04c91b8ba626c7c1fd03ab05a51c34eb.ppt

- Количество слайдов: 48

African Development Bank Financial and Operational Analysis 2005 May

Highlights 2000 to 2004 l Commission for Africa established and UN Millennium Project launched l The tenth replenishment of the African Development Fund (ADF) was the highest ever l Launched US$ 14. 2 billion Rural Water Supply and Sanitation Initiative to accelerate access to safe water for Africa l Post conflict country facility (PCCF) established l Reaffirmation of ‘AAA’ credit ratings by Fitch, JCR, Moody’s and Standard & Poor’s l Highest level of operations and income as well as lowest cost of funds ever achieved in the capital markets 2003 l African Ministers Council on Water (AMCOW) appoints Bank Group as host of the African Water Facility l Successful execution of business continuity plan and smooth relocation to back up facilities l Nigeria creates a Technical Co-operation Fund to promote intra-Africa technical cooperation l Upgrade by Standard & Poor's to 'AAA' l The largest bond transaction by the Bank - USD 1 billion global 2002 l Monterrey Consensus on Financing for Development l Ninth replenishment of the ADF l New organization structure and Strategic Plan 2003 -2007 to enhance selectivity and responsiveness l Initiated the establishment of the African Law Institute l Championed a donor coordinated initiative to clear arrears owed by Democratic Republic Congo, the bulk of arrears owed to the Bank Group l International Financing Review's (IFR) Agency/Supranational Bond of the Year Award received for first global bond (US$ 500 million) 2001 l New Partnership for Africa's Development (NEPAD) launched by African Heads of State l NEPAD appoints the Bank Group as leader on infrastructure, banking and financial standards l First Bank Group Annual meeting outside Africa - Valencia, Spain l International Accounting Standard (IAS) 39 adopted by the Bank l Unlimited Global Debt Issuance Facility set up to enhance flexibility with respect to capital markets activities l First Hong Kong dollar and Singapore dollar bond transactions by the Bank 2000 l Millennium Development Goals adopted l Creation of the African Union l Omar Kabbaj re-elected as President of the Bank Group l New financial products, including guarantees and risk management products, approved l First guarantee transaction executed (a local currency syndicated loan to MTN-Cameroon) l JPY 50 billion bond transaction by the Bank 2

Highlights 1995 to 1999 l Enhanced Highly Indebted Poor Country Initiative (HIPC) implemented l Established Joint Africa Institute with World Bank and IMF l Developed Bank Group's Vision Statement through broad consultations with all stakeholders l Eight replenishment of ADF l One billion Euro-commercial Paper facility established 1998 l Fifth General Capital Increase raised authorized capital by 35 % to US$ 34 billion l Project AFRICA, a bankwide initiative to streamline business processes using SAP as platform l First Rand denominated line of credit to Development Bank of South Africa l First Rand denominated bond issue 1997 l Uganda becomes the first country to qualify for HIPC l New loan products offering clients interest rate and currency choice l South African Rand introduced as a borrowing and lending currency l First Yen structured private placement bond transaction issued by the Bank 1996 l HIPC Initiative approved l African Heads of State meet to deliberate on the future of the Bank Group l Seventh replenishment of ADF l Financial reforms initiated l FRF 2 billion bond transaction by the Bank 1995 l New Credit Policy adopted l Accession of Republic of South Africa to Bank membership l Omar Kabbaj elected as President of the Bank Group l Strategic renewal and Institutional reforms initiated l ‘AAA’ credit ratings by Fitch, JCR, Moody’s, AA+ by Standard & Poor’s l US$ 400 million subordinated debt issued in Yankee market 3

Table of Contents I. Bank Group Profile (1995 – 2004) II. Bank Group Action Plan for the Future III. ADB Financial Profile Appendices n ADB Financial Statements n Africa at a Glance 4

I. Bank Group Profile (1995 – 2004)

The Bank Group embodies an effective partnership for the development of Africa Europe Africa Algeria Angola Benin Botswana Burkina Faso Burundi Cameroon Cape Verde Central African Rep. Chad Comoros Congo Cote d’Ivoire D. R. Congo Djibouti Egypt Equatorial Guinea Eritrea Ethiopia Gabon Gambia Ghana Guinea Bissau Kenya Lesotho Liberia Libya Madagascar Malawi Mali Mauritania Mauritius Morocco Mozambique Namibia Nigeria Rwanda S. Tome & Principe Senegal Seychelles Sierra Leone Somalia South Africa Sudan Swaziland Tanzania Togo Tunisia Uganda Zambia Zimbabwe n African Development Bank (ADB) – Established in 1964 – Subscribed capital - US$ 33. 54 billion Austria Belgium Denmark Finland France Germany Italy Netherlands Norway Portugal Spain Sweden Switzerland UK – 53 African and 24 non-African countries n African Development Fund (ADF) – Established in 1972 North & South America Argentina Brazil Canada USA – Subscriptions - US$ 19. 98 billion – Primarily financed by non-African countries n Nigeria Trust Fund (NTF) – Established by Nigeria in 1976 – Total assets of US$ 572 million Middle East Kuwait Saudi Arabia Asia China Korea India Japan 6

Through its three constituent windows, the Bank Group addresses the diverse needs of African countries n African Development Bank – Up to 20 years maturity including 5 -year grace period – Market-based lending terms n African Development Fund – Up to 50 years maturity including 10 -year grace period – Service charge of 75 bp and commitment fee of 50 bp starting 120 days after signature – Grants represent 44% of ADF-X resources g Eligible to ADB funding (13 countries) g Eligible to ADF funding (38 countries) g Eligible to ADB and ADF funding (2 countries) n Nigeria Trust Fund – All African countries are eligible to NTF funding – Up to 25 years maturity including 5 -year grace period – Interest rate of 2% to 4% and commitment fee of 75 bp 7 starting 120 days after signature

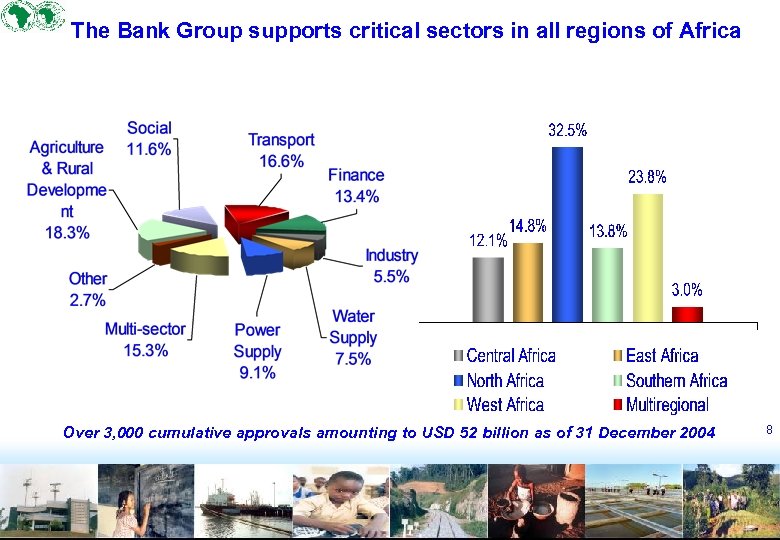

The Bank Group supports critical sectors in all regions of Africa Over 3, 000 cumulative approvals amounting to USD 52 billion as of 31 December 2004 8

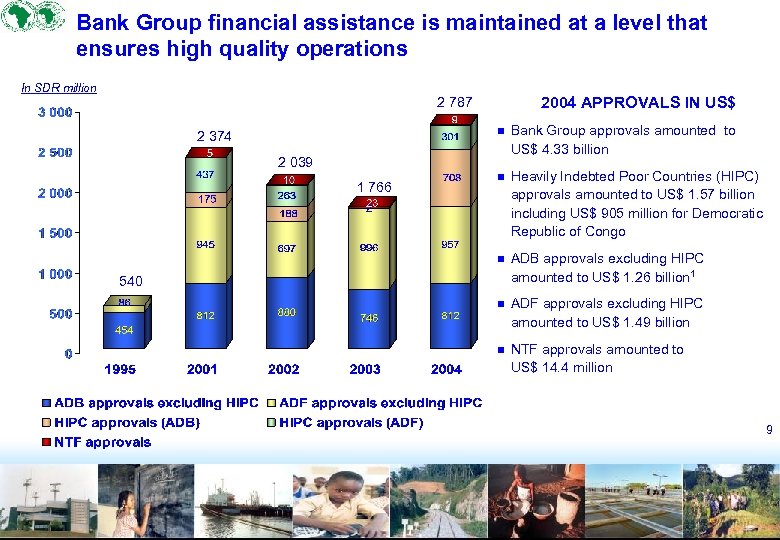

Bank Group financial assistance is maintained at a level that ensures high quality operations In SDR million 2004 APPROVALS IN US$ 2 787 n Bank Group approvals amounted to US$ 4. 33 billion n Heavily Indebted Poor Countries (HIPC) approvals amounted to US$ 1. 57 billion including US$ 905 million for Democratic Republic of Congo n 2 374 ADB approvals excluding HIPC amounted to US$ 1. 26 billion 1 n ADF approvals excluding HIPC amounted to US$ 1. 49 billion n NTF approvals amounted to US$ 14. 4 million 2 039 1 766 540 9

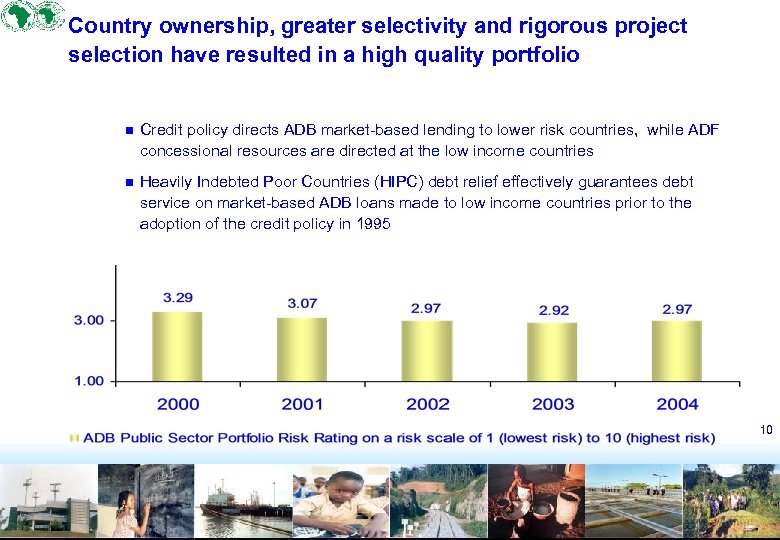

Country ownership, greater selectivity and rigorous project selection have resulted in a high quality portfolio n Credit policy directs ADB market-based lending to lower risk countries, while ADF concessional resources are directed at the low income countries n Heavily Indebted Poor Countries (HIPC) debt relief effectively guarantees debt service on market-based ADB loans made to low income countries prior to the adoption of the credit policy in 1995 10

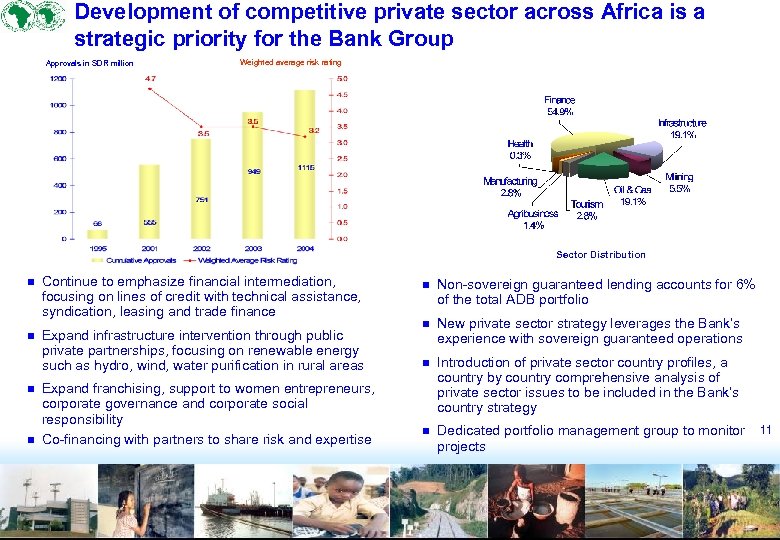

Development of competitive private sector across Africa is a strategic priority for the Bank Group Approvals in SDR million Weighted average risk rating Sector Distribution n Continue to emphasize financial intermediation, focusing on lines of credit with technical assistance, syndication, leasing and trade finance n Expand infrastructure intervention through public private partnerships, focusing on renewable energy such as hydro, wind, water purification in rural areas n n Expand franchising, support to women entrepreneurs, corporate governance and corporate social responsibility Co-financing with partners to share risk and expertise n Non-sovereign guaranteed lending accounts for 6% of the total ADB portfolio n New private sector strategy leverages the Bank’s experience with sovereign guaranteed operations n Introduction of private sector country profiles, a country by country comprehensive analysis of private sector issues to be included in the Bank’s country strategy n Dedicated portfolio management group to monitor projects 11

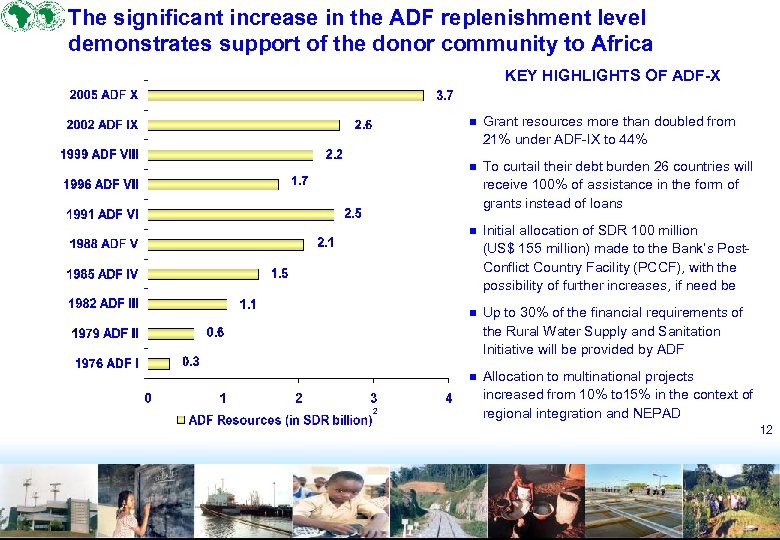

The significant increase in the ADF replenishment level demonstrates support of the donor community to Africa KEY HIGHLIGHTS OF ADF-X n n To curtail their debt burden 26 countries will receive 100% of assistance in the form of grants instead of loans n Initial allocation of SDR 100 million (US$ 155 million) made to the Bank’s Post. Conflict Country Facility (PCCF), with the possibility of further increases, if need be n Up to 30% of the financial requirements of the Rural Water Supply and Sanitation Initiative will be provided by ADF n 2 Grant resources more than doubled from 21% under ADF-IX to 44% Allocation to multinational projects increased from 10% to 15% in the context of regional integration and NEPAD 12

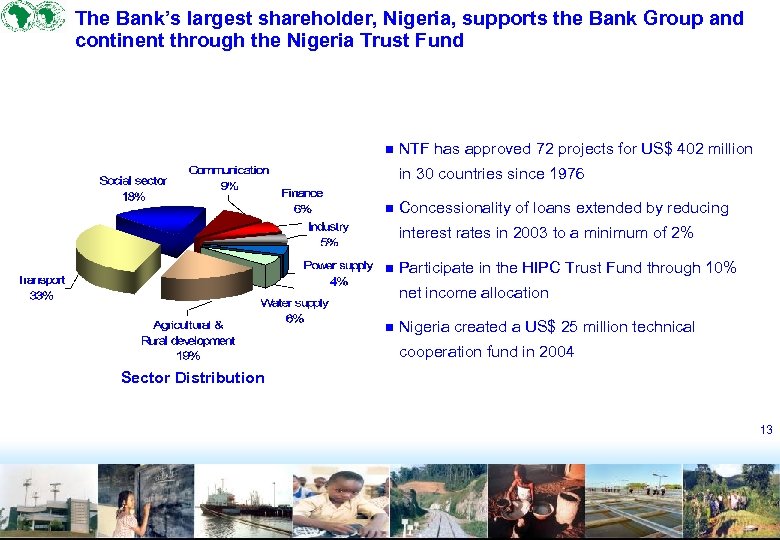

The Bank’s largest shareholder, Nigeria, supports the Bank Group and continent through the Nigeria Trust Fund n NTF has approved 72 projects for US$ 402 million in 30 countries since 1976 n Concessionality of loans extended by reducing interest rates in 2003 to a minimum of 2% n Participate in the HIPC Trust Fund through 10% net income allocation n Nigeria created a US$ 25 million technical cooperation fund in 2004 Sector Distribution 13

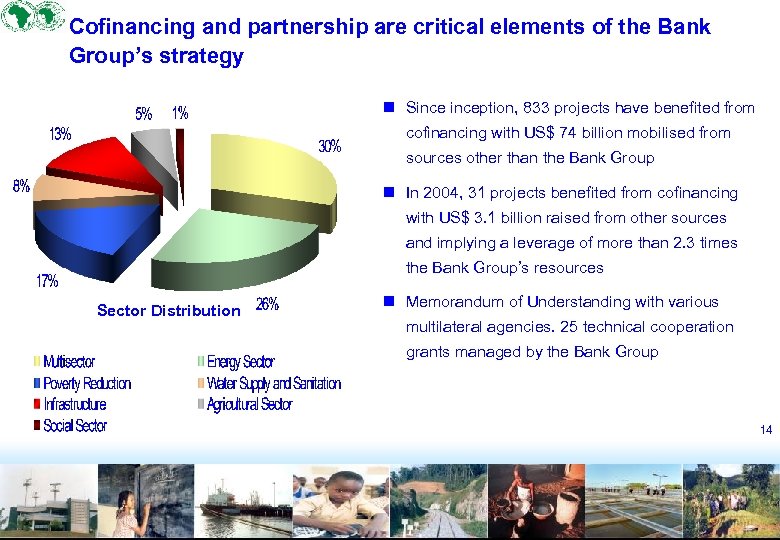

Cofinancing and partnership are critical elements of the Bank Group’s strategy n Sinception, 833 projects have benefited from cofinancing with US$ 74 billion mobilised from sources other than the Bank Group n In 2004, 31 projects benefited from cofinancing with US$ 3. 1 billion raised from other sources and implying a leverage of more than 2. 3 times the Bank Group’s resources Sector Distribution n Memorandum of Understanding with various multilateral agencies. 25 technical cooperation grants managed by the Bank Group 14

The Bank Group champions critical initiatives for the continent HIPC Initiative International Comparison Program Rural Water Supply and Sanitation Initiative Post-Conflict Country Facility African peer review mechanism African Water Facility Governance 15

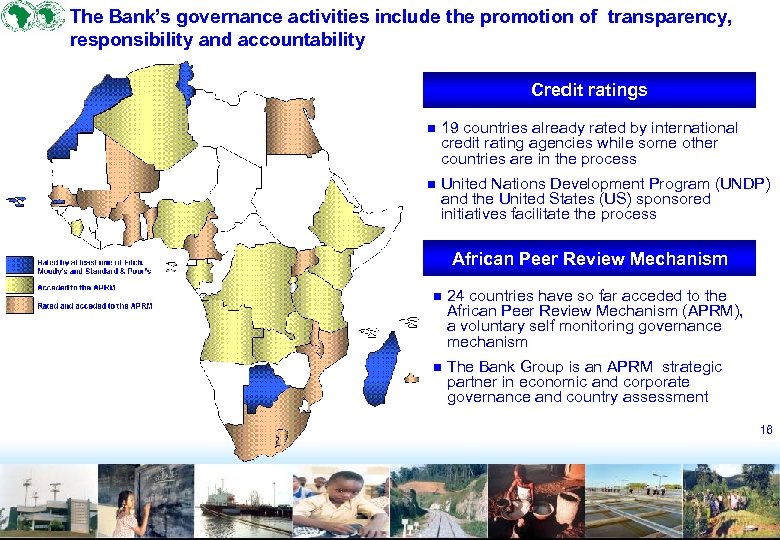

The Bank’s governance activities include the promotion of transparency, responsibility and accountability Credit ratings n 19 countries already rated by international credit rating agencies while some other countries are in the process n United Nations Development Program (UNDP) and the United States (US) sponsored initiatives facilitate the process African Peer Review Mechanism n 24 countries have so far acceded to the African Peer Review Mechanism (APRM), a voluntary self monitoring governance mechanism n The Bank Group is an APRM strategic partner in economic and corporate governance and country assessment 16

II. Bank Group Action Plan for the Future

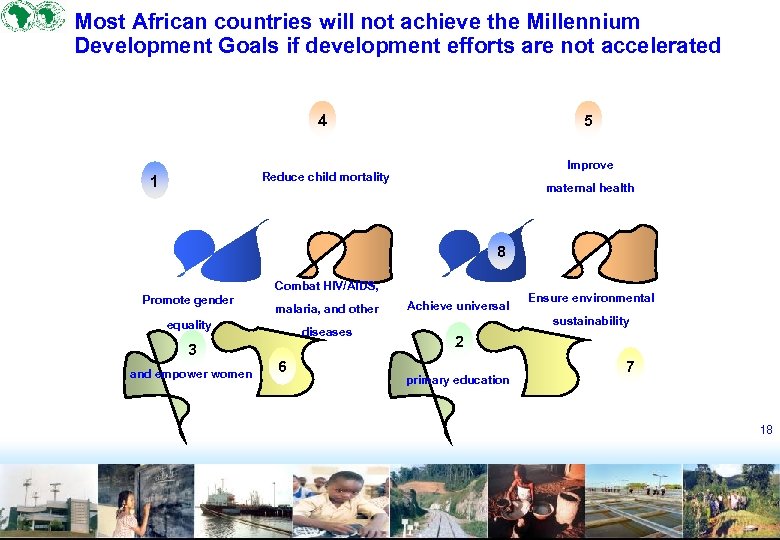

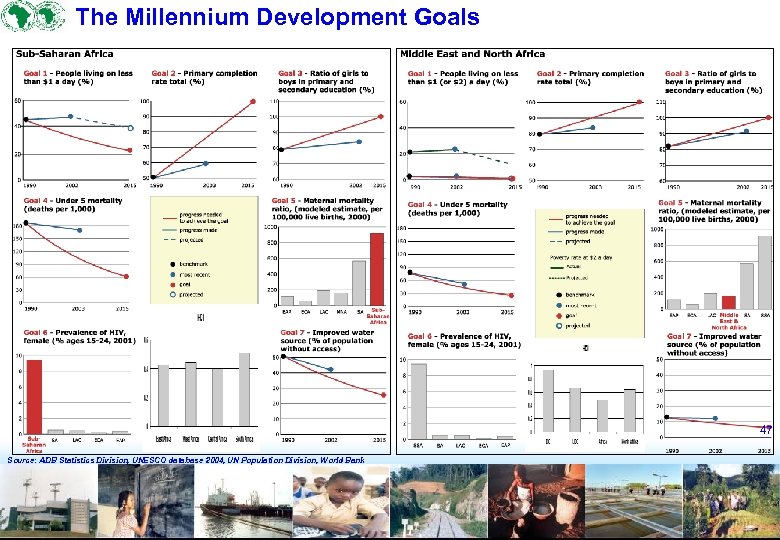

Most African countries will not achieve the Millennium Development Goals if development efforts are not accelerated 4 5 Improve Reduce child mortality 1 Eradicate extreme poverty and hunger maternal health A global partnership for development 8 Combat HIV/AIDS, Promote gender malaria, and other equality 3 and empower women diseases 6 Achieve universal Ensure environmental sustainability 2 primary education 7 18

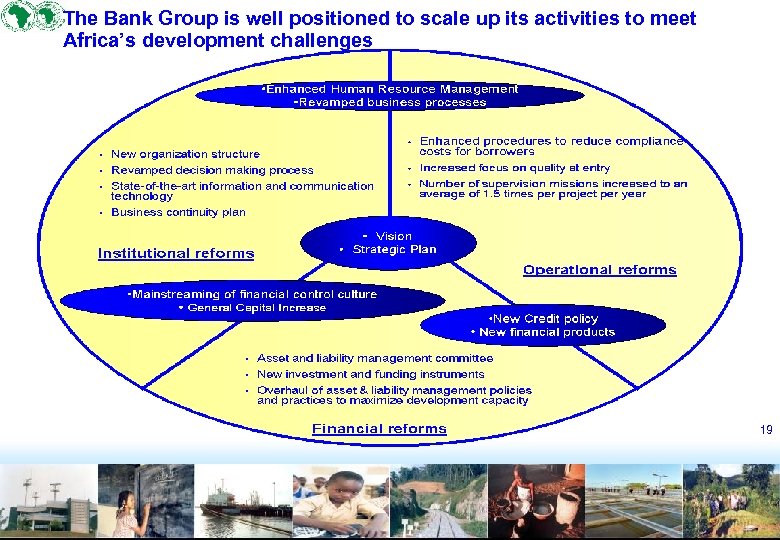

The Bank Group is well positioned to scale up its activities to meet Africa’s development challenges 19

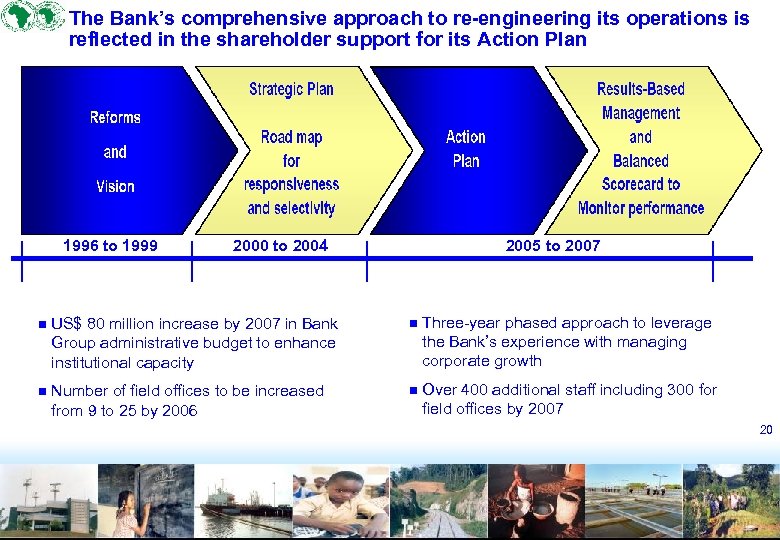

The Bank’s comprehensive approach to re-engineering its operations is reflected in the shareholder support for its Action Plan 1996 to 1999 2000 to 2004 2005 to 2007 n US$ 80 million increase by 2007 in Bank Group administrative budget to enhance institutional capacity n Three-year phased approach to leverage the Bank’s experience with managing corporate growth n Number of field offices to be increased from 9 to 25 by 2006 n Over 400 additional staff including 300 for field offices by 2007 20

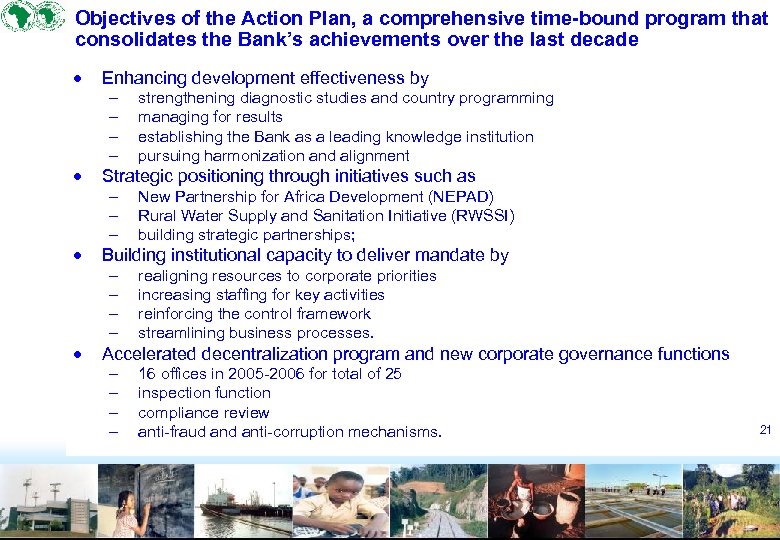

Objectives of the Action Plan, a comprehensive time-bound program that consolidates the Bank’s achievements over the last decade · · Enhancing development effectiveness by - strengthening diagnostic studies and country programming managing for results establishing the Bank as a leading knowledge institution pursuing harmonization and alignment Strategic positioning through initiatives such as - New Partnership for Africa Development (NEPAD) Rural Water Supply and Sanitation Initiative (RWSSI) building strategic partnerships; Building institutional capacity to deliver mandate by - realigning resources to corporate priorities increasing staffing for key activities reinforcing the control framework streamlining business processes. Accelerated decentralization program and new corporate governance functions - 16 offices in 2005 -2006 for total of 25 inspection function compliance review anti-fraud anti-corruption mechanisms. 21

III. ADB Financial Profile

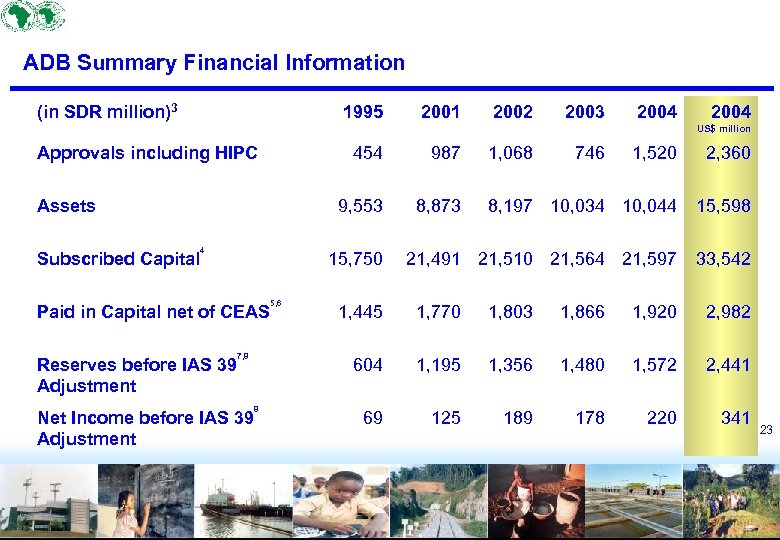

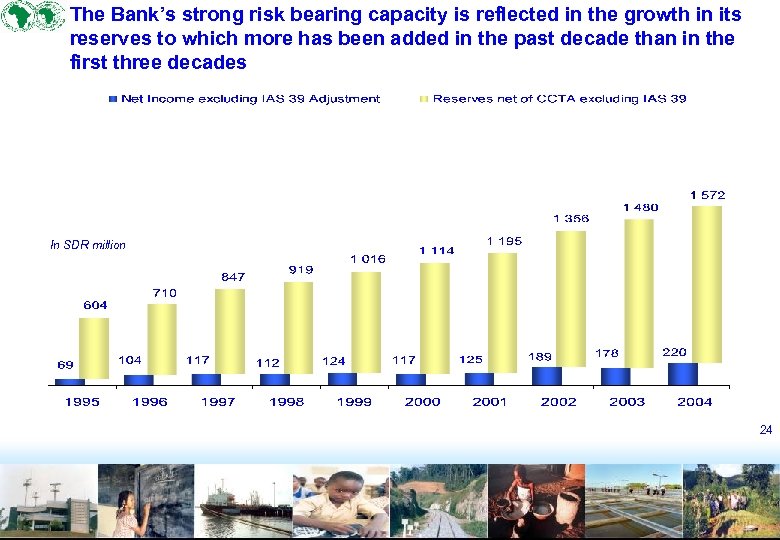

ADB Summary Financial Information (in SDR million)3 1995 2001 2002 2003 2004 US$ million Approvals including HIPC 454 9, 553 Assets Subscribed Capital 4 8, 873 15, 750 Paid in Capital net of CEAS Reserves before IAS 39 Adjustment 987 746 1, 520 2, 360 8, 197 10, 034 10, 044 15, 598 21, 491 21, 510 21, 564 21, 597 33, 542 8 1, 445 1, 770 1, 803 1, 866 1, 920 2, 982 604 7, 8 Net Income before IAS 39 Adjustment 5, 6 1, 068 1, 195 1, 356 1, 480 1, 572 2, 441 69 125 189 178 220 341 23

The Bank’s strong risk bearing capacity is reflected in the growth in its reserves to which more has been added in the past decade than in the first three decades In SDR million 24

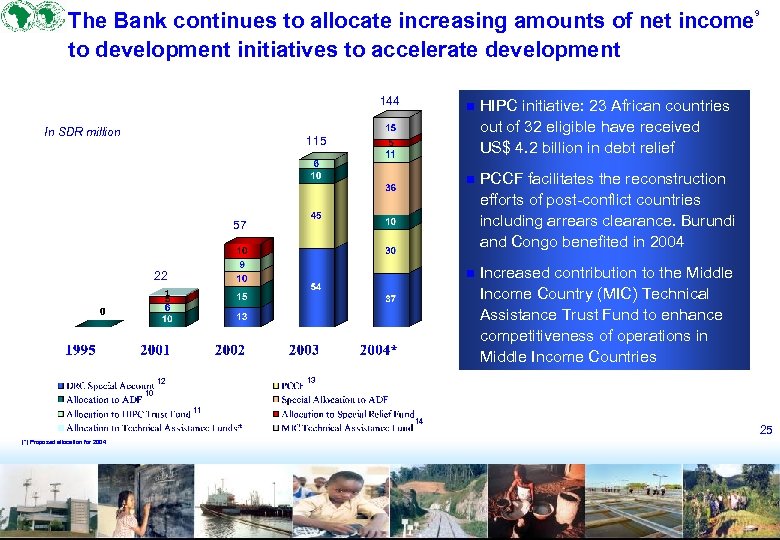

The Bank continues to allocate increasing amounts of net income to development initiatives to accelerate development 144 HIPC initiative: 23 African countries out of 32 eligible have received US$ 4. 2 billion in debt relief n PCCF facilitates the reconstruction efforts of post-conflict countries including arrears clearance. Burundi and Congo benefited in 2004 n In SDR million n Increased contribution to the Middle Income Country (MIC) Technical Assistance Trust Fund to enhance competitiveness of operations in Middle Income Countries 115 57 22 9 13 12 10 11 14 (*) Proposed allocation for 2004 25

Strong shareholder support underscores the Bank’s strong financial and operational condition In SDR million 21166 21178 21249 21294 n The Fifth General Capital increase in 1998 raised authorized capital base by 35% to US$ 34 billion 15746 n Shareholding of non-regional countries increased form one-third to 40% n Revised share transfer rules link subscription to economic capacity of 1998 member countries and curtail subscription arrears. 2, 021 763 1, 373 4, 999 3, 508 3, 059 3, 767 4, 151 26

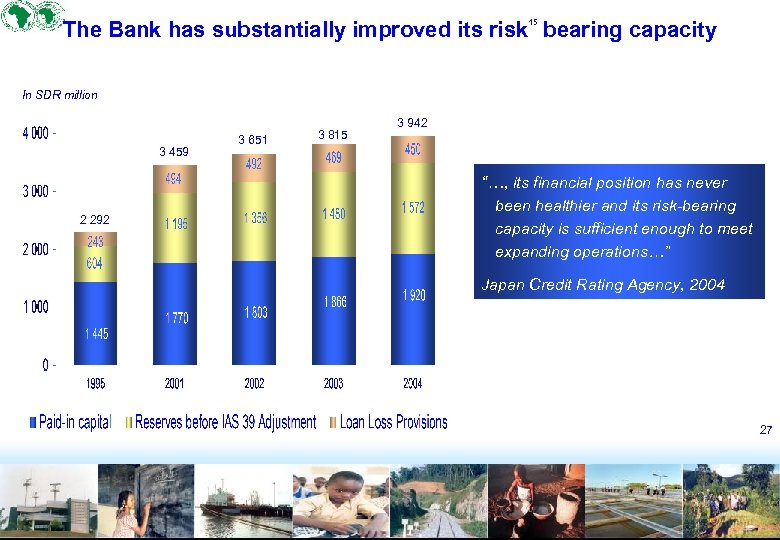

The Bank has substantially improved its risk bearing capacity 15 In SDR million 3 459 3 651 3 815 3 942 “…, its financial position has never 2 292 been healthier and its risk-bearing capacity is sufficient enough to meet expanding operations…” Japan Credit Rating Agency, 2004 27

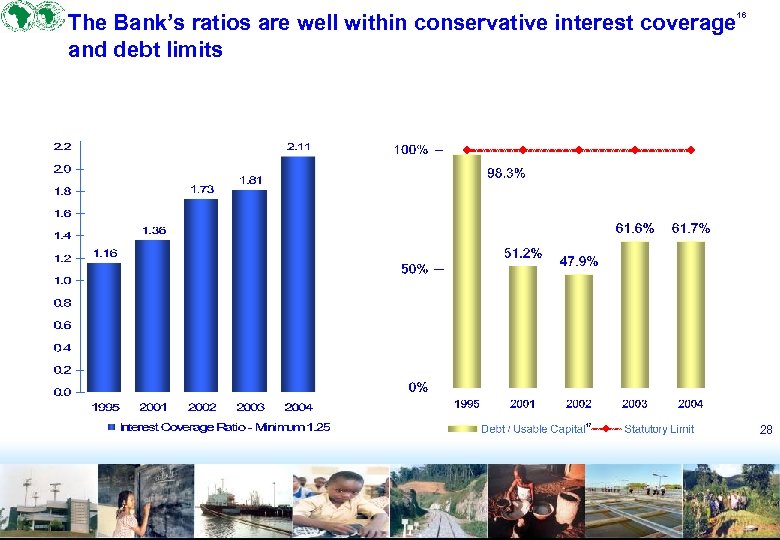

The Bank’s ratios are well within conservative interest coverage and debt limits 17 16 28

Bank wide financial controls and risk management culture lead to effective mitigation of non-core risks Loan management practices Capital adequacy and provisioning policy 18 n Strict sanctions practices including suspension n of loan disbursements to clients in arrears for at least 30 days ADB capital adequacy policy is derived from the Basle Capital Accord and links its capital requirements to the risk profile of the portfolio n No write-off on public sector loans ADB ensures that adequate provisions are made for impaired loans n Market risk Operational risks n Liquidity risk addressed by holding sufficient liquid assets to meet future cash requirements for at least one year n Operational risks are addressed by periodic review of internal controls and back-up procedures n Interest rate risk management strategy stabilizes the Bank’s net interest margin n Detailed and tested business continuity plan n COSO control framework under implementation n Statutory prohibition on taking foreign exchange risk 29

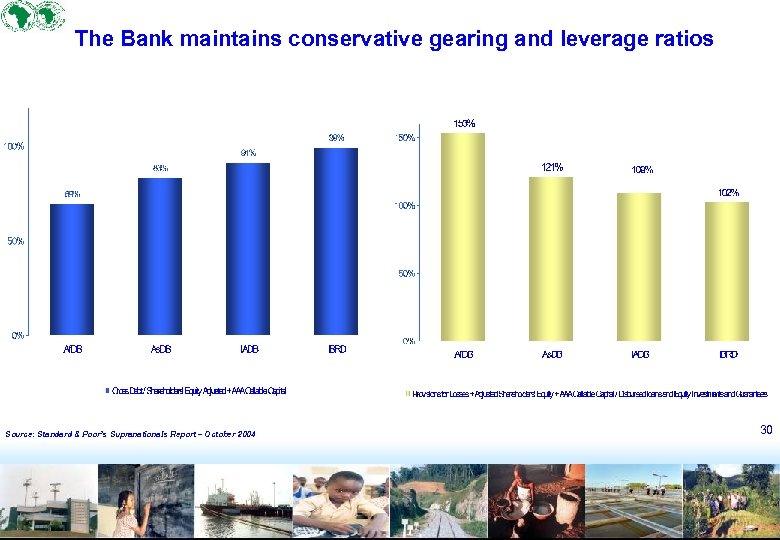

The Bank maintains conservative gearing and leverage ratios Source: Standard & Poor’s Supranationals Report – October 2004 30

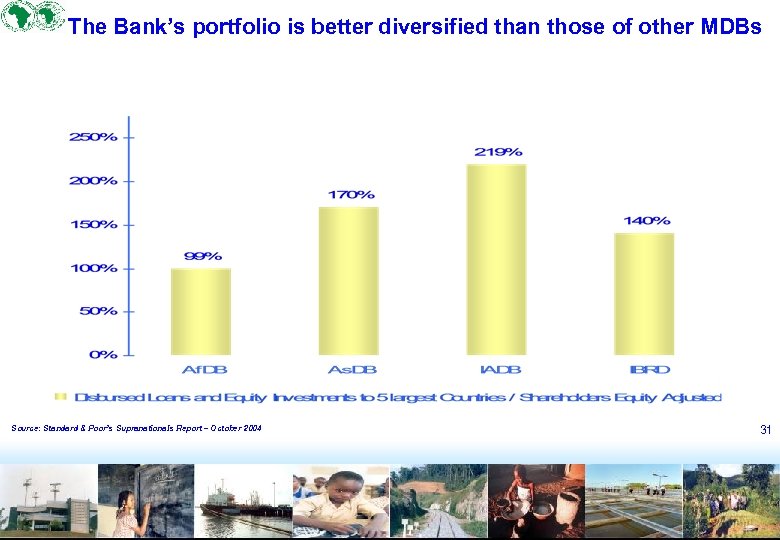

The Bank’s portfolio is better diversified than those of other MDBs Source: Standard & Poor’s Supranationals Report – October 2004 31

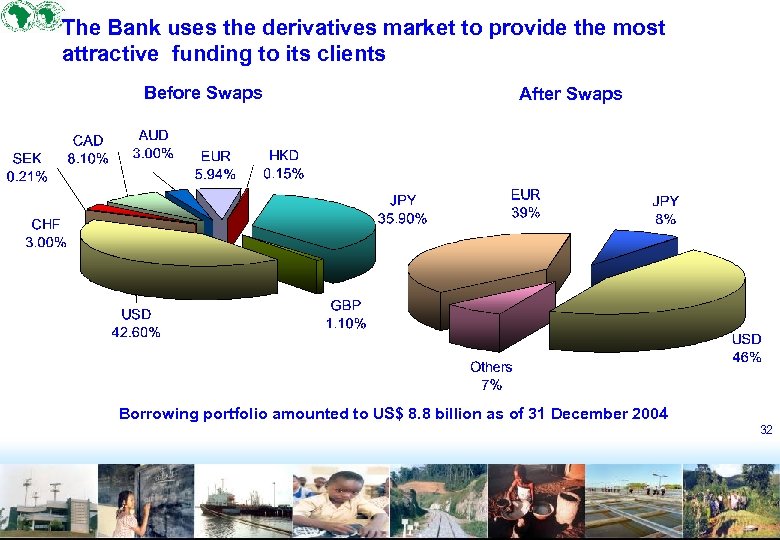

The Bank uses the derivatives market to provide the most attractive funding to its clients Before Swaps After Swaps Borrowing portfolio amounted to US$ 8. 8 billion as of 31 December 2004 32

The Bank’s effective communication strategy is facilitating investor understanding of its strong credit story Spread against USD Libor Source: Bloomberg ADB US$ 1 billion Global Bond - 1 August 2008 33

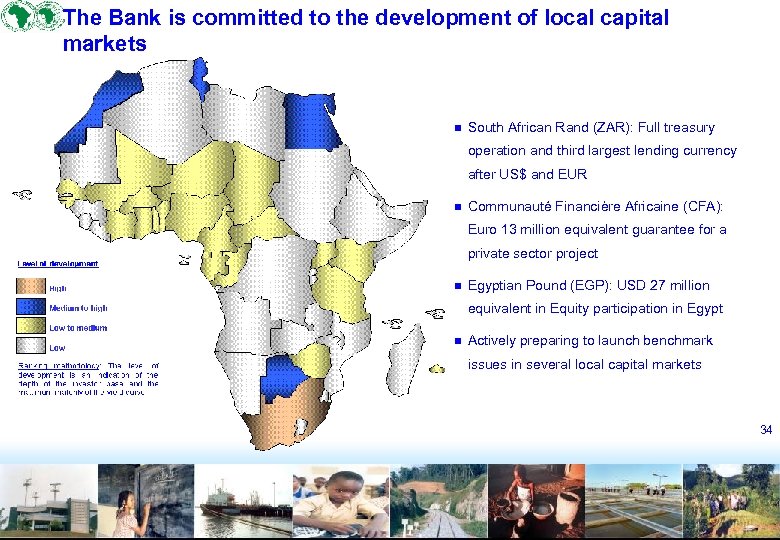

The Bank is committed to the development of local capital markets n South African Rand (ZAR): Full treasury operation and third largest lending currency after US$ and EUR n Communauté Financière Africaine (CFA): Euro 13 million equivalent guarantee for a private sector project n Egyptian Pound (EGP): USD 27 million equivalent in Equity participation in Egypt n Actively preparing to launch benchmark issues in several local capital markets 34

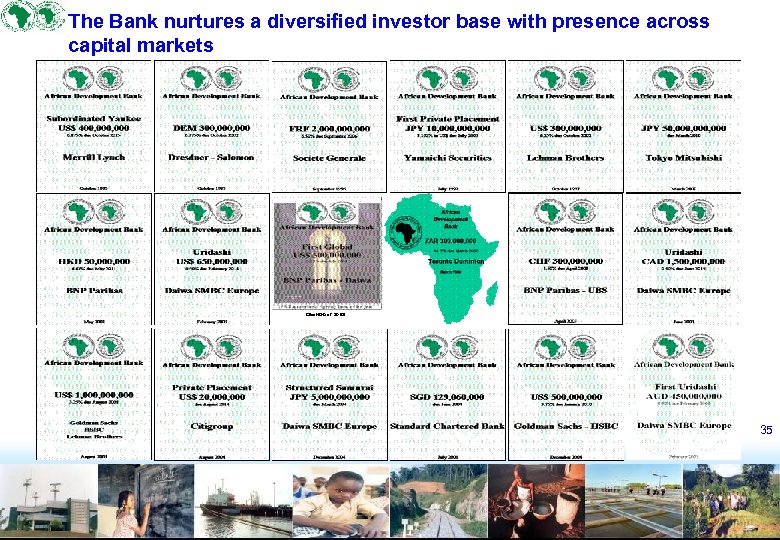

The Bank nurtures a diversified investor base with presence across capital markets 35

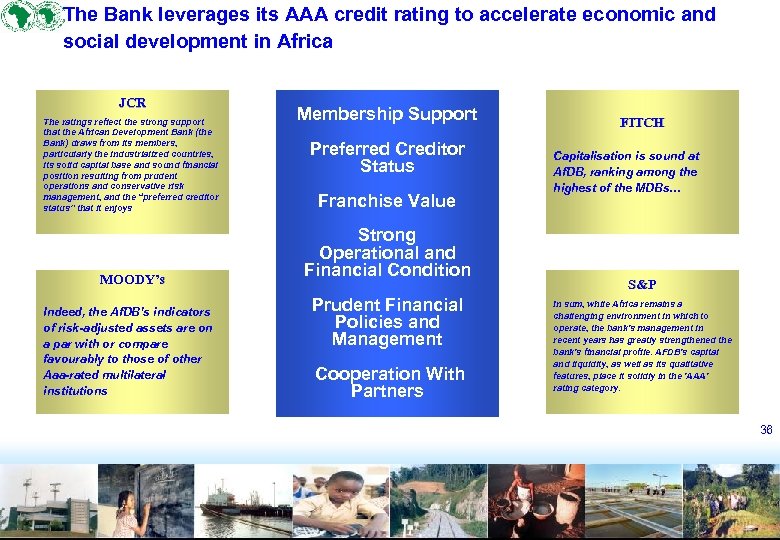

The Bank leverages its AAA credit rating to accelerate economic and social development in Africa JCR The ratings reflect the strong support that the African Development Bank (the Bank) draws from its members, particularly the industrialized countries, its solid capital base and sound financial position resulting from prudent operations and conservative risk management, and the “preferred creditor status” that it enjoys MOODY’s Indeed, the Af. DB’s indicators of risk-adjusted assets are on a par with or compare favourably to those of other Aaa-rated multilateral institutions Membership Support Preferred Creditor Status Franchise Value Strong Operational and Financial Condition Prudent Financial Policies and Management Cooperation With Partners FITCH Capitalisation is sound at Af. DB, ranking among the highest of the MDBs… S&P In sum, while Africa remains a challenging environment in which to operate, the bank's management in recent years has greatly strengthened the bank's financial profile. AFDB's capital and liquidity, as well as its qualitative features, place it solidly in the 'AAA' rating category. 36

More information is available at www. afdb. org n. Financial and Operational Analysis n. Documentation n. Rating for Debt Programs Agencies Reports n. Financial Products for Borrowers n. Exchange n. Annual Rates Report 37

Appendices I. ADB Financial Statements

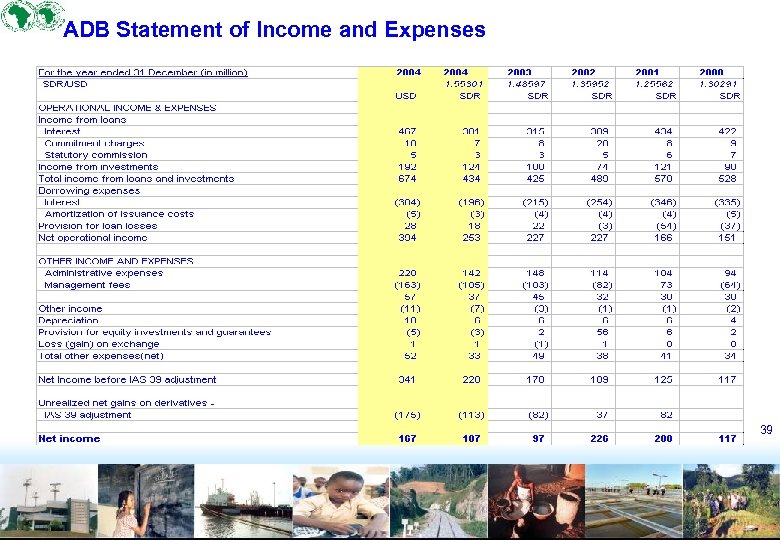

ADB Statement of Income and Expenses 39

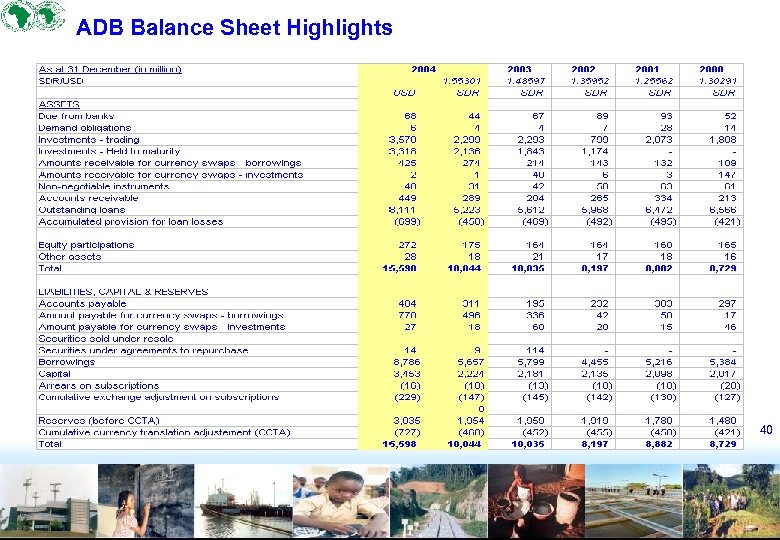

ADB Balance Sheet Highlights 40

Appendices II. Africa at a Glance

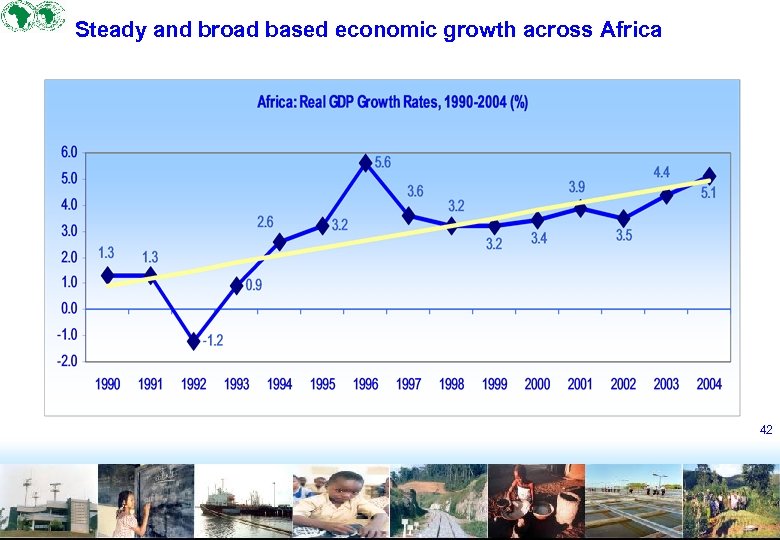

Steady and broad based economic growth across Africa 42

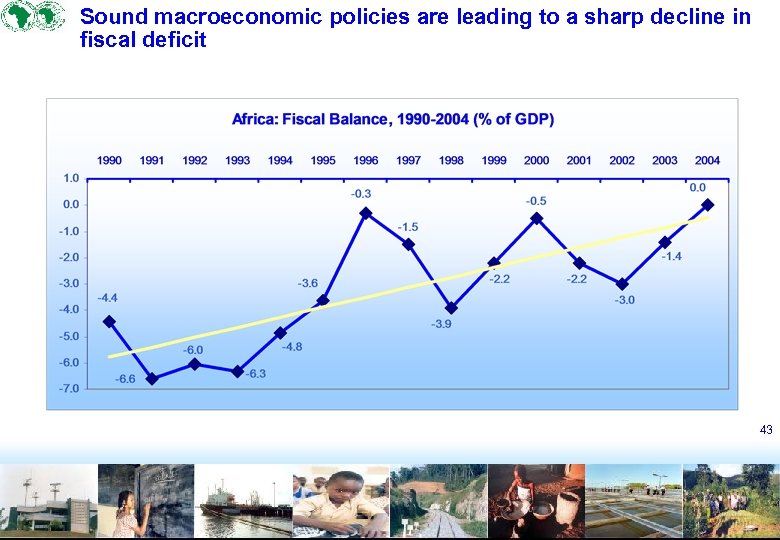

Sound macroeconomic policies are leading to a sharp decline in fiscal deficit 43

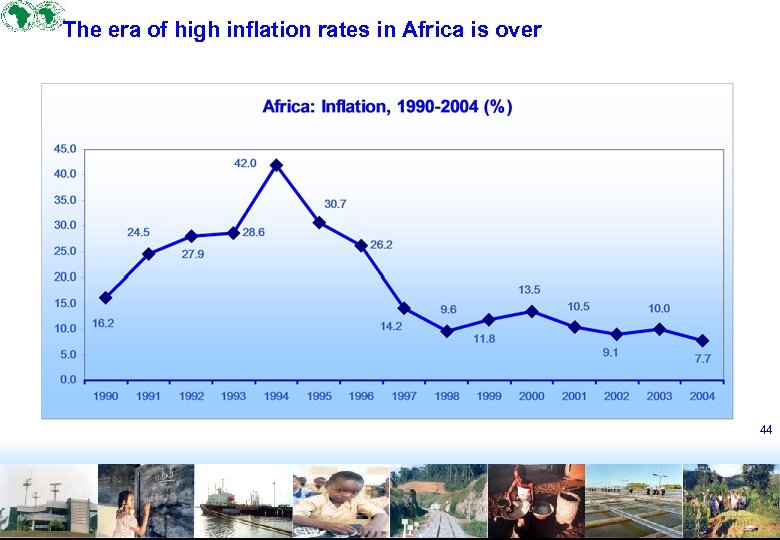

The era of high inflation rates in Africa is over (%) 44

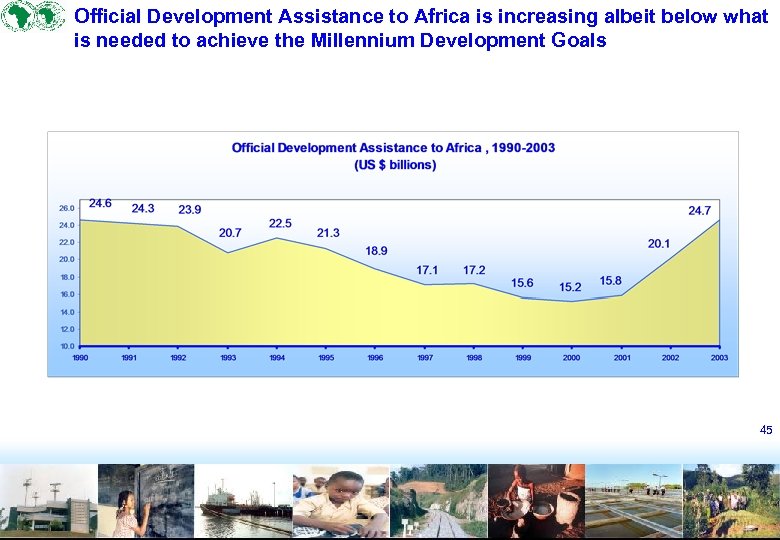

Official Development Assistance to Africa is increasing albeit below what is needed to achieve the Millennium Development Goals 45

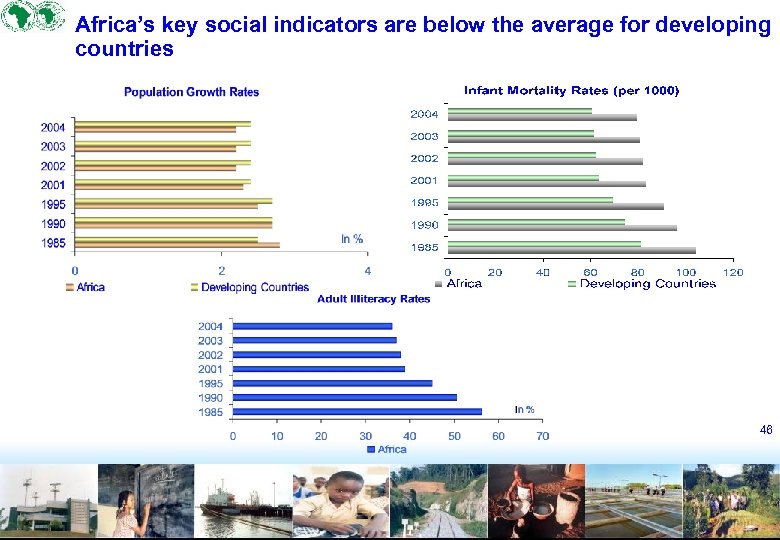

Africa’s key social indicators are below the average for developing countries 46

The Millennium Development Goals 47 Source: ADB Statistics Division, UNESCO database 2004, UN Population Division, World Bank

Notes and Glossary

04c91b8ba626c7c1fd03ab05a51c34eb.ppt