860901dce48e7f5e13d2b55c23bdfb95.ppt

- Количество слайдов: 18

Agriculture in Brazil Overview | April 2010

Section 1 Los Grobo Overview

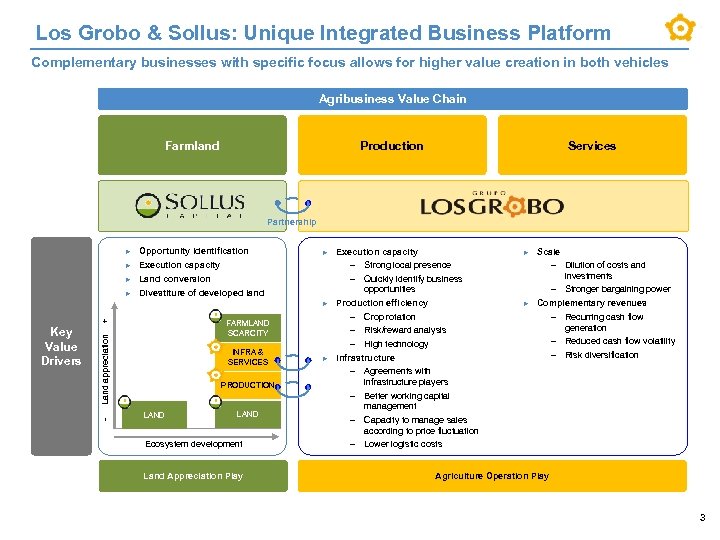

Los Grobo & Sollus: Unique Integrated Business Platform Complementary businesses with specific focus allows for higher value creation in both vehicles Agribusiness Value Chain Farmland Production Services Partnership ► Opportunity identification ► Execution capacity ► Land conversion ► Divestiture of developed land ► + Land appreciation - Scale INFRA & SERVICES PRODUCTION LAND Ecosystem development Land Appreciation Play – Dilution of costs and investments – Stronger bargaining power opportunities Production efficiency ► Complementary revenues – Crop rotation – Risk/reward analysis – High technology FARMLAND SCARCITY LAND ► – Strong local presence – Quickly identify business ► Key Value Drivers Execution capacity ► Infrastructure – Agreements with infrastructure players – Better working capital management – Capacity to manage sales according to price fluctuation – Lower logistic costs – Recurring cash flow generation – Reduced cash flow volatility – Risk diversification Agriculture Operation Play 3

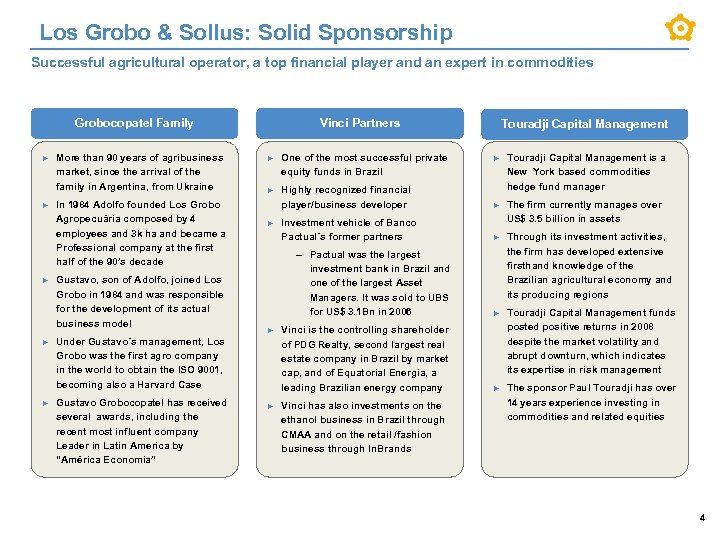

Los Grobo & Sollus: Solid Sponsorship Successful agricultural operator, a top financial player and an expert in commodities Grobocopatel Family ► More than 90 years of agribusiness market, since the arrival of the family in Argentina, from Ukraine ► In 1984 Adolfo founded Los Grobo Agropecuária composed by 4 employees and 3 k ha and became a Professional company at the first half of the 90’s decade ► ► ► Gustavo, son of Adolfo, joined Los Grobo in 1984 and was responsible for the development of its actual business model Vinci Partners ► Highly recognized financial player/business developer Touradji Capital Management is a New York based commodities hedge fund manager ► Investment vehicle of Banco Pactual´s former partners The firm currently manages over US$ 3. 5 billion in assets ► – Pactual was the largest investment bank in Brazil and one of the largest Asset Managers. It was sold to UBS for US$ 3. 1 Bn in 2006 Through its investment activities, the firm has developed extensive firsthand knowledge of the Brazilian agricultural economy and its producing regions ► Vinci is the controlling shareholder of PDG Realty, second largest real estate company in Brazil by market cap, and of Equatorial Energia, a leading Brazilian energy company Touradji Capital Management funds posted positive returns in 2008 despite the market volatility and abrupt downturn, which indicates its expertise in risk management ► The sponsor Paul Touradji has over 14 years experience investing in commodities and related equities ► One of the most successful private equity funds in Brazil ► ► ► Under Gustavo´s management, Los Grobo was the first agro company in the world to obtain the ISO 9001, becoming also a Harvard Case Gustavo Grobocopatel has received several awards, including the recent most influent company Leader in Latin America by “América Economía” Touradji Capital Management ► Vinci has also investments on the ethanol business in Brazil through CMAA and on the retail /fashion business through In. Brands 4

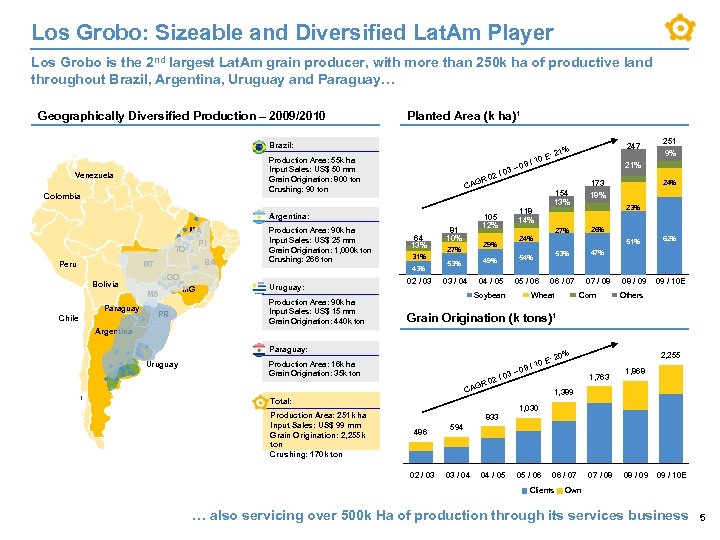

Los Grobo: Sizeable and Diversified Lat. Am Player Los Grobo is the 2 nd largest Lat. Am grain producer, with more than 250 k ha of productive land throughout Brazil, Argentina, Uruguay and Paraguay… Geographically Diversified Production – 2009/2010 Planted Area (k ha)¹ Brazil: Production Area: 55 k ha Input Sales: US$ 50 mm Grain Origination: 800 ton Crushing: 90 ton Venezuela Colombia Argentina: MA PI TO Brazil MT Peru MS Chile PR MG 64 13% 31% 43% GO Bolivia Paraguay BA Production Area: 90 k ha Input Sales: US$ 25 mm Grain Origination: 1, 000 k ton Crushing: 266 ton Uruguay: Production Area: 90 k ha Input Sales: US$ 15 mm Grain Origination: 440 k ton 2/ R 0 CAG 02 / 03 09 03 – 24% 26% 47% 51% 05 / 06 Soybean 9% 23% 54% 04 / 05 03 / 04 173 18% 154 13% 27% 49% 53% 251 21% 24% 29% 27% E 118 14% 105 12% 81 10% / 10 247 % : 21 06 / 07 Wheat 07 / 08 Corn 08 / 09 62% 09 / 10 E Others Grain Origination (k tons)¹ Argentina Paraguay: Uruguay 3 2/0 0 AGR /1 – 09 C Total: Production Area: 251 k ha Input Sales: US$ 99 mm Grain Origination: 2, 255 k ton Crushing: 170 k ton % 833 486 02 / 03 2, 255 : 20 0 E Production Area: 16 k ha Grain Origination: 35 k ton 1, 763 1, 868 1, 389 1, 030 594 03 / 04 04 / 05 05 / 06 06 / 07 Clients 07 / 08 08 / 09 09 / 10 E Own … also servicing over 500 k Ha of production through its services business 5

Section 2 Global Agribusiness Outlook

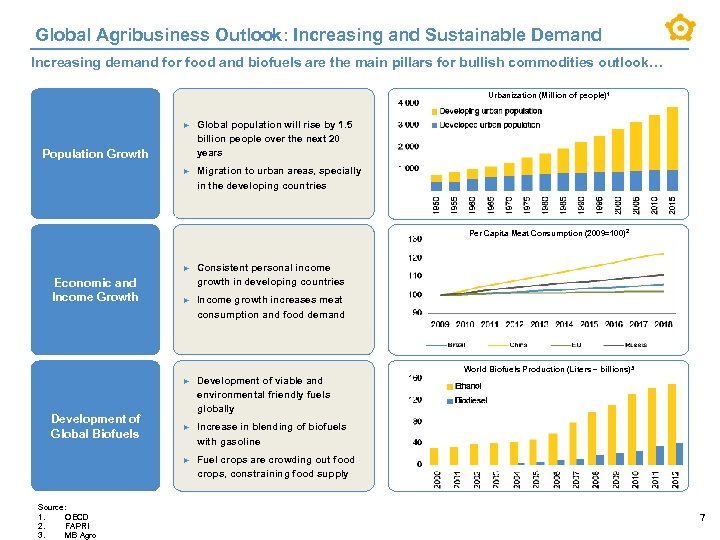

Global Agribusiness Outlook: Increasing and Sustainable Demand Increasing demand for food and biofuels are the main pillars for bullish commodities outlook… Urbanization (Million of people) 1 ► Global population will rise by 1. 5 billion people over the next 20 years ► Migration to urban areas, specially in the developing countries Population Growth Per Capita Meat Consumption (2009=100) 2 ► ► Income growth increases meat consumption and food demand ► Development of viable and environmental friendly fuels globally ► Increase in blending of biofuels with gasoline ► Economic and Income Growth Consistent personal income growth in developing countries Fuel crops are crowding out food crops, constraining food supply World Biofuels Production (Liters – billions) 3 Development of Global Biofuels Source: 1. OECD 2. FAPRI 3. MB Agro 7

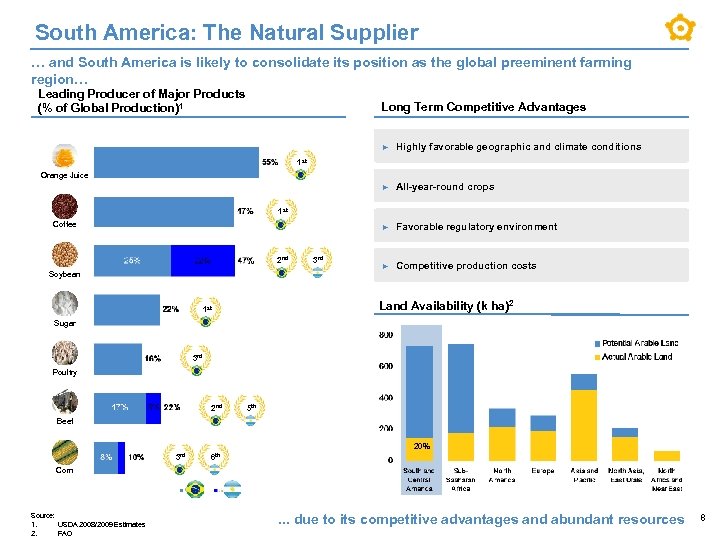

South America: The Natural Supplier … and South America is likely to consolidate its position as the global preeminent farming region… Leading Producer of Major Products (% of Global Production) 1 Long Term Competitive Advantages ► Highly favorable geographic and climate conditions ► All-year-round crops ► Favorable regulatory environment ► Competitive production costs 1 st Orange Juice 1 st Coffee 2 nd Soybean 3 rd Land Availability (k ha)2 1 st Sugar 3 rd Poultry 2 nd 5 th Beef 20% 3 rd 6 th Corn Source: 1. 2. USDA 2008/2009 Estimates FAO . . . due to its competitive advantages and abundant resources 8

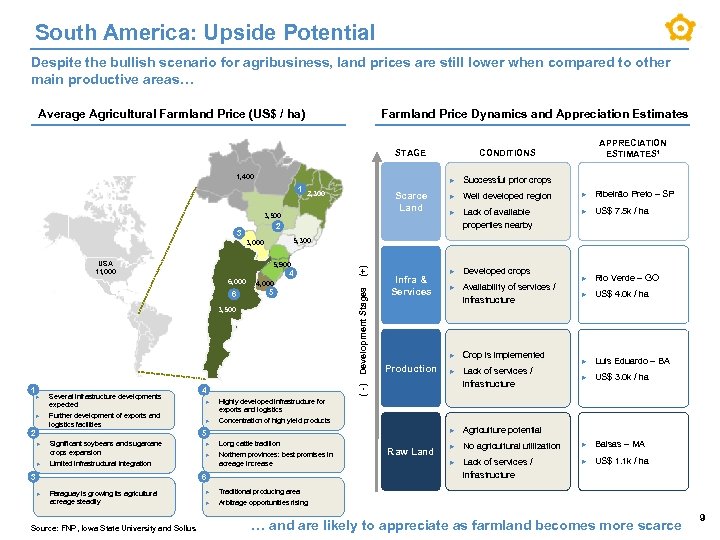

South America: Upside Potential Despite the bullish scenario for agribusiness, land prices are still lower when compared to other main productive areas… Average Agricultural Farmland Price (US$ / ha) Farmland Price Dynamics and Appreciation Estimates STAGE 1, 400 ► 2, 300 3, 500 5 3, 500 ► Several infrastructure developments expected ► Further development of exports and logistics facilities 2 4 ► Infra & Services Production ► Significant soybeans and sugarcane crops expansion ► ► Long cattle tradition ► Northern provinces: best promises in acreage increase Limited infrastructural integration 3 6 Paraguay is growing its agricultural acreage steadily Source: FNP, Iowa State University and Sollus ► Lack of available properties nearby ► US$ 7. 5 k / ha ► Developed crops ► Availability of services / infrastructure Rio Verde – GO ► ► US$ 4. 0 k / ha Crop is implemented ► Lack of services / infrastructure Luis Eduardo – BA ► ► US$ 3. 0 k / ha Agriculture potential ► No agricultural utilization ► Balsas – MA ► Lack of services / infrastructure ► US$ 1. 1 k / ha Concentration of high yield products 5 ► Ribeirão Preto – SP Highly developed infrastructure for exports and logistics ► (+) 4 4, 000 ( - ) Development Stages 5, 900 6 ► 5, 300 3, 000 6, 000 Well developed region 2 3 USA 11, 000 ► ► Scarce Land Successful prior crops ► 1 1 APPRECIATION ESTIMATES¹ CONDITIONS ► Traditional producing area ► Raw Land Arbitrage opportunities rising … and are likely to appreciate as farmland becomes more scarce 9

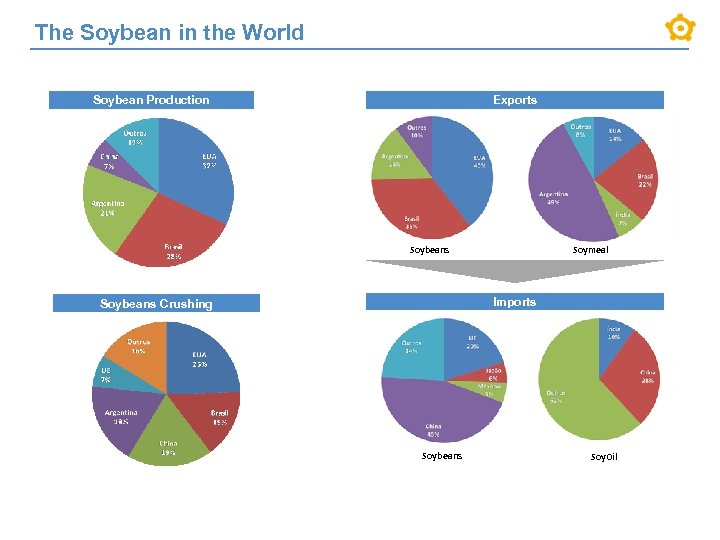

The Soybean in the World Soybean Production Exports Soymeal Soybeans Imports Soybeans Crushing Soybeans Soy. Oil

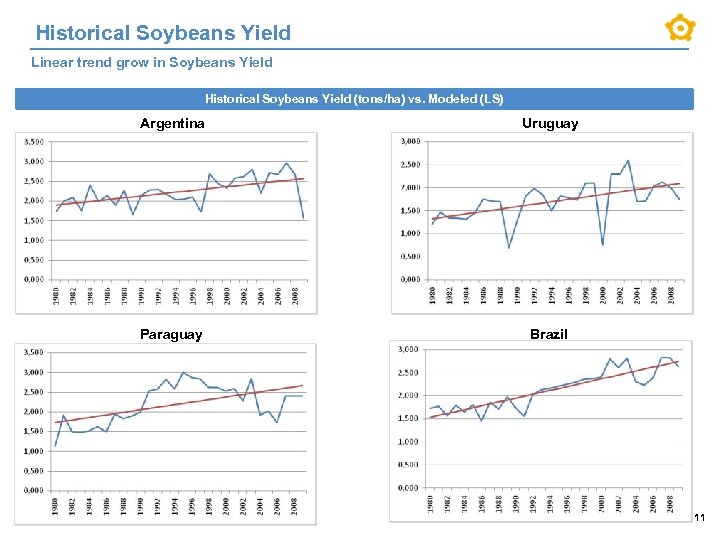

Historical Soybeans Yield Linear trend grow in Soybeans Yield Historical Soybeans Yield (tons/ha) vs. Modeled (LS) Argentina Uruguay Paraguay Brazil 11

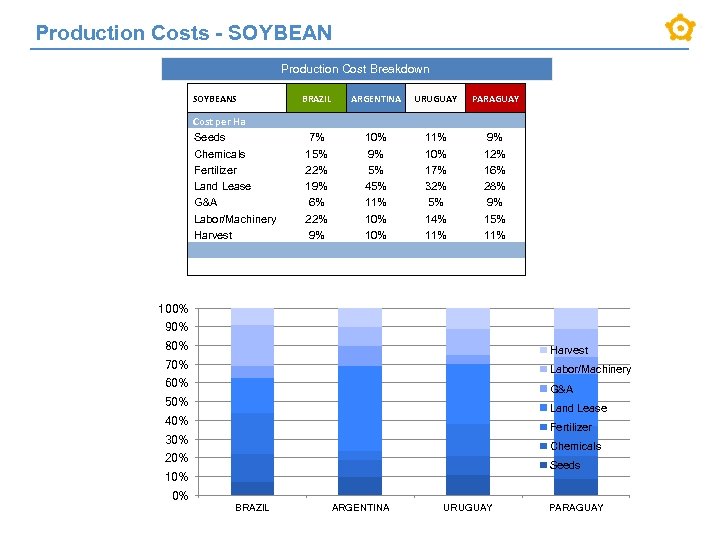

Production Costs - SOYBEAN Production Cost Breakdown SOYBEANS BRAZIL ARGENTINA URUGUAY PARAGUAY 7% 15% 22% 19% 6% 22% 9% 10% 9% 5% 45% 11% 10% 17% 32% 5% 14% 11% 9% 12% 16% 28% 9% 15% 11% Cost per Ha Seeds Chemicals Fertilizer Land Lease G&A Labor/Machinery Harvest 100% 90% 80% Harvest 70% Labor/Machinery 60% G&A 50% Land Lease 40% Fertilizer 30% Chemicals 20% Seeds 10% 0% BRAZIL ARGENTINA URUGUAY PARAGUAY

Section 3 Grain Production in Brazil

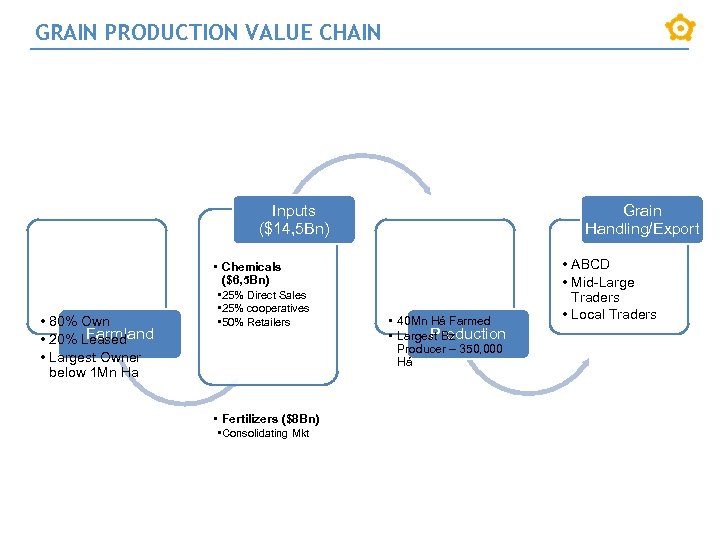

GRAIN PRODUCTION VALUE CHAIN Inputs ($14, 5 Bn) Grain Handling/Export • Chemicals ($6, 5 Bn) • 80% Own Farmland • 20% Leased • Largest Owner below 1 Mn Ha • 25% Direct Sales • 25% cooperatives • 50% Retailers • Fertilizers ($8 Bn) • Consolidating Mkt • 40 Mn Há Farmed Production • Largest Bz Producer – 350, 000 Há • ABCD • Mid-Large Traders • Local Traders

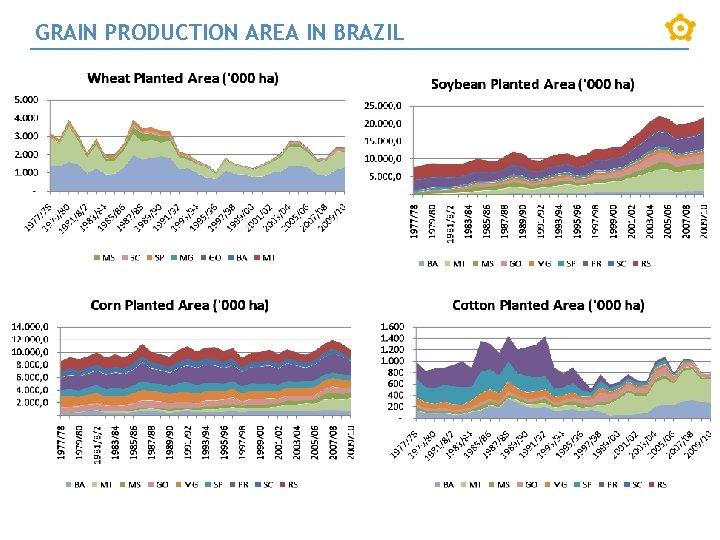

GRAIN PRODUCTION AREA IN BRAZIL

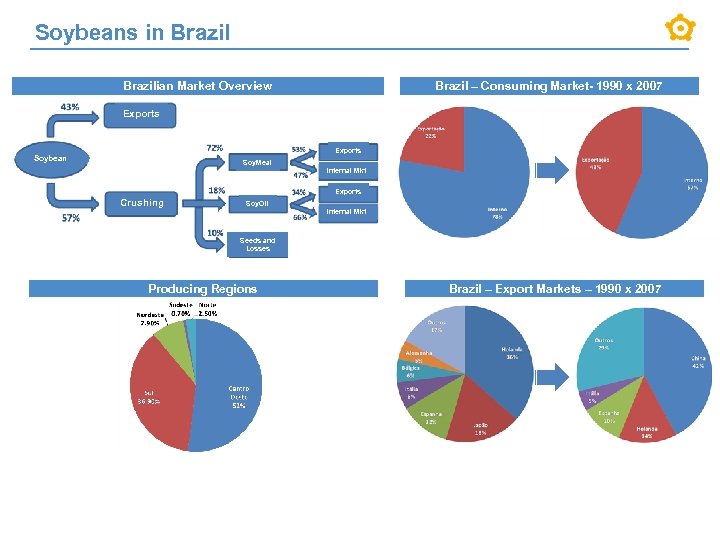

Soybeans in Brazilian Market Overview Brazil – Consuming Market- 1990 x 2007 Exports Soybean Soy. Meal Internal Mkt Exports Crushing Soy. Oil Internal Mkt Seeds and Losses Producing Regions Brazil – Export Markets – 1990 x 2007

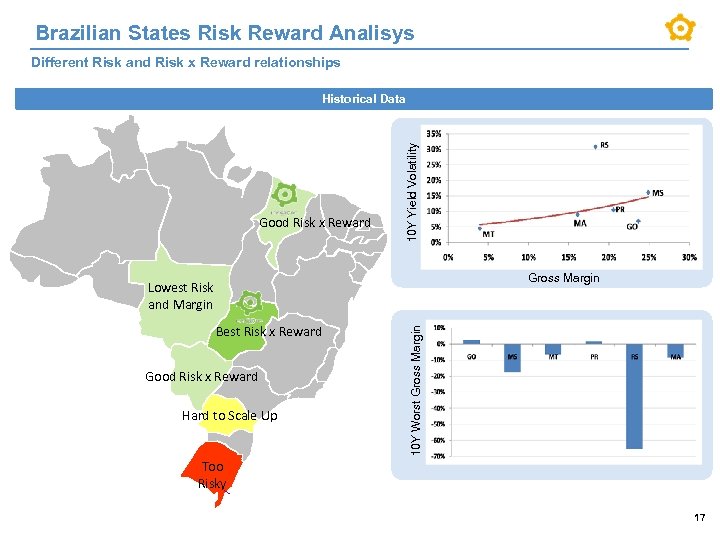

Brazilian States Risk Reward Analisys Different Risk and Risk x Reward relationships Good Risk x Reward 10 Y Yield Volatility Historical Data Gross Margin Best Risk x Reward Good Risk x Reward Hard to Scale Up 10 Y Worst Gross Margin Lowest Risk and Margin Too Risky 17

Los Grobo: Lat. Am Agribusiness Preeminent Agriculture Company … leading to a highly synergistic business to maximize value creation throughout the Agribusiness Value Chain Contacts Sizeable and Diversified Lat. Am Player + Antonio Oliva Neto CFO antonio. neto@losgrobo. com. br +55 62 3018 -2700 One-Stop-Shop + Network Model + Gustavo Barbeito CIO gustavo. barbeito@losgrobo. com. br +55 21 2554 -1300 Superior Productivity and Efficiency + Proven Track Record with Strength Financials + Sponsors & Fully Aligned Management Team With Strong Execution Capacity Structured and scalable growth platform with secured access to relevant grain production/origination 18

860901dce48e7f5e13d2b55c23bdfb95.ppt