6ae3f5400ae9e11eddd14a9a00ecdfa5.ppt

- Количество слайдов: 47

Addressing Risks in Cross Border Contracting in Established & Emerging Markets ACC Contracts Symposium Todd Taylor and Julie Bradlow November 1, 2013

Cross-Border Contracting Issues • Can it be done? • • Are there legal restrictions prohibiting the purchase or sale of the good or service? How should it be done? Are there special rules relating to the contract or the business arrangement? • Are there tax issues that need to be addressed? • • 2 Are there any issues that may be unique to certain emerging markets?

Can it be done? • • Export Restrictions • Import Restrictions • 3 Sanction Regimes Anti-Bribery Laws

OFAC Regulations • • 4 The Office of Foreign Asset Control (“OFAC”), part of the U. S. Dept. of the Treasury, is the primary U. S. regulator responsible for administration of a wide range of U. S. economic and trade sanctions. OFAC rules are largely found in Executive Orders and implementing regulations (i. e. , 12 CFR Part 501 – 598) issued pursuant to laws such as the Trading with the Enemies Act, the International Emergency Economic Powers Act and the United Nations Participation Act.

OFAC Regulations: Country-Based Rules • • Generally speaking, the countries covered by the more comprehensive country-based restrictions are: Burma, Cuba, Iran, N. Korea, Sudan & Syria. • The most onerous OFAC sanction regimes apply to Cuba, Iran & Sudan. • 5 OFAC country-based regulations generally prohibit a wide range of transactions with or within certain countries. Sanctions may apply to export, re-export and import of good or services.

OFAC Regulations: List-Based Rules • • So if my contract counter-party is not in or affiliated with a sanctioned country can I enter into the contract? -- Not necessarily. OFAC also administers sanction programs prohibiting transactions with certain persons or entities. • • 6 Such programs include enforcement of UN Security Council resolutions, anti-terrorism and anti-narcotic efforts. Restricted persons and entities are usually found on the List of Specially Designated Nationals and Blocked Persons (the “SDN List”).

OFAC Regulations: Potential Concerns • “Facilitation” -- Certain OFAC regulations contain prohibitions on U. S. persons “facilitating” transactions that otherwise would be barred under other OFAC regulations (e. g. , 31 CFR §§ 538. 206, 538. 407 & 560. 208). • 7 Penalties: Violations of OFAC regulations can lead to civil and criminal penalties.

Export Control Regulations In the U. S. (outside of OFAC) the primary export control regulations are: • The International Traffic in Arms Regulations (the “ITAR”) • 8 The Export Administration Regulations (the “EAR”) 8

ITAR (22 CFR Parts 120 – 130) • • Regulates permanent and temporary export of defense articles and defense services. • Also addresses temporary imports of defense articles and defense services. • 9 ITAR implements the Arms Export Control Act. ITAR is administered by the U. S. Dept. of State, Directorate of Defense Trade Controls (“DDTC”). 9

ITAR: Definitions • Defense articles subject to the ITAR are generally set forth on the United States Munitions List (the “USML”). See 12 CFR Part 121. • Export is broadly defined to include: • • • 10 sending/taking defense articles outside of US; transferring ownership/control to a foreign person of any vessel, aircraft or satellite covered by the USML; disclosing or transferring in the US any defense article to an embassy, agency or subdivision of a foreign government; disclosing or transferring certain technical data to a foreign person (whether in the US or abroad); and performing a defense service on behalf of, or for the benefit of, a foreign person (whether in the In US or abroad).

ITAR: General Rules • Persons manufacturing or exporting defense articles or providing defense services in or from the US are generally required to register with the DDTC. • US persons, and foreign persons in the US or subject to US jurisdiction, that broker defense articles or defense services are also generally required to register with the DDTC. • Subject to certain exceptions, the export or temporary import of defense articles requires authorization of the DDTC. • • 11 Note – US policy generally prohibits exports of defense articles/services to, or imports of defense articles/services from certain countries (e. g. , Belarus, Burma, China, Cuba, the Democratic Republic of Congo, Iran, N. Korea, Sudan, Syria and Venezuela) The furnishing of defense services also requires the approval of the DDTC. An agreement must be submitted to the DDTC for its approval.

The EAR (15 CFR Parts 730 – 774) • The EAR was originally promulgated pursuant to the Export Administration Act (which has since expired), but remains in effect pursuant to executive order under the authority of the International Emergency Economic Powers Act. • Subject to some exceptions, the EAR governs the export of most items not covered by ITAR or the nuclear related controls of the Dept. of Energy & the NRC. • The EAR is administered by the Bureau of Industry and Security (“BIS”), an agency of the U. S. Commerce Dept. 12

Understanding the EAR • The EAR is notoriously complex. • To better navigate the EAR, an exporter should have answers for four key questions in connection with every export: What is being exported? • Where will the items be exported to? • Who will receive the exported items? • What will the exported items be used for? • 13

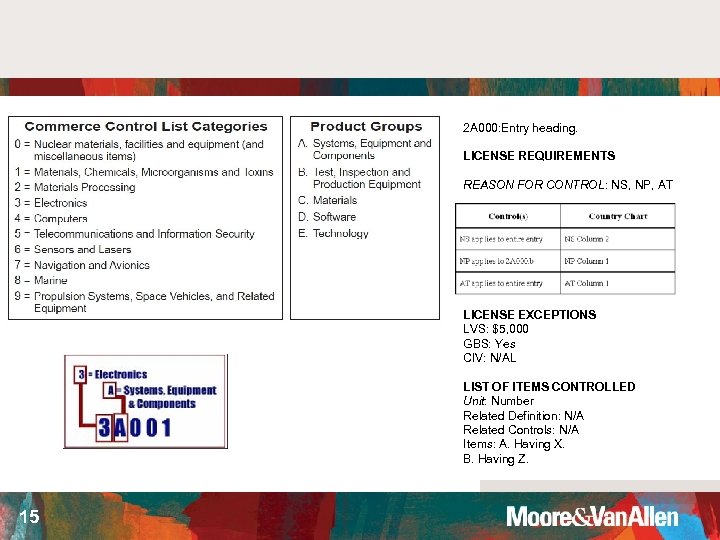

What is being exported? • Exporter must determine their Export Classification Control Number (“ECCN”) listed on the Commerce Control List (“CCL”). • Items subject to the EAR but not on the CCL are generally classified as EAR 99 – which are subject to much less stringent controls. 14

2 A 000: Entry heading. LICENSE REQUIREMENTS REASON FOR CONTROL: NS, NP, AT LICENSE EXCEPTIONS LVS: $5, 000 GBS: Yes CIV: N/AL LIST OF ITEMS CONTROLLED Unit: Number Related Definition: N/A Related Controls: N/A Items: A. Having X. B. Having Z. 15

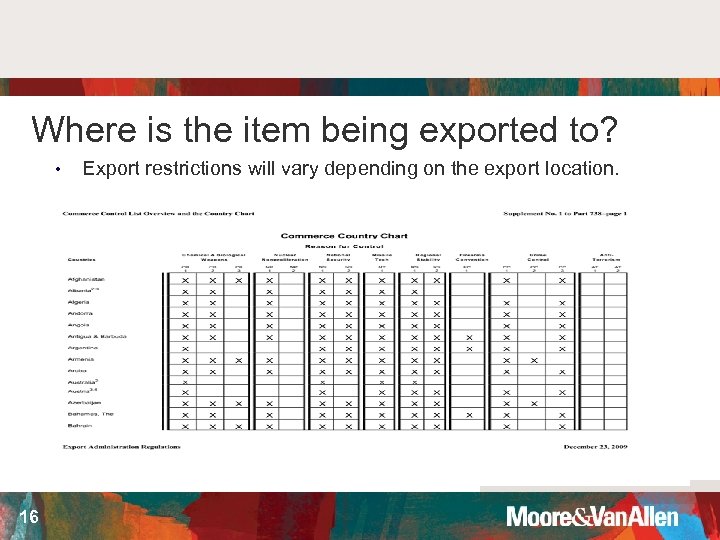

Where is the item being exported to? • 16 Export restrictions will vary depending on the export location.

Who & What • Who will receive the exported item? Even if exports are permitted to a given country, certain persons and entities are blocked from receiving US exports and licenses may be required to export to other persons and entities. • Exporters will need to review various restricted lists. • • What will the exported item be used for? • 17 Certain end uses are blocked or require a license (see e. g. , 15 CFR Part 744).

The EAR: Other Issues • Deemed Exports • Re-exports • Export Reform 18

Foreign Import Restrictions • Even if an export is permitted under U. S. law, certain countries may restrict the importation of the item. • China – Prohibits import of printed matters, films, photographs, audio tapes and other media that may be detrimental to China’s politics, economy, culture or morality. • Chinese CEC Regulations require licenses for importation of certain technology with encryption functionality. • • 19 Russia does not recognize Wassenaar personal use exception for encryption products.

Best Practices When Contracting • If you are exporting an item you are not manufacturing, require (if possible) the manufacturer to provide an ECCN. • Ensure that you understand your ECCN classification prior to entering into agreements to supply items. • Obtain appropriate representations from customers (e. g. , will not engage in prohibited re-exports, will not use items for prohibited end uses, etc. ) • Engage local counsel if there are concerns about the potential impact of local regulations on the importation of any particular items. 20

The Foreign Corrupt Practices Act (the “FCPA”) The FCPA essentially has two basic provisions: • Books & Records – The FCPA requires all issuers of U. S. registered securities or companies with U. S. reporting obligations to maintain sound internal controls and accurate books and records (15 U. S. C. § 78 m). • Anti-Bribery – The FCPA prohibits corrupt payments to foreign officials/candidates, foreign political parties or party officials for the purpose of obtaining/retaining business or improper advantage (15 U. S. C. §§ 78 dd-1 – 78 dd-3). 21

The FCPA: Anti-Bribery Provisions The FCPA’s anti-bribery provisions apply to: • Issuers (15 U. S. C. § 78 dd-1) • Domestic Concerns (15 U. S. C. § 78 dd-2) – broad category would include • Foreign persons or entities acting in the U. S. (15 U. S. C. § 78 dd-3) – broadly interpreted by DOJ 22

The FCPA: Enforcement • The SEC and the DOJ have enforcement responsibility for the FCPA. • Criminal and civil penalties may be imposed for violations (including imprisonment, fines, disgorgement of profits and government contract debarment). 23

The FCPA: Enforcement “For these reasons, fighting global corruption is, and always will be, a core priority of the Department of Justice. Since 2005, [we have] secured close to three dozen corporate guilty pleas in FCPA cases. And just since 2009, [we have] entered into over 40 corporate resolutions, including nine of the top 10 biggest resolutions ever in terms of penalties, resulting in approximately $2. 5 billion in monetary fines. And, perhaps most important, in that same period, we have successfully secured the convictions of over three dozen individuals for engaging in foreign bribery schemes. ” -- Acting Assistant Attorney General Mythili Raman, 24 June 17, 2013

The FCPA: Special Issues • Exceptions/Defenses? – Facilitation/grease payments for routine governmental action. • Payments that were lawful under written laws of applicable country. • Reasonable bona fide expenditures for promotion of products/services or execution/performance of contract. • • 25 State Owned Companies (See U. S. v. Carson, 2011 U. S. Dist. Lexis 88853 (C. D. Cal. May 18, 2011)).

The FCPA: Special Issues (cont. ) Third Party Payments – FCPA prohibits corrupt payments made by or through third party agents or intermediaries. • (See U. S. v. AGA Medical Corp. , located at http: //www. justice. gov/criminal/fraud/fcpa/cases/agamedcorp/06 -0308 aga-info. pdf). • Can’t take “head in the sand” approach with distributors/agents. • Watch for red flags • • • 26 Excessive fees, commissions & discounts Vague or non-existent consulting agreements Close relations with government officials

Other Anticorruption Laws and Treaties • OECD Convention Requires member states to take effective legal measures to combat bribery of foreign officials. • 34 states are signatories to the OECD at present. • • UK Bribery Act – similar to FCPA, but with some differences addresses both public and private bribery; • covers all companies doing business (in whole or in part) in the UK; and • does not have an exception for grease payments. • 27

Best Practices When Contracting • Consider reviewing DOJ’s 11/12 Resource Guide to the U. S. Foreign Corrupt Practices Act. • Develop, maintain and actively comply with anti-corruption policies and procedures. • Know your customer and third party distributors. • Ensure that contracts with agents, distributors and vendors adequately describe legitimate services and payments for such services. • Policies, practices and due diligence procedures may need to be varied when contracting in higher risk industries (e. g. , energy) or countries. 28

How should it be done? • Contracting Rules for Sales • Special Considerations When Outsourcing (data privacy, etc. ) 29

The United Nations Convention on Contracts for the International Sale of Goods (“CISG”) • • • 30 Governs many international business to business sale of goods transactions. Effective as of January 1, 1988 when 10 th member ratified convention. US is a founding party to the CISG and it is binding U. S. law (S. Treaty Doc. No. 98 -9 (1983)).

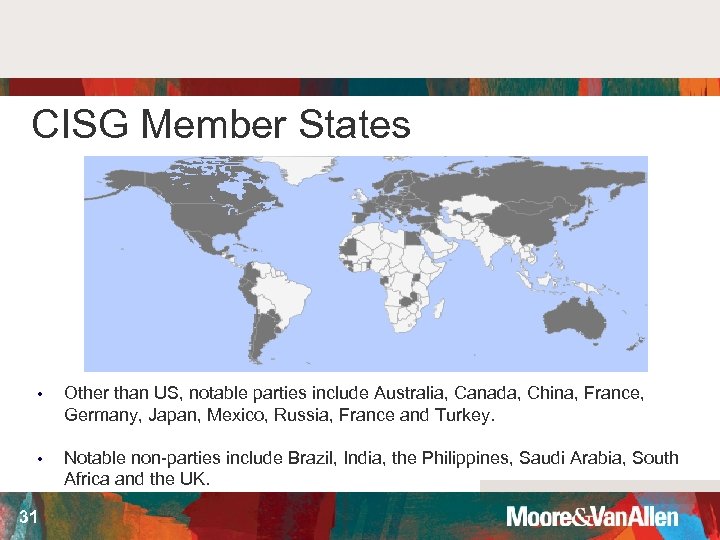

CISG Member States • Other than US, notable parties include Australia, Canada, China, France, Germany, Japan, Mexico, Russia, France and Turkey. • Notable non-parties include Brazil, India, the Philippines, Saudi Arabia, South Africa and the UK. 31

CISG: Application • In transactions between parties whose place of businesses are in different member states, the CISG will apply by default (CISG, Art. 1). • Parties can agree to exclude operation of the CISG (CISG, Art. 6). • Note for US parties, if the counterparty is not in a CISG state, the CISG will not apply – though the parties can probably agree for it to apply. • CISG will not apply: • if contract primarily relates to services (CISG Art. 3(2)). to consumer transactions [not like UCC] (CISG, Art. 2(a)) to auctions (CISG Art. 2(b); to transactions in securities, negotiable instruments & currency (CISG, Art. 2(d)); to transactions in ships or aircraft (CISG, Art. 2(e)); and • to transactions in electricity (CISG, Art. 2(f). • • 32

CISG: Key Items to Note • Contracts do not need to be in writing, unlike UCC for sales above certain dollar threshold (CISG, Art. 11). • • A party may obtain specific performance as a remedy under a CISG contract (CISG, Articles 46(1) & 62). • • 33 Note: A written agreement can include a NOM clause. (CISG, Art. 29). Note: Obtaining the remedy may depend on whether local courts would grant specific performance in a given situation (CISG, Art. 28). CISG has a force majeure defense for either party (CISG, Art. 79(1)).

Best Practices When Contracting • Know the place of business of your contract counterparty and whether that will result in the CISG applying. • • Carefully draft your choice of law clauses – if the other counterparty is in a different member state, a governing law provision that says “the law of North Carolina” will govern will result in the CISG applying. • • 34 Note: Member states can exclude the operation of certain CISG clauses in their countries. If the other party is in a CISG member state, and you do not want the CISG to apply, expressly exclude the CISG. If the CISG applies, ensure that contract is writing and include a NOM clause.

Incoterms® 2010 • Incoterms are commercial trade terms promulgated by the International Chamber of Commerce. • The current version of Incoterms was adopted in 2010. • Incoterms generally set forth carriage, insurance, delivery and risk of loss terms; they do not address all aspects of a business arrangement. • Contacting parties must expressly agree to use of Incoterms, they do not apply by default. 35

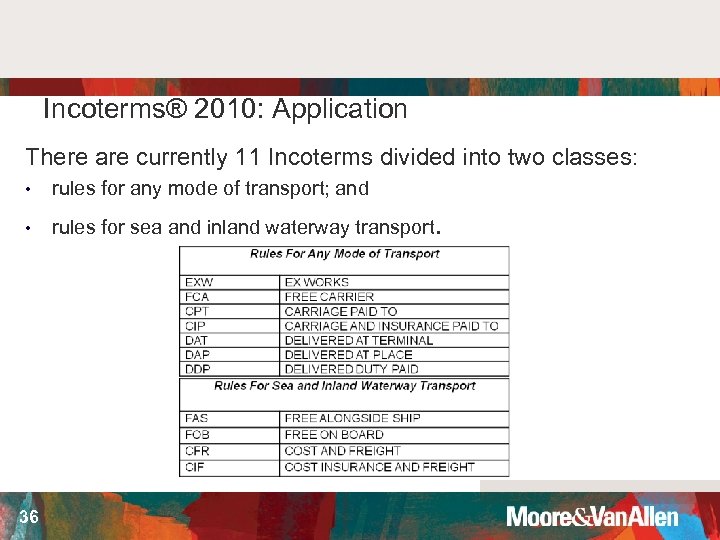

Incoterms® 2010: Application There are currently 11 Incoterms divided into two classes: • rules for any mode of transport; and • rules for sea and inland waterway transport. 36

Incoterms® 2010: Example DDP Buyer’s Warehouse Loading Dock, 111 XYZ Lane, Miami, Florida, Incoterms® 2010. • Delivered Duty Paid means the seller delivers the goods when the goods are placed at buyer’s disposal, cleared for import on the arriving form of transport ready for unloading at the place of destination. • DDP is the maximum obligation of Seller. 37

38 Cross Border Transactions: Data Privacy Issues Gramm-Leach-Bliley Act • Fair Credit Reporting Act/Fair and Accurate Credit Transactions Act • HIPAA • • 38 EU Data Privacy Directive • Promulgated by the EU in 1995, required member states to adopt implementing legislation by 1998. • Covers personally identifiable data related to a human person. • Sets restrictions on export of data from EU. • FTC safe Harbor. • Potential updates to directive?

39 Cross Border Transactions: Other Issues California Transparency in Supply Chains Act (CAL. CIV. CODE § 1714. 3) • Labor Issues • • • 39 US Visas (B-1, H 1 -B, L) Foreign Visas Outsourcing: • India Shops and Establishment Acts • Mandatory Unions European Union Acquired Rights Directive/U. K. Transfer of Undertakings (Protection of Employees) legislation. WARN Act

Overview of Tax Issues • • • 40 In General Permanent Establishment Income Tax Withholding Indirect Taxes (Customs and VAT or GST) Internal Revenue Code Section 863(b) Issues International Boycott Issues

In General • • • 41 Each contract is unique Analysis requires looking at a combination of U. S. tax law, local tax law and treaty provisions The U. S. does not have a tax treaty with every country (Brazil and Singapore are prime examples) Many emerging market countries (e. g. BRICS and Next Eleven) likely to have non-conforming tax systems Ability to utilize foreign tax credits is limited

Permanent Establishment Taxable presence in a country as determined under a tax treaty • Generally, a fixed place of business (with exceptions) • Can be an employee or other dependent agent with authority to conclude contracts in the name of his/her employer • Can be an employee who spends sufficient time in the other country • 42

Income Tax Withholding US tax law requires withholding of 30% from certain U. S. source payments made to foreign persons unless a treaty exemption applies • Withholding not required on amounts that are effectively connected income • Foreign countries’ withholding requirements vary; also may be reduced or eliminated by treaty or local law • Seller’s considerations and buyer’s considerations differ • 43

Customs Incoterms can determine who is responsible for customs duties • Customs duties often end up being dealt with in the tax section of a contract, even if the company’s tax function does not administer them • Emerging markets countries benefit from the GSP, which allows WTO member countries to impose lower tariffs on imports from certain countries • 44

VAT and GST • • • 45 Value Added Tax or Goods and Services Tax is a consumption tax Buyer pays a tax on the purchase price Seller owes tax to the extent of value added; remits that amount to the government and retains the difference to offset inputs Differs from a sales tax because collected/remitted at all points in the supply chain Contract language issues similar to income tax withholding

863(b) Issues Income from the sale or exchange of inventory produced in the U. S. and sold outside the U. S. will be treated partly as U. S. source and partly as foreign source • Under IRS regulations: • 50/50 method usually applies • Sale occurs at time and place where the seller’s “right, title and interest” are transferred to the buyer • 46

International Boycott Issues • • 47 Internal Revenue Code Sec. 999 penalizes acts of participation in or cooperation with international boycotts. Code and regulations define “participation” and “cooperation. ” Companies are required to report annually their operations in a boycotting country or with its government, companies, or nationals. Penalties include loss of foreign tax credits, loss of domestic international sales corporation(DISC) benefits and inclusion in income of certain profits of controlled foreign corporations that would otherwise not be taxed in the U. S.

6ae3f5400ae9e11eddd14a9a00ecdfa5.ppt