5cf37b3718674d7e5d752279f237d77c.ppt

- Количество слайдов: 28

Amman Stock Exchange Jalil Tarif Chief Executive Officer AMEDA Meeting Dead Sea - Jordan October 2007

Amman Stock Exchange Jalil Tarif Chief Executive Officer AMEDA Meeting Dead Sea - Jordan October 2007

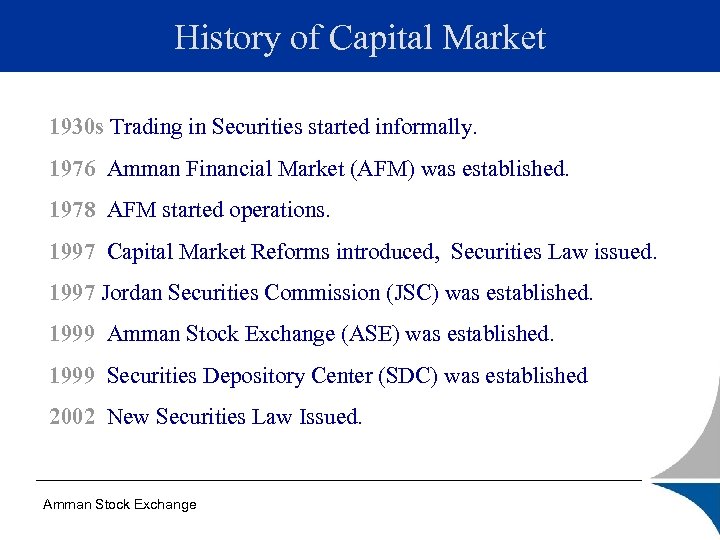

History of Capital Market 1930 s Trading in Securities started informally. 1976 Amman Financial Market (AFM) was established. 1978 AFM started operations. 1997 Capital Market Reforms introduced, Securities Law issued. 1997 Jordan Securities Commission (JSC) was established. 1999 Amman Stock Exchange (ASE) was established. 1999 Securities Depository Center (SDC) was established 2002 New Securities Law Issued. Amman Stock Exchange

History of Capital Market 1930 s Trading in Securities started informally. 1976 Amman Financial Market (AFM) was established. 1978 AFM started operations. 1997 Capital Market Reforms introduced, Securities Law issued. 1997 Jordan Securities Commission (JSC) was established. 1999 Amman Stock Exchange (ASE) was established. 1999 Securities Depository Center (SDC) was established 2002 New Securities Law Issued. Amman Stock Exchange

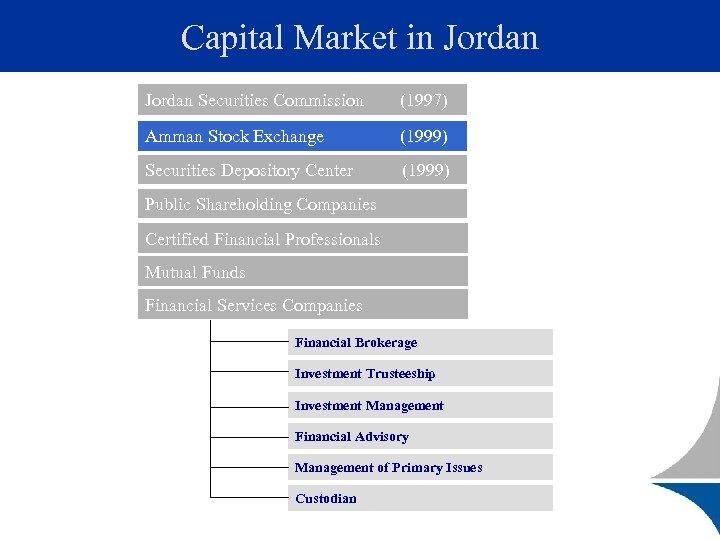

Capital Market in Jordan Securities Commission (1997) Amman Stock Exchange (1999) Securities Depository Center (1999) Public Shareholding Companies Certified Financial Professionals Mutual Funds Financial Services Companies Financial Brokerage Investment Trusteeship Investment Management Financial Advisory Management of Primary Issues Custodian

Capital Market in Jordan Securities Commission (1997) Amman Stock Exchange (1999) Securities Depository Center (1999) Public Shareholding Companies Certified Financial Professionals Mutual Funds Financial Services Companies Financial Brokerage Investment Trusteeship Investment Management Financial Advisory Management of Primary Issues Custodian

Amman Stock Exchange (ASE) Ø Established in March 1999 Ø Independent legal entity Ø Managed by private sector Ø Membership of brokers Ø Non for-profit Amman Stock Exchange

Amman Stock Exchange (ASE) Ø Established in March 1999 Ø Independent legal entity Ø Managed by private sector Ø Membership of brokers Ø Non for-profit Amman Stock Exchange

Securities Listing Requirements First Market Second Market Financial Position Requirements: Profitability Dividends ( Cash or Stock) Right to Commence Operations Liquidity Requirements: Free Float Turnover Trading Days Number of shareholders Financial Reporting: Annual Report Semi Annual Report Quarterly Report Amman Stock Exchange Financial Reporting: Annual Report Semi Annual Report Continuous Listing Requirements Bonds Government and Corporate Bonds are eligible for listing

Securities Listing Requirements First Market Second Market Financial Position Requirements: Profitability Dividends ( Cash or Stock) Right to Commence Operations Liquidity Requirements: Free Float Turnover Trading Days Number of shareholders Financial Reporting: Annual Report Semi Annual Report Quarterly Report Amman Stock Exchange Financial Reporting: Annual Report Semi Annual Report Continuous Listing Requirements Bonds Government and Corporate Bonds are eligible for listing

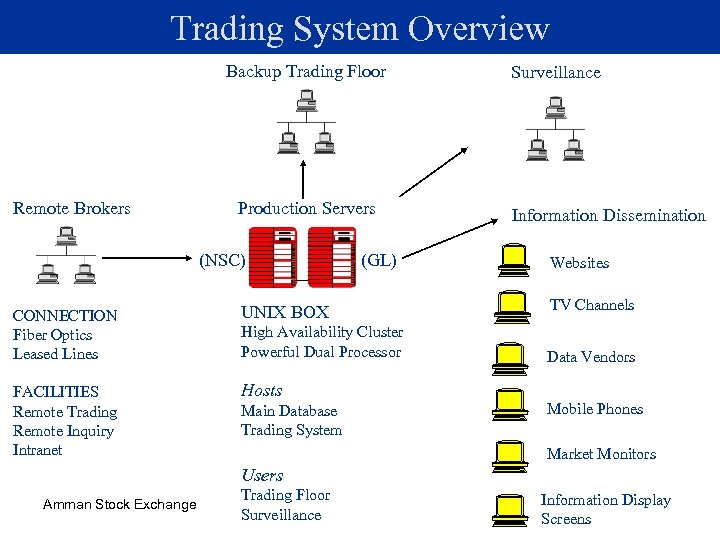

Trading System Overview Backup Trading Floor Remote Brokers Production Servers (NSC) CONNECTION Fiber Optics Leased Lines UNIX BOX FACILITIES Remote Trading Remote Inquiry Intranet Hosts (GL) High Availability Cluster Powerful Dual Processor Main Database Trading System Surveillance Information Dissemination Websites TV Channels Data Vendors Mobile Phones Market Monitors Users Amman Stock Exchange Trading Floor Surveillance Information Display Screens

Trading System Overview Backup Trading Floor Remote Brokers Production Servers (NSC) CONNECTION Fiber Optics Leased Lines UNIX BOX FACILITIES Remote Trading Remote Inquiry Intranet Hosts (GL) High Availability Cluster Powerful Dual Processor Main Database Trading System Surveillance Information Dissemination Websites TV Channels Data Vendors Mobile Phones Market Monitors Users Amman Stock Exchange Trading Floor Surveillance Information Display Screens

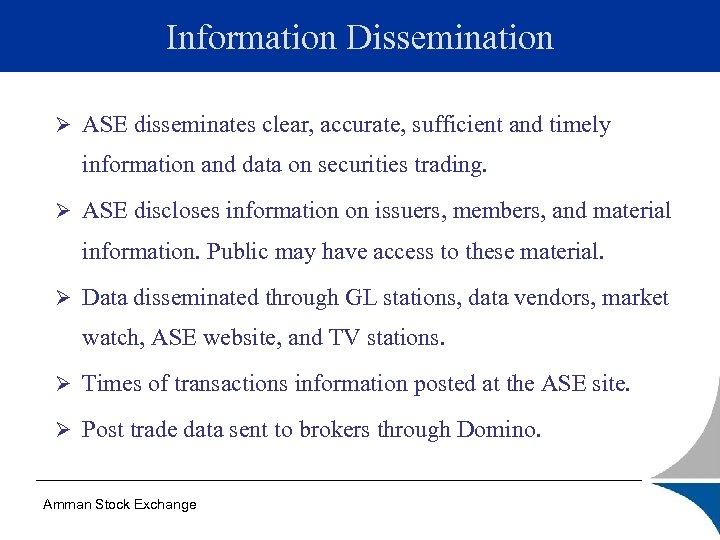

Information Dissemination Ø ASE disseminates clear, accurate, sufficient and timely information and data on securities trading. Ø ASE discloses information on issuers, members, and material information. Public may have access to these material. Ø Data disseminated through GL stations, data vendors, market watch, ASE website, and TV stations. Ø Times of transactions information posted at the ASE site. Ø Post trade data sent to brokers through Domino. Amman Stock Exchange

Information Dissemination Ø ASE disseminates clear, accurate, sufficient and timely information and data on securities trading. Ø ASE discloses information on issuers, members, and material information. Public may have access to these material. Ø Data disseminated through GL stations, data vendors, market watch, ASE website, and TV stations. Ø Times of transactions information posted at the ASE site. Ø Post trade data sent to brokers through Domino. Amman Stock Exchange

http: //www. exchange. jo

http: //www. exchange. jo

(US$ million) ASE Market Capitalization & Trading Value * End of September Trading Value Market Cap

(US$ million) ASE Market Capitalization & Trading Value * End of September Trading Value Market Cap

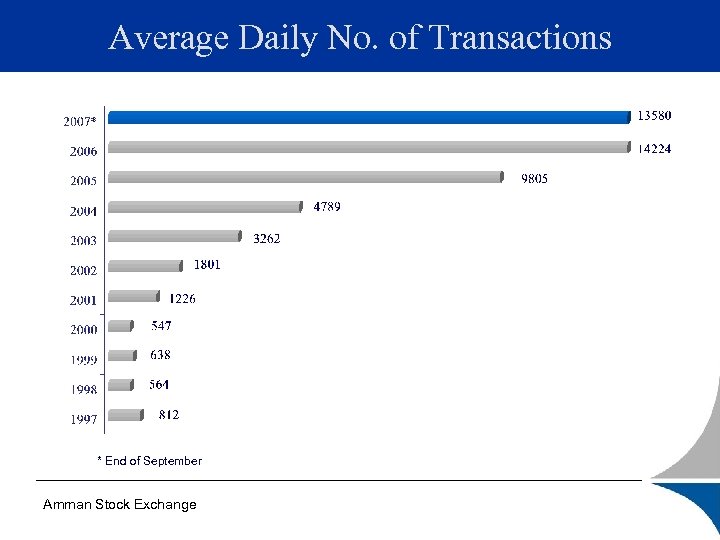

Average Daily No. of Transactions * End of September Amman Stock Exchange

Average Daily No. of Transactions * End of September Amman Stock Exchange

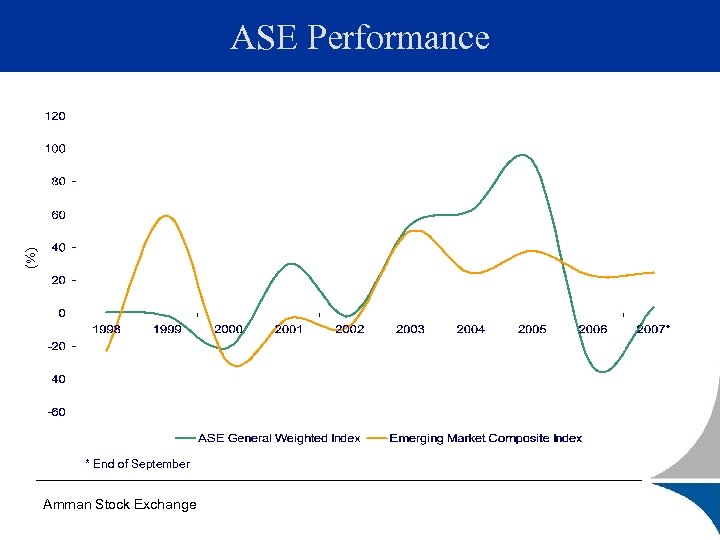

(%) ASE Performance * End of September Amman Stock Exchange

(%) ASE Performance * End of September Amman Stock Exchange

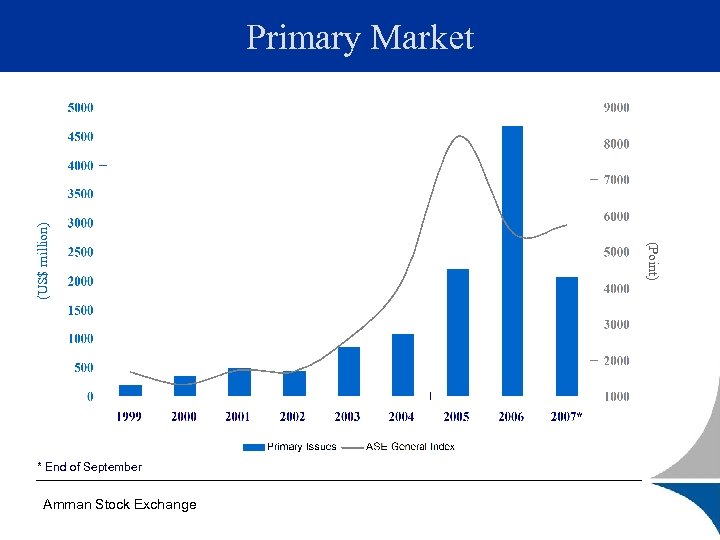

* End of September Amman Stock Exchange (Point) (US$ million) Primary Market

* End of September Amman Stock Exchange (Point) (US$ million) Primary Market

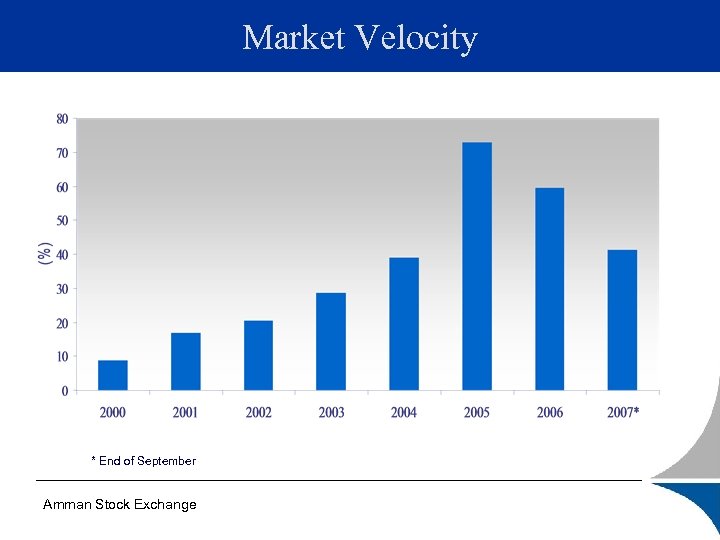

Market Velocity * End of September Amman Stock Exchange

Market Velocity * End of September Amman Stock Exchange

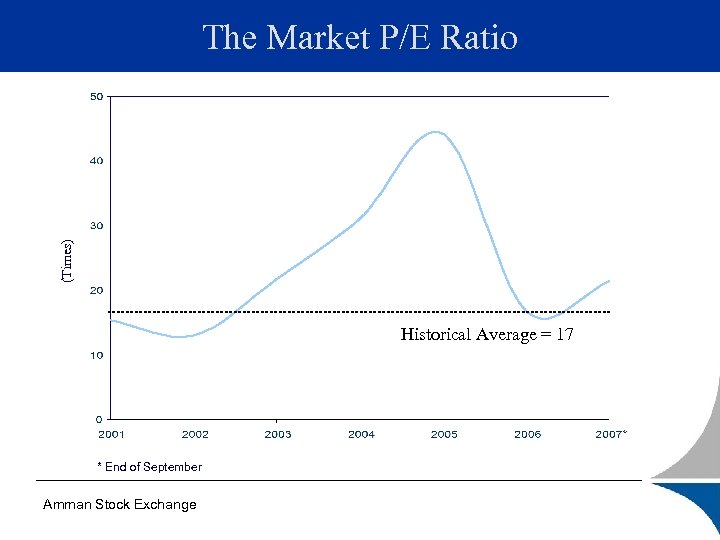

(Times) The Market P/E Ratio Historical Average = 17 * End of September Amman Stock Exchange

(Times) The Market P/E Ratio Historical Average = 17 * End of September Amman Stock Exchange

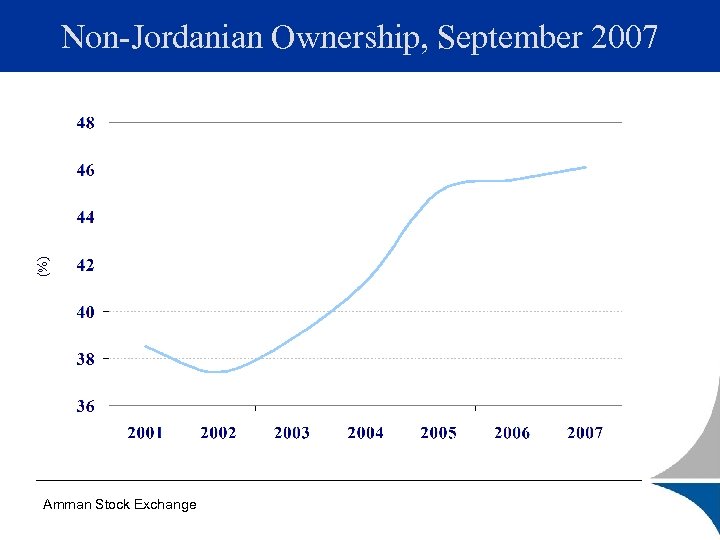

(%) Non-Jordanian Ownership, September 2007 Amman Stock Exchange

(%) Non-Jordanian Ownership, September 2007 Amman Stock Exchange

Recent Study by IMF Ø Investors may be able to achieve additional diversification by investing in the ASE Ø On a risk-adjusted basis (Sharp Ratio), the ASE outperformed most markets. Ø ASE compares favorably with many other regional markets in terms of investment climate. Ø Low price volatility. Amman Stock Exchange

Recent Study by IMF Ø Investors may be able to achieve additional diversification by investing in the ASE Ø On a risk-adjusted basis (Sharp Ratio), the ASE outperformed most markets. Ø ASE compares favorably with many other regional markets in terms of investment climate. Ø Low price volatility. Amman Stock Exchange

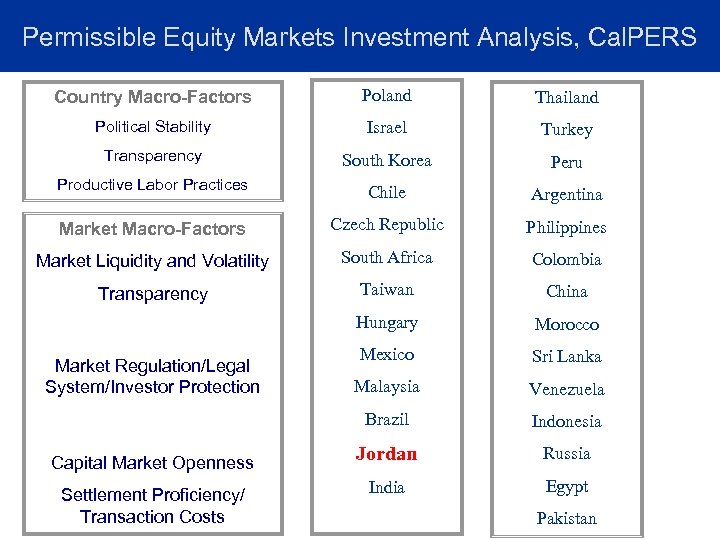

Permissible Equity Markets Investment Analysis, Cal. PERS Country Macro-Factors Poland Thailand Political Stability Israel Turkey Transparency South Korea Peru Productive Labor Practices Chile Argentina Market Macro-Factors Czech Republic Philippines Market Liquidity and Volatility South Africa Colombia Transparency Taiwan China Hungary Morocco Mexico Sri Lanka Malaysia Venezuela Brazil Indonesia Jordan Russia India Egypt Market Regulation/Legal System/Investor Protection Capital Market Openness Settlement Proficiency/ Transaction Costs Pakistan

Permissible Equity Markets Investment Analysis, Cal. PERS Country Macro-Factors Poland Thailand Political Stability Israel Turkey Transparency South Korea Peru Productive Labor Practices Chile Argentina Market Macro-Factors Czech Republic Philippines Market Liquidity and Volatility South Africa Colombia Transparency Taiwan China Hungary Morocco Mexico Sri Lanka Malaysia Venezuela Brazil Indonesia Jordan Russia India Egypt Market Regulation/Legal System/Investor Protection Capital Market Openness Settlement Proficiency/ Transaction Costs Pakistan

Future Plans Ø Jordan National Financial Center Project Ø Upgrading the trading system Ø Internet trading. Ø Demutualization Ø New ASE Dow Jones Index Amman Stock Exchange

Future Plans Ø Jordan National Financial Center Project Ø Upgrading the trading system Ø Internet trading. Ø Demutualization Ø New ASE Dow Jones Index Amman Stock Exchange

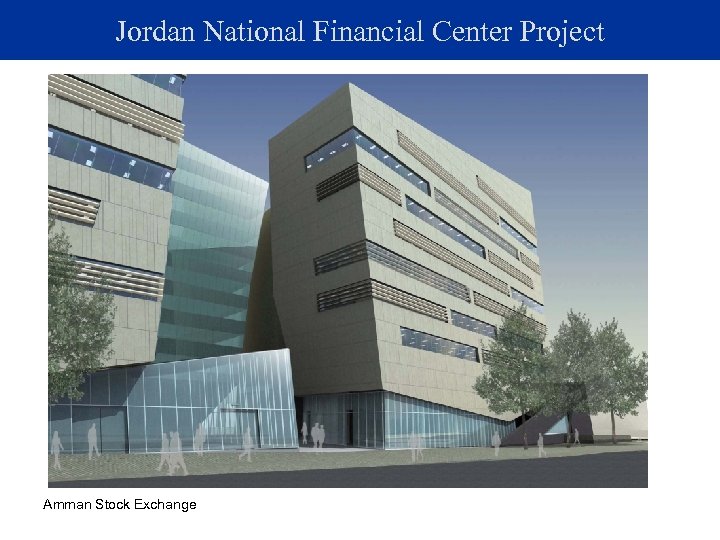

Jordan National Financial Center Project Ø The Center will contain: Ø ASE Ø SDC Ø Financial Studies Center Ø Brokers’ Offices Ø Investors Gallery Ø Other facilities Ø The Center total area 85758 m 2. (Buildings area 51766 m 2) Ø Total cost US$ 100 million Ø Expected completion date November 2009 Amman Stock Exchange

Jordan National Financial Center Project Ø The Center will contain: Ø ASE Ø SDC Ø Financial Studies Center Ø Brokers’ Offices Ø Investors Gallery Ø Other facilities Ø The Center total area 85758 m 2. (Buildings area 51766 m 2) Ø Total cost US$ 100 million Ø Expected completion date November 2009 Amman Stock Exchange

Project’s Site Amman Stock Exchange

Project’s Site Amman Stock Exchange

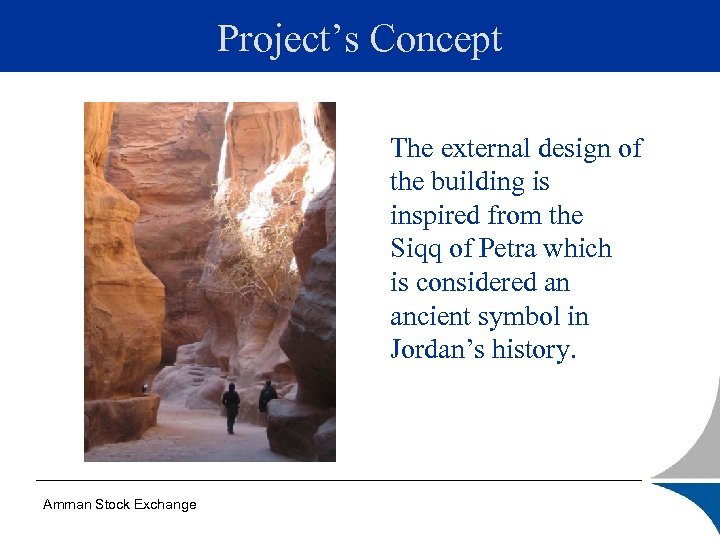

Project’s Concept The external design of the building is inspired from the Siqq of Petra which is considered an ancient symbol in Jordan’s history. Amman Stock Exchange

Project’s Concept The external design of the building is inspired from the Siqq of Petra which is considered an ancient symbol in Jordan’s history. Amman Stock Exchange

Jordan National Financial Center Project Amman Stock Exchange

Jordan National Financial Center Project Amman Stock Exchange

Upgrading the Trading System Ø A contract was signed with Atos. Euronext Market Solutions and GL Trade for Euro 2. 5 million. Ø New trading system V 900. Ø Fully Linux environment. Ø System applied in major stock exchanges. Ø Better flexibility to implement market rules. Ø Highly improve system capacity and lower latency. Ø The new system will be up and running by May 2008. Amman Stock Exchange

Upgrading the Trading System Ø A contract was signed with Atos. Euronext Market Solutions and GL Trade for Euro 2. 5 million. Ø New trading system V 900. Ø Fully Linux environment. Ø System applied in major stock exchanges. Ø Better flexibility to implement market rules. Ø Highly improve system capacity and lower latency. Ø The new system will be up and running by May 2008. Amman Stock Exchange

Demutualization Ø The new Securities Law for 2002 authorized setting up other stock exchanges Ø The ASE may be restructured by a decision of the Board of Commissioners of the JSC, upon approval of the Council of Ministers. Ø Negotiations are taking place with alliances to support demutualization process. Ø The ASE shall become shareholding company totally owned by the Government as a first step. Ø The Government then shall sell a share to financial institutions, brokerage firms, international institutions and other parties. Amman Stock Exchange

Demutualization Ø The new Securities Law for 2002 authorized setting up other stock exchanges Ø The ASE may be restructured by a decision of the Board of Commissioners of the JSC, upon approval of the Council of Ministers. Ø Negotiations are taking place with alliances to support demutualization process. Ø The ASE shall become shareholding company totally owned by the Government as a first step. Ø The Government then shall sell a share to financial institutions, brokerage firms, international institutions and other parties. Amman Stock Exchange

New ASE Dow Jones Index. Ø An agreement with Dow Jones was signed in late 2006 Ø Dow Jones will calculate a new composite index, named “The Amman Stock Exchange and Dow Jones”. Ø The new index will be weighted by market capitalization of free float shares. Ø The index can be used as a base tool in forming financial derivatives and ETFs. Ø The index will be launched in late 2007. Amman Stock Exchange

New ASE Dow Jones Index. Ø An agreement with Dow Jones was signed in late 2006 Ø Dow Jones will calculate a new composite index, named “The Amman Stock Exchange and Dow Jones”. Ø The new index will be weighted by market capitalization of free float shares. Ø The index can be used as a base tool in forming financial derivatives and ETFs. Ø The index will be launched in late 2007. Amman Stock Exchange

Other Projects Ø Internet Trading. Ø Joining the WFE. Ø Codes of Corporate Governance Ø Introducing new instruments. Ø Marketing strategy. Amman Stock Exchange

Other Projects Ø Internet Trading. Ø Joining the WFE. Ø Codes of Corporate Governance Ø Introducing new instruments. Ø Marketing strategy. Amman Stock Exchange

International Exposure Amman Stock Exchange

International Exposure Amman Stock Exchange

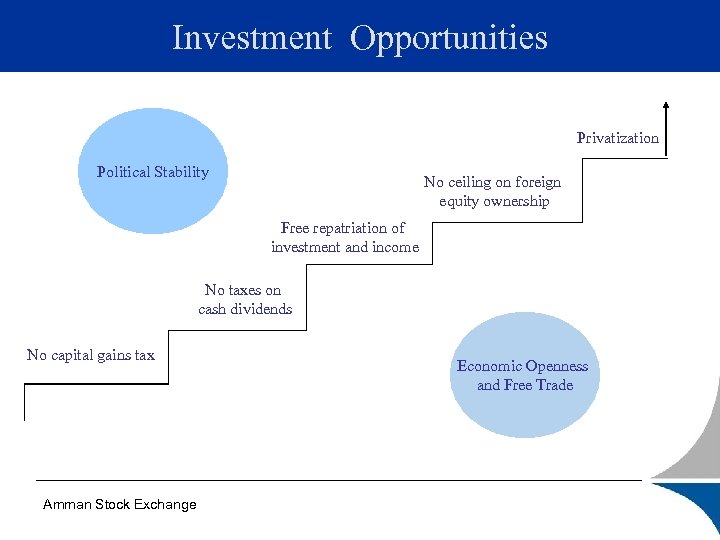

Investment Opportunities Privatization Political Stability No ceiling on foreign equity ownership Free repatriation of investment and income No taxes on cash dividends No capital gains tax Amman Stock Exchange Economic Openness and Free Trade

Investment Opportunities Privatization Political Stability No ceiling on foreign equity ownership Free repatriation of investment and income No taxes on cash dividends No capital gains tax Amman Stock Exchange Economic Openness and Free Trade