fff6d2a95756d6c2adea11b9c07bf7e1.ppt

- Количество слайдов: 41

American Barrick Resources Corporation

How Sensitive Would Barrick Stock Be to Changes in Gold Price in the Absence of Risk Management?

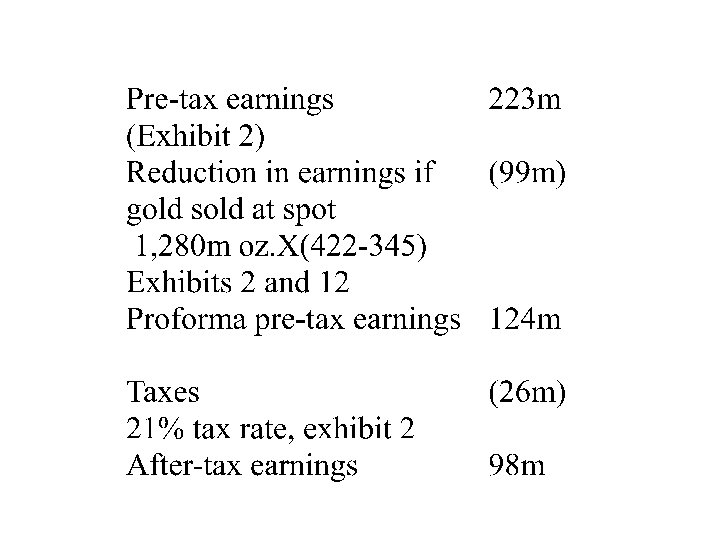

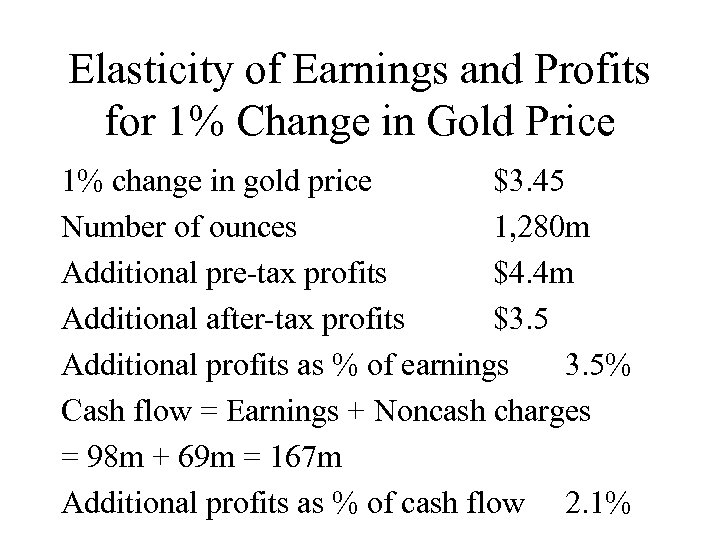

Elasticity of Earnings and Profits for 1% Change in Gold Price 1% change in gold price $3. 45 Number of ounces 1, 280 m Additional pre-tax profits $4. 4 m Additional after-tax profits $3. 5 Additional profits as % of earnings 3. 5% Cash flow = Earnings + Noncash charges = 98 m + 69 m = 167 m Additional profits as % of cash flow 2. 1%

What is Barrick’s Risk Management Program?

Guidelines • Fully protected against price declines for 3 years output. • 20 -25% for next decade.

Why Manage Gold Price Exposures?

Arguments • Pure bet on operational efficiencies for investors. – Do they want that or do they want gold? • Have funds available to invest when external financing is costly. • Eliminating deadweight costs of distress. • Tax arguments: If net income is negative, lose use of tax shields.

Ownership and Risk Management • If managers have large stake in firm, they don’t want the risk. • Eliminating hedgeable risks makes it possible to have concentrated ownership. • Barrick management owns 29. 6% of Barrick for a value of $900 m. • Let’s look at the other firms: Exhibit 3.

What Instruments Did They Use to Manage Risks?

Gold Financing of Acquisitions • Cullaton gold trust: – 3% of mine output when gold price was below $399 per ounce. – Rising to 10% when gold price was at $1, 000 per ounce. • How to value this?

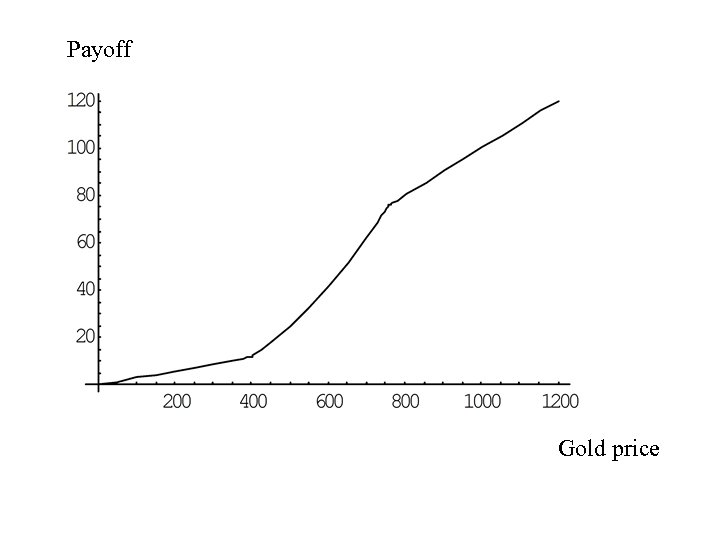

![Tricky: Nonlinear • Fraction paid: Min[(0. 03 + 0. 07*Max((P - 400)/600), 0. 1] Tricky: Nonlinear • Fraction paid: Min[(0. 03 + 0. 07*Max((P - 400)/600), 0. 1]](https://present5.com/presentation/fff6d2a95756d6c2adea11b9c07bf7e1/image-12.jpg)

Tricky: Nonlinear • Fraction paid: Min[(0. 03 + 0. 07*Max((P - 400)/600), 0. 1] Example: 600, 0. 03 +0. 07*0. 33 = 0. 053. • Payoff: Min[(0. 03 + 0. 07*Max((P - 400)/600), 0. 1]*P Example: 0. 03*600 + 0. 053*600 = 32.

Payoff Gold price

Gold Loans • Gold loan is equivalent to risk-free loan plus forward sale of gold.

Forward Price and Contango • To get gold at future date: • Solution one: Invest at risk-free rate + Long forward. • Solution two: Buy gold today. • Twist: Since you don’t need gold until future date, you can lend it and earn gold lease rate.

Example: Exhibit 9 • Interest rate is 16. 83%; lease rate 2%. • Cost of forward strategy for one year: F/1. 1683 • Cost of spot strategy. Since you gain 2% by leasing, you need 1/1. 02 units of gold to get one at maturity: S/1. 02 • F = S*1. 1683/1. 02 = S*1. 1545 or forward exceeds spot by 15. 45%

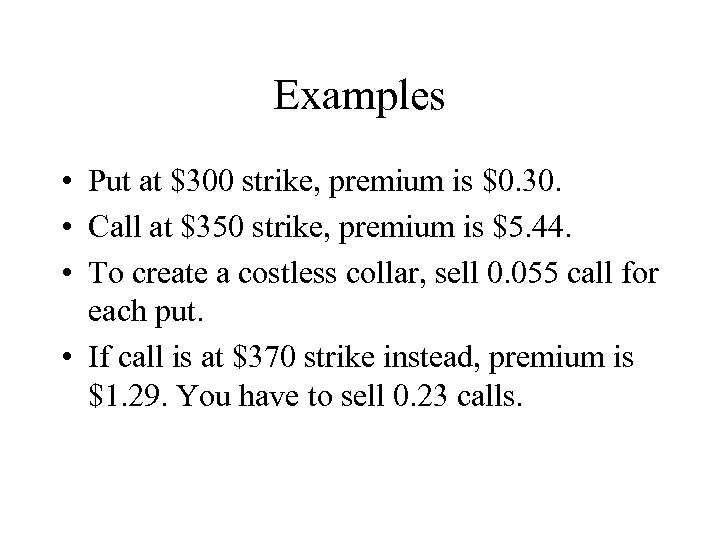

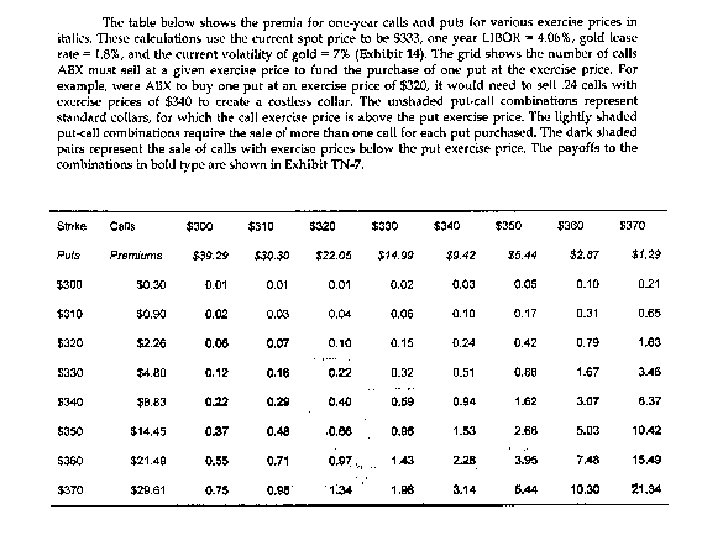

Collars • Barrick was willing to use options, but only in the form of costless collars. • Buy put and sell call so that premium of put equals premium of call. • Example: One year, gold at $333, LIBOR at 4%, gold lease rate at 1. 8%, and volatility of gold at 7%.

Examples • Put at $300 strike, premium is $0. 30. • Call at $350 strike, premium is $5. 44. • To create a costless collar, sell 0. 055 call for each put. • If call is at $370 strike instead, premium is $1. 29. You have to sell 0. 23 calls.

Spot Deferred Contracts • What are they?

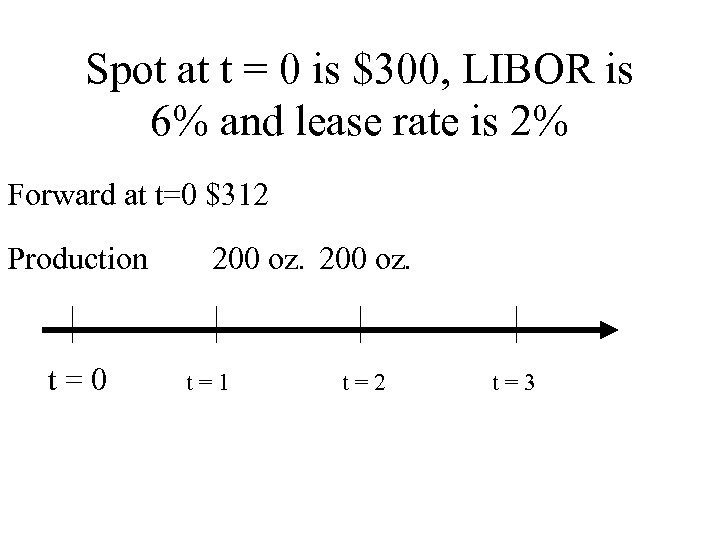

Spot at t = 0 is $300, LIBOR is 6% and lease rate is 2% Forward at t=0 $312 Production t=0 200 oz. t=1 t=2 t=3

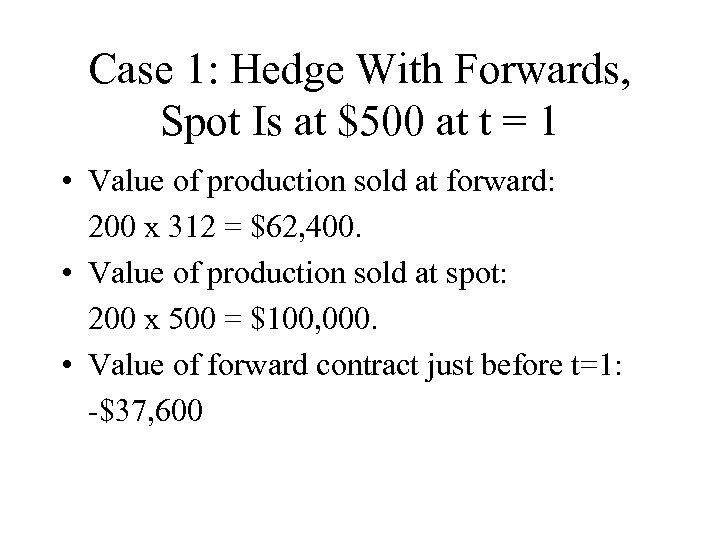

Case 1: Hedge With Forwards, Spot Is at $500 at t = 1 • Value of production sold at forward: 200 x 312 = $62, 400. • Value of production sold at spot: 200 x 500 = $100, 000. • Value of forward contract just before t=1: -$37, 600

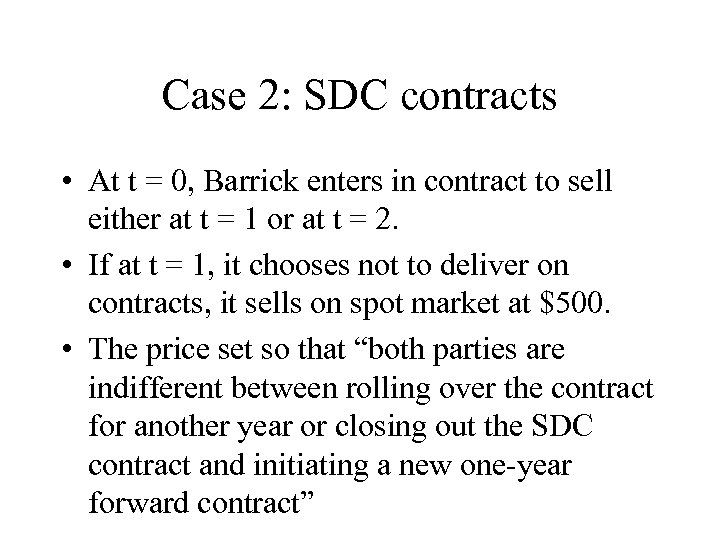

Case 2: SDC contracts • At t = 0, Barrick enters in contract to sell either at t = 1 or at t = 2. • If at t = 1, it chooses not to deliver on contracts, it sells on spot market at $500. • The price set so that “both parties are indifferent between rolling over the contract for another year or closing out the SDC contract and initiating a new one-year forward contract”

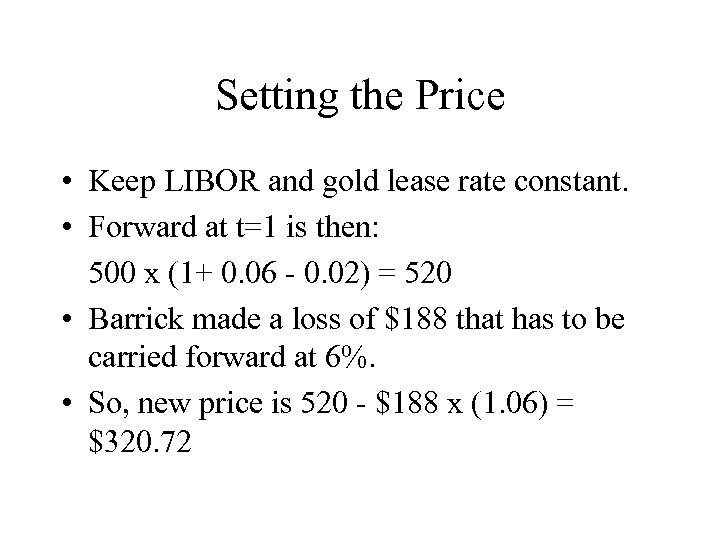

Setting the Price • Keep LIBOR and gold lease rate constant. • Forward at t=1 is then: 500 x (1+ 0. 06 - 0. 02) = 520 • Barrick made a loss of $188 that has to be carried forward at 6%. • So, new price is 520 - $188 x (1. 06) = $320. 72

Did Barrick Follow Its Policy?

No. • Stopped writing options in 1990 and used only spot deferred. • By 1992, historical low for gold and gold volatilities. • In 1992, it could insure against gold prices falling below $330 at $4. 8 an ounce. With a collar, it had to give up 88% of upside above $350. Refused to do so.

• In 1992, could have sold forward at $340 for cash costs of $205. • Was not willing to do so. • So, Barrick’s risk management involved substantial speculation.

Who Uses Derivatives? • Many surveys. Let’s look at the 1998 Wharton/CIBC survey. • Sent out to 1, 928 firms. 399 responded. • 50% use derivatives. • 42% have increased usage since previous year; 46% kept constant. • Users: 83% of large firms; 45% of medium size companies; 12% of small firms.

Most commonly managed risks for users • • FX, 96%. Interest rate, 76%. Commodity, 56%. Equity, 34%.

Concerns • • Accounting treatment (high concern for 37%). Market risk (31%). Monitoring/evaluating hedging results (29%). Credit risk (25%). Liquidity (21%). SEC disclosure (21%). Reaction by analysts, investors (18%).

Which FX hedging • Balance sheet commitments (frequently for 54%; average exposure hedged, 49%). • Off balance sheet commitments (24%; 23%). • Anticipated transactions less than 1 yr (46%; 42%). • Anticipated transactions more than 1 yr (12%; 16%). • Hedge competitive exposure (11%; 7%). • Hedge translation (14%; 12%).

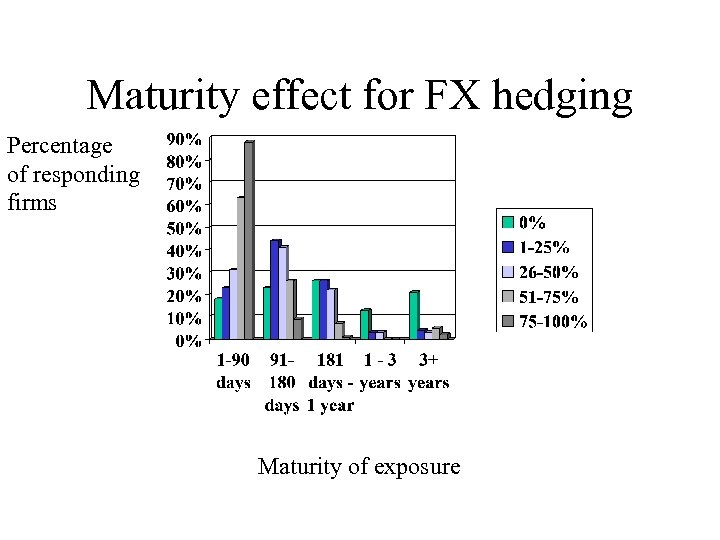

Maturity effect for FX hedging Percentage of responding firms Maturity of exposure

Does market view matter? • 49% sometimes alter timing of hedges and 51% sometimes alter size according to market view. • 6% frequently take positions, 26% do so sometimes, to exploit market view.

Interest rate derivatives • Almost all firms using interest rate derivatives report swapping from floating to fixed.

Options • 68% of firms use options; 44% use FX options. • 42% use European, 38% use American, 19% use average rate, 9% use basket, 13% use barrier. • 47% of FX derivatives users use basket options, 39% use average rate, and 69% use barrier!

Reporting and valuation • 4% report to directors monthly, 23% quarterly, and 17% annually. • 19% value daily; 9% weekly; 27% monthly. • 40% want risk management to decrease volatility; 22% want increased profit. • 60% of those who do not use do so because lack of exposure.

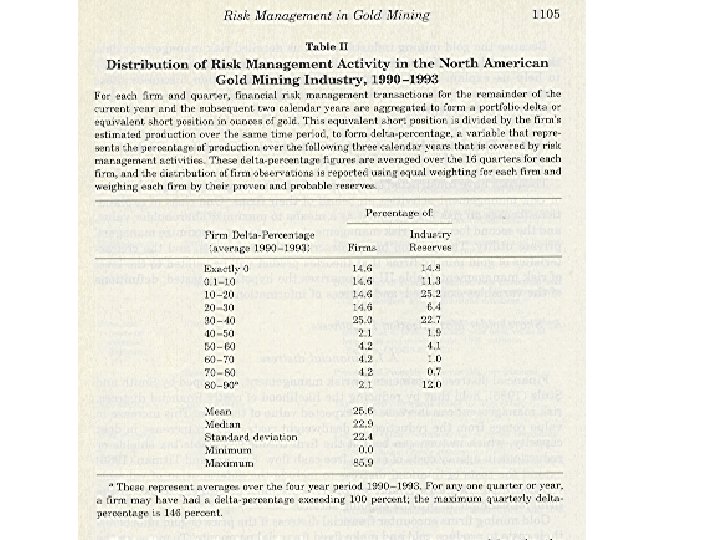

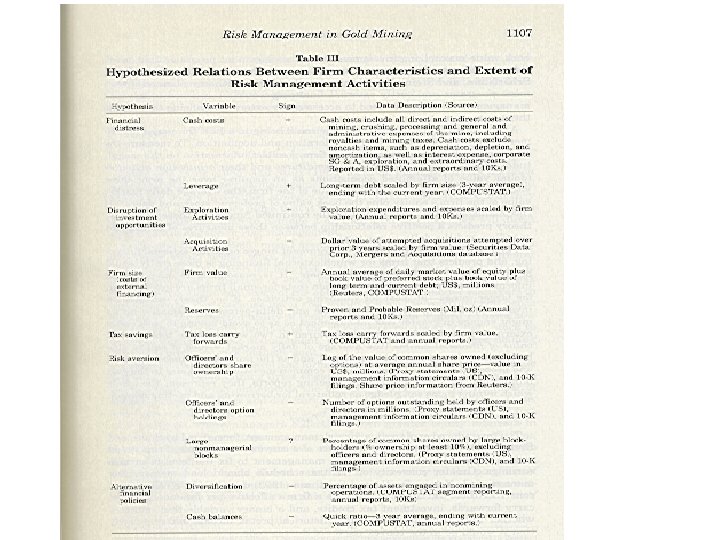

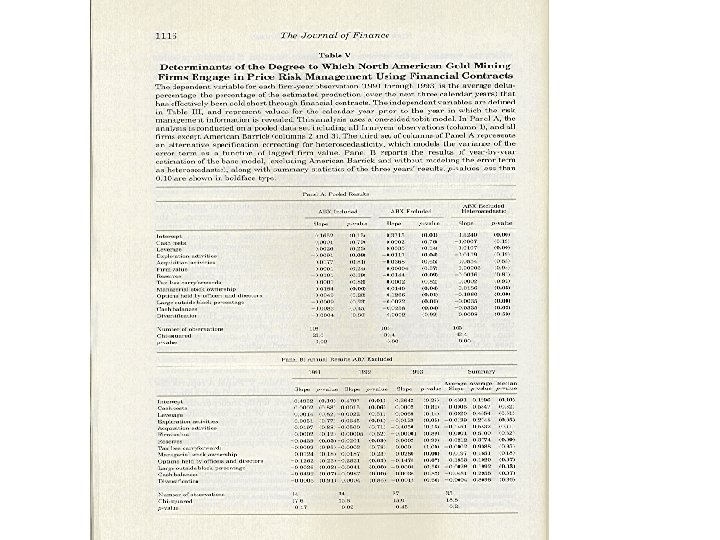

Tufano’s analysis • Looks at gold industry. • Advantage: Detailed data on exposures and hedges. • Disadvantage: One industry. • Key result: Managerial options and ownership are important.

Why the Spectacular Success of Derivatives? • They enable you to alter risk. • Derivatives can allow you to take risks that are advantageous. • Derivatives make it possible for you to shed risks that are costly. • It is only recently that finance figured out how to do all this well.

fff6d2a95756d6c2adea11b9c07bf7e1.ppt