0df45c27503686181df839dea7c7a1d9.ppt

- Количество слайдов: 16

Air New Zealand Limited New Zealand Society of Investment Analysts 30 March 2001

Air New Zealand Limited New Zealand Society of Investment Analysts 30 March 2001

Agenda • Organisation Changes • Key Issues • Outlook 1

Agenda • Organisation Changes • Key Issues • Outlook 1

Organisation Changes v Organisation Structure v Performance Enhancement 2

Organisation Changes v Organisation Structure v Performance Enhancement 2

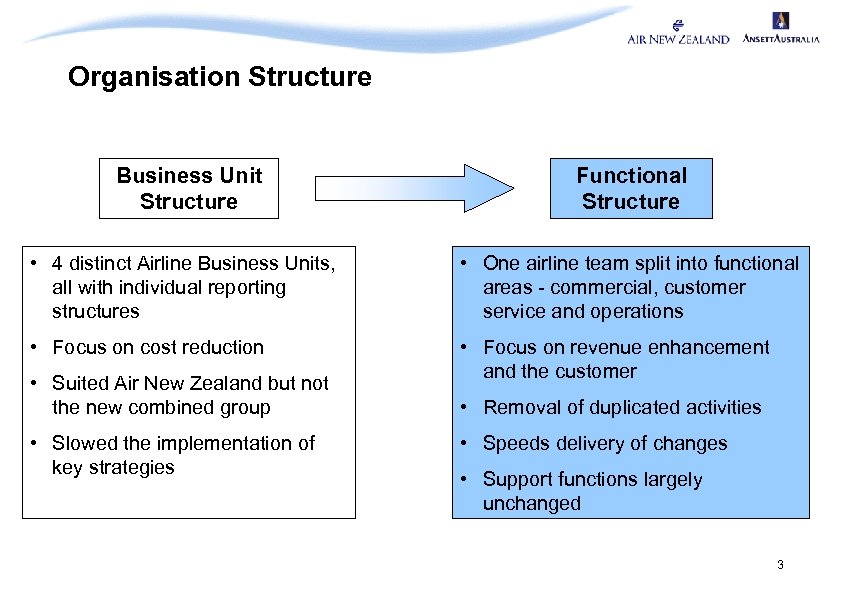

Organisation Structure Business Unit Structure Functional Structure • 4 distinct Airline Business Units, all with individual reporting structures • One airline team split into functional areas - commercial, customer service and operations • Focus on cost reduction • Focus on revenue enhancement and the customer • Suited Air New Zealand but not the new combined group • Slowed the implementation of key strategies • Removal of duplicated activities • Speeds delivery of changes • Support functions largely unchanged 3

Organisation Structure Business Unit Structure Functional Structure • 4 distinct Airline Business Units, all with individual reporting structures • One airline team split into functional areas - commercial, customer service and operations • Focus on cost reduction • Focus on revenue enhancement and the customer • Suited Air New Zealand but not the new combined group • Slowed the implementation of key strategies • Removal of duplicated activities • Speeds delivery of changes • Support functions largely unchanged 3

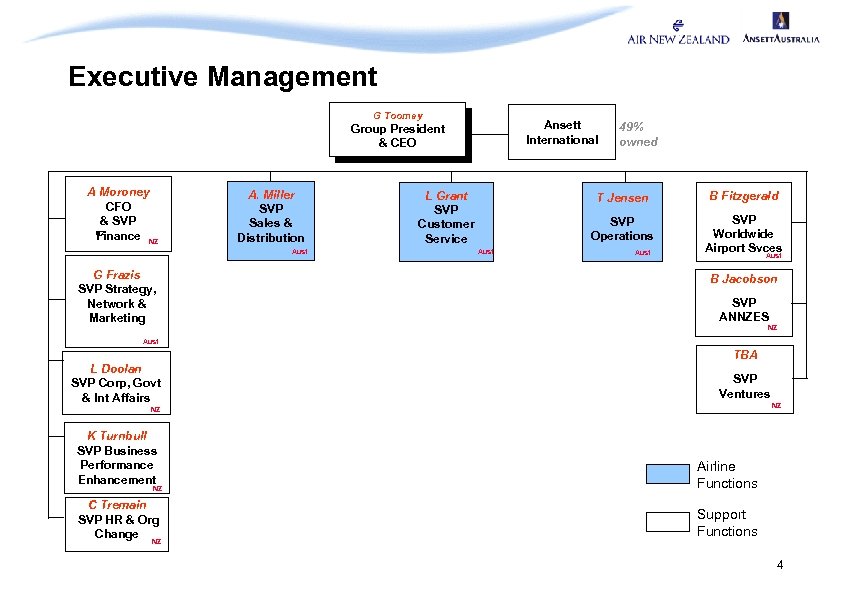

Executive Management G Toomey Ansett International Group President & CEO A Moroney CFO & SVP NZ Finance NZ A. Miller SVP Sales & Distribution Aust G Frazis SVP Strategy, Network & Marketing 49% owned T Jensen Aust B Fitzgerald SVP Operations L Grant SVP Customer Service SVP Worldwide Airport Svces Aust B Jacobson SVP ANNZES NZ Aust TBA NZL Doolan SVP Corp, Govt & Int Affairs SVP Ventures NZ NZ K Turnbull SVP Business Performance Enhancement Airline Functions C Tremain SVP HR & Org Change Support Functions NZ NZ 4

Executive Management G Toomey Ansett International Group President & CEO A Moroney CFO & SVP NZ Finance NZ A. Miller SVP Sales & Distribution Aust G Frazis SVP Strategy, Network & Marketing 49% owned T Jensen Aust B Fitzgerald SVP Operations L Grant SVP Customer Service SVP Worldwide Airport Svces Aust B Jacobson SVP ANNZES NZ Aust TBA NZL Doolan SVP Corp, Govt & Int Affairs SVP Ventures NZ NZ K Turnbull SVP Business Performance Enhancement Airline Functions C Tremain SVP HR & Org Change Support Functions NZ NZ 4

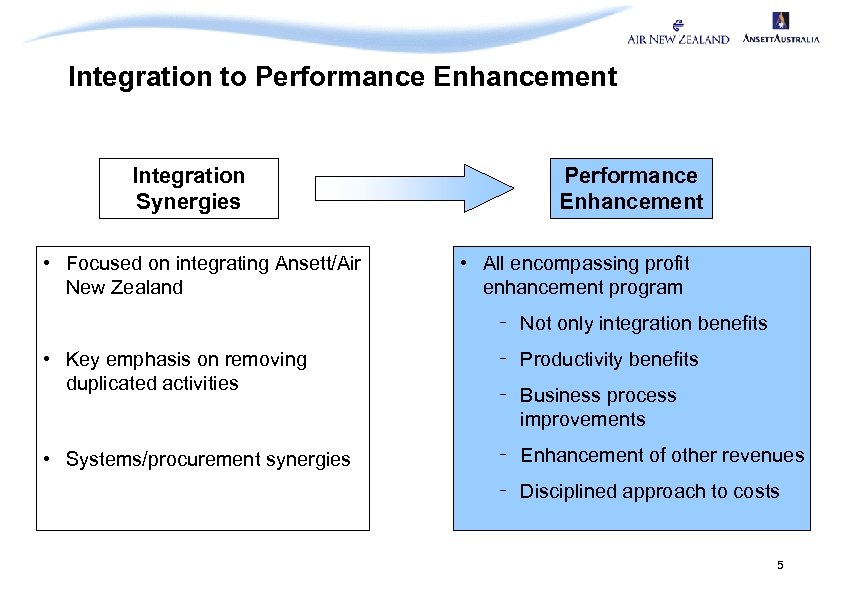

Integration to Performance Enhancement Integration Synergies • Focused on integrating Ansett/Air New Zealand Performance Enhancement • All encompassing profit enhancement program – Not only integration benefits • Key emphasis on removing duplicated activities – Productivity benefits • Systems/procurement synergies – Enhancement of other revenues – Business process improvements – Disciplined approach to costs 5

Integration to Performance Enhancement Integration Synergies • Focused on integrating Ansett/Air New Zealand Performance Enhancement • All encompassing profit enhancement program – Not only integration benefits • Key emphasis on removing duplicated activities – Productivity benefits • Systems/procurement synergies – Enhancement of other revenues – Business process improvements – Disciplined approach to costs 5

Key Issues Facing the Group v Australian Domestic Market v Fleet & Network v Management Information 6

Key Issues Facing the Group v Australian Domestic Market v Fleet & Network v Management Information 6

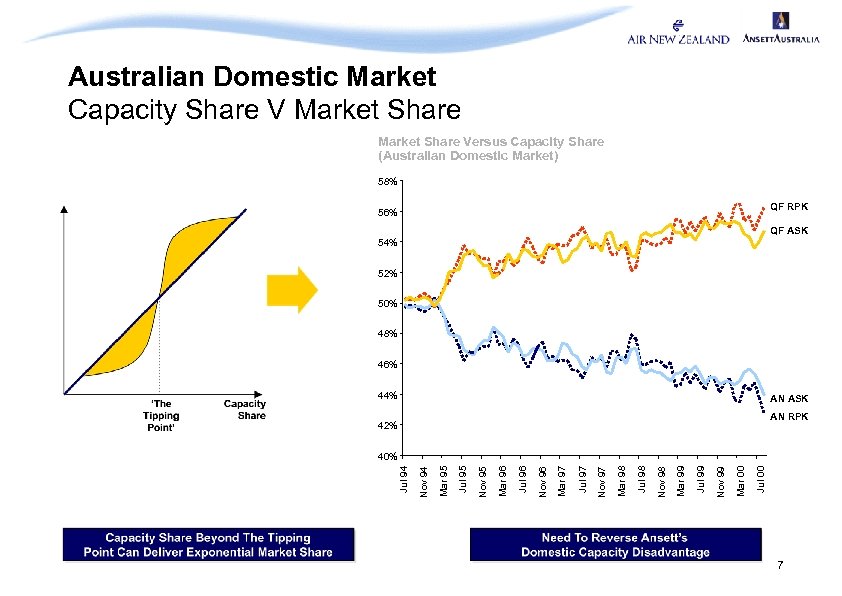

Australian Domestic Market Capacity Share V Market Share Versus Capacity Share (Australian Domestic Market) 58% QF RPK 56% QF ASK 54% 52% 50% 48% 46% 44% AN ASK AN RPK 42% Jul 00 Mar 00 Nov 99 Jul 99 Mar 99 Nov 98 Jul 98 Mar 98 Nov 97 Jul 97 Mar 97 Nov 96 Jul 96 Mar 96 Nov 95 Jul 95 Mar 95 Nov 94 Jul 94 40% 7

Australian Domestic Market Capacity Share V Market Share Versus Capacity Share (Australian Domestic Market) 58% QF RPK 56% QF ASK 54% 52% 50% 48% 46% 44% AN ASK AN RPK 42% Jul 00 Mar 00 Nov 99 Jul 99 Mar 99 Nov 98 Jul 98 Mar 98 Nov 97 Jul 97 Mar 97 Nov 96 Jul 96 Mar 96 Nov 95 Jul 95 Mar 95 Nov 94 Jul 94 40% 7

Australian Domestic Market Addressing Capacity Share • In order to keep pace with market growth and competitors, need to introduce additional capacity on the key routes in Australia • In July, 4 additional 767 -300 (wide bodies) will commence services on the Golden Triangle (SYD-MEL-BNE) • This will increase capacity of Ansett’s domestic trunk network by approximately 10% 8

Australian Domestic Market Addressing Capacity Share • In order to keep pace with market growth and competitors, need to introduce additional capacity on the key routes in Australia • In July, 4 additional 767 -300 (wide bodies) will commence services on the Golden Triangle (SYD-MEL-BNE) • This will increase capacity of Ansett’s domestic trunk network by approximately 10% 8

Australian Domestic Market Corporate Market • Until June last year, Ansett had been loosing corporate accounts – Was not competing on price – Did not have the international network offering of competitor • Impulse has also impacted Ansett’s share of SME business • However, since June 2000 this trend has stabilised and recent months have shown a positive win-loss ratio – Key accounts have been retained and new accounts have been won – Some yield decline due to competitive pressures – International network provided by NZ, AN international and SQ 9

Australian Domestic Market Corporate Market • Until June last year, Ansett had been loosing corporate accounts – Was not competing on price – Did not have the international network offering of competitor • Impulse has also impacted Ansett’s share of SME business • However, since June 2000 this trend has stabilised and recent months have shown a positive win-loss ratio – Key accounts have been retained and new accounts have been won – Some yield decline due to competitive pressures – International network provided by NZ, AN international and SQ 9

Fleet Renewal • Fleet changes will be the product of a revised network strategy and subject to balance sheet constraints Short term • Lease aircraft to meet capacity demand (e. g. 767 -300’s) Long term • Reduction of the number of aircraft types across the group • Increased number of wide bodied aircraft • Rejuvenation of the Ansett fleet • Standardised product 10

Fleet Renewal • Fleet changes will be the product of a revised network strategy and subject to balance sheet constraints Short term • Lease aircraft to meet capacity demand (e. g. 767 -300’s) Long term • Reduction of the number of aircraft types across the group • Increased number of wide bodied aircraft • Rejuvenation of the Ansett fleet • Standardised product 10

Network Changes • AN Int growth on key business markets ex-Australia are Tokyo, Hong Kong, Los Angeles and London – Ansett currently services Osaka instead of Tokyo – Standardise product on Hong Kong route – SYD-LAX services expected to begin in early 2002 • AN Domestic network being reviewed • Refinement of NZ International services • Protection of position in NZ Domestic 11

Network Changes • AN Int growth on key business markets ex-Australia are Tokyo, Hong Kong, Los Angeles and London – Ansett currently services Osaka instead of Tokyo – Standardise product on Hong Kong route – SYD-LAX services expected to begin in early 2002 • AN Domestic network being reviewed • Refinement of NZ International services • Protection of position in NZ Domestic 11

Management Information Improvements • Currently, Air New Zealand systems are adequate however Ansett systems are poor. This has lead to: – Lack of management information to understand what is driving the business – Many different systems being used and no central store of data – Inability to forecast accurately • Short term solution – Have implemented a series of “band-aid” solutions to gain a better understanding of the business and provide information for strategic planning • Long term solution – Single system with uniform data across the group – Additional analytical tools 12

Management Information Improvements • Currently, Air New Zealand systems are adequate however Ansett systems are poor. This has lead to: – Lack of management information to understand what is driving the business – Many different systems being used and no central store of data – Inability to forecast accurately • Short term solution – Have implemented a series of “band-aid” solutions to gain a better understanding of the business and provide information for strategic planning • Long term solution – Single system with uniform data across the group – Additional analytical tools 12

Outlook 13

Outlook 13

Pressure on Profitability Will Continue • Second half performance will remain poor – Substantial operating loss for full year – Traditionally a weaker half – Competition and discounting has intensified in Australia – Foreign exchange remains low year on year – Slowing Australian economy – Some relief from fuel prices • Longer term – Strategic plan for next 3 years to be finalised in July – Capital management / structure to be addressed – Business plans will take some time to implement – Future of competition in Australia is uncertain – Better management information will lead to informed decisions 14

Pressure on Profitability Will Continue • Second half performance will remain poor – Substantial operating loss for full year – Traditionally a weaker half – Competition and discounting has intensified in Australia – Foreign exchange remains low year on year – Slowing Australian economy – Some relief from fuel prices • Longer term – Strategic plan for next 3 years to be finalised in July – Capital management / structure to be addressed – Business plans will take some time to implement – Future of competition in Australia is uncertain – Better management information will lead to informed decisions 14

Air New Zealand Limited New Zealand Society of Investment Analysts 30 March 2001

Air New Zealand Limited New Zealand Society of Investment Analysts 30 March 2001