Algeria.pptx

- Количество слайдов: 17

Algeria's monetary policy Performed by students 1 -2 M: Tahir, Dmitriy, Salah, Pavel, Ruslan

Monetary policy is based on control of the money supply, exchange rates and inflation. The banking system has excess liquidity; savings exceed investment. Progress made in monetary stability and in the control of the banking system has made it possible to establish greater financial stability. In addition, the 2009 recapitalisation of the country’s banks and financial institutions helps consolidate the overall solvency of the system. For several years Algeria has adopted prudent financial and monetary policies, which were bolstered further in 2009 to meet the challenge of the world financial crisis.

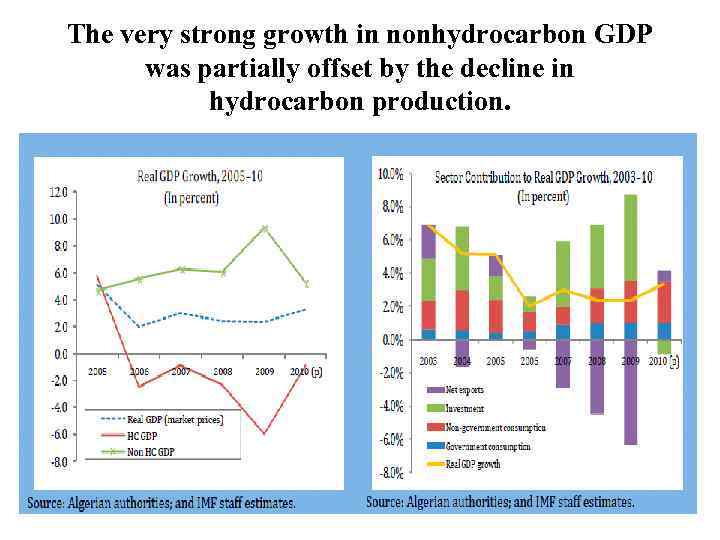

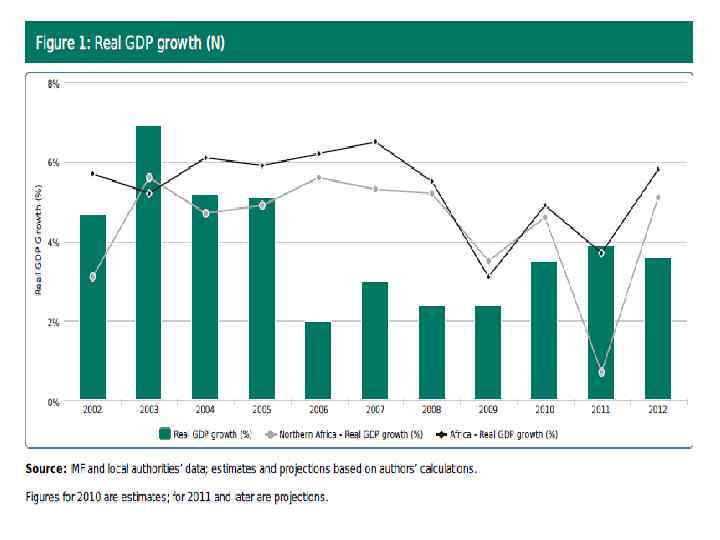

The very strong growth in nonhydrocarbon GDP was partially offset by the decline in hydrocarbon production.

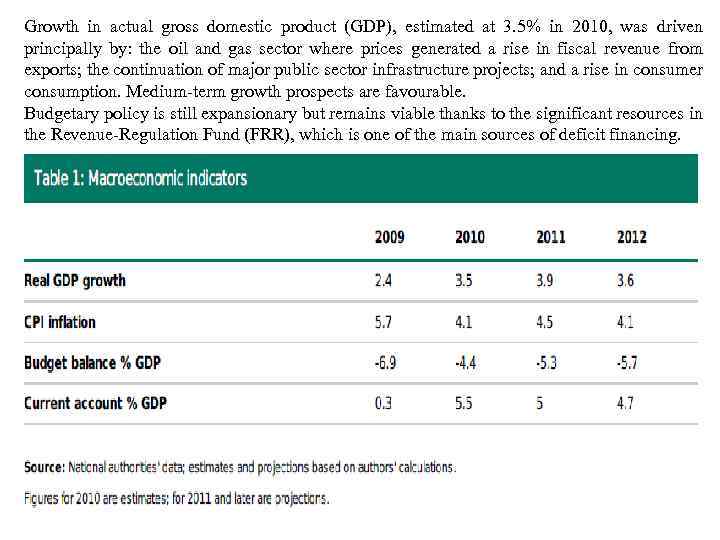

Growth in actual gross domestic product (GDP), estimated at 3. 5% in 2010, was driven principally by: the oil and gas sector where prices generated a rise in fiscal revenue from exports; the continuation of major public sector infrastructure projects; and a rise in consumer consumption. Medium-term growth prospects are favourable. Budgetary policy is still expansionary but remains viable thanks to the significant resources in the Revenue-Regulation Fund (FRR), which is one of the main sources of deficit financing.

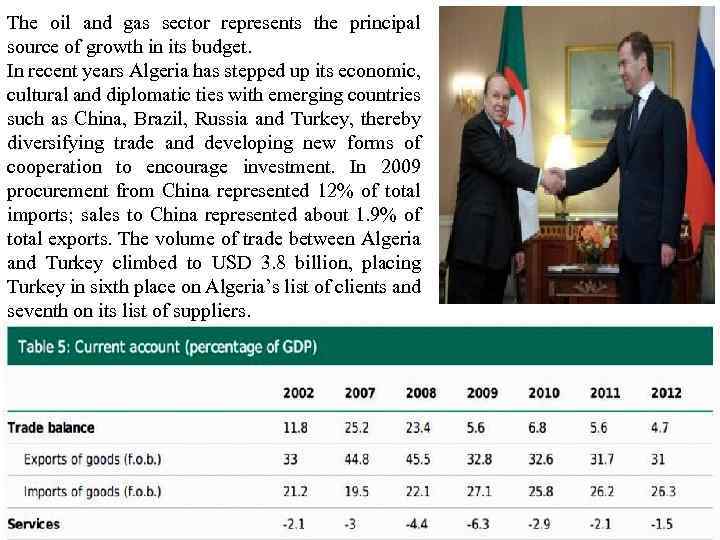

The oil and gas sector represents the principal source of growth in its budget. In recent years Algeria has stepped up its economic, cultural and diplomatic ties with emerging countries such as China, Brazil, Russia and Turkey, thereby diversifying trade and developing new forms of cooperation to encourage investment. In 2009 procurement from China represented 12% of total imports; sales to China represented about 1. 9% of total exports. The volume of trade between Algeria and Turkey climbed to USD 3. 8 billion, placing Turkey in sixth place on Algeria’s list of clients and seventh on its list of suppliers.

Algeria weathered the international crisis relatively well.

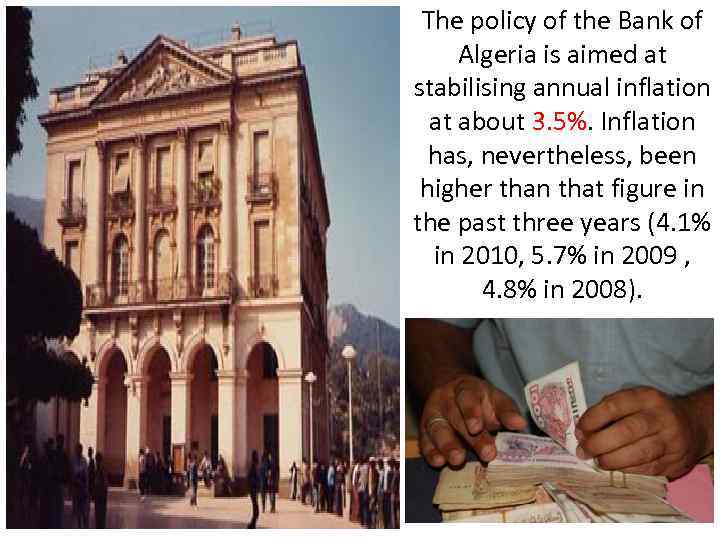

The policy of the Bank of Algeria is aimed at stabilising annual inflation at about 3. 5%. Inflation has, nevertheless, been higher than that figure in the past three years (4. 1% in 2010, 5. 7% in 2009 , 4. 8% in 2008).

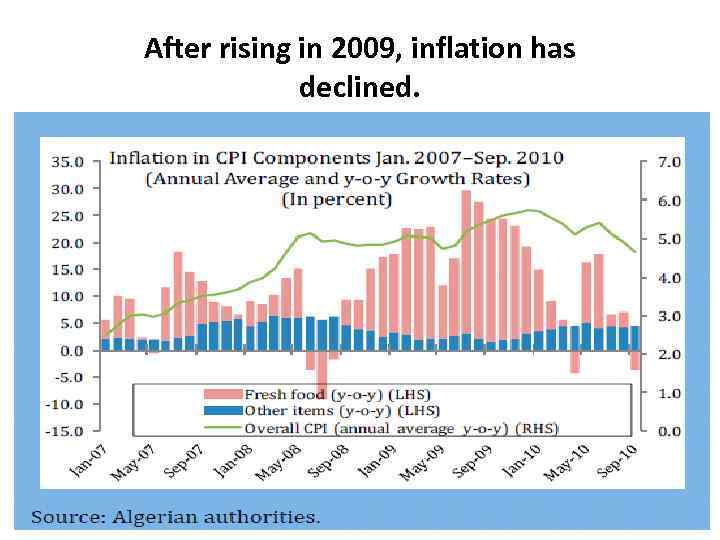

After rising in 2009, inflation has declined.

To determine the value of the Algerian dinar, the monetary authorities control the trend in the real effective exchange rate (REER) to maintain it at its equilibrium level. The exchange rate market is still strongly controlled by the Bank of Algeria, which is the principal supplier of foreign exchange. The exchange rate regime currently in place is characterised by an unannounced controlled flotation of the exchange rate trajectory (a post facto exchange control). The Bank of Algeria also plays a key role in banking supervision and control of prudential ratios and the excessive liquidity of commercial banks.

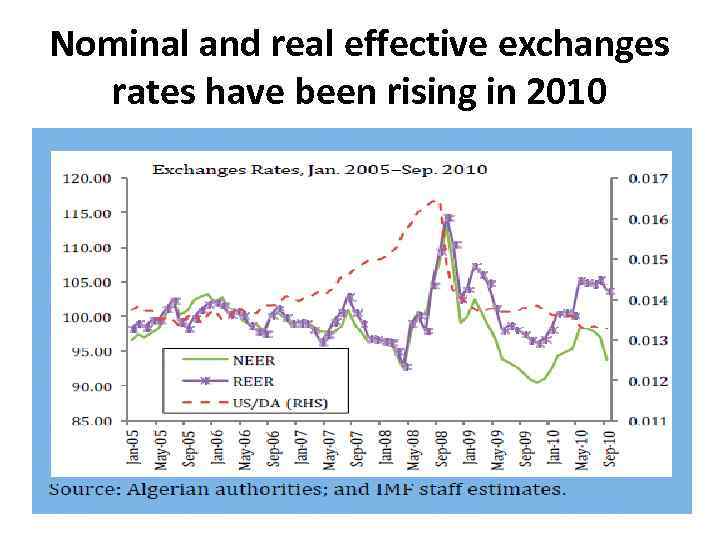

Nominal and real effective exchanges rates have been rising in 2010

The banking sector has had structural excess liquidity since 2002. Indeed, the macroeconomic trend since 2000 has seen the emergence of a surplus of savings over investment. This macroeconomic framework is confirmed by a solid financial position, which has made it possible for the country to resist shocks from outside. The “net external assets” aggregate remained the principal source of monetary creation.

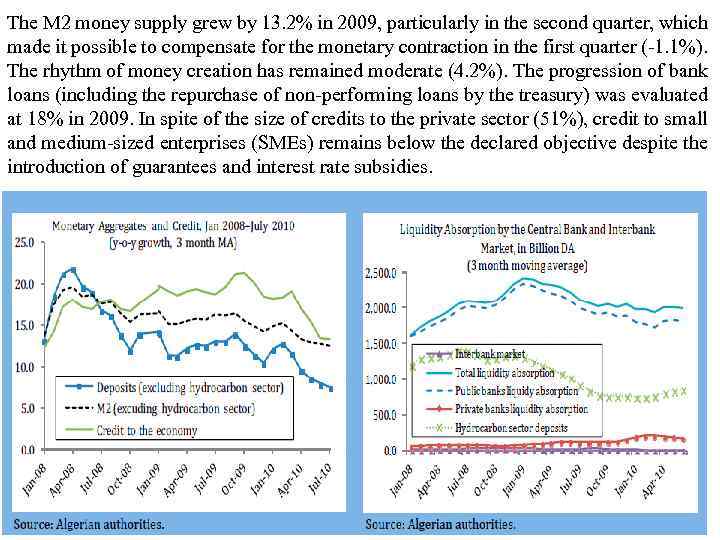

The M 2 money supply grew by 13. 2% in 2009, particularly in the second quarter, which made it possible to compensate for the monetary contraction in the first quarter (-1. 1%). The rhythm of money creation has remained moderate (4. 2%). The progression of bank loans (including the repurchase of non-performing loans by the treasury) was evaluated at 18% in 2009. In spite of the size of credits to the private sector (51%), credit to small and medium-sized enterprises (SMEs) remains below the declared objective despite the introduction of guarantees and interest rate subsidies.

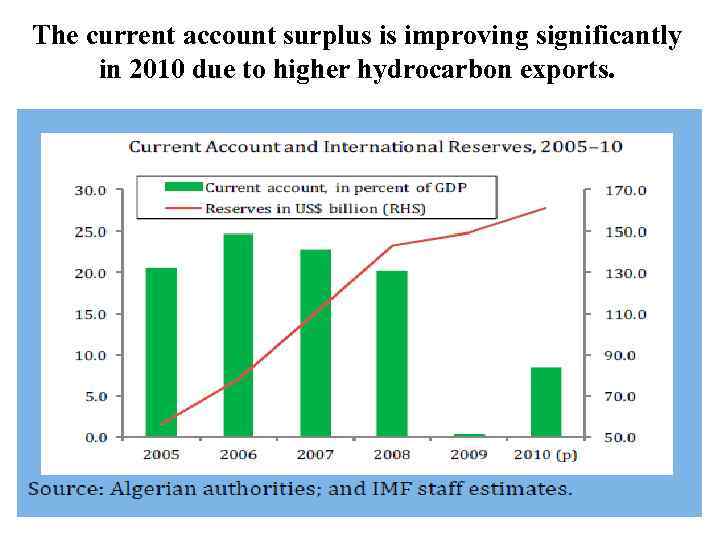

The current account surplus is improving significantly in 2010 due to higher hydrocarbon exports.

SHORT-TERM OUTLOOK The central bank should continue to pursue an exchange rate policy consistent with external stability. The BA should closely monitor developments to minimize the risks of misalignment of the real effective exchange rate, which has remained close to its equilibrium level. The containment of government spending would contribute to reduce pressures for a real appreciation.

SHORT-TERM OUTLOOK The central bank has been able to contain inflationary pressures, but should stand ready to tighten monetary policy promptly if these pressures were to increase. The BA has successfully absorbed the abundant liquidity from high oil revenues and large public spending. To avoid that the significant increase in public wages would push inflation up, the BA should reverse the rate cuts of 2009 and consider increasing the refinancing rate if a stronger signal is needed. Ongoing efforts to refine the instruments for monitoring, assessing and absorbing the abundant liquidity should continue.

Thanks for attention; )

Algeria.pptx