b61a00e7d0780b8dd9030f48781ae1d7.ppt

- Количество слайдов: 17

Addressing Climate Change while Protecting Consumers (…and a New Idea) NASUCA Annual Meeting November 16 2010 Ezra D. Hausman, Ph. D. www. synapse-energy. com | © 2010 Synapse Energy Economics Inc. All rights reserved.

Addressing Climate Change while Protecting Consumers (…and a New Idea) NASUCA Annual Meeting November 16 2010 Ezra D. Hausman, Ph. D. www. synapse-energy. com | © 2010 Synapse Energy Economics Inc. All rights reserved.

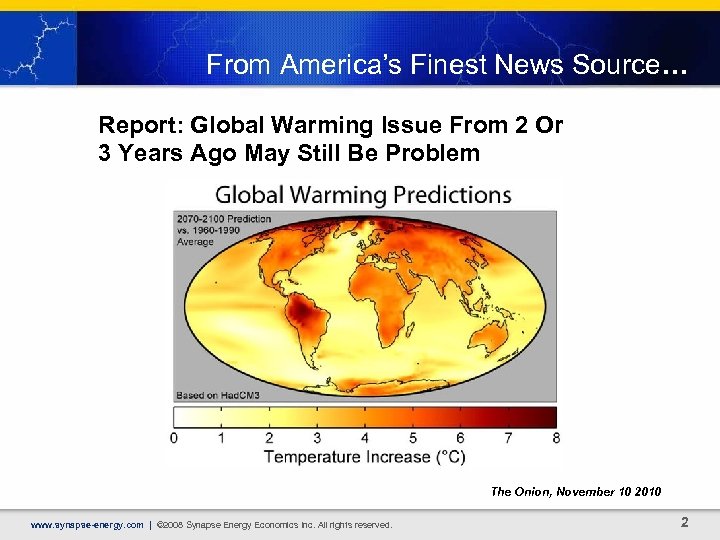

From America’s Finest News Source… Report: Global Warming Issue From 2 Or 3 Years Ago May Still Be Problem The Onion, November 10 2010 www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 2

From America’s Finest News Source… Report: Global Warming Issue From 2 Or 3 Years Ago May Still Be Problem The Onion, November 10 2010 www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 2

Basic Assertions • Human-caused, global climate change is a serious environmental, economic, social, and national security issue • Climate change will have significant and harmful impacts on our lives and on our children’s lives • The severity of this threat will become increasingly obvious and difficult to dismiss over the next decade • The U. S. Government will ultimately take action to progressively and severely restrict the emissions of greenhouse gases into the atmosphere • Consumer advocates and commissions have a role to play TODAY to protect consumers’ interest as this debate moves forward www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 3

Basic Assertions • Human-caused, global climate change is a serious environmental, economic, social, and national security issue • Climate change will have significant and harmful impacts on our lives and on our children’s lives • The severity of this threat will become increasingly obvious and difficult to dismiss over the next decade • The U. S. Government will ultimately take action to progressively and severely restrict the emissions of greenhouse gases into the atmosphere • Consumer advocates and commissions have a role to play TODAY to protect consumers’ interest as this debate moves forward www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 3

Basic Assertions “If the climate-deniers are right—but we combat climate change anyway—we’ll have slightly higher energy prices but cleaner air, more renewable energy, a stronger dollar, more innovative industries and enemies with less money. If the climate deniers are wrong, and we do nothing…” -Thomas Friedman, NY Times, November 14 2010 www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 4

Basic Assertions “If the climate-deniers are right—but we combat climate change anyway—we’ll have slightly higher energy prices but cleaner air, more renewable energy, a stronger dollar, more innovative industries and enemies with less money. If the climate deniers are wrong, and we do nothing…” -Thomas Friedman, NY Times, November 14 2010 www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 4

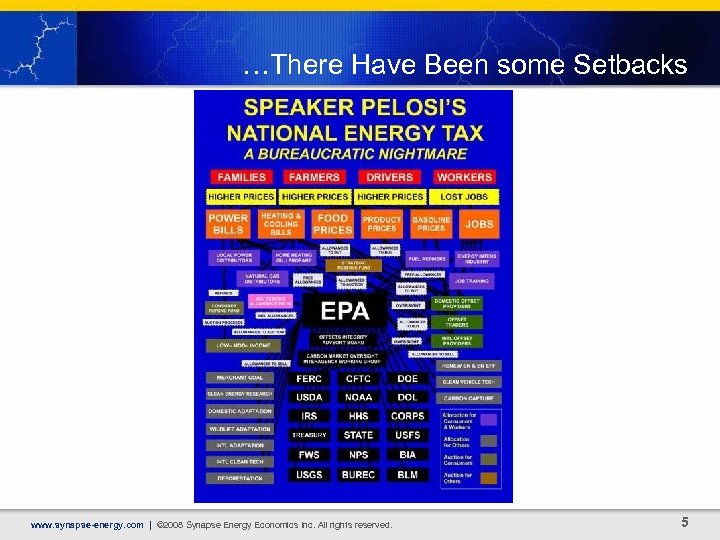

…There Have Been some Setbacks www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 5

…There Have Been some Setbacks www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 5

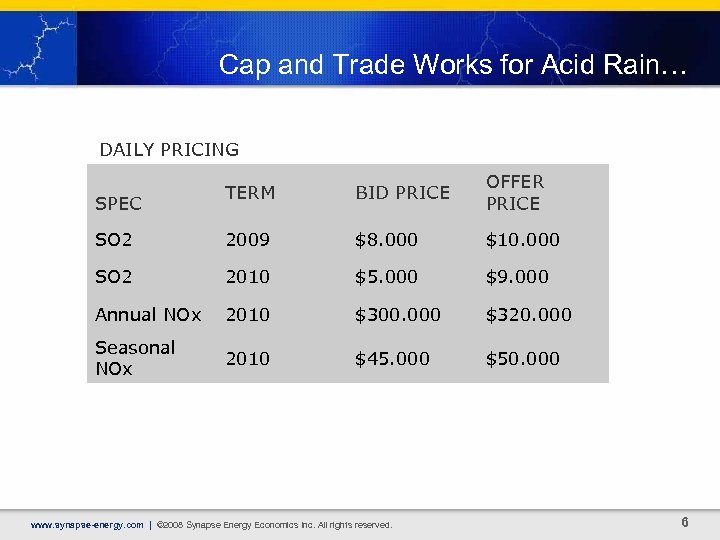

Cap and Trade Works for Acid Rain… DAILY PRICING TERM BID PRICE OFFER PRICE SO 2 2009 $8. 000 $10. 000 SO 2 2010 $5. 000 $9. 000 Annual NOx 2010 $300. 000 $320. 000 Seasonal NOx 2010 $45. 000 $50. 000 SPEC www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 6

Cap and Trade Works for Acid Rain… DAILY PRICING TERM BID PRICE OFFER PRICE SO 2 2009 $8. 000 $10. 000 SO 2 2010 $5. 000 $9. 000 Annual NOx 2010 $300. 000 $320. 000 Seasonal NOx 2010 $45. 000 $50. 000 SPEC www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 6

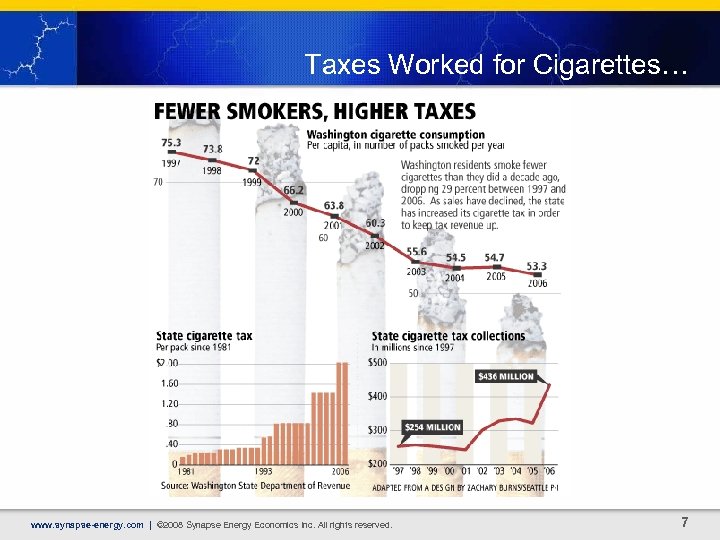

Taxes Worked for Cigarettes… www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 7

Taxes Worked for Cigarettes… www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 7

…But CO 2 is Different www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 8

…But CO 2 is Different www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 8

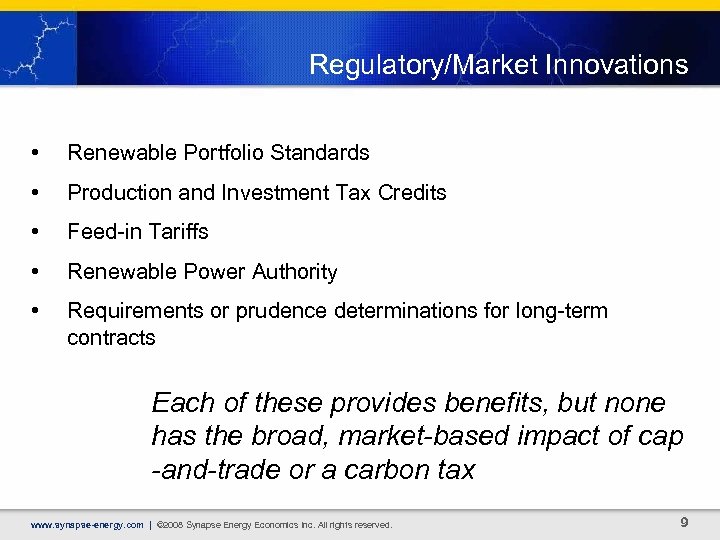

Regulatory/Market Innovations • Renewable Portfolio Standards • Production and Investment Tax Credits • Feed-in Tariffs • Renewable Power Authority • Requirements or prudence determinations for long-term contracts Each of these provides benefits, but none has the broad, market-based impact of cap -and-trade or a carbon tax www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 9

Regulatory/Market Innovations • Renewable Portfolio Standards • Production and Investment Tax Credits • Feed-in Tariffs • Renewable Power Authority • Requirements or prudence determinations for long-term contracts Each of these provides benefits, but none has the broad, market-based impact of cap -and-trade or a carbon tax www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 9

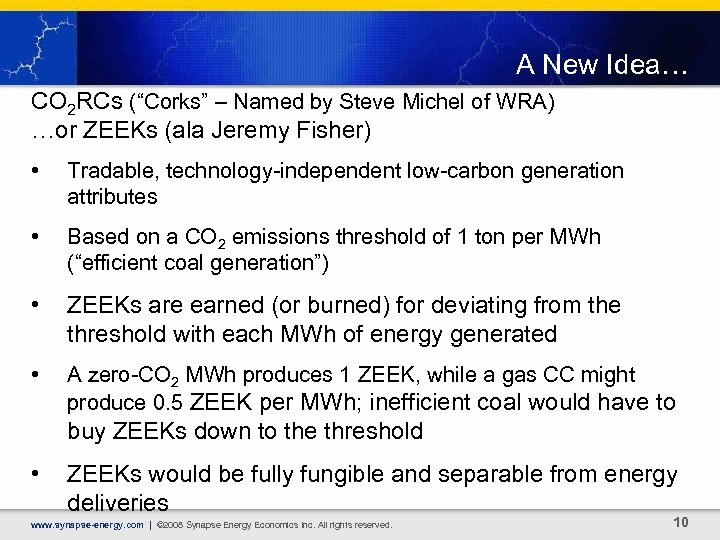

A New Idea… CO 2 RCs (“Corks” – Named by Steve Michel of WRA) …or ZEEKs (ala Jeremy Fisher) • Tradable, technology-independent low-carbon generation attributes • Based on a CO 2 emissions threshold of 1 ton per MWh (“efficient coal generation”) • ZEEKs are earned (or burned) for deviating from the threshold with each MWh of energy generated • A zero-CO 2 MWh produces 1 ZEEK, while a gas CC might produce 0. 5 ZEEK per MWh; inefficient coal would have to buy ZEEKs down to the threshold • ZEEKs would be fully fungible and separable from energy deliveries www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 10

A New Idea… CO 2 RCs (“Corks” – Named by Steve Michel of WRA) …or ZEEKs (ala Jeremy Fisher) • Tradable, technology-independent low-carbon generation attributes • Based on a CO 2 emissions threshold of 1 ton per MWh (“efficient coal generation”) • ZEEKs are earned (or burned) for deviating from the threshold with each MWh of energy generated • A zero-CO 2 MWh produces 1 ZEEK, while a gas CC might produce 0. 5 ZEEK per MWh; inefficient coal would have to buy ZEEKs down to the threshold • ZEEKs would be fully fungible and separable from energy deliveries www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 10

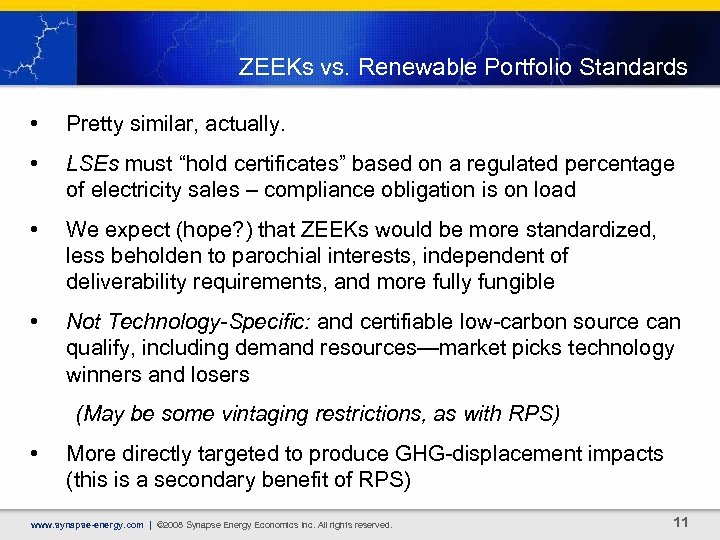

ZEEKs vs. Renewable Portfolio Standards • Pretty similar, actually. • LSEs must “hold certificates” based on a regulated percentage of electricity sales – compliance obligation is on load • We expect (hope? ) that ZEEKs would be more standardized, less beholden to parochial interests, independent of deliverability requirements, and more fully fungible • Not Technology-Specific: and certifiable low-carbon source can qualify, including demand resources—market picks technology winners and losers (May be some vintaging restrictions, as with RPS) • More directly targeted to produce GHG-displacement impacts (this is a secondary benefit of RPS) www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 11

ZEEKs vs. Renewable Portfolio Standards • Pretty similar, actually. • LSEs must “hold certificates” based on a regulated percentage of electricity sales – compliance obligation is on load • We expect (hope? ) that ZEEKs would be more standardized, less beholden to parochial interests, independent of deliverability requirements, and more fully fungible • Not Technology-Specific: and certifiable low-carbon source can qualify, including demand resources—market picks technology winners and losers (May be some vintaging restrictions, as with RPS) • More directly targeted to produce GHG-displacement impacts (this is a secondary benefit of RPS) www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 11

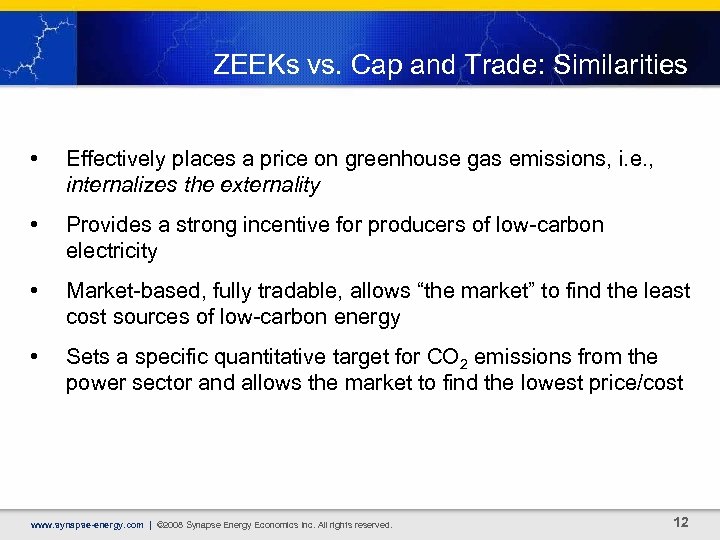

ZEEKs vs. Cap and Trade: Similarities • Effectively places a price on greenhouse gas emissions, i. e. , internalizes the externality • Provides a strong incentive for producers of low-carbon electricity • Market-based, fully tradable, allows “the market” to find the least cost sources of low-carbon energy • Sets a specific quantitative target for CO 2 emissions from the power sector and allows the market to find the lowest price/cost www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 12

ZEEKs vs. Cap and Trade: Similarities • Effectively places a price on greenhouse gas emissions, i. e. , internalizes the externality • Provides a strong incentive for producers of low-carbon electricity • Market-based, fully tradable, allows “the market” to find the least cost sources of low-carbon energy • Sets a specific quantitative target for CO 2 emissions from the power sector and allows the market to find the lowest price/cost www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 12

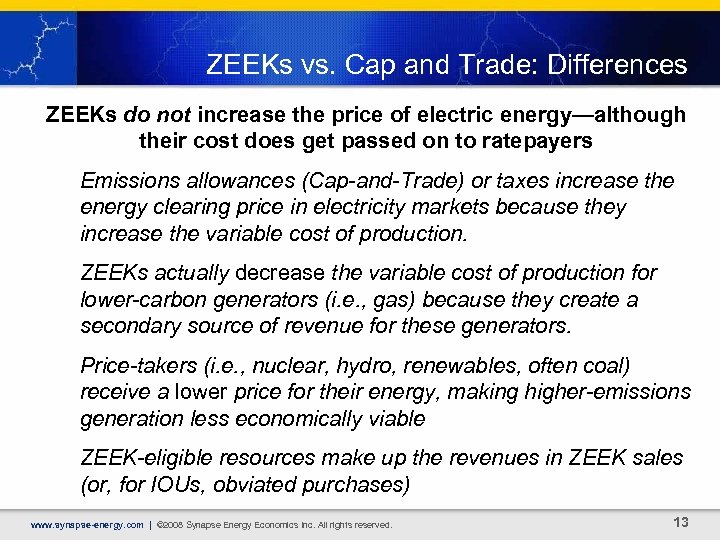

ZEEKs vs. Cap and Trade: Differences ZEEKs do not increase the price of electric energy—although their cost does get passed on to ratepayers Emissions allowances (Cap-and-Trade) or taxes increase the energy clearing price in electricity markets because they increase the variable cost of production. ZEEKs actually decrease the variable cost of production for lower-carbon generators (i. e. , gas) because they create a secondary source of revenue for these generators. Price-takers (i. e. , nuclear, hydro, renewables, often coal) receive a lower price for their energy, making higher-emissions generation less economically viable ZEEK-eligible resources make up the revenues in ZEEK sales (or, for IOUs, obviated purchases) www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 13

ZEEKs vs. Cap and Trade: Differences ZEEKs do not increase the price of electric energy—although their cost does get passed on to ratepayers Emissions allowances (Cap-and-Trade) or taxes increase the energy clearing price in electricity markets because they increase the variable cost of production. ZEEKs actually decrease the variable cost of production for lower-carbon generators (i. e. , gas) because they create a secondary source of revenue for these generators. Price-takers (i. e. , nuclear, hydro, renewables, often coal) receive a lower price for their energy, making higher-emissions generation less economically viable ZEEK-eligible resources make up the revenues in ZEEK sales (or, for IOUs, obviated purchases) www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 13

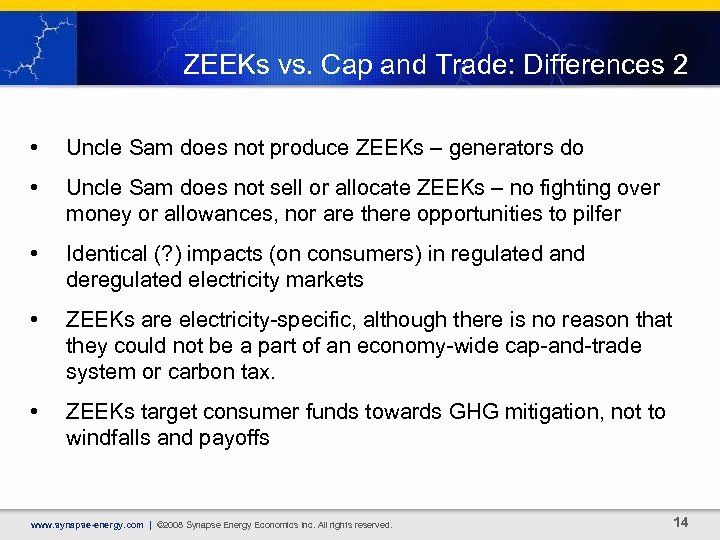

ZEEKs vs. Cap and Trade: Differences 2 • Uncle Sam does not produce ZEEKs – generators do • Uncle Sam does not sell or allocate ZEEKs – no fighting over money or allowances, nor are there opportunities to pilfer • Identical (? ) impacts (on consumers) in regulated and deregulated electricity markets • ZEEKs are electricity-specific, although there is no reason that they could not be a part of an economy-wide cap-and-trade system or carbon tax. • ZEEKs target consumer funds towards GHG mitigation, not to windfalls and payoffs www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 14

ZEEKs vs. Cap and Trade: Differences 2 • Uncle Sam does not produce ZEEKs – generators do • Uncle Sam does not sell or allocate ZEEKs – no fighting over money or allowances, nor are there opportunities to pilfer • Identical (? ) impacts (on consumers) in regulated and deregulated electricity markets • ZEEKs are electricity-specific, although there is no reason that they could not be a part of an economy-wide cap-and-trade system or carbon tax. • ZEEKs target consumer funds towards GHG mitigation, not to windfalls and payoffs www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 14

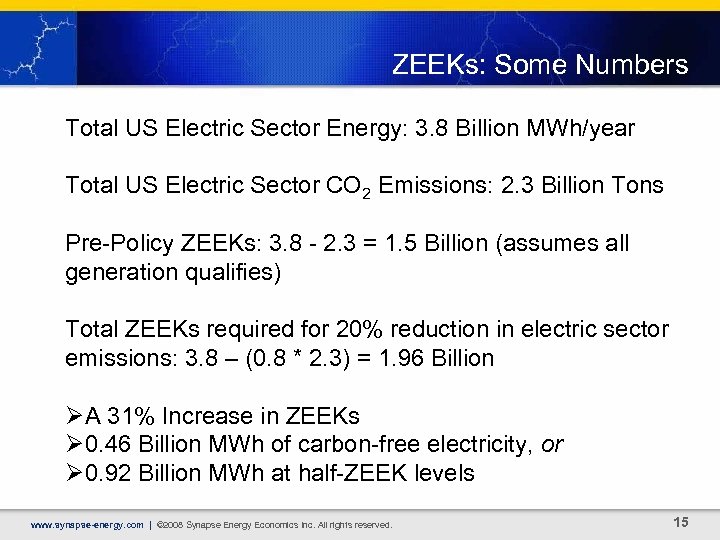

ZEEKs: Some Numbers Total US Electric Sector Energy: 3. 8 Billion MWh/year Total US Electric Sector CO 2 Emissions: 2. 3 Billion Tons Pre-Policy ZEEKs: 3. 8 - 2. 3 = 1. 5 Billion (assumes all generation qualifies) Total ZEEKs required for 20% reduction in electric sector emissions: 3. 8 – (0. 8 * 2. 3) = 1. 96 Billion ØA 31% Increase in ZEEKs Ø 0. 46 Billion MWh of carbon-free electricity, or Ø 0. 92 Billion MWh at half-ZEEK levels www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 15

ZEEKs: Some Numbers Total US Electric Sector Energy: 3. 8 Billion MWh/year Total US Electric Sector CO 2 Emissions: 2. 3 Billion Tons Pre-Policy ZEEKs: 3. 8 - 2. 3 = 1. 5 Billion (assumes all generation qualifies) Total ZEEKs required for 20% reduction in electric sector emissions: 3. 8 – (0. 8 * 2. 3) = 1. 96 Billion ØA 31% Increase in ZEEKs Ø 0. 46 Billion MWh of carbon-free electricity, or Ø 0. 92 Billion MWh at half-ZEEK levels www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 15

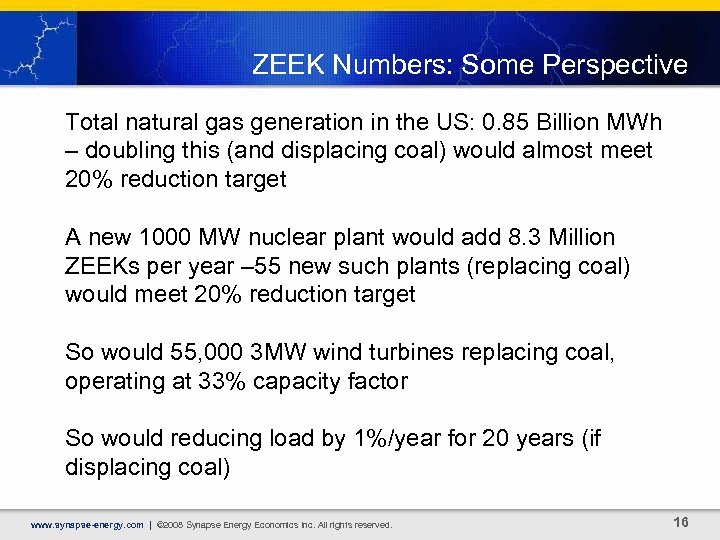

ZEEK Numbers: Some Perspective Total natural gas generation in the US: 0. 85 Billion MWh – doubling this (and displacing coal) would almost meet 20% reduction target A new 1000 MW nuclear plant would add 8. 3 Million ZEEKs per year – 55 new such plants (replacing coal) would meet 20% reduction target So would 55, 000 3 MW wind turbines replacing coal, operating at 33% capacity factor So would reducing load by 1%/year for 20 years (if displacing coal) www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 16

ZEEK Numbers: Some Perspective Total natural gas generation in the US: 0. 85 Billion MWh – doubling this (and displacing coal) would almost meet 20% reduction target A new 1000 MW nuclear plant would add 8. 3 Million ZEEKs per year – 55 new such plants (replacing coal) would meet 20% reduction target So would 55, 000 3 MW wind turbines replacing coal, operating at 33% capacity factor So would reducing load by 1%/year for 20 years (if displacing coal) www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 16

Wrap-up ZEEKs (or CO 2 RCs) represent a way to price carbon and directly support EE, renewables, and any other source of energy that is truly low-carbon. Would replace hodgepodge of state, regional, and federal incentives with a single, market-based approach while avoiding many pitfalls Steady ramp-up of requirement would provide a stable price signal for low-carbon resources in a large, liquid market Not the only idea out there for regulating carbon, but perhaps the best? www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 17

Wrap-up ZEEKs (or CO 2 RCs) represent a way to price carbon and directly support EE, renewables, and any other source of energy that is truly low-carbon. Would replace hodgepodge of state, regional, and federal incentives with a single, market-based approach while avoiding many pitfalls Steady ramp-up of requirement would provide a stable price signal for low-carbon resources in a large, liquid market Not the only idea out there for regulating carbon, but perhaps the best? www. synapse-energy. com | © 2008 Synapse Energy Economics Inc. All rights reserved. 17