881210c37ebb6892fb016668386605f5.ppt

- Количество слайдов: 18

African Economic Conference 2013 28 -30 October Johannesburg, South Africa Quantifying illicit financial flows from Africa through trade mis-pricing and assessing their incidence on African economies Simon Mevel, Siope Ofa & Stephen Karingi / RITD / UN-ECA

Outline of the Presentation I. Illicit financial flows (IFF): definition and channels II. Quantifying IFF through trade mis-pricing in Africa: Methodology & Results III. Reinvesting lost IFF into African economies: Methodology & Results IV. Implications of IFF for regional integration in Africa V. Policy Recommendations

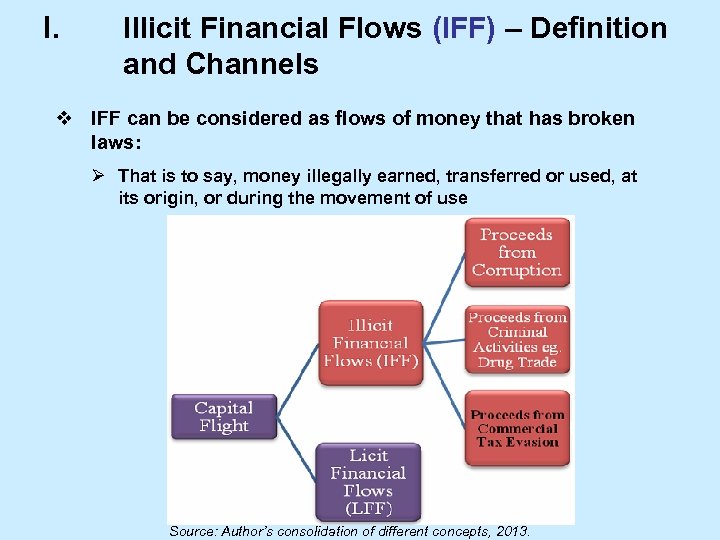

I. Illicit Financial Flows (IFF) – Definition and Channels v IFF can be considered as flows of money that has broken laws: Ø That is to say, money illegally earned, transferred or used, at its origin, or during the movement of use Source: Author’s consolidation of different concepts, 2013.

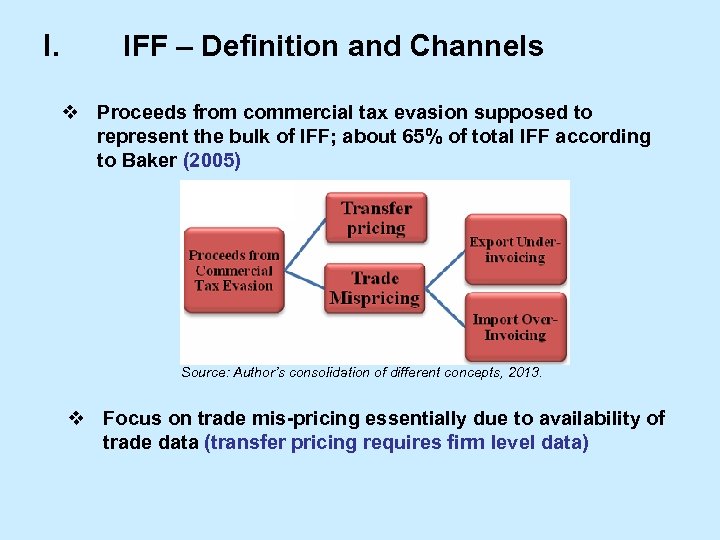

I. IFF – Definition and Channels v Proceeds from commercial tax evasion supposed to represent the bulk of IFF; about 65% of total IFF according to Baker (2005) Source: Author’s consolidation of different concepts, 2013. v Focus on trade mis-pricing essentially due to availability of trade data (transfer pricing requires firm level data)

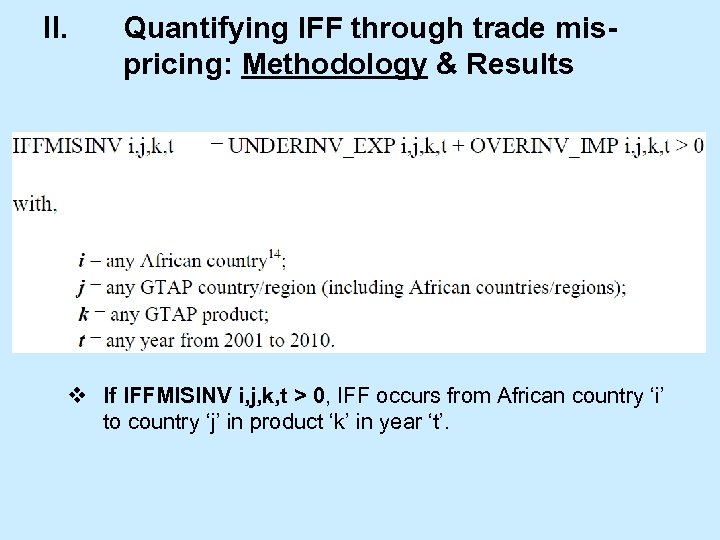

II. Quantifying IFF through trade mispricing: Methodology & Results v If IFFMISINV i, j, k, t > 0, IFF occurs from African country ‘i’ to country ‘j’ in product ‘k’ in year ‘t’.

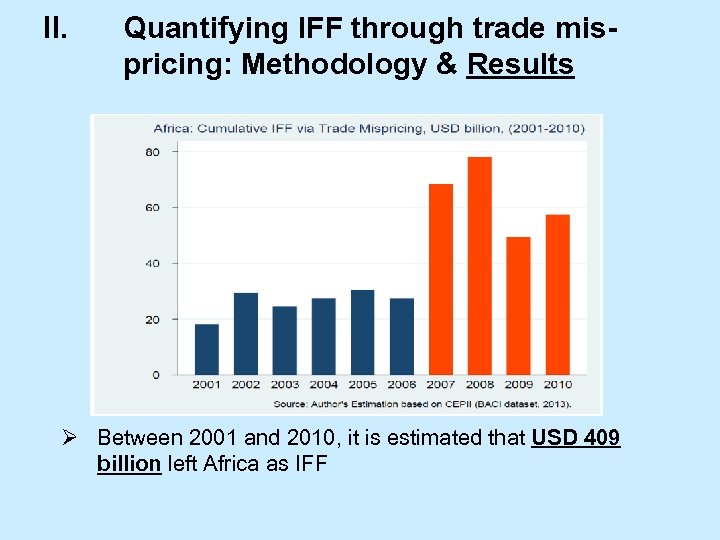

II. Quantifying IFF through trade mispricing: Methodology & Results Ø Between 2001 and 2010, it is estimated that USD 409 billion left Africa as IFF

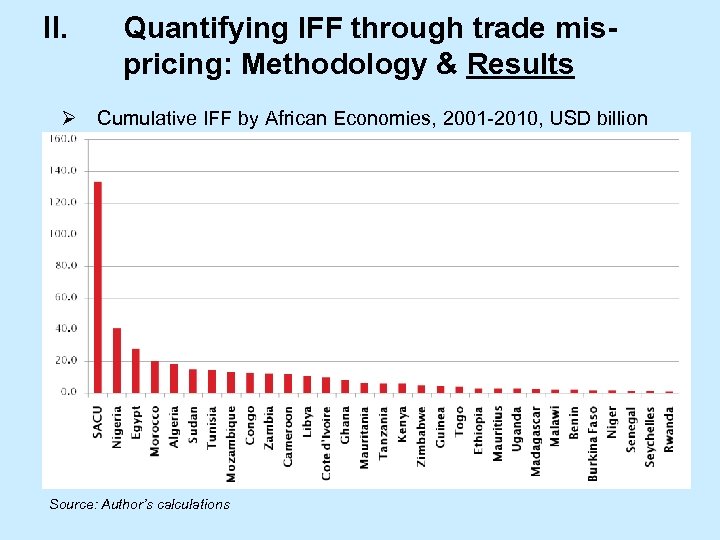

II. Quantifying IFF through trade mispricing: Methodology & Results Ø Cumulative IFF by African Economies, 2001 -2010, USD billion Source: Author’s calculations

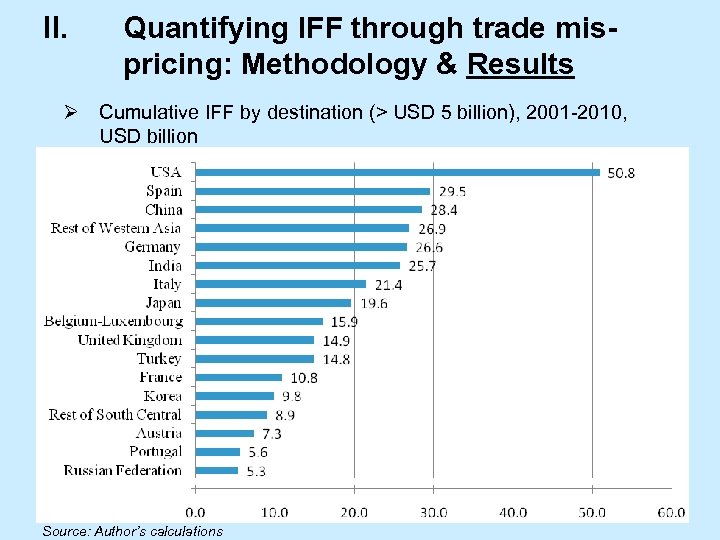

II. Quantifying IFF through trade mispricing: Methodology & Results Ø Cumulative IFF by destination (> USD 5 billion), 2001 -2010, USD billion Source: Author’s calculations

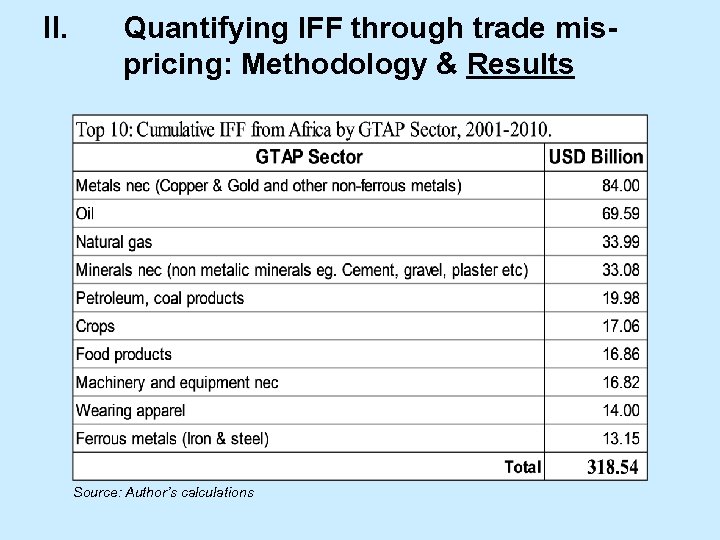

II. Quantifying IFF through trade mispricing: Methodology & Results Source: Author’s calculations

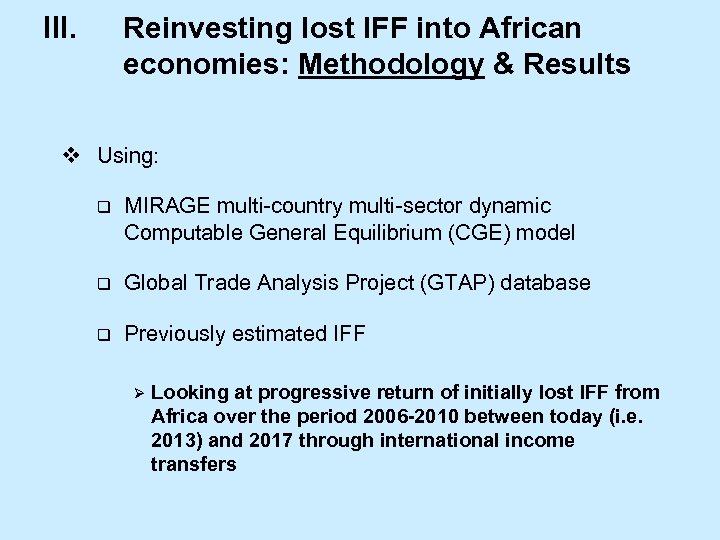

III. Reinvesting lost IFF into African economies: Methodology & Results v Using: q MIRAGE multi-country multi-sector dynamic Computable General Equilibrium (CGE) model q Global Trade Analysis Project (GTAP) database q Previously estimated IFF Ø Looking at progressive return of initially lost IFF from Africa over the period 2006 -2010 between today (i. e. 2013) and 2017 through international income transfers

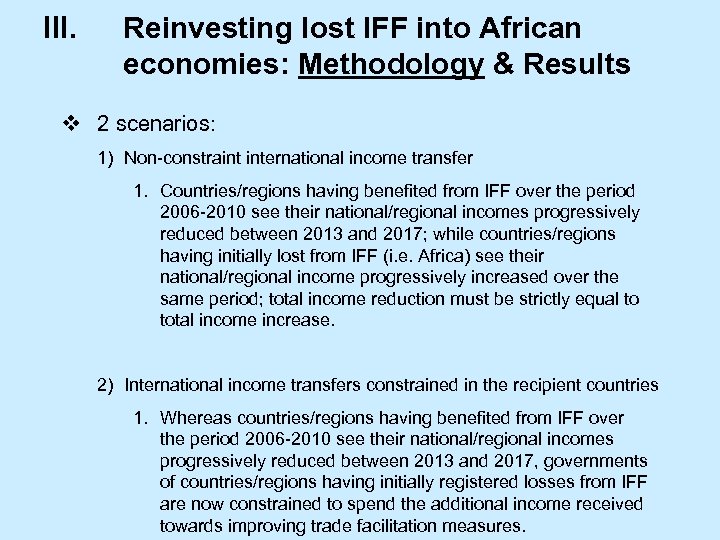

III. Reinvesting lost IFF into African economies: Methodology & Results v 2 scenarios: 1) Non-constraint international income transfer 1. Countries/regions having benefited from IFF over the period 2006 -2010 see their national/regional incomes progressively reduced between 2013 and 2017; while countries/regions having initially lost from IFF (i. e. Africa) see their national/regional income progressively increased over the same period; total income reduction must be strictly equal to total income increase. 2) International income transfers constrained in the recipient countries 1. Whereas countries/regions having benefited from IFF over the period 2006 -2010 see their national/regional incomes progressively reduced between 2013 and 2017, governments of countries/regions having initially registered losses from IFF are now constrained to spend the additional income received towards improving trade facilitation measures.

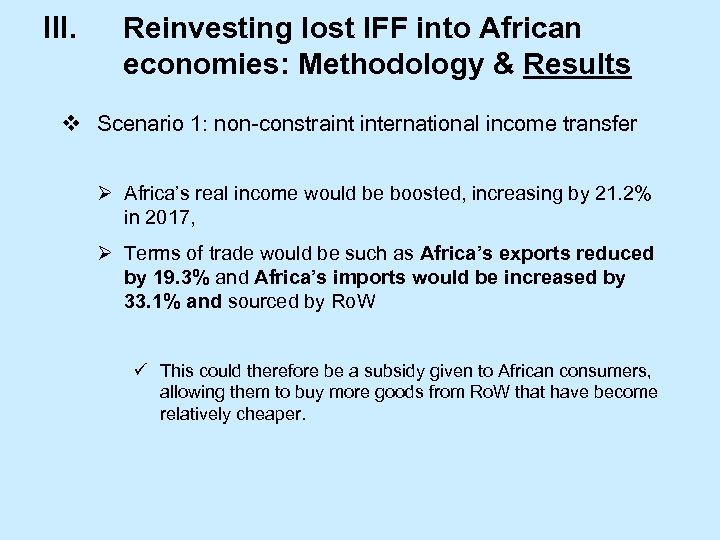

III. Reinvesting lost IFF into African economies: Methodology & Results v Scenario 1: non-constraint international income transfer Ø Africa’s real income would be boosted, increasing by 21. 2% in 2017, Ø Terms of trade would be such as Africa’s exports reduced by 19. 3% and Africa’s imports would be increased by 33. 1% and sourced by Ro. W ü This could therefore be a subsidy given to African consumers, allowing them to buy more goods from Ro. W that have become relatively cheaper.

III. Reinvesting lost IFF into African economies: Methodology & Results v Scenario 2: constraint international income transfer Ø Real income would increase in all countries and overall for Africa by 2. 7% Ø Africa’s exports and imports would increase considerably (17. 7%) and (17. 9%) respectively Ø Africa’s exports would be stimulated the most towards Africa (i. e. increased in intra-African trade)

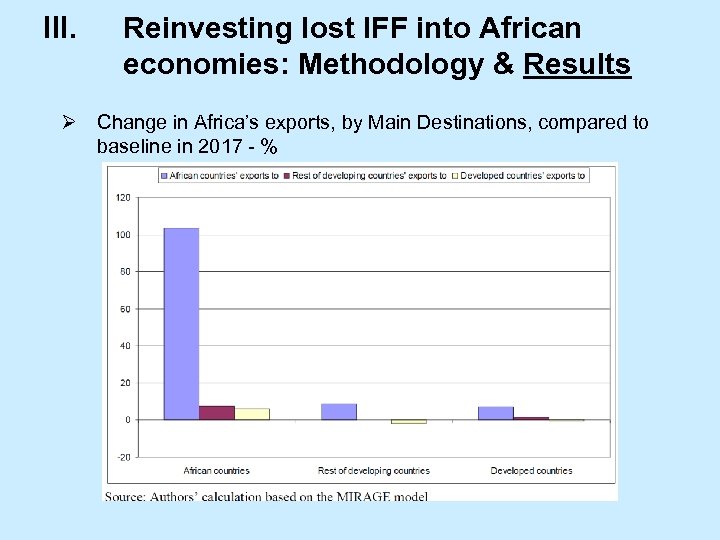

III. Reinvesting lost IFF into African economies: Methodology & Results Ø Change in Africa’s exports, by Main Destinations, compared to baseline in 2017 - %

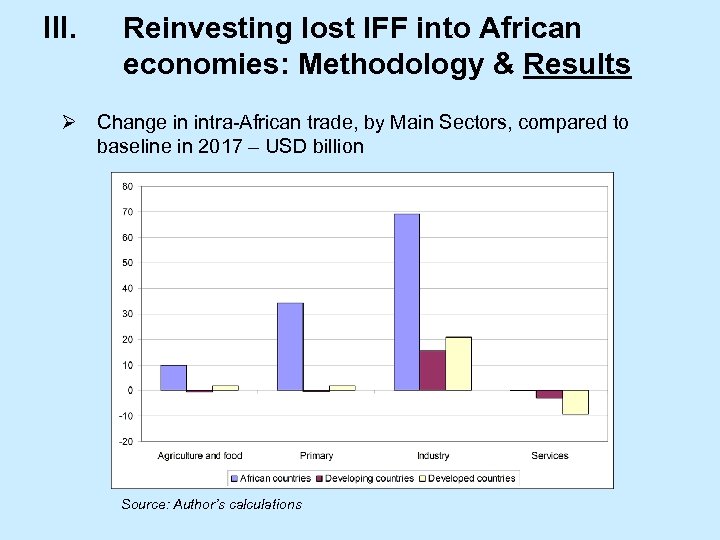

III. Reinvesting lost IFF into African economies: Methodology & Results Ø Change in intra-African trade, by Main Sectors, compared to baseline in 2017 – USD billion Source: Author’s calculations

IV. Implications for regional integration in Africa v IFF losses from the African continent are considerable (estimated at USD 409 billion between 2001 -2010) Ø Greater than Africa’s external debt Ø Greater than all ODA received by the continent Ø Greater than all FDI to Africa v While costly reforms are required to make the regional integration process more effective: Ø Trade facilitation measures show great potential to boost intra-African trade and its industrialization Ø 51 priority projects from PIDA (2012 -2020) cost about USD 70 billion

V. Policy recommendations v Although reinvesting previously lost IFF (if spent properly) into African economies can positively impact continental trade and income, what is lost cannot be fully recovered Ø It is critical to curb IFF in the first place as it could be better used for developmental purposes (domestic resource mobilisation) v Adoption of transparent and effective regulatory policy on extractive industries agreements between Governments and MNCs v Regulating the behaviours of MNCs is crucial, particularly taxation and investment policies, ensuring that MNCs adheres to such rules

Thank you!

881210c37ebb6892fb016668386605f5.ppt