502de52882073010eba0a7878ef2c1a5.ppt

- Количество слайдов: 12

Aggregate Demand IB Economics Chapter 14

Learning Objectives At the end of this chapter you will be able to ØUnderstand the meaning of aggregate demand ØUnderstand that aggregate demand can change if any of the components of C + I + G + (X – M) change ØUnderstand what causes shifts in aggregate demand ØUnderstand how to use aggregate demand diagrams

The meaning of aggregate demand ØWhen we first learned about supply and demand we were talking about supply and demand within the industry or market ØWe now use the supply and demand curves to show supply and demand in the entire economy ØNote that the axis are labelled slightly differently - we have price level (instead of price) and real output (instead of quantity) ØWe use P still for price and Y for output ØAs with the demand curve the AD curve slopes from left to right

The meaning of aggregate demand ØThe AD curve slopes down from left to right due to the following factors: ØWhen prices fall consumers experience a wealth effect – they feel better off and want to buy more goods or services. More will be consumed at lower prices ØA fall in the price of UK goods lowers the price of UK exports so more will sell abroad. Imports will become more expensive so demand for domestic goods will increase ØExpectations – if consumers expect prices to rise in the future they will increase their consumption now but if they expect prices to fall they will buy later. ØRemember that movements along the curve are only caused by changes in price levels (just as before where movements along the demand curve were caused only by changes in price

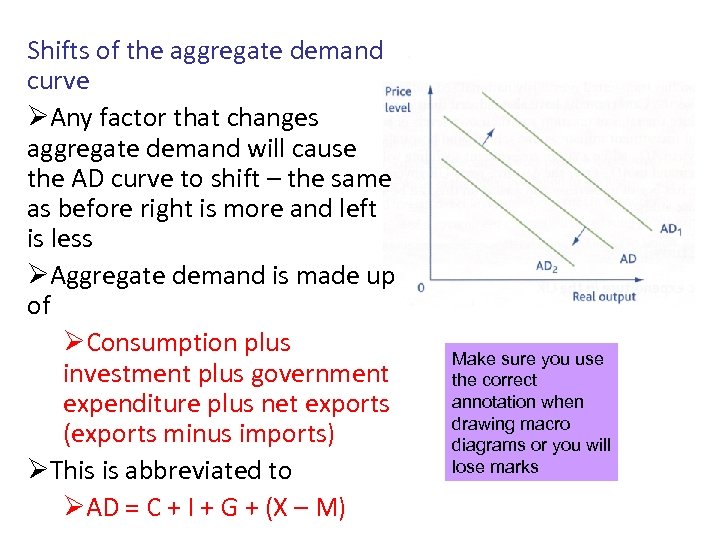

Shifts of the aggregate demand curve ØAny factor that changes aggregate demand will cause the AD curve to shift – the same as before right is more and left is less ØAggregate demand is made up of ØConsumption plus investment plus government expenditure plus net exports (exports minus imports) ØThis is abbreviated to ØAD = C + I + G + (X – M) Make sure you use the correct annotation when drawing macro diagrams or you will lose marks

Factors that affect Aggregate Demand (determinants of Aggregate demand) – Consumption (C) ØConsumption is the total spending by consumers on domestic goods and services (durable and non durable goods) ØConsumption (C) is probably the most important part of AD because it is often the largest part (around 60%) ØIt is also the most volatile and least sustainable ØThe decision to consume is affected by a number of factors ØChanges in income ØAs incomes rise people have more to spend and therefore C will increase ØChanges in interest rates ØIf interest rates increase there is more incentive to save and C will fall ØIf interest rates increase the cost of borrowing increases leading to a fall in C ØIf countries where the majority of people own their houses rather than rent an increase in interest rates means an increase in mortgage payments which leads to less disposable income and therefore less spending (less C)

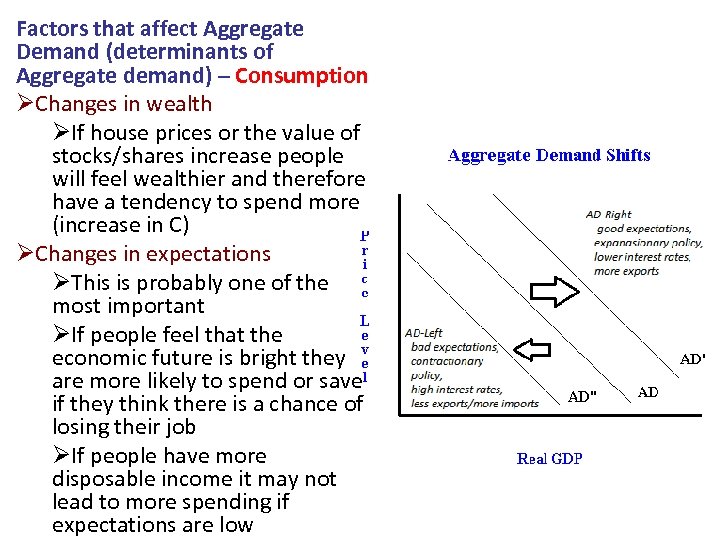

Factors that affect Aggregate Demand (determinants of Aggregate demand) – Consumption ØChanges in wealth ØIf house prices or the value of stocks/shares increase people will feel wealthier and therefore have a tendency to spend more (increase in C) ØChanges in expectations ØThis is probably one of the most important ØIf people feel that the economic future is bright they are more likely to spend or save if they think there is a chance of losing their job ØIf people have more disposable income it may not lead to more spending if expectations are low

Factors that affect Aggregate Demand (determinants of Aggregate demand) – Investment (I) ØInvestment is defined as firms investing into capital equipment machinery and premises. ØThe decision to invest is affected by a number of factors ØThe rate of interest (the amount firms pay to borrow money) ØIf there is a fall in the rate loans will be cheaper and firms will want to invest to improve their competitive position – shift to right ØIf there is a rise in the rate loans will be more expensive and firms will be less inclined to invest. – shift to left ØBusiness Expectations - if interest rates are falling consumers will have more disposable income and therefore firms will expect sales to increase ØPositive expectations (more sales in the future) will increase the likelihood of investment – shift to right ØNegative expectations (less sales in the future) will decrease the likelihood of investment – shift to left ØThe rate of technical progress – if firms don’t have state of the art (the best) equipment and there is new equipment/technology available they will want to have it so that they don’t lose sales to those that have it – they will invest – shift to the right

Factors that affect Aggregate Demand (determinants of Aggregate demand) – Investment (continued) ØThe rate of change of income – as income increases demand for goods/services will increase. If firms are working at capacity they will need to invest to cater for the increased consumption ØBecause the price of the equipment is likely to be much larger than the individual goods it produces investment expenditure will be quite a large injection into the circular flow ØCauses shift of AD curve to the right and a multiplier effect ØThe reaction of investment to the rate of change of income is called the accelerator effect ØCoupled with the multiplier effect this could lead to sizeable fluctuations in demand ØA slowdown or fall in consumer expenditure is likely to lead to a large fall in investment that will slow the growth of the macroeconomy Examiner tip: Investment is a demand side factor that will initially shift aggregate demand but in the long term is should also increase aggregate supply

Monetary Policy ØBoth consumption and investment are important parts of the AD identity ØIf there is a decrease in either AD will fall (growth will fall) ØIf there is an increase in either AD will increase (growth will increase) ØThis is why Monetary Policy is such an important macroeconomic tool ØWhen interest rates increase both C and I should decrease ØWhen interest rates decrease both C and I should increase ØNote that the amount of change in AD is dependent on confidence in the economy and the size of the multiplier (we will learn more about this later) ØGovernment (via the central bank) can use interest rates to control inflation and influence growth

Factors that affect Aggregate Demand (determinants of Aggregate demand) – Government Spending (G) ØGovernment spending is spending on public and merit goods and local government services ØOver the last 50 years UK government spending has reduced as firms have been privatised. ØGovernments have also reduced their spending to reduce taxation and their levels of borrowing ØAn increase in government spending will shift the AD curve to the right ØA decrease will shift the curve to the left ØOver the last 5 years government spending has began to increase (in the UK). ØGovernment spending can have a large multiplier effect (explained later) ØHowever government spending might mean more borrowing if there is not enough tax revenue

Factors that affect Aggregate Demand (determinants of Aggregate demand) – Net Exports (X – M) ØUK exports depend on demand from other countries ØIf other trading countries are growing there will be an AD shift to the right ØIf other trading countries are in recession there will be an AD shift to the left ØExports and Imports are affected by the value of the pound sterling ØIf sterling falls in value against the Euro UK exports will be cheaper in Europe, sales should increase and the AD will shift to the right ØIf sterling increases in value UK exports will become more expensive, sales should decrease and the AD will shift to the right ØIf the UK economy is growing and incomes are rising consumers may spend more on imports shifting the AD curve to the left (because there is less demand for domestic goods) ØIf the value of sterling rises imports will appear cheaper and consumers will purchase more cheap imports – AD curve shift to the left.

502de52882073010eba0a7878ef2c1a5.ppt