efd8125136f0d85da72d3dc510aec45a.ppt

- Количество слайдов: 20

Adviser Distribution Only Responsible Entity: Equity Trustees Limited ABN 460 004 031 298 Protection Strategy Provider and Manager: Credit Suisse International ARBN 062 787 106 Credit Suisse GP 100 Growth Plus - Australia 100% lending 100% participation

Disclaimer §The Credit Suisse GP 100 Series is issued by Equity Trustees Limited ABN 46004 031 298, Australian Financial services Licence No. 24975 in the Product Disclosure Statement (PDS). The Protection Strategy Provider and Manager is Credit Suisse International ARBN 062787106. Potential investors should read and understand the PDS before making any investment decisions. All potential investors should obtain the PDS available from us and consider the PDS before making any decision about whether to acquire the financial product. An investment in the GP 100 Series will be subject to investment risk, including loss of income and capital. § 1 The capital protection for GP 100 - Australia will be provided by Credit Suisse International to GP 100 - Australia only at maturity (year 5) and will only apply to the value of $1. 00 per unit on issue at maturity. Further, like other features of the Protection Strategy, the capital protection will not be provided directly to unitholders and will be subject to terms and conditions, including early termination events. Please refer to the Product Disclosure Statement for more information, including section 4. 2 ‘GP 100 – Australia specific risks’. § 2 Investment loans will be available during the initial offer period from Macquarie Bank Limited subject to terms and conditions including credit approval. § 3 The liquidity arrangements refer to on market and off market arrangements to be provided by Credit Suisse Equities (Australia) limited and Credit Suisse, Sydney Branch to offer to buy and sell GP 100 - Australia units to and from investors, subject to terms and conditions. While there can be no assurance that an active market for trading in units in GP 100 - Australia will develop on the ASX, on market liquidity will be facilitated by the appointment of a market maker (Credit Suisse Equities (Australia) Limited) and an off market limited liquidity facility will be available (from Credit Suisse, Sydney Branch), subject to terms and conditions including situations where the limited liquidity facility may not be available and the market maker’s obligations may not apply. After day one of trading, the amount of any bid by the market maker will be subject to a number of factors, including the net asset value of GP 100 – Australia and market conditions. 2

Disclaimer § 4 The Physical Basket will comprise the securities of the 20 largest entities (measured by Float Adjusted Market § § § Capitalisation) included in the S&P/ASX 200 Index according to their index weightings as at 14 February 2008, although Telstra Instalment Receipts will be excluded and replaced by Fosters Group Limited. The weighting allocated to an investment in Telstra Corporation Limited will be the aggregate of the weightings allocated to it and to Telstra Instalment Receipts as at 14 February 2008. 5 Any prospective financial information included in this presentation is predictive in character. Whilst every effort has been taken to ensure that the assumptions on which the prospective information is based are reasonable, the information may be affected by assumptions being or becoming inaccurate and by known or unknown risks and uncertainties. The ultimate results may differ substantially from any forecasts and prospective financial information included in this presentation. 6 The S&P/ASX 200 Index measures the performance of the 200 largest index eligible securities listed on the ASX by Float Adjusted Market Capitalisation (being a capitalisation measure of the largest entities which refers to the value of their securities available for public trading). The S&P/ASX 200 lndex referenced is a price index (i. e. dividends and distributions are not taken to be reinvested in determining the index value). 7 The protection strategy incorporates a Leverage mechanism enabling GP 100 – Australia’s investment exposure to the S&P/ASX 200 Index to be increased by up to 2. 5 times (250%). 8 The Macquarie Group does not give, nor does it purport to give, any taxation advice. The taxation discussion in this document is based on laws current at the time of writing. Those laws and the level of taxation may change. The application of taxation laws to each investor depends on that investor’s individual circumstances. Accordingly, investors should seek independent professional advice on taxation implications before making any investment decisions. 9 The content of the sample case study is purely hypothetical and does not contain actual or potential returns, estimates, projections or forecasts for investments in GP 100 - Australia. Advisers should consider their clients' objectives, financial situation and needs before providing any financial advice to their clients in relation to the appropriateness of any Investment. The taxation consequences for an investor will depend on the individual circumstances of that investor. The case study and any examples have only been included for illustrative purposes. They have been prepared without taking account of any potential investor’s personal objectives, financial situation or needs. Any strategy discussed represents our analysis only and are based on certain assumptions, including those set out in the presentation. The assumptions may have a material affect on returns. The actual performance of investments will depend on future economic conditions, investment management and future taxation. 3

Disclaimer § The information contained in this presentation referring to the Macquarie 100% Investment Loan and Macquarie Margin § § Loan has been prepared by Macquarie Bank Limited ABN 46 008 583 542, AFSL 237502 (Macquarie), as issuer of the Macquarie 100% Investment Loan and Macquarie Margin Loan. Full terms and conditions are set out in the relevant loan contracts. Fees, charges and government taxes are payable. The Macquarie 100% Investment Loan and Macquarie Margin Loan content has been prepared for general information purposes only, without taking into account any potential investors’ personal objectives, financial situation or needs. We recommend you obtain financial, legal and taxation advice before making any financial investment decision. Macquarie Private Wealth’s services are provided by Macquarie Equities Limited (MEL) ABN 41 002 574 923, Participant of Australian Securities Exchange Group, AFSL No. 237504, Level 18, 20 Bond Street, Sydney NSW 2000. This general advice has been prepared by MEL and does not take account of your objectives, financial situation or needs. Before acting on this general advice, you should consider its appropriateness having regard to your situation. We recommend that you obtain financial, legal and taxation advice before making any financial investment decision. MEL is not an authorised deposit taking institution for the purposes of the Banking Act (Cth) 1959. MEL’s obligations do not represent deposits or other liabilities of Macquarie Bank Limited ABN 46 008 583 542 (MBL). MBL does not guarantee or otherwise provide assurance in respect of the obligations of MEL, unless noted otherwise. 4

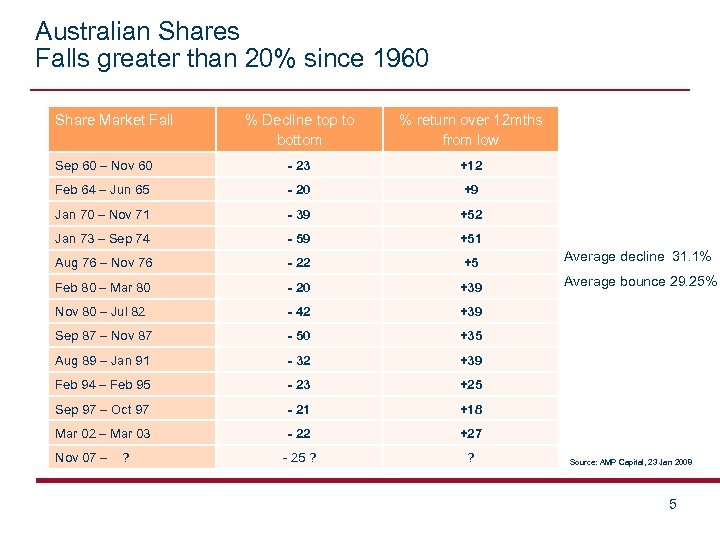

Australian Shares Falls greater than 20% since 1960 Share Market Fall % Decline top to bottom % return over 12 mths from low - 23 +12 Feb 64 – Jun 65 - 20 +9 Jan 70 – Nov 71 - 39 +52 Jan 73 – Sep 74 - 59 +51 Aug 76 – Nov 76 - 22 +5 Average decline 31. 1% Feb 80 – Mar 80 - 20 +39 Average bounce 29. 25% Nov 80 – Jul 82 - 42 +39 Sep 87 – Nov 87 - 50 +35 Aug 89 – Jan 91 - 32 +39 Feb 94 – Feb 95 - 23 +25 Sep 97 – Oct 97 - 21 +18 Mar 02 – Mar 03 - 22 +27 - 25 ? ? Sep 60 – Nov 60 Nov 07 – ? Source: AMP Capital, 23 Jan 2008 5

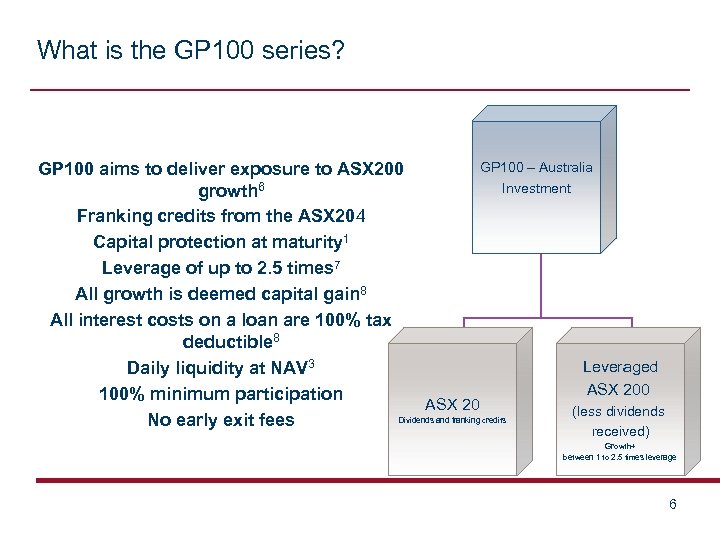

What is the GP 100 series? GP 100 – Australia GP 100 aims to deliver exposure to ASX 200 Investment growth 6 Franking credits from the ASX 204 Capital protection at maturity 1 Leverage of up to 2. 5 times 7 All growth is deemed capital gain 8 All interest costs on a loan are 100% tax deductible 8 Leveraged Daily liquidity at NAV 3 ASX 200 100% minimum participation ASX 20 (less dividends Dividends and franking credits No early exit fees received) Growth+ between 1 to 2. 5 times leverage 6

What is the GP 100 - Australia? GP 100 …. 100% Lending § Listed on the ASX § Underlying investment is via a basket of equities – physical stocks held Any distributions paid semi annually § § The investor benefits from the growth of § § the ASX 200 Minimum of 100% participation in all market conditions A maximum of 250% participation (2. 5 X leverage) following strong market conditions 7

What is the GP 100 series? Simple concise structure § Capital protected 1 with a realistic 5 year term, but early redemption available § No currency risk – AUD stocks § No manager risk – Index play § Potential for both growth and dividends NAV Calculation 8

The time has come …. Fresh, new, innovative § 100% participation on day 1 § 100% NAV on day 1 § 100% capital protected 1 § 100% lending 2 available § 100% minimum participation 9

100% Participation from day 1 …. $1. 00 bid on day 1 § 100% of funds invested are allocated to the investment 10

100% of NAV on day 1 …. Daily liquidity on and off market § Market price on day 1 will be $1. 00 bid for the total issue 3 § Daily valuation price posted to the ASX 3 § Market support – the stock will be bid at valuation price for the total issue on a daily basis 3 § Off market buy/sell facility available at NAV 3 11

100% Capital Protected § 100% Capital Protection provided to the Trust by major international investment bank Credit Suisse 1 § Credit Suisse has a AA- rating § Innovative capital protection management technique 1 § Potential for up to 250% participation § Minimum participation of 100% 12

100% Lending You can invest 4 ways §Direct investment § 100% lending §Margin lending §CPF Instalment Receipts may be available § 100% finance available 2 through the Macquarie 100% Investment Loan § Minimum loan amount is $45, 000 § Variable and fixed interest payment options available § Interest Prepayment Loan (IPL) available in June to fund year 1 and subsequent years interest prepayments 13

Margin Lending § Available through the Macquarie Margin Loan § LVR yet to be confirmed § Minimum loan amount is $20, 000 § Variable and fixed interest payment options available § IPL available in June § No financial assessment for loan under $3 million § No application or loan establishment fees (for individual borrowers) 14

Other features § Total management cost is 1. 99% per year of the Net Asset Value of GP 100 - Australia (deducted from distributions) § Low internal gearing interest rates (set at 5 year swap rate, currently 7. 3%) § Simple application process § Roll over option 15

GP 100 Series The next generation in structured products 100% participation on day 1 100% NAV on day 1^ 100% capital protected 1 100% lending 2 available 100% Minimum participation ^Market maker bid of $1. 00 per unit on day 1 16

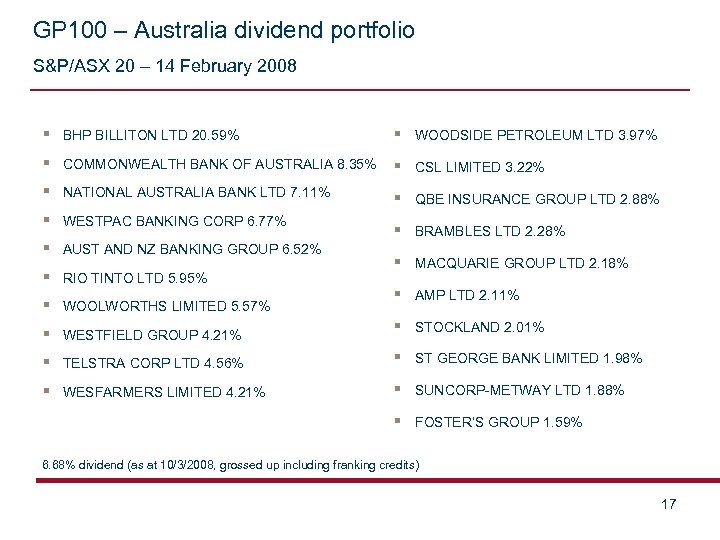

GP 100 – Australia dividend portfolio S&P/ASX 20 – 14 February 2008 § BHP BILLITON LTD 20. 59% § WOODSIDE PETROLEUM LTD 3. 97% § COMMONWEALTH BANK OF AUSTRALIA 8. 35% § CSL LIMITED 3. 22% § NATIONAL AUSTRALIA BANK LTD 7. 11% § QBE INSURANCE GROUP LTD 2. 88% § WESTPAC BANKING CORP 6. 77% § AUST AND NZ BANKING GROUP 6. 52% § RIO TINTO LTD 5. 95% § WOOLWORTHS LIMITED 5. 57% § BRAMBLES LTD 2. 28% § MACQUARIE GROUP LTD 2. 18% § AMP LTD 2. 11% § WESTFIELD GROUP 4. 21% § STOCKLAND 2. 01% § TELSTRA CORP LTD 4. 56% § ST GEORGE BANK LIMITED 1. 98% § WESFARMERS LIMITED 4. 21% § SUNCORP-METWAY LTD 1. 88% § FOSTER’S GROUP 1. 59% 6. 68% dividend (as at 10/3/2008, grossed up including franking credits) 17

GP 100 – Australia Fees and Adviser Commissions For the GP 100 – Australia investment § 1. 1% available via the investment For the Macquarie 100% Investment Loan § 1. 5% up front via investment loan application § Trailing commission 0. 55% via investment loan Total of 2. 6% up front fees Potential for placement fee on firm bids 18

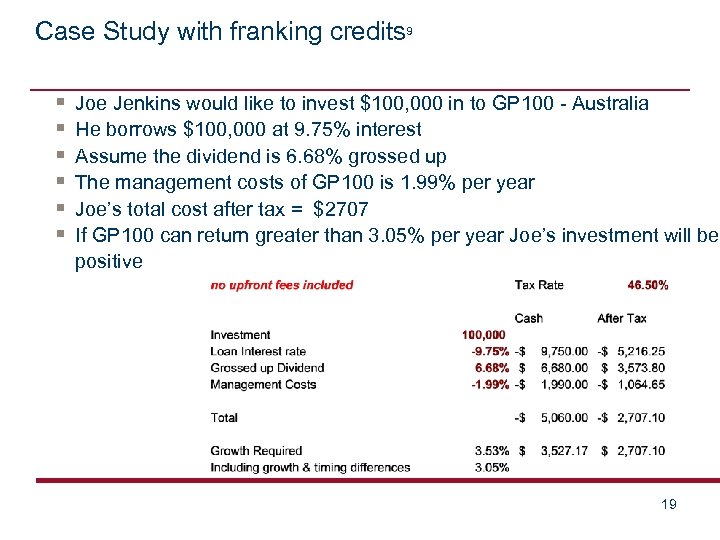

Case Study with franking credits 9 § § § Joe Jenkins would like to invest $100, 000 in to GP 100 - Australia He borrows $100, 000 at 9. 75% interest Assume the dividend is 6. 68% grossed up The management costs of GP 100 is 1. 99% per year Joe’s total cost after tax = $2707 If GP 100 can return greater than 3. 05% per year Joe’s investment will be positive 19

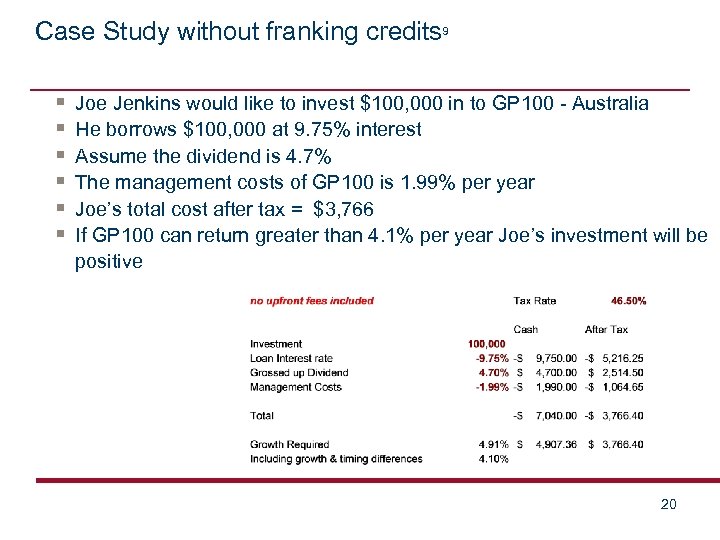

Case Study without franking credits 9 § § § Joe Jenkins would like to invest $100, 000 in to GP 100 - Australia He borrows $100, 000 at 9. 75% interest Assume the dividend is 4. 7% The management costs of GP 100 is 1. 99% per year Joe’s total cost after tax = $3, 766 If GP 100 can return greater than 4. 1% per year Joe’s investment will be positive 20

efd8125136f0d85da72d3dc510aec45a.ppt