6d83a23449c92fc8ec3af62a224f2bfb.ppt

- Количество слайдов: 39

After the Storm Lawrence Yun, Ph. D. Senior Economist NATIONAL ASSOCIATION OF REALTORS® Presentation at NAR Leadership Summit Chicago, IL August 17, 2007

After the Storm Lawrence Yun, Ph. D. Senior Economist NATIONAL ASSOCIATION OF REALTORS® Presentation at NAR Leadership Summit Chicago, IL August 17, 2007

Subprime Loan Implosion • Homeowners facing higher resetting rates and foreclosures • Wall Street reassessing risk • Sub-prime brokers desperate for Wall Street funding • Potential homebuyers left out in the cold

Subprime Loan Implosion • Homeowners facing higher resetting rates and foreclosures • Wall Street reassessing risk • Sub-prime brokers desperate for Wall Street funding • Potential homebuyers left out in the cold

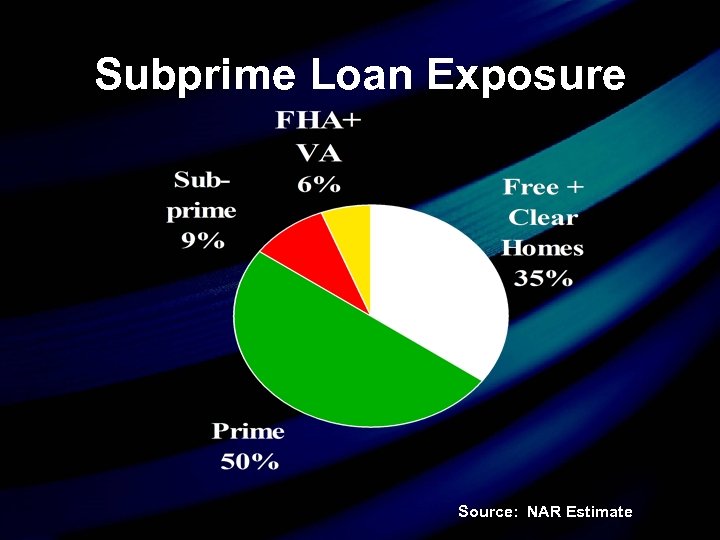

Subprime Loan Exposure Source: NAR Estimate

Subprime Loan Exposure Source: NAR Estimate

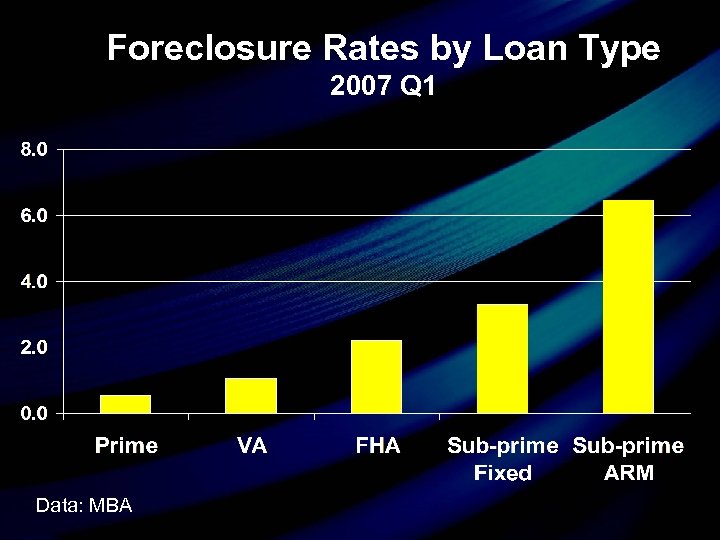

Foreclosure Rates by Loan Type 2007 Q 1 Data: MBA

Foreclosure Rates by Loan Type 2007 Q 1 Data: MBA

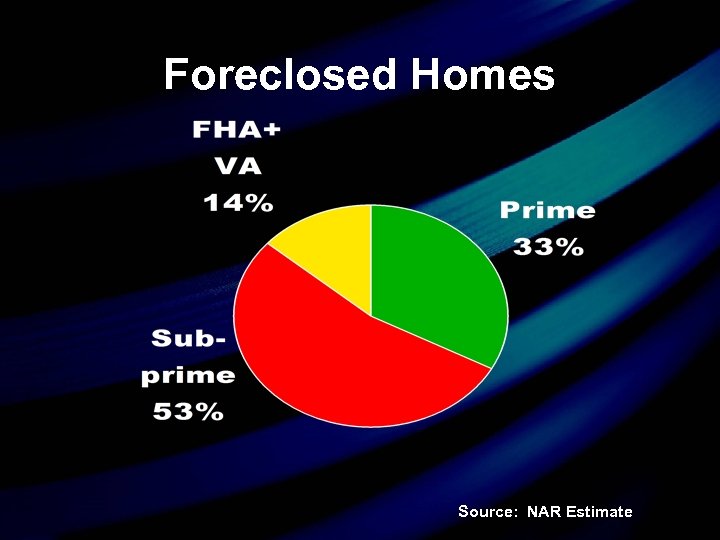

Foreclosed Homes Source: NAR Estimate

Foreclosed Homes Source: NAR Estimate

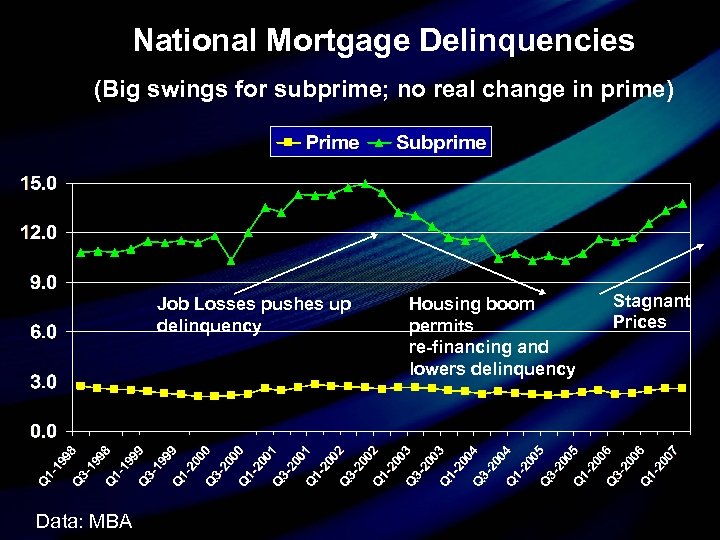

National Mortgage Delinquencies (Big swings for subprime; no real change in prime) Job Losses pushes up delinquency Data: MBA Housing boom permits re-financing and lowers delinquency Stagnant Prices

National Mortgage Delinquencies (Big swings for subprime; no real change in prime) Job Losses pushes up delinquency Data: MBA Housing boom permits re-financing and lowers delinquency Stagnant Prices

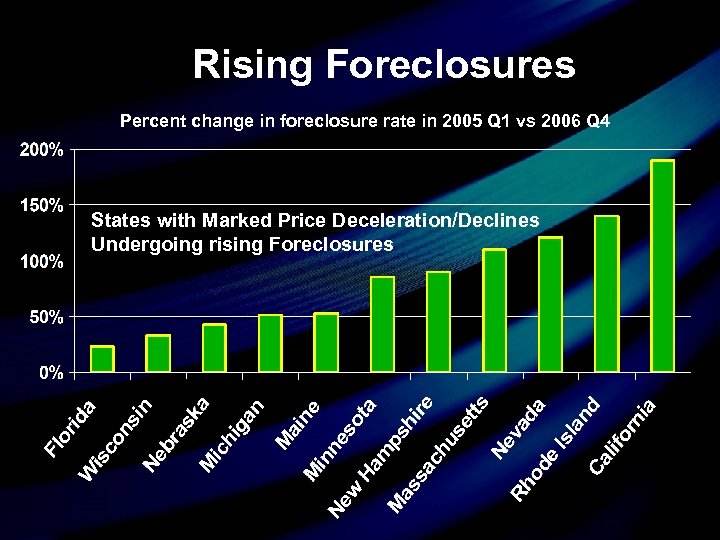

Rising Foreclosures Percent change in foreclosure rate in 2005 Q 1 vs 2006 Q 4 States with Marked Price Deceleration/Declines Undergoing rising Foreclosures

Rising Foreclosures Percent change in foreclosure rate in 2005 Q 1 vs 2006 Q 4 States with Marked Price Deceleration/Declines Undergoing rising Foreclosures

High Foreclosure States (2007 Q 1) Data: MBA

High Foreclosure States (2007 Q 1) Data: MBA

Delinquency to Foreclosure (Latest Foreclosure/Delinquency ratio) Better Loss Mitigation Programs for VA and FHA

Delinquency to Foreclosure (Latest Foreclosure/Delinquency ratio) Better Loss Mitigation Programs for VA and FHA

Not All Markets are Suffering … States with Falling Foreclosures Percent change in foreclosure rate in 2005 Q 1 vs 2006 Q 4 Mostly Strong Job Growth and Price Appreciating States

Not All Markets are Suffering … States with Falling Foreclosures Percent change in foreclosure rate in 2005 Q 1 vs 2006 Q 4 Mostly Strong Job Growth and Price Appreciating States

Healthier Future Market • Job growth leads to accumulating and releasing of pent-up housing demand • Cut back in new home construction thins out inventory and strengthen home prices • Shift to “traditional” products – Reckless lenders going belly up – Wall Street tightening – FHA revival – Higher prevalence of fixed-rate mortgages • Short-term Pain from lower home sales • Long-term Gain from lower defaults

Healthier Future Market • Job growth leads to accumulating and releasing of pent-up housing demand • Cut back in new home construction thins out inventory and strengthen home prices • Shift to “traditional” products – Reckless lenders going belly up – Wall Street tightening – FHA revival – Higher prevalence of fixed-rate mortgages • Short-term Pain from lower home sales • Long-term Gain from lower defaults

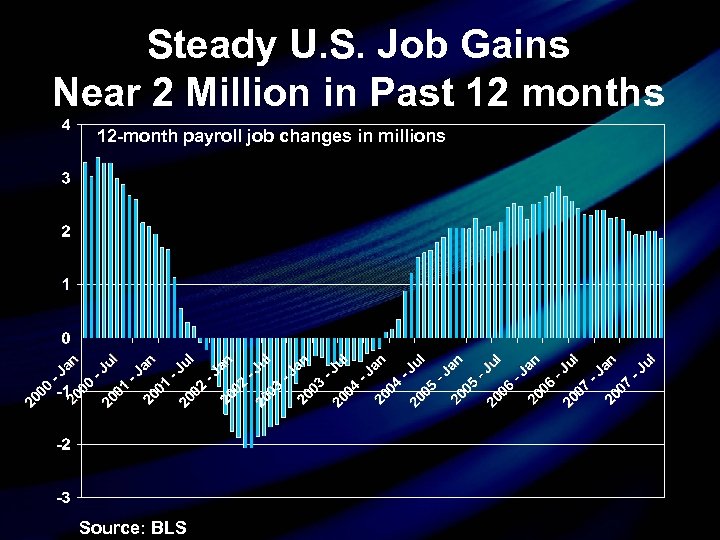

Steady U. S. Job Gains Near 2 Million in Past 12 months 12 -month payroll job changes in millions Source: BLS

Steady U. S. Job Gains Near 2 Million in Past 12 months 12 -month payroll job changes in millions Source: BLS

Wage Growth Picking Up % Source: BLS

Wage Growth Picking Up % Source: BLS

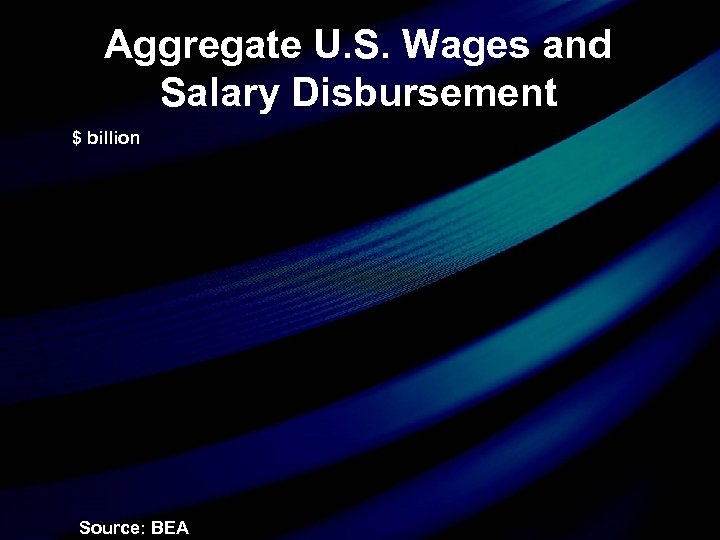

Aggregate U. S. Wages and Salary Disbursement $ billion Source: BEA

Aggregate U. S. Wages and Salary Disbursement $ billion Source: BEA

Corporate Profits – Record High $ billion Source: BEA

Corporate Profits – Record High $ billion Source: BEA

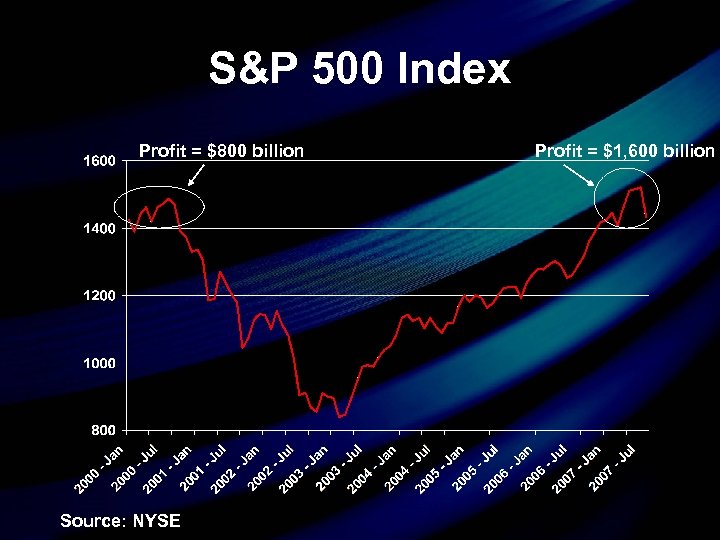

S&P 500 Index Profit = $800 billion Source: NYSE Profit = $1, 600 billion

S&P 500 Index Profit = $800 billion Source: NYSE Profit = $1, 600 billion

Economic Growth % annualized growth rate

Economic Growth % annualized growth rate

Consumer Spending % annualized growth rate

Consumer Spending % annualized growth rate

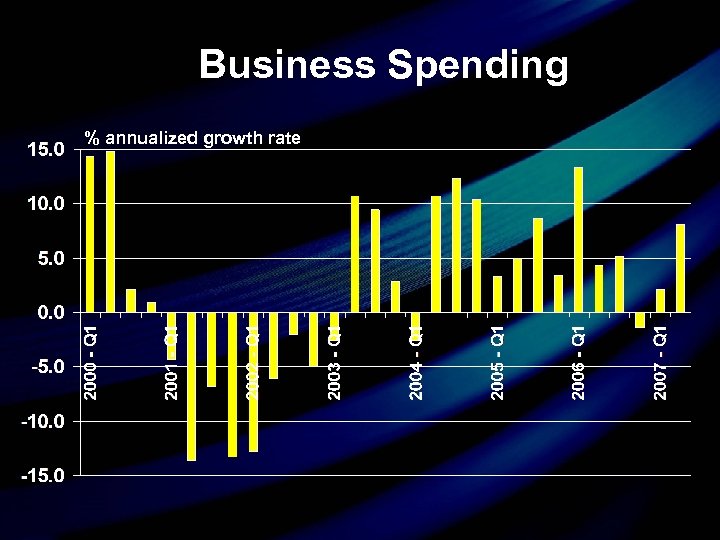

Business Spending % annualized growth rate

Business Spending % annualized growth rate

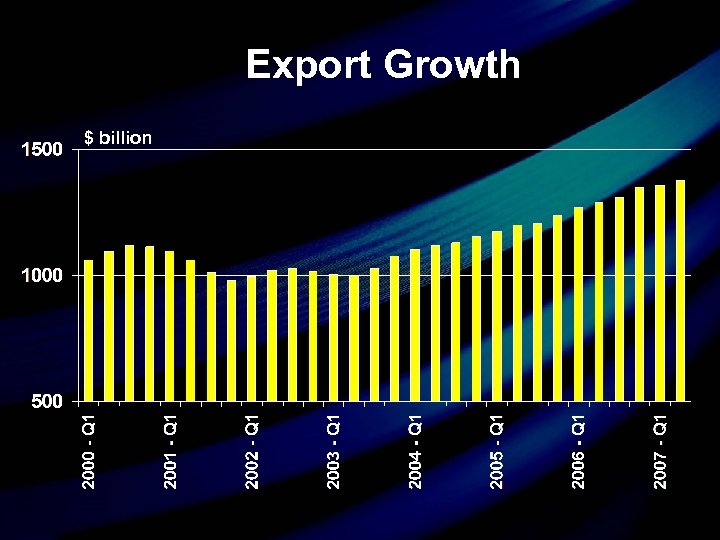

Export Growth $ billion

Export Growth $ billion

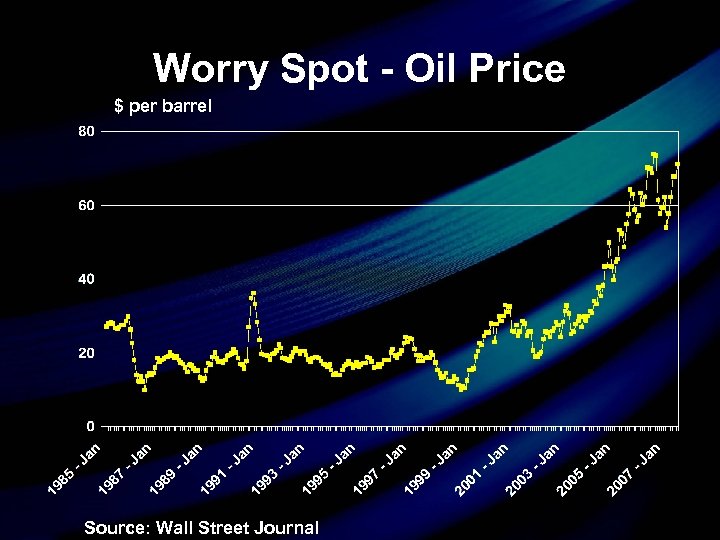

Worry Spot - Oil Price $ per barrel Source: Wall Street Journal

Worry Spot - Oil Price $ per barrel Source: Wall Street Journal

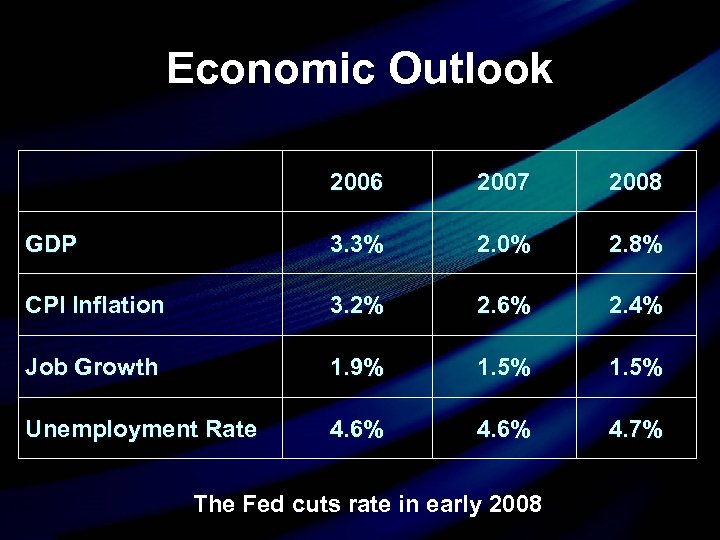

Economic Outlook 2006 2007 2008 GDP 3. 3% 2. 0% 2. 8% CPI Inflation 3. 2% 2. 6% 2. 4% Job Growth 1. 9% 1. 5% Unemployment Rate 4. 6% 4. 7% The Fed cuts rate in early 2008

Economic Outlook 2006 2007 2008 GDP 3. 3% 2. 0% 2. 8% CPI Inflation 3. 2% 2. 6% 2. 4% Job Growth 1. 9% 1. 5% Unemployment Rate 4. 6% 4. 7% The Fed cuts rate in early 2008

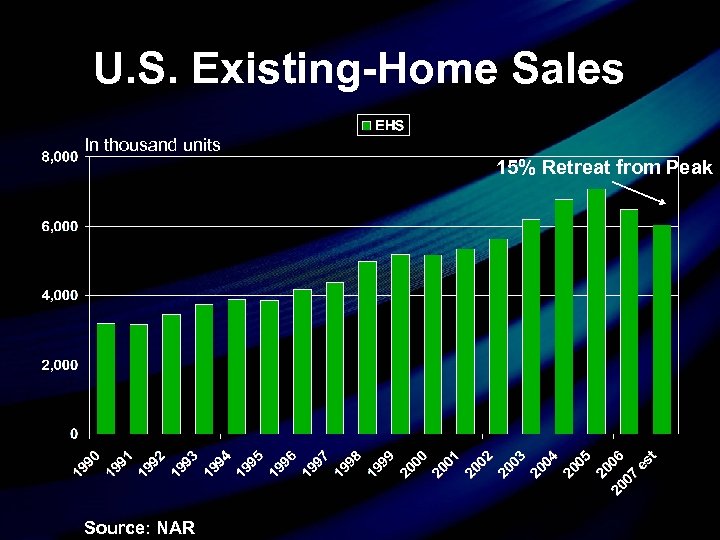

U. S. Existing-Home Sales In thousand units 15% Retreat from Peak Source: NAR

U. S. Existing-Home Sales In thousand units 15% Retreat from Peak Source: NAR

U. S. New-Home Sales In thousand units 34% Retreat from Peak Source: NAR, Census

U. S. New-Home Sales In thousand units 34% Retreat from Peak Source: NAR, Census

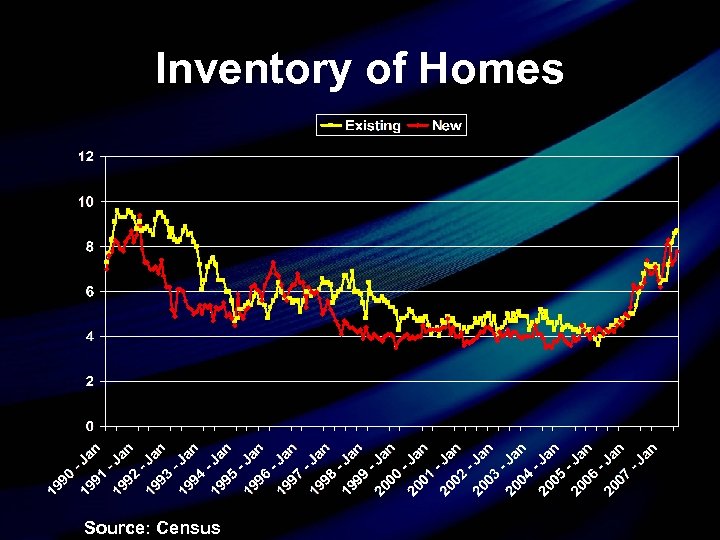

Inventory of Homes Source: Census

Inventory of Homes Source: Census

Home Price Growth % change from a year ago Source: NAR

Home Price Growth % change from a year ago Source: NAR

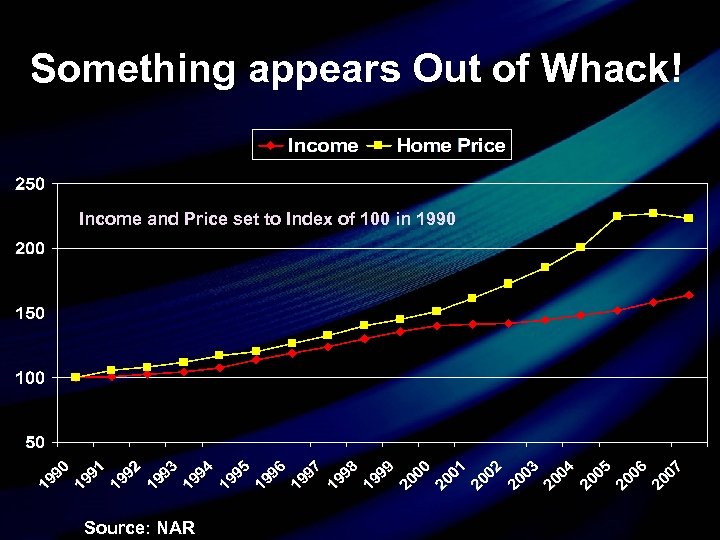

Something appears Out of Whack! Income and Price set to Index of 100 in 1990 Source: NAR

Something appears Out of Whack! Income and Price set to Index of 100 in 1990 Source: NAR

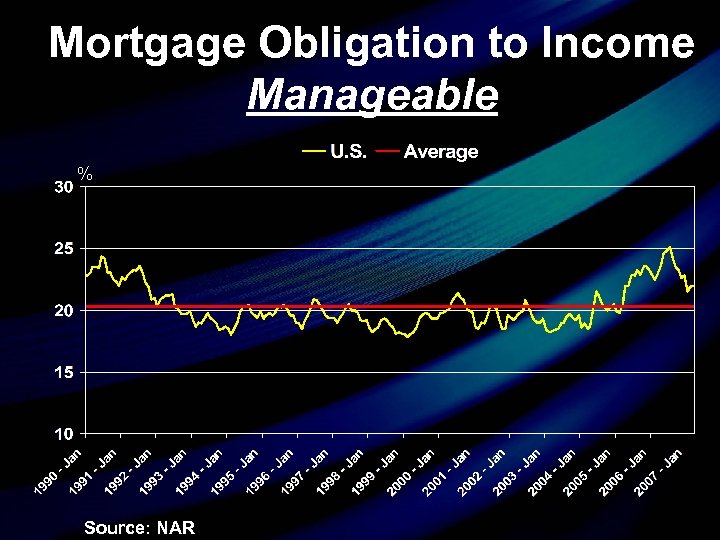

Mortgage Obligation to Income Manageable % Source: NAR

Mortgage Obligation to Income Manageable % Source: NAR

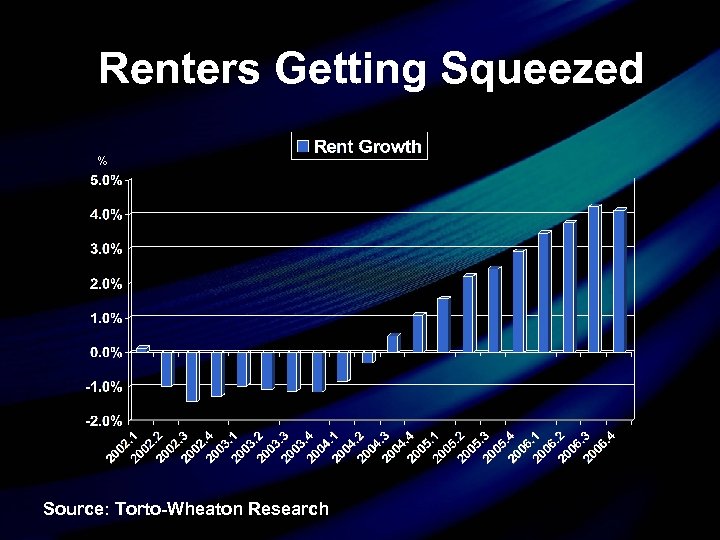

Renters Getting Squeezed % Source: Torto-Wheaton Research

Renters Getting Squeezed % Source: Torto-Wheaton Research

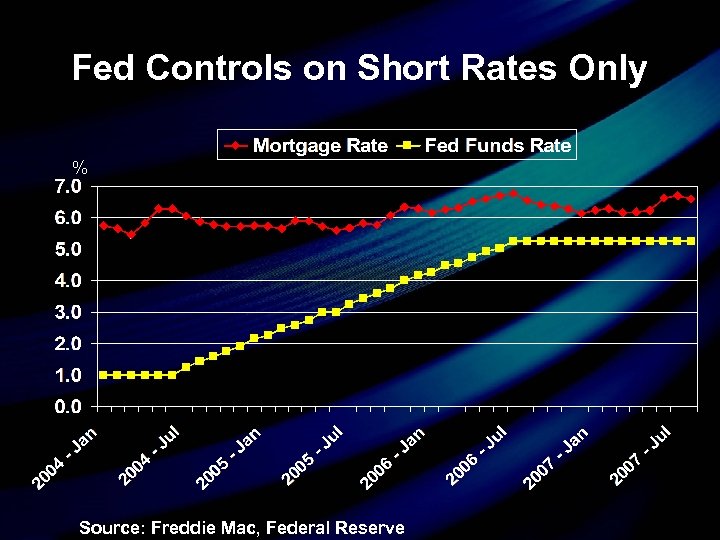

Fed Controls on Short Rates Only % Source: Freddie Mac, Federal Reserve

Fed Controls on Short Rates Only % Source: Freddie Mac, Federal Reserve

House prices 'to soar 40 percent within next five years' • News from National Housing Federation in U. K. … August 2007 • U. K. home prices soared 156% past 10 years … twice as fast as U. S. home prices • Not building Enough Homes! Housing Shortage!

House prices 'to soar 40 percent within next five years' • News from National Housing Federation in U. K. … August 2007 • U. K. home prices soared 156% past 10 years … twice as fast as U. S. home prices • Not building Enough Homes! Housing Shortage!

U. S. New Single-Family Construction 33% 2 -year Tumble Source: Census

U. S. New Single-Family Construction 33% 2 -year Tumble Source: Census

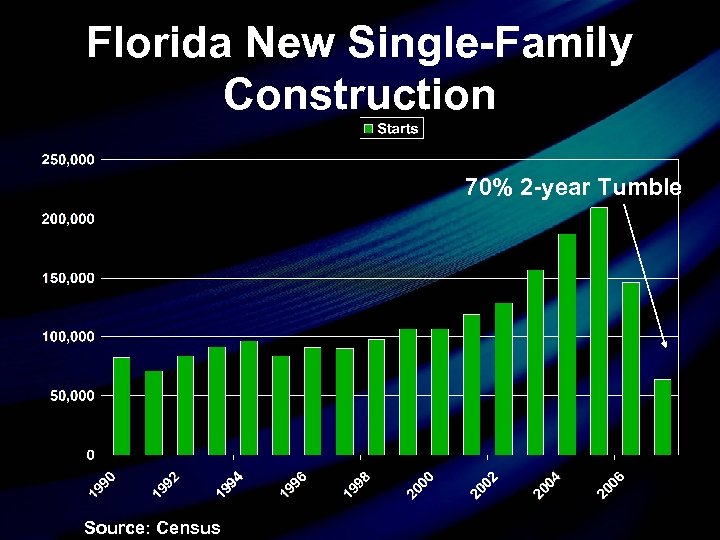

Florida New Single-Family Construction 70% 2 -year Tumble Source: Census

Florida New Single-Family Construction 70% 2 -year Tumble Source: Census

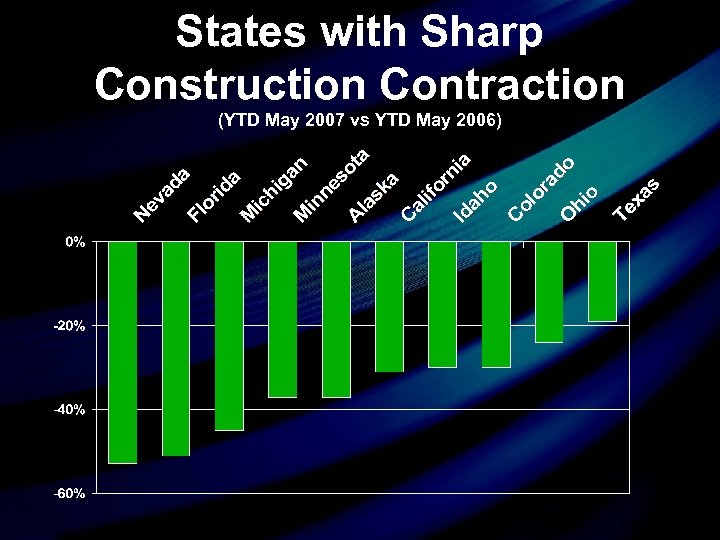

States with Sharp Construction Contraction (YTD May 2007 vs YTD May 2006)

States with Sharp Construction Contraction (YTD May 2007 vs YTD May 2006)

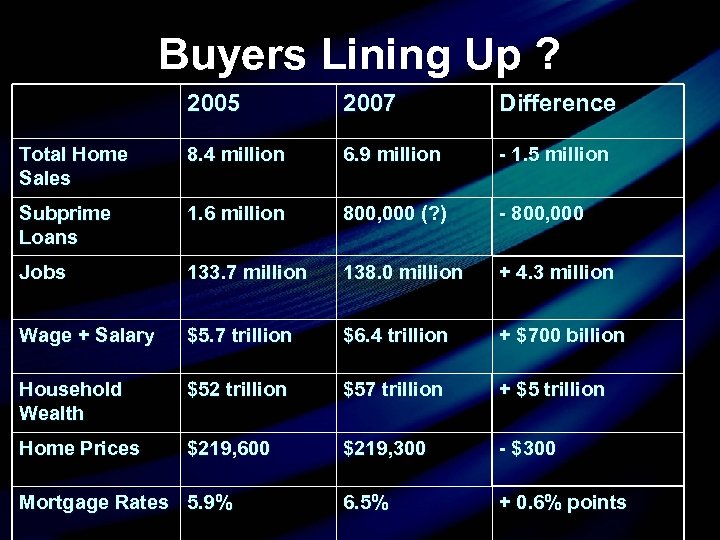

Buyers Lining Up ? 2005 2007 Difference Total Home Sales 8. 4 million 6. 9 million - 1. 5 million Subprime Loans 1. 6 million 800, 000 (? ) - 800, 000 Jobs 133. 7 million 138. 0 million + 4. 3 million Wage + Salary $5. 7 trillion $6. 4 trillion + $700 billion Household Wealth $52 trillion $57 trillion + $5 trillion Home Prices $219, 600 $219, 300 - $300 6. 5% + 0. 6% points Mortgage Rates 5. 9%

Buyers Lining Up ? 2005 2007 Difference Total Home Sales 8. 4 million 6. 9 million - 1. 5 million Subprime Loans 1. 6 million 800, 000 (? ) - 800, 000 Jobs 133. 7 million 138. 0 million + 4. 3 million Wage + Salary $5. 7 trillion $6. 4 trillion + $700 billion Household Wealth $52 trillion $57 trillion + $5 trillion Home Prices $219, 600 $219, 300 - $300 6. 5% + 0. 6% points Mortgage Rates 5. 9%

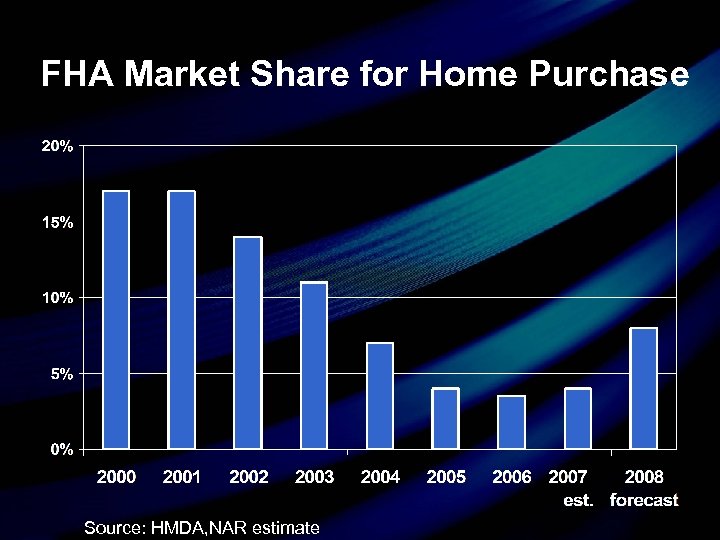

FHA Market Share for Home Purchase Source: HMDA, NAR estimate

FHA Market Share for Home Purchase Source: HMDA, NAR estimate

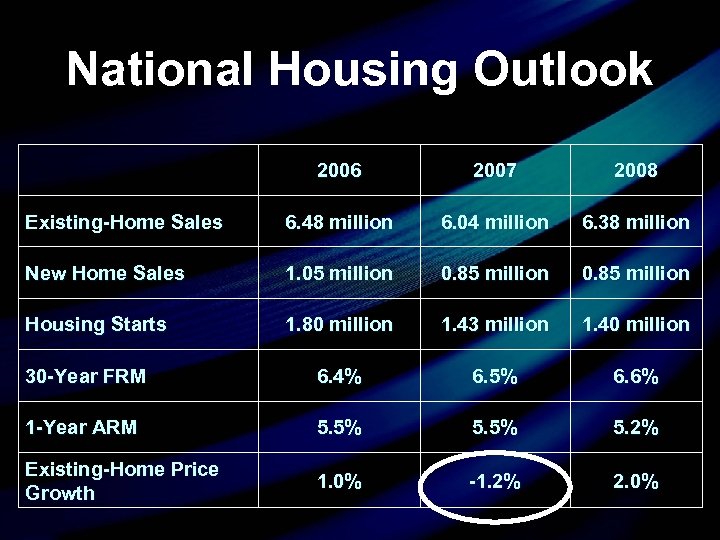

National Housing Outlook 2006 2007 2008 Existing-Home Sales 6. 48 million 6. 04 million 6. 38 million New Home Sales 1. 05 million 0. 85 million Housing Starts 1. 80 million 1. 43 million 1. 40 million 30 -Year FRM 6. 4% 6. 5% 6. 6% 1 -Year ARM 5. 5% 5. 2% Existing-Home Price Growth 1. 0% -1. 2% 2. 0%

National Housing Outlook 2006 2007 2008 Existing-Home Sales 6. 48 million 6. 04 million 6. 38 million New Home Sales 1. 05 million 0. 85 million Housing Starts 1. 80 million 1. 43 million 1. 40 million 30 -Year FRM 6. 4% 6. 5% 6. 6% 1 -Year ARM 5. 5% 5. 2% Existing-Home Price Growth 1. 0% -1. 2% 2. 0%

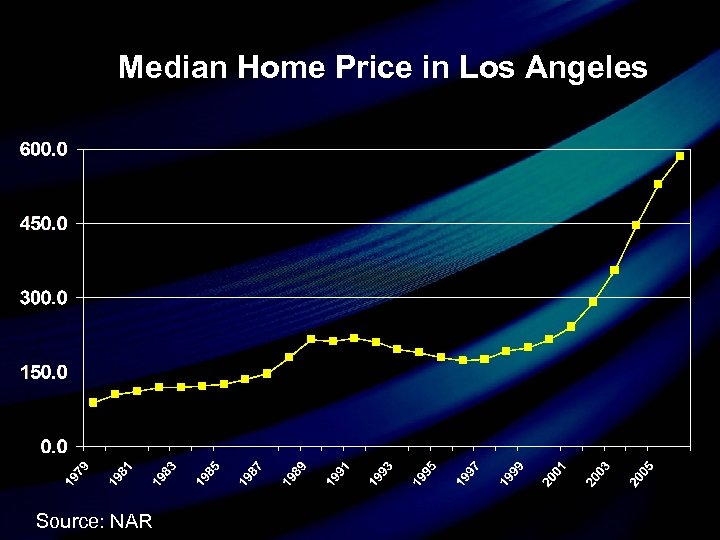

Median Home Price in Los Angeles Source: NAR

Median Home Price in Los Angeles Source: NAR

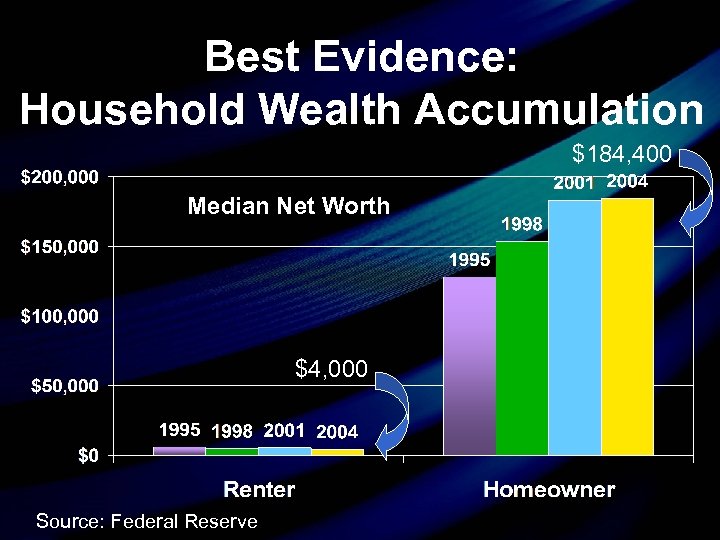

Best Evidence: Household Wealth Accumulation $184, 400 Median Net Worth $4, 000 Source: Federal Reserve

Best Evidence: Household Wealth Accumulation $184, 400 Median Net Worth $4, 000 Source: Federal Reserve