dfafa89e22fff45d2576f8da8aadf297.ppt

- Количество слайдов: 78

Advanced Topics (Private Information) 1

Advanced Topics (Private Information) 1

Private Information/ Asymmetric Information n Definition: A situation that exist when some people have better information than others. 2

Private Information/ Asymmetric Information n Definition: A situation that exist when some people have better information than others. 2

2 Types of Asymmetric Information 1. 2. Hidden Characteristics – things one party to a transaction knows about itself but which are unknown by the other party. Hidden Action – actions taken by one party in a relationship that cannot be observed by the other party. 3

2 Types of Asymmetric Information 1. 2. Hidden Characteristics – things one party to a transaction knows about itself but which are unknown by the other party. Hidden Action – actions taken by one party in a relationship that cannot be observed by the other party. 3

A) ADVERSE SELECTION n Definition Situation where individuals have hidden characteristics and in which a selection process results in a pool of individuals with undesirable characteristics. 4

A) ADVERSE SELECTION n Definition Situation where individuals have hidden characteristics and in which a selection process results in a pool of individuals with undesirable characteristics. 4

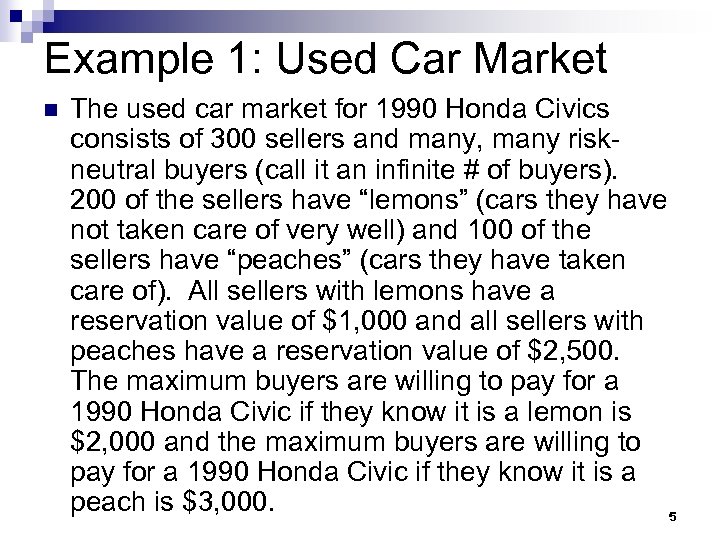

Example 1: Used Car Market n The used car market for 1990 Honda Civics consists of 300 sellers and many, many riskneutral buyers (call it an infinite # of buyers). 200 of the sellers have “lemons” (cars they have not taken care of very well) and 100 of the sellers have “peaches” (cars they have taken care of). All sellers with lemons have a reservation value of $1, 000 and all sellers with peaches have a reservation value of $2, 500. The maximum buyers are willing to pay for a 1990 Honda Civic if they know it is a lemon is $2, 000 and the maximum buyers are willing to pay for a 1990 Honda Civic if they know it is a peach is $3, 000. 5

Example 1: Used Car Market n The used car market for 1990 Honda Civics consists of 300 sellers and many, many riskneutral buyers (call it an infinite # of buyers). 200 of the sellers have “lemons” (cars they have not taken care of very well) and 100 of the sellers have “peaches” (cars they have taken care of). All sellers with lemons have a reservation value of $1, 000 and all sellers with peaches have a reservation value of $2, 500. The maximum buyers are willing to pay for a 1990 Honda Civic if they know it is a lemon is $2, 000 and the maximum buyers are willing to pay for a 1990 Honda Civic if they know it is a peach is $3, 000. 5

Table for Example 1 Lemons Sellers’ Reservation Value Peaches $1, 000 $2, 500 $2, 000 $3, 000 200 100 (minimum they are willing to accept) Buyers’ Willingness to Pay (maximum they are willing to pay) # of sellers Assume there are many, many buyers. 6

Table for Example 1 Lemons Sellers’ Reservation Value Peaches $1, 000 $2, 500 $2, 000 $3, 000 200 100 (minimum they are willing to accept) Buyers’ Willingness to Pay (maximum they are willing to pay) # of sellers Assume there are many, many buyers. 6

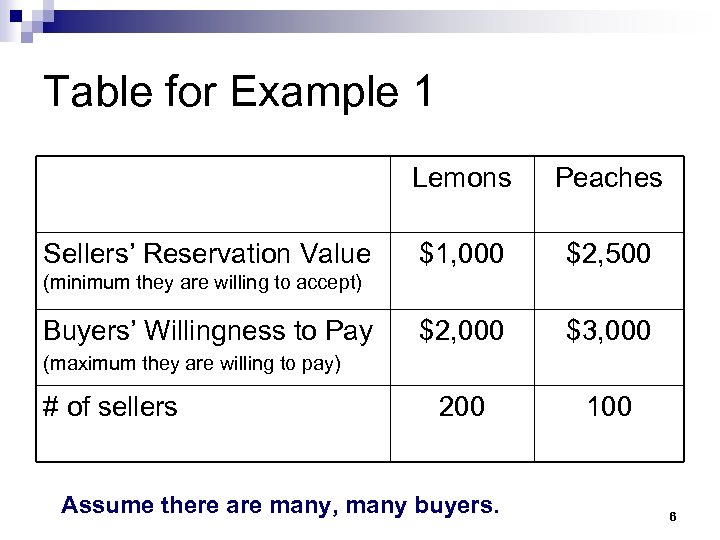

A. Assume Perfect Information (both Buyers and Sellers can tell a lemon from a peach) so no Adverse Selection n Supply and Demand for 1990 Honda Civics that are lemons. SL DL Equilibrium Price for a lemon is $2, 000 and all 200 are sold. 7

A. Assume Perfect Information (both Buyers and Sellers can tell a lemon from a peach) so no Adverse Selection n Supply and Demand for 1990 Honda Civics that are lemons. SL DL Equilibrium Price for a lemon is $2, 000 and all 200 are sold. 7

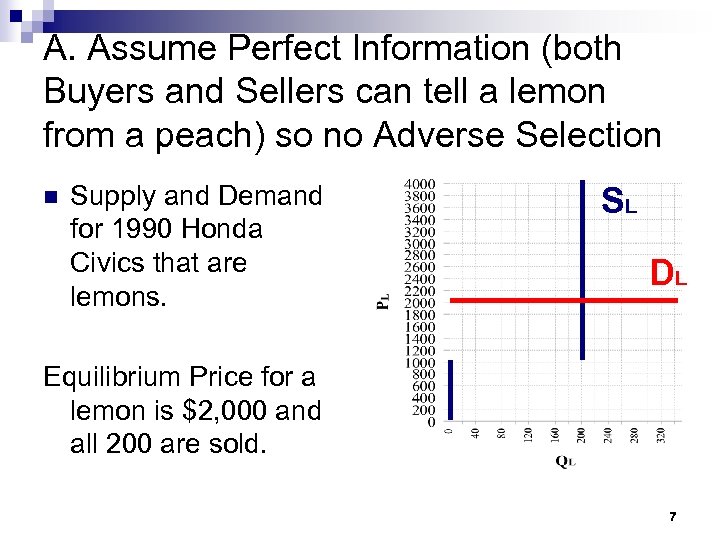

A. Assume Perfect Information (both Buyers and Sellers can tell a lemon from a peach) so no Adverse Selection n Supply and Demand for 1990 Honda Civics that are peaches. SP DP Equilibrium Price for a peach is $3, 000 and all 100 are sold. 8

A. Assume Perfect Information (both Buyers and Sellers can tell a lemon from a peach) so no Adverse Selection n Supply and Demand for 1990 Honda Civics that are peaches. SP DP Equilibrium Price for a peach is $3, 000 and all 100 are sold. 8

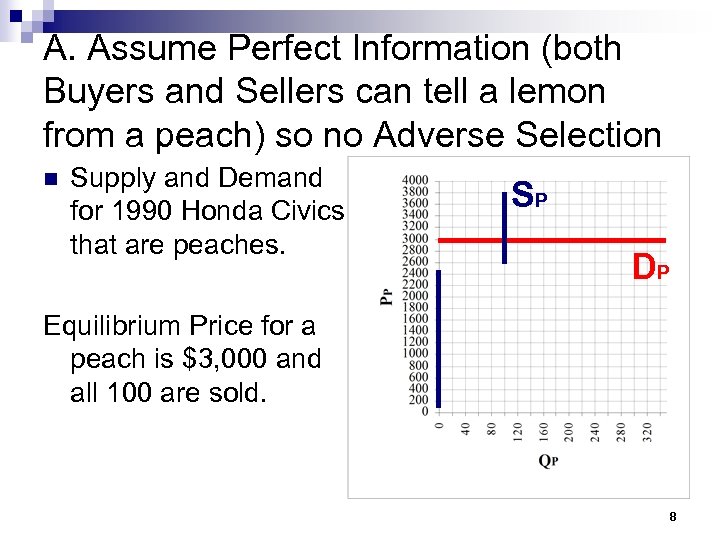

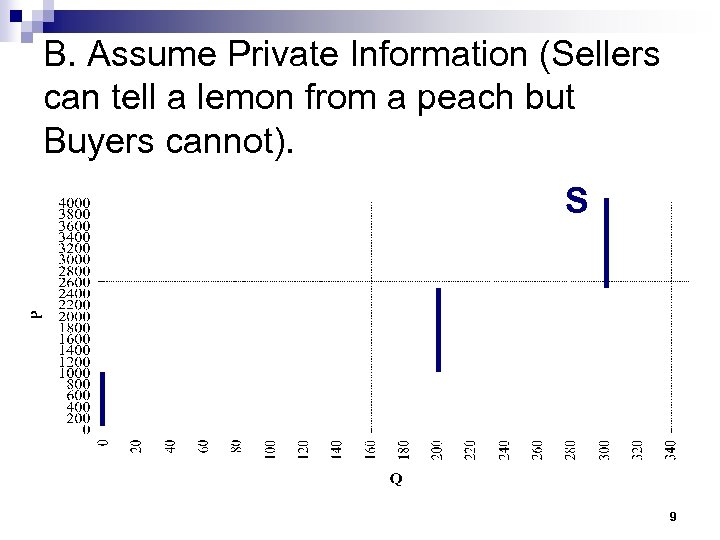

B. Assume Private Information (Sellers can tell a lemon from a peach but Buyers cannot). S 9

B. Assume Private Information (Sellers can tell a lemon from a peach but Buyers cannot). S 9

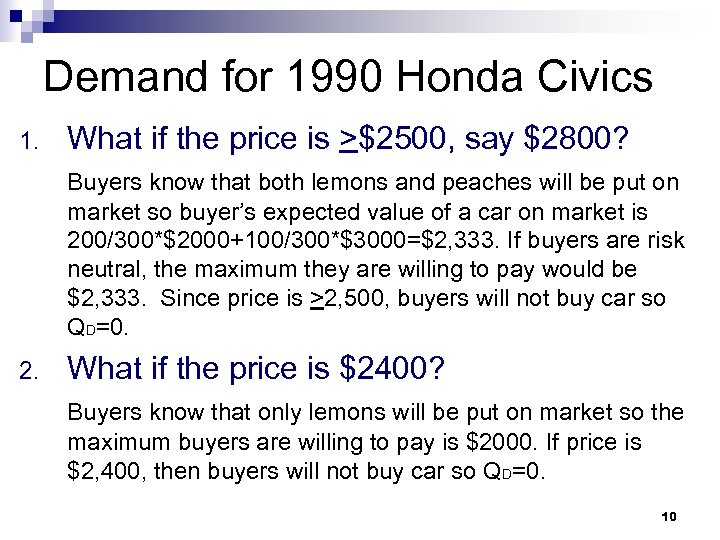

Demand for 1990 Honda Civics 1. What if the price is >$2500, say $2800? Buyers know that both lemons and peaches will be put on market so buyer’s expected value of a car on market is 200/300*$2000+100/300*$3000=$2, 333. If buyers are risk neutral, the maximum they are willing to pay would be $2, 333. Since price is >2, 500, buyers will not buy car so QD=0. 2. What if the price is $2400? Buyers know that only lemons will be put on market so the maximum buyers are willing to pay is $2000. If price is $2, 400, then buyers will not buy car so QD=0. 10

Demand for 1990 Honda Civics 1. What if the price is >$2500, say $2800? Buyers know that both lemons and peaches will be put on market so buyer’s expected value of a car on market is 200/300*$2000+100/300*$3000=$2, 333. If buyers are risk neutral, the maximum they are willing to pay would be $2, 333. Since price is >2, 500, buyers will not buy car so QD=0. 2. What if the price is $2400? Buyers know that only lemons will be put on market so the maximum buyers are willing to pay is $2000. If price is $2, 400, then buyers will not buy car so QD=0. 10

Demand for 1990 Honda Civics 3. What if the price is $2200? Buyers know that only lemons will be put on market so the maximum buyers are willing to pay is $2000. If price is $2, 200, then buyers will not buy car so QD=0. 4. What if the price is $2000? Buyers know that only lemons will be put on market so the maximum buyers are willing to pay is $2000. If price is $2, 000, buyers are indifferent between buying and not buying so QD=[0, ∞]. 5. What if the price is $1, 900? Buyers know that only lemons will be put on market so the maximum buyers are willing to pay is $2000. If price is $1, 900, all buyers want to buy so QD=∞. 11

Demand for 1990 Honda Civics 3. What if the price is $2200? Buyers know that only lemons will be put on market so the maximum buyers are willing to pay is $2000. If price is $2, 200, then buyers will not buy car so QD=0. 4. What if the price is $2000? Buyers know that only lemons will be put on market so the maximum buyers are willing to pay is $2000. If price is $2, 000, buyers are indifferent between buying and not buying so QD=[0, ∞]. 5. What if the price is $1, 900? Buyers know that only lemons will be put on market so the maximum buyers are willing to pay is $2000. If price is $1, 900, all buyers want to buy so QD=∞. 11

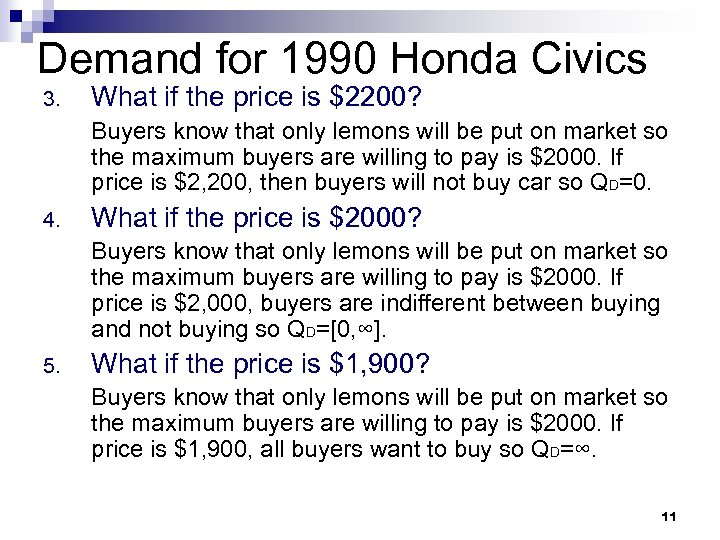

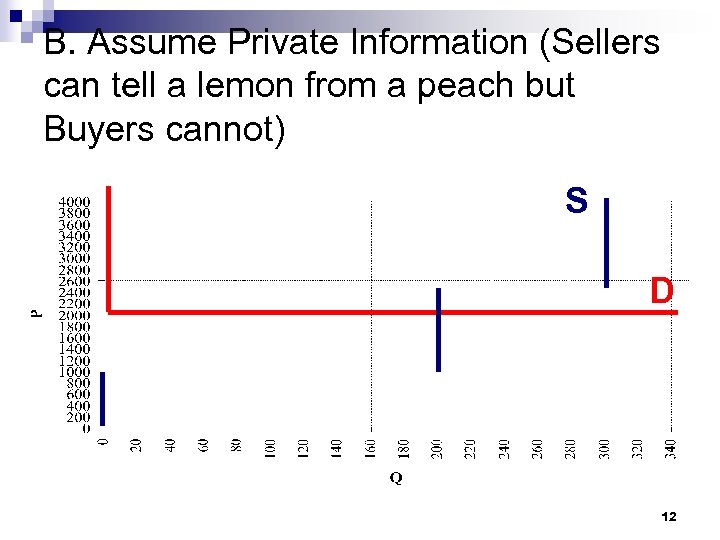

B. Assume Private Information (Sellers can tell a lemon from a peach but Buyers cannot) S D 12

B. Assume Private Information (Sellers can tell a lemon from a peach but Buyers cannot) S D 12

What Happens in the End? n Only Lemons are sold even though the maximum the buyers are willing to pay for a peach is greater than the sellers’ reservation value (i. e. , the “bad” drives the “good” out of the market). 13

What Happens in the End? n Only Lemons are sold even though the maximum the buyers are willing to pay for a peach is greater than the sellers’ reservation value (i. e. , the “bad” drives the “good” out of the market). 13

Importance of other Assumptions n There an infinite number of Buyers. n Buyers are risk neutral so are willing to pay their expected valuation for the car. n Everyone knows exactly the number of lemons and peaches and what buyers are willing to pay and sellers are willing to accept (reservation value). 14

Importance of other Assumptions n There an infinite number of Buyers. n Buyers are risk neutral so are willing to pay their expected valuation for the car. n Everyone knows exactly the number of lemons and peaches and what buyers are willing to pay and sellers are willing to accept (reservation value). 14

What actions might be taken to minimize Adverse Selection problem? 1. 2. 3. Offer a Warranty (must be credible offer). Have the car inspected by a mechanic. Have the seller incur some reputational costs from selling a lemon http: //cell-phones. shop. ebay. com/items/Bluetooth. Accessories__W 0 QQ_sacat. Z 80077 15

What actions might be taken to minimize Adverse Selection problem? 1. 2. 3. Offer a Warranty (must be credible offer). Have the car inspected by a mechanic. Have the seller incur some reputational costs from selling a lemon http: //cell-phones. shop. ebay. com/items/Bluetooth. Accessories__W 0 QQ_sacat. Z 80077 15

What does Adverse Selection have to do with the following? 1. 2. The “value” of a new car decreasing significantly as soon as it is driven off the lot. MS MSU use to allow their employees to change life insurance amounts once a year. We choose between 1 year’s salary, 2 years’ salary, $500, 000 and $1, 000. In a given year, MSU only allows their employees to increase their insurance by one increment each year– for example, an employee can go from 1 year to 2 years of salary in a given year or 2 years to $500, 000 but cannot go from 1 year to $500, 000 – unless the employee obtains a physical. This policy changed last year. Now you cannot change life insurance amounts unless you fill out a survey and if there any concerns by the insurance company, they will require you to submit your medical records. 16

What does Adverse Selection have to do with the following? 1. 2. The “value” of a new car decreasing significantly as soon as it is driven off the lot. MS MSU use to allow their employees to change life insurance amounts once a year. We choose between 1 year’s salary, 2 years’ salary, $500, 000 and $1, 000. In a given year, MSU only allows their employees to increase their insurance by one increment each year– for example, an employee can go from 1 year to 2 years of salary in a given year or 2 years to $500, 000 but cannot go from 1 year to $500, 000 – unless the employee obtains a physical. This policy changed last year. Now you cannot change life insurance amounts unless you fill out a survey and if there any concerns by the insurance company, they will require you to submit your medical records. 16

What does Adverse Selection have to do with the following? 3. 4. Why Social Security is “mandatory”. Why Universal Health Care is so costly if make health care insurance optional. 17

What does Adverse Selection have to do with the following? 3. 4. Why Social Security is “mandatory”. Why Universal Health Care is so costly if make health care insurance optional. 17

What if Social Security was optional? What does this have to do with the annuities market? Is Adverse Selection in the Annuity Market a Big Problem? by Anthony Webb – Center for Retirement Research Introduction An annuity provides an individual or a household with insurance against living too long. In exchange for a onetime premium payment, the insurer agrees to make periodic payments to the insured for life. In theory, annuities seem like a valuable product for many retirees given an uncertain date of death. However, in practice, few people purchase annuities. Researchers who have studied this puzzle have concluded that annuities are not "actuarially fair, " that is, for someone with average life expectancy they provide only about 74 to 85 cents in income for every dollar in premium payments. . . 18

What if Social Security was optional? What does this have to do with the annuities market? Is Adverse Selection in the Annuity Market a Big Problem? by Anthony Webb – Center for Retirement Research Introduction An annuity provides an individual or a household with insurance against living too long. In exchange for a onetime premium payment, the insurer agrees to make periodic payments to the insured for life. In theory, annuities seem like a valuable product for many retirees given an uncertain date of death. However, in practice, few people purchase annuities. Researchers who have studied this puzzle have concluded that annuities are not "actuarially fair, " that is, for someone with average life expectancy they provide only about 74 to 85 cents in income for every dollar in premium payments. . . 18

National Health Insurance Running for cover , The Economist , October 4, 2008 Mr Obama aims to expand coverage through a mix of new regulations, policy reforms and subsidies. Under his plan, insurers would no longer have the right to reject anyone as too ill or too costly. He would create a "National Health Insurance Marketplace" (akin to the regulated "connector" set up in Massachusetts) where individuals and firms could purchase either private insurance plans or public alternatives modelled on Medicare. In future all but the smallest of corporations would be required to offer insurance--or pay a stiff fine. Will it work? Mrs Clinton insisted it would not. Her main objection was that this plan did not contain a key feature shared by her plan and the Massachusetts reforms: an individual mandate, or legal requirement, to purchase cover. Under Mr Obama’s plan, the only personal mandate is that parents must buy insurance for their children. Fans of mandates argue that without compulsion, reform efforts will be upended by the problem of adverse selection. Young and healthy people opt not to buy coverage, leaving a sicker and so costlier risk pool. 19

National Health Insurance Running for cover , The Economist , October 4, 2008 Mr Obama aims to expand coverage through a mix of new regulations, policy reforms and subsidies. Under his plan, insurers would no longer have the right to reject anyone as too ill or too costly. He would create a "National Health Insurance Marketplace" (akin to the regulated "connector" set up in Massachusetts) where individuals and firms could purchase either private insurance plans or public alternatives modelled on Medicare. In future all but the smallest of corporations would be required to offer insurance--or pay a stiff fine. Will it work? Mrs Clinton insisted it would not. Her main objection was that this plan did not contain a key feature shared by her plan and the Massachusetts reforms: an individual mandate, or legal requirement, to purchase cover. Under Mr Obama’s plan, the only personal mandate is that parents must buy insurance for their children. Fans of mandates argue that without compulsion, reform efforts will be upended by the problem of adverse selection. Young and healthy people opt not to buy coverage, leaving a sicker and so costlier risk pool. 19

National Health Insurance (cont) Mr Obama’s pragmatic, and politically clever, retort is that it is unreasonable to require individuals to purchase something whose cost cannot be known with certainty in advance. Therefore, he insists, he will take measures that will both expand the insurance market and reduce the overall cost of coverage by (he claims) some $2, 500 per typical family over time. That will make it so attractive to individuals to buy insurance, say his advisers, that 98% of people will do so. This points to a few question-marks about Mr Obama’s plan. One is that nobody knows how big the problem of adverse selection will be in a system without mandates. But supporting his argument for pragmatism is the trouble that Massachusetts is finding in implementing its ambitious mandate. Although hefty subsidies are provided for the poorest and insurers have been pressured to offer cheaper plans, far more residents than expected have found insurance unaffordable and have therefore been granted waivers. One architect of the state’s plan says that unless costs are reined in rapidly, it "will fall apart in a couple of years". 20

National Health Insurance (cont) Mr Obama’s pragmatic, and politically clever, retort is that it is unreasonable to require individuals to purchase something whose cost cannot be known with certainty in advance. Therefore, he insists, he will take measures that will both expand the insurance market and reduce the overall cost of coverage by (he claims) some $2, 500 per typical family over time. That will make it so attractive to individuals to buy insurance, say his advisers, that 98% of people will do so. This points to a few question-marks about Mr Obama’s plan. One is that nobody knows how big the problem of adverse selection will be in a system without mandates. But supporting his argument for pragmatism is the trouble that Massachusetts is finding in implementing its ambitious mandate. Although hefty subsidies are provided for the poorest and insurers have been pressured to offer cheaper plans, far more residents than expected have found insurance unaffordable and have therefore been granted waivers. One architect of the state’s plan says that unless costs are reined in rapidly, it "will fall apart in a couple of years". 20

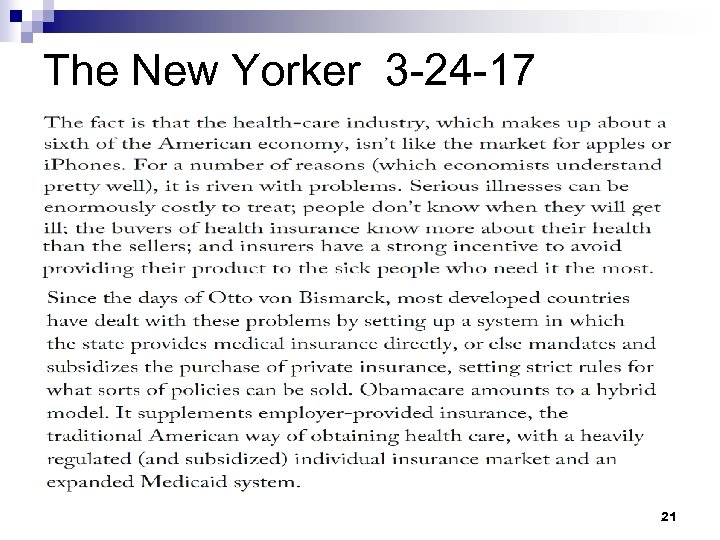

The New Yorker 3 -24 -17 21

The New Yorker 3 -24 -17 21

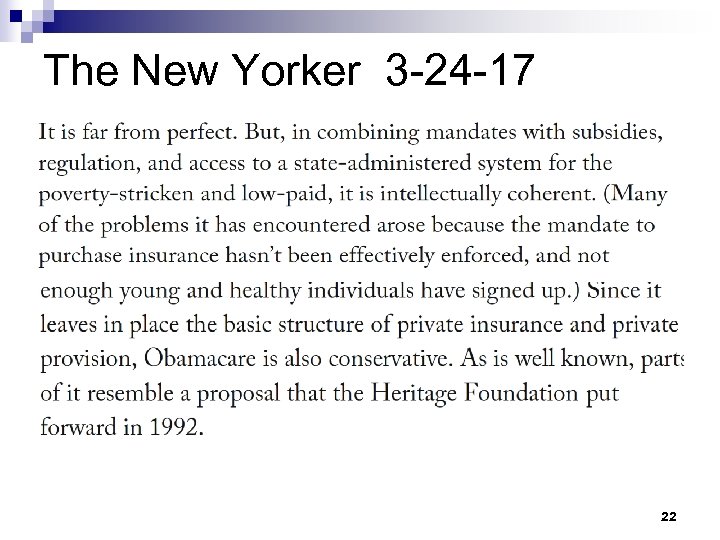

The New Yorker 3 -24 -17 22

The New Yorker 3 -24 -17 22

What does Adverse Selection have to do with the following? 6. 7. Why investors are often concerned when private companies go public with an IPO. Pool of card holders for a credit card company with high interest rates. 23

What does Adverse Selection have to do with the following? 6. 7. Why investors are often concerned when private companies go public with an IPO. Pool of card holders for a credit card company with high interest rates. 23

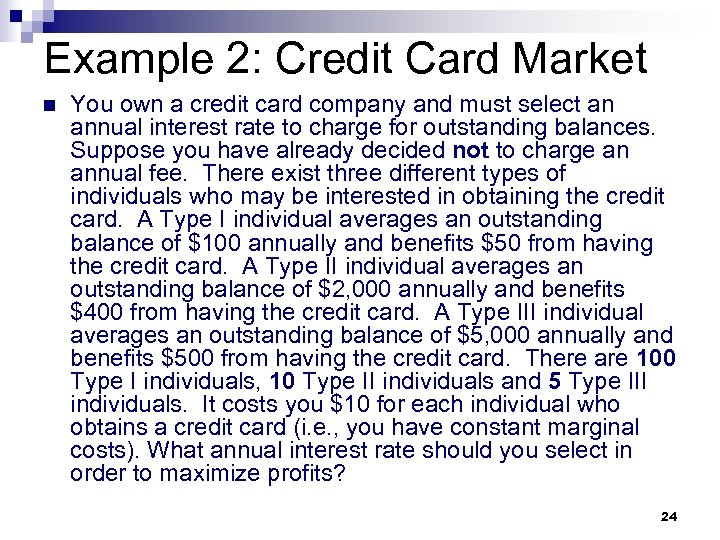

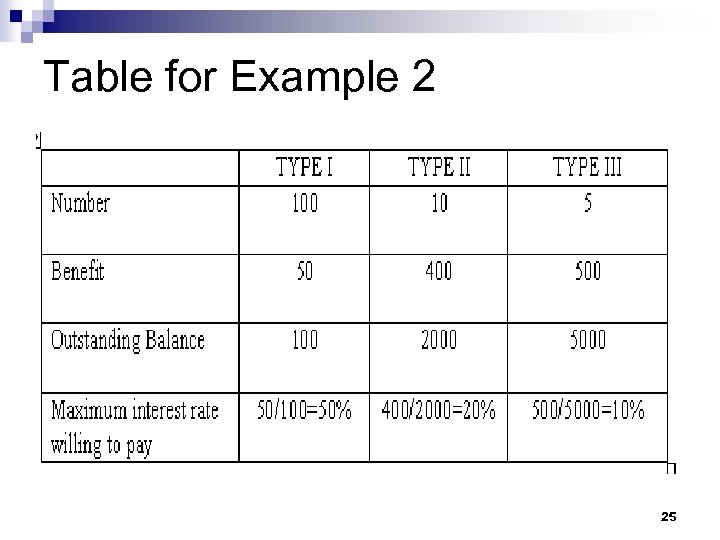

Example 2: Credit Card Market n You own a credit card company and must select an annual interest rate to charge for outstanding balances. Suppose you have already decided not to charge an annual fee. There exist three different types of individuals who may be interested in obtaining the credit card. A Type I individual averages an outstanding balance of $100 annually and benefits $50 from having the credit card. A Type II individual averages an outstanding balance of $2, 000 annually and benefits $400 from having the credit card. A Type III individual averages an outstanding balance of $5, 000 annually and benefits $500 from having the credit card. There are 100 Type I individuals, 10 Type II individuals and 5 Type III individuals. It costs you $10 for each individual who obtains a credit card (i. e. , you have constant marginal costs). What annual interest rate should you select in order to maximize profits? 24

Example 2: Credit Card Market n You own a credit card company and must select an annual interest rate to charge for outstanding balances. Suppose you have already decided not to charge an annual fee. There exist three different types of individuals who may be interested in obtaining the credit card. A Type I individual averages an outstanding balance of $100 annually and benefits $50 from having the credit card. A Type II individual averages an outstanding balance of $2, 000 annually and benefits $400 from having the credit card. A Type III individual averages an outstanding balance of $5, 000 annually and benefits $500 from having the credit card. There are 100 Type I individuals, 10 Type II individuals and 5 Type III individuals. It costs you $10 for each individual who obtains a credit card (i. e. , you have constant marginal costs). What annual interest rate should you select in order to maximize profits? 24

Table for Example 2 25

Table for Example 2 25

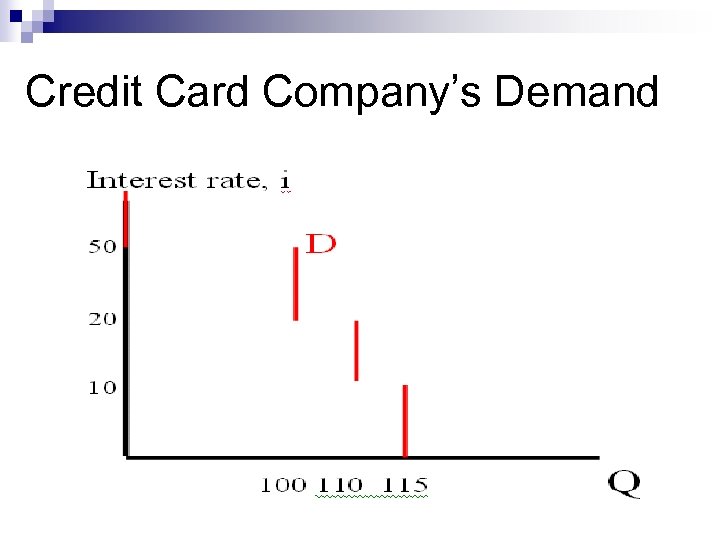

Credit Card Company’s Demand 26

Credit Card Company’s Demand 26

![What interest rate maximizes Profits? n Profits if set i=50% 100[100*. 5]-100*10 = 4, What interest rate maximizes Profits? n Profits if set i=50% 100[100*. 5]-100*10 = 4,](https://present5.com/presentation/dfafa89e22fff45d2576f8da8aadf297/image-27.jpg) What interest rate maximizes Profits? n Profits if set i=50% 100[100*. 5]-100*10 = 4, 000 n Profits if set i=20% 100[100*. 2]+10[2000*. 2]- 110*10 = 4, 900 n Profits if set i=10% 100[100*. 1]+10[2000*. 1] +5[5000*. 1] - 115*10 = 4, 350 27

What interest rate maximizes Profits? n Profits if set i=50% 100[100*. 5]-100*10 = 4, 000 n Profits if set i=20% 100[100*. 2]+10[2000*. 2]- 110*10 = 4, 900 n Profits if set i=10% 100[100*. 1]+10[2000*. 1] +5[5000*. 1] - 115*10 = 4, 350 27

What happens when Credit Card Company Maximizes Profits? n The company sets i=20% and only Types I and II obtain the credit card. Note that Type III is the good/best type for the credit card company. 28

What happens when Credit Card Company Maximizes Profits? n The company sets i=20% and only Types I and II obtain the credit card. Note that Type III is the good/best type for the credit card company. 28

Adverse Selection when Hiring Suppose you are in the HR department of a company and are deciding which of two candidates to hire. The two candidates’ qualifications look identical except one candidate lost her prior job because the company she worked for went bankrupt and the other candidate lost her prior job because she was laid-off. Which candidate would you hire and why? Gibbons and Katz, Journal Of Labor Economics http: //www. jstor. org/view/0734306 x/di 009532/00 p 0086 m/0? current. Result=0734306 x%2 bdi 009532%2 b 00 p 0086 m%2 b 0 %2 c 5755757 D&search. Url=http%3 A%2 F%2 Fwww. jstor. org%2 Fsearch%2 FBasic. Results%3 Fhp%3 D 25%26 si%3 D 1%26 gw%3 Djtx%26 jtxsi%3 D 1%26 jcpsi%3 D 1%26 artsi%3 D 1%26 Query%3 Dkatz%2 Band%2 Bgibbons%26 wc%3 D on 29

Adverse Selection when Hiring Suppose you are in the HR department of a company and are deciding which of two candidates to hire. The two candidates’ qualifications look identical except one candidate lost her prior job because the company she worked for went bankrupt and the other candidate lost her prior job because she was laid-off. Which candidate would you hire and why? Gibbons and Katz, Journal Of Labor Economics http: //www. jstor. org/view/0734306 x/di 009532/00 p 0086 m/0? current. Result=0734306 x%2 bdi 009532%2 b 00 p 0086 m%2 b 0 %2 c 5755757 D&search. Url=http%3 A%2 F%2 Fwww. jstor. org%2 Fsearch%2 FBasic. Results%3 Fhp%3 D 25%26 si%3 D 1%26 gw%3 Djtx%26 jtxsi%3 D 1%26 jcpsi%3 D 1%26 artsi%3 D 1%26 Query%3 Dkatz%2 Band%2 Bgibbons%26 wc%3 D on 29

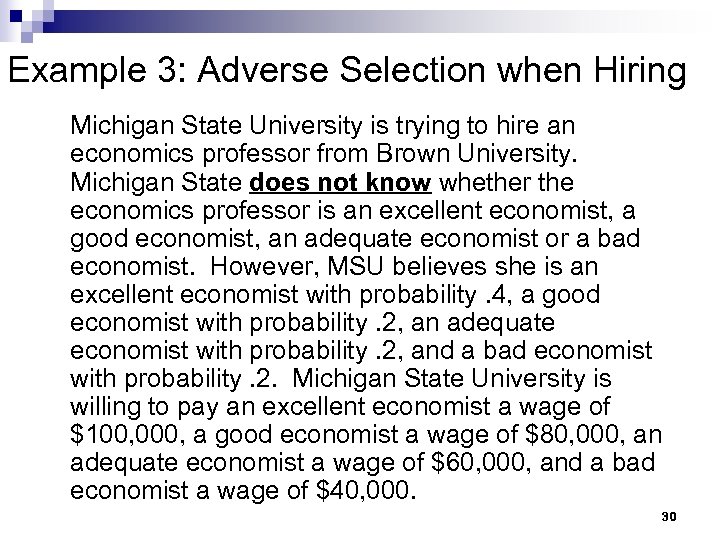

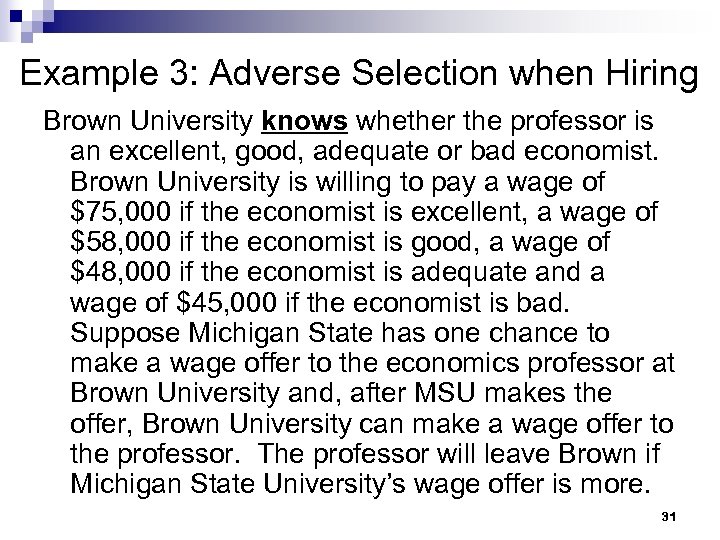

Example 3: Adverse Selection when Hiring Michigan State University is trying to hire an economics professor from Brown University. Michigan State does not know whether the economics professor is an excellent economist, a good economist, an adequate economist or a bad economist. However, MSU believes she is an excellent economist with probability. 4, a good economist with probability. 2, an adequate economist with probability. 2, and a bad economist with probability. 2. Michigan State University is willing to pay an excellent economist a wage of $100, 000, a good economist a wage of $80, 000, an adequate economist a wage of $60, 000, and a bad economist a wage of $40, 000. 30

Example 3: Adverse Selection when Hiring Michigan State University is trying to hire an economics professor from Brown University. Michigan State does not know whether the economics professor is an excellent economist, a good economist, an adequate economist or a bad economist. However, MSU believes she is an excellent economist with probability. 4, a good economist with probability. 2, an adequate economist with probability. 2, and a bad economist with probability. 2. Michigan State University is willing to pay an excellent economist a wage of $100, 000, a good economist a wage of $80, 000, an adequate economist a wage of $60, 000, and a bad economist a wage of $40, 000. 30

Example 3: Adverse Selection when Hiring Brown University knows whether the professor is an excellent, good, adequate or bad economist. Brown University is willing to pay a wage of $75, 000 if the economist is excellent, a wage of $58, 000 if the economist is good, a wage of $48, 000 if the economist is adequate and a wage of $45, 000 if the economist is bad. Suppose Michigan State has one chance to make a wage offer to the economics professor at Brown University and, after MSU makes the offer, Brown University can make a wage offer to the professor. The professor will leave Brown if Michigan State University’s wage offer is more. 31

Example 3: Adverse Selection when Hiring Brown University knows whether the professor is an excellent, good, adequate or bad economist. Brown University is willing to pay a wage of $75, 000 if the economist is excellent, a wage of $58, 000 if the economist is good, a wage of $48, 000 if the economist is adequate and a wage of $45, 000 if the economist is bad. Suppose Michigan State has one chance to make a wage offer to the economics professor at Brown University and, after MSU makes the offer, Brown University can make a wage offer to the professor. The professor will leave Brown if Michigan State University’s wage offer is more. 31

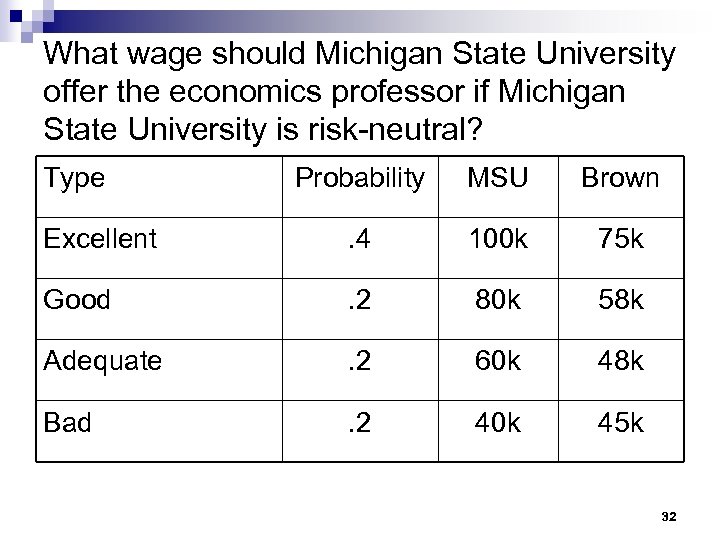

What wage should Michigan State University offer the economics professor if Michigan State University is risk-neutral? Type Probability MSU Brown Excellent . 4 100 k 75 k Good . 2 80 k 58 k Adequate . 2 60 k 48 k Bad . 2 40 k 45 k 32

What wage should Michigan State University offer the economics professor if Michigan State University is risk-neutral? Type Probability MSU Brown Excellent . 4 100 k 75 k Good . 2 80 k 58 k Adequate . 2 60 k 48 k Bad . 2 40 k 45 k 32

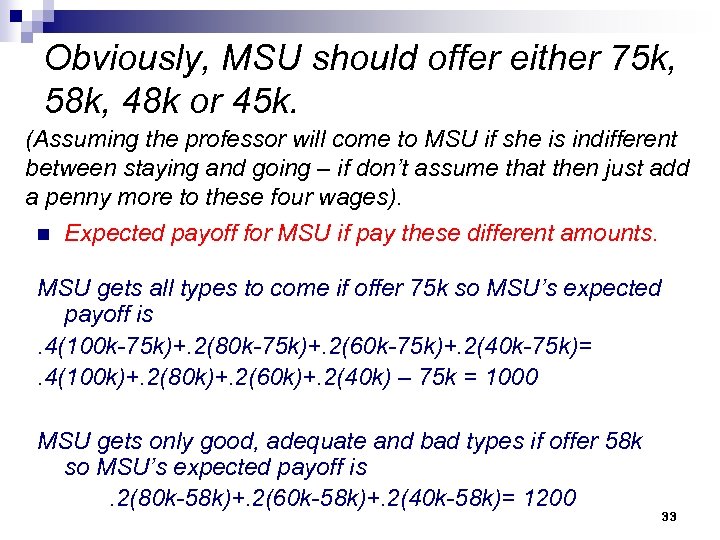

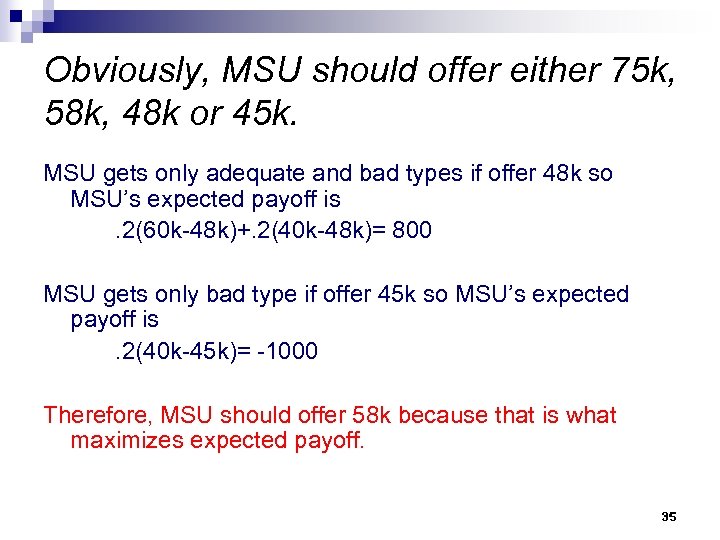

Obviously, MSU should offer either 75 k, 58 k, 48 k or 45 k. (Assuming the professor will come to MSU if she is indifferent between staying and going – if don’t assume that then just add a penny more to these four wages). n Expected payoff for MSU if pay these different amounts. MSU gets all types to come if offer 75 k so MSU’s expected payoff is. 4(100 k-75 k)+. 2(80 k-75 k)+. 2(60 k-75 k)+. 2(40 k-75 k)=. 4(100 k)+. 2(80 k)+. 2(60 k)+. 2(40 k) – 75 k = 1000 MSU gets only good, adequate and bad types if offer 58 k so MSU’s expected payoff is. 2(80 k-58 k)+. 2(60 k-58 k)+. 2(40 k-58 k)= 1200 33

Obviously, MSU should offer either 75 k, 58 k, 48 k or 45 k. (Assuming the professor will come to MSU if she is indifferent between staying and going – if don’t assume that then just add a penny more to these four wages). n Expected payoff for MSU if pay these different amounts. MSU gets all types to come if offer 75 k so MSU’s expected payoff is. 4(100 k-75 k)+. 2(80 k-75 k)+. 2(60 k-75 k)+. 2(40 k-75 k)=. 4(100 k)+. 2(80 k)+. 2(60 k)+. 2(40 k) – 75 k = 1000 MSU gets only good, adequate and bad types if offer 58 k so MSU’s expected payoff is. 2(80 k-58 k)+. 2(60 k-58 k)+. 2(40 k-58 k)= 1200 33

2 Types of Asymmetric Information 1. 2. Hidden Characteristics – things one party to a transaction knows about itself but which are unknown by the other party. Hidden Action – actions taken by one party in a relationship that cannot be observed by the other party. 34

2 Types of Asymmetric Information 1. 2. Hidden Characteristics – things one party to a transaction knows about itself but which are unknown by the other party. Hidden Action – actions taken by one party in a relationship that cannot be observed by the other party. 34

Obviously, MSU should offer either 75 k, 58 k, 48 k or 45 k. MSU gets only adequate and bad types if offer 48 k so MSU’s expected payoff is. 2(60 k-48 k)+. 2(40 k-48 k)= 800 MSU gets only bad type if offer 45 k so MSU’s expected payoff is. 2(40 k-45 k)= -1000 Therefore, MSU should offer 58 k because that is what maximizes expected payoff. 35

Obviously, MSU should offer either 75 k, 58 k, 48 k or 45 k. MSU gets only adequate and bad types if offer 48 k so MSU’s expected payoff is. 2(60 k-48 k)+. 2(40 k-48 k)= 800 MSU gets only bad type if offer 45 k so MSU’s expected payoff is. 2(40 k-45 k)= -1000 Therefore, MSU should offer 58 k because that is what maximizes expected payoff. 35

B) MORAL HAZARD n Definition Situation where one party to a contract can take a hidden action that benefits him or her at the expense of another party. 36

B) MORAL HAZARD n Definition Situation where one party to a contract can take a hidden action that benefits him or her at the expense of another party. 36

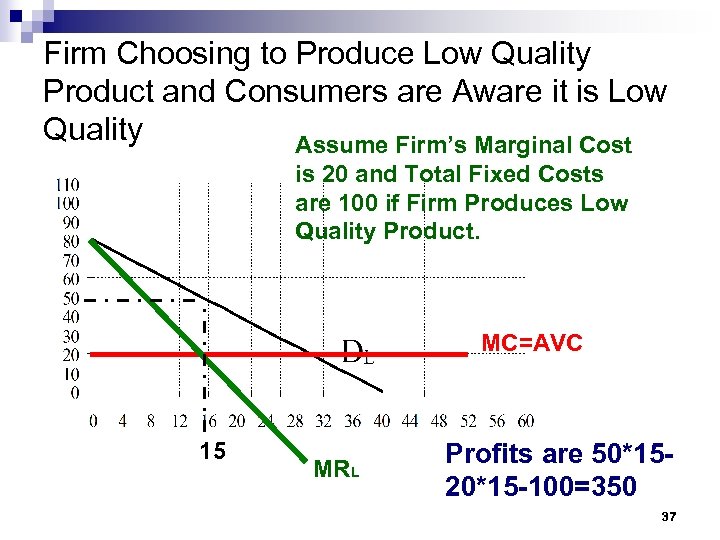

Firm Choosing to Produce Low Quality Product and Consumers are Aware it is Low Quality Assume Firm’s Marginal Cost is 20 and Total Fixed Costs are 100 if Firm Produces Low Quality Product. MC=AVC 15 MRL Profits are 50*1520*15 -100=350 37

Firm Choosing to Produce Low Quality Product and Consumers are Aware it is Low Quality Assume Firm’s Marginal Cost is 20 and Total Fixed Costs are 100 if Firm Produces Low Quality Product. MC=AVC 15 MRL Profits are 50*1520*15 -100=350 37

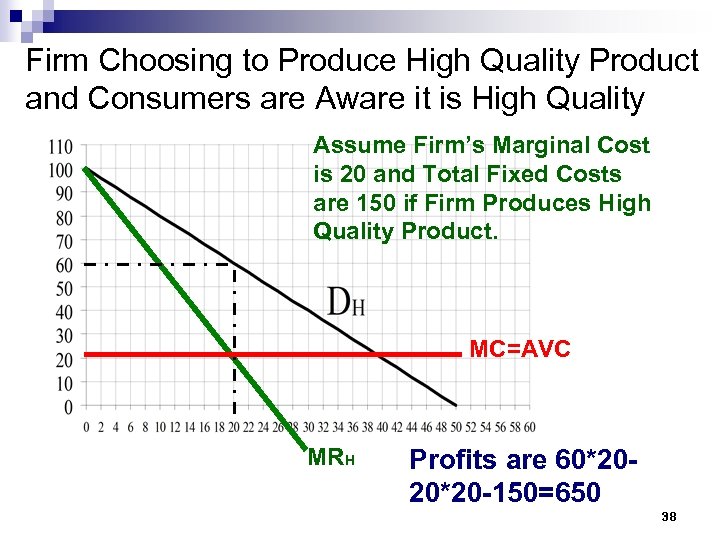

Firm Choosing to Produce High Quality Product and Consumers are Aware it is High Quality Assume Firm’s Marginal Cost is 20 and Total Fixed Costs are 150 if Firm Produces High Quality Product. MC=AVC MRH Profits are 60*2020*20 -150=650 38

Firm Choosing to Produce High Quality Product and Consumers are Aware it is High Quality Assume Firm’s Marginal Cost is 20 and Total Fixed Costs are 150 if Firm Produces High Quality Product. MC=AVC MRH Profits are 60*2020*20 -150=650 38

Example of Moral Hazard What if Firm can choose to Produce Low or High Quality and Consumers cannot differentiate a Low Quality from a High Quality Product at the time they decide whether to Purchase? Assume consumers are aware of the “game”. 39

Example of Moral Hazard What if Firm can choose to Produce Low or High Quality and Consumers cannot differentiate a Low Quality from a High Quality Product at the time they decide whether to Purchase? Assume consumers are aware of the “game”. 39

What does Firm Do? Would firm select to produce High quality if the consumers believe that the firm is producing a high quality product? No because the firm could increase profits from 650 to 700 by producing a low quality product (given that consumer believe it is a high quality product). 40

What does Firm Do? Would firm select to produce High quality if the consumers believe that the firm is producing a high quality product? No because the firm could increase profits from 650 to 700 by producing a low quality product (given that consumer believe it is a high quality product). 40

If Consumers know game, would they believe the firm is producing a high quality product? Given that the firm has incentive to produce low quality no matter what the consumers believe the quality of the product, the consumers should believe that the firm produces the low quality product. In the end, the consumers believe it is low quality, the firm produces a low quality and firm’s profits are $350. 41

If Consumers know game, would they believe the firm is producing a high quality product? Given that the firm has incentive to produce low quality no matter what the consumers believe the quality of the product, the consumers should believe that the firm produces the low quality product. In the end, the consumers believe it is low quality, the firm produces a low quality and firm’s profits are $350. 41

Other Situations/Topics involving Moral Hazard n Employee Compensation and Monitoring CEO PAY http: //www. forbes. com/2010/01/21/state-of-ceo-leadership-governance-boards. html? partner=whiteglove_bing http: //www. forbes. com/2009/04/22/executive-pay-ceo-leadership-compensation-best-boss-09 -ceo_land. html D’Antonio’s Contract (MSU Football Coach) 42

Other Situations/Topics involving Moral Hazard n Employee Compensation and Monitoring CEO PAY http: //www. forbes. com/2010/01/21/state-of-ceo-leadership-governance-boards. html? partner=whiteglove_bing http: //www. forbes. com/2009/04/22/executive-pay-ceo-leadership-compensation-best-boss-09 -ceo_land. html D’Antonio’s Contract (MSU Football Coach) 42

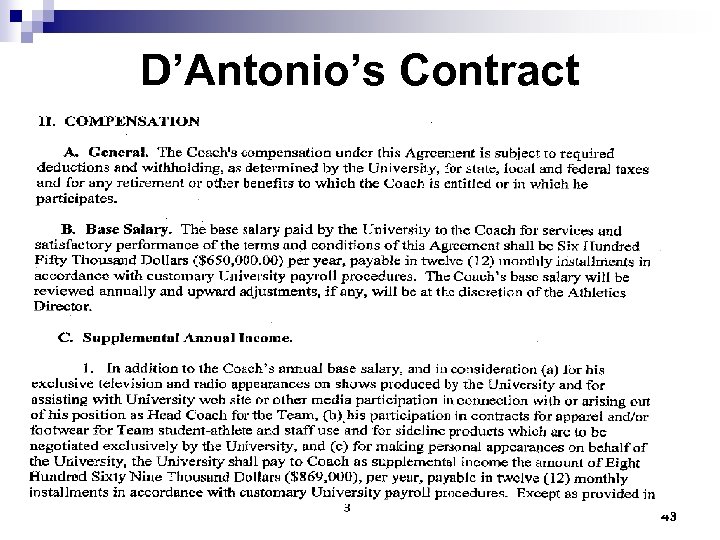

D’Antonio’s Contract 43

D’Antonio’s Contract 43

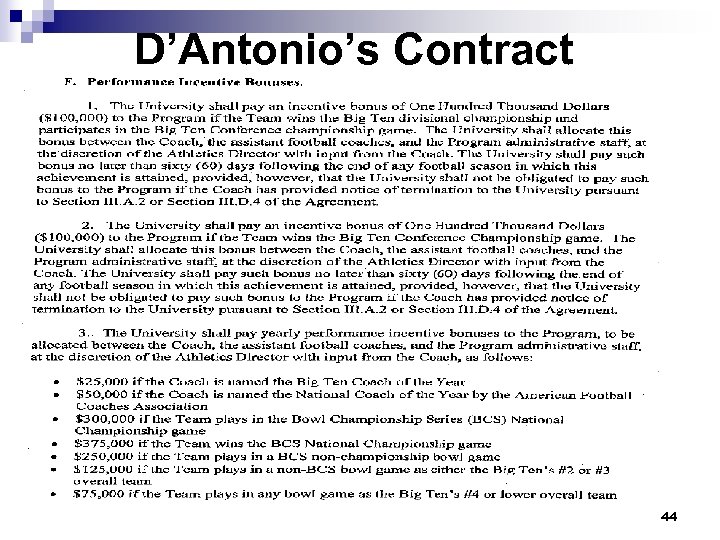

D’Antonio’s Contract 44

D’Antonio’s Contract 44

Other Situations/Topics involving Moral Hazard n Employee Compensation and Monitoring CEO PAY http: //www. forbes. com/2010/01/21/state-of-ceo-leadership-governance-boards. html? partner=whiteglove_bing http: //www. forbes. com/2009/04/22/executive-pay-ceo-leadership-compensation-best-boss-09 -ceo_land. html D’Antonio’s Contract (MSU Football Coach) Geofencing 45

Other Situations/Topics involving Moral Hazard n Employee Compensation and Monitoring CEO PAY http: //www. forbes. com/2010/01/21/state-of-ceo-leadership-governance-boards. html? partner=whiteglove_bing http: //www. forbes. com/2009/04/22/executive-pay-ceo-leadership-compensation-best-boss-09 -ceo_land. html D’Antonio’s Contract (MSU Football Coach) Geofencing 45

Cell Phones The technology causing a stir is called "geofences, " and here's how it might work: A struggling salesman veers off his route and slinks into a bar. Within moments, his boss knows he's there. The bartender didn't rat him out. It was his work-issued cell phone. By bringing it inside, the phone crossed a computer-generated "fence" drawn around the bar by the boss. A tracking chip in the phone triggered an e-mail that was sent back to the office: The salesman's drinking lunch again. Geofences, or computer-generated barriers, have become more popular as a way to boost productivity and cut waste. But they've also raised the eyebrows of workers, labor unions and privacy groups who, among other things, are concerned about the impact on morale. "It's basically telling employees: 'We don't trust you, ' " said William Herbert, a New York labor attorney who has studied the so-called "human tracking" issue. Makers of the software, though, point to the money that can be saved by paying for actual hours worked and insist good workers have nothing to fear. 46

Cell Phones The technology causing a stir is called "geofences, " and here's how it might work: A struggling salesman veers off his route and slinks into a bar. Within moments, his boss knows he's there. The bartender didn't rat him out. It was his work-issued cell phone. By bringing it inside, the phone crossed a computer-generated "fence" drawn around the bar by the boss. A tracking chip in the phone triggered an e-mail that was sent back to the office: The salesman's drinking lunch again. Geofences, or computer-generated barriers, have become more popular as a way to boost productivity and cut waste. But they've also raised the eyebrows of workers, labor unions and privacy groups who, among other things, are concerned about the impact on morale. "It's basically telling employees: 'We don't trust you, ' " said William Herbert, a New York labor attorney who has studied the so-called "human tracking" issue. Makers of the software, though, point to the money that can be saved by paying for actual hours worked and insist good workers have nothing to fear. 46

Other Situations/Topics involving Moral Hazard Employee Compensation and Monitoring CEO PAY D’Antonio’s Contract (MSU Football Coach) Geofencing n Insurance (Unemployment, Life, Health, Disability) n Hiking n 47

Other Situations/Topics involving Moral Hazard Employee Compensation and Monitoring CEO PAY D’Antonio’s Contract (MSU Football Coach) Geofencing n Insurance (Unemployment, Life, Health, Disability) n Hiking n 47

Hiking with a locator Mount Hood hikers praise dog as debate erupts over requiring locators SALEM, Ore. (AP) — The three hikers rescued after a fall and an icy night on Mount Hood said Wednesday their survival techniques included exercise and pep talks. Aiding in the successful outcome was the fact that the climbers had an electronic locator unit that helped rescuers find them. On Tuesday, a state House panel opened hearings in Salem on a bill to require that climbers who intend to go above 10, 000 feet on Mount Hood from November through March carry the locators. But veteran mountaineers urged legislators to reject the bill. Some warned that requiring locators — easily activated in a crisis — would foster passivity among climbers. The devices weigh 8 ounces and cost a rental fee of $5, hardly a physical or financial burden, Lim said. In Tuesday's hearing, however, the climbers emphasized the argument that requiring the locators would give many climbers a false sense of security in an inherently dangerous sport. 48

Hiking with a locator Mount Hood hikers praise dog as debate erupts over requiring locators SALEM, Ore. (AP) — The three hikers rescued after a fall and an icy night on Mount Hood said Wednesday their survival techniques included exercise and pep talks. Aiding in the successful outcome was the fact that the climbers had an electronic locator unit that helped rescuers find them. On Tuesday, a state House panel opened hearings in Salem on a bill to require that climbers who intend to go above 10, 000 feet on Mount Hood from November through March carry the locators. But veteran mountaineers urged legislators to reject the bill. Some warned that requiring locators — easily activated in a crisis — would foster passivity among climbers. The devices weigh 8 ounces and cost a rental fee of $5, hardly a physical or financial burden, Lim said. In Tuesday's hearing, however, the climbers emphasized the argument that requiring the locators would give many climbers a false sense of security in an inherently dangerous sport. 48

Other Situations/Topics involving Moral Hazard n Employee Compensation and Monitoring CEO PAY n D’Antonio’s Contract (MSU Football Coach) Geofencing n Insurance (Unemployment, Life, Health, Disability) n Hiking n Bailout 49

Other Situations/Topics involving Moral Hazard n Employee Compensation and Monitoring CEO PAY n D’Antonio’s Contract (MSU Football Coach) Geofencing n Insurance (Unemployment, Life, Health, Disability) n Hiking n Bailout 49

Bailout THE BAILOUT BALANCING ACT COULD WORK , Business Week , 9 - 29 -08 By refusing to pony up more money to save Lehman Brothers, the U. S. government took a high-stakes gamble over the weekend of Sept. 12 -14. After committing $29 billion to the teardown of Bear Stearns and up to $200 billion in the nationalization of Fannie Maeand Freddie Mac, Washington looked at the plight of Lehman and just said no. Yet, not two days later, the Federal Reserve gave troubled insurer American International Group an $85 billion loan, effectively taking over the company. Who survives and who doesn't? Those decisions could usher in the end of the credit crisis--or they might mark the end of any hope for an economic recovery next year. 50

Bailout THE BAILOUT BALANCING ACT COULD WORK , Business Week , 9 - 29 -08 By refusing to pony up more money to save Lehman Brothers, the U. S. government took a high-stakes gamble over the weekend of Sept. 12 -14. After committing $29 billion to the teardown of Bear Stearns and up to $200 billion in the nationalization of Fannie Maeand Freddie Mac, Washington looked at the plight of Lehman and just said no. Yet, not two days later, the Federal Reserve gave troubled insurer American International Group an $85 billion loan, effectively taking over the company. Who survives and who doesn't? Those decisions could usher in the end of the credit crisis--or they might mark the end of any hope for an economic recovery next year. 50

Bailout THE BAILOUT BALANCING ACT COULD WORK , Business Week , 9 - 29 -08 This new uncertainty in the outlook reflects the cost of stepping back from moral hazard. Policymakers know that moral hazard--which arises when institutions don't bear the full consequences of their actions--can never be eliminated. Rather, they view the problem as a trade-off between the risk that government bailouts could encourage financial imprudence and the danger that without them, an event such as the failure of AIG could collapse the system. In the case of Lehman, the Fed and Treasury took a gamble that Lehman's failure could be a major step toward healthier financial markets. As for AIG, the risk to the system was simply too great. 51

Bailout THE BAILOUT BALANCING ACT COULD WORK , Business Week , 9 - 29 -08 This new uncertainty in the outlook reflects the cost of stepping back from moral hazard. Policymakers know that moral hazard--which arises when institutions don't bear the full consequences of their actions--can never be eliminated. Rather, they view the problem as a trade-off between the risk that government bailouts could encourage financial imprudence and the danger that without them, an event such as the failure of AIG could collapse the system. In the case of Lehman, the Fed and Treasury took a gamble that Lehman's failure could be a major step toward healthier financial markets. As for AIG, the risk to the system was simply too great. 51

Bailout A cautionary tale from the future; Buttonwood , The Economist , 9 -27 -08 FINANCIAL authorities in America and Europe took sweeping powers yesterday to avert a financial crisis by imposing restrictions on markets. In their sights are a peculiar brand of speculators known as "long-buyers" who buy assets not to live off the income they generate but to profit from rising prices. "Some of these people buy homes that they have no intention of living in, " said Lord Poohbah, chairman of Britain? s Financial Services Authority, "and others buy shares they plan to own for just days or weeks, rather than the prudent time period of several years. " Their actions force prices up above fundamental valuation levels, critics say, causing some British tabloid newspapers to call leading fund managers "greedy pigs". 52

Bailout A cautionary tale from the future; Buttonwood , The Economist , 9 -27 -08 FINANCIAL authorities in America and Europe took sweeping powers yesterday to avert a financial crisis by imposing restrictions on markets. In their sights are a peculiar brand of speculators known as "long-buyers" who buy assets not to live off the income they generate but to profit from rising prices. "Some of these people buy homes that they have no intention of living in, " said Lord Poohbah, chairman of Britain? s Financial Services Authority, "and others buy shares they plan to own for just days or weeks, rather than the prudent time period of several years. " Their actions force prices up above fundamental valuation levels, critics say, causing some British tabloid newspapers to call leading fund managers "greedy pigs". 52

Bailout A cautionary tale from the future; Buttonwood , The Economist , 9 -27 -08 Particular criticism has been reserved for people dubbed "naked long-buyers", those who try to buy homes without putting up a deposit. "Such people are in effect renters with a free call option on rising house prices, " said one financial analyst, "but they expect to be bailed out by taxpayers when house prices fall. " Not only is this a clear case of moral hazard (the encouragement of irresponsible risk-taking) but their activities drive up house prices, putting them beyond the reach of hard-working families who have diligently saved up to put down a deposit. Also in the speculative category are "buy-to-letters" who buy a string of houses with borrowed money in the hope of making outsize gains. 53

Bailout A cautionary tale from the future; Buttonwood , The Economist , 9 -27 -08 Particular criticism has been reserved for people dubbed "naked long-buyers", those who try to buy homes without putting up a deposit. "Such people are in effect renters with a free call option on rising house prices, " said one financial analyst, "but they expect to be bailed out by taxpayers when house prices fall. " Not only is this a clear case of moral hazard (the encouragement of irresponsible risk-taking) but their activities drive up house prices, putting them beyond the reach of hard-working families who have diligently saved up to put down a deposit. Also in the speculative category are "buy-to-letters" who buy a string of houses with borrowed money in the hope of making outsize gains. 53

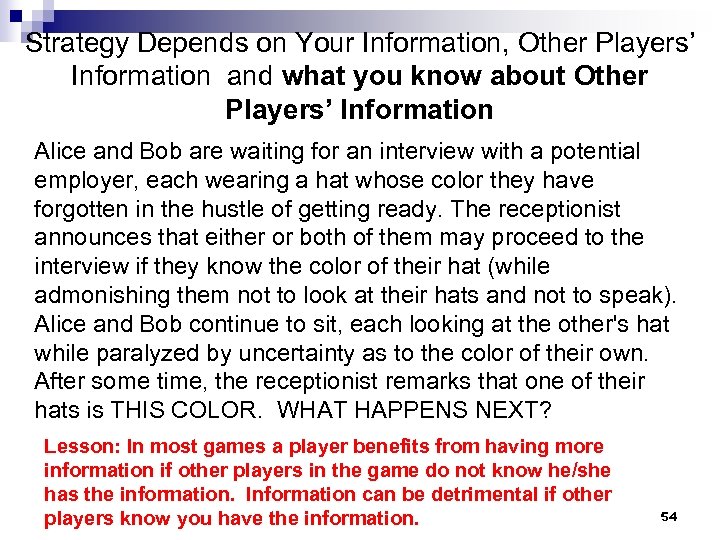

Strategy Depends on Your Information, Other Players’ Information and what you know about Other Players’ Information Alice and Bob are waiting for an interview with a potential employer, each wearing a hat whose color they have forgotten in the hustle of getting ready. The receptionist announces that either or both of them may proceed to the interview if they know the color of their hat (while admonishing them not to look at their hats and not to speak). Alice and Bob continue to sit, each looking at the other's hat while paralyzed by uncertainty as to the color of their own. After some time, the receptionist remarks that one of their hats is THIS COLOR. WHAT HAPPENS NEXT? Lesson: In most games a player benefits from having more information if other players in the game do not know he/she has the information. Information can be detrimental if other players know you have the information. 54

Strategy Depends on Your Information, Other Players’ Information and what you know about Other Players’ Information Alice and Bob are waiting for an interview with a potential employer, each wearing a hat whose color they have forgotten in the hustle of getting ready. The receptionist announces that either or both of them may proceed to the interview if they know the color of their hat (while admonishing them not to look at their hats and not to speak). Alice and Bob continue to sit, each looking at the other's hat while paralyzed by uncertainty as to the color of their own. After some time, the receptionist remarks that one of their hats is THIS COLOR. WHAT HAPPENS NEXT? Lesson: In most games a player benefits from having more information if other players in the game do not know he/she has the information. Information can be detrimental if other players know you have the information. 54

Screening and Signaling n Definitions: Screening- An attempt by an uninformed party to sort individuals according to their characteristics. Signaling- An attempt by an informed party to send an observable indicator of his or her hidden characteristics to an uniformed party.

Screening and Signaling n Definitions: Screening- An attempt by an uninformed party to sort individuals according to their characteristics. Signaling- An attempt by an informed party to send an observable indicator of his or her hidden characteristics to an uniformed party.

Examples of Screening 1. 2. 3. 4. Screening to enable price discrimination (coupons, rebates, outlet malls, …) Screening to sort different types of workers. Choice of deductibles associated with different types of insurance. Obtaining a physical to obtain a favorable life insurance policy.

Examples of Screening 1. 2. 3. 4. Screening to enable price discrimination (coupons, rebates, outlet malls, …) Screening to sort different types of workers. Choice of deductibles associated with different types of insurance. Obtaining a physical to obtain a favorable life insurance policy.

Examples of Signaling 1. 2. 3. Obtaining an advanced degree such as an MBA or Ph. D. Seller offering a warranty. Labor contract negotiations/ Negotiating a compensation package.

Examples of Signaling 1. 2. 3. Obtaining an advanced degree such as an MBA or Ph. D. Seller offering a warranty. Labor contract negotiations/ Negotiating a compensation package.

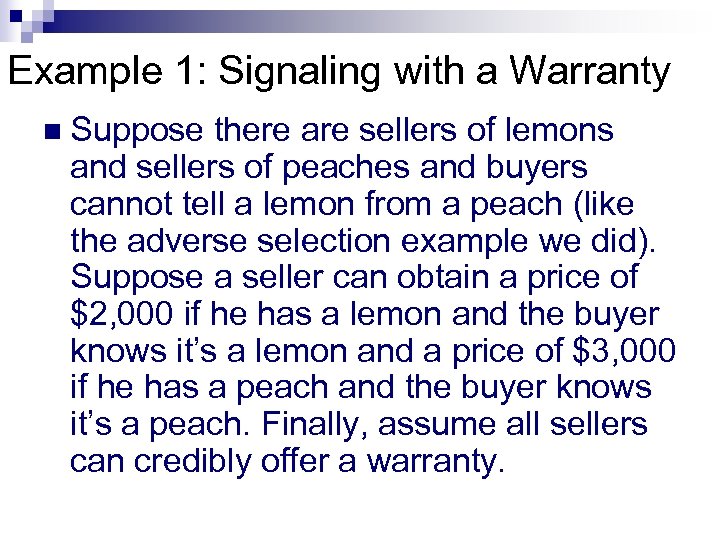

Example 1: Signaling with a Warranty n Suppose there are sellers of lemons and sellers of peaches and buyers cannot tell a lemon from a peach (like the adverse selection example we did). Suppose a seller can obtain a price of $2, 000 if he has a lemon and the buyer knows it’s a lemon and a price of $3, 000 if he has a peach and the buyer knows it’s a peach. Finally, assume all sellers can credibly offer a warranty.

Example 1: Signaling with a Warranty n Suppose there are sellers of lemons and sellers of peaches and buyers cannot tell a lemon from a peach (like the adverse selection example we did). Suppose a seller can obtain a price of $2, 000 if he has a lemon and the buyer knows it’s a lemon and a price of $3, 000 if he has a peach and the buyer knows it’s a peach. Finally, assume all sellers can credibly offer a warranty.

Example 1: Signaling with a Warranty n Let the probability of a lemon breaking down be. 70 and the probability of a peach breaking down be. 10. Suppose the warranty states that if the car breaks down, the seller will pay the buyer $1, 500 to repair the car.

Example 1: Signaling with a Warranty n Let the probability of a lemon breaking down be. 70 and the probability of a peach breaking down be. 10. Suppose the warranty states that if the car breaks down, the seller will pay the buyer $1, 500 to repair the car.

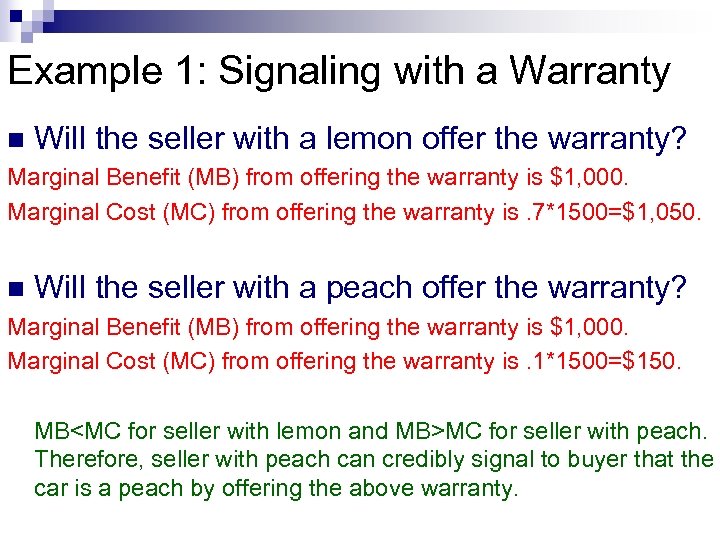

Example 1: Signaling with a Warranty n Will the seller with a lemon offer the warranty? Marginal Benefit (MB) from offering the warranty is $1, 000. Marginal Cost (MC) from offering the warranty is. 7*1500=$1, 050. n Will the seller with a peach offer the warranty? Marginal Benefit (MB) from offering the warranty is $1, 000. Marginal Cost (MC) from offering the warranty is. 1*1500=$150. MB

Example 1: Signaling with a Warranty n Will the seller with a lemon offer the warranty? Marginal Benefit (MB) from offering the warranty is $1, 000. Marginal Cost (MC) from offering the warranty is. 7*1500=$1, 050. n Will the seller with a peach offer the warranty? Marginal Benefit (MB) from offering the warranty is $1, 000. Marginal Cost (MC) from offering the warranty is. 1*1500=$150. MB

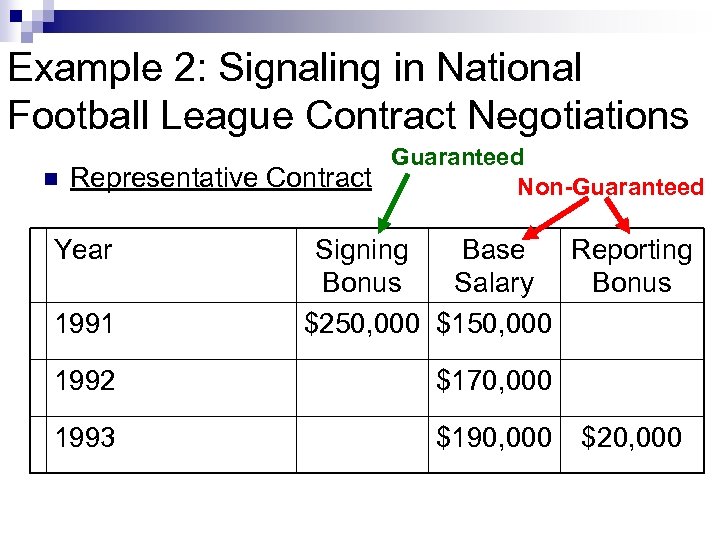

Example 2: Signaling in National Football League Contract Negotiations Guaranteed n Representative Contract Non-Guaranteed Year 1991 Signing Base Reporting Bonus Salary Bonus $250, 000 $150, 000 1992 $170, 000 1993 $190, 000 $20, 000

Example 2: Signaling in National Football League Contract Negotiations Guaranteed n Representative Contract Non-Guaranteed Year 1991 Signing Base Reporting Bonus Salary Bonus $250, 000 $150, 000 1992 $170, 000 1993 $190, 000 $20, 000

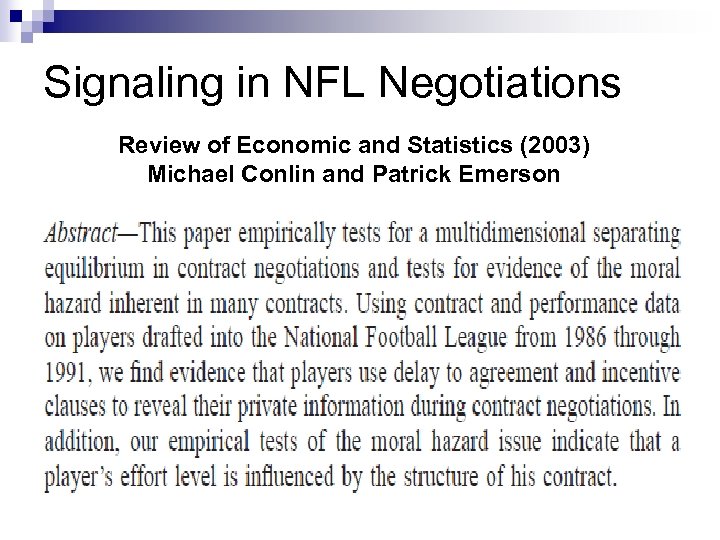

Signaling in NFL Negotiations Review of Economic and Statistics (2003) Michael Conlin and Patrick Emerson

Signaling in NFL Negotiations Review of Economic and Statistics (2003) Michael Conlin and Patrick Emerson

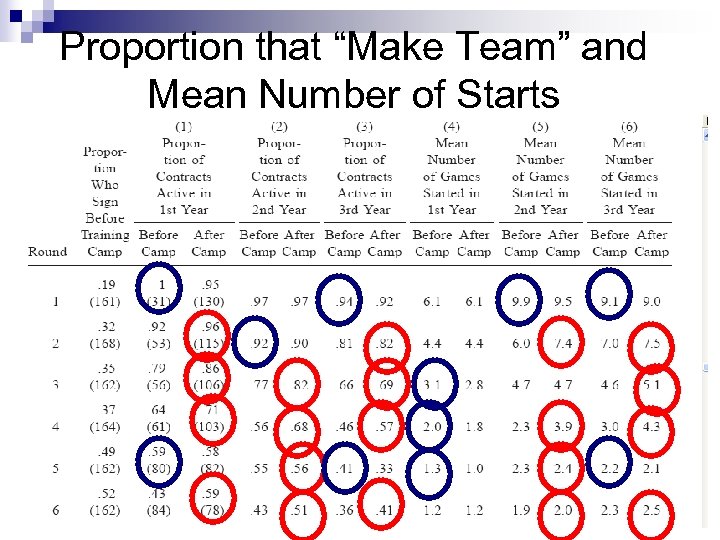

Proportion that “Make Team” and Mean Number of Starts

Proportion that “Make Team” and Mean Number of Starts

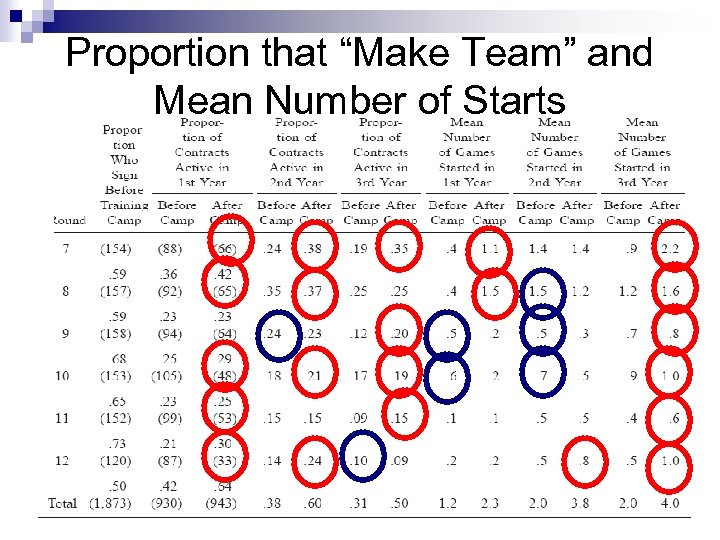

Proportion that “Make Team” and Mean Number of Starts

Proportion that “Make Team” and Mean Number of Starts

Voluntary Disclosure http: //www. bing. com/videos/search? q=let's+make+a+deal+video&FORM=VIRE 9#view=detail&mid=C 0 C 1 C 3 E 81 E 7 CAF 333 E 9 D http: //www. bing. com/videos/search? q=let's+make+a+deal+video&FORM=VIRE 7#view=detail&mid=EA 1 D 4 AEFA 3 FAC 368 BED 3 http: //www. bing. com/videos/search? q=let's+make+a+deal+video&FORM=VIRE 1#view=detail&mid=44 E 87 A 0 C 8994 C 25 F 0 CEF

Voluntary Disclosure http: //www. bing. com/videos/search? q=let's+make+a+deal+video&FORM=VIRE 9#view=detail&mid=C 0 C 1 C 3 E 81 E 7 CAF 333 E 9 D http: //www. bing. com/videos/search? q=let's+make+a+deal+video&FORM=VIRE 7#view=detail&mid=EA 1 D 4 AEFA 3 FAC 368 BED 3 http: //www. bing. com/videos/search? q=let's+make+a+deal+video&FORM=VIRE 1#view=detail&mid=44 E 87 A 0 C 8994 C 25 F 0 CEF

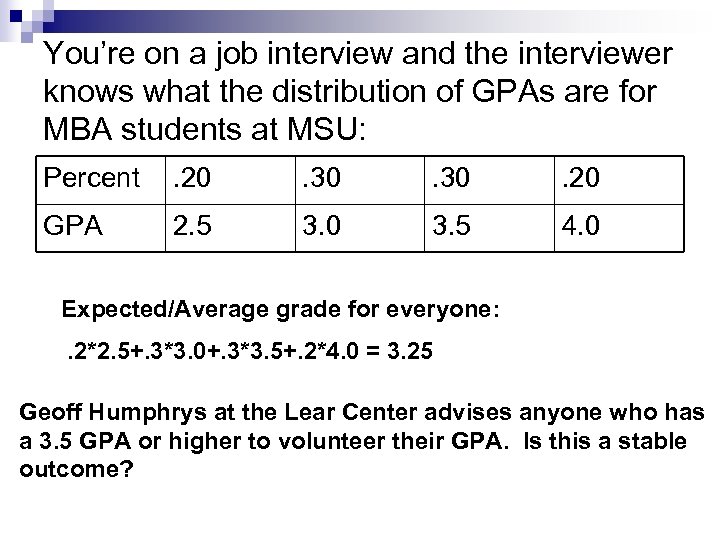

You’re on a job interview and the interviewer knows what the distribution of GPAs are for MBA students at MSU: Percent . 20 . 30 . 20 GPA 2. 5 3. 0 3. 5 4. 0 Expected/Average grade for everyone: . 2*2. 5+. 3*3. 0+. 3*3. 5+. 2*4. 0 = 3. 25 Geoff Humphrys at the Lear Center advises anyone who has a 3. 5 GPA or higher to volunteer their GPA. Is this a stable outcome?

You’re on a job interview and the interviewer knows what the distribution of GPAs are for MBA students at MSU: Percent . 20 . 30 . 20 GPA 2. 5 3. 0 3. 5 4. 0 Expected/Average grade for everyone: . 2*2. 5+. 3*3. 0+. 3*3. 5+. 2*4. 0 = 3. 25 Geoff Humphrys at the Lear Center advises anyone who has a 3. 5 GPA or higher to volunteer their GPA. Is this a stable outcome?

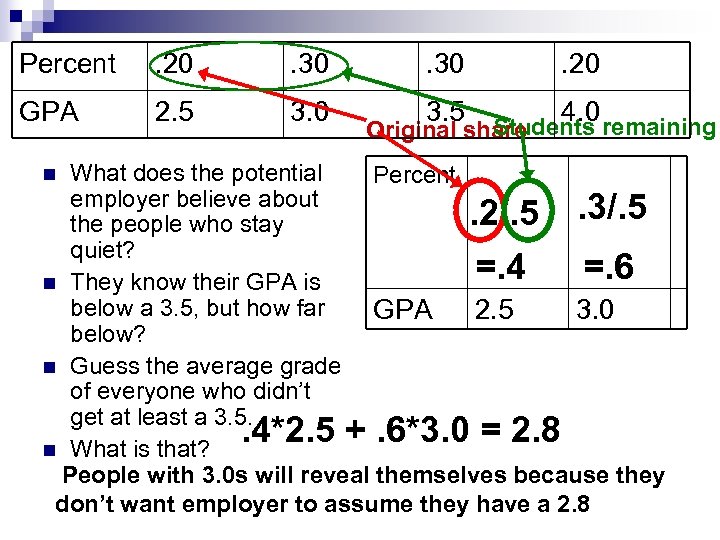

Percent . 20 . 30 . 20 GPA 2. 5 3. 0 3. 5 4. 0 Students remaining Original share What does the potential Percent employer believe about . 2/. 5. 3/. 5 the people who stay quiet? =. 4 =. 6 n They know their GPA is below a 3. 5, but how far GPA 2. 5 3. 0 below? n Guess the average grade of everyone who didn’t get at least a 3. 5. . 4*2. 5 +. 6*3. 0 = 2. 8 n What is that? People with 3. 0 s will reveal themselves because they don’t want employer to assume they have a 2. 8 n

Percent . 20 . 30 . 20 GPA 2. 5 3. 0 3. 5 4. 0 Students remaining Original share What does the potential Percent employer believe about . 2/. 5. 3/. 5 the people who stay quiet? =. 4 =. 6 n They know their GPA is below a 3. 5, but how far GPA 2. 5 3. 0 below? n Guess the average grade of everyone who didn’t get at least a 3. 5. . 4*2. 5 +. 6*3. 0 = 2. 8 n What is that? People with 3. 0 s will reveal themselves because they don’t want employer to assume they have a 2. 8 n

Voluntary disclosure Full disclosure principle - if some individuals stand to benefits by revealing a favorable trait, others will be forced to disclose their less favorable values. n If disclosure is costless, only the lowest types will not reveal their quality n

Voluntary disclosure Full disclosure principle - if some individuals stand to benefits by revealing a favorable trait, others will be forced to disclose their less favorable values. n If disclosure is costless, only the lowest types will not reveal their quality n

Voluntary Disclosure and Signaling n Voluntary Disclosure differs from Signaling because we are assuming that the cost of lying (i. e. , saying you have a GPA of 4. 0 when you have a GPA of 3. 5) is so large than no one does it. Therefore, the decision is to either reveal your private information truthfully or don’t reveal.

Voluntary Disclosure and Signaling n Voluntary Disclosure differs from Signaling because we are assuming that the cost of lying (i. e. , saying you have a GPA of 4. 0 when you have a GPA of 3. 5) is so large than no one does it. Therefore, the decision is to either reveal your private information truthfully or don’t reveal.

Voluntary Disclosure n If it is true that only the lowest types don’t reveal and that consumers/employers (the uninformed party) can infer they are the lowest type, then government should not have to intervene in the market – for example, they should not require firms producing salad dressings to report the fat content and they should not require restaurants to report their hygiene score.

Voluntary Disclosure n If it is true that only the lowest types don’t reveal and that consumers/employers (the uninformed party) can infer they are the lowest type, then government should not have to intervene in the market – for example, they should not require firms producing salad dressings to report the fat content and they should not require restaurants to report their hygiene score.

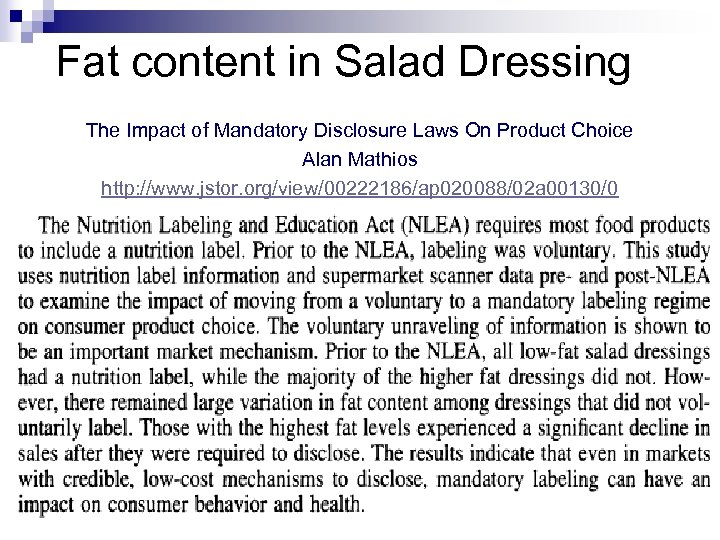

Fat content in Salad Dressing The Impact of Mandatory Disclosure Laws On Product Choice Alan Mathios http: //www. jstor. org/view/00222186/ap 020088/02 a 00130/0

Fat content in Salad Dressing The Impact of Mandatory Disclosure Laws On Product Choice Alan Mathios http: //www. jstor. org/view/00222186/ap 020088/02 a 00130/0

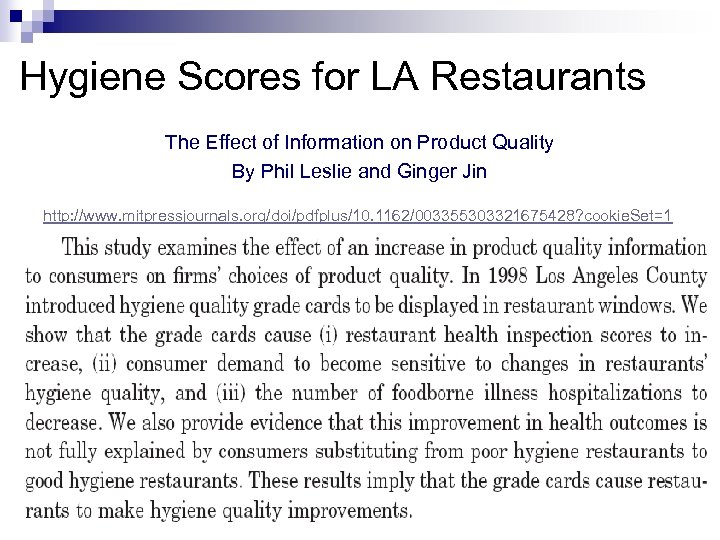

Hygiene Scores for LA Restaurants The Effect of Information on Product Quality By Phil Leslie and Ginger Jin http: //www. mitpressjournals. org/doi/pdfplus/10. 1162/003355303321675428? cookie. Set=1

Hygiene Scores for LA Restaurants The Effect of Information on Product Quality By Phil Leslie and Ginger Jin http: //www. mitpressjournals. org/doi/pdfplus/10. 1162/003355303321675428? cookie. Set=1

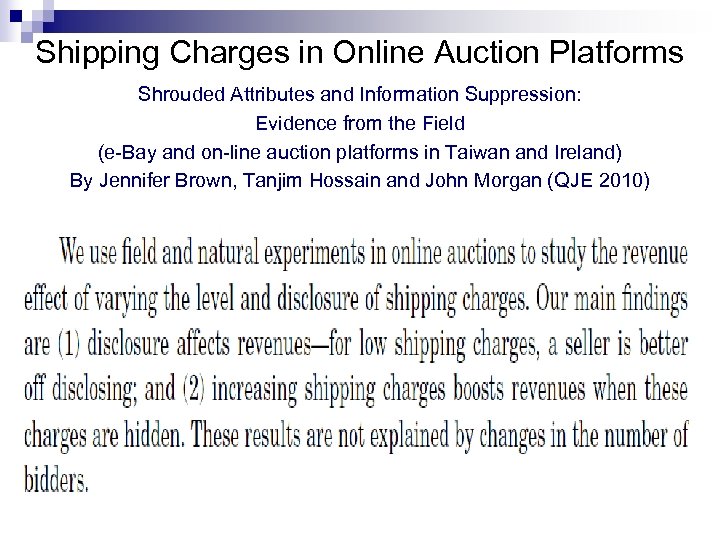

Shipping Charges in Online Auction Platforms Shrouded Attributes and Information Suppression: Evidence from the Field (e-Bay and on-line auction platforms in Taiwan and Ireland) By Jennifer Brown, Tanjim Hossain and John Morgan (QJE 2010)

Shipping Charges in Online Auction Platforms Shrouded Attributes and Information Suppression: Evidence from the Field (e-Bay and on-line auction platforms in Taiwan and Ireland) By Jennifer Brown, Tanjim Hossain and John Morgan (QJE 2010)

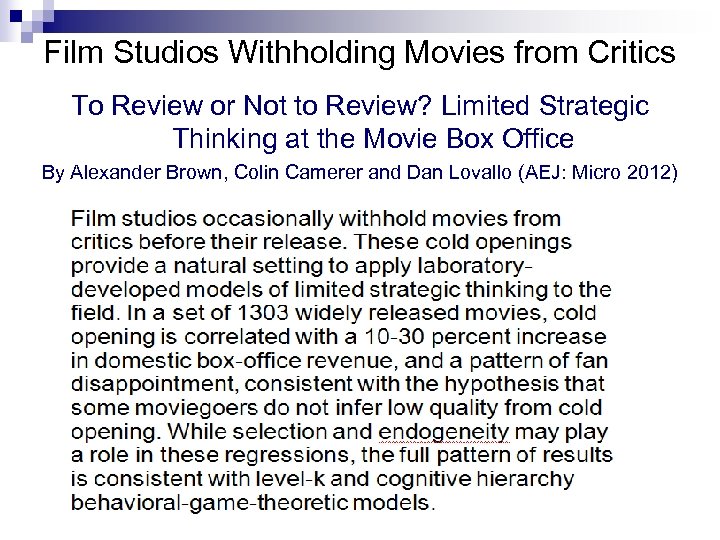

Film Studios Withholding Movies from Critics To Review or Not to Review? Limited Strategic Thinking at the Movie Box Office By Alexander Brown, Colin Camerer and Dan Lovallo (AEJ: Micro 2012)

Film Studios Withholding Movies from Critics To Review or Not to Review? Limited Strategic Thinking at the Movie Box Office By Alexander Brown, Colin Camerer and Dan Lovallo (AEJ: Micro 2012)

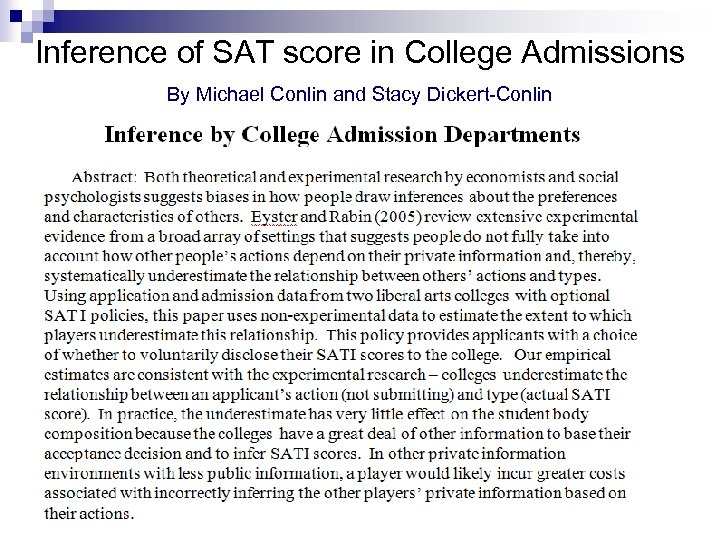

Inference of SAT score in College Admissions By Michael Conlin and Stacy Dickert-Conlin

Inference of SAT score in College Admissions By Michael Conlin and Stacy Dickert-Conlin

Why would Colleges go to Optional SAT Policy? n • • Attract a different type of student (those that don’t test well but do well in college) Maybe more diverse? Improve ratings Average SAT score included in U. S. News and World Report If don’t have SAT scores for lowest score students, reported average increases.

Why would Colleges go to Optional SAT Policy? n • • Attract a different type of student (those that don’t test well but do well in college) Maybe more diverse? Improve ratings Average SAT score included in U. S. News and World Report If don’t have SAT scores for lowest score students, reported average increases.

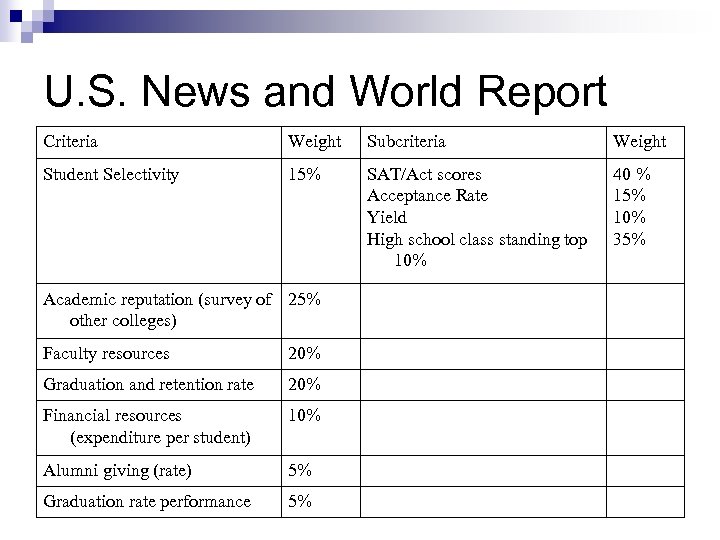

U. S. News and World Report Criteria Weight Subcriteria Weight Student Selectivity 15% SAT/Act scores Acceptance Rate Yield High school class standing top 10% 40 % 15% 10% 35% Academic reputation (survey of 25% other colleges) Faculty resources 20% Graduation and retention rate 20% Financial resources (expenditure per student) 10% Alumni giving (rate) 5% Graduation rate performance 5%

U. S. News and World Report Criteria Weight Subcriteria Weight Student Selectivity 15% SAT/Act scores Acceptance Rate Yield High school class standing top 10% 40 % 15% 10% 35% Academic reputation (survey of 25% other colleges) Faculty resources 20% Graduation and retention rate 20% Financial resources (expenditure per student) 10% Alumni giving (rate) 5% Graduation rate performance 5%

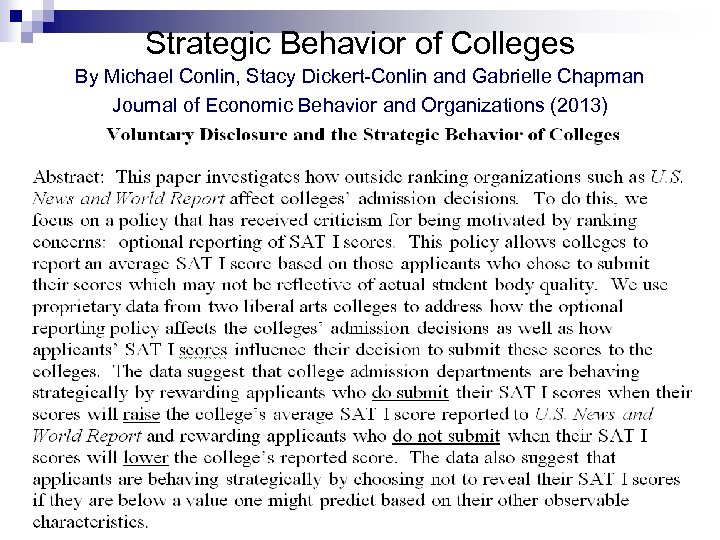

Strategic Behavior of Colleges By Michael Conlin, Stacy Dickert-Conlin and Gabrielle Chapman Journal of Economic Behavior and Organizations (2013)

Strategic Behavior of Colleges By Michael Conlin, Stacy Dickert-Conlin and Gabrielle Chapman Journal of Economic Behavior and Organizations (2013)