Additions to Topic 1 Case: P&G Acquires Gillette

Additions to Topic 1 Case: P&G Acquires Gillette

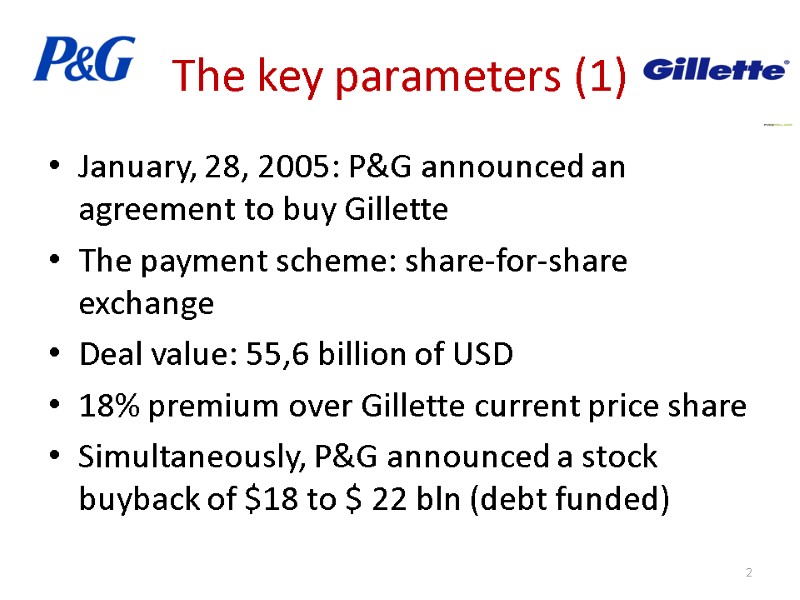

The key parameters (1) January, 28, 2005: P&G announced an agreement to buy Gillette The payment scheme: share-for-share exchange Deal value: 55,6 billion of USD 18% premium over Gillette current price share Simultaneously, P&G announced a stock buyback of $18 to $ 22 bln (debt funded) 2

The key parameters (1) January, 28, 2005: P&G announced an agreement to buy Gillette The payment scheme: share-for-share exchange Deal value: 55,6 billion of USD 18% premium over Gillette current price share Simultaneously, P&G announced a stock buyback of $18 to $ 22 bln (debt funded) 2

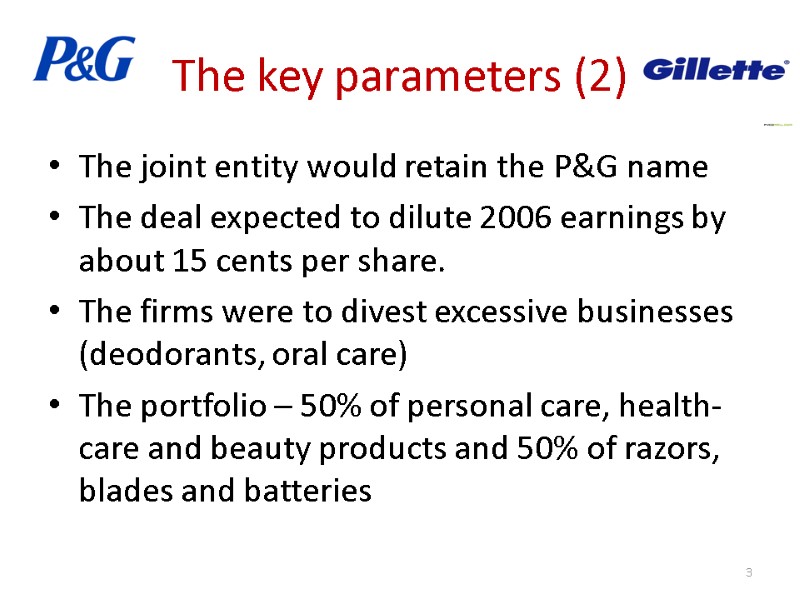

The key parameters (2) The joint entity would retain the P&G name The deal expected to dilute 2006 earnings by about 15 cents per share. The firms were to divest excessive businesses (deodorants, oral care) The portfolio – 50% of personal care, health-care and beauty products and 50% of razors, blades and batteries 3

The key parameters (2) The joint entity would retain the P&G name The deal expected to dilute 2006 earnings by about 15 cents per share. The firms were to divest excessive businesses (deodorants, oral care) The portfolio – 50% of personal care, health-care and beauty products and 50% of razors, blades and batteries 3

Information about companies P&G – premier marketing and product innovator Gillette is known for its ability to sell razors and hook customers to a lifetime of razor blades Though Gillette was No.1 in the lucrative toothbrush and men’s deodorant markets, it had difficulties with its Duracell battery brand. It was No.1 but suffered from the competitors’ price war Pressure from the retailers (30% of world sales are to Walmart) 4

Information about companies P&G – premier marketing and product innovator Gillette is known for its ability to sell razors and hook customers to a lifetime of razor blades Though Gillette was No.1 in the lucrative toothbrush and men’s deodorant markets, it had difficulties with its Duracell battery brand. It was No.1 but suffered from the competitors’ price war Pressure from the retailers (30% of world sales are to Walmart) 4

Brands portfolio of the joined company 5

Brands portfolio of the joined company 5

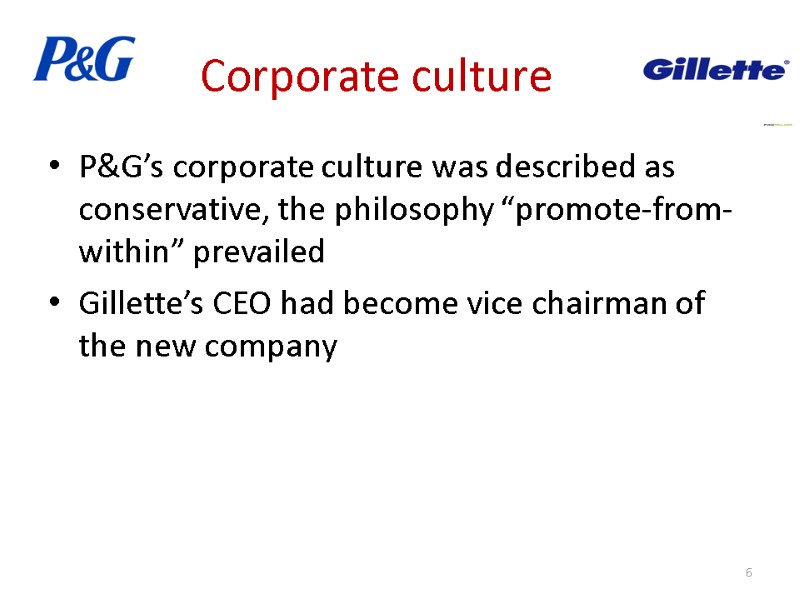

Corporate culture P&G’s corporate culture was described as conservative, the philosophy “promote-from-within” prevailed Gillette’s CEO had become vice chairman of the new company 6

Corporate culture P&G’s corporate culture was described as conservative, the philosophy “promote-from-within” prevailed Gillette’s CEO had become vice chairman of the new company 6

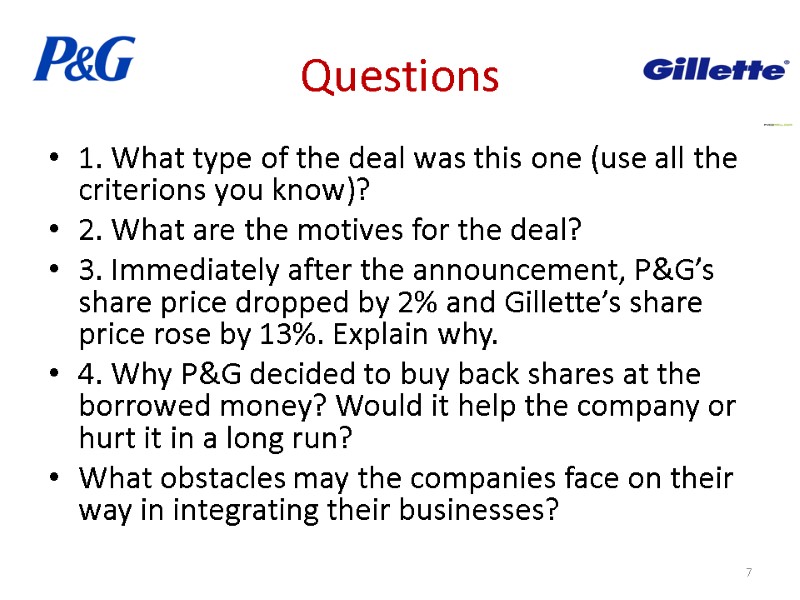

Questions 1. What type of the deal was this one (use all the criterions you know)? 2. What are the motives for the deal? 3. Immediately after the announcement, P&G’s share price dropped by 2% and Gillette’s share price rose by 13%. Explain why. 4. Why P&G decided to buy back shares at the borrowed money? Would it help the company or hurt it in a long run? What obstacles may the companies face on their way in integrating their businesses? 7

Questions 1. What type of the deal was this one (use all the criterions you know)? 2. What are the motives for the deal? 3. Immediately after the announcement, P&G’s share price dropped by 2% and Gillette’s share price rose by 13%. Explain why. 4. Why P&G decided to buy back shares at the borrowed money? Would it help the company or hurt it in a long run? What obstacles may the companies face on their way in integrating their businesses? 7