e08a118b458b8e85d878eecaf4e40ffe.ppt

- Количество слайдов: 31

Aggregate Demand SUPA Economics Chapter 13

Aggregate Demand SUPA Economics Chapter 13

Aggregate Expenditures • What components make up AE? –C –I –G –T –X –M

Aggregate Expenditures • What components make up AE? –C –I –G –T –X –M

Consumption • • Aggregate Income b+(PY) Wealth Consumer Confidence (CC) C= b (PY) + A – b stands for the share of current aggregate income that people use for consumption. – A stands for autonomous consumption

Consumption • • Aggregate Income b+(PY) Wealth Consumer Confidence (CC) C= b (PY) + A – b stands for the share of current aggregate income that people use for consumption. – A stands for autonomous consumption

Example • Consumer confidence decreases. – How does this affect consumption? – Which happens to aggregate demand? • Draw the macro model, illustrating this change in consumption. How has real GDP and the price level changed?

Example • Consumer confidence decreases. – How does this affect consumption? – Which happens to aggregate demand? • Draw the macro model, illustrating this change in consumption. How has real GDP and the price level changed?

Investment • Firms borrow money from banks, issue bonds, and sell stock in order to acquire funds used for investment • This leads to the Market for Loanable Funds, also called the Capital Market

Investment • Firms borrow money from banks, issue bonds, and sell stock in order to acquire funds used for investment • This leads to the Market for Loanable Funds, also called the Capital Market

Long Term Investment Capital Syracuse Economics

Long Term Investment Capital Syracuse Economics

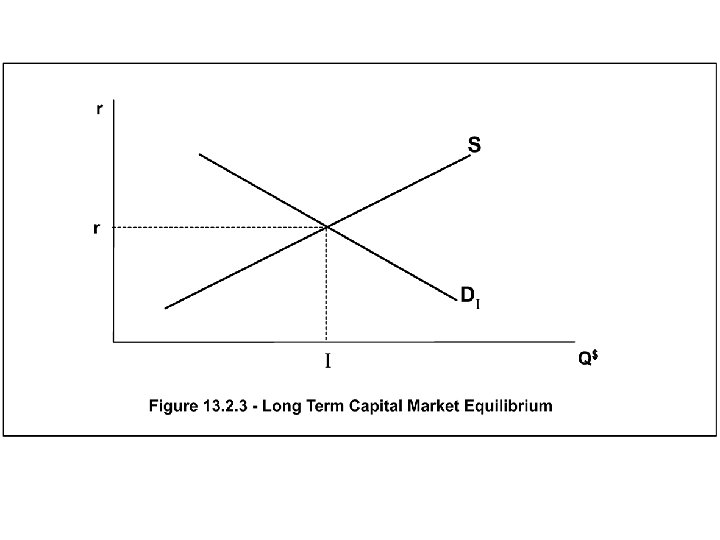

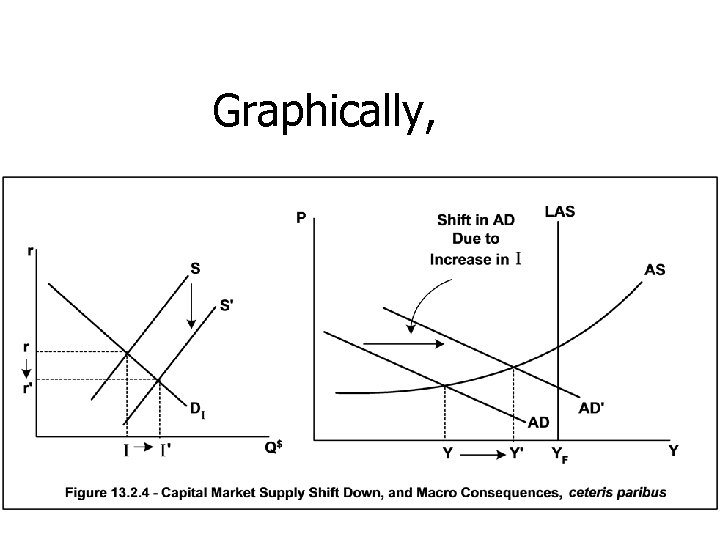

Graphically,

Graphically,

Graphically,

Graphically,

• One of the main determinants of the level of interest people charge for their capital is their perception of the risk of not being paid back • Individual like me or you –most risky • General Motors – less risky • U. S. government - least risky of all

• One of the main determinants of the level of interest people charge for their capital is their perception of the risk of not being paid back • Individual like me or you –most risky • General Motors – less risky • U. S. government - least risky of all

• One thing that determines the level of long term capital supply is Short term level of supply • People are more comfortable making short term loans than longer ones • They want control back sooner Short term loans (less than a year) get supplied at lower interest rates than long ones

• One thing that determines the level of long term capital supply is Short term level of supply • People are more comfortable making short term loans than longer ones • They want control back sooner Short term loans (less than a year) get supplied at lower interest rates than long ones

“Premiums”, or Added Costs • Are part of the long term line • They are above and beyond the short term line • Waiting premium – extra cost for having to wait to get the money back • Inflationary expectation premium – the longer the loan, the more likely the real return will be eaten up by inflation • Ex. 5% return on loan, but inflation is 5%, you made 0% real return Longer loans are more susceptible to this

“Premiums”, or Added Costs • Are part of the long term line • They are above and beyond the short term line • Waiting premium – extra cost for having to wait to get the money back • Inflationary expectation premium – the longer the loan, the more likely the real return will be eaten up by inflation • Ex. 5% return on loan, but inflation is 5%, you made 0% real return Longer loans are more susceptible to this

Three Factors • • • Determine long term capital supply line Short term supply line Inflationary expectations Waiting premium These become the shift variables for S

Three Factors • • • Determine long term capital supply line Short term supply line Inflationary expectations Waiting premium These become the shift variables for S

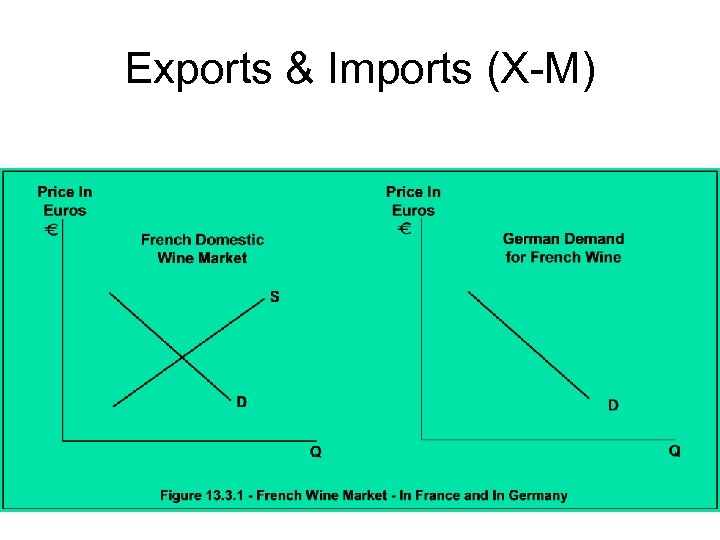

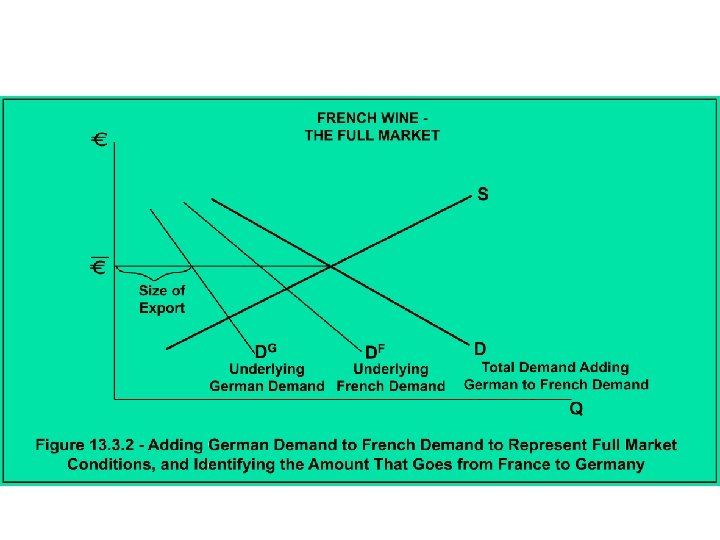

Exports & Imports (X-M)

Exports & Imports (X-M)

• In order to buy European goods, we must first buy euros (€) • In order for European people to buy American goods, they must first buy dollars ($)

• In order to buy European goods, we must first buy euros (€) • In order for European people to buy American goods, they must first buy dollars ($)

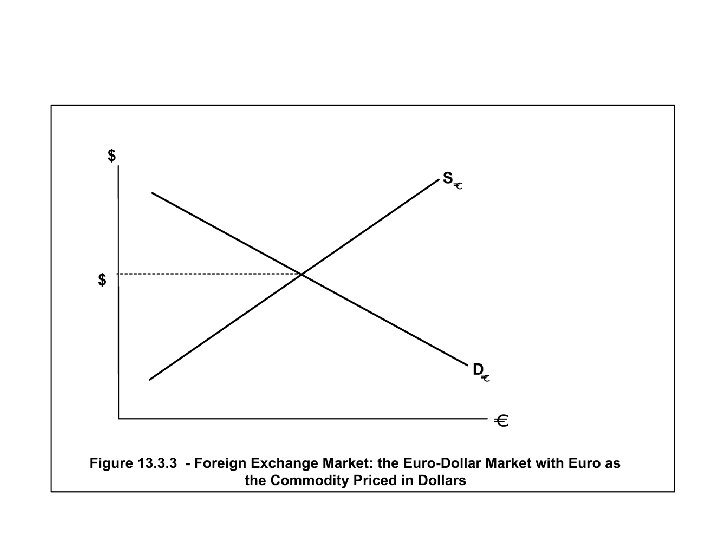

• 2 perspectives on the foreign exchange market • The first has euros as the commodity being purchased • The price of the euros is measured in dollars • There is an exchange rate for euros that is measured in dollars Ex. $1. 20 = 1 euro

• 2 perspectives on the foreign exchange market • The first has euros as the commodity being purchased • The price of the euros is measured in dollars • There is an exchange rate for euros that is measured in dollars Ex. $1. 20 = 1 euro

• Another perspective on the foreign exchange market has • The dollar as the commodity • The price of a dollar is measured in euros Ex. . 833 € = 1 dollar

• Another perspective on the foreign exchange market has • The dollar as the commodity • The price of a dollar is measured in euros Ex. . 833 € = 1 dollar

Graphically, both perspectives

Graphically, both perspectives

• Here’s the key • The demand for euros is the source of the supply of dollars • Every dollar we wish to exchange for a euro is a dollar we are willing to supply to the Europeans • There are only two goods exchanged, so if D€ increases, the S$ increases

• Here’s the key • The demand for euros is the source of the supply of dollars • Every dollar we wish to exchange for a euro is a dollar we are willing to supply to the Europeans • There are only two goods exchanged, so if D€ increases, the S$ increases

Connecting Perspectives on the Foreign Exchange Market

Connecting Perspectives on the Foreign Exchange Market

• on the same market • The exchange rates show the exact same information • If it takes X dollars to buy 1 euro • Then it takes 1/x euros to but 1 dollar • http: //finance. yahoo. com/m 3? u

• on the same market • The exchange rates show the exact same information • If it takes X dollars to buy 1 euro • Then it takes 1/x euros to but 1 dollar • http: //finance. yahoo. com/m 3? u

• economists say that currency is getting stronger • Before, 1 euro = 2 dollars Now, 1 euro = 4 dollars • The euro is stronger and the dollar is weaker

• economists say that currency is getting stronger • Before, 1 euro = 2 dollars Now, 1 euro = 4 dollars • The euro is stronger and the dollar is weaker

• An apartment that was 400 euro a month Used to cost you $800, but with the weaker dollar now costs $1, 600 • Stronger or weaker currencies aren’t necessarily bad or good, but they will affect who buys what

• An apartment that was 400 euro a month Used to cost you $800, but with the weaker dollar now costs $1, 600 • Stronger or weaker currencies aren’t necessarily bad or good, but they will affect who buys what

A stronger dollar means • More U. S. imports • Less U. S. exports T • Trade balance becomes more negative AD moves left

A stronger dollar means • More U. S. imports • Less U. S. exports T • Trade balance becomes more negative AD moves left

• Suppose confidence in the U. S. economy declines sharply • Less demand for financial capital means – lower interest rates – Capital flows out – If it flows to Europe, then increased demand for euros means a weaker U. S. dollar – More U. S. exports, less U. S. imports

• Suppose confidence in the U. S. economy declines sharply • Less demand for financial capital means – lower interest rates – Capital flows out – If it flows to Europe, then increased demand for euros means a weaker U. S. dollar – More U. S. exports, less U. S. imports

• Weak currencies mean not being able to buy U. S. exports • U. S. bought lots of foreign imports with our stronger dollar • Highest trade deficit in U. S. history by 1998 • Even though these countries were exporting huge amounts, and exports can help an economy, they are not a sufficient foundation for a healthy economy

• Weak currencies mean not being able to buy U. S. exports • U. S. bought lots of foreign imports with our stronger dollar • Highest trade deficit in U. S. history by 1998 • Even though these countries were exporting huge amounts, and exports can help an economy, they are not a sufficient foundation for a healthy economy

• The last two variables that move AD are the ones that make up the government budget position (G-T) (Government spending – Taxes) • Determined by the President and Congress – 536 people in all

• The last two variables that move AD are the ones that make up the government budget position (G-T) (Government spending – Taxes) • Determined by the President and Congress – 536 people in all