738fe54e055db139a5cfd2eb1e2ce07e.ppt

- Количество слайдов: 91

Adjusted Gross Revenue-Lite (AGR-Lite) Dr. Norm Dalsted - Colorado State University Dr. G. A. “Art” Barnaby, Jr - Kansas State University and Risk Management Agency, USDA Phone (Norm) (970) 491 -5627 Email: Norman. Dalsted@colostate. edu Phone (Art): (785) 532 -1515 Email: barnaby@ksu. edu Check out our WEB at: Ag. Manager. info Copyright 2008, All Rights Reserved 1

Adjusted Gross Revenue-Lite (AGR-Lite) Dr. Norm Dalsted - Colorado State University Dr. G. A. “Art” Barnaby, Jr - Kansas State University and Risk Management Agency, USDA Phone (Norm) (970) 491 -5627 Email: Norman. Dalsted@colostate. edu Phone (Art): (785) 532 -1515 Email: barnaby@ksu. edu Check out our WEB at: Ag. Manager. info Copyright 2008, All Rights Reserved 1

Adjusted Gross Revenue-Lite (AGRLite) A Whole Farm Revenue Protection Plan n Provides protection against loss of revenue from natural and named disasters and/or market fluctuations n Approved for Producers in States of: n AK, CT, DE, ID, MA, MD, ME, NC, NH, NJ, NY, OR, PA, RI, VA, VT, WA, WV n States approved to proceed with rating: n AZ, CO, HI, KS, MN, MT, NM, NV, UT, WI, WY n Copyright 2008, All Rights Reserved 2

Adjusted Gross Revenue-Lite (AGRLite) A Whole Farm Revenue Protection Plan n Provides protection against loss of revenue from natural and named disasters and/or market fluctuations n Approved for Producers in States of: n AK, CT, DE, ID, MA, MD, ME, NC, NH, NJ, NY, OR, PA, RI, VA, VT, WA, WV n States approved to proceed with rating: n AZ, CO, HI, KS, MN, MT, NM, NV, UT, WI, WY n Copyright 2008, All Rights Reserved 2

States Approved for Sales of AGR-Lite KS - First Great Plains State Copyright 2008, All Rights Reserved 3

States Approved for Sales of AGR-Lite KS - First Great Plains State Copyright 2008, All Rights Reserved 3

Adjusted Gross Revenue-Lite (AGR-Lite) n n Developed by PA Dept. of Agriculture (under section 508 h of the crop insurance law) to make protection available to almost all producers. Expanded to other states through respective State Depts. of Agriculture. Colorado is working with Farm Credit of Southern Colorado, Premier Farm Credit, Topeka RMA, and Kansas State University. Approved and backed by USDA. Copyright 2008, All Rights Reserved 4

Adjusted Gross Revenue-Lite (AGR-Lite) n n Developed by PA Dept. of Agriculture (under section 508 h of the crop insurance law) to make protection available to almost all producers. Expanded to other states through respective State Depts. of Agriculture. Colorado is working with Farm Credit of Southern Colorado, Premier Farm Credit, Topeka RMA, and Kansas State University. Approved and backed by USDA. Copyright 2008, All Rights Reserved 4

Adjusted Gross Revenue-Lite (AGR-Lite) n n Copyright 2008, All Rights Reserved STAND-ALONE POLICY: covering the whole farming operation OR UMBRELLA TYPE POLICY: selected crops can also be protected by Multiple Peril or revenue crop policies. Note: Loss payments from other insurance count towards AGR-Lite revenue guarantee. 5

Adjusted Gross Revenue-Lite (AGR-Lite) n n Copyright 2008, All Rights Reserved STAND-ALONE POLICY: covering the whole farming operation OR UMBRELLA TYPE POLICY: selected crops can also be protected by Multiple Peril or revenue crop policies. Note: Loss payments from other insurance count towards AGR-Lite revenue guarantee. 5

What is covered under AGR-Lite n Copyright 2008, All Rights Reserved Eligible Commodities Include: n Most Crops n Animal Production (includes aquaculture) n Animal Products (milk, honey, wool, etc. ) n Greenhouse Production n Organic Production 6

What is covered under AGR-Lite n Copyright 2008, All Rights Reserved Eligible Commodities Include: n Most Crops n Animal Production (includes aquaculture) n Animal Products (milk, honey, wool, etc. ) n Greenhouse Production n Organic Production 6

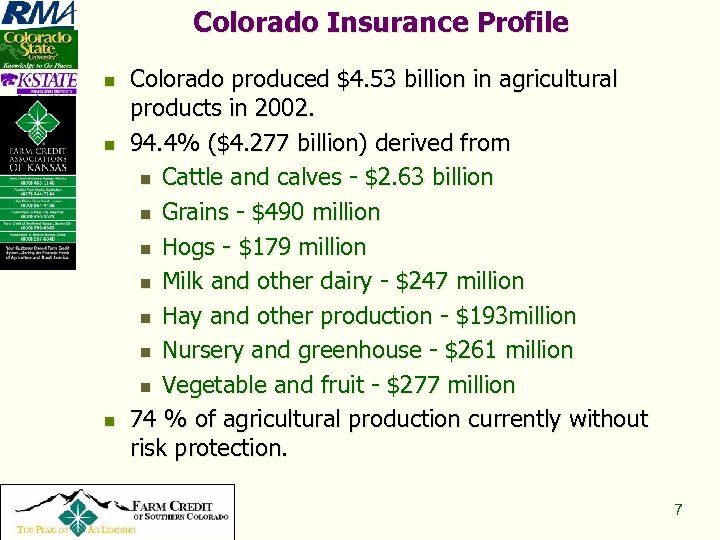

Colorado Insurance Profile n n n Copyright 2008, All Rights Reserved Colorado produced $4. 53 billion in agricultural products in 2002. 94. 4% ($4. 277 billion) derived from n Cattle and calves - $2. 63 billion n Grains - $490 million n Hogs - $179 million n Milk and other dairy - $247 million n Hay and other production - $193 million n Nursery and greenhouse - $261 million n Vegetable and fruit - $277 million 74 % of agricultural production currently without risk protection. 7

Colorado Insurance Profile n n n Copyright 2008, All Rights Reserved Colorado produced $4. 53 billion in agricultural products in 2002. 94. 4% ($4. 277 billion) derived from n Cattle and calves - $2. 63 billion n Grains - $490 million n Hogs - $179 million n Milk and other dairy - $247 million n Hay and other production - $193 million n Nursery and greenhouse - $261 million n Vegetable and fruit - $277 million 74 % of agricultural production currently without risk protection. 7

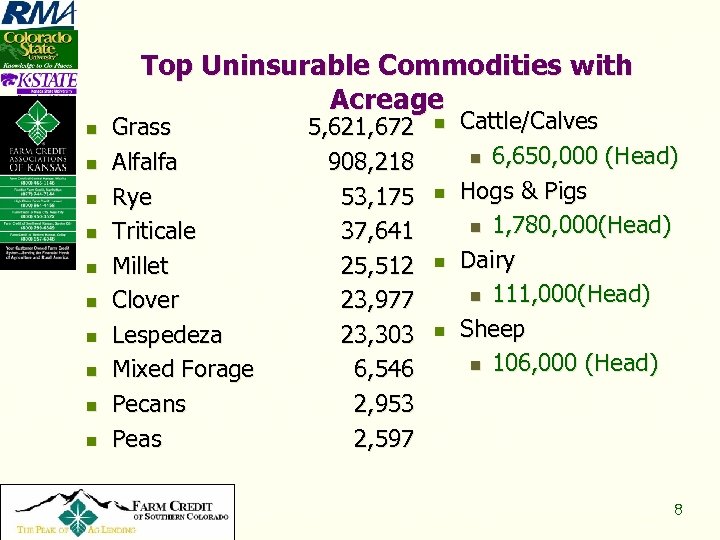

Top Uninsurable Commodities with Acreage n n n n n Copyright 2008, All Rights Reserved Grass Alfalfa Rye Triticale Millet Clover Lespedeza Mixed Forage Pecans Peas 5, 621, 672 908, 218 53, 175 37, 641 25, 512 23, 977 23, 303 6, 546 2, 953 2, 597 n n Cattle/Calves n 6, 650, 000 (Head) Hogs & Pigs n 1, 780, 000(Head) Dairy n 111, 000(Head) Sheep n 106, 000 (Head) 8

Top Uninsurable Commodities with Acreage n n n n n Copyright 2008, All Rights Reserved Grass Alfalfa Rye Triticale Millet Clover Lespedeza Mixed Forage Pecans Peas 5, 621, 672 908, 218 53, 175 37, 641 25, 512 23, 977 23, 303 6, 546 2, 953 2, 597 n n Cattle/Calves n 6, 650, 000 (Head) Hogs & Pigs n 1, 780, 000(Head) Dairy n 111, 000(Head) Sheep n 106, 000 (Head) 8

What is covered under AGR-Lite n Copyright 2008, All Rights Reserved Insurable Causes of Loss: n unavoidable natural disasters, that occurs during the current or previous insurance year n including but not limited to, adverse weather, fire, insects, disease, wildlife, earthquakes, volcanic eruption, or failure of irrigation water supply, if applicable, n market fluctuation (annual price change) that causes a loss in revenue during the current insurance year 9

What is covered under AGR-Lite n Copyright 2008, All Rights Reserved Insurable Causes of Loss: n unavoidable natural disasters, that occurs during the current or previous insurance year n including but not limited to, adverse weather, fire, insects, disease, wildlife, earthquakes, volcanic eruption, or failure of irrigation water supply, if applicable, n market fluctuation (annual price change) that causes a loss in revenue during the current insurance year 9

AGR-Lite Does Not Cover: n n n n Copyright 2008, All Rights Reserved Negligence, mismanagement, wrongdoing Failure to follow good management and irrigation practices Water contained by any government, public, private dam or reservoir Failure or breakdown of irrigation equipment or facilities Theft and Vandalism Inability to market the commodities due to quarantine, boycott or refusal of anyone to accept commodities Lack of labor Failure of buyer to pay for commodities 10

AGR-Lite Does Not Cover: n n n n Copyright 2008, All Rights Reserved Negligence, mismanagement, wrongdoing Failure to follow good management and irrigation practices Water contained by any government, public, private dam or reservoir Failure or breakdown of irrigation equipment or facilities Theft and Vandalism Inability to market the commodities due to quarantine, boycott or refusal of anyone to accept commodities Lack of labor Failure of buyer to pay for commodities 10

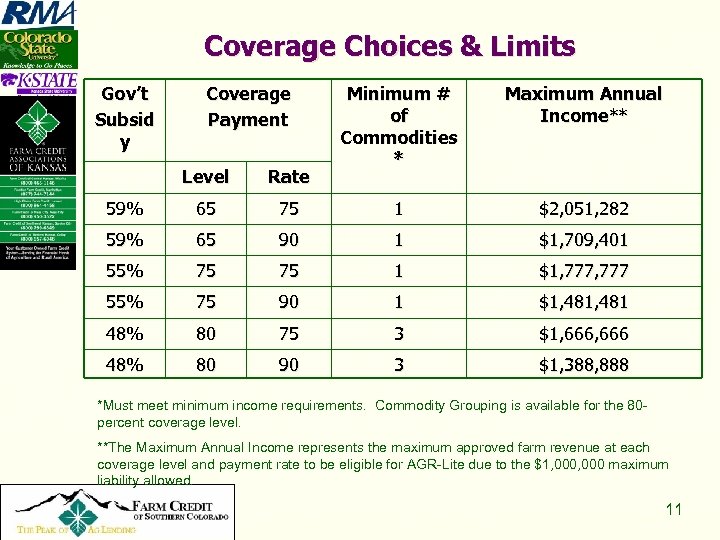

Coverage Choices & Limits Gov’t Subsid y Coverage Payment Minimum # of Commodities * Maximum Annual Income** Level Rate 59% 65 75 1 $2, 051, 282 59% 65 90 1 $1, 709, 401 55% 75 75 1 $1, 777 55% 75 90 1 $1, 481 48% 80 75 3 $1, 666 48% 80 90 3 $1, 388, 888 *Must meet minimum income requirements. Commodity Grouping is available for the 80 percent coverage level. **The Maximum Annual Income represents the maximum approved farm revenue at each coverage level and payment rate to be eligible for AGR-Lite due to the $1, 000 maximum liability allowed. Copyright 2008, All Rights Reserved 11

Coverage Choices & Limits Gov’t Subsid y Coverage Payment Minimum # of Commodities * Maximum Annual Income** Level Rate 59% 65 75 1 $2, 051, 282 59% 65 90 1 $1, 709, 401 55% 75 75 1 $1, 777 55% 75 90 1 $1, 481 48% 80 75 3 $1, 666 48% 80 90 3 $1, 388, 888 *Must meet minimum income requirements. Commodity Grouping is available for the 80 percent coverage level. **The Maximum Annual Income represents the maximum approved farm revenue at each coverage level and payment rate to be eligible for AGR-Lite due to the $1, 000 maximum liability allowed. Copyright 2008, All Rights Reserved 11

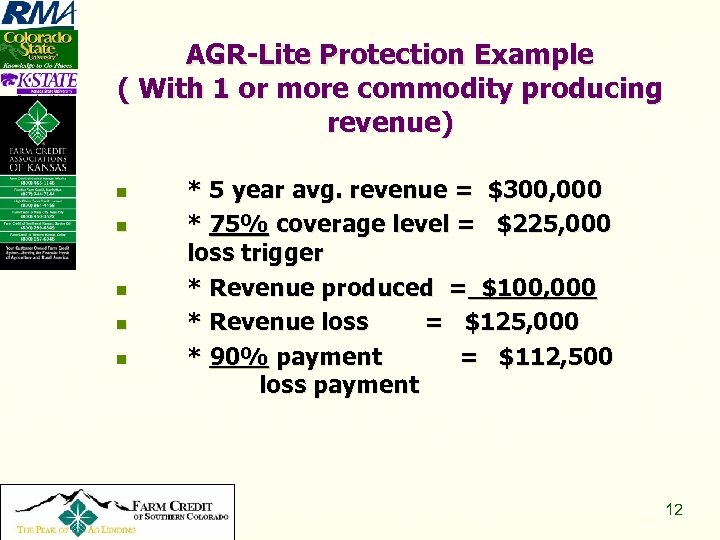

AGR-Lite Protection Example ( With 1 or more commodity producing revenue) n n n Copyright 2008, All Rights Reserved * 5 year avg. revenue = $300, 000 * 75% coverage level = $225, 000 loss trigger * Revenue produced = $100, 000 * Revenue loss = $125, 000 * 90% payment = $112, 500 loss payment 12

AGR-Lite Protection Example ( With 1 or more commodity producing revenue) n n n Copyright 2008, All Rights Reserved * 5 year avg. revenue = $300, 000 * 75% coverage level = $225, 000 loss trigger * Revenue produced = $100, 000 * Revenue loss = $125, 000 * 90% payment = $112, 500 loss payment 12

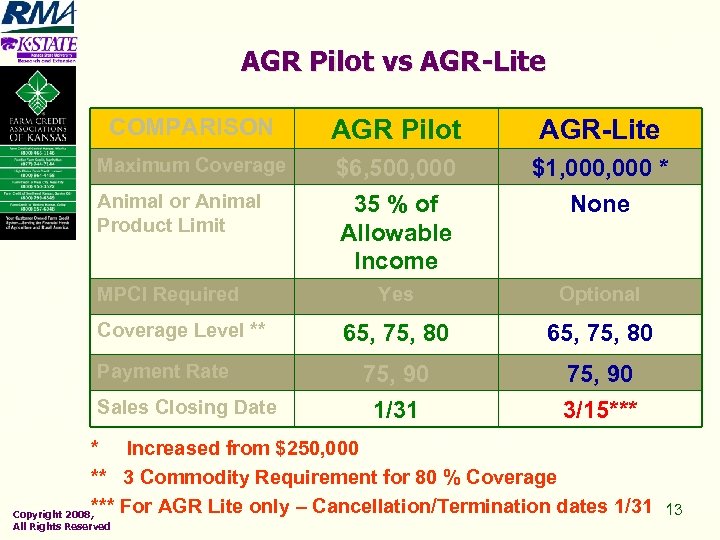

AGR Pilot vs AGR-Lite COMPARISON AGR Pilot AGR-Lite Maximum Coverage $6, 500, 000 35 % of Allowable Income $1, 000 * None Yes Optional 65, 75, 80 75, 90 1/31 75, 90 3/15*** Animal or Animal Product Limit MPCI Required Coverage Level ** Payment Rate Sales Closing Date * Increased from $250, 000 ** 3 Commodity Requirement for 80 % Coverage *** For AGR Lite only – Cancellation/Termination dates 1/31 Copyright 2008, All Rights Reserved 13

AGR Pilot vs AGR-Lite COMPARISON AGR Pilot AGR-Lite Maximum Coverage $6, 500, 000 35 % of Allowable Income $1, 000 * None Yes Optional 65, 75, 80 75, 90 1/31 75, 90 3/15*** Animal or Animal Product Limit MPCI Required Coverage Level ** Payment Rate Sales Closing Date * Increased from $250, 000 ** 3 Commodity Requirement for 80 % Coverage *** For AGR Lite only – Cancellation/Termination dates 1/31 Copyright 2008, All Rights Reserved 13

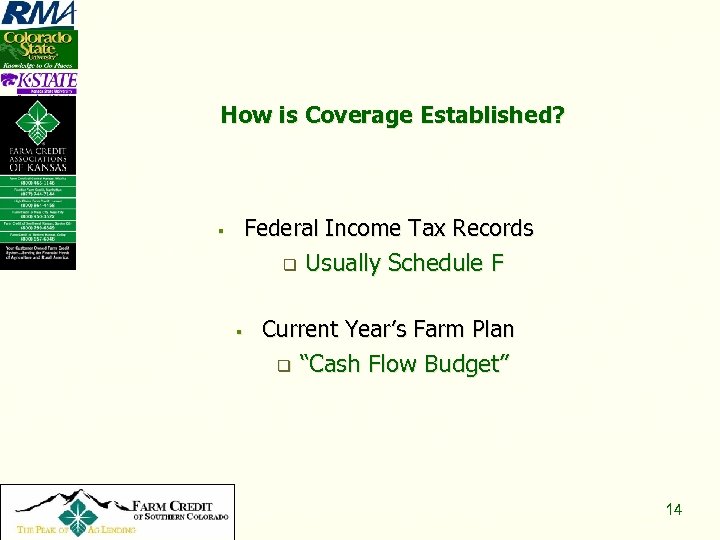

How is Coverage Established? Federal Income Tax Records q Usually Schedule F § § Copyright 2008, All Rights Reserved Current Year’s Farm Plan q “Cash Flow Budget” 14

How is Coverage Established? Federal Income Tax Records q Usually Schedule F § § Copyright 2008, All Rights Reserved Current Year’s Farm Plan q “Cash Flow Budget” 14

Files 5 Consecutive Years of Schedule F or equivalent – Tax Forms Copyright 2008, All Rights Reserved 15

Files 5 Consecutive Years of Schedule F or equivalent – Tax Forms Copyright 2008, All Rights Reserved 15

When does insurance attach? n n n Copyright 2008, All Rights Reserved Insurance begins 10 days after properly completed application is received. If a commodity is damaged prior to purchasing insurance, no coverage is provided. If commodity is damaged after insurance is purchased, but before insurance year begins, coverage may be provided 16

When does insurance attach? n n n Copyright 2008, All Rights Reserved Insurance begins 10 days after properly completed application is received. If a commodity is damaged prior to purchasing insurance, no coverage is provided. If commodity is damaged after insurance is purchased, but before insurance year begins, coverage may be provided 16

How are Claims Calculated? § § Copyright 2008, All Rights Reserved Federal Income Tax Records reflect sales Beginning and End of year inventories are used to determine change in value allocated to current year. 17

How are Claims Calculated? § § Copyright 2008, All Rights Reserved Federal Income Tax Records reflect sales Beginning and End of year inventories are used to determine change in value allocated to current year. 17

Where AGR-Lite makes sense n n n n Copyright 2008, All Rights Reserved Otherwise uninsurable commodities are covered Organic production is protected at realistic prices Direct Marketed production is protected at realistic prices Umbrella over selected individual crop coverages Bottom line for operation from severe economic loss Individual protection based on personal yield, quality and price history plus low price protection, Provide an alternative for farmers with reduced APH caused by multiple years of drought. 18

Where AGR-Lite makes sense n n n n Copyright 2008, All Rights Reserved Otherwise uninsurable commodities are covered Organic production is protected at realistic prices Direct Marketed production is protected at realistic prices Umbrella over selected individual crop coverages Bottom line for operation from severe economic loss Individual protection based on personal yield, quality and price history plus low price protection, Provide an alternative for farmers with reduced APH caused by multiple years of drought. 18

Things to Consider with AGR-Lite n Copyright 2008, All Rights Reserved AGR-Lite does not include indemnity payments when calculating 5 years average Gross Income that will set future guarantees. n This has no impact on current year’s indemnity payment but it lowers future guarantees. 19

Things to Consider with AGR-Lite n Copyright 2008, All Rights Reserved AGR-Lite does not include indemnity payments when calculating 5 years average Gross Income that will set future guarantees. n This has no impact on current year’s indemnity payment but it lowers future guarantees. 19

Things to Consider with AGR-Lite n AGR-Lite does not adjust for feed or product purchased. n n n Copyright 2008, All Rights Reserved If farmers must buy fruit/vegetables/ product to meet their market commitments, this will lower Net Income but not Gross. If it turns dry, and producers purchase hay to cover lost forage this loss may not be covered. This will lower Net Income but not Gross. If producers normally sell excess hay, then it is covered because there will be reduced hay sales. 20

Things to Consider with AGR-Lite n AGR-Lite does not adjust for feed or product purchased. n n n Copyright 2008, All Rights Reserved If farmers must buy fruit/vegetables/ product to meet their market commitments, this will lower Net Income but not Gross. If it turns dry, and producers purchase hay to cover lost forage this loss may not be covered. This will lower Net Income but not Gross. If producers normally sell excess hay, then it is covered because there will be reduced hay sales. 20

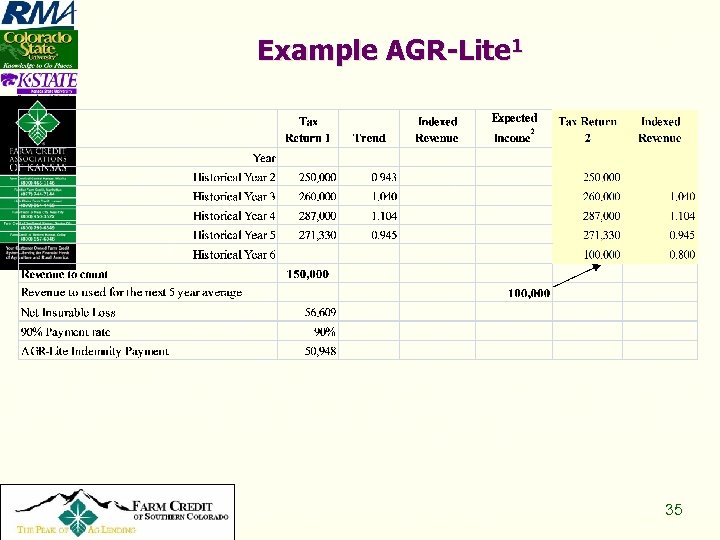

Example AGR-Lite 1 1 Prepared by Andrew Saffert (Graduate Student), Dr. Jeffery R. Williams, Dr. G. A. (Art) Barnaby, Jr. , and Dr. Michael R. Langemeier, Professors, Department of Agricultural Economics, K-State Research and Extension, Kansas State University, Manhattan, KS 66502, Risk & Profit August 17 & 18, 2006, Phone 785 -532 -1515, e-mail – Barnaby@ksu. edu, or Andrew Saffert asaffert@mail. agecon. ksu. edu. 2 The expected income is generated from the annual “farm plan” similar to a cash flow budget for the upcoming year. Copyright 2008, All Rights Reserved 21

Example AGR-Lite 1 1 Prepared by Andrew Saffert (Graduate Student), Dr. Jeffery R. Williams, Dr. G. A. (Art) Barnaby, Jr. , and Dr. Michael R. Langemeier, Professors, Department of Agricultural Economics, K-State Research and Extension, Kansas State University, Manhattan, KS 66502, Risk & Profit August 17 & 18, 2006, Phone 785 -532 -1515, e-mail – Barnaby@ksu. edu, or Andrew Saffert asaffert@mail. agecon. ksu. edu. 2 The expected income is generated from the annual “farm plan” similar to a cash flow budget for the upcoming year. Copyright 2008, All Rights Reserved 21

Example AGR-Lite Copyright 2008, All Rights Reserved 22

Example AGR-Lite Copyright 2008, All Rights Reserved 22

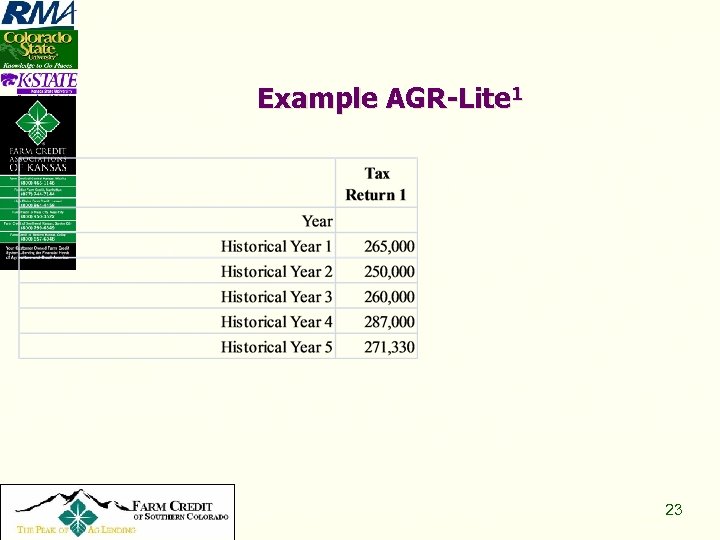

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 23

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 23

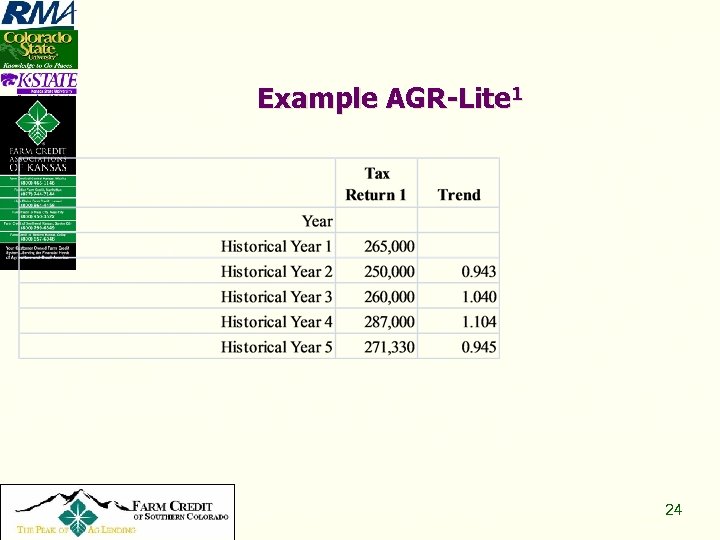

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 24

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 24

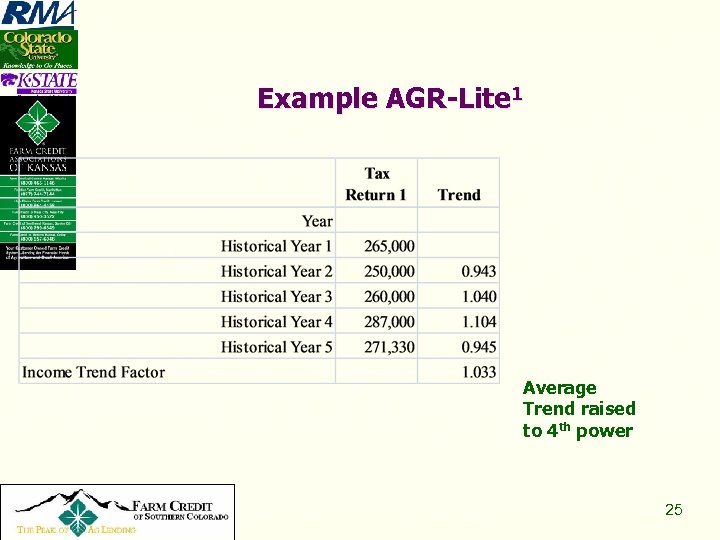

Example AGR-Lite 1 Average Trend raised to 4 th power Copyright 2008, All Rights Reserved 25

Example AGR-Lite 1 Average Trend raised to 4 th power Copyright 2008, All Rights Reserved 25

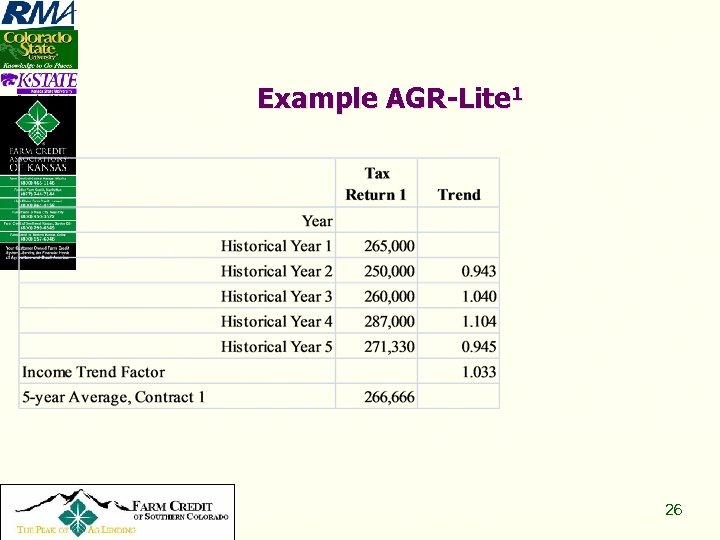

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 26

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 26

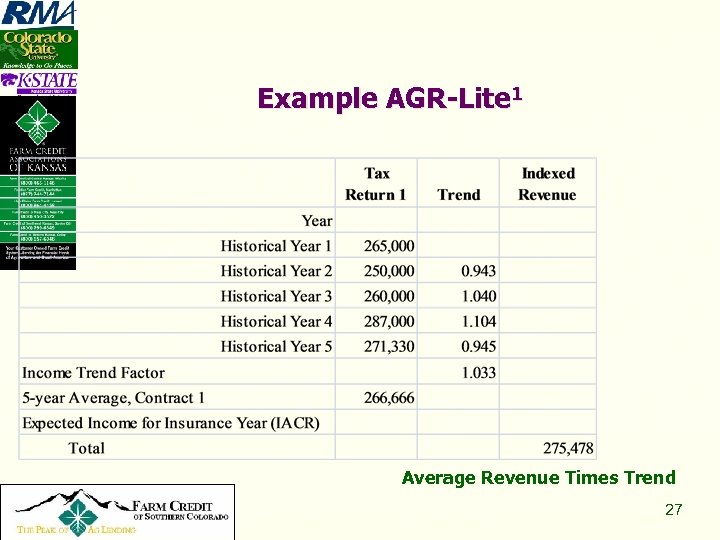

Example AGR-Lite 1 Average Revenue Times Trend Copyright 2008, All Rights Reserved 27

Example AGR-Lite 1 Average Revenue Times Trend Copyright 2008, All Rights Reserved 27

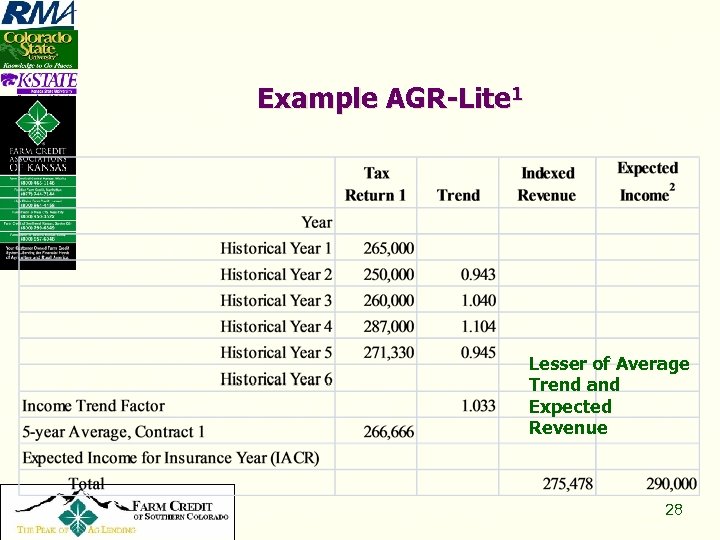

Example AGR-Lite 1 Lesser of Average Trend and Expected Revenue Copyright 2008, All Rights Reserved 28

Example AGR-Lite 1 Lesser of Average Trend and Expected Revenue Copyright 2008, All Rights Reserved 28

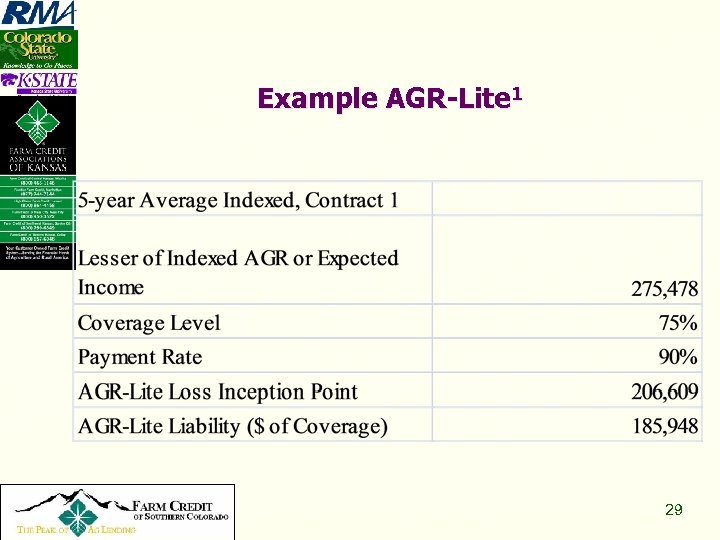

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 29

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 29

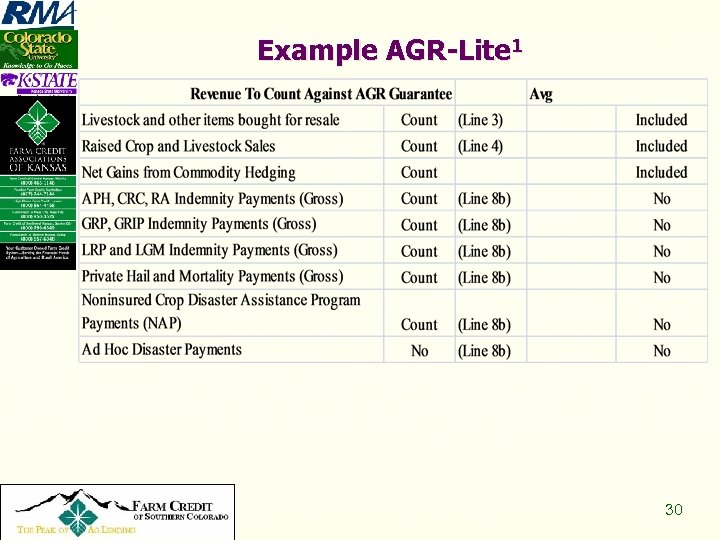

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 30

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 30

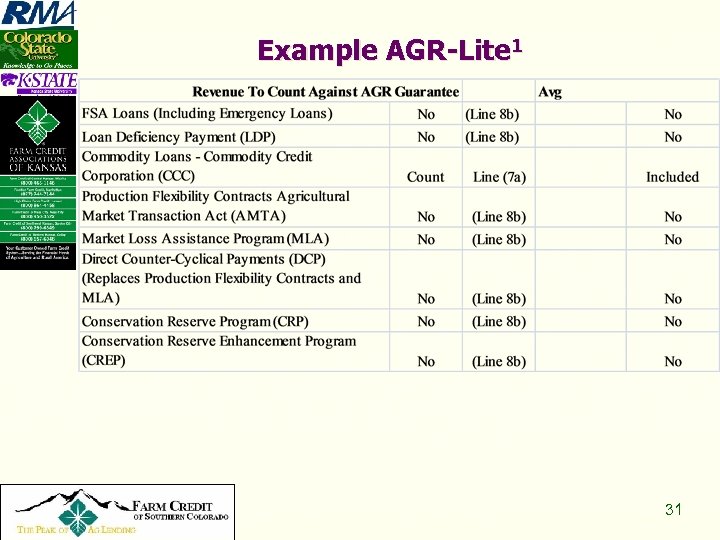

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 31

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 31

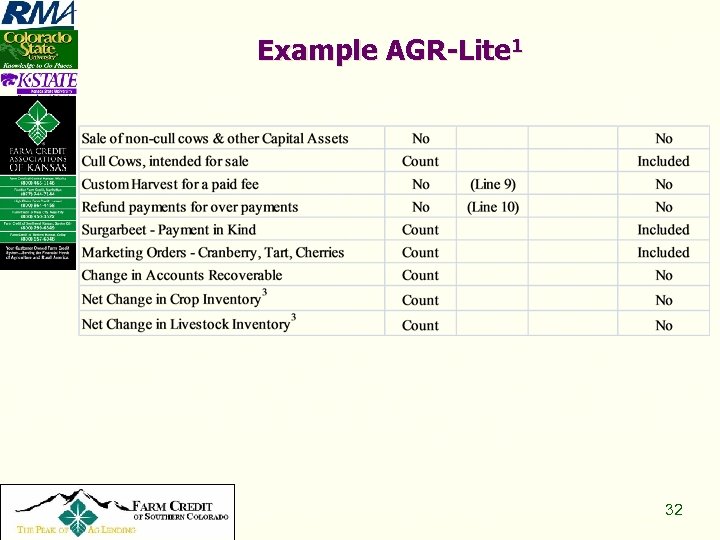

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 32

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 32

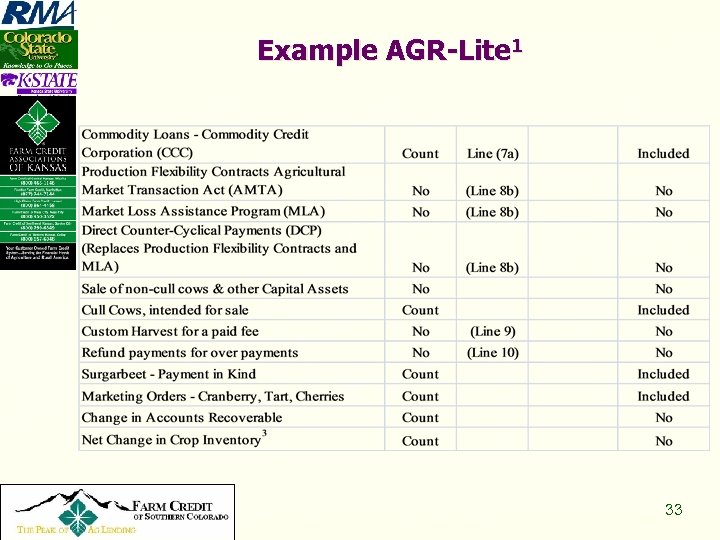

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 33

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 33

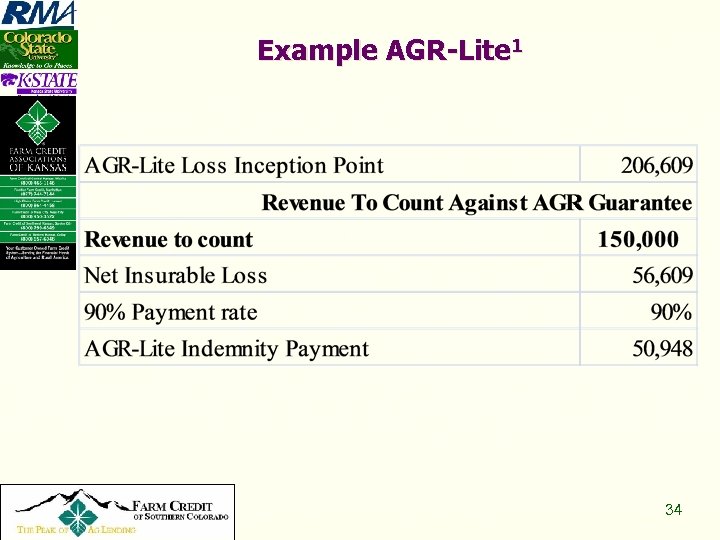

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 34

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 34

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 35

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 35

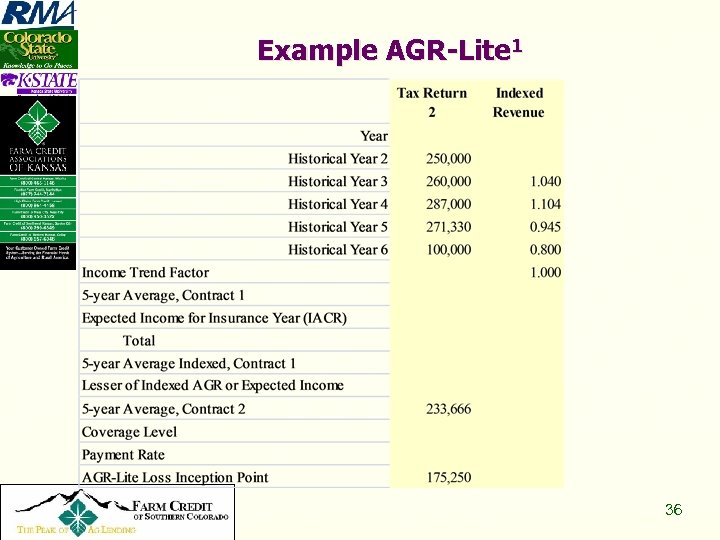

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 36

Example AGR-Lite 1 Copyright 2008, All Rights Reserved 36

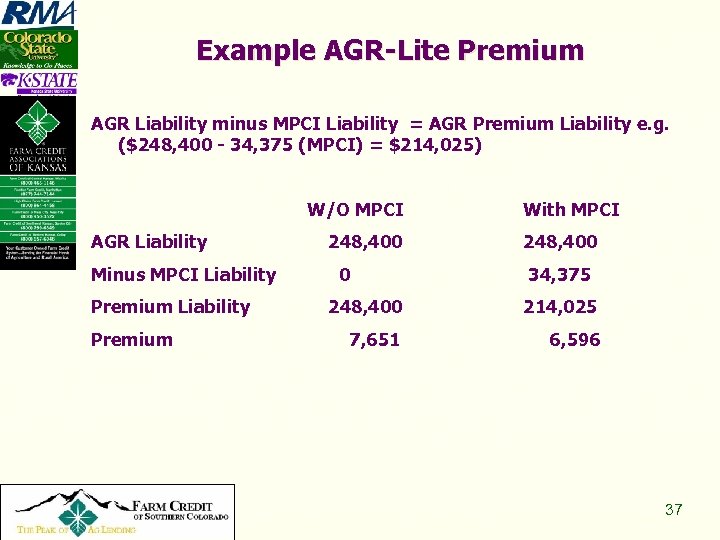

Example AGR-Lite Premium AGR Liability minus MPCI Liability = AGR Premium Liability e. g. ($248, 400 - 34, 375 (MPCI) = $214, 025) W/O MPCI AGR Liability Minus MPCI Liability Premium Copyright 2008, All Rights Reserved 248, 400 0 With MPCI 248, 400 34, 375 248, 400 214, 025 7, 651 6, 596 37

Example AGR-Lite Premium AGR Liability minus MPCI Liability = AGR Premium Liability e. g. ($248, 400 - 34, 375 (MPCI) = $214, 025) W/O MPCI AGR Liability Minus MPCI Liability Premium Copyright 2008, All Rights Reserved 248, 400 0 With MPCI 248, 400 34, 375 248, 400 214, 025 7, 651 6, 596 37

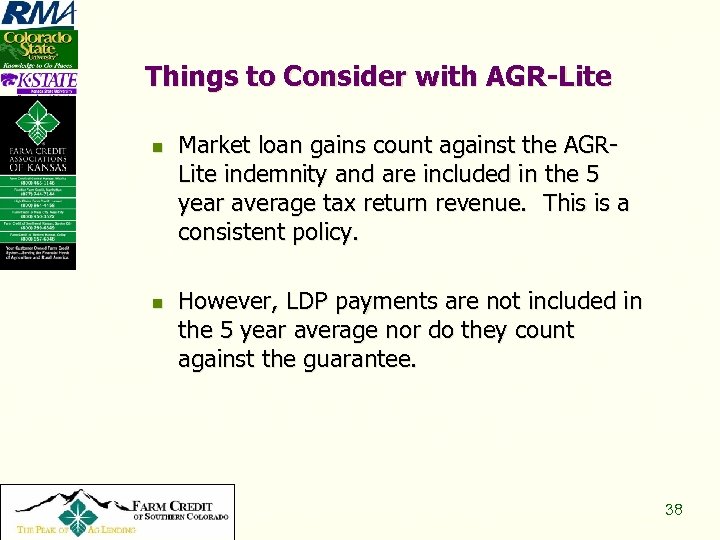

Things to Consider with AGR-Lite n n Copyright 2008, All Rights Reserved Market loan gains count against the AGRLite indemnity and are included in the 5 year average tax return revenue. This is a consistent policy. However, LDP payments are not included in the 5 year average nor do they count against the guarantee. 38

Things to Consider with AGR-Lite n n Copyright 2008, All Rights Reserved Market loan gains count against the AGRLite indemnity and are included in the 5 year average tax return revenue. This is a consistent policy. However, LDP payments are not included in the 5 year average nor do they count against the guarantee. 38

Things to Consider with AGR-Lite n n Copyright 2008, All Rights Reserved Currently “cull cows” are counted in the sales to count against the AGR-Lite guarantees and the 5 year average tax return revenue. If the cows are sold as part of a herd reduction the sales do not count against the guarantee. 39

Things to Consider with AGR-Lite n n Copyright 2008, All Rights Reserved Currently “cull cows” are counted in the sales to count against the AGR-Lite guarantees and the 5 year average tax return revenue. If the cows are sold as part of a herd reduction the sales do not count against the guarantee. 39

Things to Consider with AGR-Lite n n Copyright 2008, All Rights Reserved Currently the counter cyclical payment does not count against the AGR-Lite guarantee nor does it count in the 5 year average tax return revenue. This works in the favor of farmers because it does not reduce AGR-Lite payments in a loss year caused by lower prices. 40

Things to Consider with AGR-Lite n n Copyright 2008, All Rights Reserved Currently the counter cyclical payment does not count against the AGR-Lite guarantee nor does it count in the 5 year average tax return revenue. This works in the favor of farmers because it does not reduce AGR-Lite payments in a loss year caused by lower prices. 40

Adjusted Gross Revenue-Lite (AGR-Lite) n AGR Lite is whole farm revenue coverage based on tax returns n Receives full subsidy n Can be purchased in addition to MPCI/RA/CRC n Insures livestock, hay, specialty crops, & other uninsurable crops n Available in Kansas for 2007 with March 15 signup n All day risk workshops Copyright 2008, All Rights Reserved 41

Adjusted Gross Revenue-Lite (AGR-Lite) n AGR Lite is whole farm revenue coverage based on tax returns n Receives full subsidy n Can be purchased in addition to MPCI/RA/CRC n Insures livestock, hay, specialty crops, & other uninsurable crops n Available in Kansas for 2007 with March 15 signup n All day risk workshops Copyright 2008, All Rights Reserved 41

Adjusted Gross Revenue-Lite (AGR-Lite) n n Copyright 2008, All Rights Reserved This presentation does not provide full details of policy provisions or approved procedures. Producers should consult with a local agent for specific details and program requirement Farmers interested in AGR-Lite should talk to an agent ASAP because it will require time to gather all of the information for an application. DO NOT WAIT UNTIL MARCH 15! 42

Adjusted Gross Revenue-Lite (AGR-Lite) n n Copyright 2008, All Rights Reserved This presentation does not provide full details of policy provisions or approved procedures. Producers should consult with a local agent for specific details and program requirement Farmers interested in AGR-Lite should talk to an agent ASAP because it will require time to gather all of the information for an application. DO NOT WAIT UNTIL MARCH 15! 42

Thank You DR. NORM DALSTED – COLORADO STATE UNIVERSITY PHONE: 970 -491 -5627 EMAIL: Norman. Dalsted@colostate. edu DR. G. A. “ART” BARNABY, JR-KANSAS STATE UNIVERSITY PHONE: 785 -532 -1515 EMAIL: barnaby@ksu. edu Check out our WEB page at: http: //www. Ag. Manager. info Copyright 2008, All Rights Reserved 43

Thank You DR. NORM DALSTED – COLORADO STATE UNIVERSITY PHONE: 970 -491 -5627 EMAIL: Norman. Dalsted@colostate. edu DR. G. A. “ART” BARNABY, JR-KANSAS STATE UNIVERSITY PHONE: 785 -532 -1515 EMAIL: barnaby@ksu. edu Check out our WEB page at: http: //www. Ag. Manager. info Copyright 2008, All Rights Reserved 43

Details on data that farmers will need to apply for AGR-Lite! Dr. Norm Dalsted - Colorado State University Dr. G. A. “Art” Barnaby, Jr - Kansas State University and Risk Management Agency, USDA Phone (Norm) (970) 491 -5627 Email: Norman. Dalsted@colostate. edu Phone (Art): (785) 532 -1515 Email: barnaby@ksu. edu Check out our WEB at: www. Ag. Manager. info

Details on data that farmers will need to apply for AGR-Lite! Dr. Norm Dalsted - Colorado State University Dr. G. A. “Art” Barnaby, Jr - Kansas State University and Risk Management Agency, USDA Phone (Norm) (970) 491 -5627 Email: Norman. Dalsted@colostate. edu Phone (Art): (785) 532 -1515 Email: barnaby@ksu. edu Check out our WEB at: www. Ag. Manager. info

Steps in the Process n n n Copyright 2008, All Rights Reserved Step 1 – Application Step 2 - Determine Approved AGR and Underwriting Step 3 - Claim 45

Steps in the Process n n n Copyright 2008, All Rights Reserved Step 1 – Application Step 2 - Determine Approved AGR and Underwriting Step 3 - Claim 45

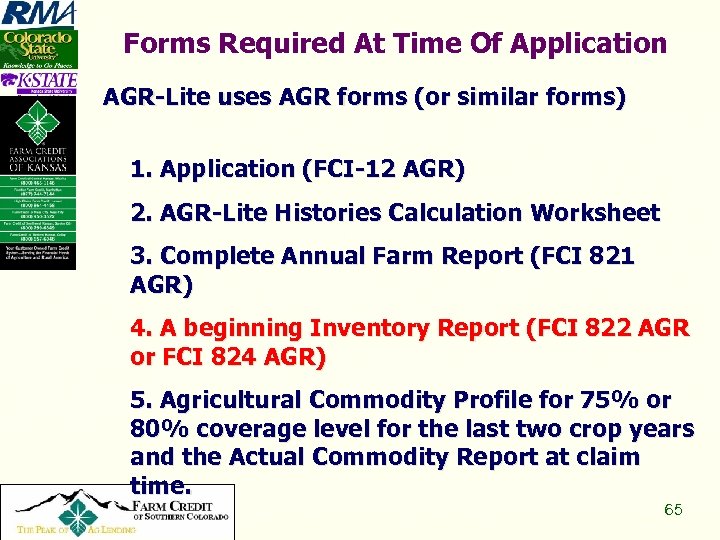

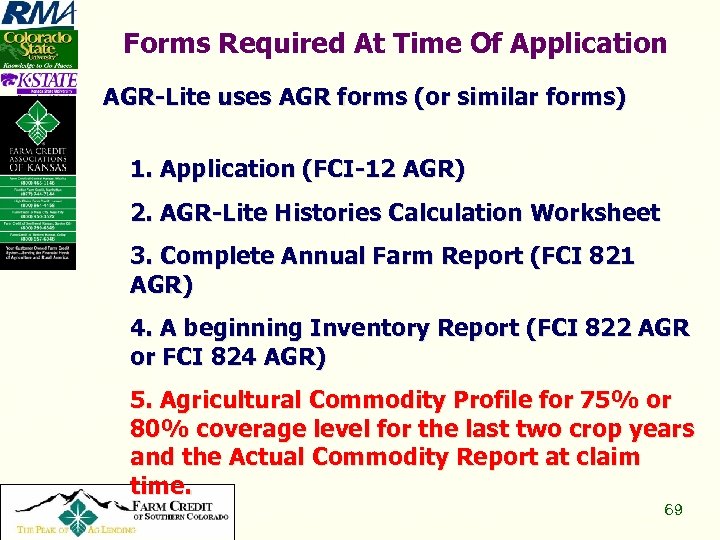

Forms Required At Time Of Application AGR-Lite uses AGR forms (or similar forms) 1. Application (FCI-12 AGR) 2. AGR-Lite Histories Calculation Worksheet 3. Complete Annual Farm Report (FCI 821 AGR) 4. A beginning Inventory Report (FCI 822 AGR or FCI 824 AGR) 5. Agricultural Commodity Profile for 75% or 80% coverage level for the last two crop years and the Actual Commodity Report at claim time. Copyright 2008, All Rights Reserved 46

Forms Required At Time Of Application AGR-Lite uses AGR forms (or similar forms) 1. Application (FCI-12 AGR) 2. AGR-Lite Histories Calculation Worksheet 3. Complete Annual Farm Report (FCI 821 AGR) 4. A beginning Inventory Report (FCI 822 AGR or FCI 824 AGR) 5. Agricultural Commodity Profile for 75% or 80% coverage level for the last two crop years and the Actual Commodity Report at claim time. Copyright 2008, All Rights Reserved 46

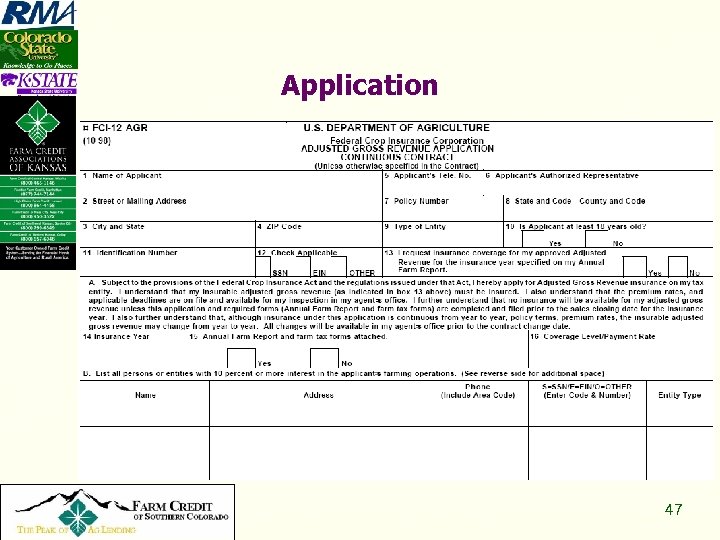

Application Copyright 2008, All Rights Reserved 47

Application Copyright 2008, All Rights Reserved 47

Step 1 - Determine Approved AGR n Copyright 2008, All Rights Reserved The Approved AGR is used as a whole farm revenue basis upon which coverage is provided 48

Step 1 - Determine Approved AGR n Copyright 2008, All Rights Reserved The Approved AGR is used as a whole farm revenue basis upon which coverage is provided 48

Forms Required At Time Of Application n n n Copyright 2008, All Rights Reserved AGR-Lite uses AGR forms (or similar forms) 1. Application (FCI-12 AGR) 2. AGR-Lite Histories Calculation Worksheet 3. Complete Annual Farm Report (FCI 821 AGR) 4. A beginning Inventory Report (FCI 822 AGR or FCI 824 AGR) 5. Agricultural Commodity Profile for 75% or 85% coverage level for the last two crop years and the Actual Commodity Report at claim time 49

Forms Required At Time Of Application n n n Copyright 2008, All Rights Reserved AGR-Lite uses AGR forms (or similar forms) 1. Application (FCI-12 AGR) 2. AGR-Lite Histories Calculation Worksheet 3. Complete Annual Farm Report (FCI 821 AGR) 4. A beginning Inventory Report (FCI 822 AGR or FCI 824 AGR) 5. Agricultural Commodity Profile for 75% or 85% coverage level for the last two crop years and the Actual Commodity Report at claim time 49

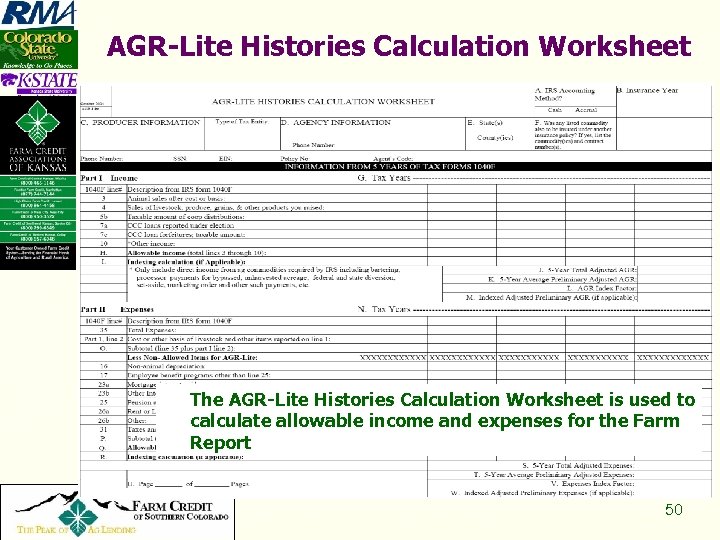

AGR-Lite Histories Calculation Worksheet The AGR-Lite Histories Calculation Worksheet is used to calculate allowable income and expenses for the Farm Report Copyright 2008, All Rights Reserved 50

AGR-Lite Histories Calculation Worksheet The AGR-Lite Histories Calculation Worksheet is used to calculate allowable income and expenses for the Farm Report Copyright 2008, All Rights Reserved 50

Excluded income applies to: n n Intended Commodities n Inventory Adjustments n Accounts Receivable Adjustments n Copyright 2008, All Rights Reserved 5 Year History – Income and Expenses for Claims 51

Excluded income applies to: n n Intended Commodities n Inventory Adjustments n Accounts Receivable Adjustments n Copyright 2008, All Rights Reserved 5 Year History – Income and Expenses for Claims 51

AGR-Lite – Allowable Expenses n Copyright 2008, All Rights Reserved Allowable expenses - Farm expenses that are reported to the IRS for the production of agricultural commodities, including only those specifically listed… 52

AGR-Lite – Allowable Expenses n Copyright 2008, All Rights Reserved Allowable expenses - Farm expenses that are reported to the IRS for the production of agricultural commodities, including only those specifically listed… 52

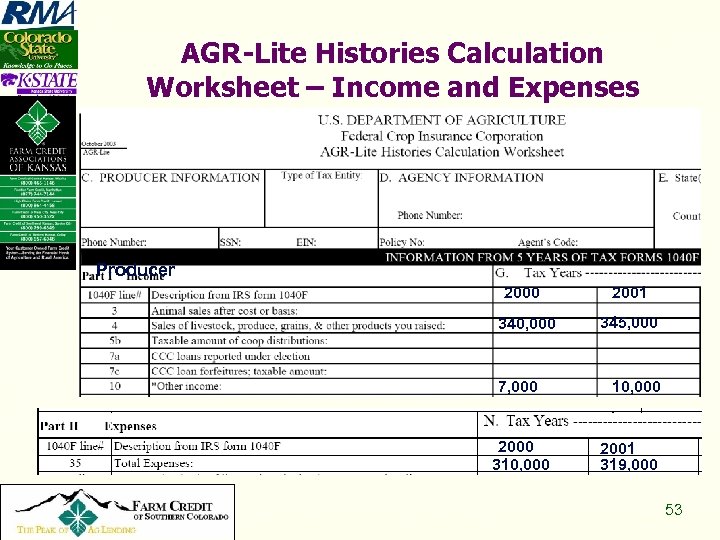

AGR-Lite Histories Calculation Worksheet – Income and Expenses Producer 2000 340, 000 7, 000 2000 310, 000 Copyright 2008, All Rights Reserved 2001 345, 000 10, 000 2001 319, 000 53

AGR-Lite Histories Calculation Worksheet – Income and Expenses Producer 2000 340, 000 7, 000 2000 310, 000 Copyright 2008, All Rights Reserved 2001 345, 000 10, 000 2001 319, 000 53

Forms Required At Time Of Application n n n Copyright 2008, All Rights Reserved AGR-Lite uses AGR forms (or similar forms) 1. Application (FCI-12 AGR) 2. AGR-Lite Histories Calculation Worksheet 3. Complete Annual Farm Report (FCI 821 AGR) 4. A beginning Inventory Report (FCI 822 AGR or FCI 824 AGR) 5. Agricultural Commodity Profile for 75% or 80% coverage level for the last two crop years and the Actual Commodity Report at claim time 54

Forms Required At Time Of Application n n n Copyright 2008, All Rights Reserved AGR-Lite uses AGR forms (or similar forms) 1. Application (FCI-12 AGR) 2. AGR-Lite Histories Calculation Worksheet 3. Complete Annual Farm Report (FCI 821 AGR) 4. A beginning Inventory Report (FCI 822 AGR or FCI 824 AGR) 5. Agricultural Commodity Profile for 75% or 80% coverage level for the last two crop years and the Actual Commodity Report at claim time 54

Annual Farm Report The Approved AGR is determined using the Annual Farm Report The Farm Report includes 5 Years Allowable Income and Expense History - From Histories Calculation Worksheet n n n Copyright 2008, All Rights Reserved Intended Commodity Report of Changes Adjustments to Approved AGR 55

Annual Farm Report The Approved AGR is determined using the Annual Farm Report The Farm Report includes 5 Years Allowable Income and Expense History - From Histories Calculation Worksheet n n n Copyright 2008, All Rights Reserved Intended Commodity Report of Changes Adjustments to Approved AGR 55

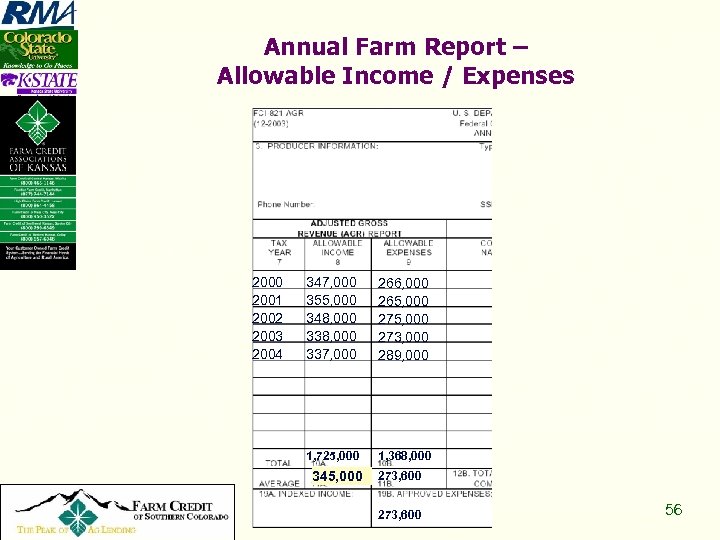

Annual Farm Report – Allowable Income / Expenses 2000 2001 2002 2003 2004 347, 000 355, 000 348, 000 337, 000 266, 000 265, 000 273, 000 289, 000 1, 725, 000 1, 368, 000 345, 000 Copyright 2008, All Rights Reserved 273, 600 56

Annual Farm Report – Allowable Income / Expenses 2000 2001 2002 2003 2004 347, 000 355, 000 348, 000 337, 000 266, 000 265, 000 273, 000 289, 000 1, 725, 000 1, 368, 000 345, 000 Copyright 2008, All Rights Reserved 273, 600 56

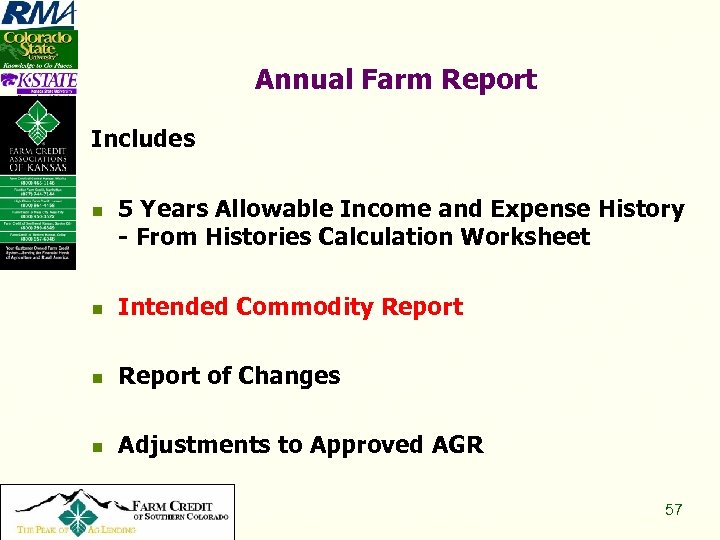

Annual Farm Report Includes n 5 Years Allowable Income and Expense History - From Histories Calculation Worksheet n Intended Commodity Report n Report of Changes n Adjustments to Approved AGR Copyright 2008, All Rights Reserved 57

Annual Farm Report Includes n 5 Years Allowable Income and Expense History - From Histories Calculation Worksheet n Intended Commodity Report n Report of Changes n Adjustments to Approved AGR Copyright 2008, All Rights Reserved 57

Intended Commodities The commodities to be produced during the insurance year (see definitions) n n n Copyright 2008, All Rights Reserved Commodity name No. Years Produced Intended Amount (acres, bu, etc) Expected Value Total Number Commodities Total Expected Income 58

Intended Commodities The commodities to be produced during the insurance year (see definitions) n n n Copyright 2008, All Rights Reserved Commodity name No. Years Produced Intended Amount (acres, bu, etc) Expected Value Total Number Commodities Total Expected Income 58

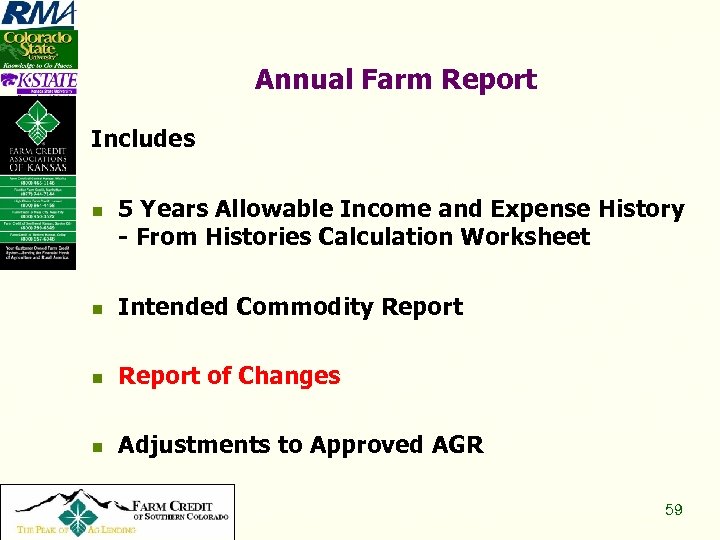

Annual Farm Report Includes n 5 Years Allowable Income and Expense History - From Histories Calculation Worksheet n Intended Commodity Report n Report of Changes n Adjustments to Approved AGR Copyright 2008, All Rights Reserved 59

Annual Farm Report Includes n 5 Years Allowable Income and Expense History - From Histories Calculation Worksheet n Intended Commodity Report n Report of Changes n Adjustments to Approved AGR Copyright 2008, All Rights Reserved 59

Annual Farm Report: Changes Must report any changes that affect the Approved AGR Farm changes may include: n Tax Entities or Accounting Methods n Ownership / Business Structure n Crops/Crop Mix / Marketing Plans n Copyright 2008, All Rights Reserved Size of Operation / Farming Practice / Type of Farming Activity 60

Annual Farm Report: Changes Must report any changes that affect the Approved AGR Farm changes may include: n Tax Entities or Accounting Methods n Ownership / Business Structure n Crops/Crop Mix / Marketing Plans n Copyright 2008, All Rights Reserved Size of Operation / Farming Practice / Type of Farming Activity 60

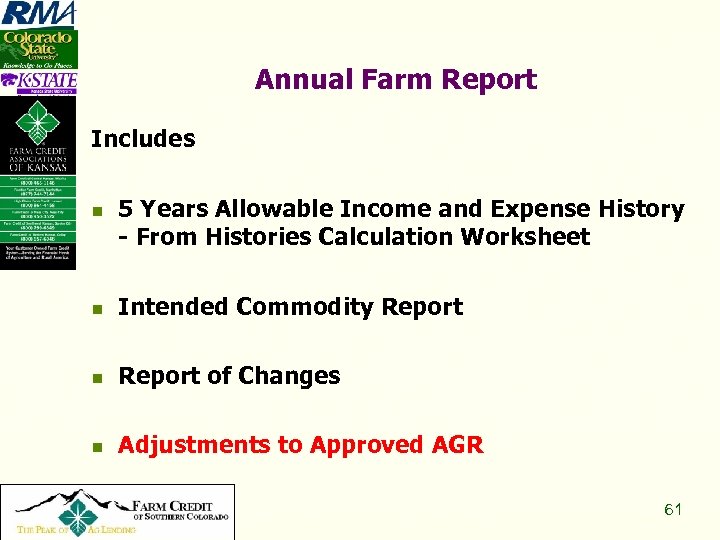

Annual Farm Report Includes n 5 Years Allowable Income and Expense History - From Histories Calculation Worksheet n Intended Commodity Report n Report of Changes n Adjustments to Approved AGR Copyright 2008, All Rights Reserved 61

Annual Farm Report Includes n 5 Years Allowable Income and Expense History - From Histories Calculation Worksheet n Intended Commodity Report n Report of Changes n Adjustments to Approved AGR Copyright 2008, All Rights Reserved 61

Possible Adjustments To Approved AGR For Expanding Operations Income may be indexed if: n n Copyright 2008, All Rights Reserved At least one of the last two years of allowable income is greater than the average of the 5 years of allowable income, and Expected income for current year is higher than the 5 year average of allowable income. 62

Possible Adjustments To Approved AGR For Expanding Operations Income may be indexed if: n n Copyright 2008, All Rights Reserved At least one of the last two years of allowable income is greater than the average of the 5 years of allowable income, and Expected income for current year is higher than the 5 year average of allowable income. 62

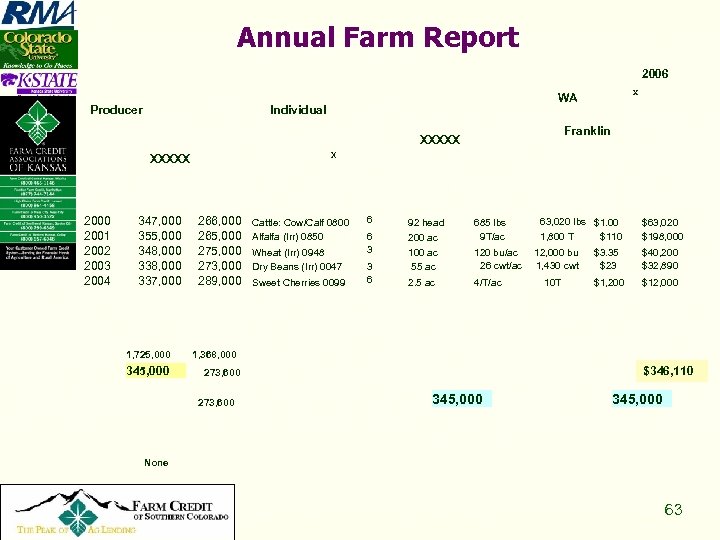

Annual Farm Report 2006 Producer Individual Franklin XXXXX X XXXXX 2000 2001 2002 2003 2004 347, 000 355, 000 348, 000 337, 000 1, 725, 000 345, 000 x WA 266, 000 265, 000 273, 000 289, 000 Cattle: Cow/Calf 0800 Alfalfa (Irr) 0850 Wheat (Irr) 0948 Dry Beans (Irr) 0047 Sweet Cherries 0099 6 92 head 6 3 200 ac 100 ac 55 ac 3 6 2. 5 ac 685 lbs 9 T/ac 120 bu/ac 26 cwt/ac 4/T/ac 63, 020 lbs $1. 00 1, 800 T $110 12, 000 bu 1, 430 cwt 10 T $63, 020 $198, 000 $3. 35 $23 $40, 200 $32, 890 $1, 200 $12, 000 1, 368, 000 $346, 110 273, 600 345, 000 None Copyright 2008, All Rights Reserved 63

Annual Farm Report 2006 Producer Individual Franklin XXXXX X XXXXX 2000 2001 2002 2003 2004 347, 000 355, 000 348, 000 337, 000 1, 725, 000 345, 000 x WA 266, 000 265, 000 273, 000 289, 000 Cattle: Cow/Calf 0800 Alfalfa (Irr) 0850 Wheat (Irr) 0948 Dry Beans (Irr) 0047 Sweet Cherries 0099 6 92 head 6 3 200 ac 100 ac 55 ac 3 6 2. 5 ac 685 lbs 9 T/ac 120 bu/ac 26 cwt/ac 4/T/ac 63, 020 lbs $1. 00 1, 800 T $110 12, 000 bu 1, 430 cwt 10 T $63, 020 $198, 000 $3. 35 $23 $40, 200 $32, 890 $1, 200 $12, 000 1, 368, 000 $346, 110 273, 600 345, 000 None Copyright 2008, All Rights Reserved 63

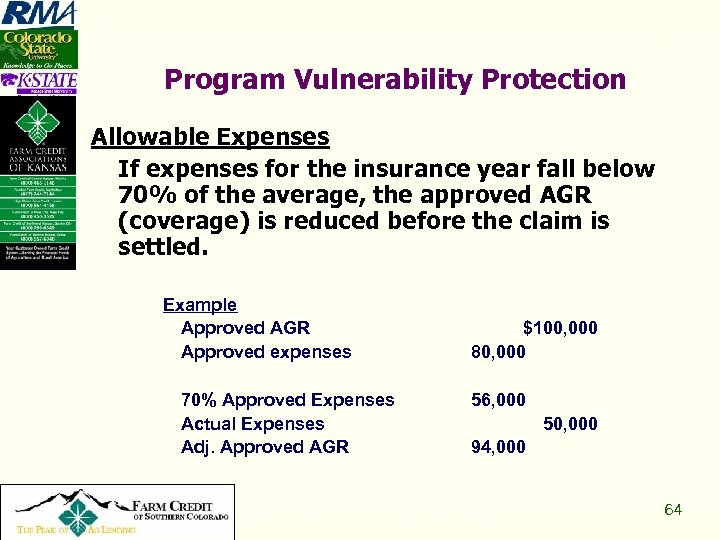

Program Vulnerability Protection Allowable Expenses If expenses for the insurance year fall below 70% of the average, the approved AGR (coverage) is reduced before the claim is settled. Example Approved AGR Approved expenses 70% Approved Expenses Actual Expenses Adj. Approved AGR Copyright 2008, All Rights Reserved $100, 000 80, 000 56, 000 50, 000 94, 000 64

Program Vulnerability Protection Allowable Expenses If expenses for the insurance year fall below 70% of the average, the approved AGR (coverage) is reduced before the claim is settled. Example Approved AGR Approved expenses 70% Approved Expenses Actual Expenses Adj. Approved AGR Copyright 2008, All Rights Reserved $100, 000 80, 000 56, 000 50, 000 94, 000 64

Forms Required At Time Of Application AGR-Lite uses AGR forms (or similar forms) 1. Application (FCI-12 AGR) 2. AGR-Lite Histories Calculation Worksheet 3. Complete Annual Farm Report (FCI 821 AGR) 4. A beginning Inventory Report (FCI 822 AGR or FCI 824 AGR) 5. Agricultural Commodity Profile for 75% or 80% coverage level for the last two crop years and the Actual Commodity Report at claim time. Copyright 2008, All Rights Reserved 65

Forms Required At Time Of Application AGR-Lite uses AGR forms (or similar forms) 1. Application (FCI-12 AGR) 2. AGR-Lite Histories Calculation Worksheet 3. Complete Annual Farm Report (FCI 821 AGR) 4. A beginning Inventory Report (FCI 822 AGR or FCI 824 AGR) 5. Agricultural Commodity Profile for 75% or 80% coverage level for the last two crop years and the Actual Commodity Report at claim time. Copyright 2008, All Rights Reserved 65

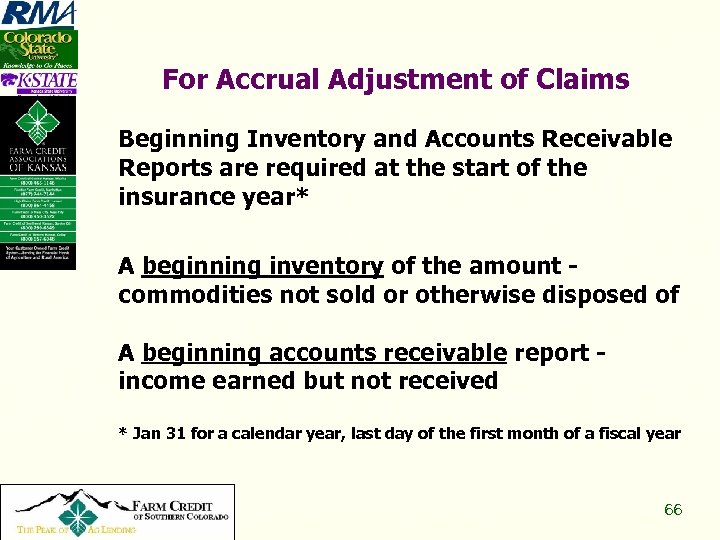

For Accrual Adjustment of Claims Beginning Inventory and Accounts Receivable Reports are required at the start of the insurance year* A beginning inventory of the amount commodities not sold or otherwise disposed of A beginning accounts receivable report income earned but not received * Jan 31 for a calendar year, last day of the first month of a fiscal year Copyright 2008, All Rights Reserved 66

For Accrual Adjustment of Claims Beginning Inventory and Accounts Receivable Reports are required at the start of the insurance year* A beginning inventory of the amount commodities not sold or otherwise disposed of A beginning accounts receivable report income earned but not received * Jan 31 for a calendar year, last day of the first month of a fiscal year Copyright 2008, All Rights Reserved 66

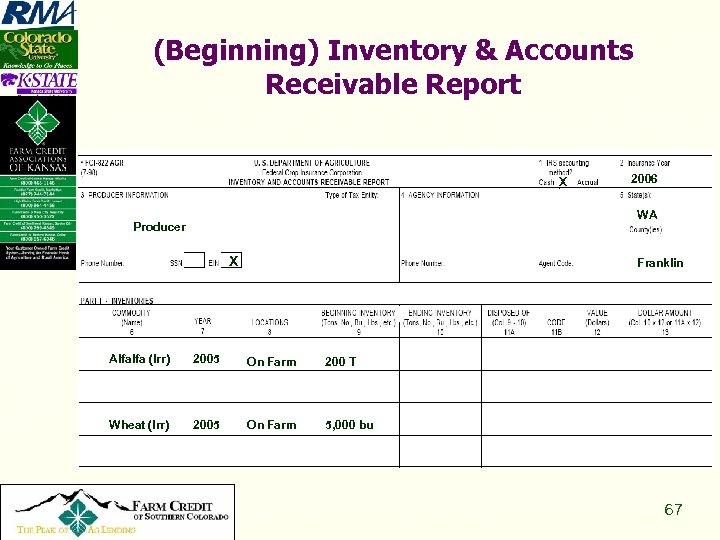

(Beginning) Inventory & Accounts Receivable Report X 2006 WA Producer X Franklin Alfalfa (Irr) 2005 On Farm 200 T Wheat (Irr) 2005 On Farm 5, 000 bu Copyright 2008, All Rights Reserved 67

(Beginning) Inventory & Accounts Receivable Report X 2006 WA Producer X Franklin Alfalfa (Irr) 2005 On Farm 200 T Wheat (Irr) 2005 On Farm 5, 000 bu Copyright 2008, All Rights Reserved 67

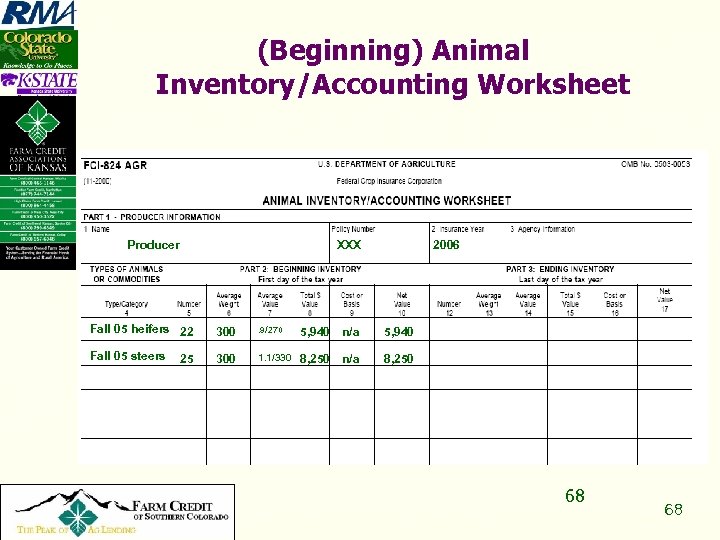

(Beginning) Animal Inventory/Accounting Worksheet Producer XXX 2006 Fall 05 heifers 22 300 . 9/270 5, 940 n/a 5, 940 Fall 05 steers 300 1. 1/330 8, 250 n/a 8, 250 25 68 Copyright 2008, All Rights Reserved 68

(Beginning) Animal Inventory/Accounting Worksheet Producer XXX 2006 Fall 05 heifers 22 300 . 9/270 5, 940 n/a 5, 940 Fall 05 steers 300 1. 1/330 8, 250 n/a 8, 250 25 68 Copyright 2008, All Rights Reserved 68

Forms Required At Time Of Application AGR-Lite uses AGR forms (or similar forms) 1. Application (FCI-12 AGR) 2. AGR-Lite Histories Calculation Worksheet 3. Complete Annual Farm Report (FCI 821 AGR) 4. A beginning Inventory Report (FCI 822 AGR or FCI 824 AGR) 5. Agricultural Commodity Profile for 75% or 80% coverage level for the last two crop years and the Actual Commodity Report at claim time. Copyright 2008, All Rights Reserved 69

Forms Required At Time Of Application AGR-Lite uses AGR forms (or similar forms) 1. Application (FCI-12 AGR) 2. AGR-Lite Histories Calculation Worksheet 3. Complete Annual Farm Report (FCI 821 AGR) 4. A beginning Inventory Report (FCI 822 AGR or FCI 824 AGR) 5. Agricultural Commodity Profile for 75% or 80% coverage level for the last two crop years and the Actual Commodity Report at claim time. Copyright 2008, All Rights Reserved 69

Commodity Profile Report For 75 and 80 percent coverage For last two years include: Commodity Acres Market percent by open vs. contracted Copyright 2008, All Rights Reserved 70

Commodity Profile Report For 75 and 80 percent coverage For last two years include: Commodity Acres Market percent by open vs. contracted Copyright 2008, All Rights Reserved 70

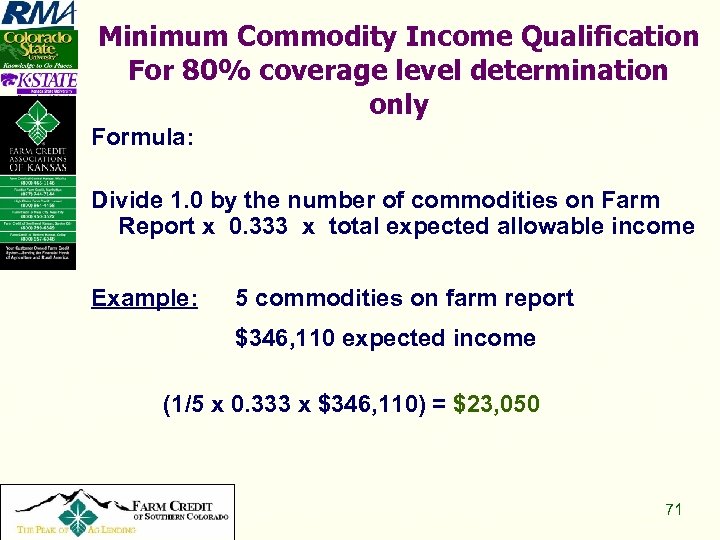

Minimum Commodity Income Qualification For 80% coverage level determination only Formula: Divide 1. 0 by the number of commodities on Farm Report x 0. 333 x total expected allowable income Example: 5 commodities on farm report $346, 110 expected income (1/5 x 0. 333 x $346, 110) = $23, 050 Copyright 2008, All Rights Reserved 71

Minimum Commodity Income Qualification For 80% coverage level determination only Formula: Divide 1. 0 by the number of commodities on Farm Report x 0. 333 x total expected allowable income Example: 5 commodities on farm report $346, 110 expected income (1/5 x 0. 333 x $346, 110) = $23, 050 Copyright 2008, All Rights Reserved 71

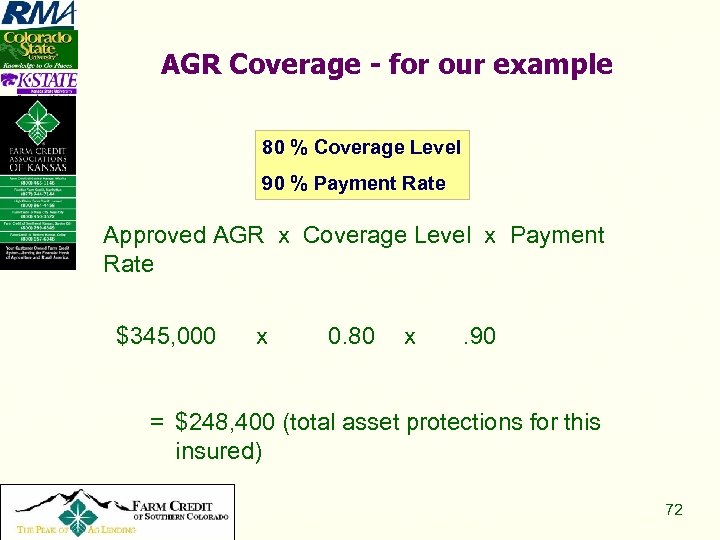

AGR Coverage - for our example 80 % Coverage Level 90 % Payment Rate Approved AGR x Coverage Level x Payment Rate $345, 000 x 0. 80 x . 90 = $248, 400 (total asset protections for this insured) Copyright 2008, All Rights Reserved 72

AGR Coverage - for our example 80 % Coverage Level 90 % Payment Rate Approved AGR x Coverage Level x Payment Rate $345, 000 x 0. 80 x . 90 = $248, 400 (total asset protections for this insured) Copyright 2008, All Rights Reserved 72

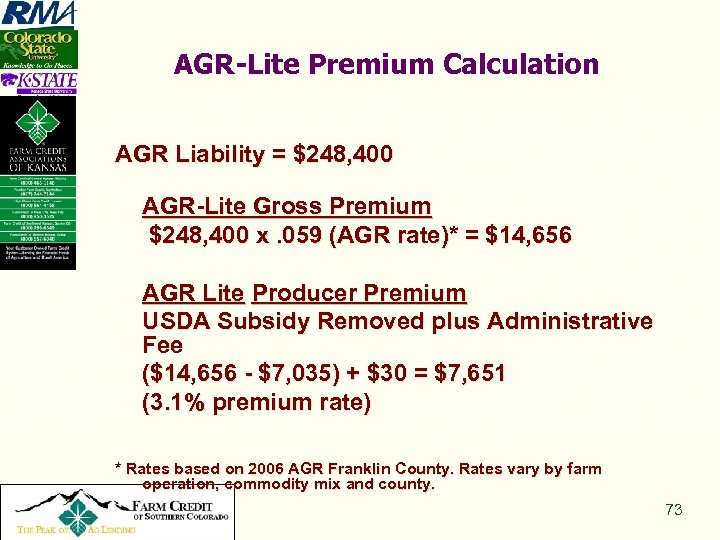

AGR-Lite Premium Calculation AGR Liability = $248, 400 AGR-Lite Gross Premium $248, 400 x. 059 (AGR rate)* = $14, 656 AGR Lite Producer Premium USDA Subsidy Removed plus Administrative Fee ($14, 656 - $7, 035) + $30 = $7, 651 (3. 1% premium rate) * Rates based on 2006 AGR Franklin County. Rates vary by farm operation, commodity mix and county. Copyright 2008, All Rights Reserved 73

AGR-Lite Premium Calculation AGR Liability = $248, 400 AGR-Lite Gross Premium $248, 400 x. 059 (AGR rate)* = $14, 656 AGR Lite Producer Premium USDA Subsidy Removed plus Administrative Fee ($14, 656 - $7, 035) + $30 = $7, 651 (3. 1% premium rate) * Rates based on 2006 AGR Franklin County. Rates vary by farm operation, commodity mix and county. Copyright 2008, All Rights Reserved 73

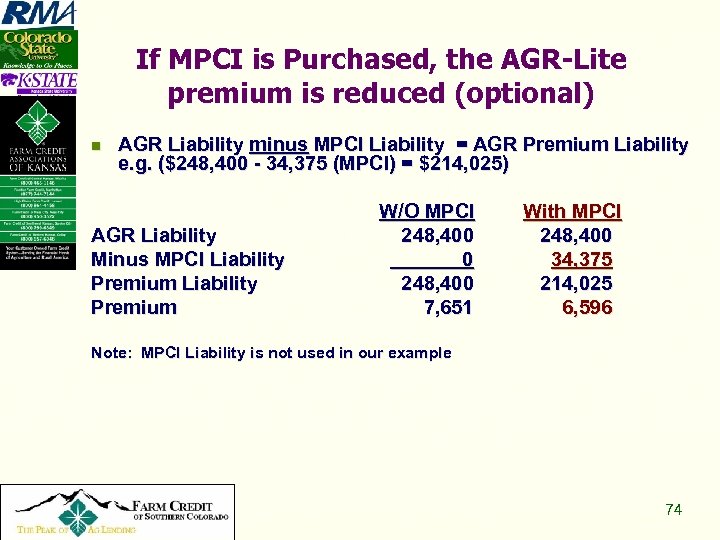

If MPCI is Purchased, the AGR-Lite premium is reduced (optional) n AGR Liability minus MPCI Liability = AGR Premium Liability e. g. ($248, 400 - 34, 375 (MPCI) = $214, 025) AGR Liability Minus MPCI Liability Premium W/O MPCI 248, 400 0 248, 400 7, 651 With MPCI 248, 400 34, 375 214, 025 6, 596 Note: MPCI Liability is not used in our example Copyright 2008, All Rights Reserved 74

If MPCI is Purchased, the AGR-Lite premium is reduced (optional) n AGR Liability minus MPCI Liability = AGR Premium Liability e. g. ($248, 400 - 34, 375 (MPCI) = $214, 025) AGR Liability Minus MPCI Liability Premium W/O MPCI 248, 400 0 248, 400 7, 651 With MPCI 248, 400 34, 375 214, 025 6, 596 Note: MPCI Liability is not used in our example Copyright 2008, All Rights Reserved 74

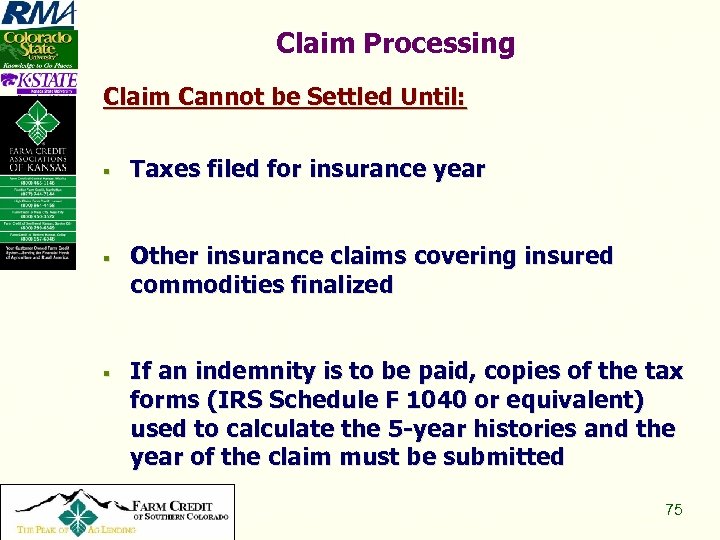

Claim Processing Claim Cannot be Settled Until: § § § Copyright 2008, All Rights Reserved Taxes filed for insurance year Other insurance claims covering insured commodities finalized If an indemnity is to be paid, copies of the tax forms (IRS Schedule F 1040 or equivalent) used to calculate the 5 -year histories and the year of the claim must be submitted 75

Claim Processing Claim Cannot be Settled Until: § § § Copyright 2008, All Rights Reserved Taxes filed for insurance year Other insurance claims covering insured commodities finalized If an indemnity is to be paid, copies of the tax forms (IRS Schedule F 1040 or equivalent) used to calculate the 5 -year histories and the year of the claim must be submitted 75

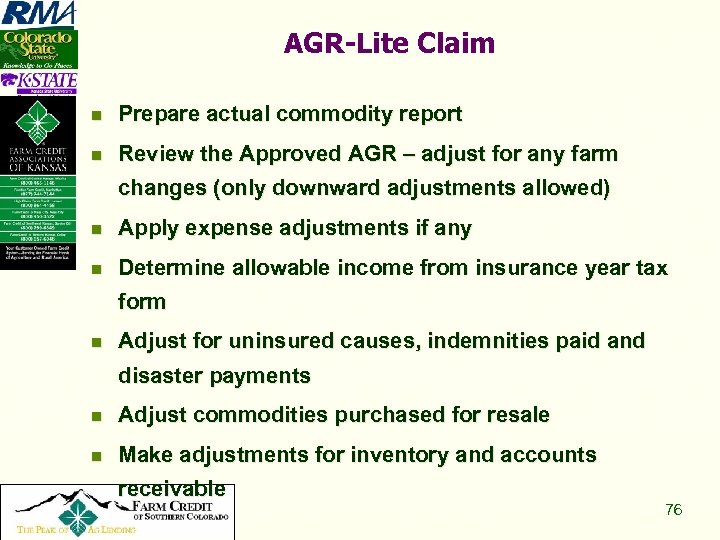

AGR-Lite Claim n Prepare actual commodity report n Review the Approved AGR – adjust for any farm changes (only downward adjustments allowed) n Apply expense adjustments if any n Determine allowable income from insurance year tax form n Adjust for uninsured causes, indemnities paid and disaster payments n Adjust commodities purchased for resale n Make adjustments for inventory and accounts receivable Copyright 2008, All Rights Reserved 76

AGR-Lite Claim n Prepare actual commodity report n Review the Approved AGR – adjust for any farm changes (only downward adjustments allowed) n Apply expense adjustments if any n Determine allowable income from insurance year tax form n Adjust for uninsured causes, indemnities paid and disaster payments n Adjust commodities purchased for resale n Make adjustments for inventory and accounts receivable Copyright 2008, All Rights Reserved 76

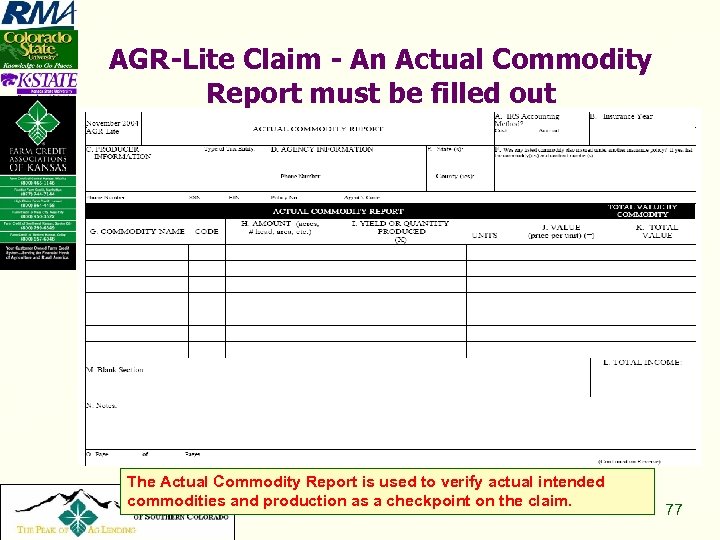

AGR-Lite Claim - An Actual Commodity Report must be filled out Copyright 2008, All Rights Reserved The Actual Commodity Report is used to verify actual intended commodities and production as a checkpoint on the claim. 77

AGR-Lite Claim - An Actual Commodity Report must be filled out Copyright 2008, All Rights Reserved The Actual Commodity Report is used to verify actual intended commodities and production as a checkpoint on the claim. 77

AGR-Lite Claim Revenue to Count for the Insurance Year (Line 26 Claim Form) n Determine allowable income from tax form n Adjust commodities purchased for resale n Copyright 2008, All Rights Reserved Adjust for uninsured causes, indemnities paid and disaster payment 78

AGR-Lite Claim Revenue to Count for the Insurance Year (Line 26 Claim Form) n Determine allowable income from tax form n Adjust commodities purchased for resale n Copyright 2008, All Rights Reserved Adjust for uninsured causes, indemnities paid and disaster payment 78

Excluded Revenue Income for Claim Purposes n Additional income from value added items n Cooperative dividends (not related to commodity production) n Processing of insured commodities n Custom hire (machine work) n Agricultural program payments n Commodities not covered n Ad Hoc disaster payments Copyright 2008, All Rights Reserved 79

Excluded Revenue Income for Claim Purposes n Additional income from value added items n Cooperative dividends (not related to commodity production) n Processing of insured commodities n Custom hire (machine work) n Agricultural program payments n Commodities not covered n Ad Hoc disaster payments Copyright 2008, All Rights Reserved 79

AGR-Lite Claim Adjustments to Revenue to Count n n Copyright 2008, All Rights Reserved Make inventory adjustments (line 27 claim form) Subtract beginning inventory (price received/value) Add ending inventory (value first of month claim settled) Make accounts receivable adjustments (line 28 claim form) Ending accounts receivable (adjusted for costs) - beginning accounts receivable (adjusted for costs) 80

AGR-Lite Claim Adjustments to Revenue to Count n n Copyright 2008, All Rights Reserved Make inventory adjustments (line 27 claim form) Subtract beginning inventory (price received/value) Add ending inventory (value first of month claim settled) Make accounts receivable adjustments (line 28 claim form) Ending accounts receivable (adjusted for costs) - beginning accounts receivable (adjusted for costs) 80

Inventory Market Value The value of ending inventories will be the actual price received if the inventory is sold prior to the time the claim is finalized, Or The local market value on the first day of the month in which the claim is finalized if the inventory is not sold at the time the claim is finalized Copyright 2008, All Rights Reserved 81

Inventory Market Value The value of ending inventories will be the actual price received if the inventory is sold prior to the time the claim is finalized, Or The local market value on the first day of the month in which the claim is finalized if the inventory is not sold at the time the claim is finalized Copyright 2008, All Rights Reserved 81

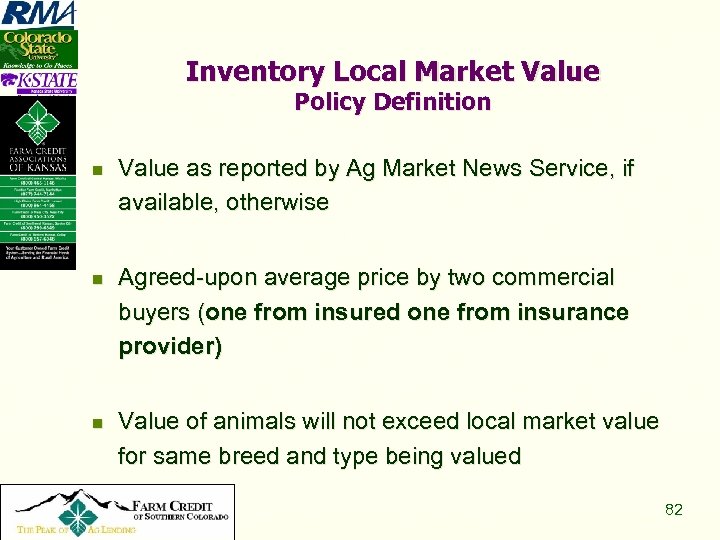

Inventory Local Market Value Policy Definition n Value as reported by Ag Market News Service, if available, otherwise n Agreed-upon average price by two commercial buyers (one from insured one from insurance provider) n Value of animals will not exceed local market value for same breed and type being valued Copyright 2008, All Rights Reserved 82

Inventory Local Market Value Policy Definition n Value as reported by Ag Market News Service, if available, otherwise n Agreed-upon average price by two commercial buyers (one from insured one from insurance provider) n Value of animals will not exceed local market value for same breed and type being valued Copyright 2008, All Rights Reserved 82

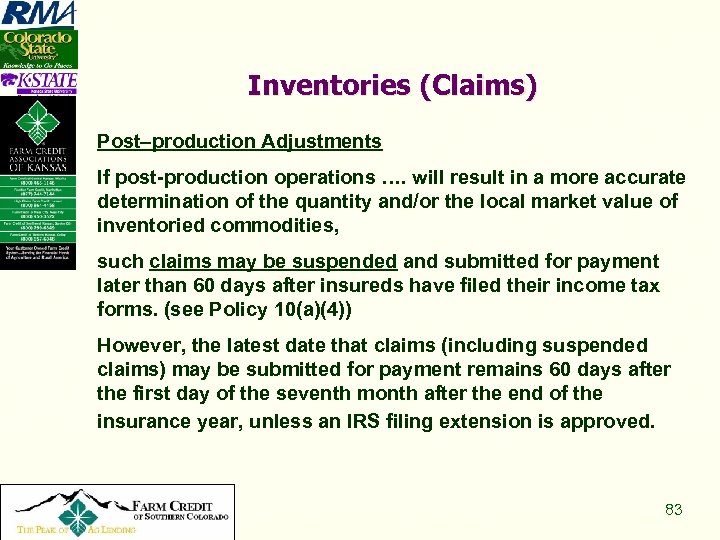

Inventories (Claims) Post–production Adjustments If post-production operations …. will result in a more accurate determination of the quantity and/or the local market value of inventoried commodities, such claims may be suspended and submitted for payment later than 60 days after insureds have filed their income tax forms. (see Policy 10(a)(4)) However, the latest date that claims (including suspended claims) may be submitted for payment remains 60 days after the first day of the seventh month after the end of the insurance year, unless an IRS filing extension is approved. Copyright 2008, All Rights Reserved 83

Inventories (Claims) Post–production Adjustments If post-production operations …. will result in a more accurate determination of the quantity and/or the local market value of inventoried commodities, such claims may be suspended and submitted for payment later than 60 days after insureds have filed their income tax forms. (see Policy 10(a)(4)) However, the latest date that claims (including suspended claims) may be submitted for payment remains 60 days after the first day of the seventh month after the end of the insurance year, unless an IRS filing extension is approved. Copyright 2008, All Rights Reserved 83

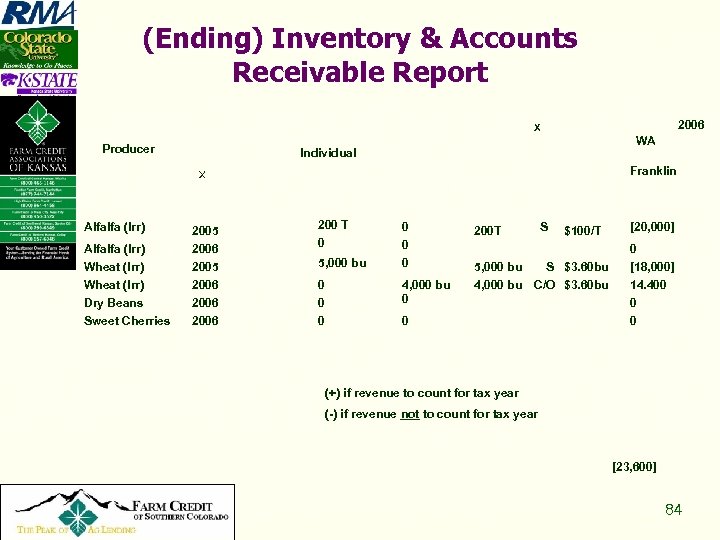

(Ending) Inventory & Accounts Receivable Report 2006 X Producer WA Individual Franklin X Alfalfa (Irr) Wheat (Irr) Dry Beans Sweet Cherries 2005 2006 200 T 0 5, 000 bu 0 0 0 4, 000 bu 0 S 200 T 5, 000 bu 4, 000 bu $100/T S $3. 60 bu C/O $3. 60 bu 0 [20, 000] 0 [18, 000] 14. 400 0 0 (+) if revenue to count for tax year (-) if revenue not to count for tax year [23, 600] Copyright 2008, All Rights Reserved 84

(Ending) Inventory & Accounts Receivable Report 2006 X Producer WA Individual Franklin X Alfalfa (Irr) Wheat (Irr) Dry Beans Sweet Cherries 2005 2006 200 T 0 5, 000 bu 0 0 0 4, 000 bu 0 S 200 T 5, 000 bu 4, 000 bu $100/T S $3. 60 bu C/O $3. 60 bu 0 [20, 000] 0 [18, 000] 14. 400 0 0 (+) if revenue to count for tax year (-) if revenue not to count for tax year [23, 600] Copyright 2008, All Rights Reserved 84

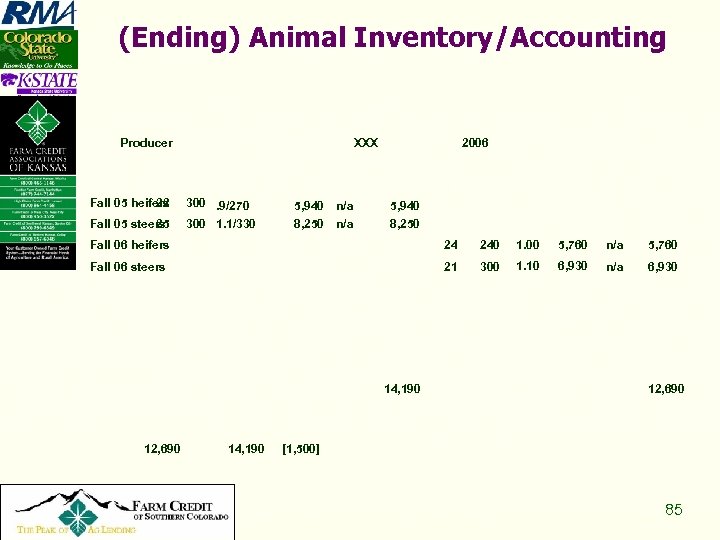

(Ending) Animal Inventory/Accounting Producer Fall 05 heifers 22 Fall 05 steers 25 XXX 300. 9/270 300 1. 1/330 5, 940 n/a 8, 250 n/a 2006 5, 940 8, 250 Fall 06 heifers 24 240 1. 00 5, 760 n/a 5, 760 Fall 06 steers 21 300 1. 10 6, 930 n/a 6, 930 14, 190 12, 690 Copyright 2008, All Rights Reserved 14, 190 12, 690 [1, 500] 85

(Ending) Animal Inventory/Accounting Producer Fall 05 heifers 22 Fall 05 steers 25 XXX 300. 9/270 300 1. 1/330 5, 940 n/a 8, 250 n/a 2006 5, 940 8, 250 Fall 06 heifers 24 240 1. 00 5, 760 n/a 5, 760 Fall 06 steers 21 300 1. 10 6, 930 n/a 6, 930 14, 190 12, 690 Copyright 2008, All Rights Reserved 14, 190 12, 690 [1, 500] 85

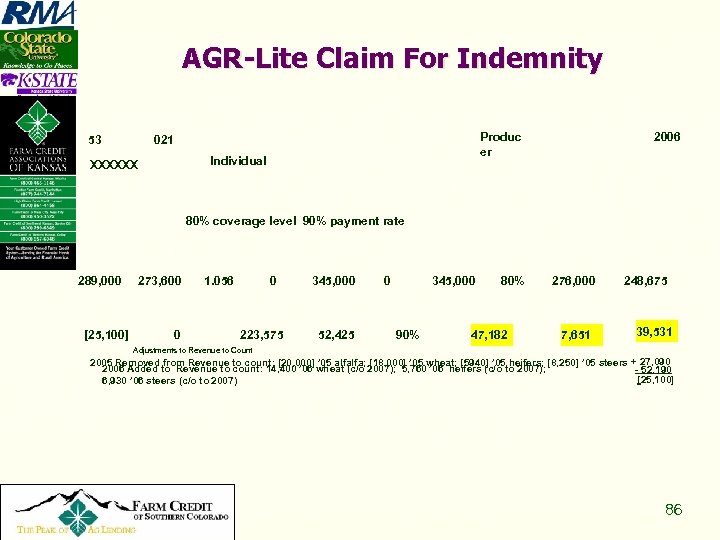

AGR-Lite Claim For Indemnity 53 Produc er 021 Individual XXXXXX 2006 80% coverage level 90% payment rate 289, 000 [25, 100] 273, 600 0 1. 056 0 223, 575 345, 000 52, 425 0 345, 000 90% 80% 47, 182 276, 000 7, 651 248, 675 39, 531 Adjustments to Revenue to Count 2005 Removed from Revenue to count: [20, 000] ’ 05 alfalfa; [18, 000] ’ 05 wheat; [5940] ’ 05 heifers; [8, 250] ’ 05 steers + 27, 090 2006 Added to Revenue to count: 14, 400 ’ 06 wheat (c/o 2007); 5, 760 ’ 06 heifers (c/o to 2007); - 52, 190 [25, 100] 6, 930 ’ 06 steers (c/o to 2007) Copyright 2008, All Rights Reserved 86

AGR-Lite Claim For Indemnity 53 Produc er 021 Individual XXXXXX 2006 80% coverage level 90% payment rate 289, 000 [25, 100] 273, 600 0 1. 056 0 223, 575 345, 000 52, 425 0 345, 000 90% 80% 47, 182 276, 000 7, 651 248, 675 39, 531 Adjustments to Revenue to Count 2005 Removed from Revenue to count: [20, 000] ’ 05 alfalfa; [18, 000] ’ 05 wheat; [5940] ’ 05 heifers; [8, 250] ’ 05 steers + 27, 090 2006 Added to Revenue to count: 14, 400 ’ 06 wheat (c/o 2007); 5, 760 ’ 06 heifers (c/o to 2007); - 52, 190 [25, 100] 6, 930 ’ 06 steers (c/o to 2007) Copyright 2008, All Rights Reserved 86

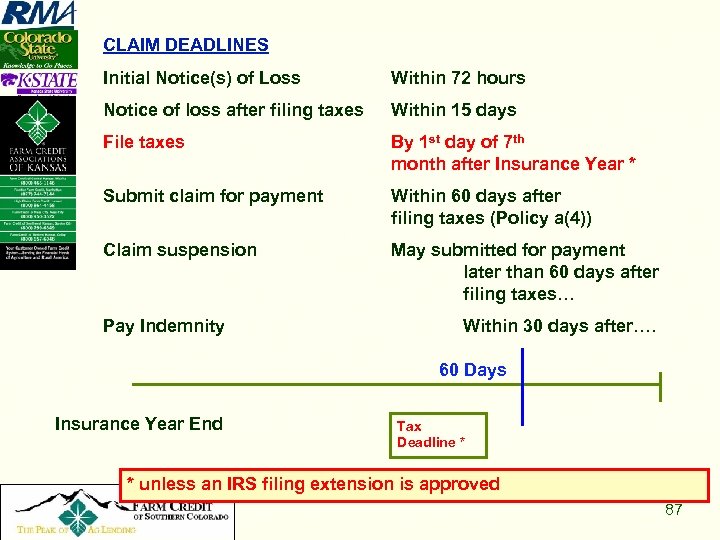

CLAIM DEADLINES Initial Notice(s) of Loss Within 72 hours Notice of loss after filing taxes Within 15 days File taxes By 1 st day of 7 th month after Insurance Year * Submit claim for payment Within 60 days after filing taxes (Policy a(4)) Claim suspension May submitted for payment later than 60 days after filing taxes… Pay Indemnity Within 30 days after…. 60 Days Insurance Year End Tax Deadline * * unless an IRS filing extension is approved Copyright 2008, All Rights Reserved 87

CLAIM DEADLINES Initial Notice(s) of Loss Within 72 hours Notice of loss after filing taxes Within 15 days File taxes By 1 st day of 7 th month after Insurance Year * Submit claim for payment Within 60 days after filing taxes (Policy a(4)) Claim suspension May submitted for payment later than 60 days after filing taxes… Pay Indemnity Within 30 days after…. 60 Days Insurance Year End Tax Deadline * * unless an IRS filing extension is approved Copyright 2008, All Rights Reserved 87

AGR- Lite Date Summary Copyright 2008, All Rights Reserved 88

AGR- Lite Date Summary Copyright 2008, All Rights Reserved 88

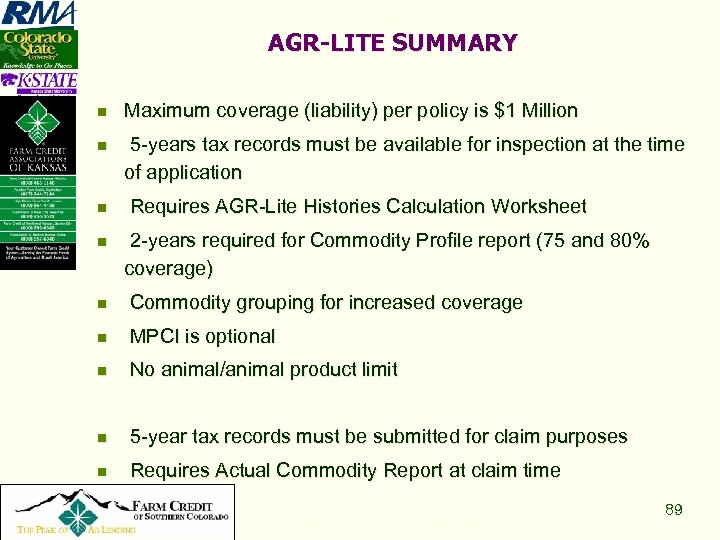

AGR-LITE SUMMARY n Maximum coverage (liability) per policy is $1 Million n 5 -years tax records must be available for inspection at the time of application n n Requires AGR-Lite Histories Calculation Worksheet 2 -years required for Commodity Profile report (75 and 80% coverage) n Commodity grouping for increased coverage n MPCI is optional n No animal/animal product limit n 5 -year tax records must be submitted for claim purposes n Requires Actual Commodity Report at claim time Copyright 2008, All Rights Reserved 89

AGR-LITE SUMMARY n Maximum coverage (liability) per policy is $1 Million n 5 -years tax records must be available for inspection at the time of application n n Requires AGR-Lite Histories Calculation Worksheet 2 -years required for Commodity Profile report (75 and 80% coverage) n Commodity grouping for increased coverage n MPCI is optional n No animal/animal product limit n 5 -year tax records must be submitted for claim purposes n Requires Actual Commodity Report at claim time Copyright 2008, All Rights Reserved 89

Adjusted Gross Revenue-Lite (AGR-Lite) n n Copyright 2008, All Rights Reserved This presentation does not provide full details of policy provisions or approved procedures. Producers should consult with a local agent for specific details and program requirement Farmers interested in AGR-Lite should talk to an agent ASAP because it will require time to gather all of the information for an application. DO NOT WAIT UNTIL MARCH 15! 90

Adjusted Gross Revenue-Lite (AGR-Lite) n n Copyright 2008, All Rights Reserved This presentation does not provide full details of policy provisions or approved procedures. Producers should consult with a local agent for specific details and program requirement Farmers interested in AGR-Lite should talk to an agent ASAP because it will require time to gather all of the information for an application. DO NOT WAIT UNTIL MARCH 15! 90

Thank You DR. NORM DALSTED – COLORADO STATE UNIVERSITY PHONE: 970 -491 -5627 EMAIL: Norman. Dalsted@colostate. edu DR. G. A. “ART” BARNABY, JR-KANSAS STATE UNIVERSITY PHONE: 785 -532 -1515 EMAIL: barnaby@ksu. edu Check out our WEB page at: http: //www. Ag. Manager. info Copyright 2008, All Rights Reserved 91

Thank You DR. NORM DALSTED – COLORADO STATE UNIVERSITY PHONE: 970 -491 -5627 EMAIL: Norman. Dalsted@colostate. edu DR. G. A. “ART” BARNABY, JR-KANSAS STATE UNIVERSITY PHONE: 785 -532 -1515 EMAIL: barnaby@ksu. edu Check out our WEB page at: http: //www. Ag. Manager. info Copyright 2008, All Rights Reserved 91