9c3a8fd09339505693769f75cc10cb0c.ppt

- Количество слайдов: 15

Affordable Housing Preservation: An Historical Perspective Michael Bodaken National Housing Trust Michael Bodaken, National Housing Trust 2010 Ohio Preservation Summit: 2010

National Housing Trust § Committed to safeguarding affordable housing. § Only national nonprofit engaged in housing preservation through real estate development, lending and public policy initiatives. § The National Housing Trust: § Partners with investors to raise capital to buy and renovate affordable apartments. Preserved 4, 800 affordable apartments. § Lends early money to developers to help them purchase and renovate affordable apartments. Loans have helped preserve 5, 000 apartments. § Educates policymakers of the need to dedicate resources towards the revitalization of existing affordable apartments. National Housing Trust, Affordable Housing Preservation: An Historical Perspective

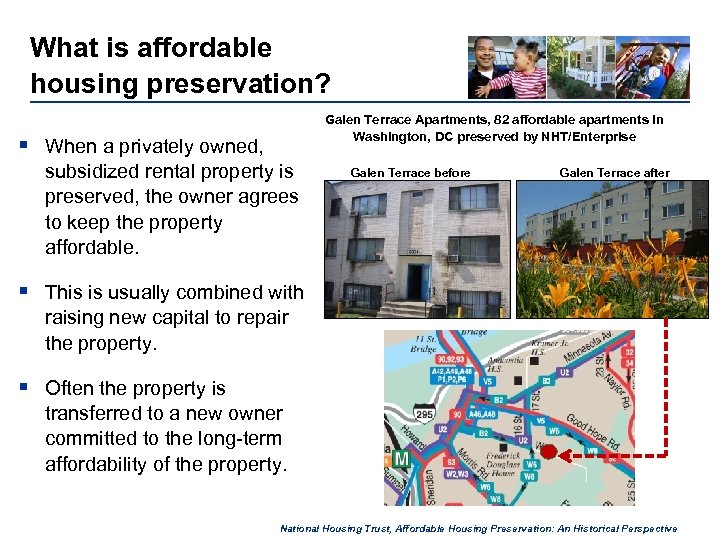

What is affordable housing preservation? Galen Terrace Apartments, 82 affordable apartments in Washington, DC preserved by NHT/Enterprise § When a privately owned, subsidized rental property is preserved, the owner agrees to keep the property affordable. Galen Terrace before Galen Terrace after § This is usually combined with raising new capital to repair the property. § Often the property is transferred to a new owner committed to the long-term affordability of the property. National Housing Trust, Affordable Housing Preservation: An Historical Perspective

Why Preserve? Stable rental housing is critical to diverse, healthy communities. 3 out of every 10 households rent. It is stable housing, not tenure, that is key to providing quality of life benefits. Preserving affordable housing is cost effective. Rehabilitating an existing affordable apartment can cost one-third less than building a new apartment Preserving affordable housing creates jobs quickly. Rehabilitating existing housing is easier and faster than building new housing. This means creating new, well paying jobs sooner. National Housing Trust, Affordable Housing Preservation: An Historical Perspective

Preserving affordable housing is inherently energy and resource efficient. § Building Reuse. Produces less waste and uses less new materials and energy than new construction. §Infrastructure. Does not require new utility or transportation infrastructure. §Green space. Does not require developing more land. §Household energy use. Integrate green technology and methods into rehabilitation. Copyright National Trust for Historic Preservation National Housing Trust, Affordable Housing Preservation: An Historical Perspective

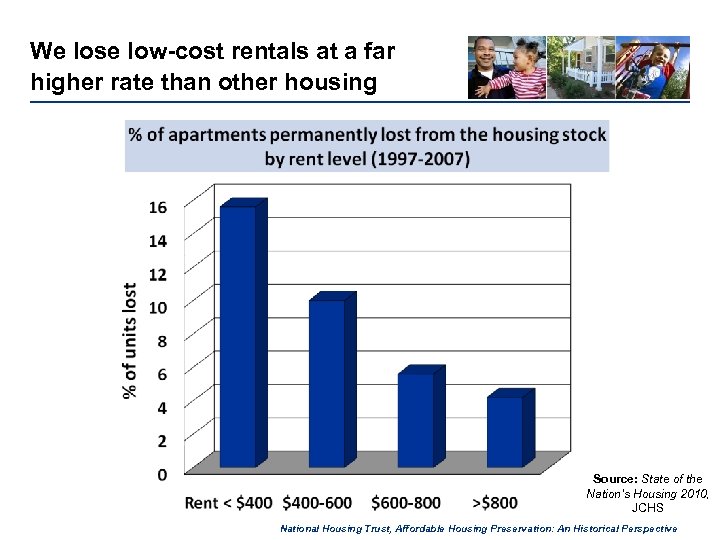

We lose low-cost rentals at a far higher rate than other housing Source: State of the Nation’s Housing 2010, JCHS National Housing Trust, Affordable Housing Preservation: An Historical Perspective

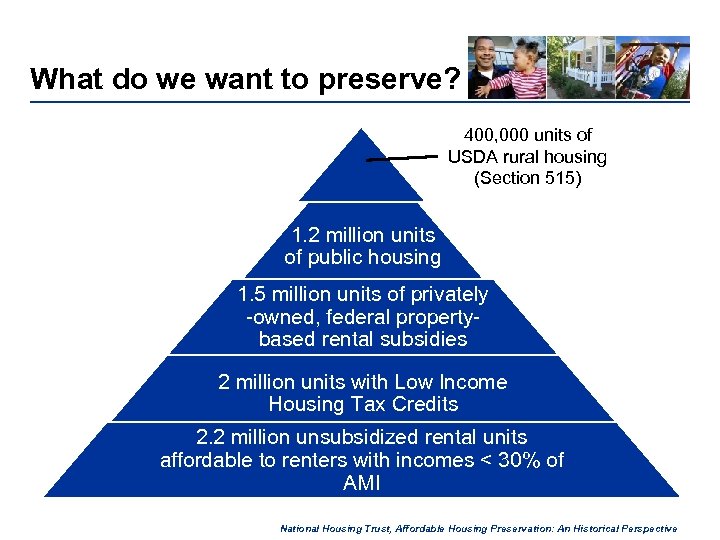

What do we want to preserve? 400, 000 units of USDA rural housing (Section 515) 1. 2 million units of public housing 1. 5 million units of privately -owned, federal propertybased rental subsidies 2 million units with Low Income Housing Tax Credits 2. 2 million unsubsidized rental units affordable to renters with incomes < 30% of AMI National Housing Trust, Affordable Housing Preservation: An Historical Perspective

Why is this stock at risk? Market Risk • Strong market- Gentrification • Weak market- Downward pressure on rents Policy Risk • Owners “opt out” or mortgages are prepaid or mature • HUD takes enforcement action Owner Capacity/ Interest • Owner may want out of the business • Owner may lack capacity to maintain/ recapitalize housing National Housing Trust, Affordable Housing Preservation: An Historical Perspective

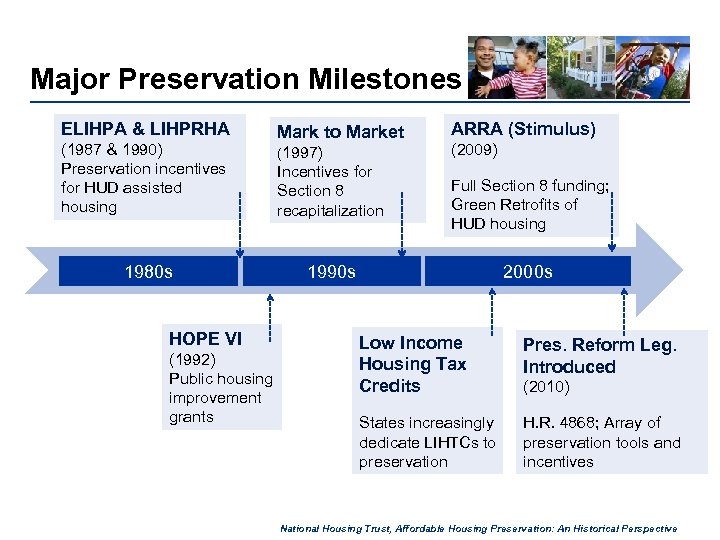

Major Preservation Milestones ELIHPA & LIHPRHA (1987 & 1990) Preservation incentives for HUD assisted housing 1980 s HOPE VI (1992) Public housing improvement grants Mark to Market (1997) Incentives for Section 8 recapitalization ARRA (Stimulus) (2009) Full Section 8 funding; Green Retrofits of HUD housing 1990 s 2000 s Low Income Housing Tax Credits Pres. Reform Leg. Introduced States increasingly dedicate LIHTCs to preservation H. R. 4868; Array of preservation tools and incentives (2010) National Housing Trust, Affordable Housing Preservation: An Historical Perspective

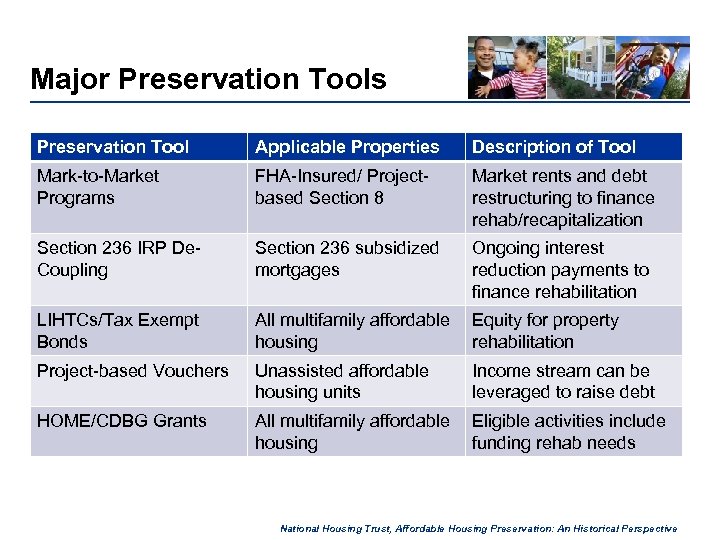

Major Preservation Tools Preservation Tool Applicable Properties Description of Tool Mark-to-Market Programs FHA-Insured/ Projectbased Section 8 Market rents and debt restructuring to finance rehab/recapitalization Section 236 IRP De. Coupling Section 236 subsidized mortgages Ongoing interest reduction payments to finance rehabilitation LIHTCs/Tax Exempt Bonds All multifamily affordable housing Equity for property rehabilitation Project-based Vouchers Unassisted affordable housing units Income stream can be leveraged to raise debt HOME/CDBG Grants All multifamily affordable housing Eligible activities include funding rehab needs National Housing Trust, Affordable Housing Preservation: An Historical Perspective

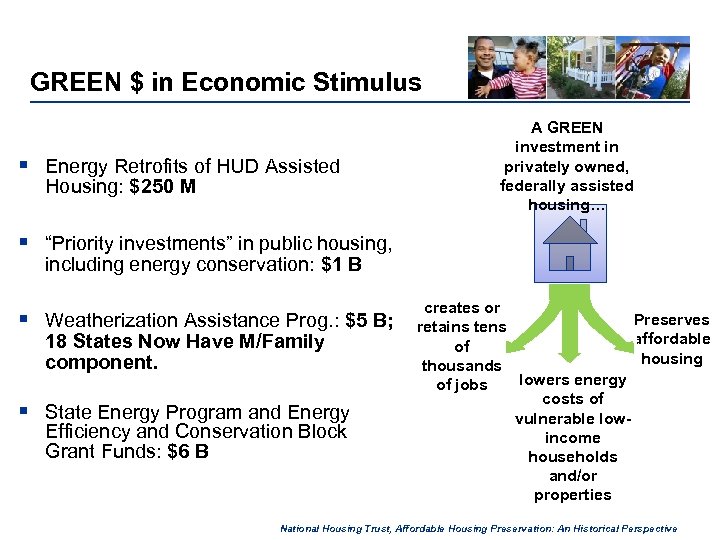

GREEN $ in Economic Stimulus § Energy Retrofits of HUD Assisted Housing: $250 M A GREEN investment in privately owned, federally assisted housing… § “Priority investments” in public housing, including energy conservation: $1 B § Weatherization Assistance Prog. : $5 B; 18 States Now Have M/Family component. § State Energy Program and Energy Efficiency and Conservation Block Grant Funds: $6 B creates or Preserves retains tens affordable of housing thousands lowers energy of jobs costs of vulnerable lowincome households and/or properties National Housing Trust, Affordable Housing Preservation: An Historical Perspective

National Issue: Local Challenge § While preservation is a national challenge, the wide variety of local conditions requires a local, special response. § Intervention requires a local understanding of the market, the population being served and level of state and local support. § Many states/cities/counties have resources dedicated to development and/or preservation of affordable housing. § Resources come in the form of soft loans, grants, allocation of tax credits, or tax relief (e. g. , real estate tax abatement). National Housing Trust, Affordable Housing Preservation: An Historical Perspective

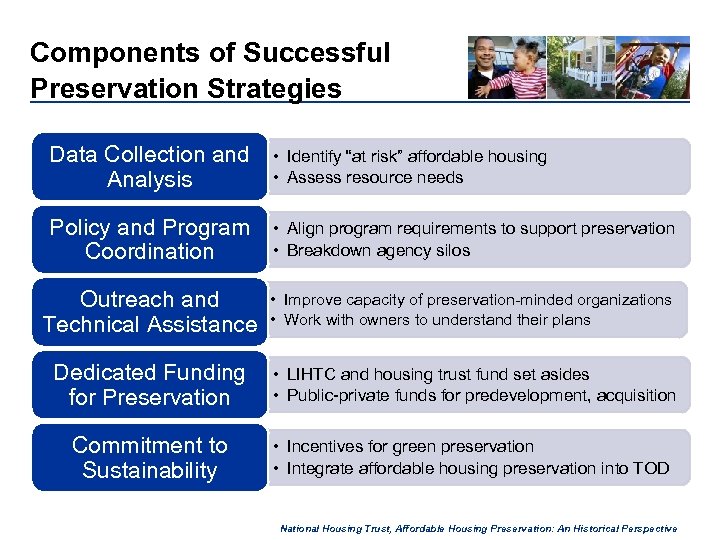

Components of Successful Preservation Strategies Data Collection and Analysis • Identify “at risk” affordable housing • Assess resource needs Policy and Program Coordination • Align program requirements to support preservation • Breakdown agency silos Outreach and Technical Assistance • Improve capacity of preservation-minded organizations • Work with owners to understand their plans Dedicated Funding for Preservation • LIHTC and housing trust fund set asides • Public-private funds for predevelopment, acquisition Commitment to Sustainability • Incentives for green preservation • Integrate affordable housing preservation into TOD National Housing Trust, Affordable Housing Preservation: An Historical Perspective

Effective Preservation Strategies: Dedicate LIHTCs to Preservation § Low Income Housing Tax Credits = Largest source of resources for affordable housing. § Administered by each state. States given broad discretion for allocating tax credits. § Affordable housing providers apply. Very competitive process. § State housing agencies are increasingly dedicating resources to preservation National Housing Trust, Affordable Housing Preservation: An Historical Perspective

For more information: Michael Bodaken National Housing Trust ¨ E-mail: mbodaken@nhtinc. org ¨ Address: 1101 30 th St, NW, Suite 400 Washington, DC 20007 ¨ Phone: (202) 333 -8931 ¨ Web: www. nhtinc. org National Housing Trust, Affordable Housing Preservation: An Historical Perspective

9c3a8fd09339505693769f75cc10cb0c.ppt