c0d8de502e92dd73a7a9229bf0fc968c.ppt

- Количество слайдов: 20

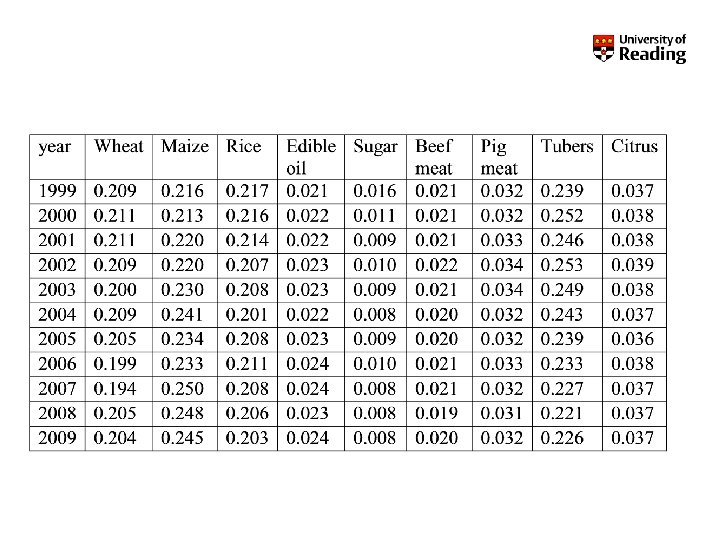

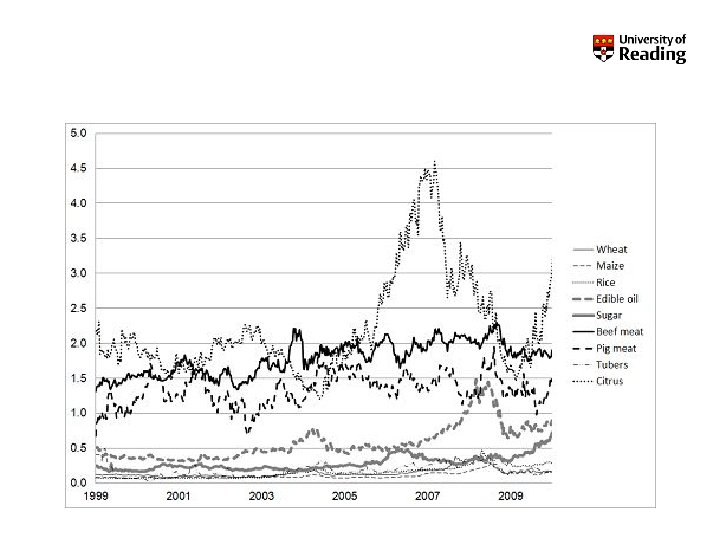

An alternative is to use a weighted basket of goods, to represent real purchasing power

countries that are considered to have ‘commodity currencies' include Australia, New Zealand Canada as well as some East Asia countries that are rich in natural resources Clements and Fry (2008) found that spillovers from commodities to currencies contributed less than 1% to the volatility of currencies, while spillovers from currencies to commodities contributed between 2 and 5. 2% to commodity price volatility

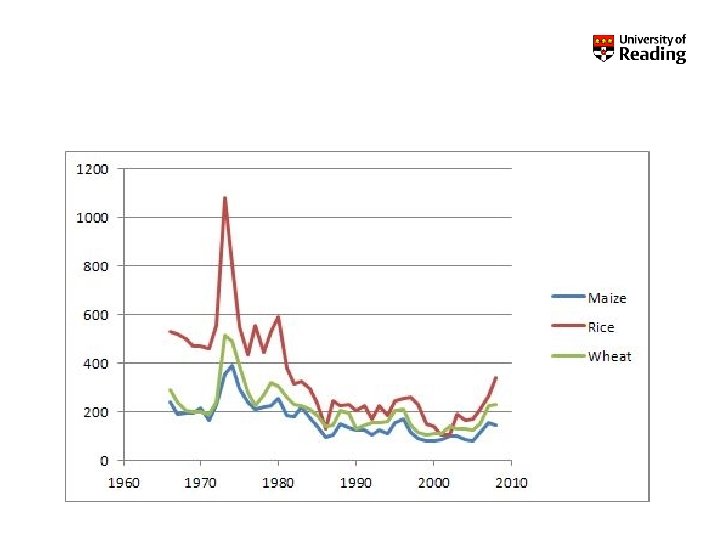

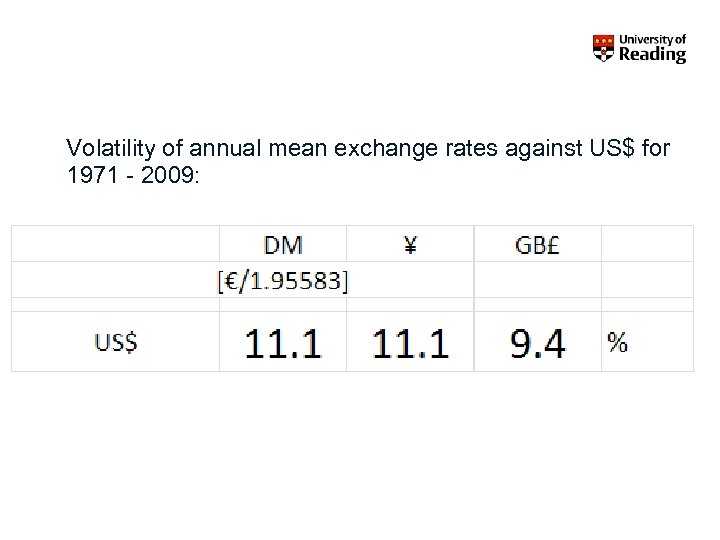

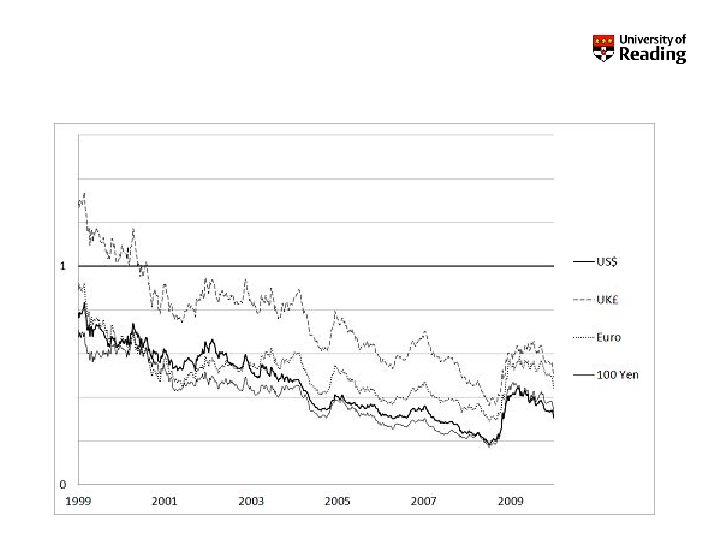

Volatility of annual mean exchange rates against US$ for 1971 - 2009:

The volatility of aggregate real exchange rates exceeds what economists believe to be consistent with a plausible degree of price rigidity (Crucini et al, 2010) Richard Cooper (1999) foresaw that as international financial transactions continue to grow, financial factors will come to dominate exchange rate determination Flexible rates, hitherto providing a useful mechanism for absorbing trade shocks and disturbances, themselves become a source of financial shocks

Agricultural commodities are by their nature entirely replaceable, and agricultural economists can predict the marginal cost of producing approximately sufficient of each commodity to satisfy the market in the short term Agricultural commodity supply in the long run is infinitely elastic

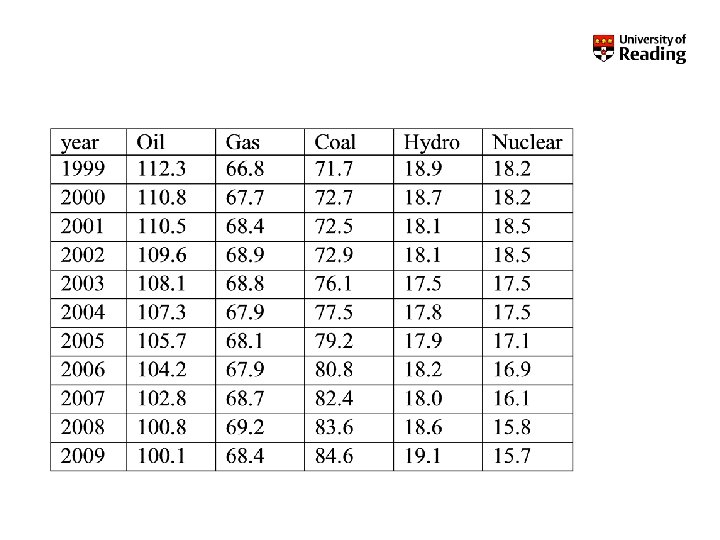

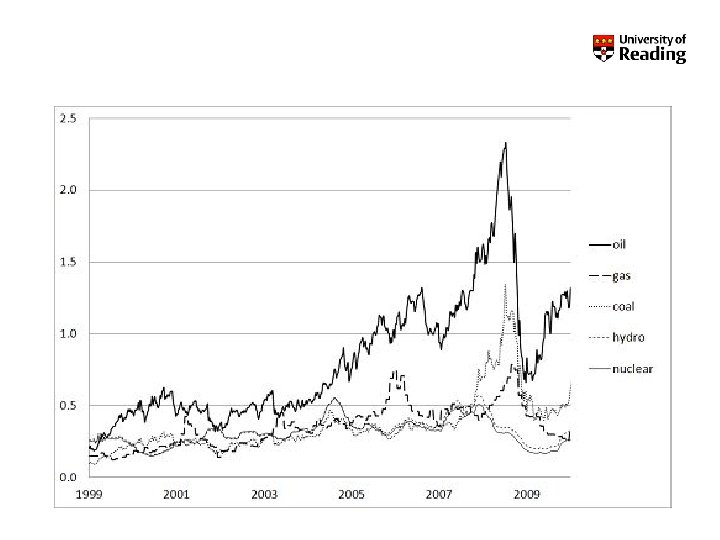

FAO estimated 2620 food calories (10. 97 MJ) per capita per day to be actual world food energy consumption in 2009 (FAO, 2011) For our numéraire, a basket of food commodities is defined, and used to convert the requirement for 10. 97 MJ/cap/d to monetary units We add a second component, representing the cost of actual energy usage

c0d8de502e92dd73a7a9229bf0fc968c.ppt