d1c01fc7b8c8238d67a49c7d02ba7c85.ppt

- Количество слайдов: 18

AIR Innovations Conference Location Efficient Mortgages August 12, 2004 Jacky Grimshaw Center for Neighborhood Technology

AIR Innovations Conference Location Efficient Mortgages August 12, 2004 Jacky Grimshaw Center for Neighborhood Technology

LEM Partnership • Center for Neighborhood Technology-- Chicagobased, 26 years of experience in housing, transportation, and air quality • Natural Resources Defense Council -- Using law and science to protect the environment • Surface Transportation Policy Project -- Washington -based transportation policy reform organization

LEM Partnership • Center for Neighborhood Technology-- Chicagobased, 26 years of experience in housing, transportation, and air quality • Natural Resources Defense Council -- Using law and science to protect the environment • Surface Transportation Policy Project -- Washington -based transportation policy reform organization

Why create a LEM? • Response to affordable urban home ownership • Consideration of transportation costs in relation to location and transportation options • Examination of the disincentives to urban ownership – Mortgage underwriting criteria – Sticker Shock from urban costs © 2001 Center for Neighborhood Technology 3

Why create a LEM? • Response to affordable urban home ownership • Consideration of transportation costs in relation to location and transportation options • Examination of the disincentives to urban ownership – Mortgage underwriting criteria – Sticker Shock from urban costs © 2001 Center for Neighborhood Technology 3

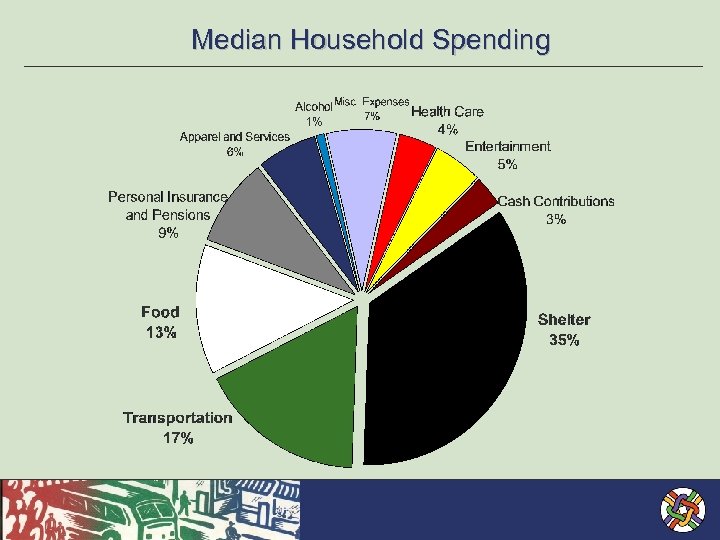

Median Household Spending

Median Household Spending

Local Characteristics That Shape “Location Efficiency” • Residential density at the community level • Access to public transit services • Access to shopping, services, cultural amenities, and schools • Pedestrian “friendliness” of sidewalks, bikeways, benches, lighting, plantings

Local Characteristics That Shape “Location Efficiency” • Residential density at the community level • Access to public transit services • Access to shopping, services, cultural amenities, and schools • Pedestrian “friendliness” of sidewalks, bikeways, benches, lighting, plantings

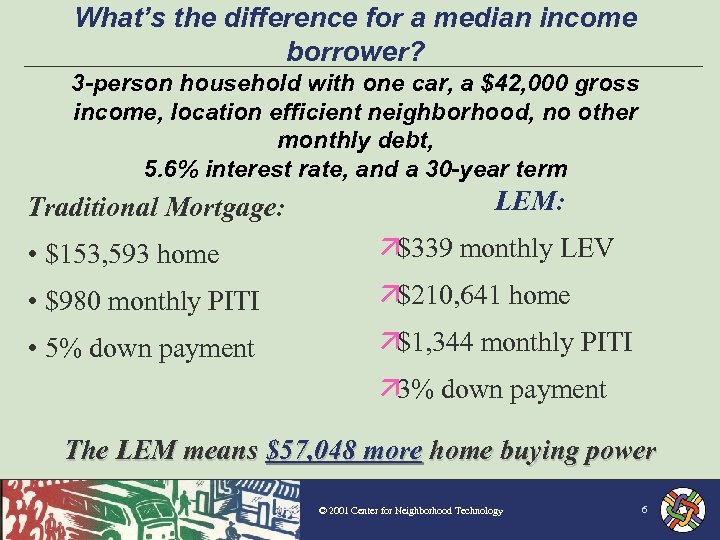

What’s the difference for a median income borrower? 3 -person household with one car, a $42, 000 gross income, location efficient neighborhood, no other monthly debt, 5. 6% interest rate, and a 30 -year term Traditional Mortgage: LEM: • $153, 593 home ä$339 monthly LEV • $980 monthly PITI ä$210, 641 home • 5% down payment ä$1, 344 monthly PITI ä 3% down payment The LEM means $57, 048 more home buying power © 2001 Center for Neighborhood Technology 6

What’s the difference for a median income borrower? 3 -person household with one car, a $42, 000 gross income, location efficient neighborhood, no other monthly debt, 5. 6% interest rate, and a 30 -year term Traditional Mortgage: LEM: • $153, 593 home ä$339 monthly LEV • $980 monthly PITI ä$210, 641 home • 5% down payment ä$1, 344 monthly PITI ä 3% down payment The LEM means $57, 048 more home buying power © 2001 Center for Neighborhood Technology 6

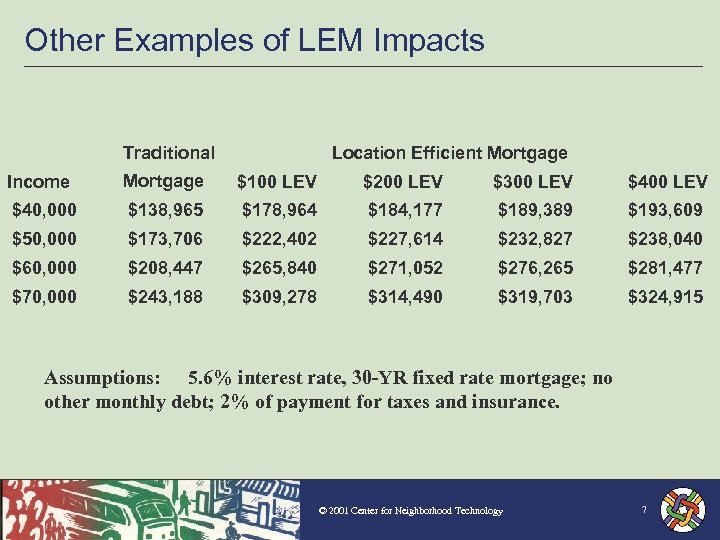

Other Examples of LEM Impacts Location Efficient Mortgage Traditional Income Mortgage $100 LEV $200 LEV $300 LEV $40, 000 $138, 965 $178, 964 $184, 177 $189, 389 $193, 609 $50, 000 $173, 706 $222, 402 $227, 614 $232, 827 $238, 040 $60, 000 $208, 447 $265, 840 $271, 052 $276, 265 $281, 477 $70, 000 $243, 188 $309, 278 $314, 490 $319, 703 $324, 915 Assumptions: 5. 6% interest rate, 30 -YR fixed rate mortgage; no other monthly debt; 2% of payment for taxes and insurance. © 2001 Center for Neighborhood Technology 7

Other Examples of LEM Impacts Location Efficient Mortgage Traditional Income Mortgage $100 LEV $200 LEV $300 LEV $40, 000 $138, 965 $178, 964 $184, 177 $189, 389 $193, 609 $50, 000 $173, 706 $222, 402 $227, 614 $232, 827 $238, 040 $60, 000 $208, 447 $265, 840 $271, 052 $276, 265 $281, 477 $70, 000 $243, 188 $309, 278 $314, 490 $319, 703 $324, 915 Assumptions: 5. 6% interest rate, 30 -YR fixed rate mortgage; no other monthly debt; 2% of payment for taxes and insurance. © 2001 Center for Neighborhood Technology 7

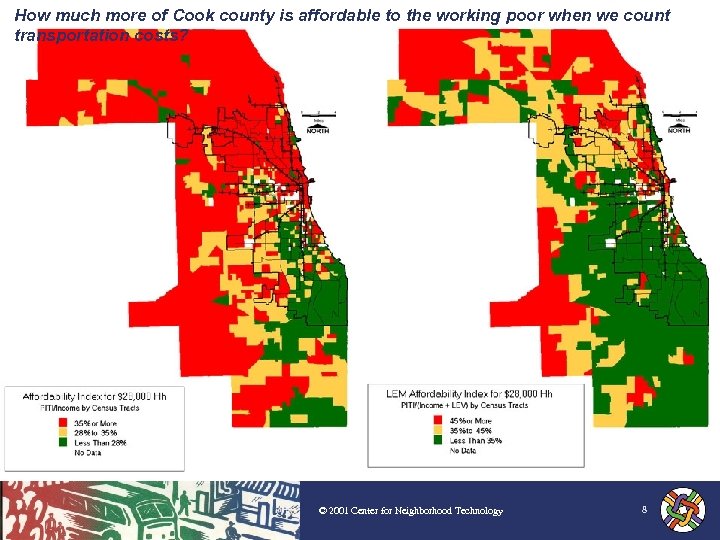

How much more of Cook county is affordable to the working poor when we count transportation costs? © 2001 Center for Neighborhood Technology 8

How much more of Cook county is affordable to the working poor when we count transportation costs? © 2001 Center for Neighborhood Technology 8

Who is Likely to Apply for a LEM? • Moderate to middle income families • Interested in living in an urban community • Prior experience with public transportation • Regular or predictable travel patterns

Who is Likely to Apply for a LEM? • Moderate to middle income families • Interested in living in an urban community • Prior experience with public transportation • Regular or predictable travel patterns

Key Features of the LEM • Family transportation savings “stretch” income/expense ratios • Fully insured, 15 - to 30 -year, fixed rate mortgage product • Single-unit, owner-occupied principal residences, including condos and town homes • Loan-to-value ratio (LTV) of 97% • Long-term total debt/income ratio of 45% with location advantage included

Key Features of the LEM • Family transportation savings “stretch” income/expense ratios • Fully insured, 15 - to 30 -year, fixed rate mortgage product • Single-unit, owner-occupied principal residences, including condos and town homes • Loan-to-value ratio (LTV) of 97% • Long-term total debt/income ratio of 45% with location advantage included

LEM Uses Standard Borrower Qualifying Features • Credit and income history • Employment history and stability • Front-end and back-end ratio calculations • Professional property appraisal

LEM Uses Standard Borrower Qualifying Features • Credit and income history • Employment history and stability • Front-end and back-end ratio calculations • Professional property appraisal

Underwriting Criteria • Minimum borrower contribution is 3% from own funds • Minimum PITI reserves are two months • Qualifying ratios with Location Efficient Value (LEV) added to income: – 35% maximum housing ratio – 45% maximum debt-to-income ratio

Underwriting Criteria • Minimum borrower contribution is 3% from own funds • Minimum PITI reserves are two months • Qualifying ratios with Location Efficient Value (LEV) added to income: – 35% maximum housing ratio – 45% maximum debt-to-income ratio

Underwriting Criteria (con’t) • Qualifying ratios without Location Efficient Value (LEV) added to income: – 39% maximum housing ratio – 49% maximum debt-to-income ratio (may go higher with compensating factors but cannot exceed 50%)

Underwriting Criteria (con’t) • Qualifying ratios without Location Efficient Value (LEV) added to income: – 39% maximum housing ratio – 49% maximum debt-to-income ratio (may go higher with compensating factors but cannot exceed 50%)

Home Buyer Education • Pre-purchase home buyer education is required • Curriculum includes additional module on pitfalls of new credit after closing

Home Buyer Education • Pre-purchase home buyer education is required • Curriculum includes additional module on pitfalls of new credit after closing

Other LEM Features • Transportation data monitored by a voluntary annual survey for 3 years – Key household information reported annually to LEM program for research purposes only – Where available, a transit pass would record basic use data

Other LEM Features • Transportation data monitored by a voluntary annual survey for 3 years – Key household information reported annually to LEM program for research purposes only – Where available, a transit pass would record basic use data

Location Efficient Mortgage. SM Benefits ä Enables more moderate and middle income families buy homes in urban communities ä Increases use of public transportation ä Supports local economies and amenities

Location Efficient Mortgage. SM Benefits ä Enables more moderate and middle income families buy homes in urban communities ä Increases use of public transportation ä Supports local economies and amenities

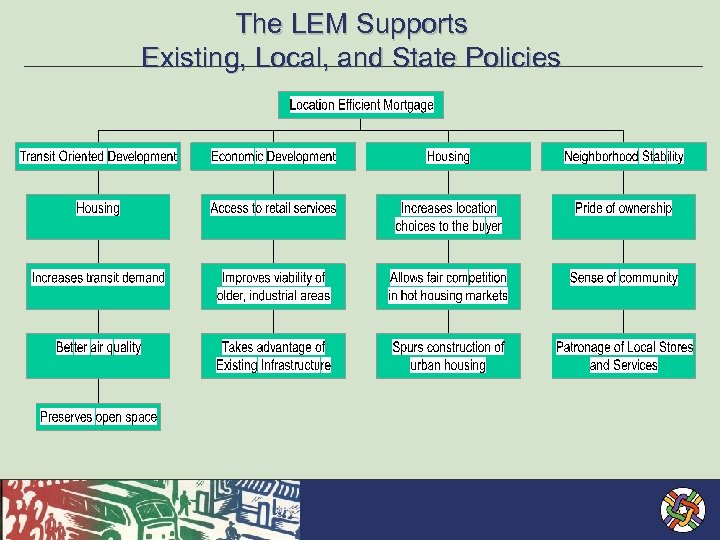

The LEM Supports Existing, Local, and State Policies

The LEM Supports Existing, Local, and State Policies

Jacky Grimshaw jacky@cnt. org www. cnt. org

Jacky Grimshaw jacky@cnt. org www. cnt. org