ddfc43406b95b3372ea017dd64742e2c.ppt

- Количество слайдов: 12

Agenda § Introduction § History of Oracle Treasury § The Best Practices Journey – Cash Pooling – Intercompany Netting – P-card Processing – Global Treasury/ Banking Integration § Best Practices in Treasury § Getting Started … 1

Agenda § Introduction § History of Oracle Treasury § The Best Practices Journey – Cash Pooling – Intercompany Netting – P-card Processing – Global Treasury/ Banking Integration § Best Practices in Treasury § Getting Started … 1

Paul Kirch: Director, Oracle Applications Consulting, Answerthink § Currently, a Director in Answerthink’s Oracle Consulting Practice, with responsibility for consulting implementation on the West Coast § More than 20 years experience in the implementation of ERP systems, principally in Finance, Global Supply Chain, and Distribution § MBA in International Finance, CPA (licensed in the State of Maryland) § CFA (Certified Financial Analyst) candidate, Level I, June, 2007 § Worked for Oracle Corporation in the period 1995 -2000, first as a Sales Consultant in Latin America and later as a Practice Manager in the Oracle One international consulting group § Have worked on treasury systems design, including many of the problems related to integration, at KLA-Tencor, FEI Company, Cisco, and Qualcomm 2

Paul Kirch: Director, Oracle Applications Consulting, Answerthink § Currently, a Director in Answerthink’s Oracle Consulting Practice, with responsibility for consulting implementation on the West Coast § More than 20 years experience in the implementation of ERP systems, principally in Finance, Global Supply Chain, and Distribution § MBA in International Finance, CPA (licensed in the State of Maryland) § CFA (Certified Financial Analyst) candidate, Level I, June, 2007 § Worked for Oracle Corporation in the period 1995 -2000, first as a Sales Consultant in Latin America and later as a Practice Manager in the Oracle One international consulting group § Have worked on treasury systems design, including many of the problems related to integration, at KLA-Tencor, FEI Company, Cisco, and Qualcomm 2

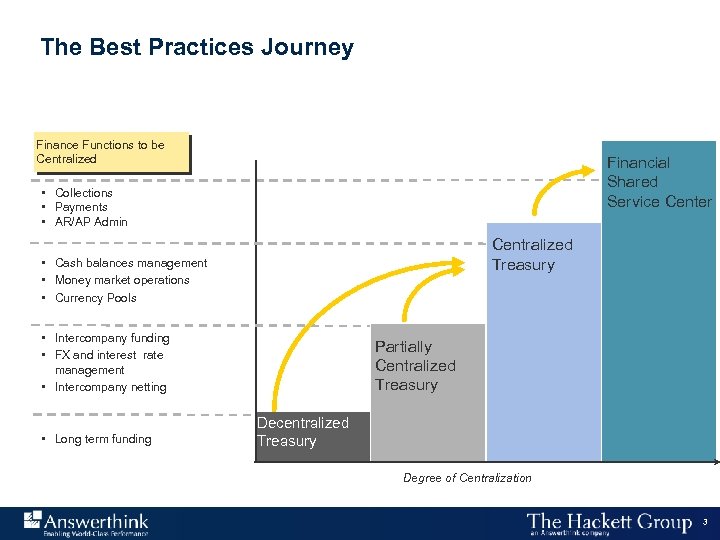

The Best Practices Journey Finance Functions to be Centralized Financial Shared Service Center • Collections • Payments • AR/AP Admin Centralized Treasury • Cash balances management • Money market operations • Currency Pools • Intercompany funding • FX and interest rate management • Intercompany netting • Long term funding Partially Centralized Treasury Decentralized Treasury Degree of Centralization 3

The Best Practices Journey Finance Functions to be Centralized Financial Shared Service Center • Collections • Payments • AR/AP Admin Centralized Treasury • Cash balances management • Money market operations • Currency Pools • Intercompany funding • FX and interest rate management • Intercompany netting • Long term funding Partially Centralized Treasury Decentralized Treasury Degree of Centralization 3

![Automated Balance Transfer for Intercompany Sweeps Best Practice: Cash Pooling R Europe Entity [TBD] Automated Balance Transfer for Intercompany Sweeps Best Practice: Cash Pooling R Europe Entity [TBD]](https://present5.com/presentation/ddfc43406b95b3372ea017dd64742e2c/image-4.jpg) Automated Balance Transfer for Intercompany Sweeps Best Practice: Cash Pooling R Europe Entity [TBD] USD Account, Current (OD) [ABN AMRO Amsterdam] OFF-SHORE USD ACCOUNTS in Hong Kong R FEI HK Company ASIA Net USD Position Master USD Account Current (OD) 1 AUTOMATED USD NOTIONAL POOL R Hong Kong USD Current (OD) NR Singapore USD Current (OD) FX NR Japan USD Current (OD) 2 NR Taiwan USD Current (OD) FX Operational Expenses FX R Hong Kong HKD Savings (No OD) Current (OD) R Singapore SGD Savings (No OD) Current (OD) FX FX FX R Taiwan TWD DDA/Savings (No OD) Current (OD) R China CNY Current (No OD “ST-Loan”) R Malaysia MYR Current (OD) No Savgs allowed R Thailand THB Savings (No OD) Current (OD) ON-SHORE LOCAL CURRENCY ACCOUNTS Payables FX Receivables FX (Spot/Fwd/Option) available on/offshore, per regulation R: Resident entity FX NR: Non-Resident entity FX (Spot/Fwd/Option) available onshore only, per regulation 4

Automated Balance Transfer for Intercompany Sweeps Best Practice: Cash Pooling R Europe Entity [TBD] USD Account, Current (OD) [ABN AMRO Amsterdam] OFF-SHORE USD ACCOUNTS in Hong Kong R FEI HK Company ASIA Net USD Position Master USD Account Current (OD) 1 AUTOMATED USD NOTIONAL POOL R Hong Kong USD Current (OD) NR Singapore USD Current (OD) FX NR Japan USD Current (OD) 2 NR Taiwan USD Current (OD) FX Operational Expenses FX R Hong Kong HKD Savings (No OD) Current (OD) R Singapore SGD Savings (No OD) Current (OD) FX FX FX R Taiwan TWD DDA/Savings (No OD) Current (OD) R China CNY Current (No OD “ST-Loan”) R Malaysia MYR Current (OD) No Savgs allowed R Thailand THB Savings (No OD) Current (OD) ON-SHORE LOCAL CURRENCY ACCOUNTS Payables FX Receivables FX (Spot/Fwd/Option) available on/offshore, per regulation R: Resident entity FX NR: Non-Resident entity FX (Spot/Fwd/Option) available onshore only, per regulation 4

Best Practice: Intercompany Netting (1 of 3) § “A process by which the inter-group payables of each participating group member are settled, on predetermined dates, by effecting one transfer, in the functional currency of each participant, to or from a corporate netting centre (“CNC”) § Settlement of intercompany obligations (3 rd parties can be included) § Pre-determined calendar § Payable or receivable § One amount § One currency 5

Best Practice: Intercompany Netting (1 of 3) § “A process by which the inter-group payables of each participating group member are settled, on predetermined dates, by effecting one transfer, in the functional currency of each participant, to or from a corporate netting centre (“CNC”) § Settlement of intercompany obligations (3 rd parties can be included) § Pre-determined calendar § Payable or receivable § One amount § One currency 5

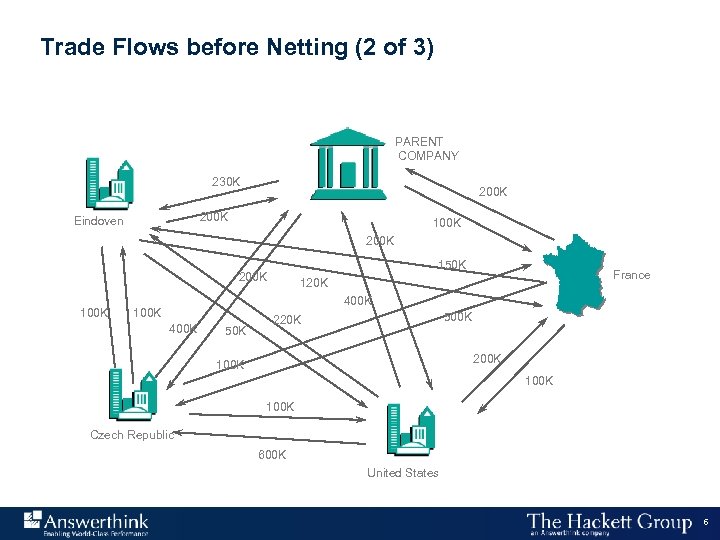

Trade Flows before Netting (2 of 3) PARENT COMPANY 230 K 200 K Eindoven 100 K 200 K 150 K 200 K 100 K France 120 K 400 K 100 K 400 K 500 K 220 K 200 K 100 K Czech Republic 600 K United States 6

Trade Flows before Netting (2 of 3) PARENT COMPANY 230 K 200 K Eindoven 100 K 200 K 150 K 200 K 100 K France 120 K 400 K 100 K 400 K 500 K 220 K 200 K 100 K Czech Republic 600 K United States 6

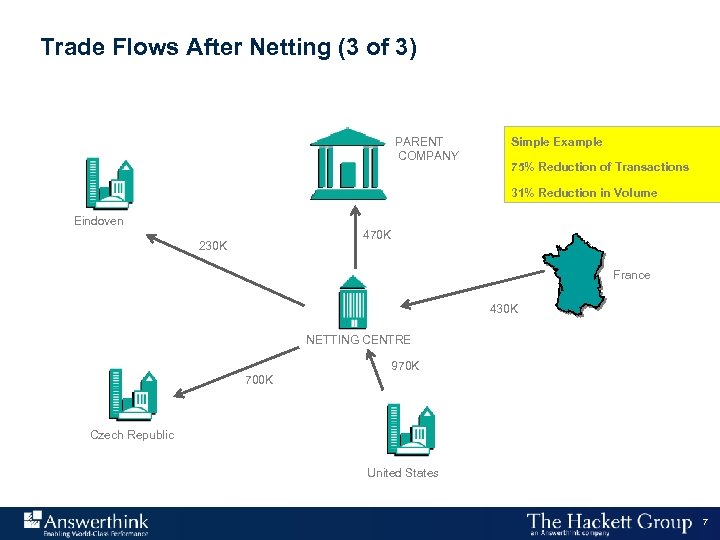

Trade Flows After Netting (3 of 3) PARENT COMPANY Simple Example 75% Reduction of Transactions 31% Reduction in Volume Eindoven 470 K 230 K France 430 K NETTING CENTRE 970 K 700 K Czech Republic United States 7

Trade Flows After Netting (3 of 3) PARENT COMPANY Simple Example 75% Reduction of Transactions 31% Reduction in Volume Eindoven 470 K 230 K France 430 K NETTING CENTRE 970 K 700 K Czech Republic United States 7

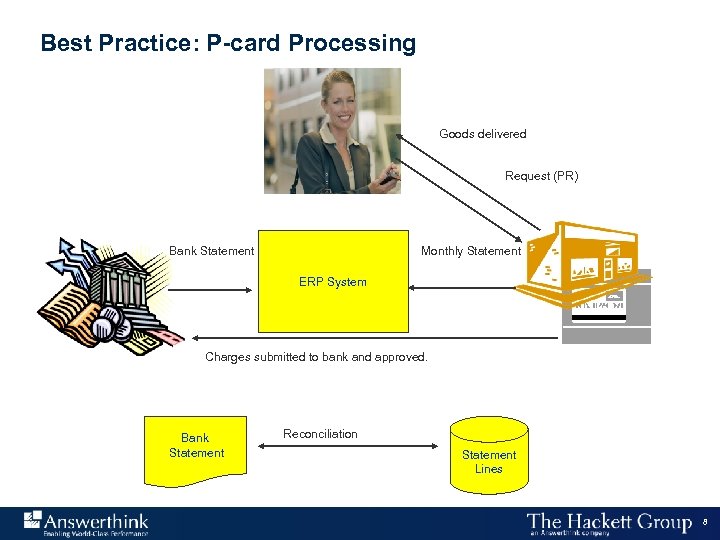

Best Practice: P-card Processing Goods delivered Request (PR) Bank Statement Monthly Statement ERP System Charges submitted to bank and approved. Bank Statement Reconciliation Statement Lines 8

Best Practice: P-card Processing Goods delivered Request (PR) Bank Statement Monthly Statement ERP System Charges submitted to bank and approved. Bank Statement Reconciliation Statement Lines 8

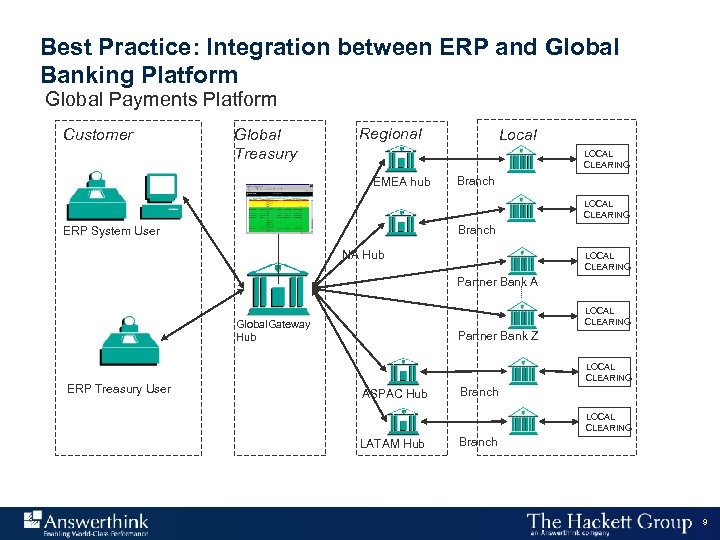

Best Practice: Integration between ERP and Global Banking Platform Global Payments Platform Customer Global Treasury Regional Local LOCAL CLEARING EMEA hub Branch LOCAL CLEARING Branch ERP System User NA Hub LOCAL CLEARING Partner Bank A LOCAL CLEARING Global. Gateway Hub ERP Treasury User Partner Bank Z LOCAL CLEARING ASPAC Hub Branch LOCAL CLEARING LATAM Hub Branch 9

Best Practice: Integration between ERP and Global Banking Platform Global Payments Platform Customer Global Treasury Regional Local LOCAL CLEARING EMEA hub Branch LOCAL CLEARING Branch ERP System User NA Hub LOCAL CLEARING Partner Bank A LOCAL CLEARING Global. Gateway Hub ERP Treasury User Partner Bank Z LOCAL CLEARING ASPAC Hub Branch LOCAL CLEARING LATAM Hub Branch 9

Best Practices in Treasury § Consolidation to 1 or 2 banks – globally; reduction in the number and location of bank accounts; centralization of Treasury function § Better use of cash through use of sweep accounts, cash pooling, and netting of intercompany transactions § Greater transactional efficiencies including the use of electronic links to external banking partners and markets and increased use of EDI/EFT for cash receipts and cash disbursements § Increased use of P-cards and Ghost Cards for low dollar transaction processing § Tighter integration between banking web based portals/ global payments platforms and ERP-based Treasury management systems § Straight-through-Processing (STP) of Treasury Transactions (automated confirmation e-mail, accounting, and payment scheduling) § Improved information management and reporting including 10

Best Practices in Treasury § Consolidation to 1 or 2 banks – globally; reduction in the number and location of bank accounts; centralization of Treasury function § Better use of cash through use of sweep accounts, cash pooling, and netting of intercompany transactions § Greater transactional efficiencies including the use of electronic links to external banking partners and markets and increased use of EDI/EFT for cash receipts and cash disbursements § Increased use of P-cards and Ghost Cards for low dollar transaction processing § Tighter integration between banking web based portals/ global payments platforms and ERP-based Treasury management systems § Straight-through-Processing (STP) of Treasury Transactions (automated confirmation e-mail, accounting, and payment scheduling) § Improved information management and reporting including 10

Getting Started … § Recognize that Oracle treasury setup heavily dependent upon company banking relationships and that Oracle Treasury configuration MUST reflect current company banking relationships § Begin best practices journey by: – adopting global, web based cash management solution – seek to more fully integrate Oracle to back-end bank processing platform – net intercompany transactions and replace intercompany cash movements with weekly/monthly/quarterly USD movements – increase use of bank services, such as P-card transaction processing – adopt centralized treasury/centralized disbursements processing (AP shared services) with 70% or more of dollars disbursed electronically 11

Getting Started … § Recognize that Oracle treasury setup heavily dependent upon company banking relationships and that Oracle Treasury configuration MUST reflect current company banking relationships § Begin best practices journey by: – adopting global, web based cash management solution – seek to more fully integrate Oracle to back-end bank processing platform – net intercompany transactions and replace intercompany cash movements with weekly/monthly/quarterly USD movements – increase use of bank services, such as P-card transaction processing – adopt centralized treasury/centralized disbursements processing (AP shared services) with 70% or more of dollars disbursed electronically 11

Contact Information Paul Kirch Director, Oracle Applications Consulting Hackett Certified Advisor Answerthink, Inc. Telephone: (408) 316 -5899 e-mail: pkirch@answerthink. com Statement of Confidentiality This document contains confidential material proprietary to Answerthink, Inc. . The materials, ideas and concepts contained herein are to be used exclusively to evaluate the capabilities of Answerthink to provide value-added assistance to The Williams Company. This information and the ideas herein may not be disclosed, copied or distributed to anyone outside of The Williams Company Industries or be used for purposes other than the evaluation of Answerthink’s capabilities on this particular engagement Copyright © 2006 Answerthink, Inc. . All rights reserved. 12

Contact Information Paul Kirch Director, Oracle Applications Consulting Hackett Certified Advisor Answerthink, Inc. Telephone: (408) 316 -5899 e-mail: pkirch@answerthink. com Statement of Confidentiality This document contains confidential material proprietary to Answerthink, Inc. . The materials, ideas and concepts contained herein are to be used exclusively to evaluate the capabilities of Answerthink to provide value-added assistance to The Williams Company. This information and the ideas herein may not be disclosed, copied or distributed to anyone outside of The Williams Company Industries or be used for purposes other than the evaluation of Answerthink’s capabilities on this particular engagement Copyright © 2006 Answerthink, Inc. . All rights reserved. 12