966863cbb0129ff7629939f3d5bd3f86.ppt

- Количество слайдов: 18

African projects and programs: Developing enhanced relationships between private sector project developers and financial institutions Africa Carbon Forum, Nairobi, March 2010 Hela Cheikhrouhou Manager, Private Sector Infrastructure Finance 1

• The African Development Bank (Af. DB) has extensive experience of working with Private Sector Project Developers and other Financial Institutions to structure project finance deals, including in the renewable energy sector. • This includes sectors such as hydro power, solar, wind energy and cogeneration • Af. DB has track record helping local sponsors get interested European Sovereigns (i) finance the Project Validation documents for CDM (ii) commit to buy the carbon credits at a fair market price. • Af. DB does not buy carbon credits but is interested to know about the potential buyers as it can facilitate contacts with local project developers. 2

Key Bottleneck--For Local project sponsors, preparing CDM proposals is an uphill battle. Complicated access rules of the CDM. – Limited expertise of project developers and little external support in the area. – Long time period taken for validation of project proposals. 3

• Leveraging financing: A key role is to leverage financing from other sources, providing comfort to investors on the financial viability of projects. Project structuring by Af. DB: • Af. DB by mandate has appetite for greenfield project finance, and can provide competitively priced long maturity loans, both hard currencies and where possible in local currency. Af. DB leverages its AAA balance sheet. • Af. DB can offer guarantee instruments to mitigate risk. • Africa Financing Partnership is a platform for DFIs active in Africa to work jointly. This allows for timely process to financial closing. 4

• Af. DB offers the A-B Loan structure where it extends the benefit of its Preferred Creditor Status to interested international commercial lenders. • Af. DB nurtures/invests in a portfolio of Private Equity Funds, which in turn can provide much-needed equity to help project developers reach financial closing. • Af. DB encourages local project developers to approach it at early stage. We provide guidance and advice to help along the project preparation as per best standards in project finance. • On a targeted basis there can be grant support, and when feasible financing can be provided to Governments to help with sovereign project/project components. 5

Providing a complete package: • Financing via both Public and Private Sector Windows: This helps achieve synergies between the Government and Private sector in countries and makes the financing of Public Private Partnerships easier. • The Af. DB is able to provide financing for both small and large projects. 6

7

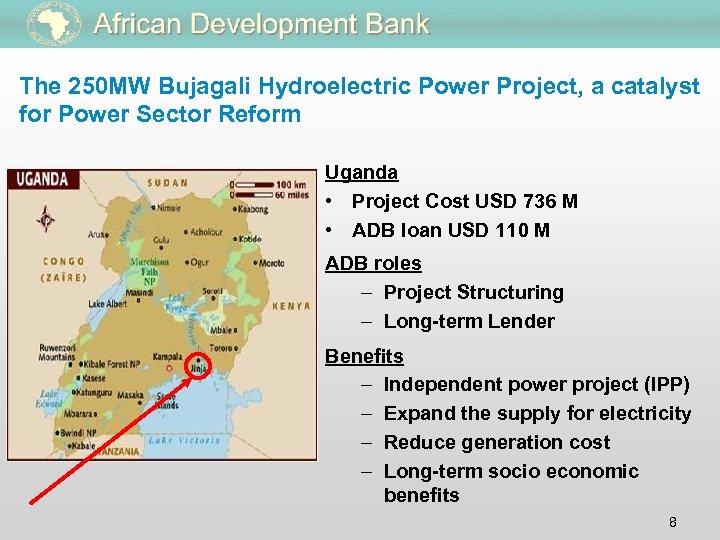

The 250 MW Bujagali Hydroelectric Power Project, a catalyst for Power Sector Reform Uganda • Project Cost USD 736 M • ADB loan USD 110 M ADB roles – Project Structuring – Long-term Lender Benefits – Independent power project (IPP) – Expand the supply for electricity – Reduce generation cost – Long-term socio economic benefits 8

The 15 MW Sahanivotry Small Hydroelectric Power Project, a catalyst for Power Sector in Madagascar Project Cost • Project Cost USD 13 M • ADB loan USD 6 M ADB roles – Project Structuring – Long-term Lender Benefits – Independent power project (IPP) – Expand the supply for electricity – Reduce generation cost – Long-term socio economic benefits 9

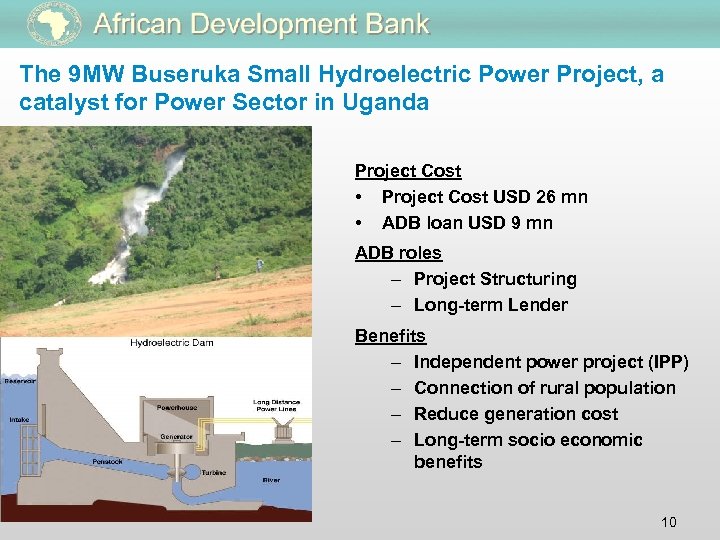

The 9 MW Buseruka Small Hydroelectric Power Project, a catalyst for Power Sector in Uganda Project Cost • Project Cost USD 26 mn • ADB loan USD 9 mn ADB roles – Project Structuring – Long-term Lender Benefits – Independent power project (IPP) – Connection of rural population – Reduce generation cost – Long-term socio economic benefits 10

THANK YOU h. cheikhrouhou@afdb. org 11

Additional slides 12

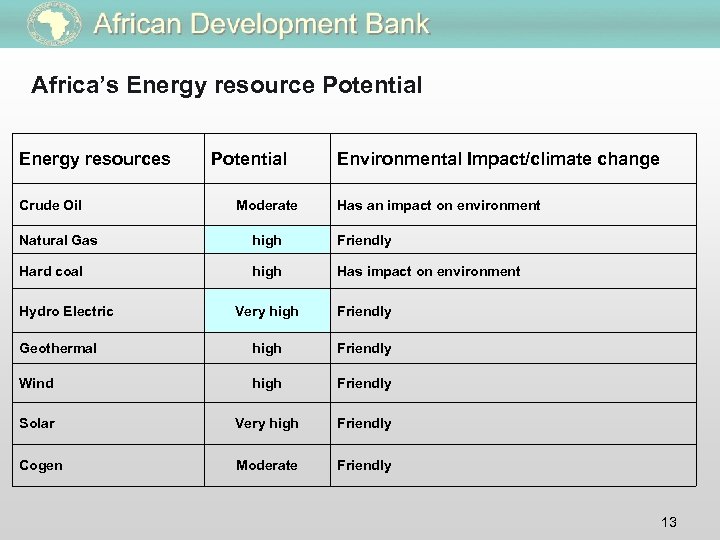

Africa’s Energy resource Potential Energy resources Crude Oil Potential Moderate Environmental Impact/climate change Has an impact on environment Natural Gas high Friendly Hard coal high Has impact on environment Hydro Electric Very high Friendly Geothermal high Friendly Wind high Friendly Solar Very high Friendly Cogen Moderate Friendly 13

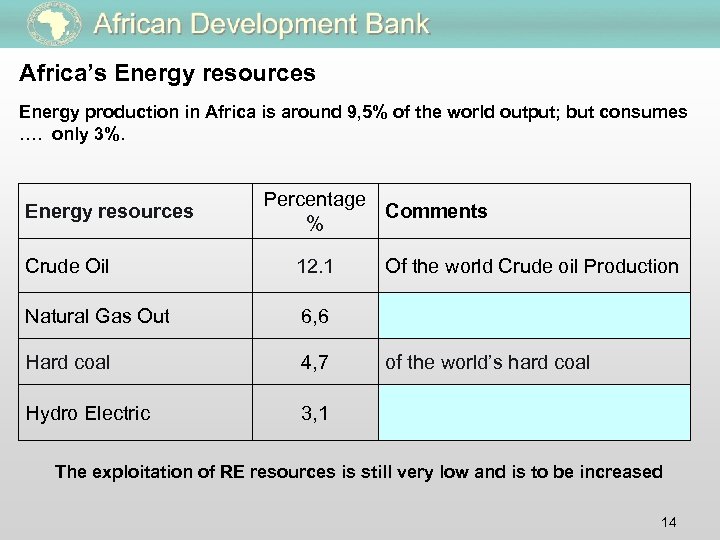

Africa’s Energy resources Energy production in Africa is around 9, 5% of the world output; but consumes …. only 3%. Energy resources Percentage Comments % Crude Oil 12. 1 Natural Gas Out 6, 6 Hard coal 4, 7 Hydro Electric Of the world Crude oil Production 3, 1 of the world’s hard coal The exploitation of RE resources is still very low and is to be increased 14

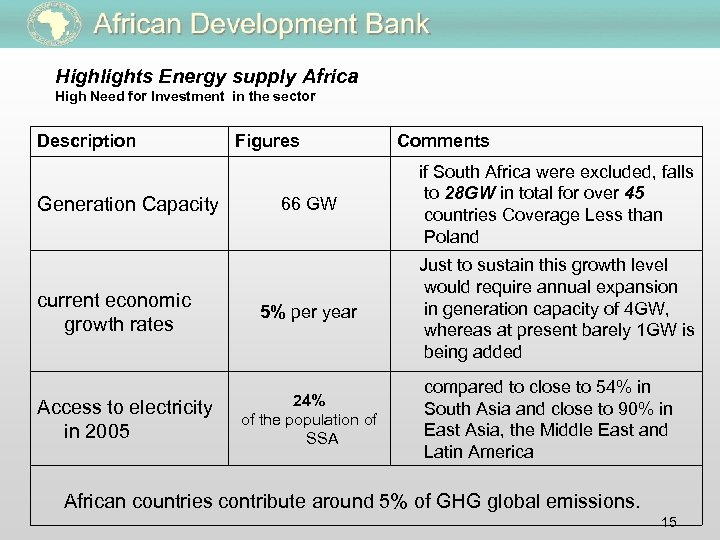

Highlights Energy supply Africa High Need for Investment in the sector Description Figures Comments if South Africa were excluded, falls Generation Capacity 66 GW to 28 GW in total for over 45 countries Coverage Less than Poland Just to sustain this growth level current economic growth rates Access to electricity in 2005 5% per year 24% of the population of SSA would require annual expansion in generation capacity of 4 GW, whereas at present barely 1 GW is being added compared to close to 54% in South Asia and close to 90% in East Asia, the Middle East and Latin America African countries contribute around 5% of GHG global emissions. 15

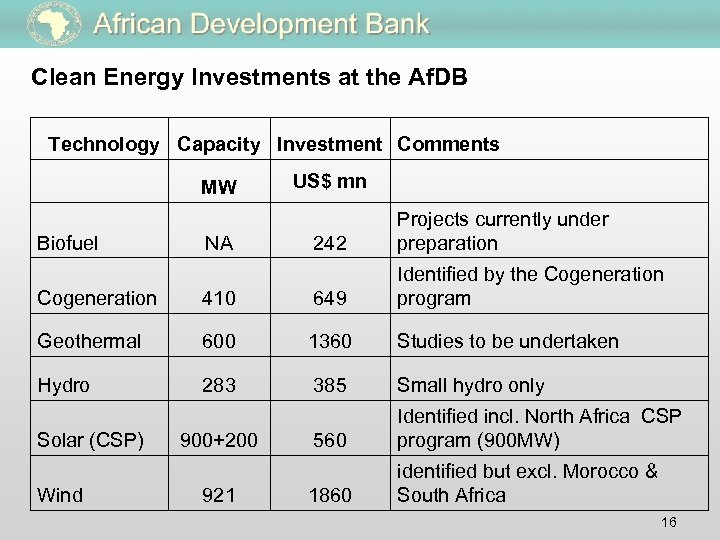

Clean Energy Investments at the Af. DB Technology Capacity Investment Comments MW Biofuel NA US$ mn 242 Projects currently under preparation Cogeneration 410 649 Identified by the Cogeneration program Geothermal 600 1360 Studies to be undertaken Hydro 283 385 Small hydro only 560 Identified incl. North Africa CSP program (900 MW) 1860 identified but excl. Morocco & South Africa Solar (CSP) Wind 900+200 921 16

Way forward Africa needs to continue it investments programs in particular in the Energy sector – with Focus on Clean Investments: q New Credit facility put in place by the Af. DB q Assistance to Low Income Countries (LIC) with concessional resources q Support Private Sector investments in Africa q Technical assistance to RMC to increase their clean investment 17

In Summary • Opportunity for lucrative investment in Africa expanding rapidly. • Investment climate improving, but remains challenging with region and sector specific knowledge critical. • The Infrastructure Finance Team is a partner that provides the key expertise required to assist investors/project sponsors achieve business success in Africa whilst harnessing sustainable development. 18

966863cbb0129ff7629939f3d5bd3f86.ppt