910b01fc6b446087e28e1791f4e9b0ce.ppt

- Количество слайдов: 79

alance of B yments: Pa nalysis and A orecasting F Thorvaldur Gylfason

Outline 1. Balance of payments accounting – How BOP accounts are put together and how they relate to monetary, fiscal, and national income accounts 2. Balance of payments analysis – Economics of exports, imports, exchange rates, etc. 3. Balance of payments forecasting – How to forecast exports, imports, capital flows, etc.

1 Balance of payments accounting Accounting system for macroeconomic analysis, in four parts 1. 2. 3. 4. Balance of payments National income accounts Fiscal accounts Monetary accounts First look at balance of payments accounts, and then look at linkages

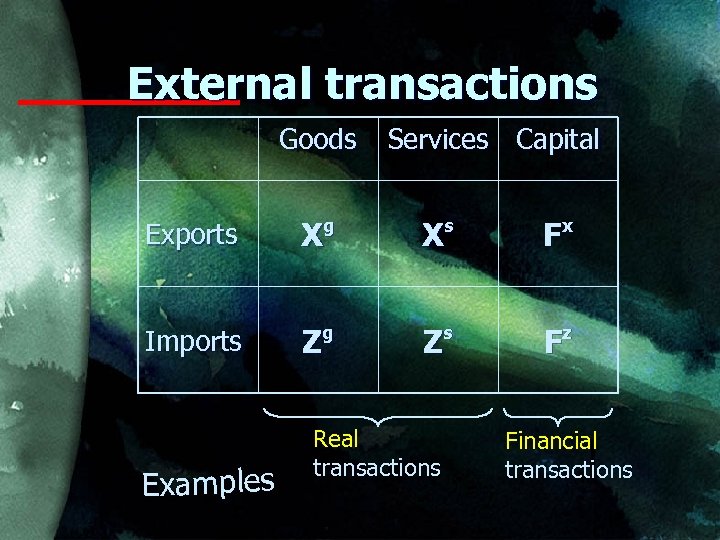

External transactions Goods Services Capital Exports Xg Xs Fx Imports g s z Examples Z Z Real transactions F Financial transactions

Recording external transactions Balance of payments BOP = Xg + Xs + Fx – Zg – Zs – Fz =X–Z+F = current account + capital account Here X = Xg + Xs Exports of good and services Z = Zg + Zs Imports of good and services F = Fx – Fz Net exports of capital = Net capital inflow

Recording external transactions Balance of payments BOP = Xg + Xs + Fx – Zg – Zs – Fz =X–Z+F = current account + capital account Here X = Xg + Xs Exports of good and services Z = Zg + Zs Imports of good and services F = Fx – Fz Net exports of capital = Net capital inflow

Recording external transactions Balance of payments BOP = Xg + Xs + Fx – Zg – Zs – Fz =X–Z+F = current account + capital account Here X = Xg + Xs Exports of good and services Z = Zg + Zs Imports of good and services F = Fx – Fz Net exports of capital = Net capital inflow

Recording external transactions Balance of payments BOP = Xg + Xs + Fx – Zg – Zs – Fz =X–Z+F = current account + capital account Here X = Xg + Xs Exports of good and services Z = Zg + Zs Imports of good and services F = Fx – Fz Net exports of capital = Net capital inflow

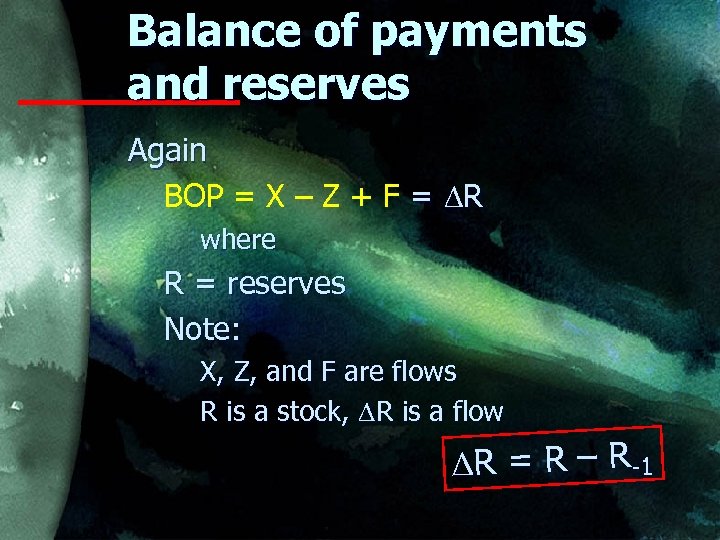

Balance of payments and reserves Again BOP = X – Z + F = R where R = reserves Note: X, Z, and F are flows R is a stock, R is a flow R = R – R-1

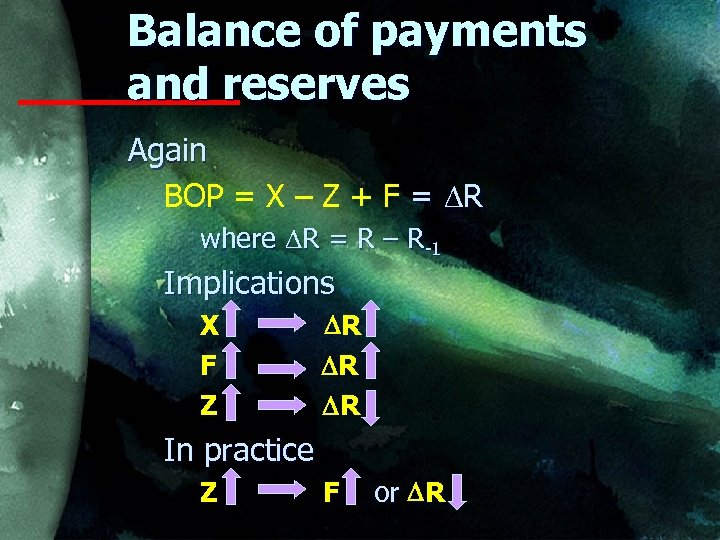

Balance of payments and reserves Again BOP = X – Z + F = R where R = R – R-1 Implications X F Z DR DR DR In practice Z F or DR

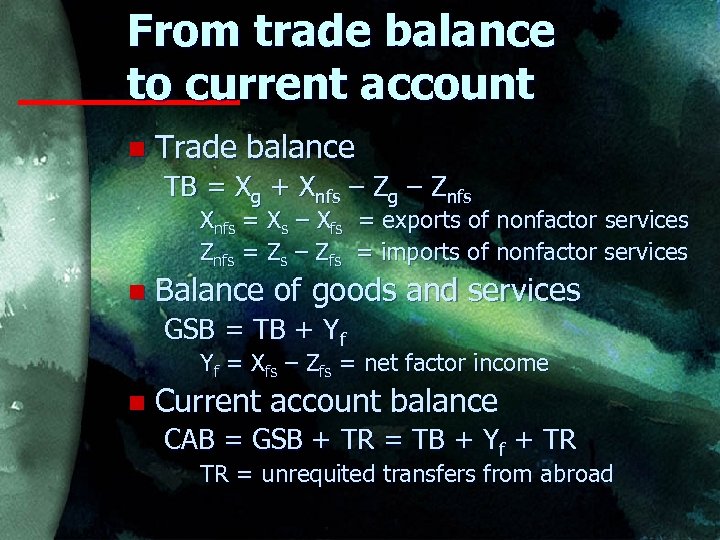

From trade balance to current account n Trade balance TB = Xg + Xnfs – Zg – Znfs Xnfs = Xs – Xfs = exports of nonfactor services Znfs = Zs – Zfs = imports of nonfactor services n Balance of goods and services GSB = TB + Yf Yf = Xfs – Zfs = net factor income n Current account balance CAB = GSB + TR = TB + Yf + TR TR = unrequited transfers from abroad

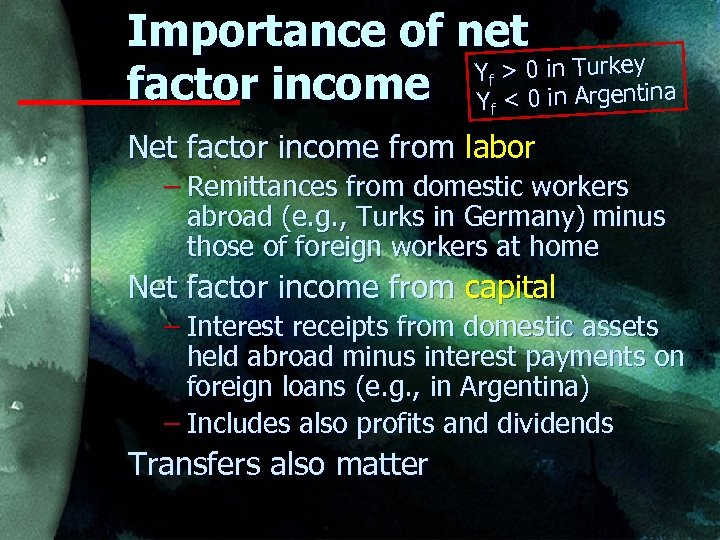

Importance of net Y > 0 in Turkey factor income Y < 0 in Argentina f f Net factor income from labor – Remittances from domestic workers abroad (e. g. , Turks in Germany) minus those of foreign workers at home Net factor income from capital – Interest receipts from domestic assets held abroad minus interest payments on foreign loans (e. g. , in Argentina) – Includes also profits and dividends Transfers also matter

Capital account Also called capital and financial account Four main items 1. Direct investment – Involves control by owners 2. Portfolio investment – – Includes long-term foreign borrowing Does not involve control by owners 3. Other investment – Includes short-term borrowing 4. Errors and omissions – Statistical discrepancy

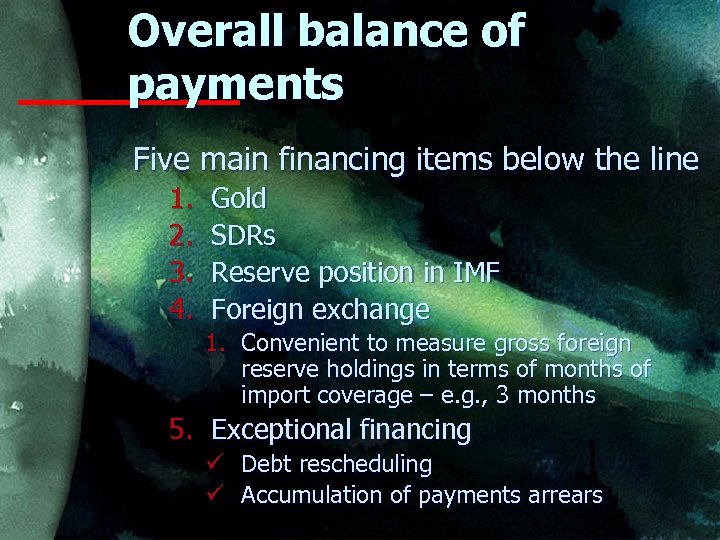

Overall balance of payments Five main financing items below the line 1. 2. 3. 4. Gold SDRs Reserve position in IMF Foreign exchange 1. Convenient to measure gross foreign reserve holdings in terms of months of import coverage – e. g. , 3 months 5. Exceptional financing ü ü Debt rescheduling Accumulation of payments arrears

Overall balance of payments Five ways to finance a BOP deficit 1. 2. 3. 4. Drawing on gold reserves Using SDRs Using IMF resources Running down foreign exchange reserves 1. … by running down foreign assets or accumulating foreign liabilities 5. Resorting to exceptional financing ü Deferring debt repayments via rescheduling or accumulation of arrears

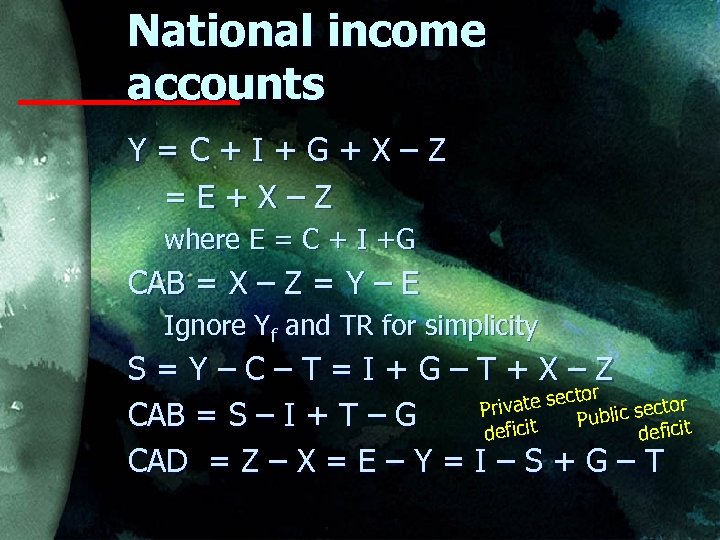

National income accounts Y=C+I+G+X–Z =E+X–Z where E = C + I +G CAB = X – Z = Y – E Ignore Yf and TR for simplicity S=Y–C–T=I+G–T+X–Z or ate sect lic sector Priv CAB = S – I + T – G Pub cit deficit CAD = Z – X = E – Y = I – S + G – T

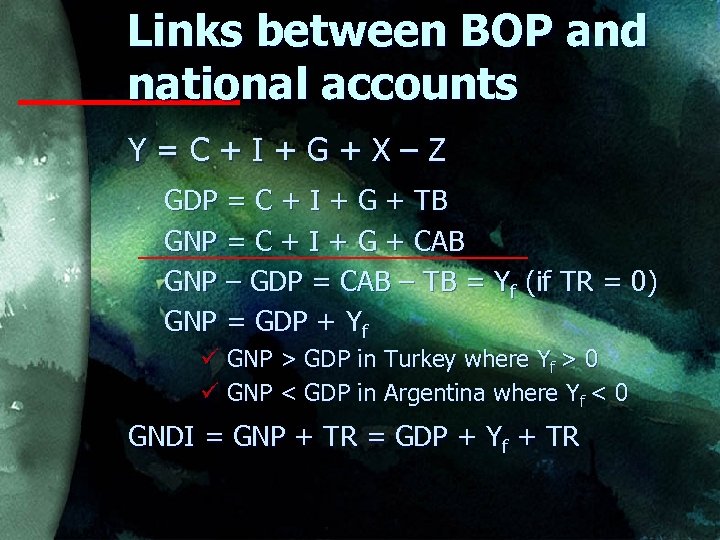

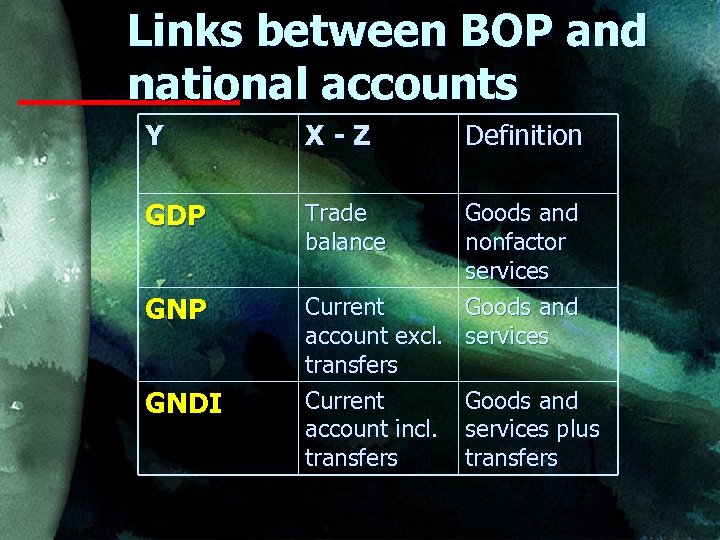

Links between BOP and national accounts Y=C+I+G+X–Z GDP = C + I + G + TB GNP = C + I + G + CAB GNP – GDP = CAB – TB = Yf (if TR = 0) GNP = GDP + Yf ü GNP > GDP in Turkey where Yf > 0 ü GNP < GDP in Argentina where Yf < 0 GNDI = GNP + TR = GDP + Yf + TR

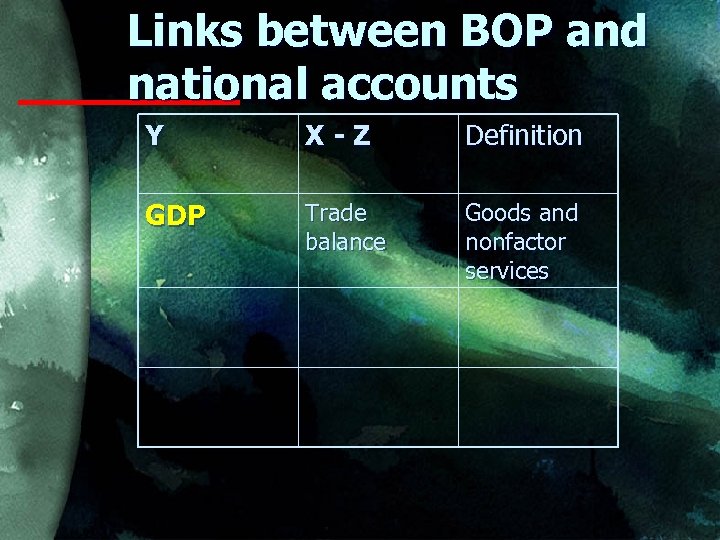

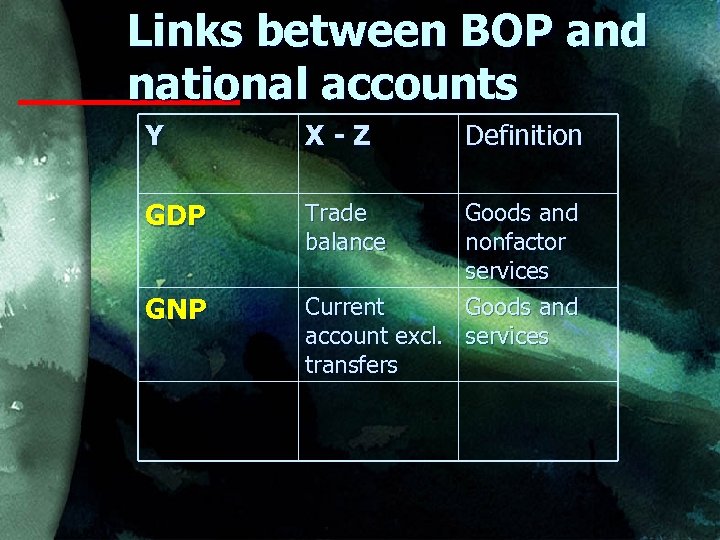

Links between BOP and national accounts Y X-Z Definition GDP Trade balance Goods and nonfactor services

Links between BOP and national accounts Y X-Z GDP Trade balance GNP Definition Goods and nonfactor services Current Goods and account excl. services transfers

Links between BOP and national accounts Y X-Z GDP Trade balance GNP GNDI Definition Goods and nonfactor services Current Goods and account excl. services transfers Current Goods and account incl. services plus transfers

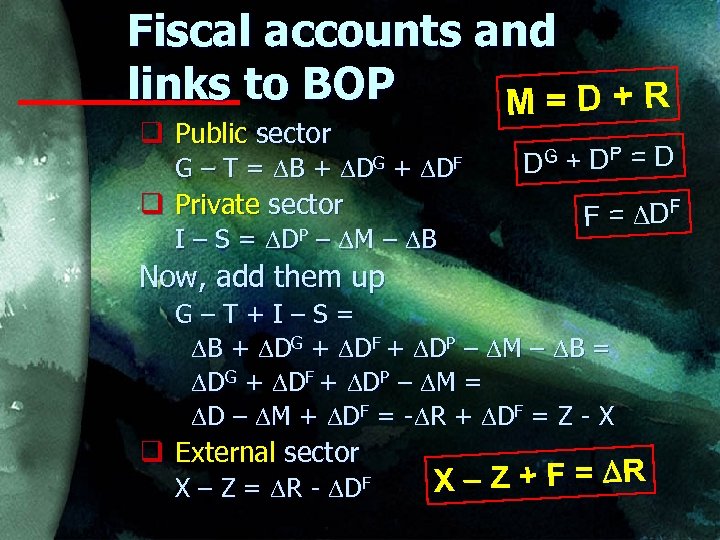

Fiscal accounts and links to BOP M=D+R q Public sector G – T = B + DG + DF q Private sector I – S = DP – M – B + DP = D D G F = DF Now, add them up G–T+I–S= B + DG + DF + DP – M – B = DG + DF + DP – M = D – M + DF = - R + DF = Z - X q External sector X – Z = R - DF X – Z + F = DR

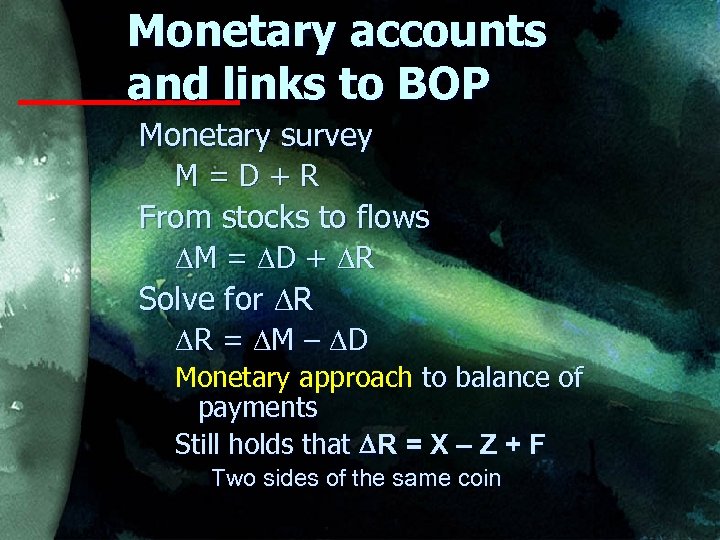

Monetary accounts and links to BOP Monetary survey M=D+R From stocks to flows M = D + R Solve for R R = M – D Monetary approach to balance of payments Still holds that DR = X – Z + F Two sides of the same coin

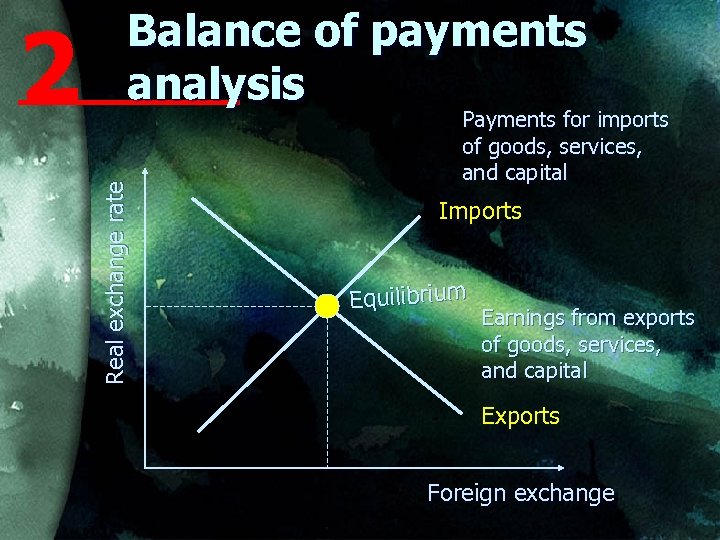

Real exchange rate 2 Balance of payments analysis Payments for imports of goods, services, and capital Imports Equilibrium Earnings from exports of goods, services, and capital Exports Foreign exchange

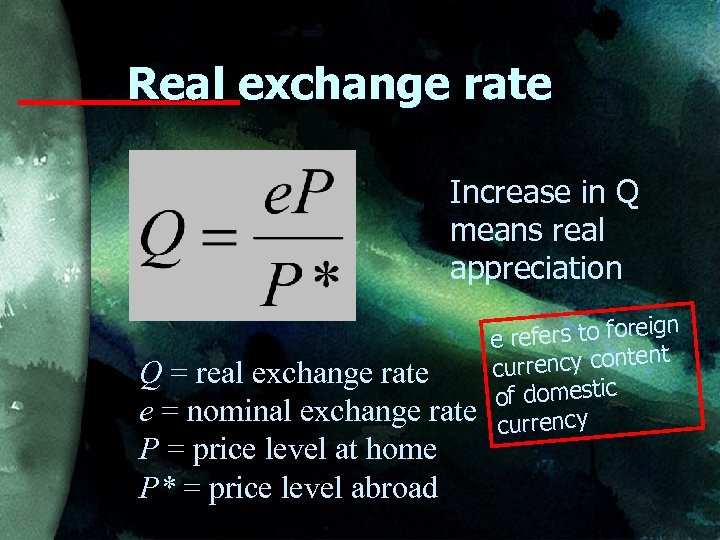

Real exchange rate Increase in Q means real appreciation Q = real exchange rate e = nominal exchange rate P = price level at home P* = price level abroad ign refers to fore e nt urrency conte c of domestic currency

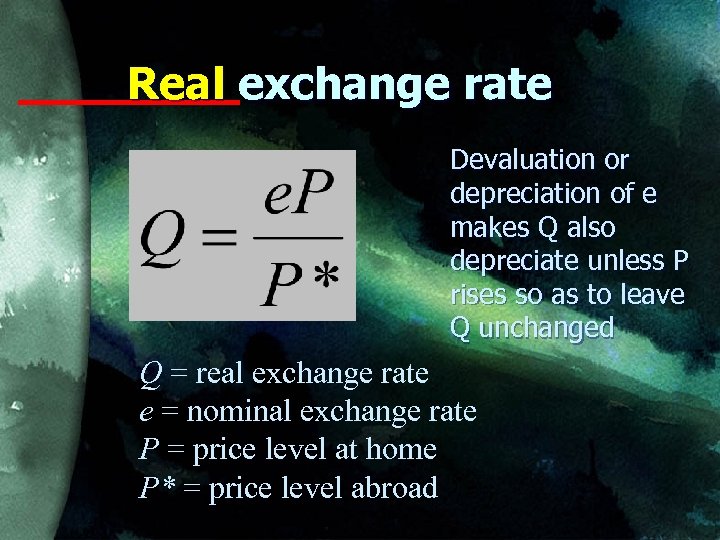

Real exchange rate Devaluation or depreciation of e makes Q also depreciate unless P rises so as to leave Q unchanged Q = real exchange rate e = nominal exchange rate P = price level at home P* = price level abroad

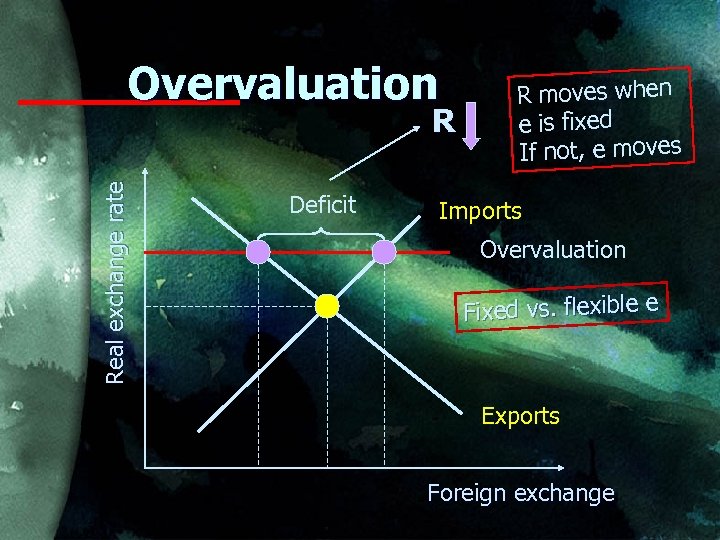

Overvaluation Real exchange rate R Deficit R moves when e is fixed If not, e moves Imports Overvaluation Fixed vs. flexible e Exports Foreign exchange

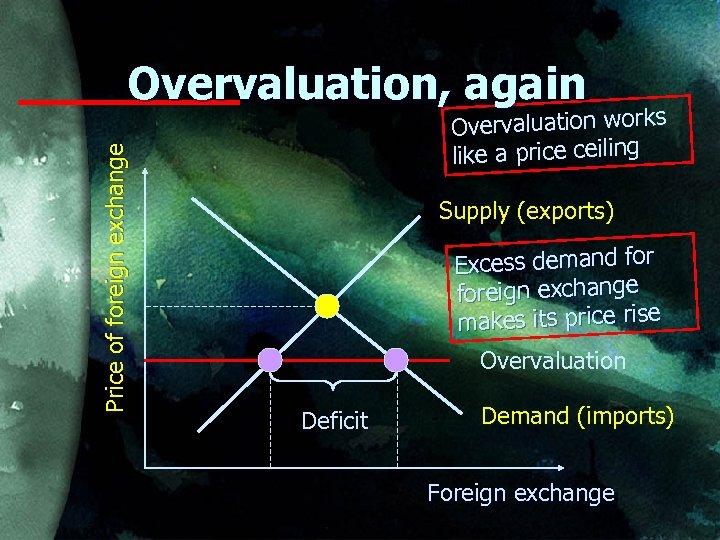

Price of foreign exchange Overvaluation, again Overvaluation works like a price ceiling Supply (exports) Excess demand foreign exchange makes its price rise Overvaluation Deficit Demand (imports) Foreign exchange

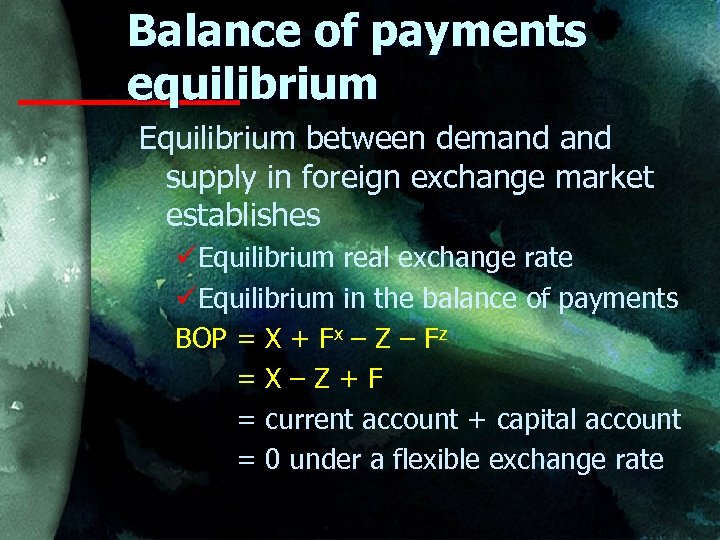

Balance of payments equilibrium Equilibrium between demand supply in foreign exchange market establishes üEquilibrium real exchange rate üEquilibrium in the balance of payments BOP = X + Fx – Z – Fz =X–Z+F = current account + capital account = 0 under a flexible exchange rate

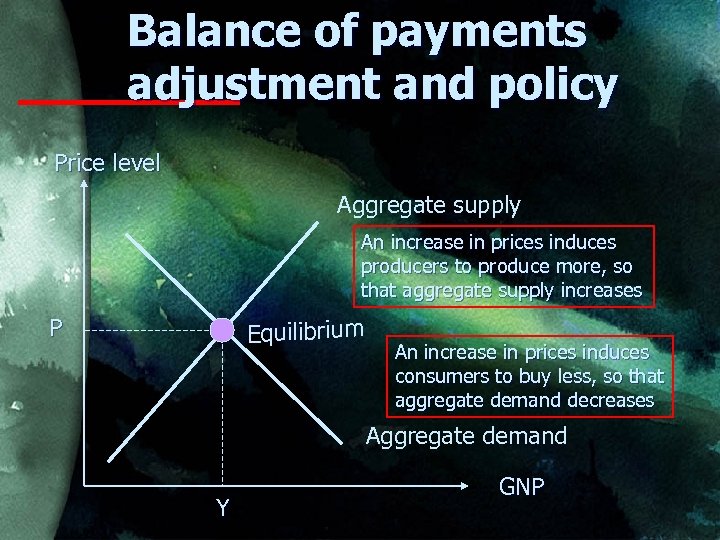

Balance of payments adjustment and policy Price level Aggregate supply An increase in prices induces producers to produce more, so that aggregate supply increases P Equilibrium An increase in prices induces consumers to buy less, so that aggregate demand decreases Aggregate demand Y GNP

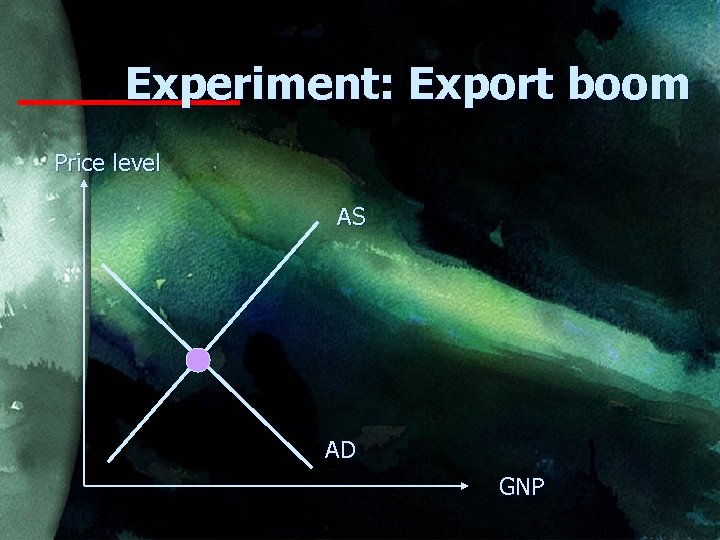

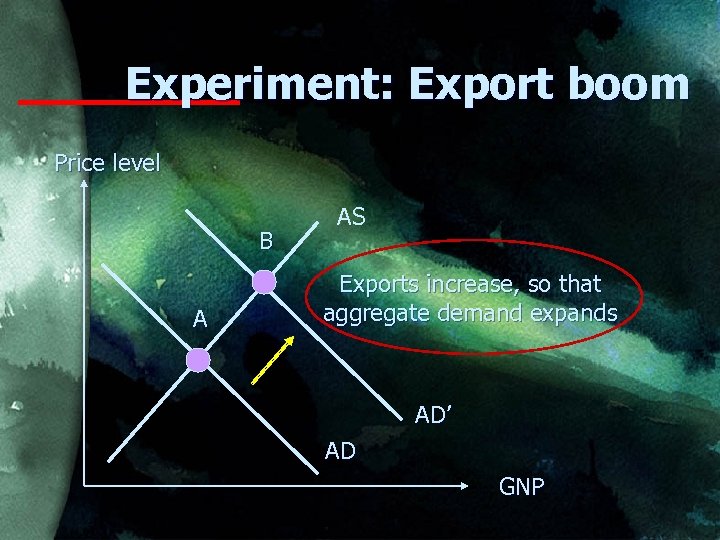

Experiment: Export boom Price level AS AD GNP

Experiment: Export boom Price level B A AS Exports increase, so that aggregate demand expands AD’ AD GNP

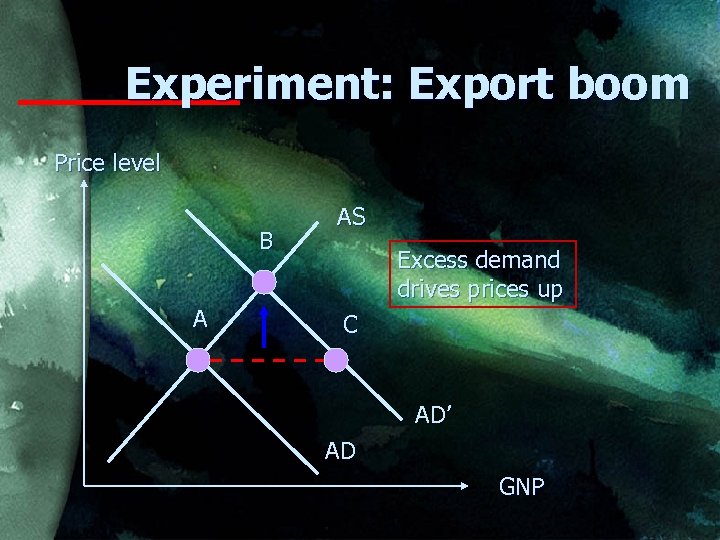

Experiment: Export boom Price level B A AS Excess demand drives prices up C AD’ AD GNP

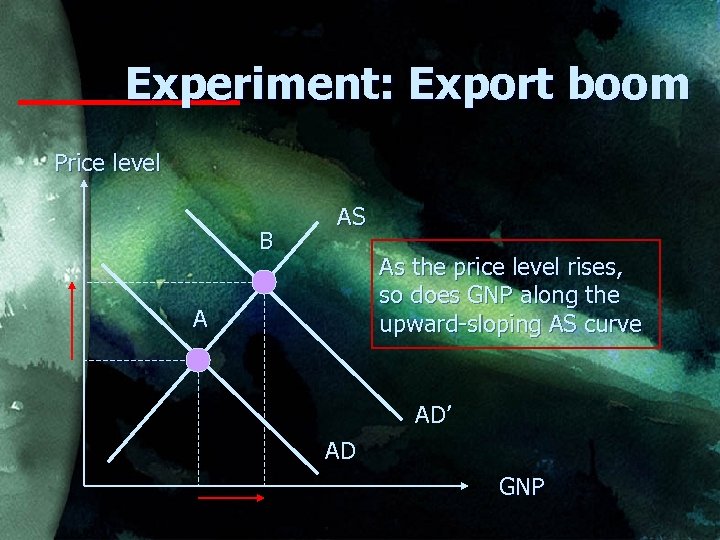

Experiment: Export boom Price level B AS As the price level rises, so does GNP along the upward-sloping AS curve A AD’ AD GNP

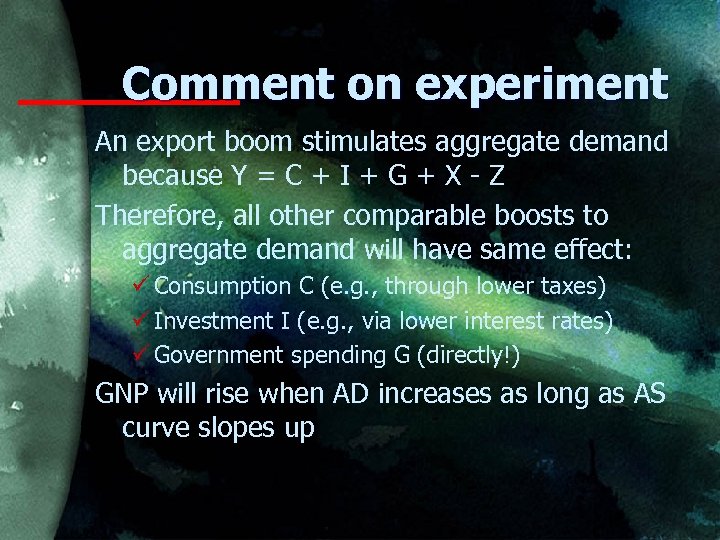

Comment on experiment An export boom stimulates aggregate demand because Y = C + I + G + X - Z Therefore, all other comparable boosts to aggregate demand will have same effect: ü Consumption C (e. g. , through lower taxes) ü Investment I (e. g. , via lower interest rates) ü Government spending G (directly!) GNP will rise when AD increases as long as AS curve slopes up

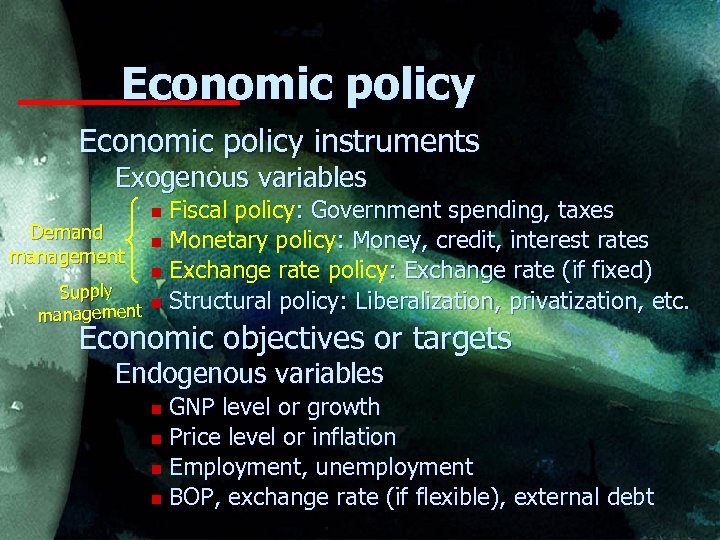

Economic policy instruments Exogenous variables Demand management Supply management Fiscal policy: Government spending, taxes n Monetary policy: Money, credit, interest rates n Exchange rate policy: Exchange rate (if fixed) n Structural policy: Liberalization, privatization, etc. n Economic objectives or targets Endogenous variables GNP level or growth n Price level or inflation n Employment, unemployment n BOP, exchange rate (if flexible), external debt n

Aims of economic policy Apply policy instruments to attain given economic objectives External balance: conduct monetary, fiscal, balance and exchange rate policy so as to make the balance of payments position sustainable ü Key to financial programming ü Not only crisis management in short run Internal balance: conduct policy so as to balance foster rapid, sustainable economic growth with low inflation and unemployment 1. Key to economic and social prosperity

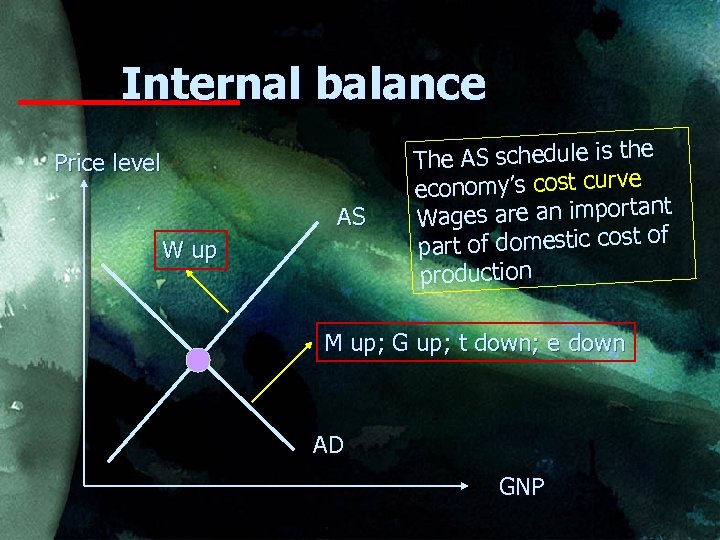

Internal balance Price level AS W up The AS schedule is the economy’s cost curve nt Wages are an importa of part of domestic cost production M up; G up; t down; e down AD GNP

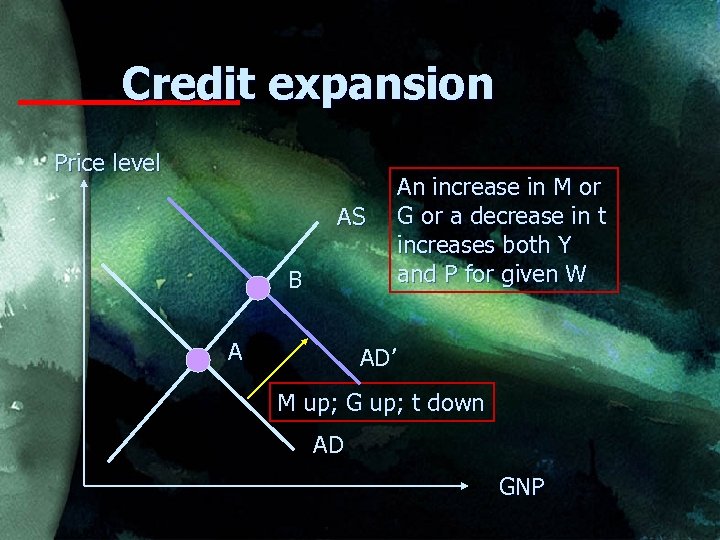

Credit expansion Price level AS B A An increase in M or G or a decrease in t increases both Y and P for given W AD’ M up; G up; t down AD GNP

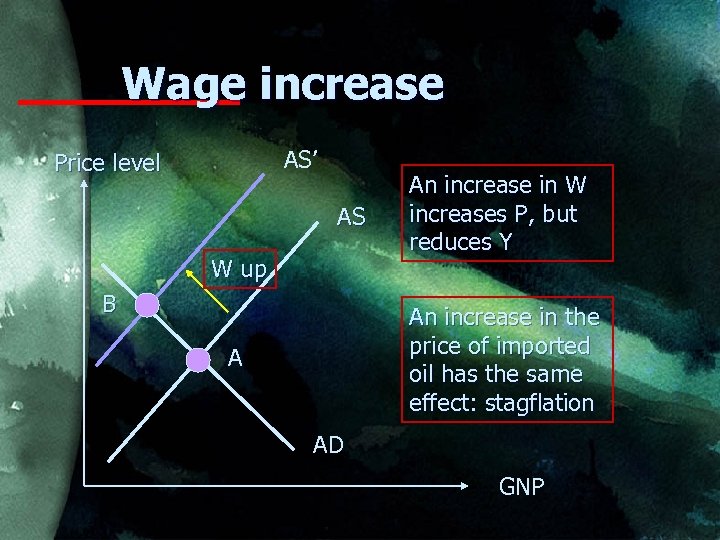

Wage increase AS’ Price level AS W up B An increase in W increases P, but reduces Y An increase in the price of imported oil has the same effect: stagflation A AD GNP

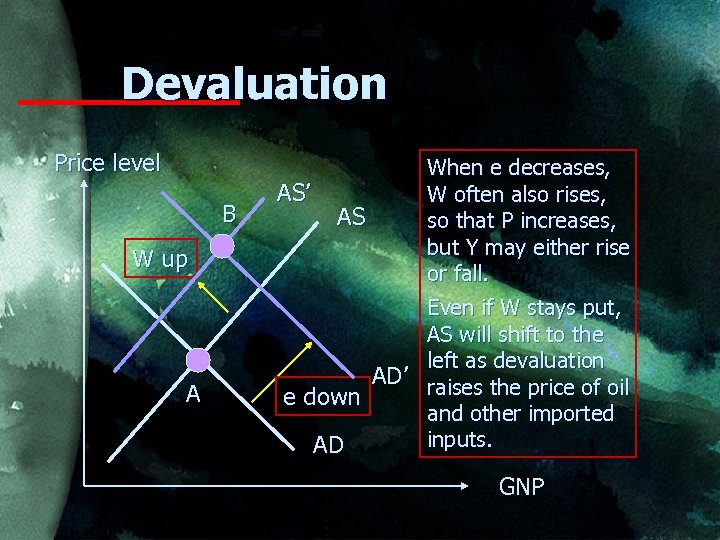

Devaluation Price level B W up A AS’ AS When e decreases, W often also rises, so that P increases, but Y may either rise or fall. Even if W stays put, AS will shift to the left as devaluation AD’ raises the price of oil e down and other imported inputs. AD GNP

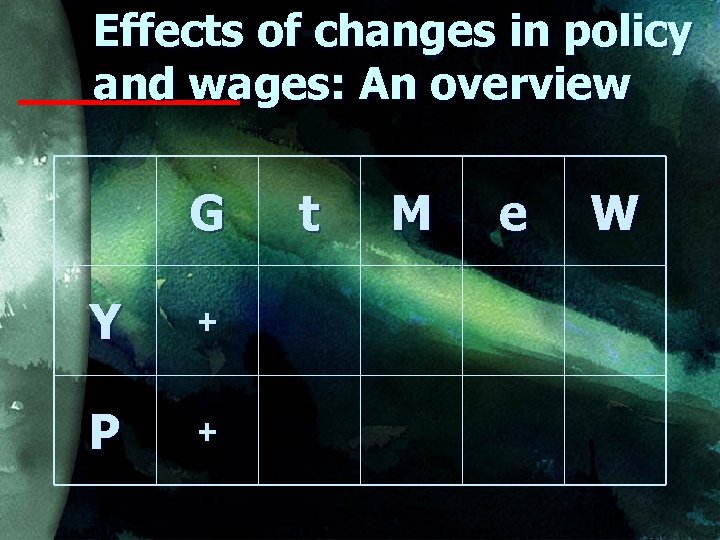

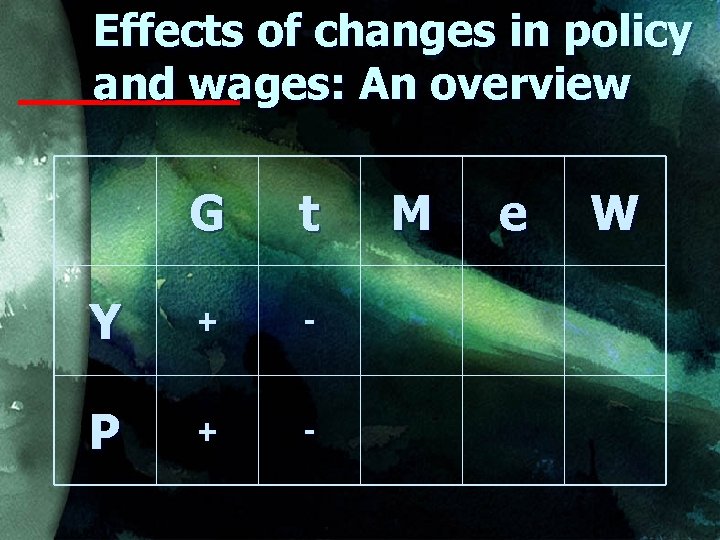

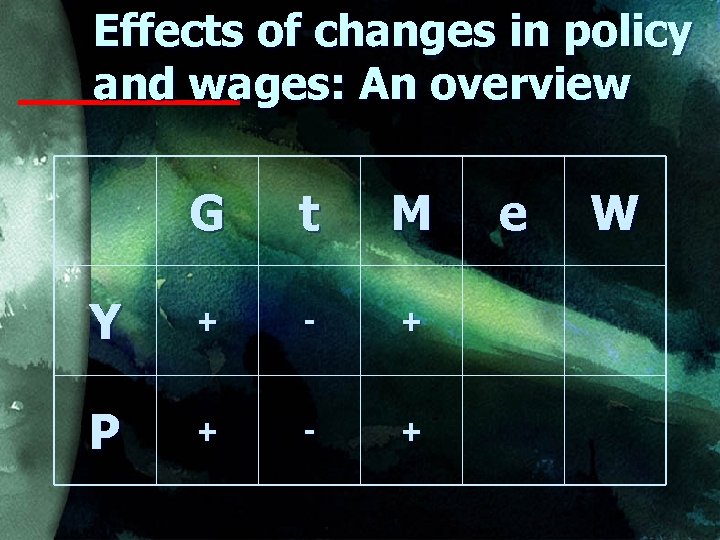

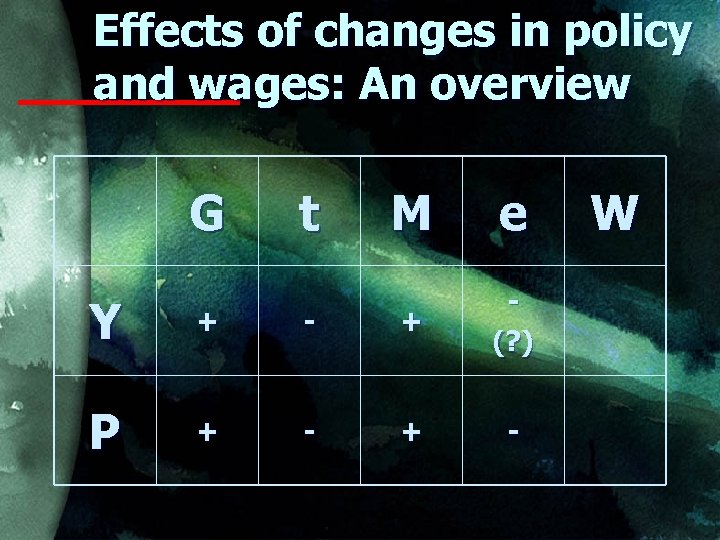

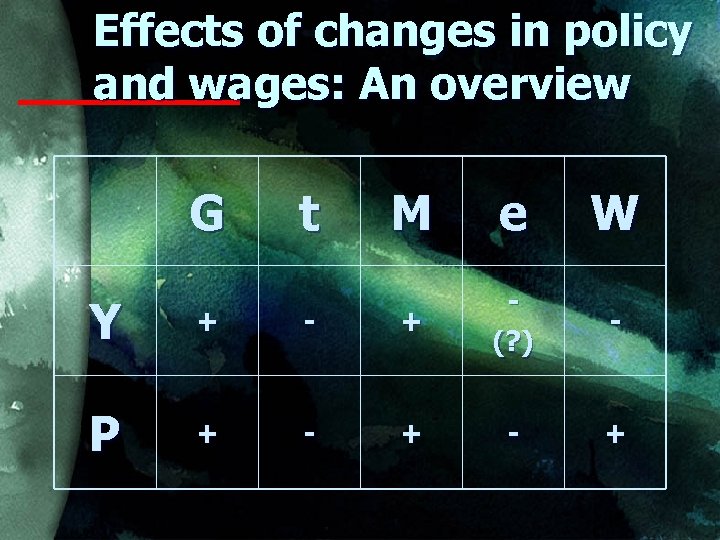

Effects of changes in policy and wages: An overview G Y + P + t M e W

Effects of changes in policy and wages: An overview G t Y + - P + - M e W

Effects of changes in policy and wages: An overview G t M Y + - + P + - + e W

Effects of changes in policy and wages: An overview G t M e Y + - + (? ) P + - W

Effects of changes in policy and wages: An overview G t M e W - + Y + - + (? ) P + -

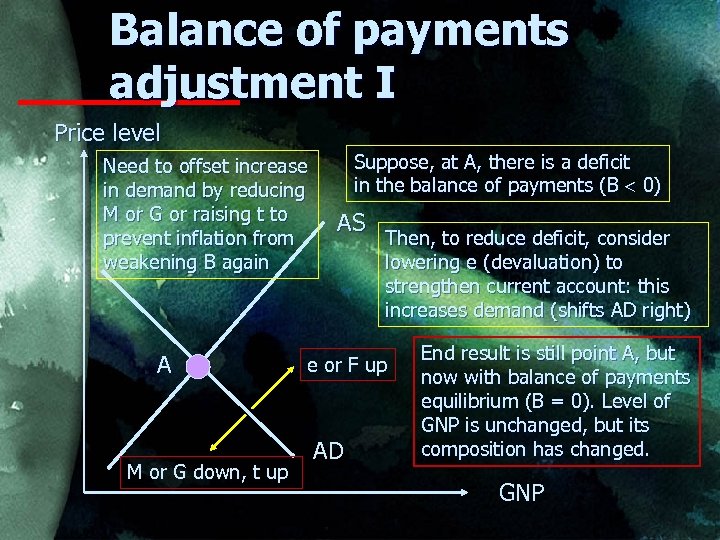

Balance of payments adjustment I Price level Need to offset increase in demand by reducing M or G or raising t to prevent inflation from weakening B again A M or G down, t up Suppose, at A, there is a deficit in the balance of payments (B 0) AS Then, to reduce deficit, consider lowering e (devaluation) to strengthen current account: this increases demand (shifts AD right) e or F up AD End result is still point A, but now with balance of payments equilibrium (B = 0). Level of GNP is unchanged, but its composition has changed. GNP

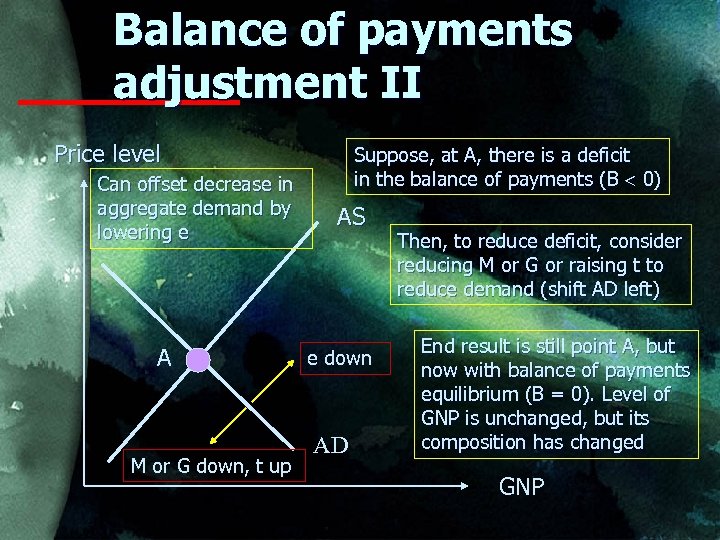

Balance of payments adjustment II Price level Can offset decrease in aggregate demand by lowering e A M or G down, t up Suppose, at A, there is a deficit in the balance of payments (B 0) AS e down AD Then, to reduce deficit, consider reducing M or G or raising t to reduce demand (shift AD left) End result is still point A, but now with balance of payments equilibrium (B = 0). Level of GNP is unchanged, but its composition has changed GNP

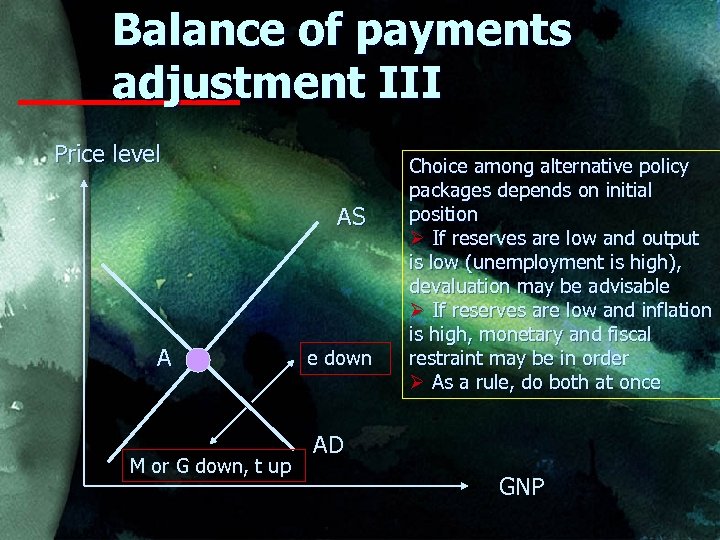

Balance of payments adjustment III Price level AS A M or G down, t up e down Choice among alternative policy packages depends on initial position Ø If reserves are low and output is low (unemployment is high), devaluation may be advisable Ø If reserves are low and inflation is high, monetary and fiscal restraint may be in order Ø As a rule, do both at once AD GNP

3 Balance of payments rio forecasting The baseline scen, abasisdaon e gram Task at hand financial pro e policies already in plac q Develop financial program for 2000 q Use information available up 1999, plus forecasts Two steps q Prepare baseline scenario assuming unchanged economic policy q If baseline scenario is unsatisfactory, then design financial program with better policies and better results

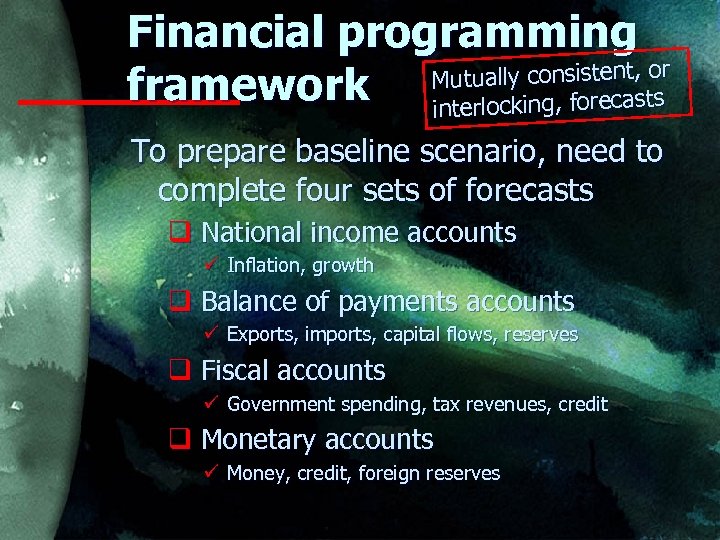

Financial programming r Mutually consistent, o framework interlocking, forecasts To prepare baseline scenario, need to complete four sets of forecasts q National income accounts ü Inflation, growth q Balance of payments accounts ü Exports, imports, capital flows, reserves q Fiscal accounts ü Government spending, tax revenues, credit q Monetary accounts ü Money, credit, foreign reserves

Financial programming framework For example, based on what we know in 1999, what will BOP be in 2000? q Exports q Imports üIncluding interest payments on foreign debt q Capital flows üIncluding foreign borrowing and FDI q. Reserve movements üIncluding target for reserves

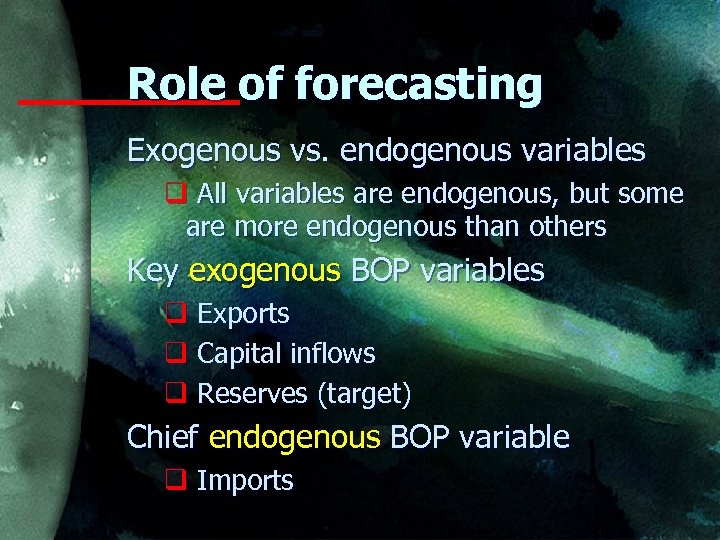

Role of forecasting Exogenous vs. endogenous variables q All variables are endogenous, but some are more endogenous than others Key exogenous BOP variables q Exports q Capital inflows q Reserves (target) Chief endogenous BOP variable q Imports

Role of forecasting Forecasts of exogenous variables enable us to forecast endogenous variables For example, once we have forecast X, F, and R, we can derive the forecast of Z as a residual: Z = X + F – R Forecast of Z needs to be consistent with forecasts of inflation and growth

Role of forecasting History and targets q Record history, establish targets Forecasting q Make forecasts for balance of payments, output and inflation, money Policy decisions q Set domestic credit at a level that is consistent with forecasts as well as foreign reserve target

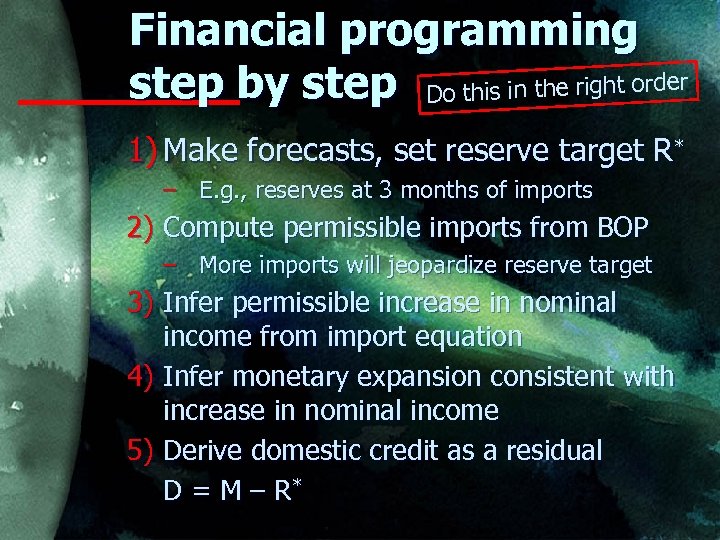

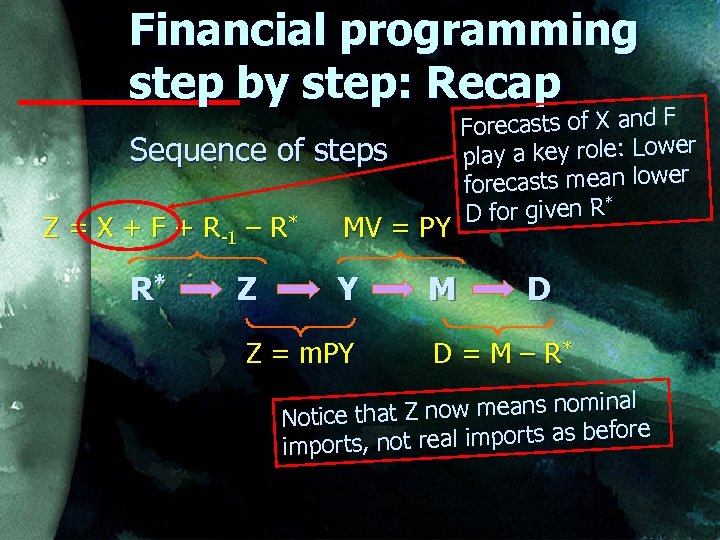

Financial programming step by step Do this in the right order 1) Make forecasts, set reserve target R* – E. g. , reserves at 3 months of imports 2) Compute permissible imports from BOP – More imports will jeopardize reserve target 3) Infer permissible increase in nominal income from import equation 4) Infer monetary expansion consistent with increase in nominal income 5) Derive domestic credit as a residual D = M – R*

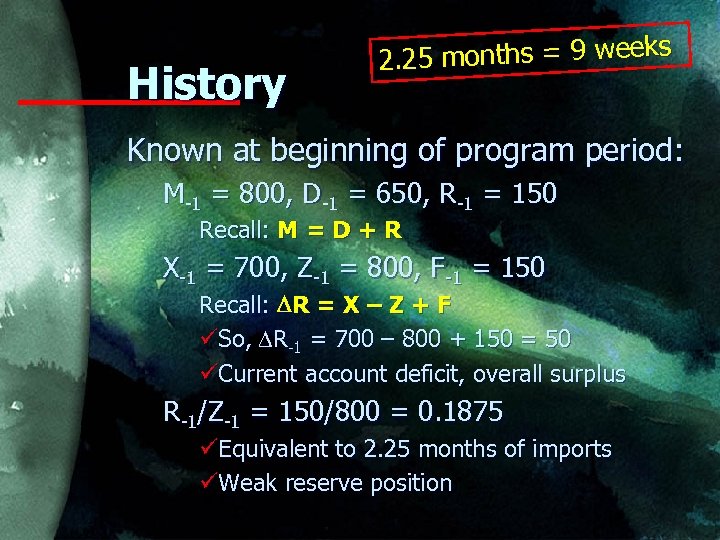

History months = 9 weeks 2. 25 Known at beginning of program period: M-1 = 800, D-1 = 650, R-1 = 150 Recall: M = D + R X-1 = 700, Z-1 = 800, F-1 = 150 Recall: DR = X – Z + F üSo, R-1 = 700 – 800 + 150 = 50 üCurrent account deficit, overall surplus R-1/Z-1 = 150/800 = 0. 1875 üEquivalent to 2. 25 months of imports üWeak reserve position

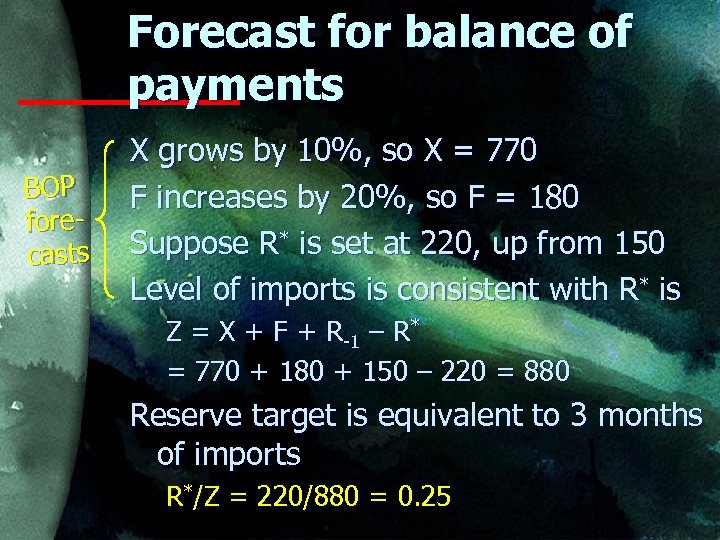

Forecast for balance of payments BOP forecasts X grows by 10%, so X = 770 F increases by 20%, so F = 180 Suppose R* is set at 220, up from 150 Level of imports is consistent with R* is Z = X + F + R-1 – R* = 770 + 180 + 150 – 220 = 880 Reserve target is equivalent to 3 months of imports R*/Z = 220/880 = 0. 25

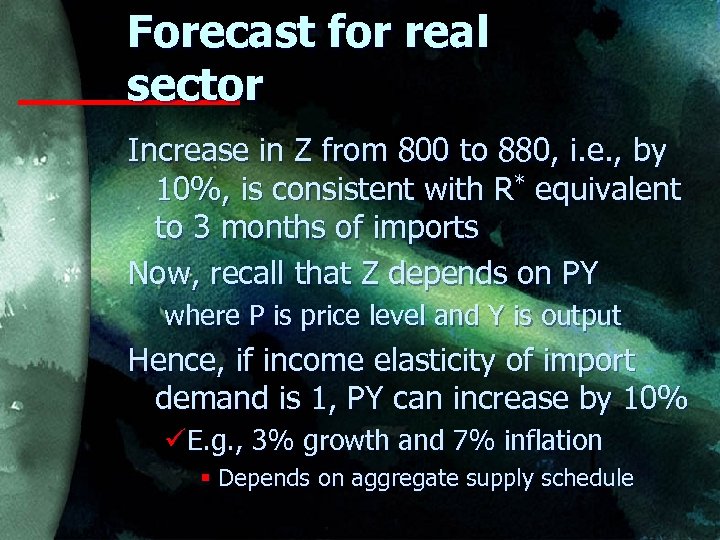

Forecast for real sector Increase in Z from 800 to 880, i. e. , by 10%, is consistent with R* equivalent to 3 months of imports Now, recall that Z depends on PY where P is price level and Y is output Hence, if income elasticity of import demand is 1, PY can increase by 10% üE. g. , 3% growth and 7% inflation § Depends on aggregate supply schedule

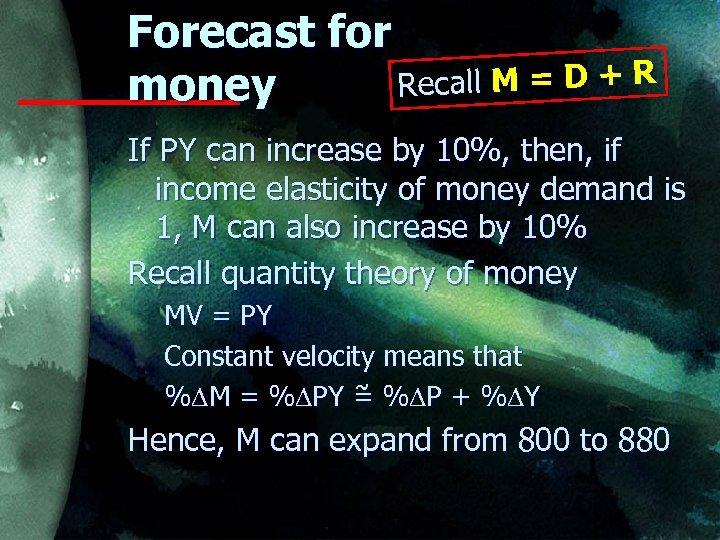

Forecast for Recall M = D + R money If PY can increase by 10%, then, if income elasticity of money demand is 1, M can also increase by 10% Recall quantity theory of money MV = PY Constant velocity means that % M = % PY = % P + % Y ˜ Hence, M can expand from 800 to 880

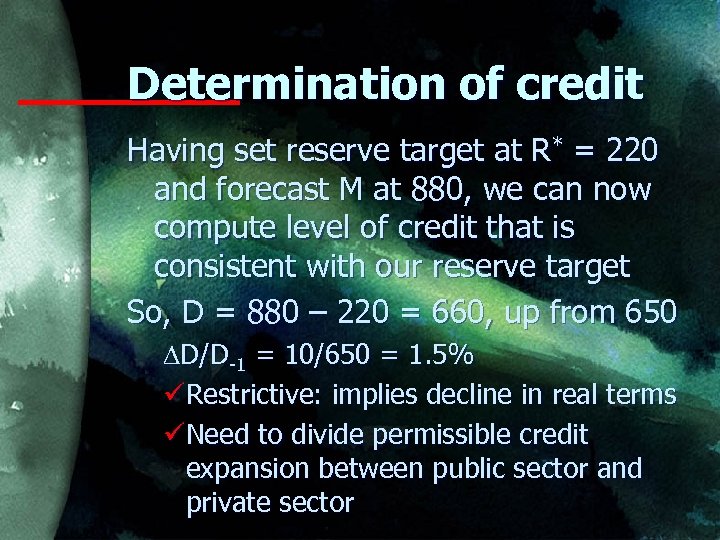

Determination of credit Having set reserve target at R* = 220 and forecast M at 880, we can now compute level of credit that is consistent with our reserve target So, D = 880 – 220 = 660, up from 650 D/D-1 = 10/650 = 1. 5% üRestrictive: implies decline in real terms üNeed to divide permissible credit expansion between public sector and private sector

Financial programming step by step: Recap Sequence of steps Z = X + F + R-1 – R* R* Z MV = PY Y Z = m. PY M Forecasts of X and F play a key role: Lower forecasts mean lower * r given R D fo D D = M – R* ominal e that Z now means n Notic before s, not real imports as import

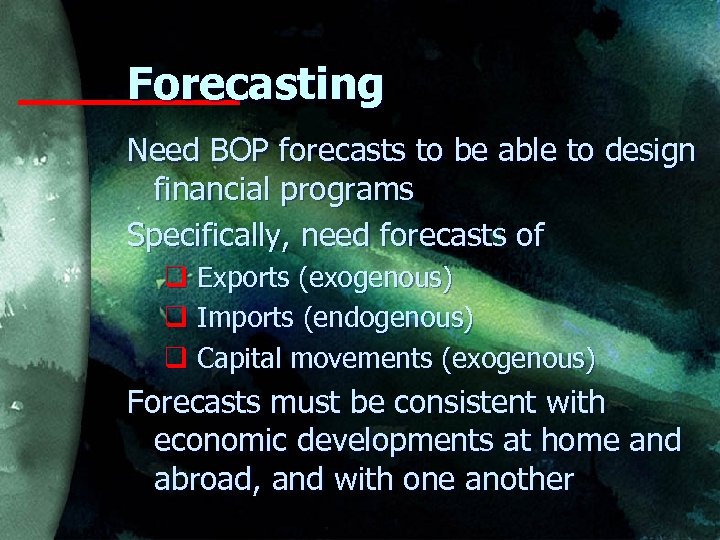

Forecasting Need BOP forecasts to be able to design financial programs Specifically, need forecasts of q Exports (exogenous) q Imports (endogenous) q Capital movements (exogenous) Forecasts must be consistent with economic developments at home and abroad, and with one another

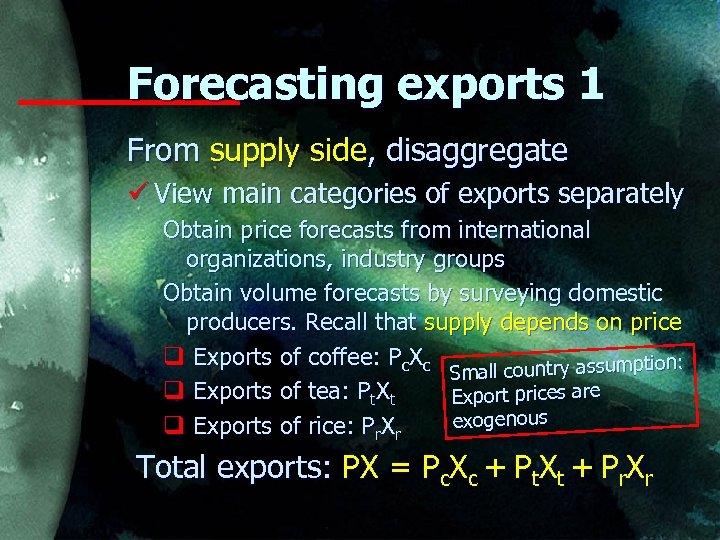

Forecasting exports 1 From supply side, disaggregate ü View main categories of exports separately Obtain price forecasts from international organizations, industry groups Obtain volume forecasts by surveying domestic producers. Recall that supply depends on price q Exports of coffee: Pc. Xc tion: Small country assump q Exports of tea: Pt. Xt Export prices are exogenous q Exports of rice: Pr. Xr Total exports: PX = Pc. Xc + Pt. Xt + Pr. Xr

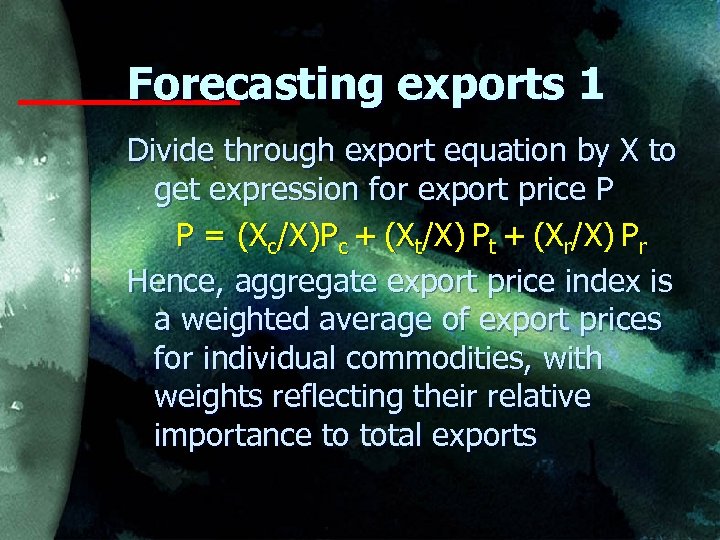

Forecasting exports 1 Divide through export equation by X to get expression for export price P P = (Xc/X)Pc + (Xt/X) Pt + (Xr/X) Pr Hence, aggregate export price index is a weighted average of export prices for individual commodities, with weights reflecting their relative importance to total exports

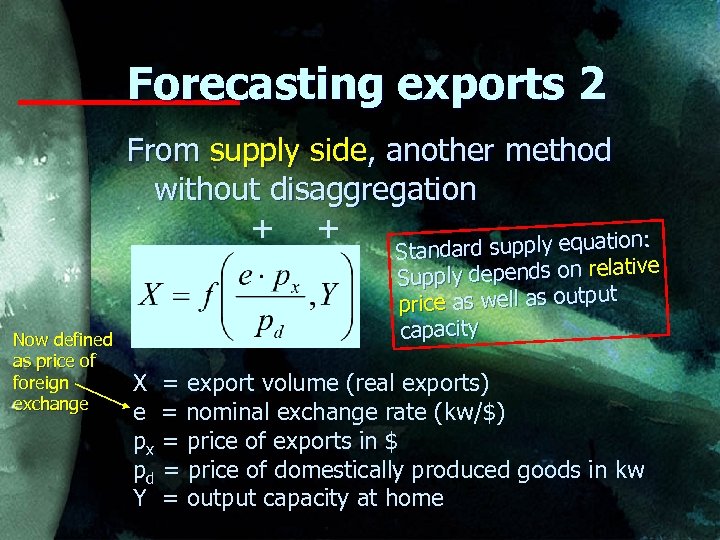

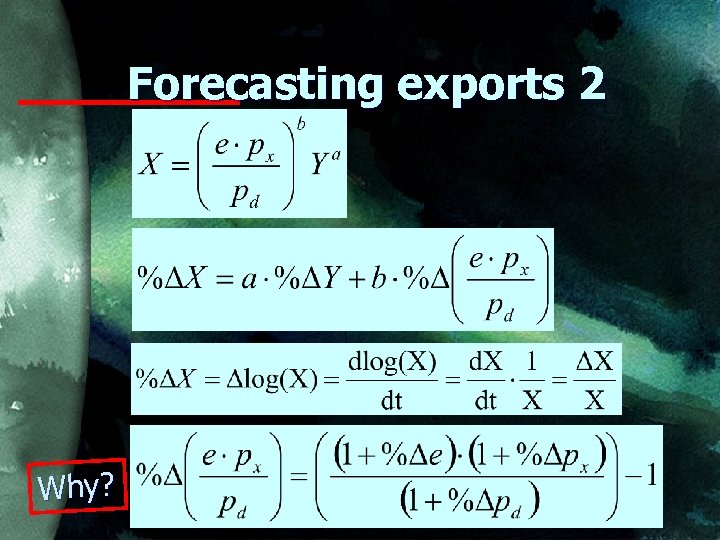

Forecasting exports 2 From supply side, another method without disaggregation + + supply equation: Now defined as price of foreign exchange Standard s lative Supply depends on re t price as well as outpu capacity X = export volume (real exports) e = nominal exchange rate (kw/$) px = price of exports in $ pd = price of domestically produced goods in kw Y = output capacity at home

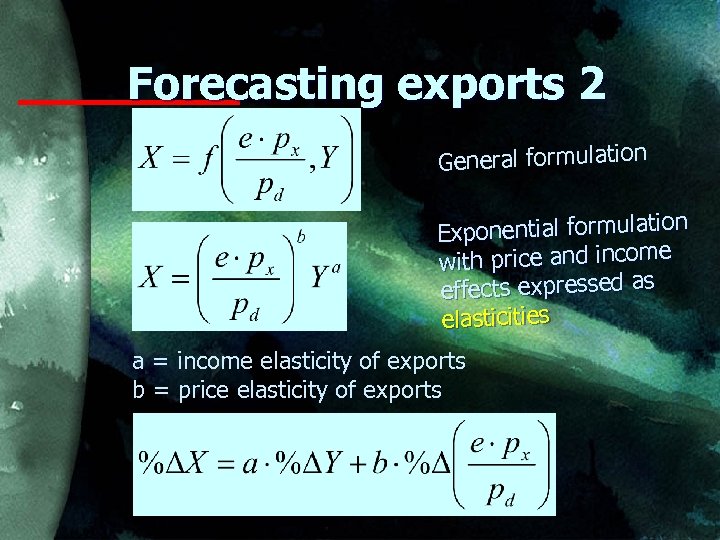

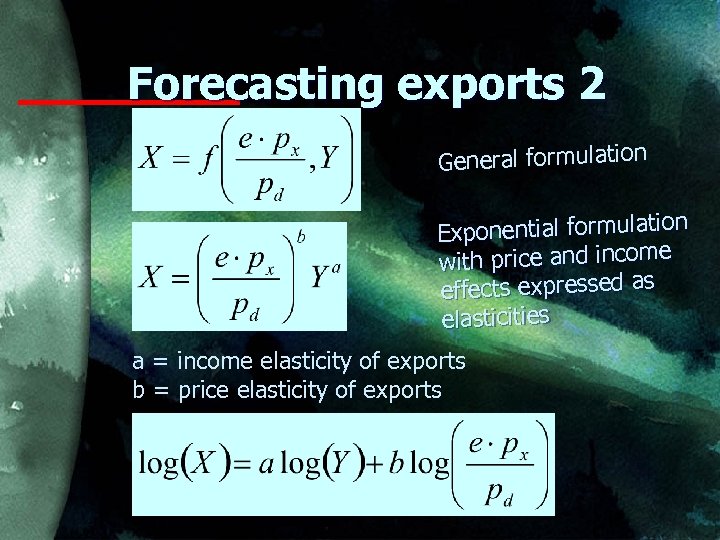

Forecasting exports 2 General formulation n Exponential formulatio with price and income effects expressed as elasticities a = income elasticity of exports b = price elasticity of exports

Forecasting exports 2 General formulation n Exponential formulatio with price and income effects expressed as elasticities a = income elasticity of exports b = price elasticity of exports

Forecasting exports 2 Why?

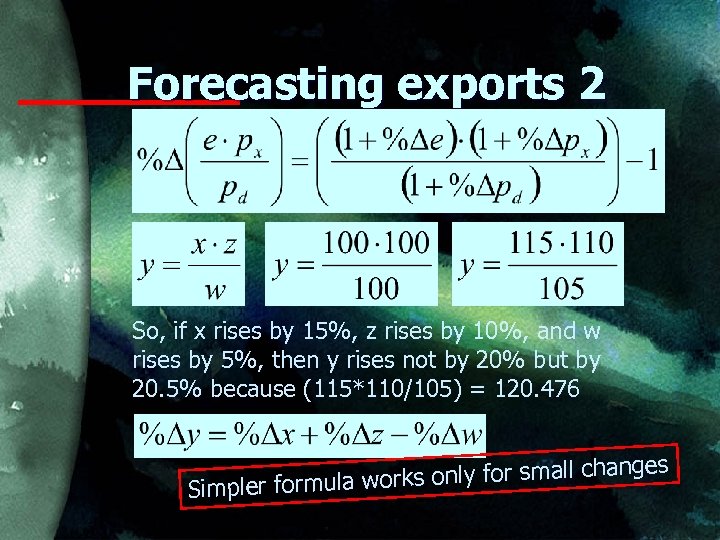

Forecasting exports 2 So, if x rises by 15%, z rises by 10%, and w rises by 5%, then y rises not by 20% but by 20. 5% because (115*110/105) = 120. 476 nges orks only for small cha Simpler formula w

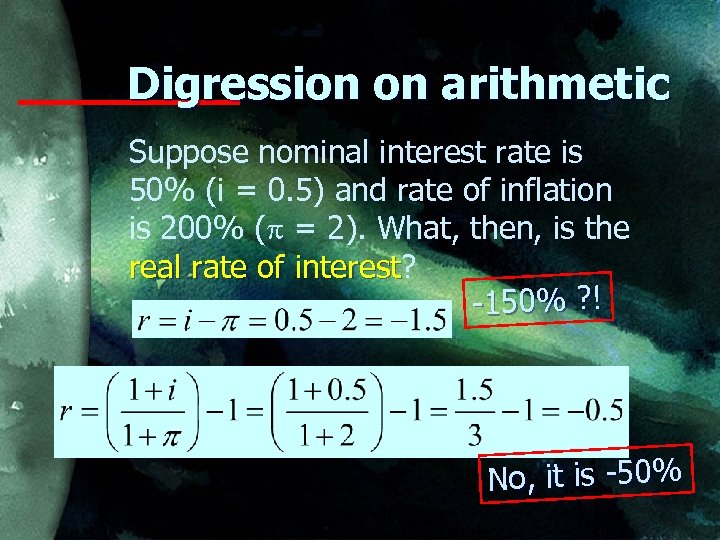

Digression on arithmetic Suppose nominal interest rate is 50% (i = 0. 5) and rate of inflation is 200% (p = 2). What, then, is the real rate of interest? interest -150% ? ! No, it is -50%

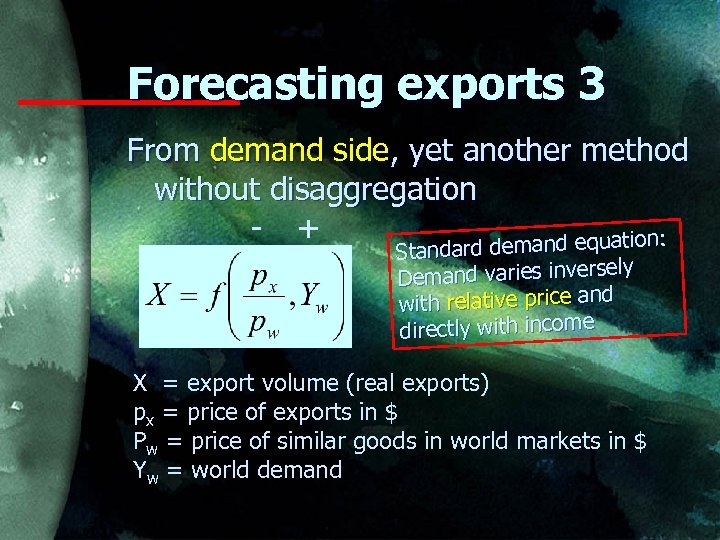

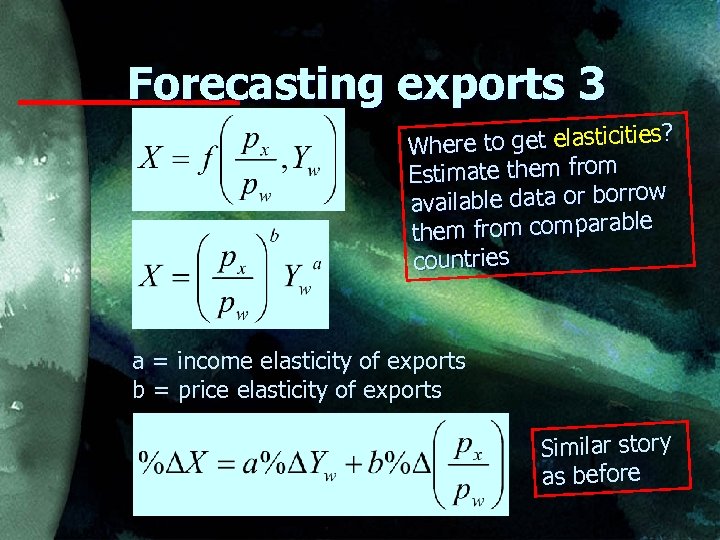

Forecasting exports 3 From demand side, yet another method without disaggregation - + demand equation: Standard d ly Demand varies inverse with relative price and directly with income X = export volume (real exports) px = price of exports in $ Pw = price of similar goods in world markets in $ Yw = world demand

Forecasting exports 3 ? s? Where to get elasticitie s Estimate them from vailable data or borrow a them from comparable countries a = income elasticity of exports b = price elasticity of exports Similar story as before

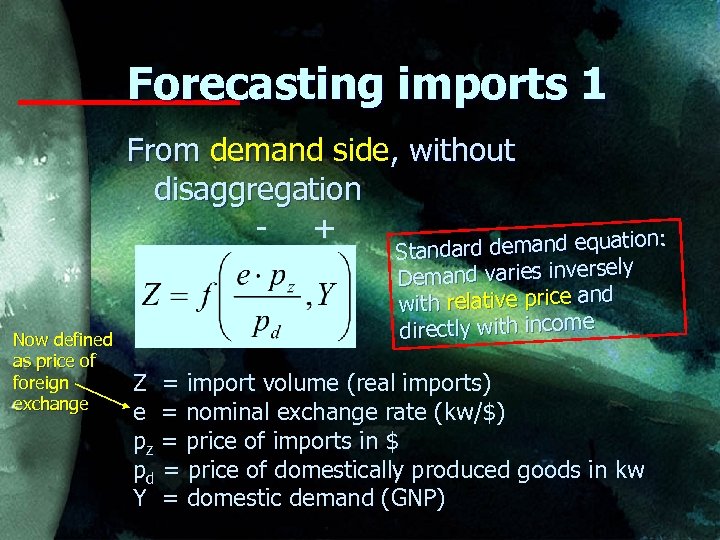

Forecasting imports 1 From demand side, without disaggregation - + demand equation: Now defined as price of foreign exchange Standard d ly Demand varies inverse with relative price and directly with income Z = import volume (real imports) e = nominal exchange rate (kw/$) pz = price of imports in $ pd = price of domestically produced goods in kw Y = domestic demand (GNP)

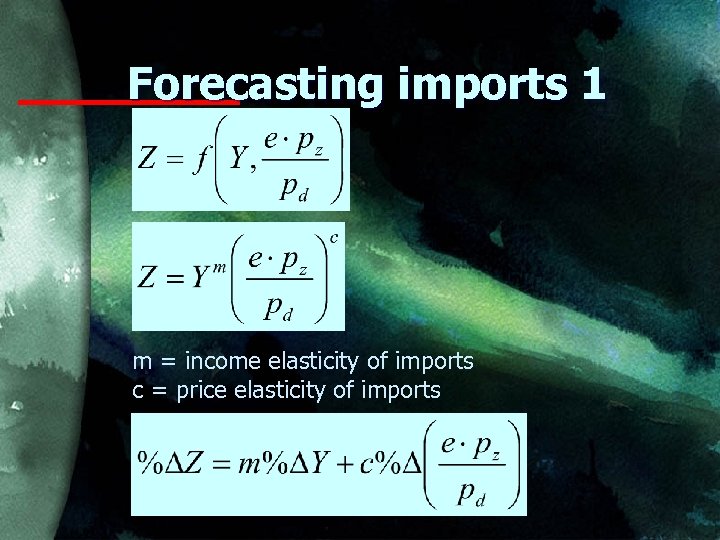

Forecasting imports 1 m = income elasticity of imports c = price elasticity of imports

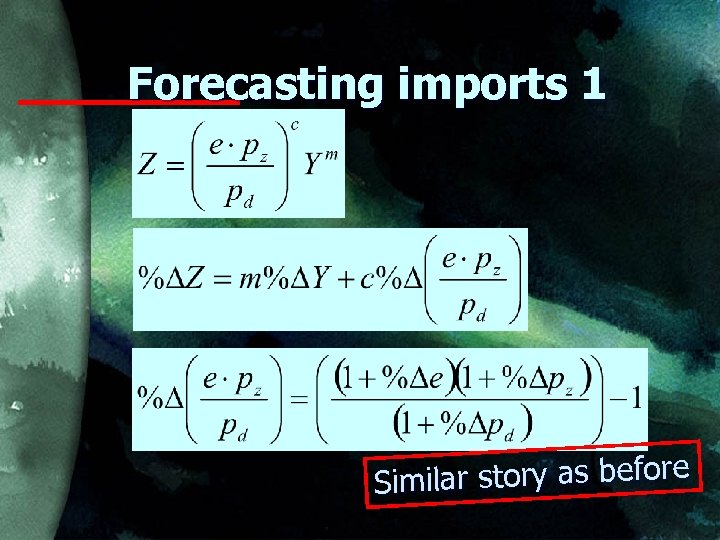

Forecasting imports 1 ilar story as before Sim

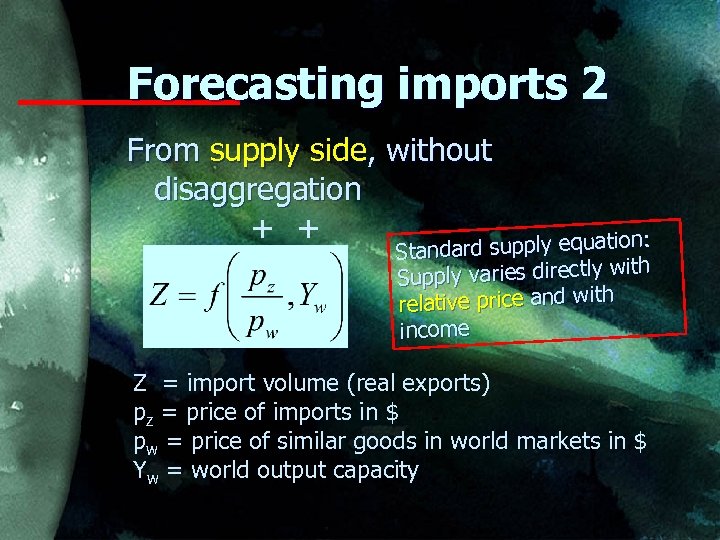

Forecasting imports 2 From supply side, without disaggregation + + supply equation: Standard s with Supply varies directly relative price and with income Z = import volume (real exports) pz = price of imports in $ pw = price of similar goods in world markets in $ Yw = world output capacity

Forecasting services Principles are the same as for goods ü Service exports (e. g. , travel receipts) depend on income abroad and relative prices ü Service imports (e. g. , transportation) depend on income at home and relative prices ü Interest payments reflect multiple of foreign debt outstanding and interest rate payable on the debt ü Transfers, private and public, depend on past trends, income abroad, official commitments, special relationships (e. g. , EU)

Forecasting capital flows This is more difficult ü Foreign borrowing: depends on plans of domestic authorities, commitments of foreign lenders, interest rates at home and abroad ü Foreign direct investment: depends on domestic market size, labor skills, investment and export opportunities, macroeconomic stability, track record, growth prospects, stability and transparency of regulations ü Errors and omissions: depends on trends, political and economic events

These slides will be posted on my website: www. hi. is/~gylfason Forecasting reserves This is easy üBaseline scenario: reserve movements are simply the sum of the current account and the capital account: R = X – Z + F üFinancial program: reserve movements are a policy variable, programmed so as to meet a given target of reserves at the end of the program period, set, e. g. , in terms of months of import coverage End The

910b01fc6b446087e28e1791f4e9b0ce.ppt