5f540f77b0d83e352d588dd583a9107d.ppt

- Количество слайдов: 58

Algorithmic Game Theory Polynomial Time Algorithms and Internet Computing For Market Equilibria Vijay V. Vazirani

Algorithmic Game Theory Polynomial Time Algorithms and Internet Computing For Market Equilibria Vijay V. Vazirani

Markets

Markets

Stock Markets

Stock Markets

Internet

Internet

n Revolution in definition of markets

n Revolution in definition of markets

n Revolution in definition of markets n New markets defined by ¨ Google ¨ Amazon ¨ Yahoo! ¨ Ebay

n Revolution in definition of markets n New markets defined by ¨ Google ¨ Amazon ¨ Yahoo! ¨ Ebay

n Revolution in definition of markets n Massive computational power available

n Revolution in definition of markets n Massive computational power available

n Revolution in definition of markets n Massive computational power available n Important to find good models and algorithms for these markets

n Revolution in definition of markets n Massive computational power available n Important to find good models and algorithms for these markets

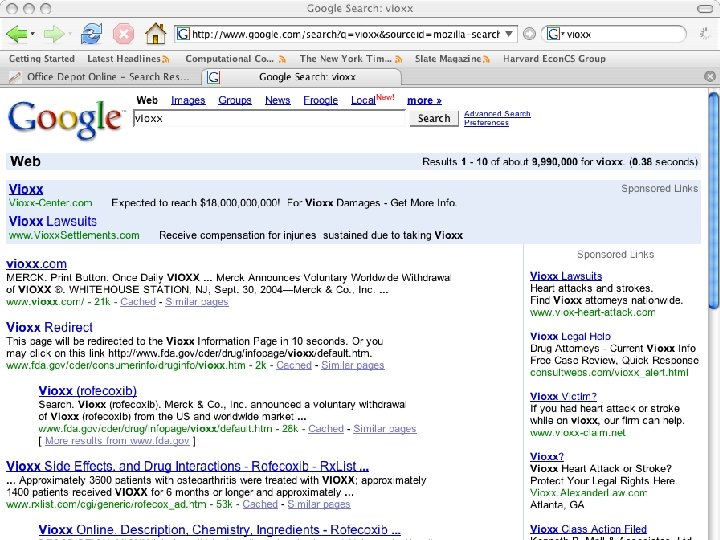

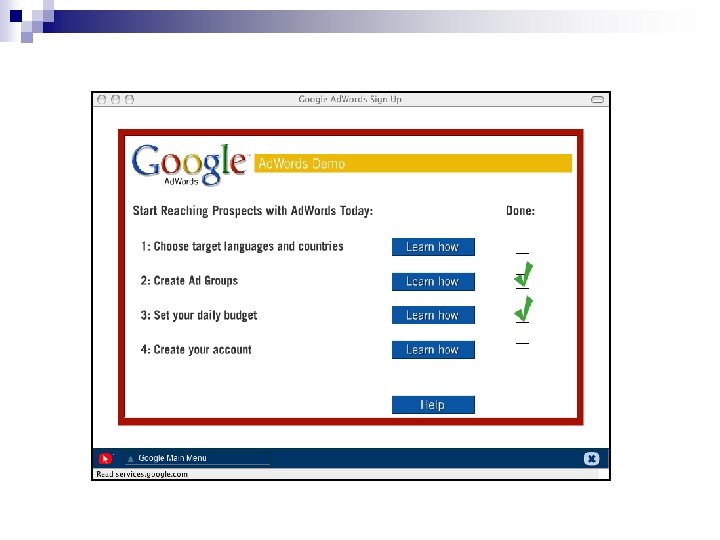

Adwords Market n Created by search engine companies ¨ Google ¨ Yahoo! ¨ MSN n Multi-billion dollar market n Totally revolutionized advertising, especially by small companies.

Adwords Market n Created by search engine companies ¨ Google ¨ Yahoo! ¨ MSN n Multi-billion dollar market n Totally revolutionized advertising, especially by small companies.

How will this market evolve? ?

How will this market evolve? ?

n The study of market equilibria has occupied center stage within Mathematical Economics for over a century.

n The study of market equilibria has occupied center stage within Mathematical Economics for over a century.

n The study of market equilibria has occupied center stage within Mathematical Economics for over a century. n This talk: Historical perspective & key notions from this theory.

n The study of market equilibria has occupied center stage within Mathematical Economics for over a century. n This talk: Historical perspective & key notions from this theory.

2). Algorithmic Game Theory n Combinatorial algorithms for traditional market models

2). Algorithmic Game Theory n Combinatorial algorithms for traditional market models

3). New Market Models n Resource Allocation Model of Kelly, 1997

3). New Market Models n Resource Allocation Model of Kelly, 1997

3). New Market Models n Resource Allocation Model of Kelly, 1997 n For mathematically modeling TCP congestion control n Highly successful theory

3). New Market Models n Resource Allocation Model of Kelly, 1997 n For mathematically modeling TCP congestion control n Highly successful theory

A Capitalistic Economy Depends crucially on pricing mechanisms to ensure: Stability n Efficiency n Fairness n

A Capitalistic Economy Depends crucially on pricing mechanisms to ensure: Stability n Efficiency n Fairness n

Adam Smith n The Wealth of Nations 2 volumes, 1776.

Adam Smith n The Wealth of Nations 2 volumes, 1776.

Adam Smith n The Wealth of Nations 2 volumes, 1776. n ‘invisible hand’ of the market

Adam Smith n The Wealth of Nations 2 volumes, 1776. n ‘invisible hand’ of the market

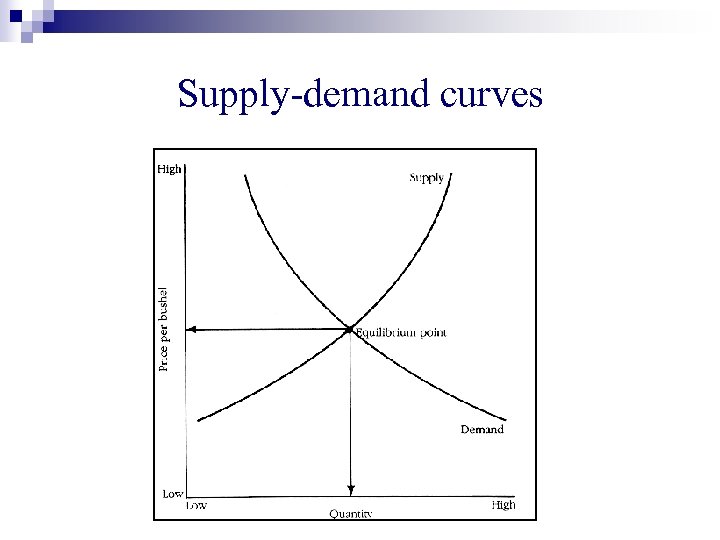

Supply-demand curves

Supply-demand curves

Leon Walras, 1874 n Pioneered general equilibrium theory

Leon Walras, 1874 n Pioneered general equilibrium theory

Irving Fisher, 1891 n First fundamental market model

Irving Fisher, 1891 n First fundamental market model

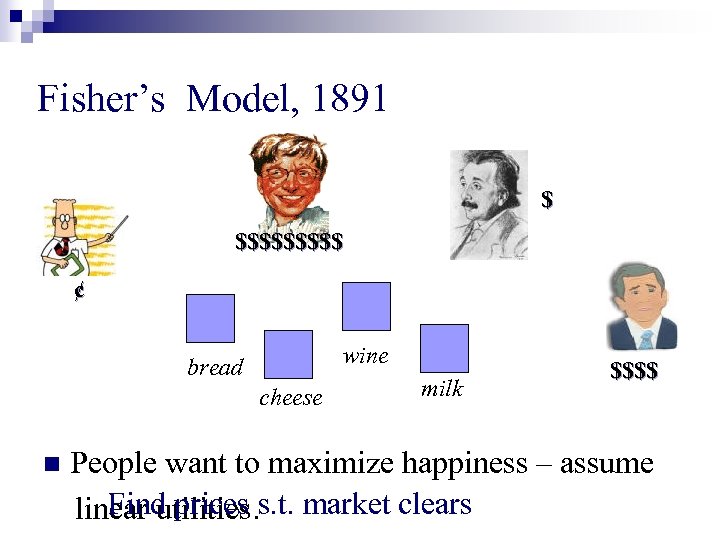

Fisher’s Model, 1891 $ $$$$$ ¢ wine bread cheese n milk $$$$ People want to maximize happiness – assume Find prices linear utilities. s. t. market clears

Fisher’s Model, 1891 $ $$$$$ ¢ wine bread cheese n milk $$$$ People want to maximize happiness – assume Find prices linear utilities. s. t. market clears

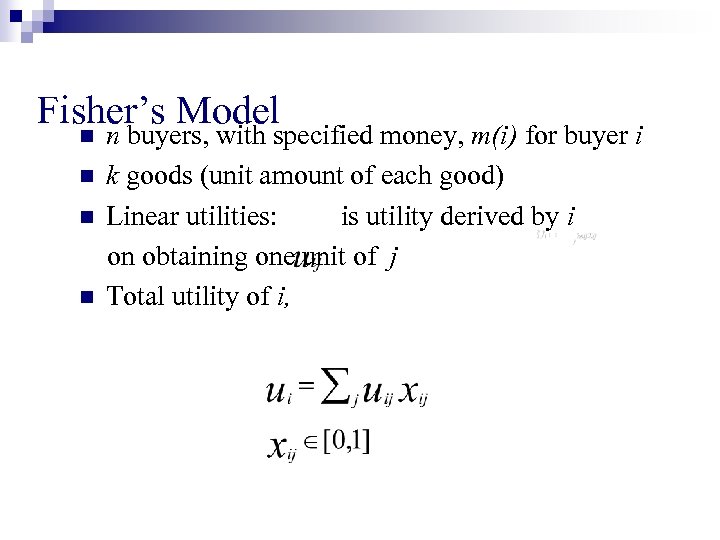

Fisher’s Model n n n buyers, with specified money, m(i) for buyer i k goods (unit amount of each good) Linear utilities: is utility derived by i on obtaining one unit of j Total utility of i,

Fisher’s Model n n n buyers, with specified money, m(i) for buyer i k goods (unit amount of each good) Linear utilities: is utility derived by i on obtaining one unit of j Total utility of i,

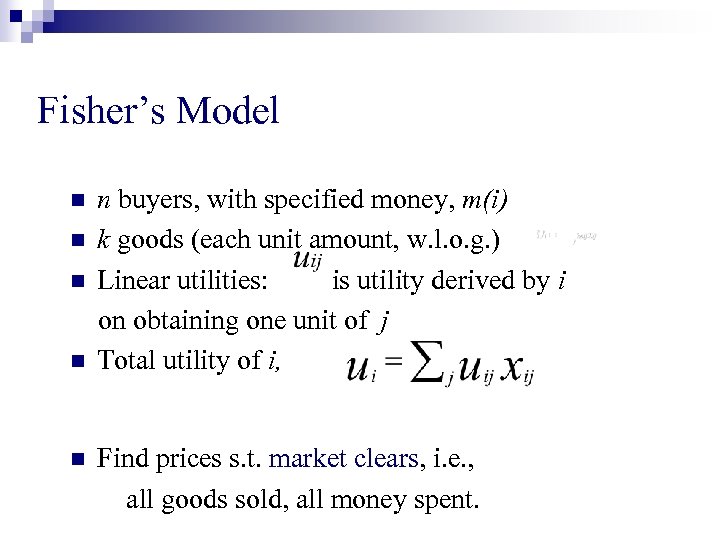

Fisher’s Model n n n buyers, with specified money, m(i) k goods (each unit amount, w. l. o. g. ) Linear utilities: is utility derived by i on obtaining one unit of j Total utility of i, Find prices s. t. market clears, i. e. , all goods sold, all money spent.

Fisher’s Model n n n buyers, with specified money, m(i) k goods (each unit amount, w. l. o. g. ) Linear utilities: is utility derived by i on obtaining one unit of j Total utility of i, Find prices s. t. market clears, i. e. , all goods sold, all money spent.

Arrow-Debreu Model, 1954 Exchange Economy n Second fundamental market model n Celebrated theorem in Mathematical Economics

Arrow-Debreu Model, 1954 Exchange Economy n Second fundamental market model n Celebrated theorem in Mathematical Economics

Kenneth Arrow n Nobel Prize, 1972

Kenneth Arrow n Nobel Prize, 1972

Gerard Debreu n Nobel Prize, 1983

Gerard Debreu n Nobel Prize, 1983

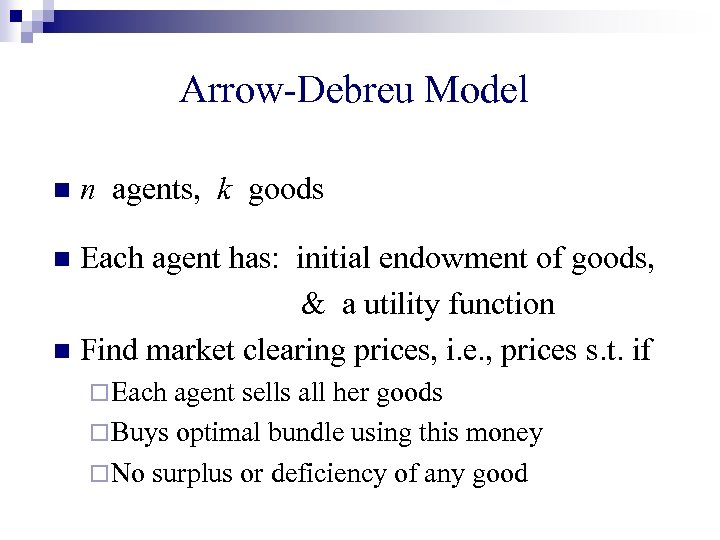

Arrow-Debreu Model n n agents, k goods

Arrow-Debreu Model n n agents, k goods

Arrow-Debreu Model n n agents, k goods n Each agent has: initial endowment of goods, & a utility function

Arrow-Debreu Model n n agents, k goods n Each agent has: initial endowment of goods, & a utility function

Arrow-Debreu Model n n agents, k goods Each agent has: initial endowment of goods, & a utility function n Find market clearing prices, i. e. , prices s. t. if n ¨ Each agent sells all her goods ¨ Buys optimal bundle using this money ¨ No surplus or deficiency of any good

Arrow-Debreu Model n n agents, k goods Each agent has: initial endowment of goods, & a utility function n Find market clearing prices, i. e. , prices s. t. if n ¨ Each agent sells all her goods ¨ Buys optimal bundle using this money ¨ No surplus or deficiency of any good

Utility function of agent i n n Continuous, monotonic and strictly concave n For any given prices and money m, there is a unique utility maximizing bundle for agent i.

Utility function of agent i n n Continuous, monotonic and strictly concave n For any given prices and money m, there is a unique utility maximizing bundle for agent i.

Arrow-Debreu Model Agents: Buyers/sellers

Arrow-Debreu Model Agents: Buyers/sellers

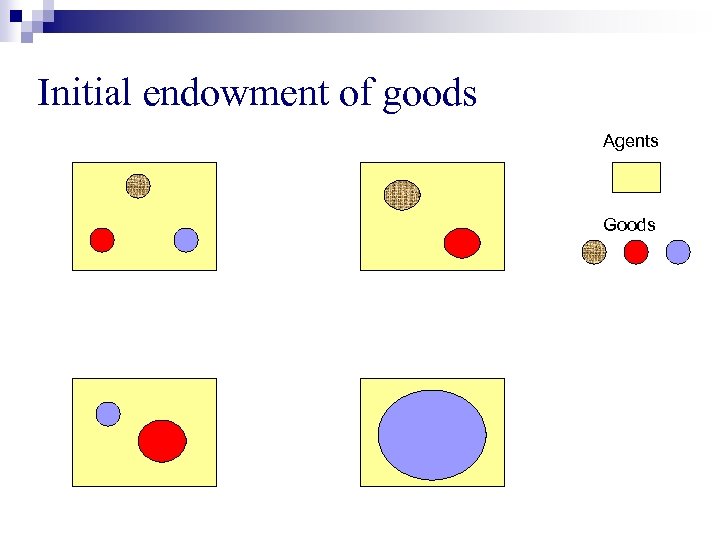

Initial endowment of goods Agents Goods

Initial endowment of goods Agents Goods

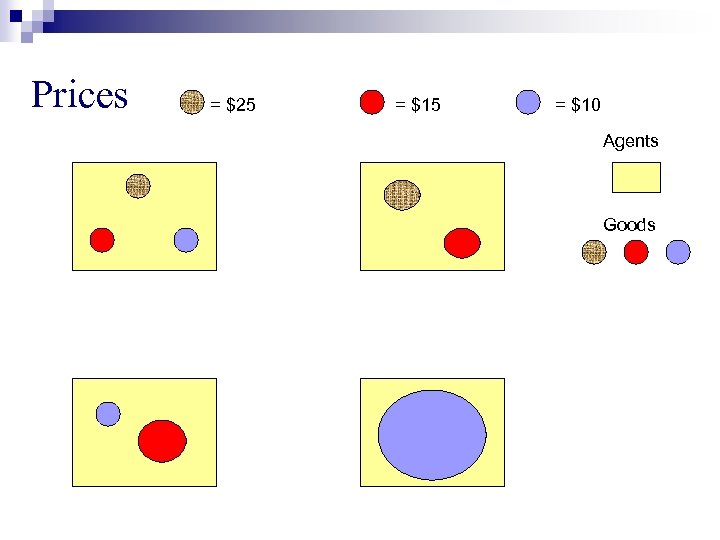

Prices = $25 = $10 Agents Goods

Prices = $25 = $10 Agents Goods

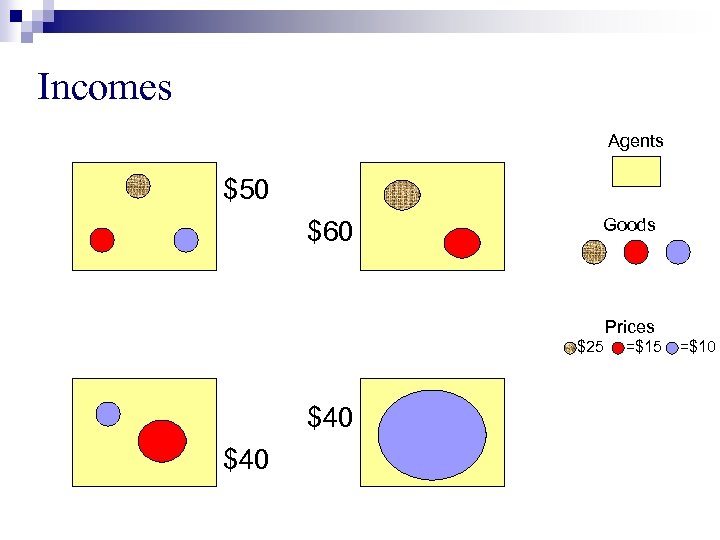

Incomes Agents $50 $60 Goods Prices =$25 $40 =$15 =$10

Incomes Agents $50 $60 Goods Prices =$25 $40 =$15 =$10

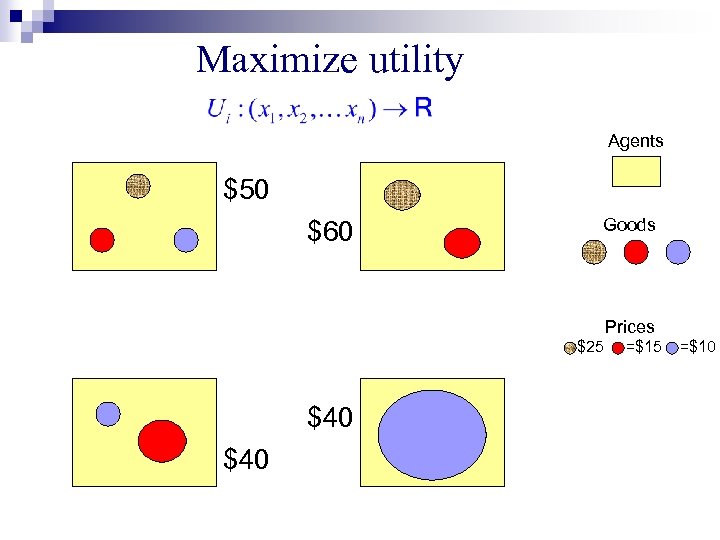

Maximize utility Agents $50 $60 Goods Prices =$25 $40 =$15 =$10

Maximize utility Agents $50 $60 Goods Prices =$25 $40 =$15 =$10

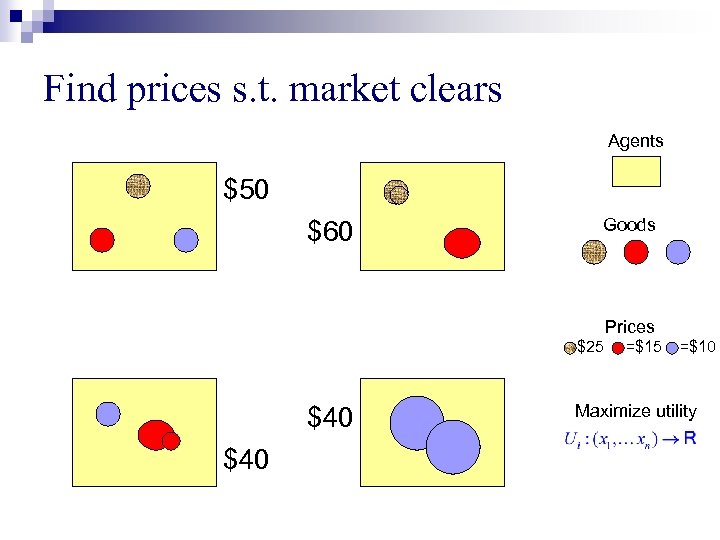

Find prices s. t. market clears Agents $50 $60 Goods Prices =$25 $40 =$15 =$10 Maximize utility

Find prices s. t. market clears Agents $50 $60 Goods Prices =$25 $40 =$15 =$10 Maximize utility

n n n Observe: If p is market clearing prices, then so is any scaling of p Assume w. l. o. g. that sum of prices of k goods is 1. k-1 dimensional unit simplex

n n n Observe: If p is market clearing prices, then so is any scaling of p Assume w. l. o. g. that sum of prices of k goods is 1. k-1 dimensional unit simplex

Arrow-Debreu Theorem n For continuous, monotonic, strictly concave utility functions, market clearing prices exist.

Arrow-Debreu Theorem n For continuous, monotonic, strictly concave utility functions, market clearing prices exist.

Proof n Uses Kakutani’s Fixed Point Theorem. ¨ Deep theorem in topology

Proof n Uses Kakutani’s Fixed Point Theorem. ¨ Deep theorem in topology

Proof n Uses Kakutani’s Fixed Point Theorem. ¨ Deep n theorem in topology Will illustrate main idea via Brouwer’s Fixed Point Theorem (buggy proof!!)

Proof n Uses Kakutani’s Fixed Point Theorem. ¨ Deep n theorem in topology Will illustrate main idea via Brouwer’s Fixed Point Theorem (buggy proof!!)

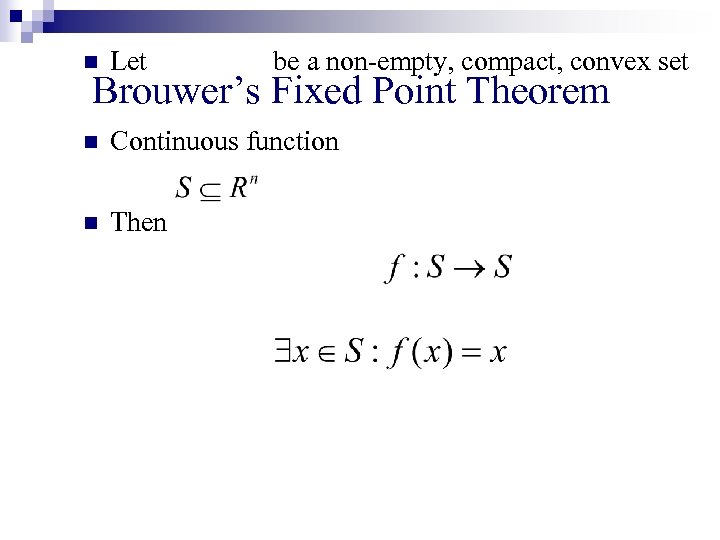

n Let be a non-empty, compact, convex set n Continuous function n Then Brouwer’s Fixed Point Theorem

n Let be a non-empty, compact, convex set n Continuous function n Then Brouwer’s Fixed Point Theorem

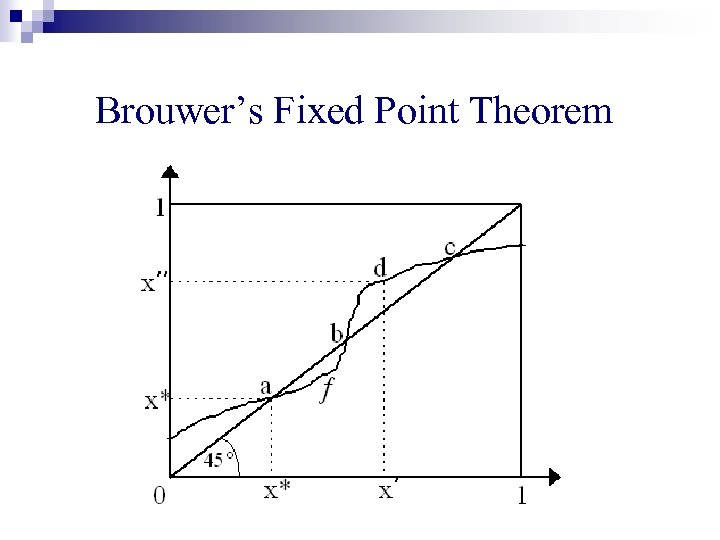

Brouwer’s Fixed Point Theorem

Brouwer’s Fixed Point Theorem

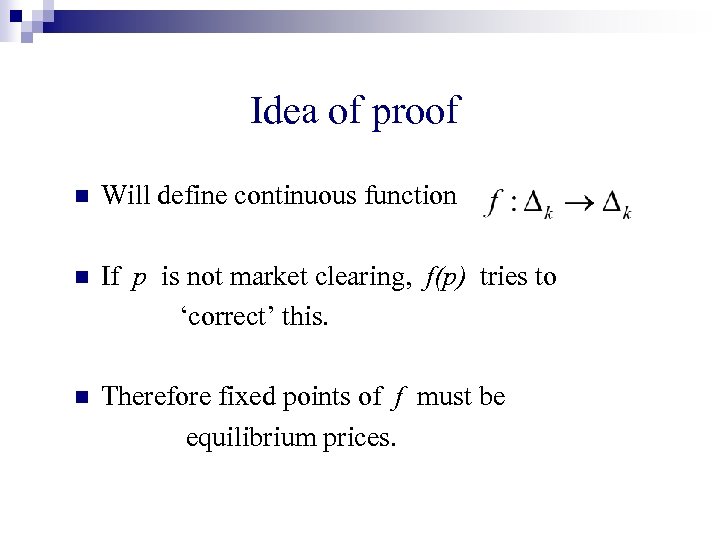

Idea of proof n Will define continuous function n If p is not market clearing, f(p) tries to ‘correct’ this. n Therefore fixed points of f must be equilibrium prices.

Idea of proof n Will define continuous function n If p is not market clearing, f(p) tries to ‘correct’ this. n Therefore fixed points of f must be equilibrium prices.

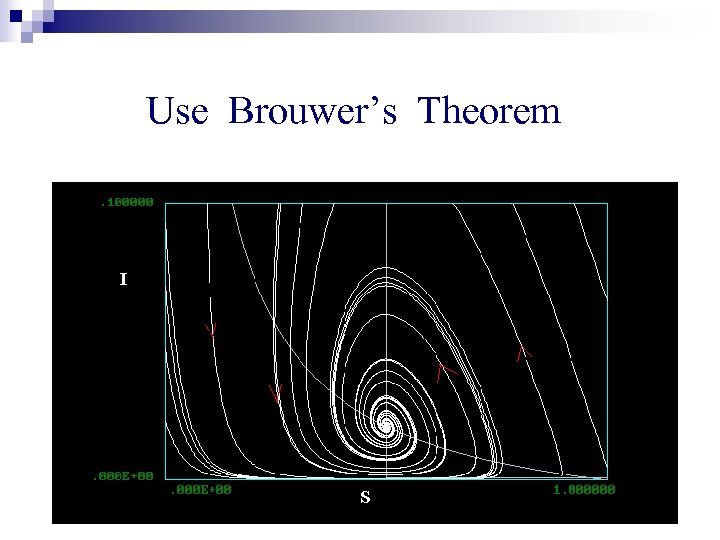

Use Brouwer’s Theorem

Use Brouwer’s Theorem

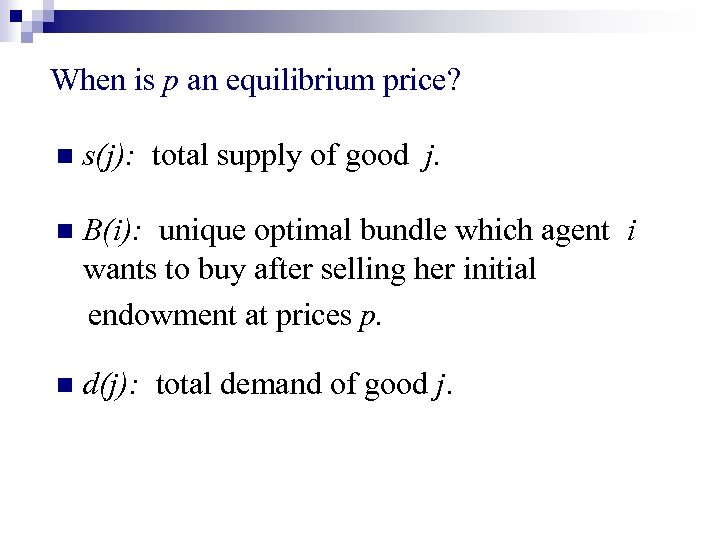

When is p an equilibrium price? n s(j): total supply of good j. n B(i): unique optimal bundle which agent i wants to buy after selling her initial endowment at prices p. n d(j): total demand of good j.

When is p an equilibrium price? n s(j): total supply of good j. n B(i): unique optimal bundle which agent i wants to buy after selling her initial endowment at prices p. n d(j): total demand of good j.

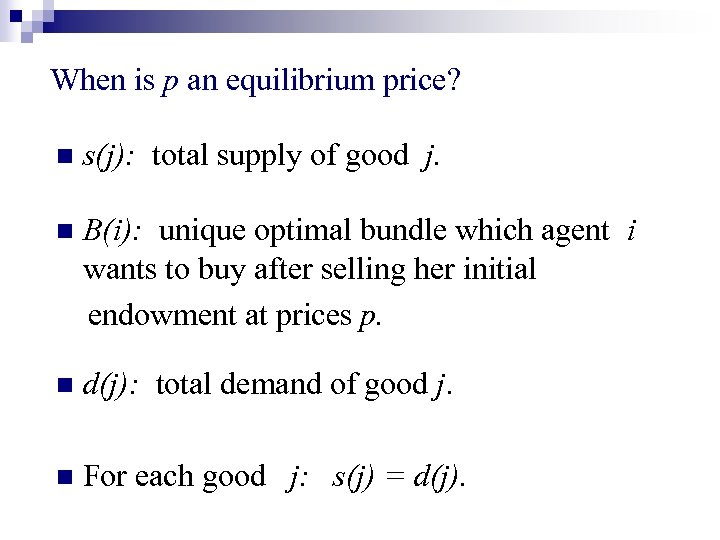

When is p an equilibrium price? n s(j): total supply of good j. n B(i): unique optimal bundle which agent i wants to buy after selling her initial endowment at prices p. n d(j): total demand of good j. n For each good j: s(j) = d(j).

When is p an equilibrium price? n s(j): total supply of good j. n B(i): unique optimal bundle which agent i wants to buy after selling her initial endowment at prices p. n d(j): total demand of good j. n For each good j: s(j) = d(j).

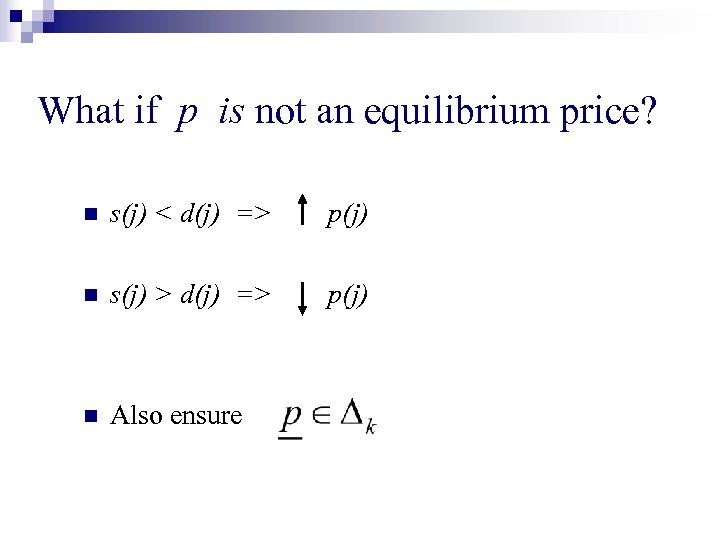

What if p is not an equilibrium price? n s(j) < d(j) => p(j) n s(j) > d(j) => p(j) n Also ensure

What if p is not an equilibrium price? n s(j) < d(j) => p(j) n s(j) > d(j) => p(j) n Also ensure

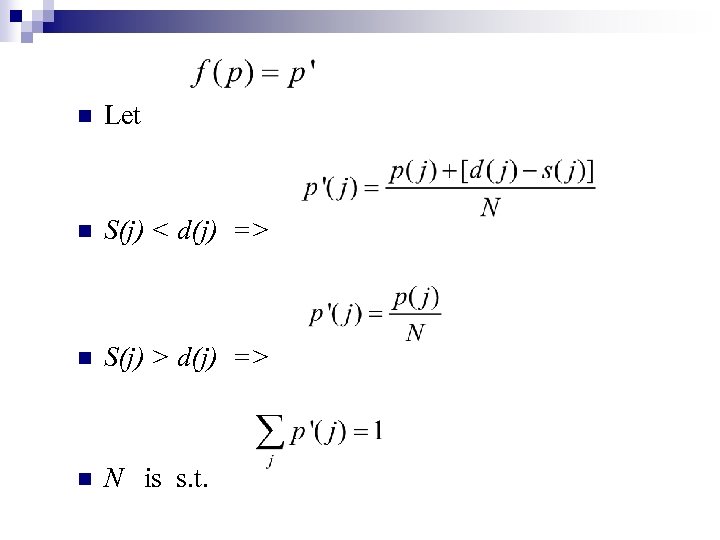

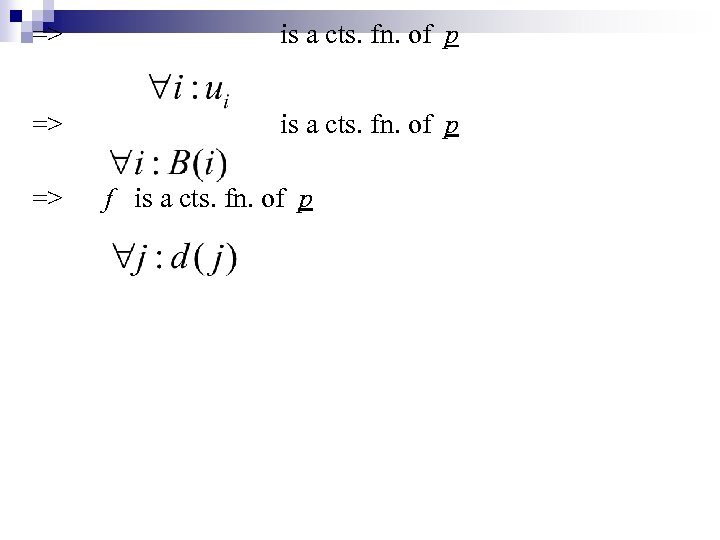

n Let n S(j) < d(j) => n S(j) > d(j) => n N is s. t.

n Let n S(j) < d(j) => n S(j) > d(j) => n N is s. t.

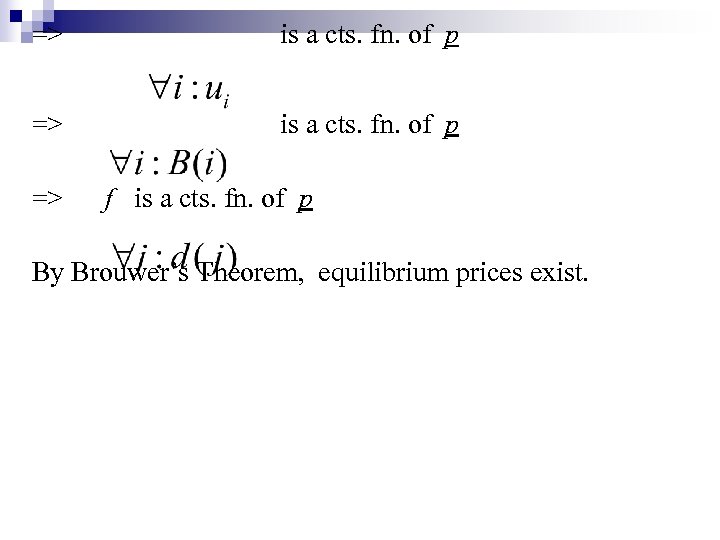

=> is a cts. fn. of p => f is a cts. fn. of p

=> is a cts. fn. of p => f is a cts. fn. of p

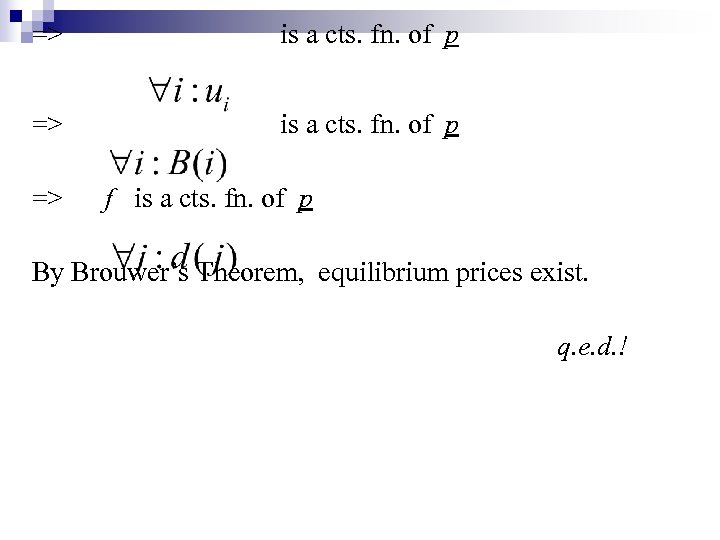

=> is a cts. fn. of p => f is a cts. fn. of p By Brouwer’s Theorem, equilibrium prices exist.

=> is a cts. fn. of p => f is a cts. fn. of p By Brouwer’s Theorem, equilibrium prices exist.

=> is a cts. fn. of p => f is a cts. fn. of p By Brouwer’s Theorem, equilibrium prices exist. q. e. d. !

=> is a cts. fn. of p => f is a cts. fn. of p By Brouwer’s Theorem, equilibrium prices exist. q. e. d. !

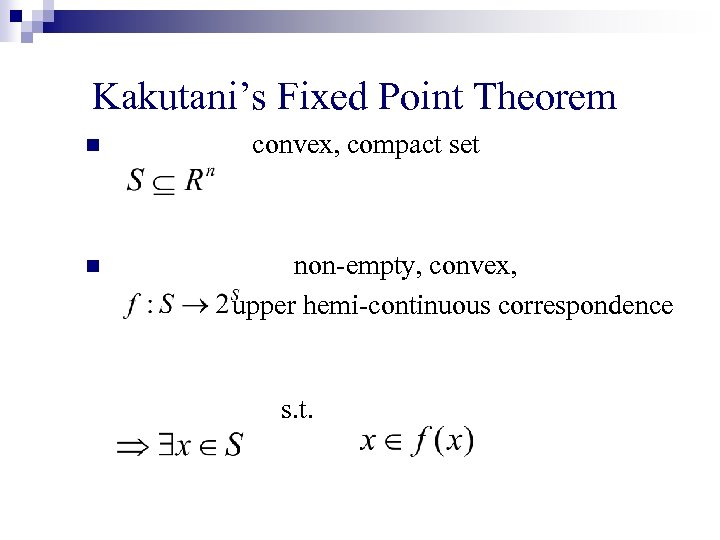

Kakutani’s Fixed Point Theorem n n convex, compact set non-empty, convex, upper hemi-continuous correspondence s. t.

Kakutani’s Fixed Point Theorem n n convex, compact set non-empty, convex, upper hemi-continuous correspondence s. t.

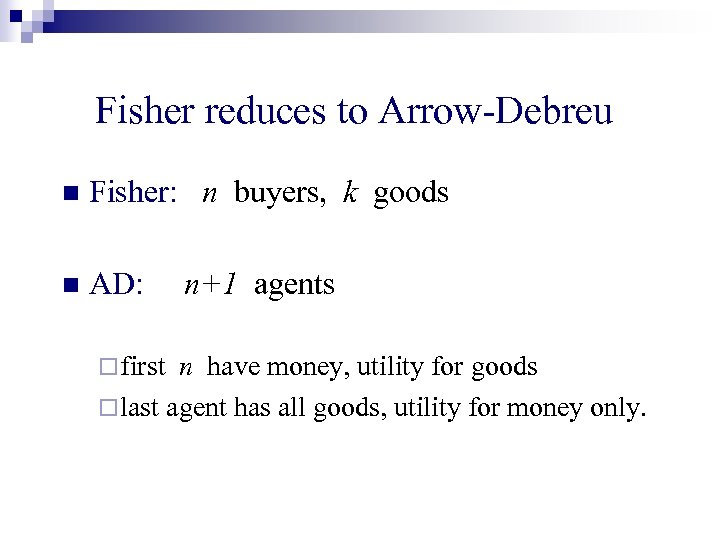

Fisher reduces to Arrow-Debreu n Fisher: n buyers, k goods n AD: ¨ first n+1 agents n have money, utility for goods ¨ last agent has all goods, utility for money only.

Fisher reduces to Arrow-Debreu n Fisher: n buyers, k goods n AD: ¨ first n+1 agents n have money, utility for goods ¨ last agent has all goods, utility for money only.