a489e453979089afc23190d05bfe2aff.ppt

- Количество слайдов: 17

American Benefits Council: Deferred Compensation of Expatriate (International) Employees June 8, 2010 Miller & Chevalier

Deferred Compensation: Section 457 A • Background: § Section 457 A was enacted on October 3, 2008, in the tax section of the Emergency Economic Stabilization Act of 2008 § The section was intended to limit deferrals of compensation by U. S. individuals employed by “tax indifferent” entities (such as certain foreign corporations in “tax haven” jurisdictions). Lack of tax tension exists in this situation § Original legislative concern was hedge fund employees, but statute as enacted impacts all industries 2

Executive Compensation – Section 457 A • Summary of Section 457 A § Under new section 457 A, deferred amounts under plan of a nonqualified entity are includible in gross income of US-taxpayer employee as soon as there is no substantial risk of forfeiture, even if plan meets section 409 A; special rule where amount not determinable at vest § Effective for deferred compensation attributable to services performed after December 31, 2008 § No permanent grandfather of pre-2009 amounts § Guidance issued (as Q’s and A’s) in Notice 2009 -8 3

Executive Compensation – Section 457 A • Key Elements of Compensation Subject to Section 457 A: Deferred Compensation § The compensation is deferred compensation generally using a definition like that in section 409 A § The compensation is not exempt as a short-term deferral – using rules slightly different than section 409 A (substantial risk of forfeiture (SROF) is defined more narrowly, but get 12 months to pay) § The compensation is not exempt equity compensation – again using rules slightly different than section 409 A (cash settled SARs are subject to 457 A) 4

Executive Compensation – Section 457 A • Key Elements of Compensation Subject to Section 457 A (continued): Deferred Compensation of a Nonqualified Entity § The compensation is under plan of a nonqualified entity (NQE) if under US tax standards, the NQE would be entitled to deduct the compensation. Notice 2009 -8, Q&A 14 5

Executive Compensation – Section 457 A • Key Elements of Compensation Subject to Section 457 A (continued): Deferred Compensation of a Nonqualified Entity § Very generally, a “nonqualified entity” or NQE is v v A foreign corporation or US or foreign partnership The income of which is not subject to significant US or foreign income tax 6

Executive Compensation – Section 457 A • Notice 2009 -8 provides Q&A-style guidance for determining “nonqualified entity” status more specifically • Generally tests on two bases: § Whether the entity’s income is subject to a comprehensive foreign income tax (i. e. , an examination of the foreign tax system and how it applies to the entity) § Whether the entity is in fact liable for comprehensive income tax on substantially all of its income (i. e. , an examination of the entity’s foreign income tax return) 7

Executive Compensation – Section 457 A • Notice 2009 -8 provides Q&A-style guidance for determining “nonqualified entity” status, which generally tests on two bases: § Whether the entity’s income is subject to a “comprehensive foreign income tax” v Either eligible for the benefits of a “comprehensive income tax treaty” between the U. S. and its residence country v Or, the foreign corporation is resident in a country that has a comprehensive income tax v But in either case, the entity is non-qualified if subject to a tax regime “materially more favorable” than the generally applicable corporate tax regime 8

Executive Compensation – Section 457 A • Open Issues § What is a “comprehensive foreign income tax”? v“Angel list” possible? v. Carve out U. S. possessions? § What does “materially more favorable” mean? § Which CFIT counts for the substantially all test? v. How to account for reverse hybrid income (not taxed in the R/H’s country but possibly taxed at the owner level)? v. How to account for checked branch income (possibly taxed at the DE level but not taxed at the owner level)? 9

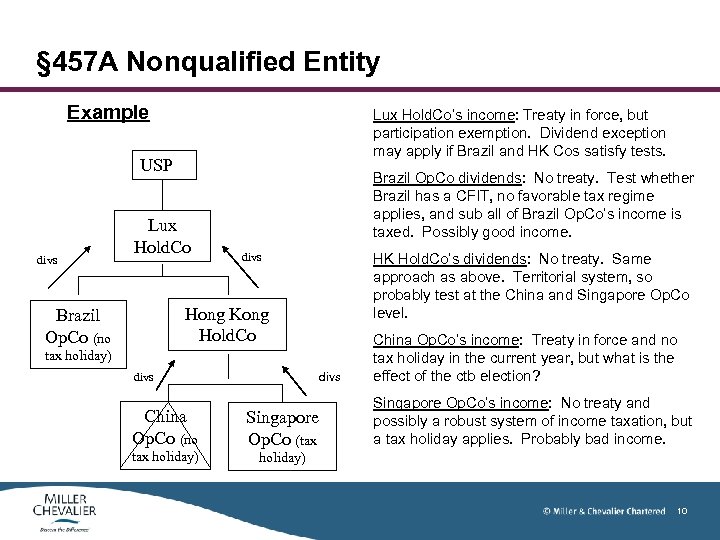

§ 457 A Nonqualified Entity Example Lux Hold. Co’s income: Treaty in force, but participation exemption. Dividend exception may apply if Brazil and HK Cos satisfy tests. USP divs Lux Hold. Co Brazil Op. Co dividends: No treaty. Test whether Brazil has a CFIT, no favorable tax regime applies, and sub all of Brazil Op. Co’s income is taxed. Possibly good income. divs HK Hold. Co’s dividends: No treaty. Same approach as above. Territorial system, so probably test at the China and Singapore Op. Co level. Hong Kong Hold. Co Brazil Op. Co (no tax holiday) divs China Op. Co (no Singapore Op. Co (tax holiday) China Op. Co’s income: Treaty in force and no tax holiday in the current year, but what is the effect of the ctb election? Singapore Op. Co’s income: No treaty and possibly a robust system of income taxation, but a tax holiday applies. Probably bad income. holiday) 10

Executive Compensation – Section 457 A • Examples where Sec. 457 A Applies: § Example 1: In Year 1, US citizen working in US is granted RSUs that vest December 31, Year 3 and are payable by March 15, Year 4. However, units “continue to vest” on retirement, even though payable by March 14, Year 4, and the employee becomes retirement eligible in Year 2. Employee is transferred to a Puerto Rican affiliate in Year 1. Section 457 A applies and the employee is taxable in Year 2. § Example 2: Same facts as above example, but units are PSUs. Section 457 A would apply, but taxation would not occur until December 31, Year 3, at which time there would be penalty taxes. 11

Executive Compensation – Section 457 A • Examples where Sec. 457 A Applies: § Example 3: Employee who is transferred to a UK affiliate that is located in the Scottish Development Zone continues to accrue benefits under the SERP. Employee is fully vested. The affiliate is a NQE under section 457 A. Incremental increase in SERP benefits due to service performed for NQE is taxable currently under section 457 A. 12

Executive Compensation – Section 457 A • Common 457 A Myths Debunked § Expats in US plans can be impacted § Seconding arrangements do not necessarily work to protect employees from section 457 A § The fact that the foreign entity is in a treaty country does not necessarily protect employees from section 457 A § Puerto Rico and other U. S. possessions are “foreign” for these purposes 13

Executive Compensation – Section 457 A • Consequences if Section 457 A Applies: § Employee generally is taxed at vesting. Employer likely is required to report the income at vesting; withholding obligation is unclear because there is no payment of wages then § If amount of compensation is not then determinable (e. g. , because the compensation is performance-based), the tax under section 457 A is when the compensation is determinable, but it is at that time subject to 409 A-like penalties, a 20% penalty tax and an interest charge tax § Deduction would seem to follow income to employee 14

Executive Compensation – Section 457 A • Why should sponsors care? § Section 457 A is effective now § Information reporting requirement § Compliance requires a team of international benefits and tax personnel § Expat agreements generally provide for tax equalization, so the company may bear the ultimate burden of the tax acceleration § Action item in 2011 re: accelerating grandfathered amounts without violating section 409 A 15

Executive Compensation – Section 457 A • What to do? § The government has been requesting comments on Notice 2009 -8 § This appears to be an area where comments will be taken very seriously 16

Contact Information Anne G. Batter 202 -626 -1473 abatter@milchev. com Kimberly Tan Majure 202 -626 -1576 kmajure@milchev. com 17

a489e453979089afc23190d05bfe2aff.ppt