04f91e7ad75d98210f7ecdf4b317681f.ppt

- Количество слайдов: 70

AICP Gulf States – January 2012 1 (866) 845 -3658; Participant code: 929109

AICP Gulf States – January 2012 1 (866) 845 -3658; Participant code: 929109

Today’s Agenda • • 2011 Legislative and regulatory activity with key trends and issues 2011 Enforcement Actions and Trends What to expect in 2012 Best Practices to help anticipate and manage

Today’s Agenda • • 2011 Legislative and regulatory activity with key trends and issues 2011 Enforcement Actions and Trends What to expect in 2012 Best Practices to help anticipate and manage

Current Regulatory Environment • Legislative and regulatory 1. Intense 2. Traditional focus 3. New issues continue to evolve • Market Regulation 1. Assessment resources 2. Enforcement activity

Current Regulatory Environment • Legislative and regulatory 1. Intense 2. Traditional focus 3. New issues continue to evolve • Market Regulation 1. Assessment resources 2. Enforcement activity

Looking back…

Looking back…

2011 Activity • Over 11, 000 bills impacting the insurance industry were introduced in 2011 • Nearly 22, 000 citations were impacted by legislative or regulatory action

2011 Activity • Over 11, 000 bills impacting the insurance industry were introduced in 2011 • Nearly 22, 000 citations were impacted by legislative or regulatory action

Legislative & Regulatory Activity “Content” • • • Underwriting Claims Product Filings Certificates of Insurance Annuities Suitability Retained Asset Accounts Unclaimed Property Disclosures Health Care Reform Mandated Benefits Trade Practices

Legislative & Regulatory Activity “Content” • • • Underwriting Claims Product Filings Certificates of Insurance Annuities Suitability Retained Asset Accounts Unclaimed Property Disclosures Health Care Reform Mandated Benefits Trade Practices

Property & Casualty

Property & Casualty

Property & Casualty • • Cancellation/Nonrenewal Certificates of Insurance Credit scoring Claims

Property & Casualty • • Cancellation/Nonrenewal Certificates of Insurance Credit scoring Claims

Property & Casualty - Underwriting • Florida: lawful ownership, possession or storage of a firearm or ammunition • Maryland North Dakota: individual’s status as a victim of a violent crime • New York the covered motor vehicle is used for volunteer firefighting • Oregon: personal vehicle sharing

Property & Casualty - Underwriting • Florida: lawful ownership, possession or storage of a firearm or ammunition • Maryland North Dakota: individual’s status as a victim of a violent crime • New York the covered motor vehicle is used for volunteer firefighting • Oregon: personal vehicle sharing

Property & Casualty • Total Loss changes: Maryland Rhode Island • Certificates of Insurance: Arizona, Georgia, Maryland, Massachusetts, Michigan, North Carolina, Utah • Commercial risks: New York, Virginia

Property & Casualty • Total Loss changes: Maryland Rhode Island • Certificates of Insurance: Arizona, Georgia, Maryland, Massachusetts, Michigan, North Carolina, Utah • Commercial risks: New York, Virginia

What to File – “Confidential” Utah • Under the Government Records Access and Management Act (GRAMA) supporting information in a rate filing is considered open for public inspection unless it is classified as private, controlled, or protected • Filer will need to request which specific document the filer believes qualifies under GRAMA when the filing is submitted • The document must include a written statement of reasons supporting the request that the information should be classified as protected • If the filer does not request the information in the document to be classified as protected, the document will be classified as public • DOI will not automatically classify any document in a filing as protected • DOI will not re-open a filing to permit a company to request protected classification of previously filed documents R 590 -225 -11 Effective December 8, 2011

What to File – “Confidential” Utah • Under the Government Records Access and Management Act (GRAMA) supporting information in a rate filing is considered open for public inspection unless it is classified as private, controlled, or protected • Filer will need to request which specific document the filer believes qualifies under GRAMA when the filing is submitted • The document must include a written statement of reasons supporting the request that the information should be classified as protected • If the filer does not request the information in the document to be classified as protected, the document will be classified as public • DOI will not automatically classify any document in a filing as protected • DOI will not re-open a filing to permit a company to request protected classification of previously filed documents R 590 -225 -11 Effective December 8, 2011

All Lines – Privacy Notices • • The new Federal Model Privacy Form was developed for use by federally regulated financial institutions to increase consumers’ understanding and ability to make informed decisions regarding the sharing of personal information as required by the privacy provisions of GLBA. Insurance companies that do business in this state may use the new Federal Model Privacy Form or continue to use other types of privacy notices that differ from the Federal Model Privacy Form to meet the notice content requirements of the Nebraska Privacy of Insurance Consumer Information Act Nebraska Bulletin CB-127

All Lines – Privacy Notices • • The new Federal Model Privacy Form was developed for use by federally regulated financial institutions to increase consumers’ understanding and ability to make informed decisions regarding the sharing of personal information as required by the privacy provisions of GLBA. Insurance companies that do business in this state may use the new Federal Model Privacy Form or continue to use other types of privacy notices that differ from the Federal Model Privacy Form to meet the notice content requirements of the Nebraska Privacy of Insurance Consumer Information Act Nebraska Bulletin CB-127

Life & Annuities

Life & Annuities

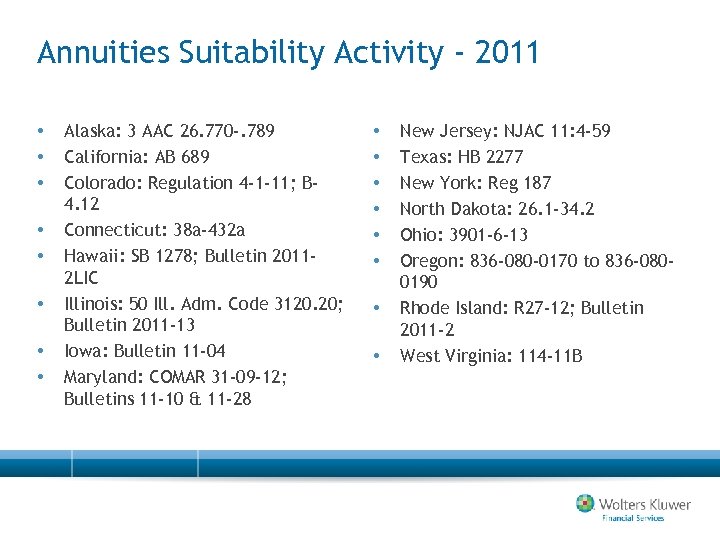

Annuities Suitability Activity - 2011 • • Alaska: 3 AAC 26. 770 -. 789 California: AB 689 Colorado: Regulation 4 -1 -11; B 4. 12 Connecticut: 38 a-432 a Hawaii: SB 1278; Bulletin 20112 LIC Illinois: 50 Ill. Adm. Code 3120. 20; Bulletin 2011 -13 Iowa: Bulletin 11 -04 Maryland: COMAR 31 -09 -12; Bulletins 11 -10 & 11 -28 • • New Jersey: NJAC 11: 4 -59 Texas: HB 2277 New York: Reg 187 North Dakota: 26. 1 -34. 2 Ohio: 3901 -6 -13 Oregon: 836 -080 -0170 to 836 -0800190 Rhode Island: R 27 -12; Bulletin 2011 -2 West Virginia: 114 -11 B

Annuities Suitability Activity - 2011 • • Alaska: 3 AAC 26. 770 -. 789 California: AB 689 Colorado: Regulation 4 -1 -11; B 4. 12 Connecticut: 38 a-432 a Hawaii: SB 1278; Bulletin 20112 LIC Illinois: 50 Ill. Adm. Code 3120. 20; Bulletin 2011 -13 Iowa: Bulletin 11 -04 Maryland: COMAR 31 -09 -12; Bulletins 11 -10 & 11 -28 • • New Jersey: NJAC 11: 4 -59 Texas: HB 2277 New York: Reg 187 North Dakota: 26. 1 -34. 2 Ohio: 3901 -6 -13 Oregon: 836 -080 -0170 to 836 -0800190 Rhode Island: R 27 -12; Bulletin 2011 -2 West Virginia: 114 -11 B

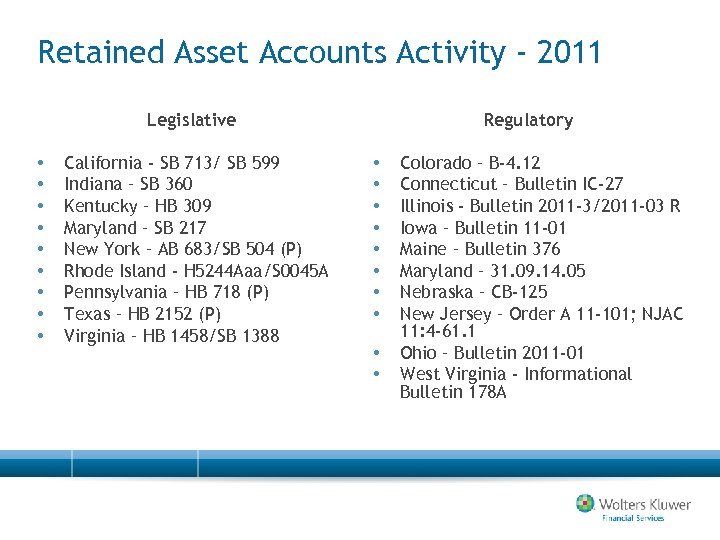

Retained Asset Accounts Activity - 2011 Legislative • • • California - SB 713/ SB 599 Indiana – SB 360 Kentucky – HB 309 Maryland – SB 217 New York – AB 683/SB 504 (P) Rhode Island - H 5244 Aaa/S 0045 A Pennsylvania – HB 718 (P) Texas – HB 2152 (P) Virginia – HB 1458/SB 1388 Regulatory • • • Colorado – B-4. 12 Connecticut – Bulletin IC-27 Illinois - Bulletin 2011 -3/2011 -03 R Iowa – Bulletin 11 -01 Maine – Bulletin 376 Maryland – 31. 09. 14. 05 Nebraska – CB-125 New Jersey – Order A 11 -101; NJAC 11: 4 -61. 1 Ohio – Bulletin 2011 -01 West Virginia - Informational Bulletin 178 A

Retained Asset Accounts Activity - 2011 Legislative • • • California - SB 713/ SB 599 Indiana – SB 360 Kentucky – HB 309 Maryland – SB 217 New York – AB 683/SB 504 (P) Rhode Island - H 5244 Aaa/S 0045 A Pennsylvania – HB 718 (P) Texas – HB 2152 (P) Virginia – HB 1458/SB 1388 Regulatory • • • Colorado – B-4. 12 Connecticut – Bulletin IC-27 Illinois - Bulletin 2011 -3/2011 -03 R Iowa – Bulletin 11 -01 Maine – Bulletin 376 Maryland – 31. 09. 14. 05 Nebraska – CB-125 New Jersey – Order A 11 -101; NJAC 11: 4 -61. 1 Ohio – Bulletin 2011 -01 West Virginia - Informational Bulletin 178 A

Health

Health

Discretionary Clauses Existing legislative or regulatory provisions/restrictions: • Alaska, California, Connecticut, District of Columbia, Hawaii, Idaho, Illinois, Kentucky, Maryland, Michigan, New Jersey, New York, South Dakota, Utah, Washington, Wyoming

Discretionary Clauses Existing legislative or regulatory provisions/restrictions: • Alaska, California, Connecticut, District of Columbia, Hawaii, Idaho, Illinois, Kentucky, Maryland, Michigan, New Jersey, New York, South Dakota, Utah, Washington, Wyoming

Mandated Benefits • • • Autism Spectrum Disorder Telehealth Cochlear implants Oral chemotherapy Hearing aids Clinical trials

Mandated Benefits • • • Autism Spectrum Disorder Telehealth Cochlear implants Oral chemotherapy Hearing aids Clinical trials

Health Care Reform • • • Rate Filing Authority Internal Appeals External Appeals

Health Care Reform • • • Rate Filing Authority Internal Appeals External Appeals

Health Care Reform – Rate Authority Pennsylvania SB 1336 • • Establishes health insurance rate authority Provides for federal compliance for required filings

Health Care Reform – Rate Authority Pennsylvania SB 1336 • • Establishes health insurance rate authority Provides for federal compliance for required filings

Health Care Claims Virginia • Notification of an adverse benefit to include a statement describing the availability, upon request, of the diagnosis code and its corresponding meaning, and the treatment code and its corresponding meaning. The health carrier may not consider a request for diagnosis or treatment information, in itself, to be a request for internal appeal • All notices to be provided in a culturally and linguistically appropriate manner; and upon request, any notice in any applicable non-English language • Provision of oral language services, such as a telephone customer hotline, that include answering questions and providing assistance with filing claims, benefit requests, internal appeals, and external review in any applicable non-English language • Inclusion in the English versions of all notices, a statement prominently displayed in any applicable non-English language clearly indicating how to access the language services provided by the health carrier. 14 VAC 5 -216 -70 (Effective January 1, 2012)

Health Care Claims Virginia • Notification of an adverse benefit to include a statement describing the availability, upon request, of the diagnosis code and its corresponding meaning, and the treatment code and its corresponding meaning. The health carrier may not consider a request for diagnosis or treatment information, in itself, to be a request for internal appeal • All notices to be provided in a culturally and linguistically appropriate manner; and upon request, any notice in any applicable non-English language • Provision of oral language services, such as a telephone customer hotline, that include answering questions and providing assistance with filing claims, benefit requests, internal appeals, and external review in any applicable non-English language • Inclusion in the English versions of all notices, a statement prominently displayed in any applicable non-English language clearly indicating how to access the language services provided by the health carrier. 14 VAC 5 -216 -70 (Effective January 1, 2012)

Regulatory Environment • Continuum of legislative & regulatory activity • Other initiatives keep growing in number • Regulator and media focus on consumer protection

Regulatory Environment • Continuum of legislative & regulatory activity • Other initiatives keep growing in number • Regulator and media focus on consumer protection

2011 Enforcement Activity

2011 Enforcement Activity

Market Conduct Market Regulation • MCAS • Complaints • Other states’ actions • State “history”

Market Conduct Market Regulation • MCAS • Complaints • Other states’ actions • State “history”

Market Conduct Focus: Through the Years • • Claims Underwriting Producers Advertising

Market Conduct Focus: Through the Years • • Claims Underwriting Producers Advertising

P&C Market Conduct: Underwriting • Failed to provide a compliant Summary of Rights for all homeowner, manufactured home, private passenger auto and motorcycle non-renewals and cancellations. Arizona (September 2011)

P&C Market Conduct: Underwriting • Failed to provide a compliant Summary of Rights for all homeowner, manufactured home, private passenger auto and motorcycle non-renewals and cancellations. Arizona (September 2011)

P&C Market Conduct: Underwriting • In regard to the company's use of zip codes for territorial rating in Connecticut, a company is not allowed to split a town or city into more than one rating territory. The examiners found that the company's filed and approved rating plan contained instances of a town or city containing more than one rating territory. Connecticut (October 2011)

P&C Market Conduct: Underwriting • In regard to the company's use of zip codes for territorial rating in Connecticut, a company is not allowed to split a town or city into more than one rating territory. The examiners found that the company's filed and approved rating plan contained instances of a town or city containing more than one rating territory. Connecticut (October 2011)

P&C Market Conduct: Underwriting • 42 errors were due to failure to properly document the use of the filed Schedule Rating Plan…files either failed to document the credit/debits applied or did not have documentation supporting the application of the plan • Failure to follow its filed rating plan Georgia (October 2011)

P&C Market Conduct: Underwriting • 42 errors were due to failure to properly document the use of the filed Schedule Rating Plan…files either failed to document the credit/debits applied or did not have documentation supporting the application of the plan • Failure to follow its filed rating plan Georgia (October 2011)

P&C Market Conduct: Underwriting • 194 errors were due to failure to limit schedule rating factors to no more than 15% when Schedule Rating reports were not sent to the Commissioner’s Office. • 986 errors were due to failure to limit schedule rating factors to no more than 15% when Schedule Rating reports were not sent to the Commissioner's Office… there were 336 errors involving credits and 650 errors involving debits. Georgia (October 2011)

P&C Market Conduct: Underwriting • 194 errors were due to failure to limit schedule rating factors to no more than 15% when Schedule Rating reports were not sent to the Commissioner’s Office. • 986 errors were due to failure to limit schedule rating factors to no more than 15% when Schedule Rating reports were not sent to the Commissioner's Office… there were 336 errors involving credits and 650 errors involving debits. Georgia (October 2011)

P&C Market Conduct: Underwriting • Sent 905 non-payment cancellation notices to Maine policyholders that did not contain the notice of right to request a hearing. Maine (November 2011)

P&C Market Conduct: Underwriting • Sent 905 non-payment cancellation notices to Maine policyholders that did not contain the notice of right to request a hearing. Maine (November 2011)

P&C Market Conduct: Underwriting • Issued premium increase notices…failed to contain the Administration's new address at 200 St. Paul Place Suite 2700 Baltimore MD 21202. • The address became effective January 1, 2010, and “companies” were so notified in March 2009. Maryland (September 2011)

P&C Market Conduct: Underwriting • Issued premium increase notices…failed to contain the Administration's new address at 200 St. Paul Place Suite 2700 Baltimore MD 21202. • The address became effective January 1, 2010, and “companies” were so notified in March 2009. Maryland (September 2011)

P&C Market Conduct: Underwriting • Failing to provide notice to insureds at their policy inception and/or renewal that claims history is considered for purposes of canceling or refusing to renew coverage • Renewal offers failed to advise insureds of the amounts of expiring premiums Maryland (September 2011)

P&C Market Conduct: Underwriting • Failing to provide notice to insureds at their policy inception and/or renewal that claims history is considered for purposes of canceling or refusing to renew coverage • Renewal offers failed to advise insureds of the amounts of expiring premiums Maryland (September 2011)

P&C Market Conduct: Underwriting • 10, 913 Violations Title 75, Pa. C. S. § 1791. 1(c) • Failed to provide a notice at renewal regarding discounts available for drivers who meet the requirements relating to restraint systems, anti-theft devices and driver improvement course. Pennsylvania (October 2011)

P&C Market Conduct: Underwriting • 10, 913 Violations Title 75, Pa. C. S. § 1791. 1(c) • Failed to provide a notice at renewal regarding discounts available for drivers who meet the requirements relating to restraint systems, anti-theft devices and driver improvement course. Pennsylvania (October 2011)

P&C Market Conduct: Underwriting • 8, 266 Violations Title 75, Pa. CS. § 1822 • The Company did not provide the fraud warning at renewal for the 8, 266 files noted. Pennsylvania (October 2011)

P&C Market Conduct: Underwriting • 8, 266 Violations Title 75, Pa. CS. § 1822 • The Company did not provide the fraud warning at renewal for the 8, 266 files noted. Pennsylvania (October 2011)

P&C Market Conduct: Underwriting • Issued 152 notices, non-renewing policies because the agent was terminated, which did not contain an offer to continue/renew the policy • Issued 473 cancellation/non-renewal notices which did not contain the correct address for the Wisconsin Automobile Insurance Plan (WAIP) Wisconsin (October 2011)

P&C Market Conduct: Underwriting • Issued 152 notices, non-renewing policies because the agent was terminated, which did not contain an offer to continue/renew the policy • Issued 473 cancellation/non-renewal notices which did not contain the correct address for the Wisconsin Automobile Insurance Plan (WAIP) Wisconsin (October 2011)

Market Conduct: Documentation • Failed to maintain its books, records, documents, and other business records and to provide relevant materials, files, and documentation in such a way to allow the examiners to sufficiently ascertain the claims handling and payment practices of the Company Missouri (October 2011)

Market Conduct: Documentation • Failed to maintain its books, records, documents, and other business records and to provide relevant materials, files, and documentation in such a way to allow the examiners to sufficiently ascertain the claims handling and payment practices of the Company Missouri (October 2011)

Life Market Conduct: Underwriting • “Company” violated the following provision of the Florida Insurance Code: Section 626. 9541(1)(dd), Florida Statutes - Refusal of life insurance; refusal to continue the life insurance of; or limiting the amount, extent, or kind of life insurance coverage available to an individual based solely on the individual’s past or future lawful foreign travel plans. Florida (October 2011)

Life Market Conduct: Underwriting • “Company” violated the following provision of the Florida Insurance Code: Section 626. 9541(1)(dd), Florida Statutes - Refusal of life insurance; refusal to continue the life insurance of; or limiting the amount, extent, or kind of life insurance coverage available to an individual based solely on the individual’s past or future lawful foreign travel plans. Florida (October 2011)

Life Market Conduct: Claims • {Company} provided the examiner a sample term life proof of claim form in which the fraud warning notice did not comply with the language required by California law. • {Company} reported that the claim payments made 30 days after the date of death did not specify the rate of interest paid on these claims. California (August 2011)

Life Market Conduct: Claims • {Company} provided the examiner a sample term life proof of claim form in which the fraud warning notice did not comply with the language required by California law. • {Company} reported that the claim payments made 30 days after the date of death did not specify the rate of interest paid on these claims. California (August 2011)

Health Market Conduct: Underwriting/Advertising • Used misleading statements within its advertising • Failed to document the providing of an Outline of Coverage • Failed to document the providing of a Guide to Health Insurance for people with Medicare • Failed to notify terminated insureds’ of their right to a conversion policy Kentucky (August 2011)

Health Market Conduct: Underwriting/Advertising • Used misleading statements within its advertising • Failed to document the providing of an Outline of Coverage • Failed to document the providing of a Guide to Health Insurance for people with Medicare • Failed to notify terminated insureds’ of their right to a conversion policy Kentucky (August 2011)

Health Market Conduct: Claims • • • Failed to send written notice of an adverse decision to certain members Failed to provide the correct address, for the Maryland Insurance Commissioner on its adverse decision notices. Failed to provide its internal grievance process as a component of the adverse decision notice sent to Maryland members and providers. Failed to include required information on adverse decision notices sent to Maryland members and to providers. Failed to send a copy of a grievance decision notice after rendering a grievance decision. Failed to provide the correct address for the office of the Commissioner on grievance decision notices sent to Maryland members and to providers. Failed to send out a grievance decision notice to some members after rendering a grievance decision in emergency cases. Failed to include the required information on a grievance decision notice sent to members and health care providers acting on behalf of a member as a result of an emergency case. Failed to make a determination on whether to authorize or certify additional health care services within one working day after receipt of the information necessary to make the determination. Failed to authorize or certify an inpatient admission within two hours after receipt of the information necessary to make the determination Maryland (October 2011)

Health Market Conduct: Claims • • • Failed to send written notice of an adverse decision to certain members Failed to provide the correct address, for the Maryland Insurance Commissioner on its adverse decision notices. Failed to provide its internal grievance process as a component of the adverse decision notice sent to Maryland members and providers. Failed to include required information on adverse decision notices sent to Maryland members and to providers. Failed to send a copy of a grievance decision notice after rendering a grievance decision. Failed to provide the correct address for the office of the Commissioner on grievance decision notices sent to Maryland members and to providers. Failed to send out a grievance decision notice to some members after rendering a grievance decision in emergency cases. Failed to include the required information on a grievance decision notice sent to members and health care providers acting on behalf of a member as a result of an emergency case. Failed to make a determination on whether to authorize or certify additional health care services within one working day after receipt of the information necessary to make the determination. Failed to authorize or certify an inpatient admission within two hours after receipt of the information necessary to make the determination Maryland (October 2011)

2012 – Activity to Date

2012 – Activity to Date

Regulatory Environment - 2012 • • Strong start Legislative sessions: pre-filed and introduced Regulatory activity Enforcement activity

Regulatory Environment - 2012 • • Strong start Legislative sessions: pre-filed and introduced Regulatory activity Enforcement activity

Health – Mandated Benefits New Jersey AB 1120 – Enacted 1/17/12 • Requires insurers to cover treatment for sickle cell anemia • If the insurance policy provides benefits for expenses incurred in the purchase of outpatient prescription drugs, then the contract shall provide coverage for prescription drug expenses incurred by a covered person for the treatment of sickle cell anemia

Health – Mandated Benefits New Jersey AB 1120 – Enacted 1/17/12 • Requires insurers to cover treatment for sickle cell anemia • If the insurance policy provides benefits for expenses incurred in the purchase of outpatient prescription drugs, then the contract shall provide coverage for prescription drug expenses incurred by a covered person for the treatment of sickle cell anemia

Health – Mandated Benefits New Jersey SB 1834 – Enacted 1/17/12 • Coverage for expenses for prescribed, orally administered anticancer medications used to kill or slow the growth of cancerous cells shall not be subject to any prior authorization, dollar limit, copayment, deductible or coinsurance provision that does not apply to intravenously administered or injected anticancer medications. • Insurers shall not achieve compliance with the provisions of this section by imposing an increase in patient cost sharing, including any copayment, deductible or coinsurance, for anticancer medications, whether intravenously administered or injected or orally administered, that are covered under the contract as of the effective date of this act

Health – Mandated Benefits New Jersey SB 1834 – Enacted 1/17/12 • Coverage for expenses for prescribed, orally administered anticancer medications used to kill or slow the growth of cancerous cells shall not be subject to any prior authorization, dollar limit, copayment, deductible or coinsurance provision that does not apply to intravenously administered or injected anticancer medications. • Insurers shall not achieve compliance with the provisions of this section by imposing an increase in patient cost sharing, including any copayment, deductible or coinsurance, for anticancer medications, whether intravenously administered or injected or orally administered, that are covered under the contract as of the effective date of this act

2012 - Introduced Bills

2012 - Introduced Bills

Property & Casualty – Credit Scoring Kentucky SB 31 • Insurers shall not use the credit history or the lack of credit history, including a credit score or insurance score, of an insured or an applicant as the basis in whole or in part to decline, refuse to renew, cancel, rate, or determine the premium rate for any insurance policy, contract, or plan of insurance

Property & Casualty – Credit Scoring Kentucky SB 31 • Insurers shall not use the credit history or the lack of credit history, including a credit score or insurance score, of an insured or an applicant as the basis in whole or in part to decline, refuse to renew, cancel, rate, or determine the premium rate for any insurance policy, contract, or plan of insurance

Property & Casualty – Credit Scoring Virginia HB 355/HB 432 • Motor vehicle insurers shall not set rates or make pricing decisions based on a person's credit history, lack of credit history, or credit score

Property & Casualty – Credit Scoring Virginia HB 355/HB 432 • Motor vehicle insurers shall not set rates or make pricing decisions based on a person's credit history, lack of credit history, or credit score

Property & Casualty – Credit Scoring West Virginia: HB 2049 Insurers shall not: • Refuse to underwrite, cancel, refuse to renew a risk or increase a renewal premium based, in whole or in part, on the credit history of an applicant or insured; • Rate a risk based, in whole or in part, on the credit history of an applicant or insured person in any manner, including, but not limited to, the provision or removal of a discount, assigning an applicant or insured person to a rating tier, or placing an applicant or insured person with an affiliated company; or • Require a particular payment plan based, in whole or in part, on the credit history of the applicant or the insured

Property & Casualty – Credit Scoring West Virginia: HB 2049 Insurers shall not: • Refuse to underwrite, cancel, refuse to renew a risk or increase a renewal premium based, in whole or in part, on the credit history of an applicant or insured; • Rate a risk based, in whole or in part, on the credit history of an applicant or insured person in any manner, including, but not limited to, the provision or removal of a discount, assigning an applicant or insured person to a rating tier, or placing an applicant or insured person with an affiliated company; or • Require a particular payment plan based, in whole or in part, on the credit history of the applicant or the insured

Property & Casualty - Underwriting Tennessee SB 2372 • All contracts of insurance issued for delivery after July 1, 2012, shall provide for 10% premium reduction for any renewed insurance policy if a claim has not been filed against such policy that resulted in payment by the insurance company for the previous year

Property & Casualty - Underwriting Tennessee SB 2372 • All contracts of insurance issued for delivery after July 1, 2012, shall provide for 10% premium reduction for any renewed insurance policy if a claim has not been filed against such policy that resulted in payment by the insurance company for the previous year

Property & Casualty - Claims Kentucky HB 207 • • An insurer shall inform a claimant upon notification of a motor vehicle damage claim that he or she has the right to choose the repair facility of his or her choice to repair a damaged vehicle. After the effective date of this Act, all appraisals shall include the following notice, printed in not less than 10 point, boldfaced type: "NOTICE: UNDER KENTUCKY LAW, THE CONSUMER AND/OR LESSEE HAS THE RIGHT TO CHOOSE THE REPAIR FACILITY TO MAKE REPAIRS TO HIS OR HER MOTOR VEHICLE. "

Property & Casualty - Claims Kentucky HB 207 • • An insurer shall inform a claimant upon notification of a motor vehicle damage claim that he or she has the right to choose the repair facility of his or her choice to repair a damaged vehicle. After the effective date of this Act, all appraisals shall include the following notice, printed in not less than 10 point, boldfaced type: "NOTICE: UNDER KENTUCKY LAW, THE CONSUMER AND/OR LESSEE HAS THE RIGHT TO CHOOSE THE REPAIR FACILITY TO MAKE REPAIRS TO HIS OR HER MOTOR VEHICLE. "

Property & Casualty Virginia HB 523/SB 369 • New or renewal contracts/policies of fire insurance which policy or contract exclude coverage for damage due to earthquake shall provide written notice that explicitly states that: 1. Earthquake coverage is excluded and 2. Information regarding earthquake insurance is available from the insurer or the insurance agent and that such coverage may be available for an additional premium

Property & Casualty Virginia HB 523/SB 369 • New or renewal contracts/policies of fire insurance which policy or contract exclude coverage for damage due to earthquake shall provide written notice that explicitly states that: 1. Earthquake coverage is excluded and 2. Information regarding earthquake insurance is available from the insurer or the insurance agent and that such coverage may be available for an additional premium

Property & Casualty – Certificates of Insurance Virginia HB 867/SB 47 • • No person shall issue or deliver any certificate of insurance that attempts to confer any rights upon a third party beyond what the referenced policy of insurance expressly provides. No certificate of insurance may represent an insurer's obligation to give notice of cancellation or nonrenewal to a third party unless the giving of such notice is required by the policy. No person shall issue or deliver a certificate of insurance unless it contains a substantially similar statement to the following: "This certificate of insurance is issued as a matter of information only. It confers no rights upon the third party requesting the certificate beyond what the referenced policy of insurance expressly provides. This certificate of insurance does not extend, amend, or alter the coverage, terms, exclusions, or conditions afforded by the policy referenced in this certificate of insurance. " No person shall knowingly prepare or issue a certificate of insurance that contains any false or misleading information or that purports to affirmatively or negatively alter, amend, or extend the coverage provided by the policy of insurance to which the certificate makes reference.

Property & Casualty – Certificates of Insurance Virginia HB 867/SB 47 • • No person shall issue or deliver any certificate of insurance that attempts to confer any rights upon a third party beyond what the referenced policy of insurance expressly provides. No certificate of insurance may represent an insurer's obligation to give notice of cancellation or nonrenewal to a third party unless the giving of such notice is required by the policy. No person shall issue or deliver a certificate of insurance unless it contains a substantially similar statement to the following: "This certificate of insurance is issued as a matter of information only. It confers no rights upon the third party requesting the certificate beyond what the referenced policy of insurance expressly provides. This certificate of insurance does not extend, amend, or alter the coverage, terms, exclusions, or conditions afforded by the policy referenced in this certificate of insurance. " No person shall knowingly prepare or issue a certificate of insurance that contains any false or misleading information or that purports to affirmatively or negatively alter, amend, or extend the coverage provided by the policy of insurance to which the certificate makes reference.

Life – Unclaimed Property Kentucky HB 135 • Requires insurers to compare in-force life insurance policies against the Death Master File to determine potential matches of their insureds; requires escheat of policy proceeds after the expiration of the fee statutory time period only if no claim for the policy's proceeds has been made and if good faith efforts to contact the retained asset holder and any beneficiary are unsuccessful.

Life – Unclaimed Property Kentucky HB 135 • Requires insurers to compare in-force life insurance policies against the Death Master File to determine potential matches of their insureds; requires escheat of policy proceeds after the expiration of the fee statutory time period only if no claim for the policy's proceeds has been made and if good faith efforts to contact the retained asset holder and any beneficiary are unsuccessful.

Life – Unclaimed Property Maryland SB 77 • Requires an insurer that issues or delivers a policy of life insurance or an annuity contract to perform a crosscheck of the insurer's in- force life insurance policies, annuity contracts, and retained asset accounts against a specified death master file to identify any death benefit payments that may be due as a result of the death of an insured, annuitant, or account holder

Life – Unclaimed Property Maryland SB 77 • Requires an insurer that issues or delivers a policy of life insurance or an annuity contract to perform a crosscheck of the insurer's in- force life insurance policies, annuity contracts, and retained asset accounts against a specified death master file to identify any death benefit payments that may be due as a result of the death of an insured, annuitant, or account holder

Life – Unclaimed Property TN HB 2283 includes requirements for insurers to: • Perform a comparison of its insureds' in-force life insurance policies and retained asset accounts against a death master file, on at least a quarterly basis, using criteria reasonably designed to identify potential matches of its insureds. For those potential matches identified as a result of a death master file match, the insurer shall: 1. Within ninety (90) days of a death master file match: 2. Complete a good faith effort, which shall be documented by the insurer, to confirm 3. 4. 5. the death of the insured or retained asset account holder against other available records and information; and Determine whether benefits are due in accordance with the applicable policy or contract; and if benefits are due in accordance with the applicable policy or contract: Use good faith efforts, which shall be documented by the insurer, to locate the beneficiary or beneficiaries; and Provide the appropriate claims forms or instructions to the beneficiary or beneficiaries to make a claim including the need to provide an official death certificate, if applicable under the policy or contract.

Life – Unclaimed Property TN HB 2283 includes requirements for insurers to: • Perform a comparison of its insureds' in-force life insurance policies and retained asset accounts against a death master file, on at least a quarterly basis, using criteria reasonably designed to identify potential matches of its insureds. For those potential matches identified as a result of a death master file match, the insurer shall: 1. Within ninety (90) days of a death master file match: 2. Complete a good faith effort, which shall be documented by the insurer, to confirm 3. 4. 5. the death of the insured or retained asset account holder against other available records and information; and Determine whether benefits are due in accordance with the applicable policy or contract; and if benefits are due in accordance with the applicable policy or contract: Use good faith efforts, which shall be documented by the insurer, to locate the beneficiary or beneficiaries; and Provide the appropriate claims forms or instructions to the beneficiary or beneficiaries to make a claim including the need to provide an official death certificate, if applicable under the policy or contract.

Health – Discretionary Clauses Georgia HB 736 • Disability income protection coverage - shall not contain a provision purporting to reserve discretion to the insurer to interpret the terms of the contract, or to provide standards of interpretation or review that are inconsistent with the laws of this state.

Health – Discretionary Clauses Georgia HB 736 • Disability income protection coverage - shall not contain a provision purporting to reserve discretion to the insurer to interpret the terms of the contract, or to provide standards of interpretation or review that are inconsistent with the laws of this state.

Health – Dental Coverage Kentucky HB 98 • Provides that a dental plan shall not require a participating dentist to provide noncovered services at a fee set by or subject to the dental plan • Provides that a TPA for a dental plan shall not make available any providers in its dentist network that sets dental fees for any noncovered services

Health – Dental Coverage Kentucky HB 98 • Provides that a dental plan shall not require a participating dentist to provide noncovered services at a fee set by or subject to the dental plan • Provides that a TPA for a dental plan shall not make available any providers in its dentist network that sets dental fees for any noncovered services

Health – Mandated Benefits Nebraska LB 882 • Coverage for cancer treatment shall provide coverage for a prescribed, orally administered anticancer medication that is used to kill or slow the growth of cancerous cells on a basis no less favorable than intravenously administered or injected cancer medications that are covered as medical benefits by the policy, certificate, contract, or plan • This does not prohibit the policy, certificate, contract, or plan from requiring prior authorization for a prescribed, orally administered anticancer medication. • Cost to the covered individual shall not exceed the coinsurance or copayment that would be applied to any other cancer treatment • Prohibited from reclassifying any anticancer medication or increase a coinsurance, copayment, deductible, or other out-of-pocket expense imposed on any anticancer medication to achieve compliance with this section

Health – Mandated Benefits Nebraska LB 882 • Coverage for cancer treatment shall provide coverage for a prescribed, orally administered anticancer medication that is used to kill or slow the growth of cancerous cells on a basis no less favorable than intravenously administered or injected cancer medications that are covered as medical benefits by the policy, certificate, contract, or plan • This does not prohibit the policy, certificate, contract, or plan from requiring prior authorization for a prescribed, orally administered anticancer medication. • Cost to the covered individual shall not exceed the coinsurance or copayment that would be applied to any other cancer treatment • Prohibited from reclassifying any anticancer medication or increase a coinsurance, copayment, deductible, or other out-of-pocket expense imposed on any anticancer medication to achieve compliance with this section

Health – Mandated Benefits Virginia SB 450 • Requires health insurers, health care subscription plans, and health maintenance organizations whose policies provide coverage for cancer chemotherapy treatment to provide coverage for a prescribed, orally administered anticancer medication on a basis no less favorable than that on which it provides coverage for intravenously administered or injected anticancer medications.

Health – Mandated Benefits Virginia SB 450 • Requires health insurers, health care subscription plans, and health maintenance organizations whose policies provide coverage for cancer chemotherapy treatment to provide coverage for a prescribed, orally administered anticancer medication on a basis no less favorable than that on which it provides coverage for intravenously administered or injected anticancer medications.

Health – Mandated Benefits Virginia HB 705 • If a health carrier is prohibited from imposing any costsharing requirements with respect to preventive care or screening, the health carrier shall not impose costsharing requirements such as: • A copayment, coinsurance, or deductible with respect to any diagnostic service or test, or related procedure, that is administered or conducted as a result of, or in conjunction with, the preventive care or screening

Health – Mandated Benefits Virginia HB 705 • If a health carrier is prohibited from imposing any costsharing requirements with respect to preventive care or screening, the health carrier shall not impose costsharing requirements such as: • A copayment, coinsurance, or deductible with respect to any diagnostic service or test, or related procedure, that is administered or conducted as a result of, or in conjunction with, the preventive care or screening

Health - Claims Virginia SB 135 • Establishes the Virginia All-Payer Claims Database system, in order to facilitate data-driven, evidencebased improvements in access, quality, and cost of health care through understanding of health care expenditure patterns and operation and performance of the health care system

Health - Claims Virginia SB 135 • Establishes the Virginia All-Payer Claims Database system, in order to facilitate data-driven, evidencebased improvements in access, quality, and cost of health care through understanding of health care expenditure patterns and operation and performance of the health care system

All Lines – Electronic & Telephonic Applications Montana Advisory Memorandum of January 9, 2012 • • • Prior to May 9, 2012, insurers must file with the CSI all electronic and telephonic application forms, including any currently in use. Insurers may submit a list of all questions that may be asked throughout a logic tree, screenshots of the questions as they appear on the application, or any other format which details the questions that may be asked. Companies may make an informational filing if they are using electronic or telephonic forms that mimic forms already approved by the CSI. An informational filing must indicate that the electronic or telephonic form equates to a form already on file, and must include the number of the previously approved form on the bottom of each page. Companies that have already provided an informational filing are not required to do so again. Electronic/telephonic applications in use prior to t 1/9/12 and submitted for review and approval prior to May 9, 2012, may continue to be used unless/until the CSI informs an insurer otherwise. Forms not submitted for review and approval prior to 5/9/12 may not be used.

All Lines – Electronic & Telephonic Applications Montana Advisory Memorandum of January 9, 2012 • • • Prior to May 9, 2012, insurers must file with the CSI all electronic and telephonic application forms, including any currently in use. Insurers may submit a list of all questions that may be asked throughout a logic tree, screenshots of the questions as they appear on the application, or any other format which details the questions that may be asked. Companies may make an informational filing if they are using electronic or telephonic forms that mimic forms already approved by the CSI. An informational filing must indicate that the electronic or telephonic form equates to a form already on file, and must include the number of the previously approved form on the bottom of each page. Companies that have already provided an informational filing are not required to do so again. Electronic/telephonic applications in use prior to t 1/9/12 and submitted for review and approval prior to May 9, 2012, may continue to be used unless/until the CSI informs an insurer otherwise. Forms not submitted for review and approval prior to 5/9/12 may not be used.

2012 – Market Conduct

2012 – Market Conduct

Market Conduct - Complaint Log • “TPA” keeps records of inquiries and complaints; however, the complaints are comingled in a database with other plans and the TPA had difficulty segregating them. As a result, the examination concluded that, effectively, no separate complaint log had been kept. Idaho (January 2012)

Market Conduct - Complaint Log • “TPA” keeps records of inquiries and complaints; however, the complaints are comingled in a database with other plans and the TPA had difficulty segregating them. As a result, the examination concluded that, effectively, no separate complaint log had been kept. Idaho (January 2012)

Market Conduct - Homeowners • Did not include written complaints in its compliant logs • Not in compliance with statutory requirements regarding the licensing of producers • Failed to follow its rating manual • Not in compliance with statutory requirements regarding the declination of homeowners policies • Use of unlicensed claims adjusters Connecticut (January 2012)

Market Conduct - Homeowners • Did not include written complaints in its compliant logs • Not in compliance with statutory requirements regarding the licensing of producers • Failed to follow its rating manual • Not in compliance with statutory requirements regarding the declination of homeowners policies • Use of unlicensed claims adjusters Connecticut (January 2012)

Trends & Challenges – 2012 • Legislative and regulatory 1. Consumer protection 2. Disclosures • Market conduct 1. Claims compliance 2. Underwriting compliance

Trends & Challenges – 2012 • Legislative and regulatory 1. Consumer protection 2. Disclosures • Market conduct 1. Claims compliance 2. Underwriting compliance

Key Steps in Managing “All these changes” • • Identify Analyze for business impact Implement Minimizing de-implementation

Key Steps in Managing “All these changes” • • Identify Analyze for business impact Implement Minimizing de-implementation

What’s Best – Going Forward • • Making sure you have all you need Managing all of it through to implementation Updating/aligning policies & procedures Making sure compliance is maintained

What’s Best – Going Forward • • Making sure you have all you need Managing all of it through to implementation Updating/aligning policies & procedures Making sure compliance is maintained

Thank You Questions?

Thank You Questions?

For more information, please visit www. Insurance. Compliance. Corner. com Kathy Donovan Senior Compliance Counsel, Insurance Solutions Wolters Kluwer Financial Services kathy. donovan@wolterskluwer. com 781. 907. 6689

For more information, please visit www. Insurance. Compliance. Corner. com Kathy Donovan Senior Compliance Counsel, Insurance Solutions Wolters Kluwer Financial Services kathy. donovan@wolterskluwer. com 781. 907. 6689