9c7ed9f3756d2b4f98b817bd754c0bb1.ppt

- Количество слайдов: 12

Aladdin Overview ™ ************** NOTICE ************* PROPRIETARY AND CONFIDENTIAL MATERIAL. DISTRIBUTION, USE, AND DISCLOSURE RESTRICTED BY LICENSE. Copyright MBRM - MB Risk Management (c) 2003 ALL RIGHTS RESERVED. ************** NOTICE *************

Aladdin Overview ™ ************** NOTICE ************* PROPRIETARY AND CONFIDENTIAL MATERIAL. DISTRIBUTION, USE, AND DISCLOSURE RESTRICTED BY LICENSE. Copyright MBRM - MB Risk Management (c) 2003 ALL RIGHTS RESERVED. ************** NOTICE *************

Aladdin Overview Aladdin is an Excel based pricing system designed primarily for cashflow based interest rate and exotic derivatives. It is a menu driven set of standard “building blocks” that can be added together to construct complex structured trades. These “building blocks” consist of market data modules and trade templates - allowing modeling of various product types ranging from simple swaps and options right up to high-end exotics. Cross/Multi currency trades are allowed where the pricing analytics are available. The Excel user interface allows the end user to construct customized payoff functions and build highly structured and specialized trades. However, where this is insufficient, the Aladdin infrastructure is geared towards RAD development of new product templates which can be seamlessly integrated into the core system. As well as pricing trades, Aladdin also has some risk management functionality. Credit and market risk sensitivities and charges can be calculated. 2

Aladdin Overview Aladdin is an Excel based pricing system designed primarily for cashflow based interest rate and exotic derivatives. It is a menu driven set of standard “building blocks” that can be added together to construct complex structured trades. These “building blocks” consist of market data modules and trade templates - allowing modeling of various product types ranging from simple swaps and options right up to high-end exotics. Cross/Multi currency trades are allowed where the pricing analytics are available. The Excel user interface allows the end user to construct customized payoff functions and build highly structured and specialized trades. However, where this is insufficient, the Aladdin infrastructure is geared towards RAD development of new product templates which can be seamlessly integrated into the core system. As well as pricing trades, Aladdin also has some risk management functionality. Credit and market risk sensitivities and charges can be calculated. 2

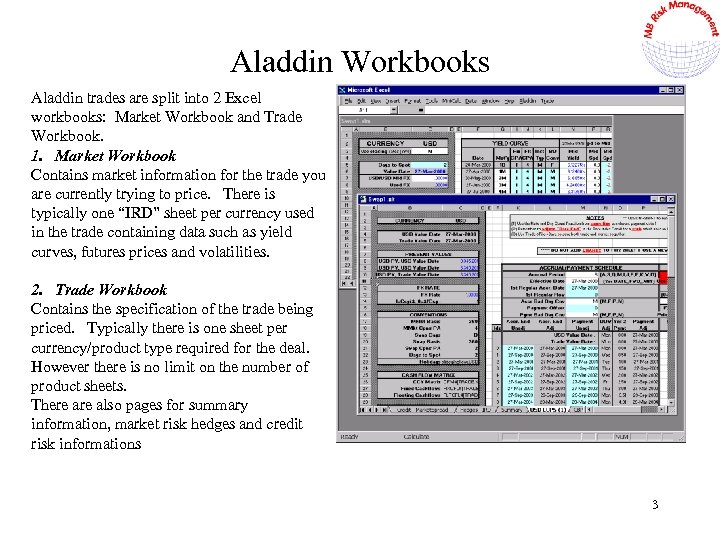

Aladdin Workbooks Aladdin trades are split into 2 Excel workbooks: Market Workbook and Trade Workbook. 1. Market Workbook Contains market information for the trade you are currently trying to price. There is typically one “IRD” sheet per currency used in the trade containing data such as yield curves, futures prices and volatilities. 2. Trade Workbook Contains the specification of the trade being priced. Typically there is one sheet per currency/product type required for the deal. However there is no limit on the number of product sheets. There also pages for summary information, market risk hedges and credit risk informations 3

Aladdin Workbooks Aladdin trades are split into 2 Excel workbooks: Market Workbook and Trade Workbook. 1. Market Workbook Contains market information for the trade you are currently trying to price. There is typically one “IRD” sheet per currency used in the trade containing data such as yield curves, futures prices and volatilities. 2. Trade Workbook Contains the specification of the trade being priced. Typically there is one sheet per currency/product type required for the deal. However there is no limit on the number of product sheets. There also pages for summary information, market risk hedges and credit risk informations 3

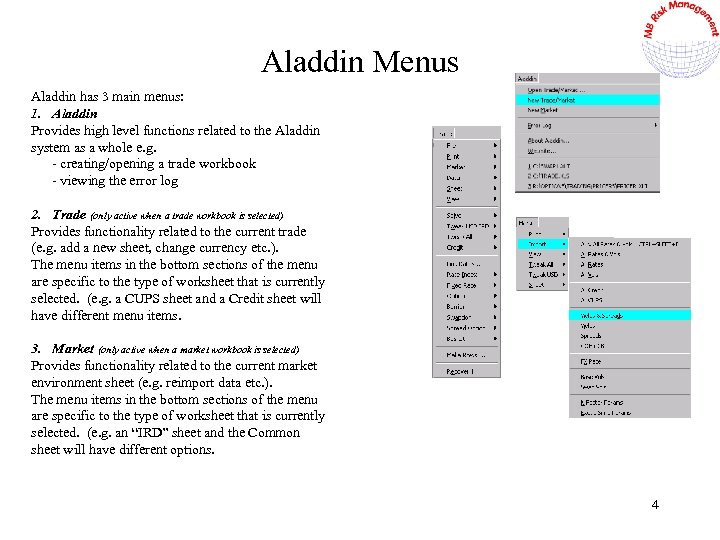

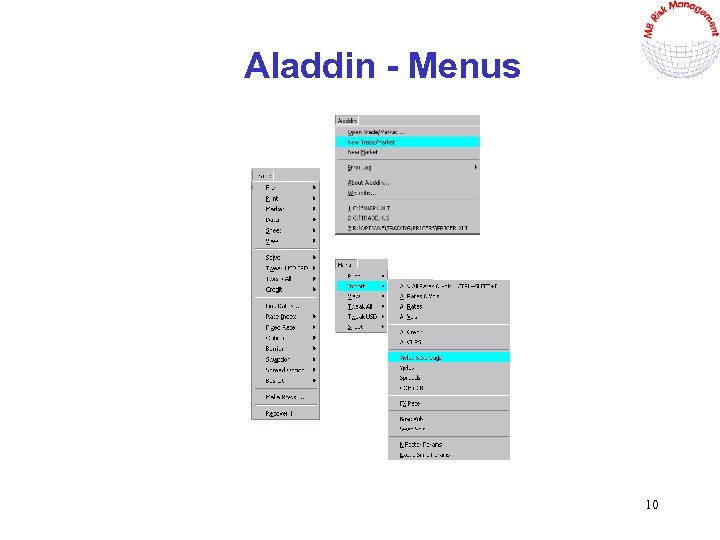

Aladdin Menus Aladdin has 3 main menus: 1. Aladdin Provides high level functions related to the Aladdin system as a whole e. g. - creating/opening a trade workbook - viewing the error log 2. Trade (only active when a trade workbook is selected) Provides functionality related to the current trade (e. g. add a new sheet, change currency etc. ). The menu items in the bottom sections of the menu are specific to the type of worksheet that is currently selected. (e. g. a CUPS sheet and a Credit sheet will have different menu items. 3. Market (only active when a market workbook is selected) Provides functionality related to the current market environment sheet (e. g. reimport data etc. ). The menu items in the bottom sections of the menu are specific to the type of worksheet that is currently selected. (e. g. an “IRD” sheet and the Common sheet will have different options. 4

Aladdin Menus Aladdin has 3 main menus: 1. Aladdin Provides high level functions related to the Aladdin system as a whole e. g. - creating/opening a trade workbook - viewing the error log 2. Trade (only active when a trade workbook is selected) Provides functionality related to the current trade (e. g. add a new sheet, change currency etc. ). The menu items in the bottom sections of the menu are specific to the type of worksheet that is currently selected. (e. g. a CUPS sheet and a Credit sheet will have different menu items. 3. Market (only active when a market workbook is selected) Provides functionality related to the current market environment sheet (e. g. reimport data etc. ). The menu items in the bottom sections of the menu are specific to the type of worksheet that is currently selected. (e. g. an “IRD” sheet and the Common sheet will have different options. 4

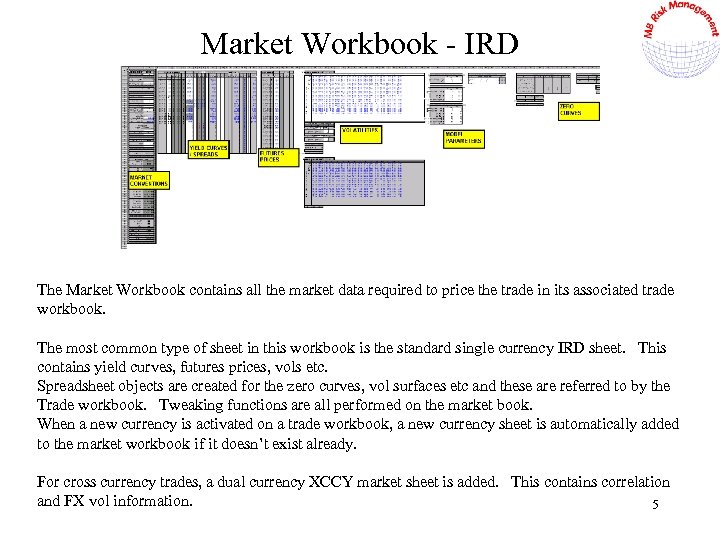

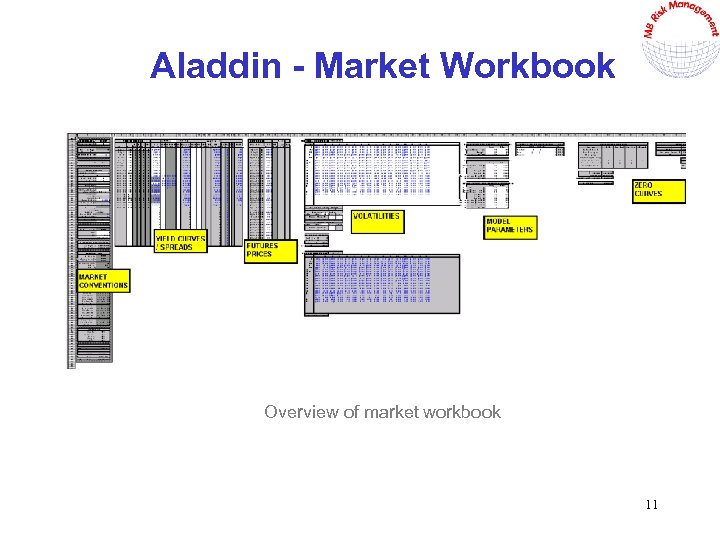

Market Workbook - IRD The Market Workbook contains all the market data required to price the trade in its associated trade workbook. The most common type of sheet in this workbook is the standard single currency IRD sheet. This contains yield curves, futures prices, vols etc. Spreadsheet objects are created for the zero curves, vol surfaces etc and these are referred to by the Trade workbook. Tweaking functions are all performed on the market book. When a new currency is activated on a trade workbook, a new currency sheet is automatically added to the market workbook if it doesn’t exist already. For cross currency trades, a dual currency XCCY market sheet is added. This contains correlation and FX vol information. 5

Market Workbook - IRD The Market Workbook contains all the market data required to price the trade in its associated trade workbook. The most common type of sheet in this workbook is the standard single currency IRD sheet. This contains yield curves, futures prices, vols etc. Spreadsheet objects are created for the zero curves, vol surfaces etc and these are referred to by the Trade workbook. Tweaking functions are all performed on the market book. When a new currency is activated on a trade workbook, a new currency sheet is automatically added to the market workbook if it doesn’t exist already. For cross currency trades, a dual currency XCCY market sheet is added. This contains correlation and FX vol information. 5

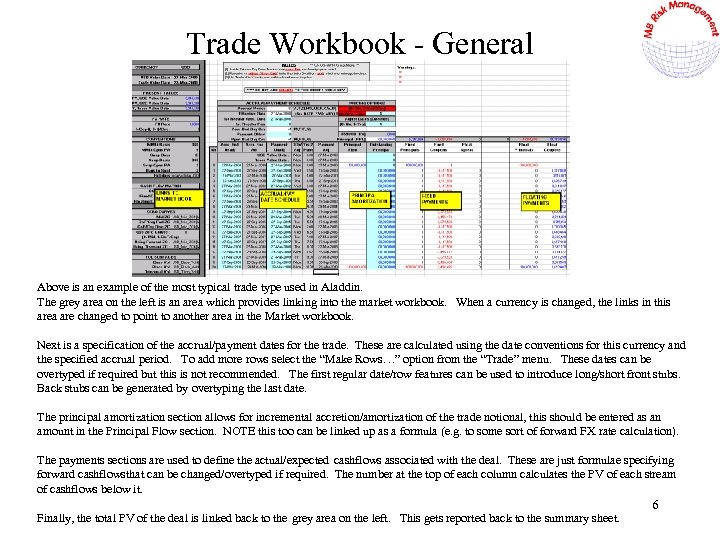

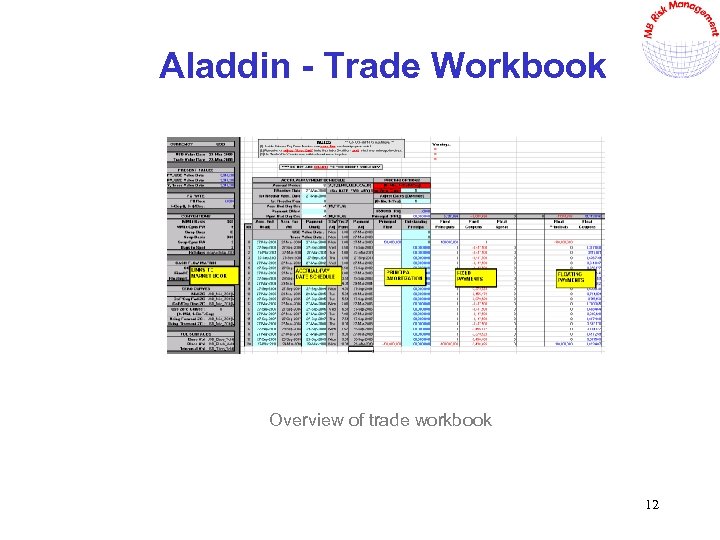

Trade Workbook - General Above is an example of the most typical trade type used in Aladdin. The grey area on the left is an area which provides linking into the market workbook. When a currency is changed, the links in this area are changed to point to another area in the Market workbook. Next is a specification of the accrual/payment dates for the trade. These are calculated using the date conventions for this currency and the specified accrual period. To add more rows select the “Make Rows…” option from the “Trade” menu. These dates can be overtyped if required but this is not recommended. The first regular date/row features can be used to introduce long/short front stubs. Back stubs can be generated by overtyping the last date. The principal amortization section allows for incremental accretion/amortization of the trade notional, this should be entered as an amount in the Principal Flow section. NOTE this too can be linked up as a formula (e. g. to some sort of forward FX rate calculation). The payments sections are used to define the actual/expected cashflows associated with the deal. These are just formulae specifying forward cashflowsthat can be changed/overtyped if required. The number at the top of each column calculates the PV of each stream of cashflows below it. Finally, the total PV of the deal is linked back to the grey area on the left. This gets reported back to the summary sheet. 6

Trade Workbook - General Above is an example of the most typical trade type used in Aladdin. The grey area on the left is an area which provides linking into the market workbook. When a currency is changed, the links in this area are changed to point to another area in the Market workbook. Next is a specification of the accrual/payment dates for the trade. These are calculated using the date conventions for this currency and the specified accrual period. To add more rows select the “Make Rows…” option from the “Trade” menu. These dates can be overtyped if required but this is not recommended. The first regular date/row features can be used to introduce long/short front stubs. Back stubs can be generated by overtyping the last date. The principal amortization section allows for incremental accretion/amortization of the trade notional, this should be entered as an amount in the Principal Flow section. NOTE this too can be linked up as a formula (e. g. to some sort of forward FX rate calculation). The payments sections are used to define the actual/expected cashflows associated with the deal. These are just formulae specifying forward cashflowsthat can be changed/overtyped if required. The number at the top of each column calculates the PV of each stream of cashflows below it. Finally, the total PV of the deal is linked back to the grey area on the left. This gets reported back to the summary sheet. 6

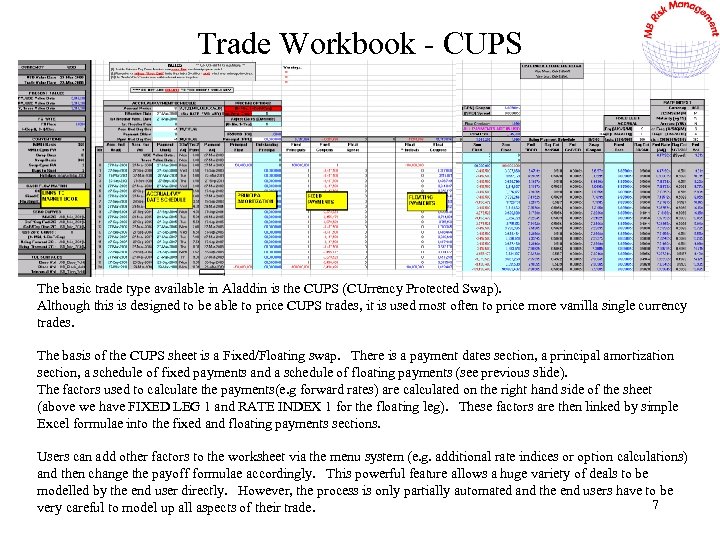

Trade Workbook - CUPS The basic trade type available in Aladdin is the CUPS (CUrrency Protected Swap). Although this is designed to be able to price CUPS trades, it is used most often to price more vanilla single currency trades. The basis of the CUPS sheet is a Fixed/Floating swap. There is a payment dates section, a principal amortization section, a schedule of fixed payments and a schedule of floating payments (see previous slide). The factors used to calculate the payments(e. g forward rates) are calculated on the right hand side of the sheet (above we have FIXED LEG 1 and RATE INDEX 1 for the floating leg). These factors are then linked by simple Excel formulae into the fixed and floating payments sections. Users can add other factors to the worksheet via the menu system (e. g. additional rate indices or option calculations) and then change the payoff formulae accordingly. This powerful feature allows a huge variety of deals to be modelled by the end user directly. However, the process is only partially automated and the end users have to be 7 very careful to model up all aspects of their trade.

Trade Workbook - CUPS The basic trade type available in Aladdin is the CUPS (CUrrency Protected Swap). Although this is designed to be able to price CUPS trades, it is used most often to price more vanilla single currency trades. The basis of the CUPS sheet is a Fixed/Floating swap. There is a payment dates section, a principal amortization section, a schedule of fixed payments and a schedule of floating payments (see previous slide). The factors used to calculate the payments(e. g forward rates) are calculated on the right hand side of the sheet (above we have FIXED LEG 1 and RATE INDEX 1 for the floating leg). These factors are then linked by simple Excel formulae into the fixed and floating payments sections. Users can add other factors to the worksheet via the menu system (e. g. additional rate indices or option calculations) and then change the payoff formulae accordingly. This powerful feature allows a huge variety of deals to be modelled by the end user directly. However, the process is only partially automated and the end users have to be 7 very careful to model up all aspects of their trade.

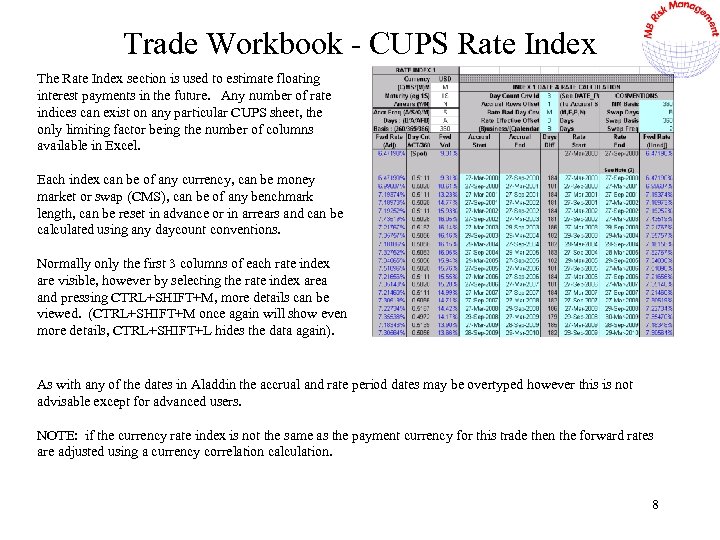

Trade Workbook - CUPS Rate Index The Rate Index section is used to estimate floating interest payments in the future. Any number of rate indices can exist on any particular CUPS sheet, the only limiting factor being the number of columns available in Excel. Each index can be of any currency, can be money market or swap (CMS), can be of any benchmark length, can be reset in advance or in arrears and can be calculated using any daycount conventions. Normally only the first 3 columns of each rate index are visible, however by selecting the rate index area and pressing CTRL+SHIFT+M, more details can be viewed. (CTRL+SHIFT+M once again will show even more details, CTRL+SHIFT+L hides the data again). As with any of the dates in Aladdin the accrual and rate period dates may be overtyped however this is not advisable except for advanced users. NOTE: if the currency rate index is not the same as the payment currency for this trade then the forward rates are adjusted using a currency correlation calculation. 8

Trade Workbook - CUPS Rate Index The Rate Index section is used to estimate floating interest payments in the future. Any number of rate indices can exist on any particular CUPS sheet, the only limiting factor being the number of columns available in Excel. Each index can be of any currency, can be money market or swap (CMS), can be of any benchmark length, can be reset in advance or in arrears and can be calculated using any daycount conventions. Normally only the first 3 columns of each rate index are visible, however by selecting the rate index area and pressing CTRL+SHIFT+M, more details can be viewed. (CTRL+SHIFT+M once again will show even more details, CTRL+SHIFT+L hides the data again). As with any of the dates in Aladdin the accrual and rate period dates may be overtyped however this is not advisable except for advanced users. NOTE: if the currency rate index is not the same as the payment currency for this trade then the forward rates are adjusted using a currency correlation calculation. 8

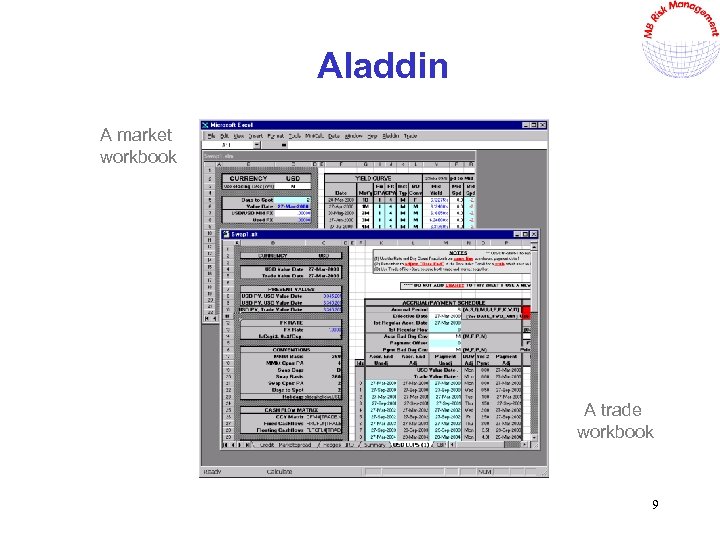

Aladdin A market workbook A trade workbook 9

Aladdin A market workbook A trade workbook 9

Aladdin - Menus 10

Aladdin - Menus 10

Aladdin - Market Workbook Overview of market workbook 11

Aladdin - Market Workbook Overview of market workbook 11

Aladdin - Trade Workbook Overview of trade workbook 12

Aladdin - Trade Workbook Overview of trade workbook 12