bfd83970559395518a18d8885ee2d8eb.ppt

- Количество слайдов: 62

Agricultural Derivatives 101 The Agricultural Products Division of the JSE Copyright © 2005 JSE Limited

Agricultural Derivatives 101 The Agricultural Products Division of the JSE Copyright © 2005 JSE Limited

Agriculture in South Africa • 3, 5 – 4, 0% contribution to GDP (but 40% of population dependant on agriculture) • 10% of South African exports (by value) • Major agric export earner = sugar (maize, wine, fruit) • Farmers: 50 000 commercial 240 000 small scale farmers 3 m subsistence farmers • 13% of South Africa is arable land (only 20% is high potential) • Major limiting resource is WATER • RSA = 6% of African population 4% of African land area 25 – 30% of maize produced in Africa 10% of wheat produced in Africa 50 – 60% of maize produced in SADC Copyright © 2005 JSE Limited 2

Agriculture in South Africa • 3, 5 – 4, 0% contribution to GDP (but 40% of population dependant on agriculture) • 10% of South African exports (by value) • Major agric export earner = sugar (maize, wine, fruit) • Farmers: 50 000 commercial 240 000 small scale farmers 3 m subsistence farmers • 13% of South Africa is arable land (only 20% is high potential) • Major limiting resource is WATER • RSA = 6% of African population 4% of African land area 25 – 30% of maize produced in Africa 10% of wheat produced in Africa 50 – 60% of maize produced in SADC Copyright © 2005 JSE Limited 2

Agriculture in South Africa • 1930 – early 90’s Regulated Marketing Centralized marketing Centralized price determination • 1995 Agricultural market deregulated Control Boards / Marketing Boards scrapped NO centralized price determination Copyright © 2005 JSE Limited 3

Agriculture in South Africa • 1930 – early 90’s Regulated Marketing Centralized marketing Centralized price determination • 1995 Agricultural market deregulated Control Boards / Marketing Boards scrapped NO centralized price determination Copyright © 2005 JSE Limited 3

Agricultural marketing in South Africa is a whole new ball game in a deregulated market place

Agricultural marketing in South Africa is a whole new ball game in a deregulated market place

Agricultural marketing in South Africa is a whole new ball game in a deregulated market place

Agricultural marketing in South Africa is a whole new ball game in a deregulated market place

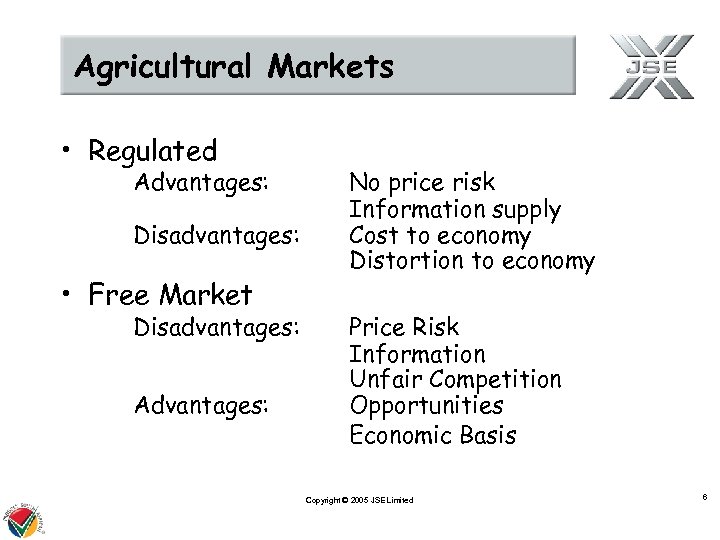

Agricultural Markets • Regulated Advantages: Disadvantages: • Free Market Disadvantages: Advantages: No price risk Information supply Cost to economy Distortion to economy Price Risk Information Unfair Competition Opportunities Economic Basis Copyright © 2005 JSE Limited 6

Agricultural Markets • Regulated Advantages: Disadvantages: • Free Market Disadvantages: Advantages: No price risk Information supply Cost to economy Distortion to economy Price Risk Information Unfair Competition Opportunities Economic Basis Copyright © 2005 JSE Limited 6

Challenges of the Free Market • • Unfair Competition – not level playing field One sided – inputs / outputs (no link) Requires decisions Requires sourcing and interpretation of information • Does not respect tradition or history • Makes use of technological progress Copyright © 2005 JSE Limited 7

Challenges of the Free Market • • Unfair Competition – not level playing field One sided – inputs / outputs (no link) Requires decisions Requires sourcing and interpretation of information • Does not respect tradition or history • Makes use of technological progress Copyright © 2005 JSE Limited 7

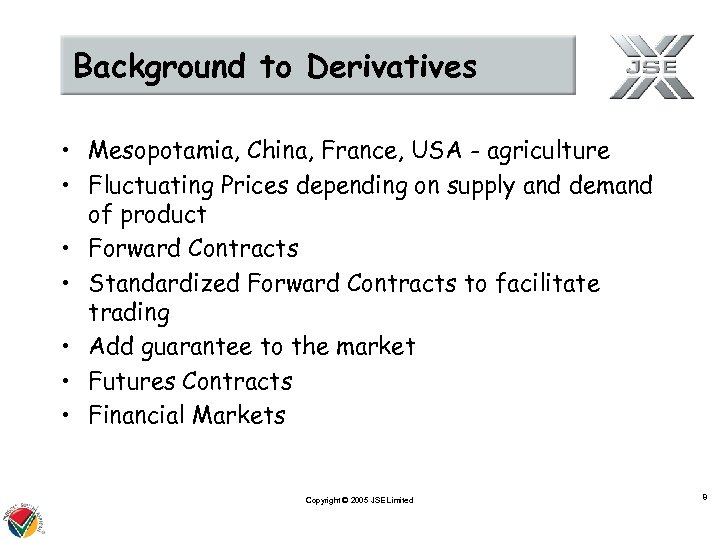

Background to Derivatives • Mesopotamia, China, France, USA - agriculture • Fluctuating Prices depending on supply and demand of product • Forward Contracts • Standardized Forward Contracts to facilitate trading • Add guarantee to the market • Futures Contracts • Financial Markets Copyright © 2005 JSE Limited 8

Background to Derivatives • Mesopotamia, China, France, USA - agriculture • Fluctuating Prices depending on supply and demand of product • Forward Contracts • Standardized Forward Contracts to facilitate trading • Add guarantee to the market • Futures Contracts • Financial Markets Copyright © 2005 JSE Limited 8

A futures market is. . . • A trading operation that provides market participants with a price determination mechanism and a price risk management facility through which they can manage their exposure to adverse price movements on the underlying physical market and where performance by both counterparties to the contract is guaranteed Copyright © 2005 JSE Limited 9

A futures market is. . . • A trading operation that provides market participants with a price determination mechanism and a price risk management facility through which they can manage their exposure to adverse price movements on the underlying physical market and where performance by both counterparties to the contract is guaranteed Copyright © 2005 JSE Limited 9

It is NOT a “get rich quick” scheme

It is NOT a “get rich quick” scheme

…. it is to avoid losing money!

…. it is to avoid losing money!

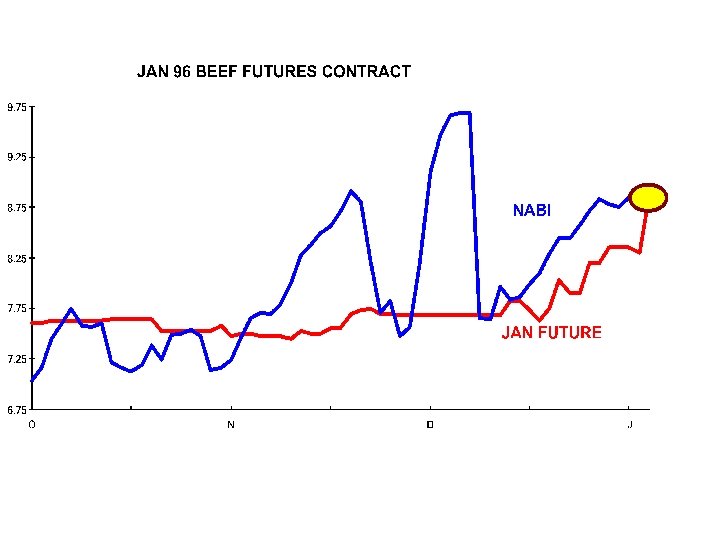

The Agricultural Derivatives Market in South Africa • • Establishment of the South African Futures Exchange (SAFEX) in 1988 to trade financial derivative instruments Establishment of the Agricultural Markets Division of SAFEX in 1995 separate membership start-up capital raised by the issue of seats Initial futures contracts (chilled beef and potatoes) not successful White and yellow maize contracts listed in 1996 August 2001 - became Agricultural Products Division of the JSE Securities Exchange South Africa Presently trade maize, wheat, sunflower seeds and soyabean futures and options contracts Recognised as the price discovery facility for grains in South and Southern Africa Copyright © 2005 JSE Limited 12

The Agricultural Derivatives Market in South Africa • • Establishment of the South African Futures Exchange (SAFEX) in 1988 to trade financial derivative instruments Establishment of the Agricultural Markets Division of SAFEX in 1995 separate membership start-up capital raised by the issue of seats Initial futures contracts (chilled beef and potatoes) not successful White and yellow maize contracts listed in 1996 August 2001 - became Agricultural Products Division of the JSE Securities Exchange South Africa Presently trade maize, wheat, sunflower seeds and soyabean futures and options contracts Recognised as the price discovery facility for grains in South and Southern Africa Copyright © 2005 JSE Limited 12

futures contracts. . . • standardised agreement through exchange (product, quality, quantity, time & place) • • • indirect locked-in price physical delivery not implied profit / loss profile exactly opposite to physical market • basis risk • margins payable

futures contracts. . . • standardised agreement through exchange (product, quality, quantity, time & place) • • • indirect locked-in price physical delivery not implied profit / loss profile exactly opposite to physical market • basis risk • margins payable

WHY use a futures market ? . . for two very good reasons ! • price determination and • price-risk management

WHY use a futures market ? . . for two very good reasons ! • price determination and • price-risk management

Maize Price determinants • South African Demand Supply - role of weather - input suppliers - crop estimates committee • Regional Demand Supply - actual economic demand ? • International Demand Supply • Exchange Rates Copyright © 2005 JSE Limited 15

Maize Price determinants • South African Demand Supply - role of weather - input suppliers - crop estimates committee • Regional Demand Supply - actual economic demand ? • International Demand Supply • Exchange Rates Copyright © 2005 JSE Limited 15

Price determination. . . • futures exchanges do not set prices, they are free markets where the forces that influence prices, notably supply and demand, are brought together in a transparent way.

Price determination. . . • futures exchanges do not set prices, they are free markets where the forces that influence prices, notably supply and demand, are brought together in a transparent way.

How are prices determined? by brokers representing clients who trade on a trading floor (pit) or electronically on a trading screen the trading screen reflects the best bids (highest) and offers (lowest).

How are prices determined? by brokers representing clients who trade on a trading floor (pit) or electronically on a trading screen the trading screen reflects the best bids (highest) and offers (lowest).

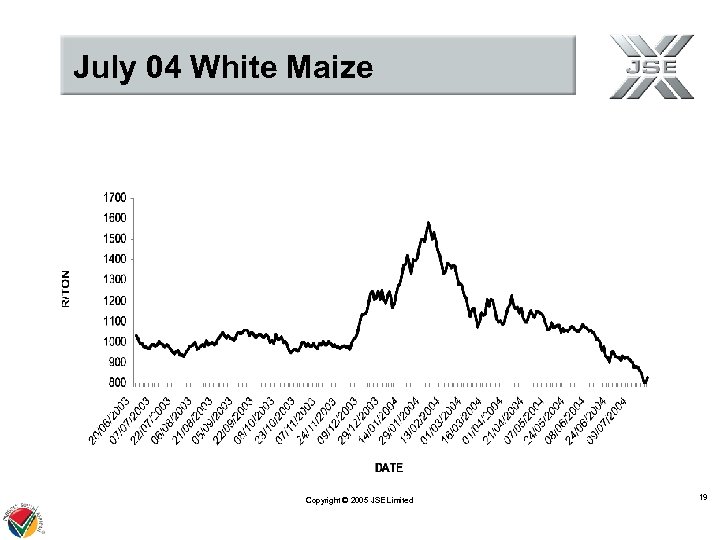

July 04 White Maize Copyright © 2005 JSE Limited 19

July 04 White Maize Copyright © 2005 JSE Limited 19

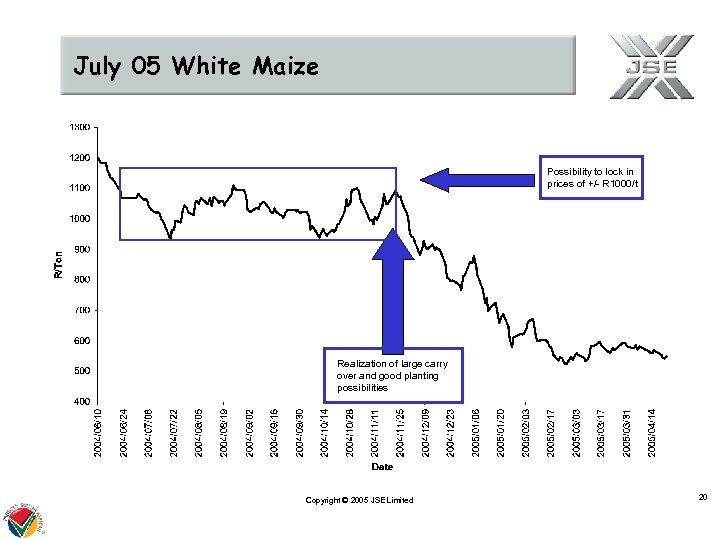

July 05 White Maize Possibility to lock in prices of +/- R 1000/t Realization of large carry over and good planting possibilities Copyright © 2005 JSE Limited 20

July 05 White Maize Possibility to lock in prices of +/- R 1000/t Realization of large carry over and good planting possibilities Copyright © 2005 JSE Limited 20

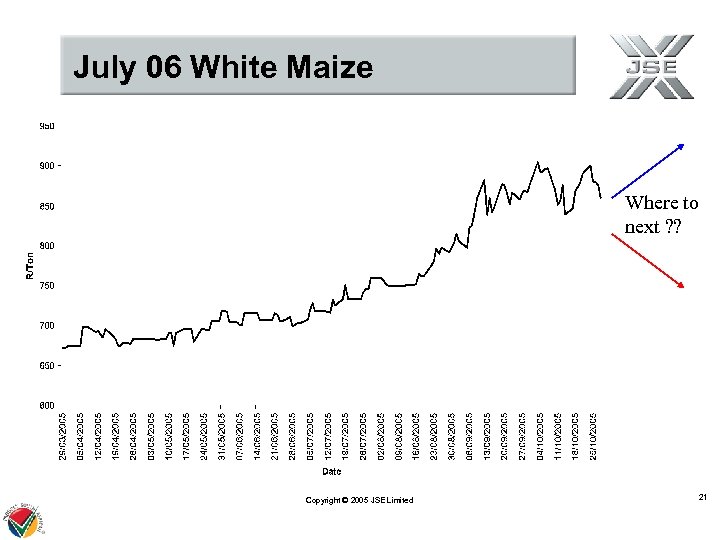

July 06 White Maize Where to next ? ? Copyright © 2005 JSE Limited 21

July 06 White Maize Where to next ? ? Copyright © 2005 JSE Limited 21

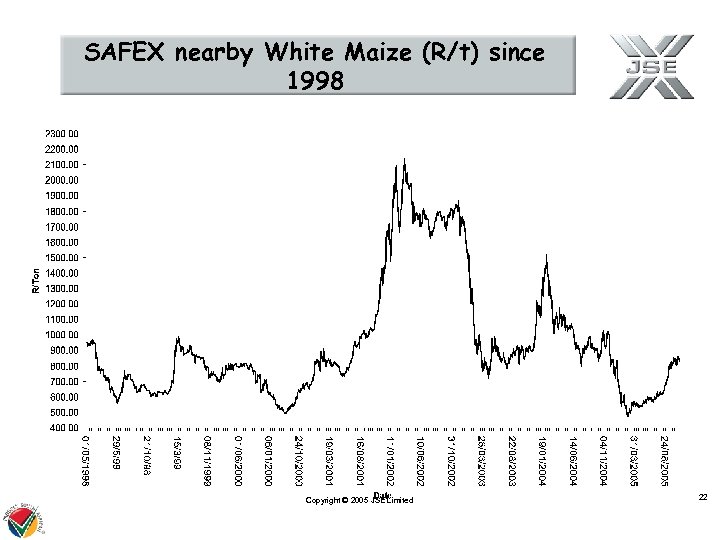

SAFEX nearby White Maize (R/t) since 1998 Copyright © 2005 JSE Limited 22

SAFEX nearby White Maize (R/t) since 1998 Copyright © 2005 JSE Limited 22

Price-risk management instruments. . • • • state intervention hold physical stocks forward contracts futures contracts options

Price-risk management instruments. . • • • state intervention hold physical stocks forward contracts futures contracts options

To hedge or not to hedge, that is the question! Whether it is better for farmers in the production of maize to suffer the ups and downs of outrageous maize prices, or to take precautions against a sea of uncertainty and by managing price risk, end the uncertainty. RMGB (with apologies) Copyright © 2005 JSE Limited 24

To hedge or not to hedge, that is the question! Whether it is better for farmers in the production of maize to suffer the ups and downs of outrageous maize prices, or to take precautions against a sea of uncertainty and by managing price risk, end the uncertainty. RMGB (with apologies) Copyright © 2005 JSE Limited 24

Guarantee in Market • Structure of the market • Margin Payments - initial margin - variation margin Copyright © 2005 JSE Limited 25

Guarantee in Market • Structure of the market • Margin Payments - initial margin - variation margin Copyright © 2005 JSE Limited 25

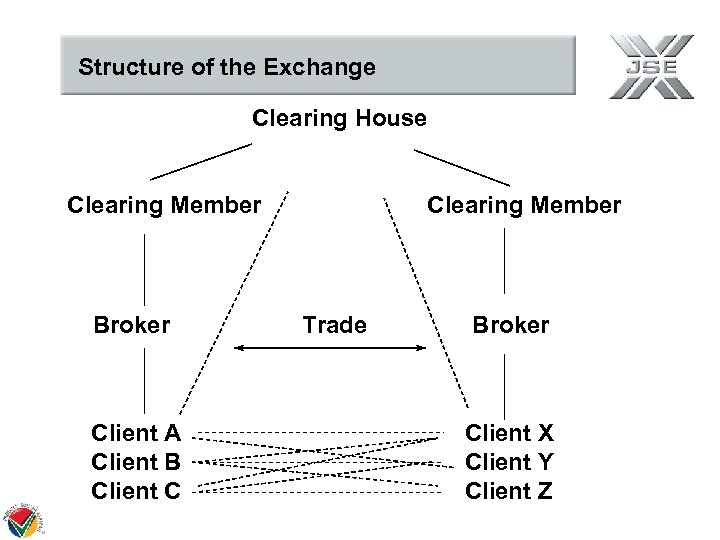

Structure of the Exchange Clearing House Clearing Member Broker Client A Client B Client C Clearing Member Trade Broker Client X Client Y Client Z

Structure of the Exchange Clearing House Clearing Member Broker Client A Client B Client C Clearing Member Trade Broker Client X Client Y Client Z

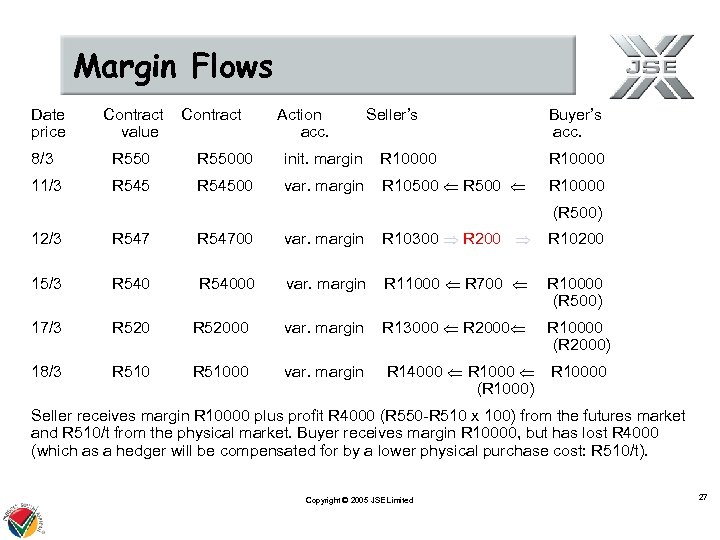

Margin Flows Date price Contract value Contract Action acc. Seller’s Buyer’s acc. 8/3 R 55000 init. margin R 10000 11/3 R 54500 var. margin R 10500 Ü R 10000 (R 500) 12/3 R 54700 var. margin R 10300 Þ R 200 Þ R 10200 15/3 R 54000 var. margin R 11000 Ü R 700 Ü R 10000 (R 500) 17/3 R 52000 var. margin R 13000 Ü R 2000Ü R 10000 (R 2000) 18/3 R 51000 var. margin R 14000 Ü R 1000 Ü (R 1000) R 10000 Seller receives margin R 10000 plus profit R 4000 (R 550 -R 510 x 100) from the futures market and R 510/t from the physical market. Buyer receives margin R 10000, but has lost R 4000 (which as a hedger will be compensated for by a lower physical purchase cost: R 510/t). Copyright © 2005 JSE Limited 27

Margin Flows Date price Contract value Contract Action acc. Seller’s Buyer’s acc. 8/3 R 55000 init. margin R 10000 11/3 R 54500 var. margin R 10500 Ü R 10000 (R 500) 12/3 R 54700 var. margin R 10300 Þ R 200 Þ R 10200 15/3 R 54000 var. margin R 11000 Ü R 700 Ü R 10000 (R 500) 17/3 R 52000 var. margin R 13000 Ü R 2000Ü R 10000 (R 2000) 18/3 R 51000 var. margin R 14000 Ü R 1000 Ü (R 1000) R 10000 Seller receives margin R 10000 plus profit R 4000 (R 550 -R 510 x 100) from the futures market and R 510/t from the physical market. Buyer receives margin R 10000, but has lost R 4000 (which as a hedger will be compensated for by a lower physical purchase cost: R 510/t). Copyright © 2005 JSE Limited 27

. . . by using the futures market individuals, companies or countries selling or buying a commodity can protect themselves against price movements in the underlying physical market. This is achieved by selling or buying futures or options contracts through a broker who is a member of the futures exchange.

. . . by using the futures market individuals, companies or countries selling or buying a commodity can protect themselves against price movements in the underlying physical market. This is achieved by selling or buying futures or options contracts through a broker who is a member of the futures exchange.

Requirements for a Successful Agric Futures Market • Liquidity in underlying spot market (volume of production, multiple buyers and multiple sellers) • Commodity must be able to be standardized • Price must be volatile (must be a need for price risk management) • No state intervention in the price making mechanism • Guaranteed contract performance (clearing & financial system) • Deliverability (infrastructure / grading regulations / warehouse receipts) Copyright © 2005 JSE Limited 29

Requirements for a Successful Agric Futures Market • Liquidity in underlying spot market (volume of production, multiple buyers and multiple sellers) • Commodity must be able to be standardized • Price must be volatile (must be a need for price risk management) • No state intervention in the price making mechanism • Guaranteed contract performance (clearing & financial system) • Deliverability (infrastructure / grading regulations / warehouse receipts) Copyright © 2005 JSE Limited 29

Growth of the Market. . . Copyright © 2005 JSE Limited 30

Growth of the Market. . . Copyright © 2005 JSE Limited 30

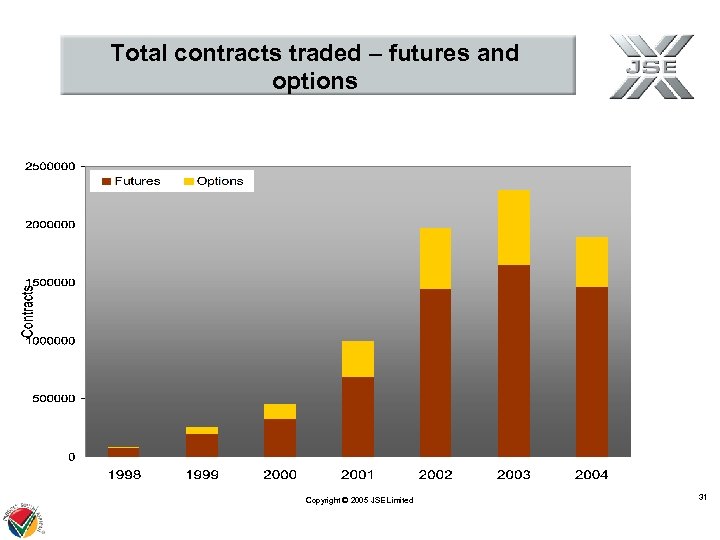

Total contracts traded – futures and options Copyright © 2005 JSE Limited 31

Total contracts traded – futures and options Copyright © 2005 JSE Limited 31

Physical delivery in completion of a futures contract…. Copyright © 2005 JSE Limited

Physical delivery in completion of a futures contract…. Copyright © 2005 JSE Limited

Delivery starts at the silo …. Copyright © 2005 JSE Limited 33

Delivery starts at the silo …. Copyright © 2005 JSE Limited 33

Why allow for physical delivery on the futures market. • no underlying cash market to base prices off – therefore no cash index available to settle the futures contract • guaranteed delivery to the buyer of a Safex silo receipt representing good delivery • guaranteed payment to the seller • standardisation of the contract is required (quantity, quality, place, storage) Copyright © 2005 JSE Limited 34

Why allow for physical delivery on the futures market. • no underlying cash market to base prices off – therefore no cash index available to settle the futures contract • guaranteed delivery to the buyer of a Safex silo receipt representing good delivery • guaranteed payment to the seller • standardisation of the contract is required (quantity, quality, place, storage) Copyright © 2005 JSE Limited 34

Delivery onto Safex…. • physical delivery is a two day process on Safex, first the notice day followed by the delivery day • delivery can take place anytime during the delivery month ie May • commodity is deliverable all months of the year, five main hedging months with the remainder as constant delivery months • short position holder gives notice any time during the delivery month • long position holder is randomly allocated commodity as deliveries are received Copyright © 2005 JSE Limited 35

Delivery onto Safex…. • physical delivery is a two day process on Safex, first the notice day followed by the delivery day • delivery can take place anytime during the delivery month ie May • commodity is deliverable all months of the year, five main hedging months with the remainder as constant delivery months • short position holder gives notice any time during the delivery month • long position holder is randomly allocated commodity as deliveries are received Copyright © 2005 JSE Limited 35

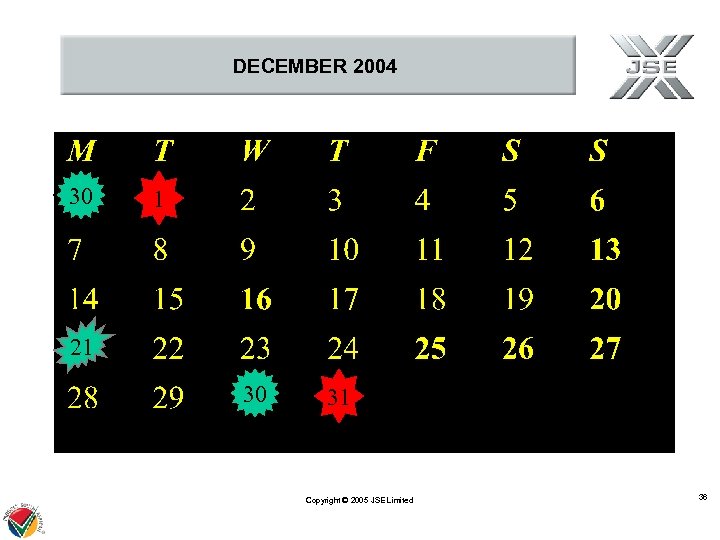

DECEMBER 2004 30 1 21 30 31 Copyright © 2005 JSE Limited 36

DECEMBER 2004 30 1 21 30 31 Copyright © 2005 JSE Limited 36

Initial margin requirements • Contracts traded before delivery require R 10000 for white and yellow maize, • Extended price limits margins increase • on the first delivery day margins move to R 13000 per contract and price limits removed, • from last trading day to expiry, margins are increased to R 23000 per contract, Copyright © 2005 JSE Limited 37

Initial margin requirements • Contracts traded before delivery require R 10000 for white and yellow maize, • Extended price limits margins increase • on the first delivery day margins move to R 13000 per contract and price limits removed, • from last trading day to expiry, margins are increased to R 23000 per contract, Copyright © 2005 JSE Limited 37

Detail required for delivery… • A short futures position is required in the particular delivery month before any notice can be tendered • Short position holder tenders notice through his broker – the following information is required • • silo receipt number quantity location date storage is paid to • Delivery notice is faxed/emailed to Safex before 12 h 45 on notice day Copyright © 2005 JSE Limited 38

Detail required for delivery… • A short futures position is required in the particular delivery month before any notice can be tendered • Short position holder tenders notice through his broker – the following information is required • • silo receipt number quantity location date storage is paid to • Delivery notice is faxed/emailed to Safex before 12 h 45 on notice day Copyright © 2005 JSE Limited 38

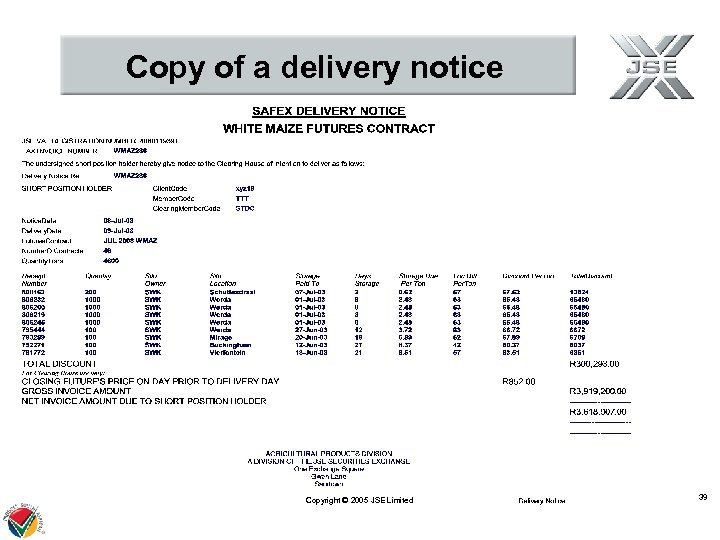

Copy of a delivery notice Copyright © 2005 JSE Limited 39

Copy of a delivery notice Copyright © 2005 JSE Limited 39

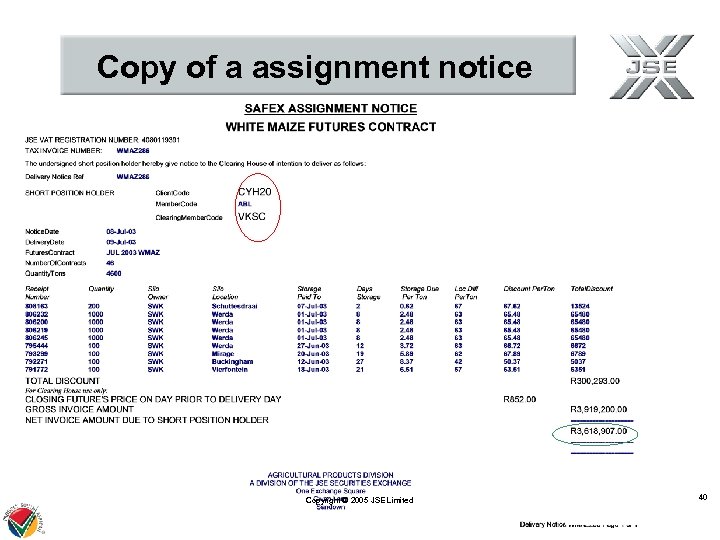

Copy of a assignment notice Copyright © 2005 JSE Limited 40

Copy of a assignment notice Copyright © 2005 JSE Limited 40

Settlement as follows… • broker will deliver silo receipt by 12 h 00 on the delivery day • silo receipt has to be signed off • payment is finalised by 12 h 00 on delivery day • buyer’s broker can pick up silo receipt from 14 h 00 on delivery day • initial margin to both buyer and seller will be returned the following day Copyright © 2005 JSE Limited 41

Settlement as follows… • broker will deliver silo receipt by 12 h 00 on the delivery day • silo receipt has to be signed off • payment is finalised by 12 h 00 on delivery day • buyer’s broker can pick up silo receipt from 14 h 00 on delivery day • initial margin to both buyer and seller will be returned the following day Copyright © 2005 JSE Limited 41

Lets step outside for some refreshments…. . Copyright © 2005 JSE Limited 42

Lets step outside for some refreshments…. . Copyright © 2005 JSE Limited 42

Welcome back ! Lets look at your “OPTIONS” Copyright © 2005 JSE Limited

Welcome back ! Lets look at your “OPTIONS” Copyright © 2005 JSE Limited

DUCK or DIVE Hope you’ve taken out travel insurance ! Copyright © 2005 JSE Limited 44

DUCK or DIVE Hope you’ve taken out travel insurance ! Copyright © 2005 JSE Limited 44

Price-risk management instruments. . • • state intervention hold physical stocks forward contracts futures contracts • exchange traded options

Price-risk management instruments. . • • state intervention hold physical stocks forward contracts futures contracts • exchange traded options

OPTIONS…. another type of insurance! Fire Hail PRICE RISK Drought Floods Copyright © 2005 JSE Limited 46

OPTIONS…. another type of insurance! Fire Hail PRICE RISK Drought Floods Copyright © 2005 JSE Limited 46

Futures vs Options • as a buyer, fundamentally different risks • buyer and seller of futures assume the same risk, and face a legally binding obligation – margin requirements • seller of an option has legally binding obligation if the option is exercised • buyer of an option has no legally binding obligation, BUT to pay for the option (premium) • the most a buyer of an option can lose is the price paid for the option (the premium agreed on) • the seller of an option is potentially exposed in the same fashion as a futures contract (variation margin)

Futures vs Options • as a buyer, fundamentally different risks • buyer and seller of futures assume the same risk, and face a legally binding obligation – margin requirements • seller of an option has legally binding obligation if the option is exercised • buyer of an option has no legally binding obligation, BUT to pay for the option (premium) • the most a buyer of an option can lose is the price paid for the option (the premium agreed on) • the seller of an option is potentially exposed in the same fashion as a futures contract (variation margin)

willing buyerwilling seller • Two types of options: – PUT options (floor price insurance) A farmer would buy this instrument – CALL options (ceiling price insurance) Millers interested in this insurance Copyright © 2005 JSE Limited 48

willing buyerwilling seller • Two types of options: – PUT options (floor price insurance) A farmer would buy this instrument – CALL options (ceiling price insurance) Millers interested in this insurance Copyright © 2005 JSE Limited 48

Buying floor price insurance…. • as a buyer of floor price insurance (PUT options) you buy the RIGHT but not the obligation to sell maize at an agreed floor price • a seller of PUT options is OBLIGATED to buy your product should you exercise your right • the PUT option trade involves a willing buyerwilling seller at an agreed premium for a specific strike price • the buyer can exercise the right to sell maize at any time (American style options) • the buyer pays premium (negotiated on market) • seller receives the premium, but is margined by the exchange to make sure that he can meet his commitment Copyright © 2005 JSE Limited 49

Buying floor price insurance…. • as a buyer of floor price insurance (PUT options) you buy the RIGHT but not the obligation to sell maize at an agreed floor price • a seller of PUT options is OBLIGATED to buy your product should you exercise your right • the PUT option trade involves a willing buyerwilling seller at an agreed premium for a specific strike price • the buyer can exercise the right to sell maize at any time (American style options) • the buyer pays premium (negotiated on market) • seller receives the premium, but is margined by the exchange to make sure that he can meet his commitment Copyright © 2005 JSE Limited 49

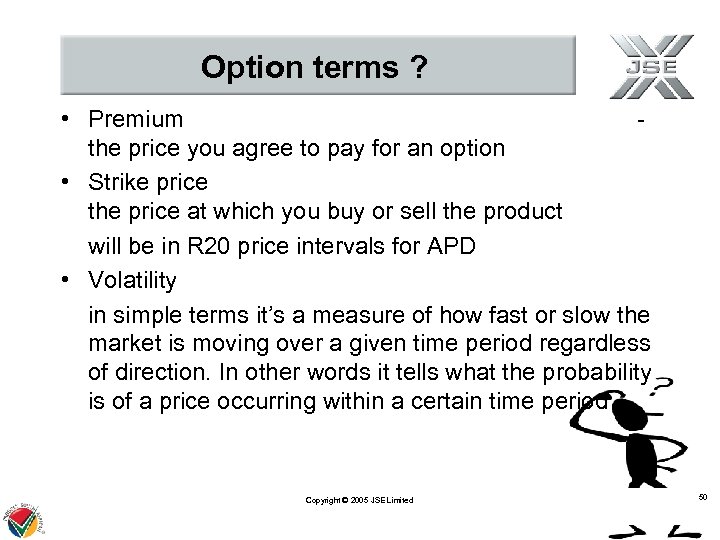

Option terms ? • Premium the price you agree to pay for an option • Strike price the price at which you buy or sell the product will be in R 20 price intervals for APD • Volatility in simple terms it’s a measure of how fast or slow the market is moving over a given time period regardless of direction. In other words it tells what the probability is of a price occurring within a certain time period Copyright © 2005 JSE Limited 50

Option terms ? • Premium the price you agree to pay for an option • Strike price the price at which you buy or sell the product will be in R 20 price intervals for APD • Volatility in simple terms it’s a measure of how fast or slow the market is moving over a given time period regardless of direction. In other words it tells what the probability is of a price occurring within a certain time period Copyright © 2005 JSE Limited 50

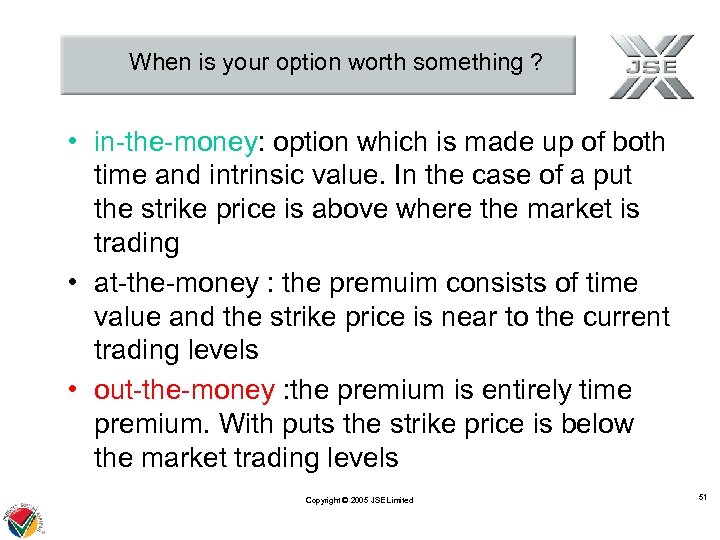

When is your option worth something ? • in-the-money: option which is made up of both time and intrinsic value. In the case of a put the strike price is above where the market is trading • at-the-money : the premuim consists of time value and the strike price is near to the current trading levels • out-the-money : the premium is entirely time premium. With puts the strike price is below the market trading levels Copyright © 2005 JSE Limited 51

When is your option worth something ? • in-the-money: option which is made up of both time and intrinsic value. In the case of a put the strike price is above where the market is trading • at-the-money : the premuim consists of time value and the strike price is near to the current trading levels • out-the-money : the premium is entirely time premium. With puts the strike price is below the market trading levels Copyright © 2005 JSE Limited 51

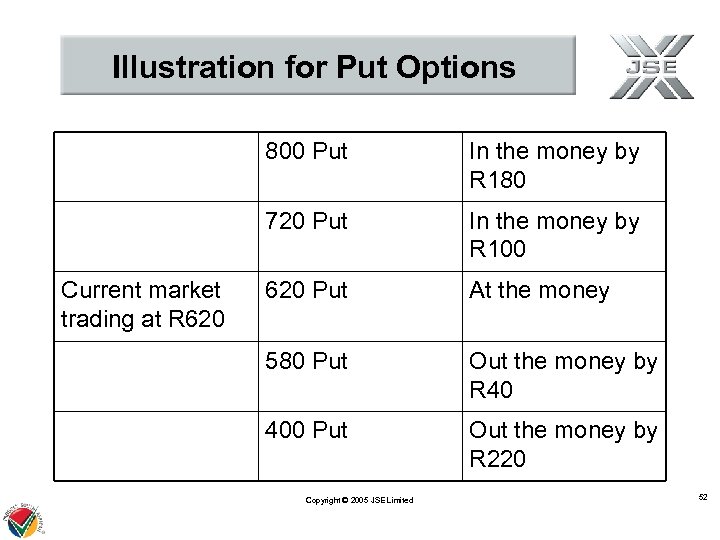

Illustration for Put Options 800 Put 720 Put Current market trading at R 620 In the money by R 180 In the money by R 100 620 Put At the money 580 Put Out the money by R 40 400 Put Out the money by R 220 Copyright © 2005 JSE Limited 52

Illustration for Put Options 800 Put 720 Put Current market trading at R 620 In the money by R 180 In the money by R 100 620 Put At the money 580 Put Out the money by R 40 400 Put Out the money by R 220 Copyright © 2005 JSE Limited 52

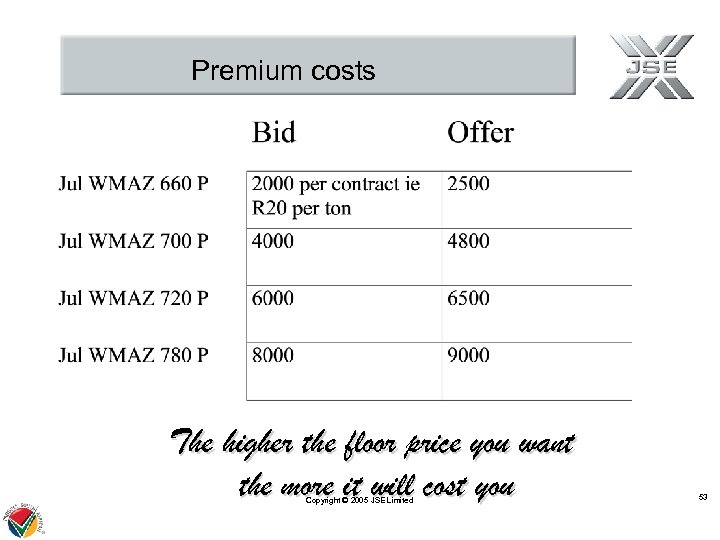

Premium costs The higher the floor price you want the more it will cost you Copyright © 2005 JSE Limited 53

Premium costs The higher the floor price you want the more it will cost you Copyright © 2005 JSE Limited 53

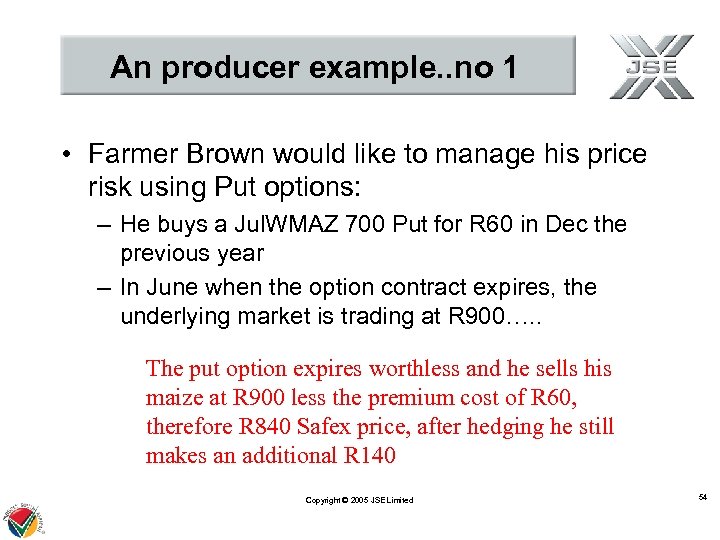

An producer example. . no 1 • Farmer Brown would like to manage his price risk using Put options: – He buys a Jul. WMAZ 700 Put for R 60 in Dec the previous year – In June when the option contract expires, the underlying market is trading at R 900…. . The put option expires worthless and he sells his maize at R 900 less the premium cost of R 60, therefore R 840 Safex price, after hedging he still makes an additional R 140 Copyright © 2005 JSE Limited 54

An producer example. . no 1 • Farmer Brown would like to manage his price risk using Put options: – He buys a Jul. WMAZ 700 Put for R 60 in Dec the previous year – In June when the option contract expires, the underlying market is trading at R 900…. . The put option expires worthless and he sells his maize at R 900 less the premium cost of R 60, therefore R 840 Safex price, after hedging he still makes an additional R 140 Copyright © 2005 JSE Limited 54

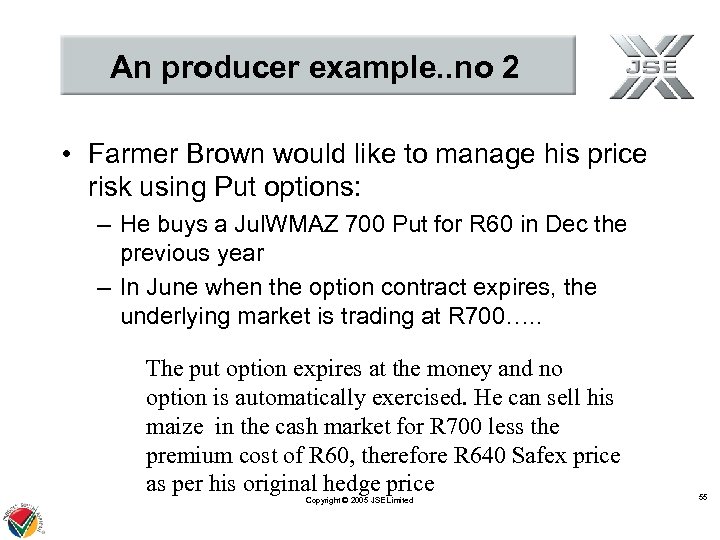

An producer example. . no 2 • Farmer Brown would like to manage his price risk using Put options: – He buys a Jul. WMAZ 700 Put for R 60 in Dec the previous year – In June when the option contract expires, the underlying market is trading at R 700…. . The put option expires at the money and no option is automatically exercised. He can sell his maize in the cash market for R 700 less the premium cost of R 60, therefore R 640 Safex price as per his original hedge price Copyright © 2005 JSE Limited 55

An producer example. . no 2 • Farmer Brown would like to manage his price risk using Put options: – He buys a Jul. WMAZ 700 Put for R 60 in Dec the previous year – In June when the option contract expires, the underlying market is trading at R 700…. . The put option expires at the money and no option is automatically exercised. He can sell his maize in the cash market for R 700 less the premium cost of R 60, therefore R 640 Safex price as per his original hedge price Copyright © 2005 JSE Limited 55

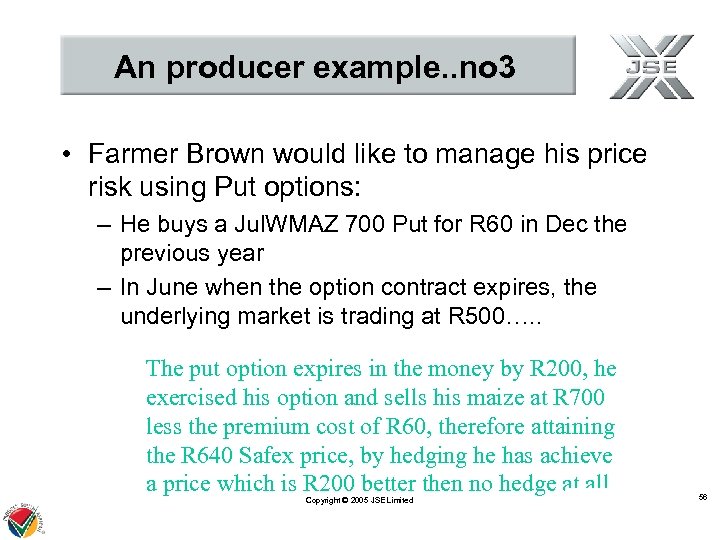

An producer example. . no 3 • Farmer Brown would like to manage his price risk using Put options: – He buys a Jul. WMAZ 700 Put for R 60 in Dec the previous year – In June when the option contract expires, the underlying market is trading at R 500…. . The put option expires in the money by R 200, he exercised his option and sells his maize at R 700 less the premium cost of R 60, therefore attaining the R 640 Safex price, by hedging he has achieve a price which is R 200 better then no hedge at all Copyright © 2005 JSE Limited 56

An producer example. . no 3 • Farmer Brown would like to manage his price risk using Put options: – He buys a Jul. WMAZ 700 Put for R 60 in Dec the previous year – In June when the option contract expires, the underlying market is trading at R 500…. . The put option expires in the money by R 200, he exercised his option and sells his maize at R 700 less the premium cost of R 60, therefore attaining the R 640 Safex price, by hedging he has achieve a price which is R 200 better then no hedge at all Copyright © 2005 JSE Limited 56

Buying options to manage price risk can only result in a win-win situation, once you have decided on the relevant strike price and paid the premium, if it expires in the money you have read the market well and reap the rewards, if it expires out the money you lose the premium but can sell your product at a higher market price CJS (with sincere apologies) Copyright © 2005 JSE Limited 57

Buying options to manage price risk can only result in a win-win situation, once you have decided on the relevant strike price and paid the premium, if it expires in the money you have read the market well and reap the rewards, if it expires out the money you lose the premium but can sell your product at a higher market price CJS (with sincere apologies) Copyright © 2005 JSE Limited 57

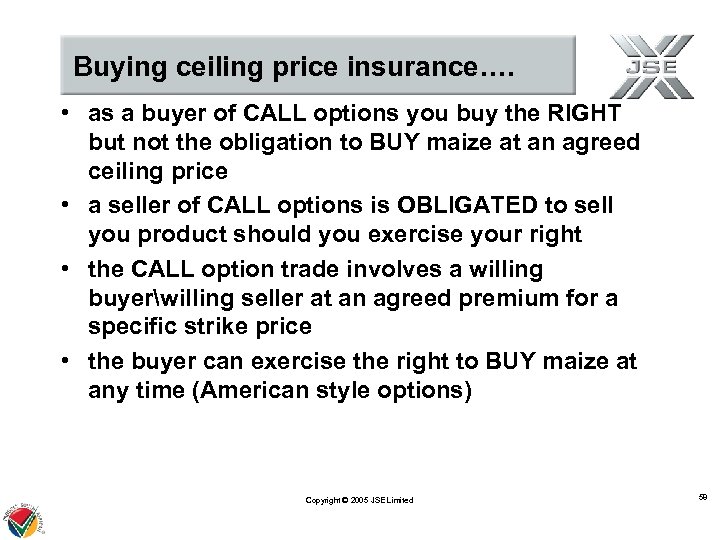

Buying ceiling price insurance…. • as a buyer of CALL options you buy the RIGHT but not the obligation to BUY maize at an agreed ceiling price • a seller of CALL options is OBLIGATED to sell you product should you exercise your right • the CALL option trade involves a willing buyerwilling seller at an agreed premium for a specific strike price • the buyer can exercise the right to BUY maize at any time (American style options) Copyright © 2005 JSE Limited 58

Buying ceiling price insurance…. • as a buyer of CALL options you buy the RIGHT but not the obligation to BUY maize at an agreed ceiling price • a seller of CALL options is OBLIGATED to sell you product should you exercise your right • the CALL option trade involves a willing buyerwilling seller at an agreed premium for a specific strike price • the buyer can exercise the right to BUY maize at any time (American style options) Copyright © 2005 JSE Limited 58

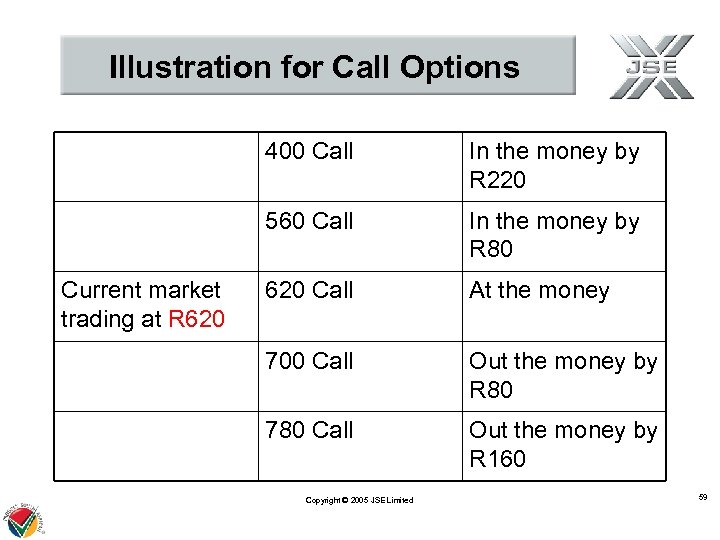

Illustration for Call Options 400 Call 560 Call Current market trading at R 620 In the money by R 220 In the money by R 80 620 Call At the money 700 Call Out the money by R 80 780 Call Out the money by R 160 Copyright © 2005 JSE Limited 59

Illustration for Call Options 400 Call 560 Call Current market trading at R 620 In the money by R 220 In the money by R 80 620 Call At the money 700 Call Out the money by R 80 780 Call Out the money by R 160 Copyright © 2005 JSE Limited 59

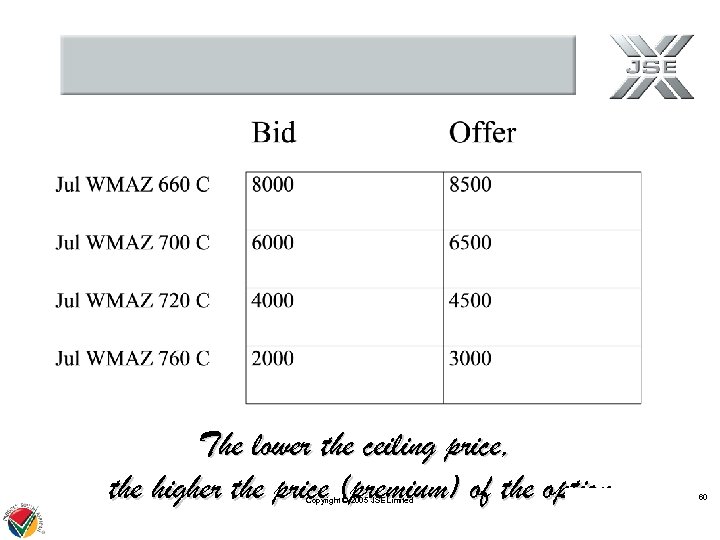

The lower the ceiling price, the higher the price (premium) of the option Copyright © 2005 JSE Limited 60

The lower the ceiling price, the higher the price (premium) of the option Copyright © 2005 JSE Limited 60

WITH THE HELP OF A REGISTERED JSE AGRICULTURAL BROKER, BE GUIDED TO MAKE THE RIGHT DECISIONS ! Copyright © 2005 JSE Limited 61

WITH THE HELP OF A REGISTERED JSE AGRICULTURAL BROKER, BE GUIDED TO MAKE THE RIGHT DECISIONS ! Copyright © 2005 JSE Limited 61

Failure is an opportunity to begin again, more intelligently – Henry Ford Copyright © 2005 JSE Limited 62

Failure is an opportunity to begin again, more intelligently – Henry Ford Copyright © 2005 JSE Limited 62