 100 Sharpe Ratio 0. 07 -0. 10 Treynor Ratio 0. 97 -0. 87 Jensen Alpha 1. 23 Beta 0. 64 1 Standard Deviation 8. 50 8. 36

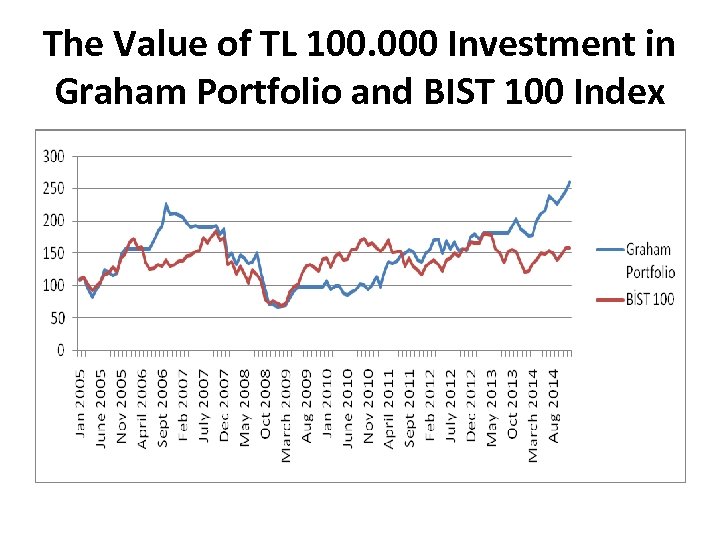

The Value of TL 100. 000 Investment in Graham Portfolio and BIST 100 Index

The Value of TL 100. 000 Investment in Graham Portfolio and BIST 100 Index

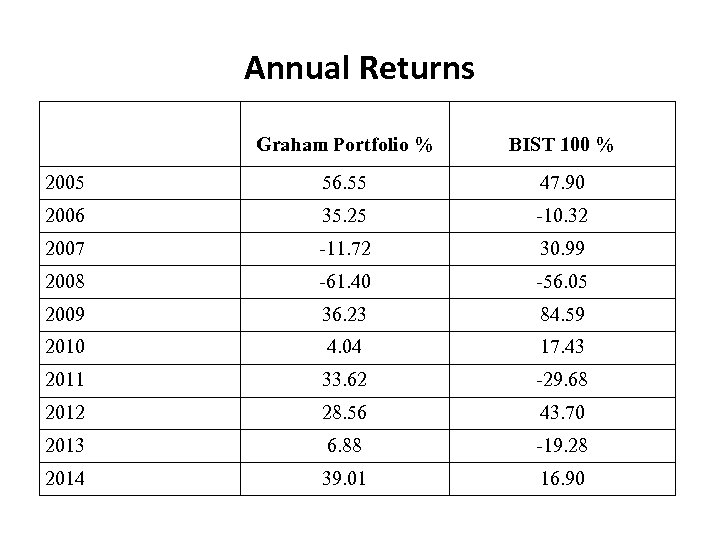

Annual Returns Graham Portfolio % BIST 100 % 2005 56. 55 47. 90 2006 35. 25 -10. 32 2007 -11. 72 30. 99 2008 -61. 40 -56. 05 2009 36. 23 84. 59 2010 4. 04 17. 43 2011 33. 62 -29. 68 2012 28. 56 43. 70 2013 6. 88 -19. 28 2014 39. 01 16. 90

Annual Returns Graham Portfolio % BIST 100 % 2005 56. 55 47. 90 2006 35. 25 -10. 32 2007 -11. 72 30. 99 2008 -61. 40 -56. 05 2009 36. 23 84. 59 2010 4. 04 17. 43 2011 33. 62 -29. 68 2012 28. 56 43. 70 2013 6. 88 -19. 28 2014 39. 01 16. 90

Conclusion… • This paper has mainly aimed to examine the profitability of stock selection criteria of Benjamin Graham Turkey’s capital market by using the data on stocks listed on Borsa İstanbul for the period from 2005 to 2014.

Conclusion… • This paper has mainly aimed to examine the profitability of stock selection criteria of Benjamin Graham Turkey’s capital market by using the data on stocks listed on Borsa İstanbul for the period from 2005 to 2014.

Conclusion… • Results of this research indicate that an investor who made use of the combinations of Graham’s criteria investigated to create a portfolio, would have achieved results better than that of the BIST-100 during the period 2005 and 2014, excluded crisis period. • When considered in conjunction with market conditions, the criteria of stock selection of Graham can optimize the investment decision making. Additionally, due to the Graham criteria are stringent, if they are modified, it will give better results for developing markets.

Conclusion… • Results of this research indicate that an investor who made use of the combinations of Graham’s criteria investigated to create a portfolio, would have achieved results better than that of the BIST-100 during the period 2005 and 2014, excluded crisis period. • When considered in conjunction with market conditions, the criteria of stock selection of Graham can optimize the investment decision making. Additionally, due to the Graham criteria are stringent, if they are modified, it will give better results for developing markets.

Thank you for your attention !

Thank you for your attention !