0381580519d7804e05b607348d97a7b8.ppt

- Количество слайдов: 21

Agri-trading and Hedging: Opportunities for Farmers Ann Berg Futures and Commodity Markets Specialist National Conference on Emerging Platforms for Agriculture Marketing Commodity Futures Market Project 1 Implemented by Financial Markets International of Washington, DC and Mumbai, India.

What is hedging?

Hedging is the transfer of risk from one party to another by buying or selling futures contracts These risks include: • Price risks • Counterparty risks

Futures defined n n n Futures are purchase and sales agreements Futures are cleared by a central counterparty – called the Clearing House Futures are a zero sum game

Futures defined n n n Futures are not stocks – no equity ownership exists Futures are not bonds -No fixed income return is guaranteed Futures are proxy instruments held until exchanged for the underlying good

Value of futures contracts n n n Price transparency Price discovery Markets integrator Liquidity Infrastructure booster Forward price indicator

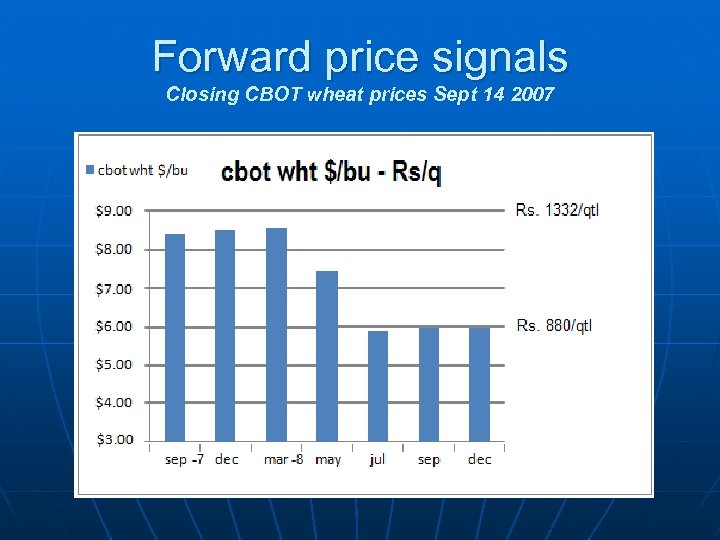

Forward price signals Closing CBOT wheat prices Sept 14 2007

Why hedge? n n n Lock in an attractive price Achieve income stability Avoid risk Plan cropping mix Obtain better credit arrangements

Who should hedge? n n n Warehouses that stock seasonal inventories (short hedgers) Millers, processors, feedlot operators (long hedgers) Exporters Importers Any supply chain player wanting to avoid price risks

Which farmers should hedge? n n Large capitalized farmers able to withstand margin calls Farmers with year to year stable production Farmers with skill set and sophistication for futures trading Only about 30% of US farmers hedge

Short Hedging Short hedging involves the sale of futures contracts against ownership of the underlying commodity

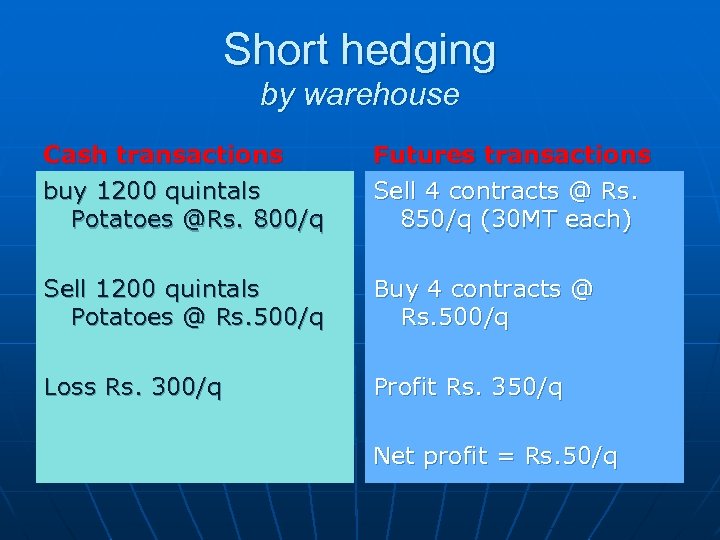

Short hedging by warehouse Cash transactions buy 1200 quintals Potatoes @Rs. 800/q Futures transactions Sell 4 contracts @ Rs. 850/q (30 MT each) Sell 1200 quintals Potatoes @ Rs. 500/q Buy 4 contracts @ Rs. 500/q Loss Rs. 300/q Profit Rs. 350/q Net profit = Rs. 50/q

The HAFED Experience: Textbook case of wheat hedging n n HAFED began using futures soon after launch of wheat contract in July 2004 Strictly a short hedger – sold futures against cash purchases Quickly increased its use of the NCDEX wheat futures Quickly increased its use of the delivery mechanism

HAFED’s hedging program Year Qty purchased Qty hedged MT MT (short futures (physical sales) wheat) Qty delivered MT (against futures short) 2004 -05 70000 4770 10 2005 -06 31814 35710 13300 2006 -07 107043 81450 20860

HAFED took advantage of large carrying charge between harvest and mid-year prices and placed short hedge in December contract to maximize returns

HAFED’S hedge executions MSP + Bonus of Wheat (April 2006) 700 Mandi, VAT & Transportation Charges 110 Interest & Storage Charges (for 8 months - i. e. , up to Dec 2006 72 Cost of MSP Wheat in Dec 2006 882 Selling Rate of Wheat in Dec 2006 on NCDEX (Rs. 1017 – Rs. 27 expenses) 990 Net Profits per Quintal 108

Deliveries in NCDEX were scant during April May harvest months, occurring later in the year.

HAFED’s assessment of futures n n n Auditable records of sales prices – i. e. , futures transactions Aggregation of small purchases Quality assurance - achieved by strict assaying methods by registered warehouses Liquidity Price stabilization

Aggregation can optimize results for farmers n n n n Avoid margin calls Reduce distressed selling Benefit from quality production Reduce exploitation Increase credit availability Increase income Profit share in aggregation

Thank you

0381580519d7804e05b607348d97a7b8.ppt