Additional materials to Topic 2 Rationale for share-paid

additional_materials_to_topic_2.ppt

- Количество слайдов: 23

Additional materials to Topic 2 Rationale for share-paid deals Using Financial Modeling Techniques to Value and Structure M&As Exercises

Additional materials to Topic 2 Rationale for share-paid deals Using Financial Modeling Techniques to Value and Structure M&As Exercises

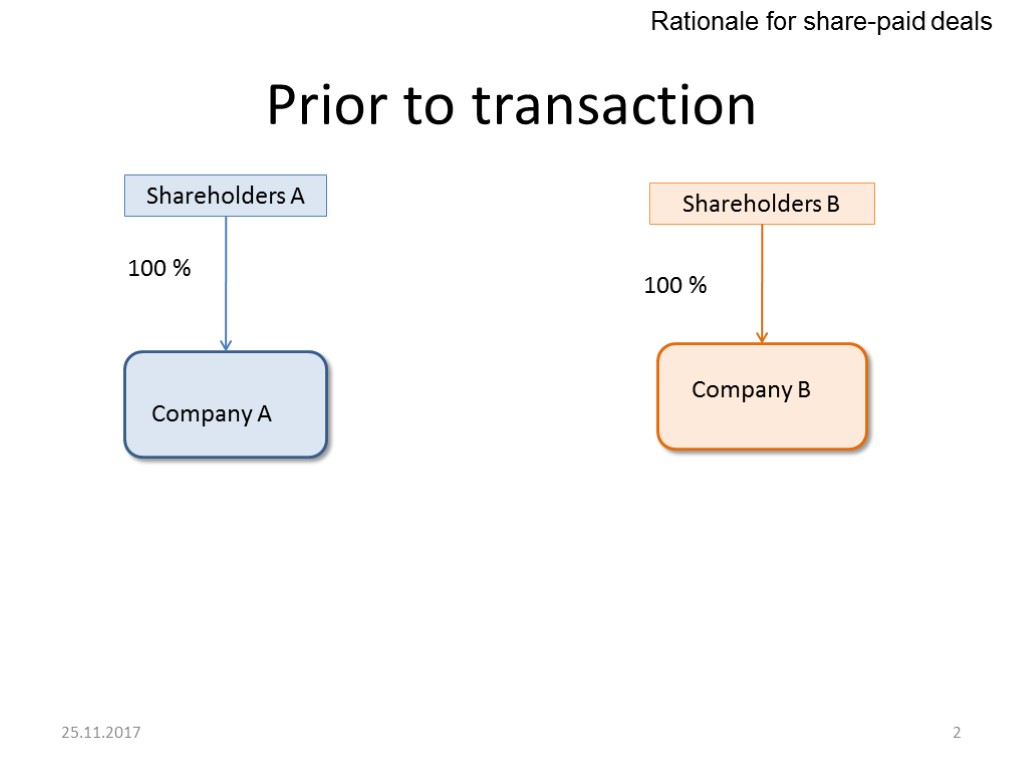

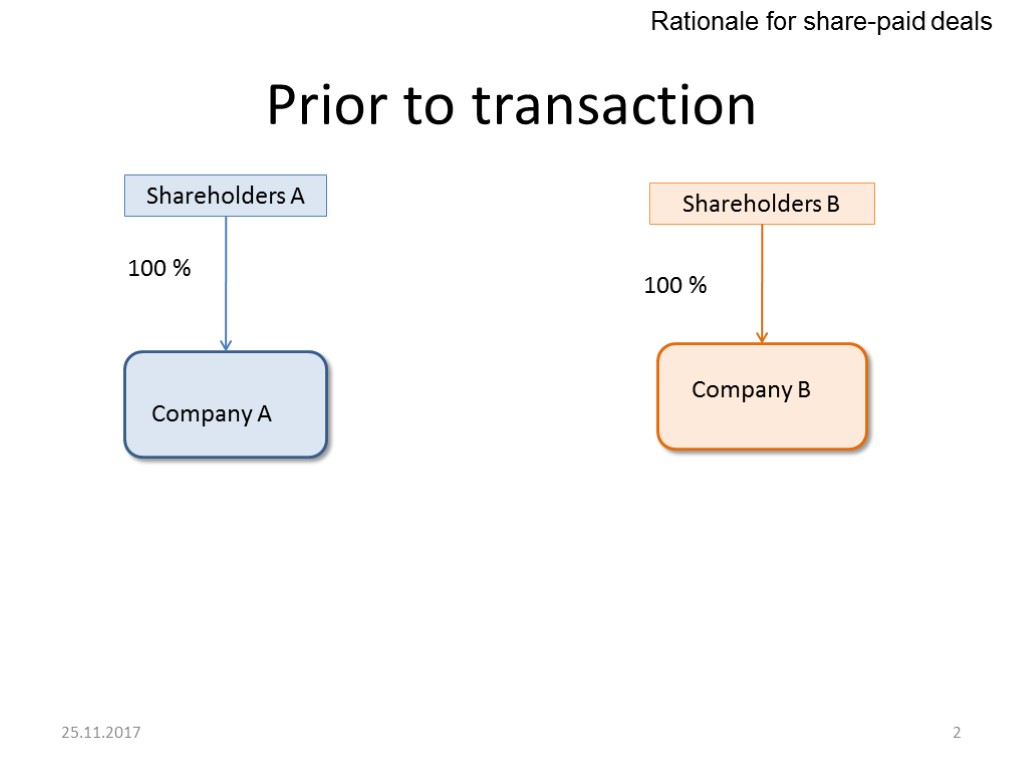

Prior to transaction Shareholders A Company A 100 % Shareholders B Company B 100 % 25.11.2017 2 Rationale for share-paid deals

Prior to transaction Shareholders A Company A 100 % Shareholders B Company B 100 % 25.11.2017 2 Rationale for share-paid deals

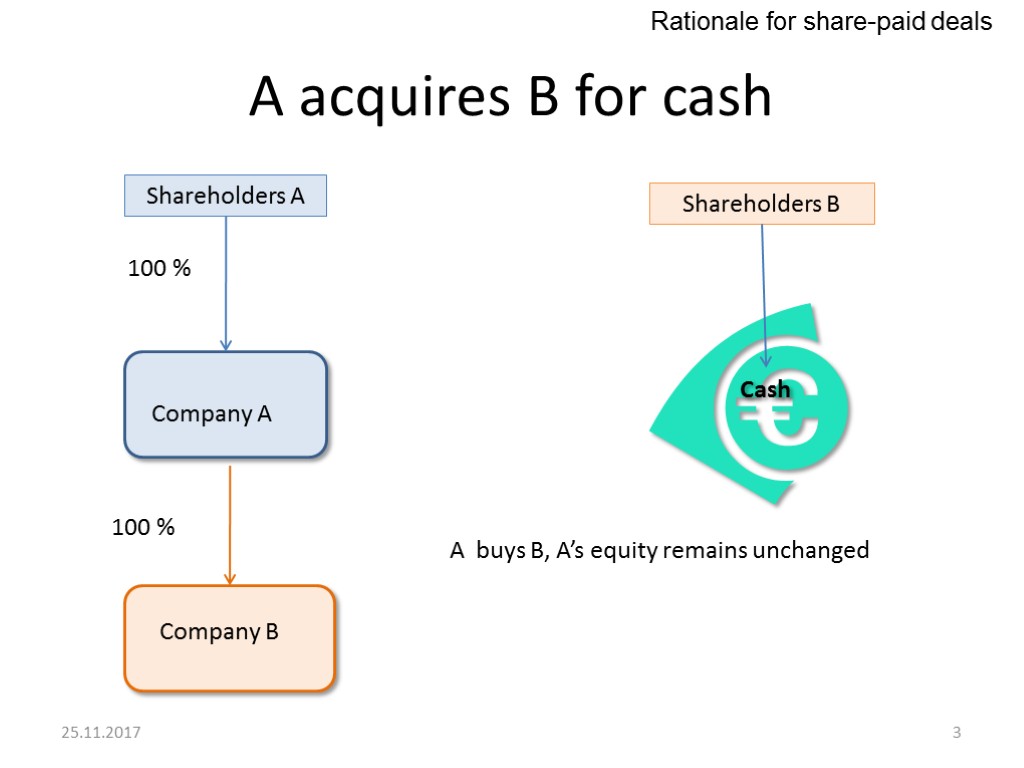

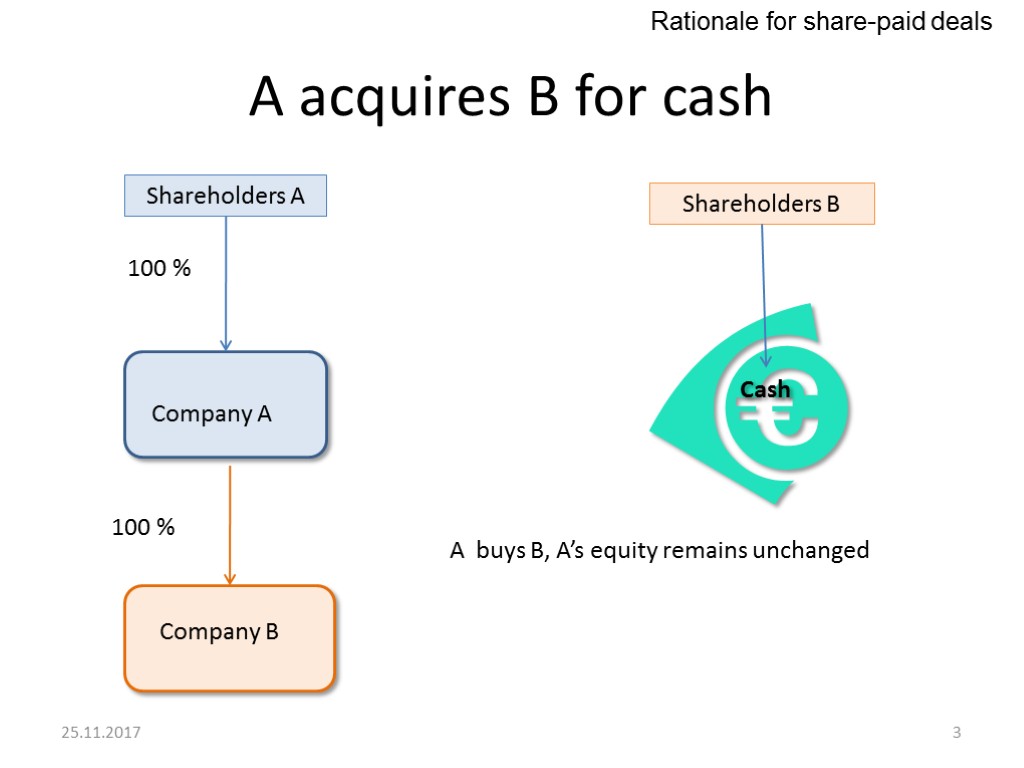

A acquires B for cash Shareholders A 100 % Company A Company B 100 % Shareholders B Cash A buys B, A’s equity remains unchanged 25.11.2017 3 Rationale for share-paid deals

A acquires B for cash Shareholders A 100 % Company A Company B 100 % Shareholders B Cash A buys B, A’s equity remains unchanged 25.11.2017 3 Rationale for share-paid deals

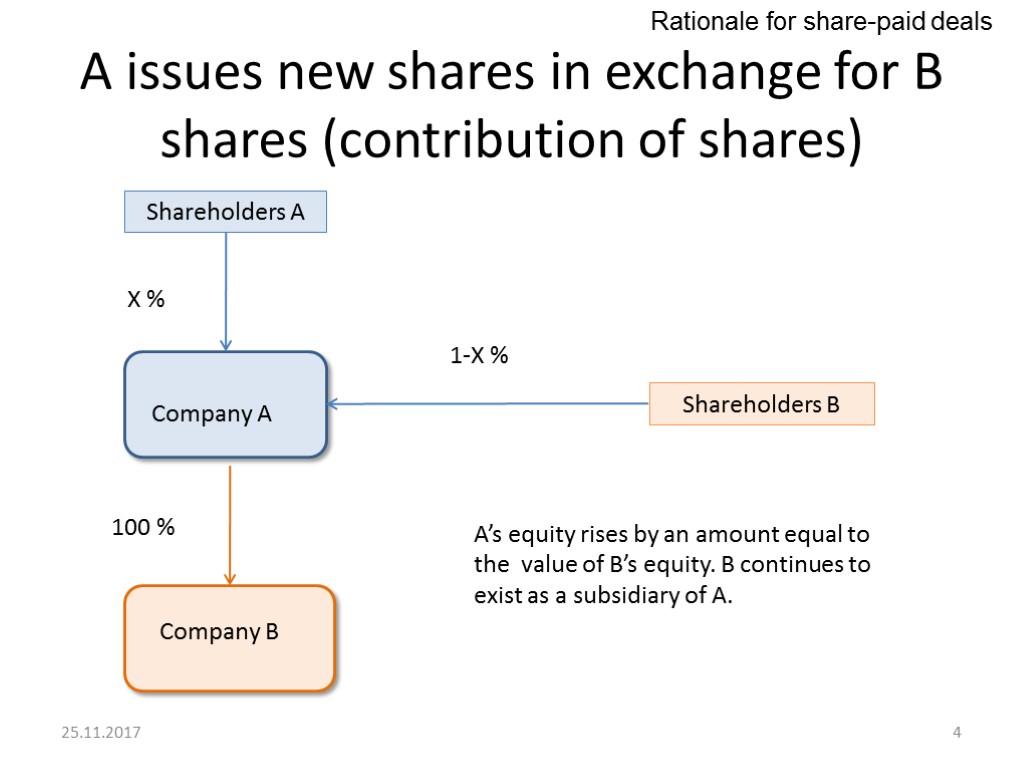

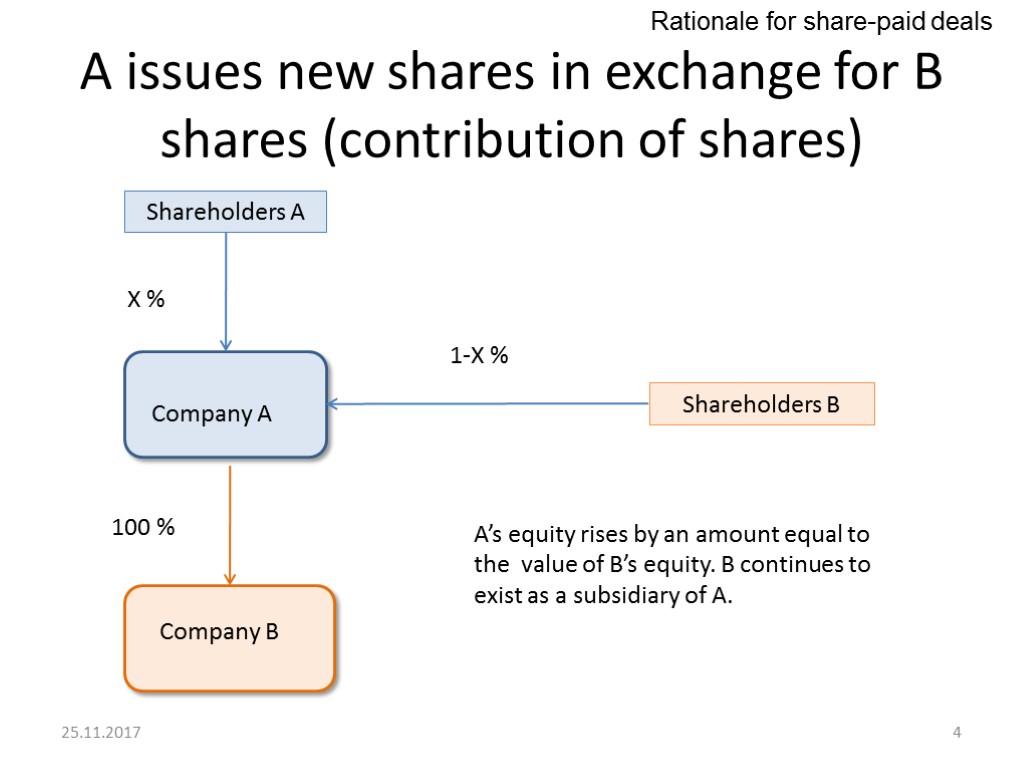

A issues new shares in exchange for B shares (contribution of shares) Shareholders A X % Company A 100 % Company B Shareholders B 1-X % A’s equity rises by an amount equal to the value of B’s equity. B continues to exist as a subsidiary of A. 25.11.2017 4 Rationale for share-paid deals

A issues new shares in exchange for B shares (contribution of shares) Shareholders A X % Company A 100 % Company B Shareholders B 1-X % A’s equity rises by an amount equal to the value of B’s equity. B continues to exist as a subsidiary of A. 25.11.2017 4 Rationale for share-paid deals

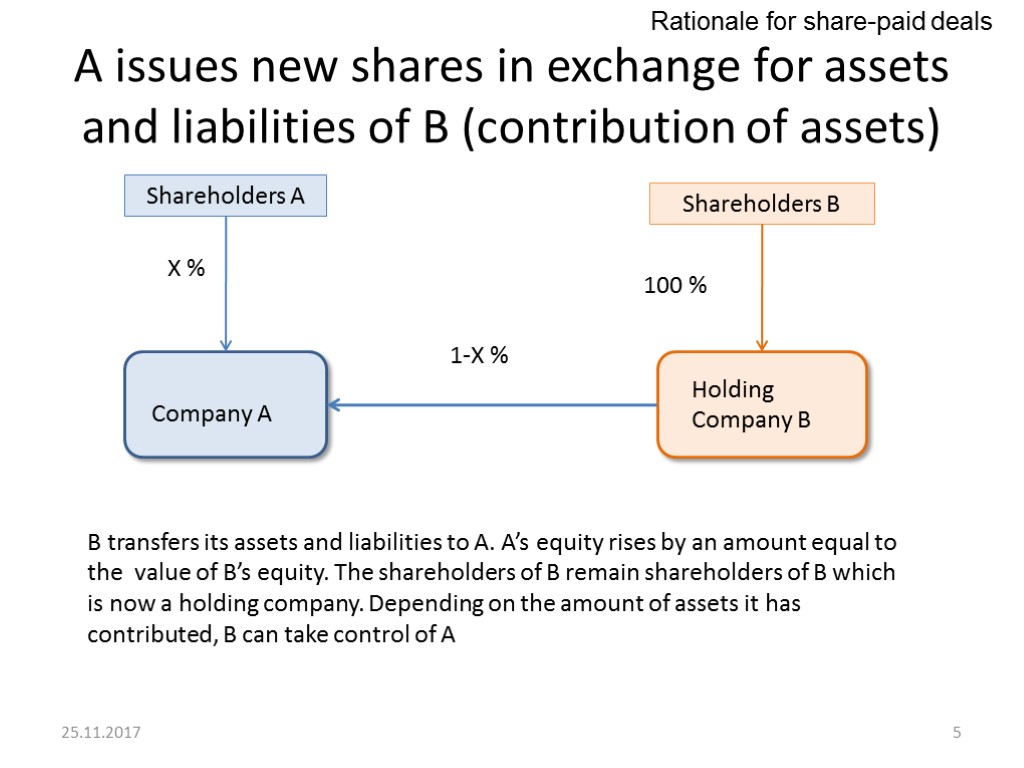

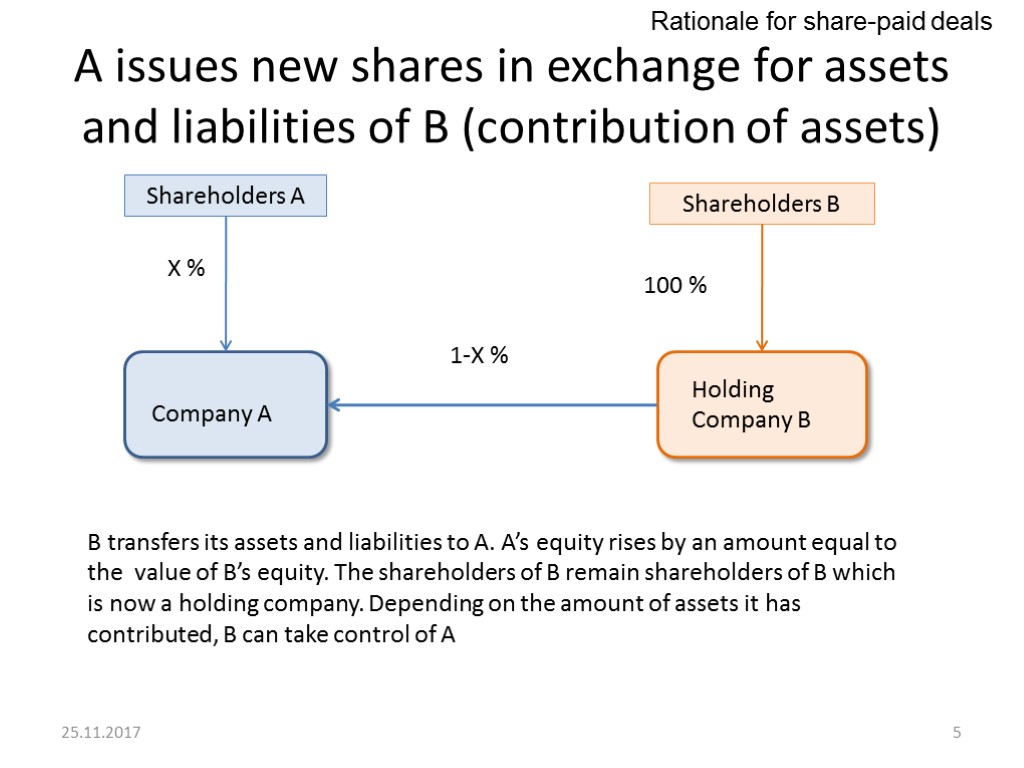

A issues new shares in exchange for assets and liabilities of B (contribution of assets) Shareholders A Company A X % Shareholders B Holding Company B 100 % 1-X % B transfers its assets and liabilities to A. A’s equity rises by an amount equal to the value of B’s equity. The shareholders of B remain shareholders of B which is now a holding company. Depending on the amount of assets it has contributed, B can take control of A 25.11.2017 5 Rationale for share-paid deals

A issues new shares in exchange for assets and liabilities of B (contribution of assets) Shareholders A Company A X % Shareholders B Holding Company B 100 % 1-X % B transfers its assets and liabilities to A. A’s equity rises by an amount equal to the value of B’s equity. The shareholders of B remain shareholders of B which is now a holding company. Depending on the amount of assets it has contributed, B can take control of A 25.11.2017 5 Rationale for share-paid deals

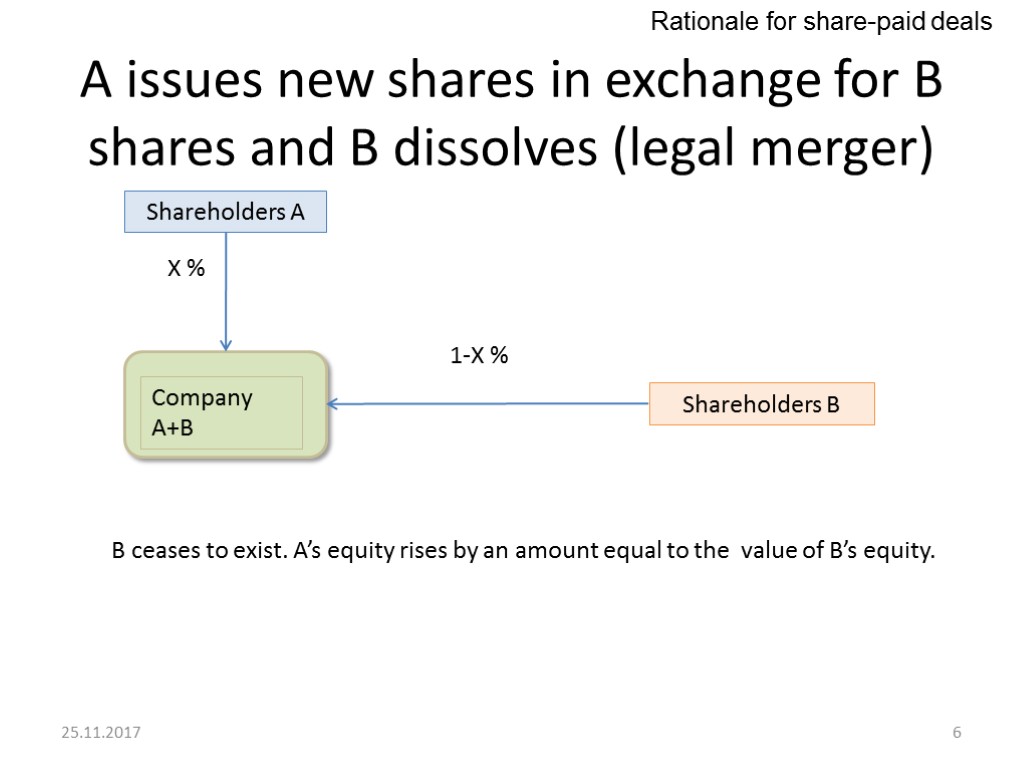

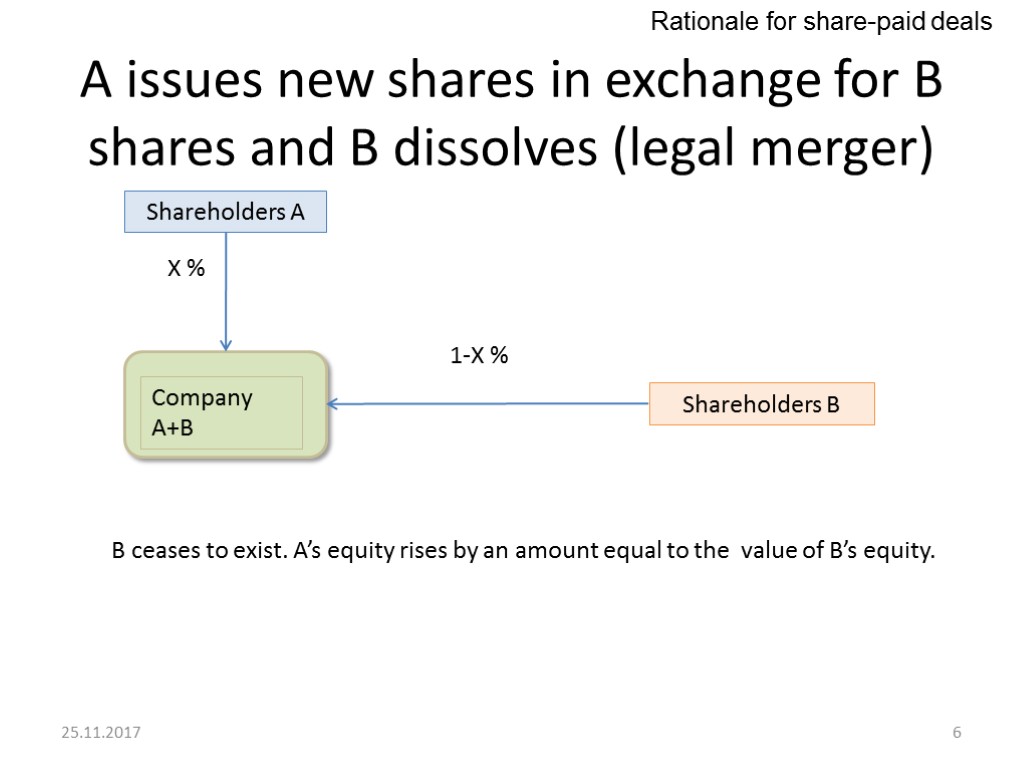

A issues new shares in exchange for B shares and B dissolves (legal merger) Shareholders A Company A+B X % Shareholders B 1-X % B ceases to exist. A’s equity rises by an amount equal to the value of B’s equity. 25.11.2017 6 Rationale for share-paid deals

A issues new shares in exchange for B shares and B dissolves (legal merger) Shareholders A Company A+B X % Shareholders B 1-X % B ceases to exist. A’s equity rises by an amount equal to the value of B’s equity. 25.11.2017 6 Rationale for share-paid deals

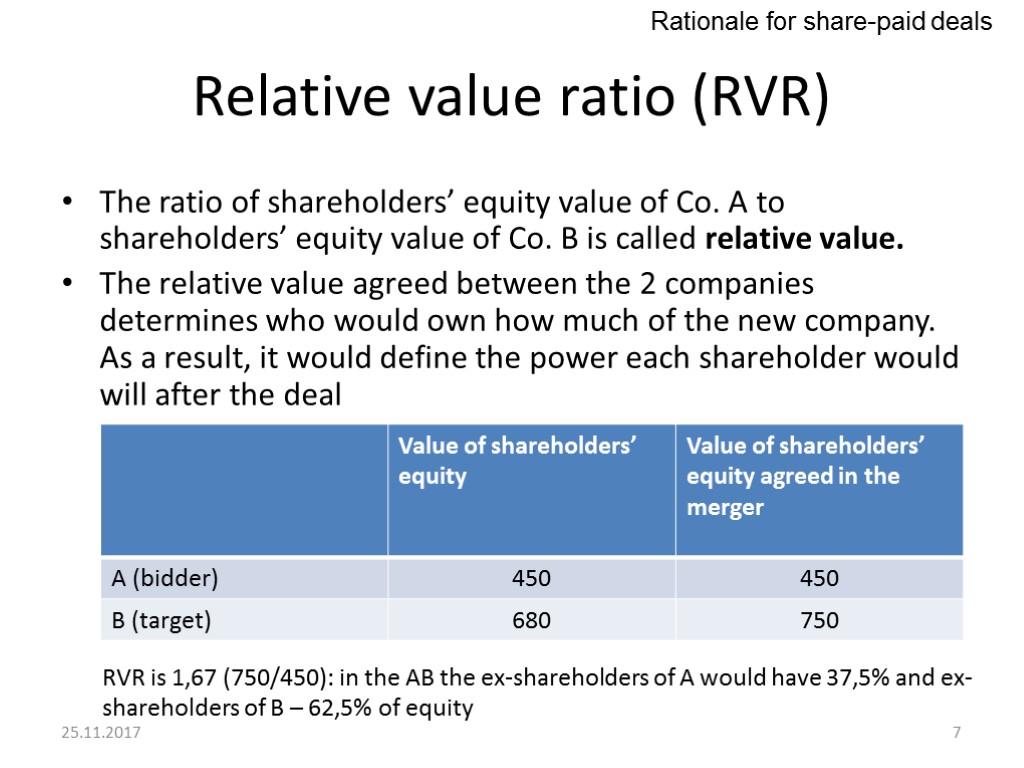

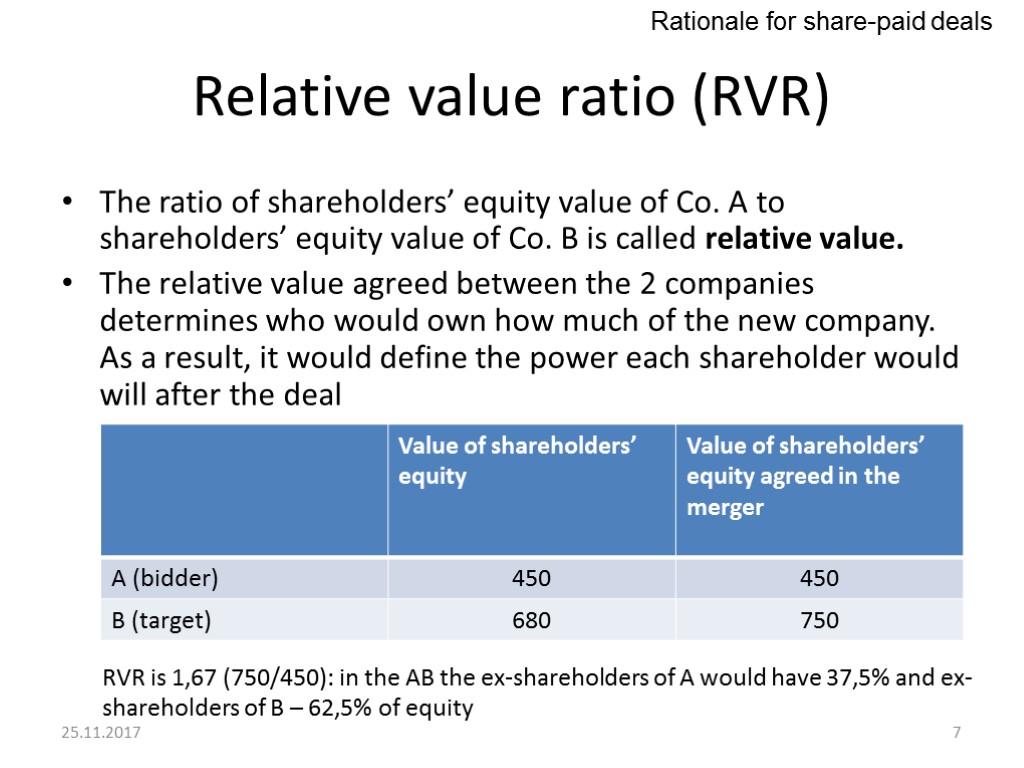

Relative value ratio (RVR) The ratio of shareholders’ equity value of Co. A to shareholders’ equity value of Co. B is called relative value. The relative value agreed between the 2 companies determines who would own how much of the new company. As a result, it would define the power each shareholder would will after the deal RVR is 1,67 (750/450): in the AB the ex-shareholders of A would have 37,5% and ex-shareholders of B – 62,5% of equity 25.11.2017 7 Rationale for share-paid deals

Relative value ratio (RVR) The ratio of shareholders’ equity value of Co. A to shareholders’ equity value of Co. B is called relative value. The relative value agreed between the 2 companies determines who would own how much of the new company. As a result, it would define the power each shareholder would will after the deal RVR is 1,67 (750/450): in the AB the ex-shareholders of A would have 37,5% and ex-shareholders of B – 62,5% of equity 25.11.2017 7 Rationale for share-paid deals

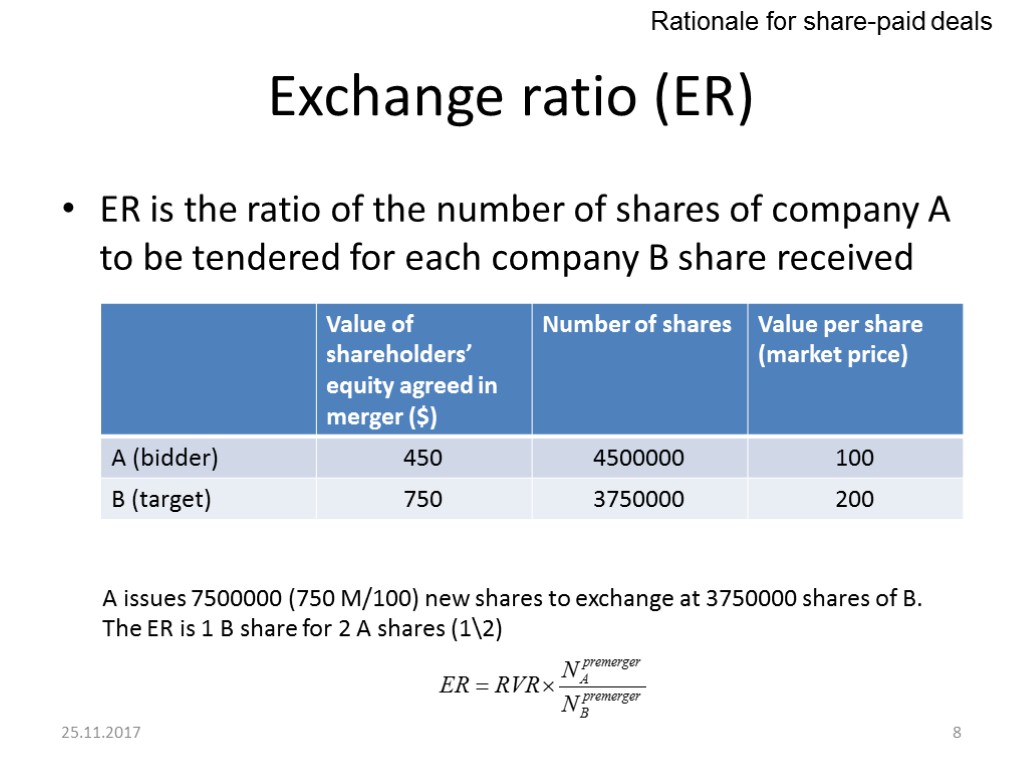

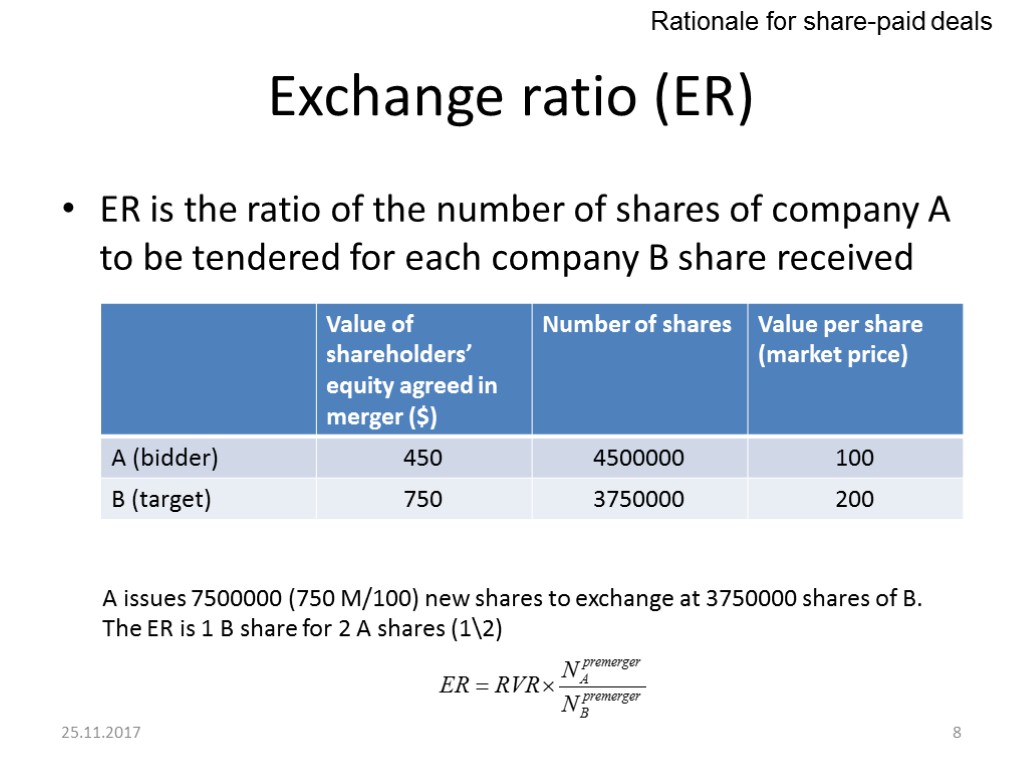

Exchange ratio (ER) ER is the ratio of the number of shares of company A to be tendered for each company B share received A issues 7500000 (750 M/100) new shares to exchange at 3750000 shares of B. The ER is 1 B share for 2 A shares (12) 25.11.2017 8 Rationale for share-paid deals

Exchange ratio (ER) ER is the ratio of the number of shares of company A to be tendered for each company B share received A issues 7500000 (750 M/100) new shares to exchange at 3750000 shares of B. The ER is 1 B share for 2 A shares (12) 25.11.2017 8 Rationale for share-paid deals

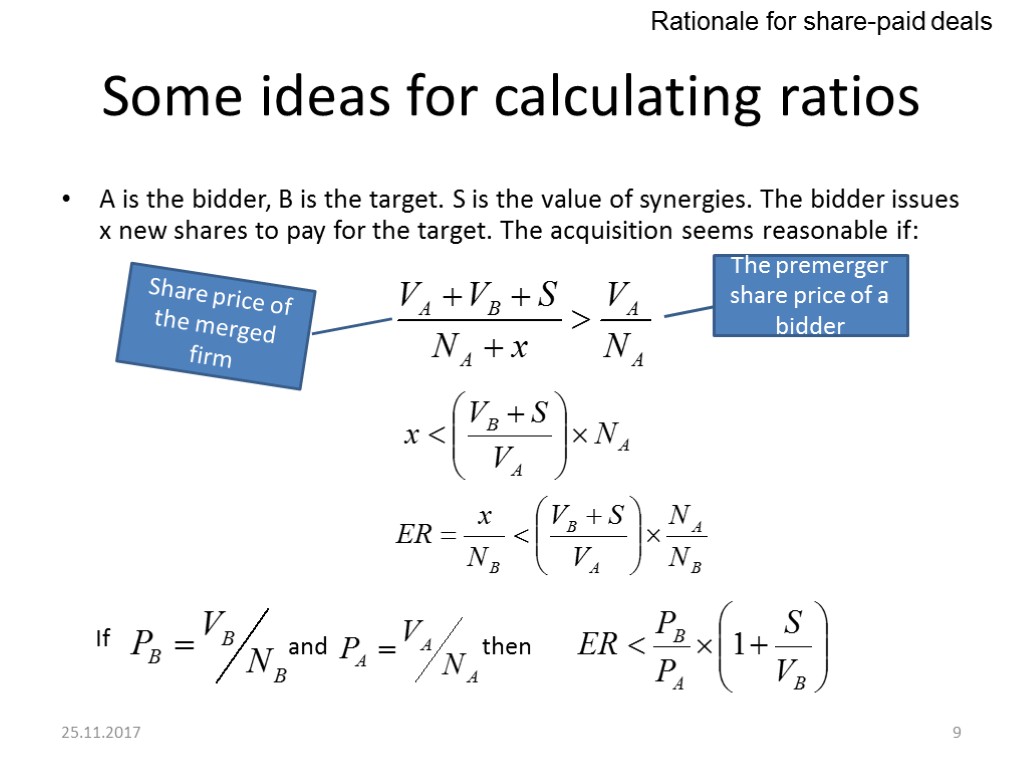

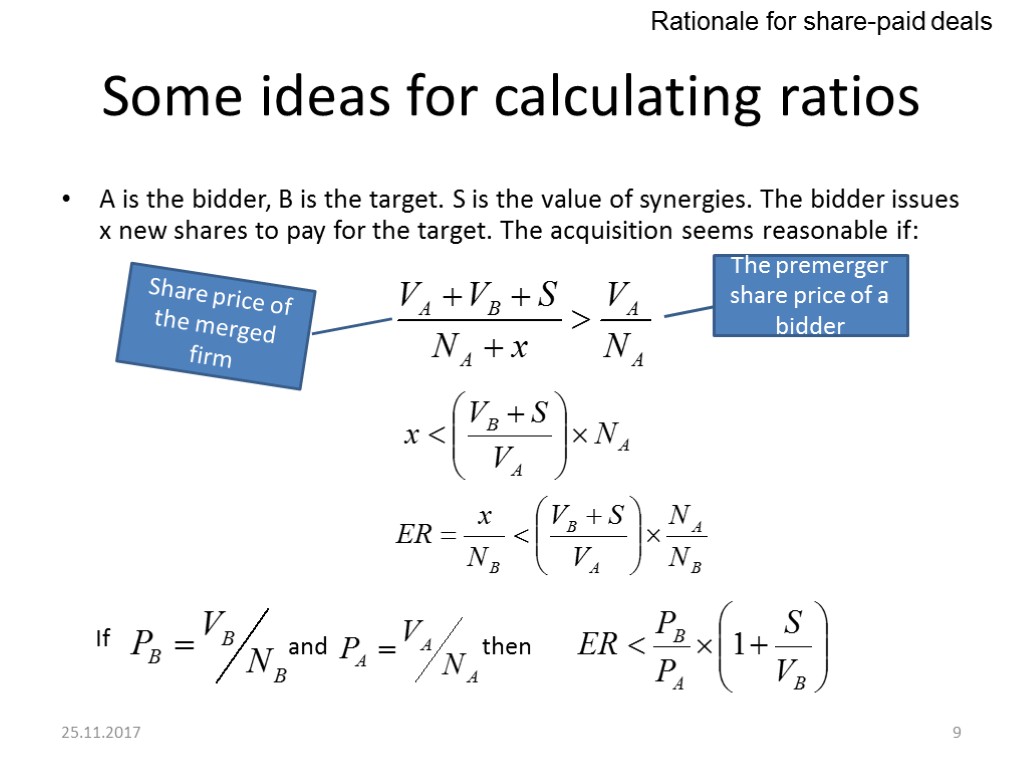

Some ideas for calculating ratios A is the bidder, B is the target. S is the value of synergies. The bidder issues x new shares to pay for the target. The acquisition seems reasonable if: The premerger share price of a bidder Share price of the merged firm If and then 25.11.2017 9 Rationale for share-paid deals

Some ideas for calculating ratios A is the bidder, B is the target. S is the value of synergies. The bidder issues x new shares to pay for the target. The acquisition seems reasonable if: The premerger share price of a bidder Share price of the merged firm If and then 25.11.2017 9 Rationale for share-paid deals

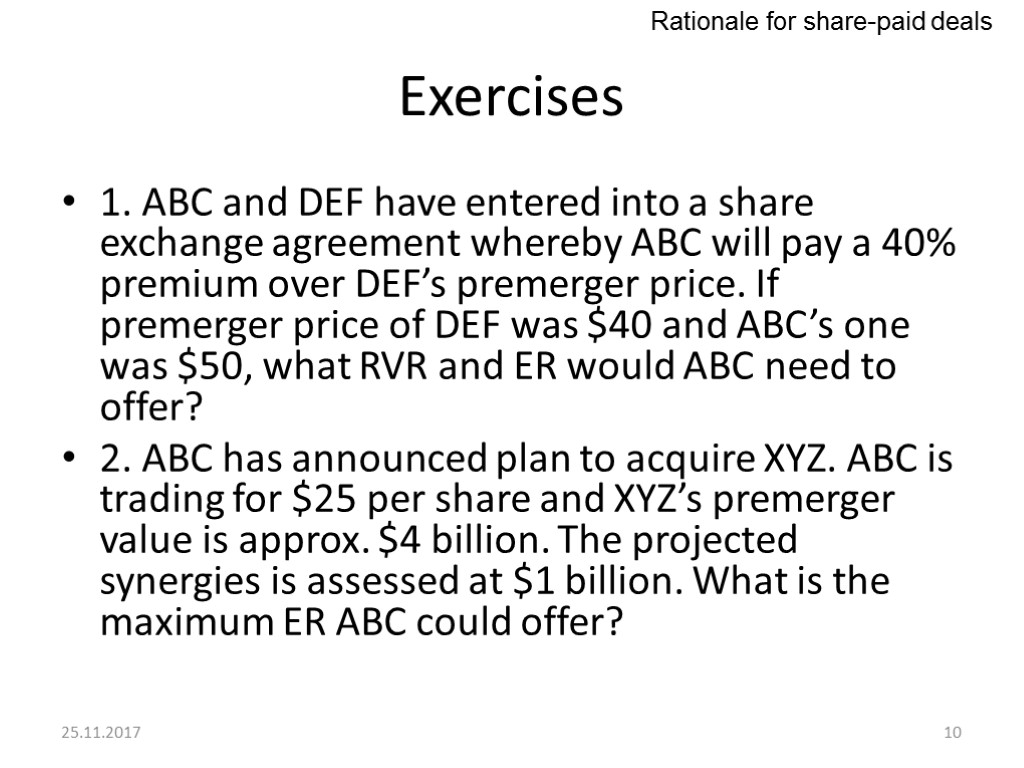

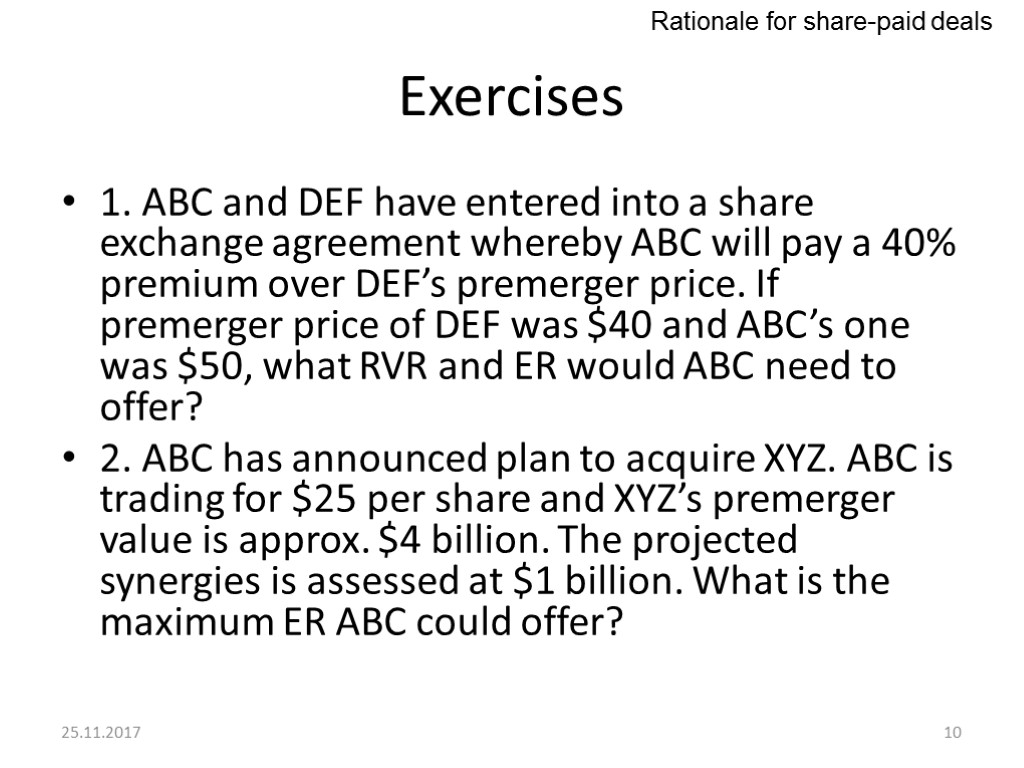

Exercises 1. ABC and DEF have entered into a share exchange agreement whereby ABC will pay a 40% premium over DEF’s premerger price. If premerger price of DEF was $40 and ABC’s one was $50, what RVR and ER would ABC need to offer? 2. ABC has announced plan to acquire XYZ. ABC is trading for $25 per share and XYZ’s premerger value is approx. $4 billion. The projected synergies is assessed at $1 billion. What is the maximum ER ABC could offer? 25.11.2017 10 Rationale for share-paid deals

Exercises 1. ABC and DEF have entered into a share exchange agreement whereby ABC will pay a 40% premium over DEF’s premerger price. If premerger price of DEF was $40 and ABC’s one was $50, what RVR and ER would ABC need to offer? 2. ABC has announced plan to acquire XYZ. ABC is trading for $25 per share and XYZ’s premerger value is approx. $4 billion. The projected synergies is assessed at $1 billion. What is the maximum ER ABC could offer? 25.11.2017 10 Rationale for share-paid deals

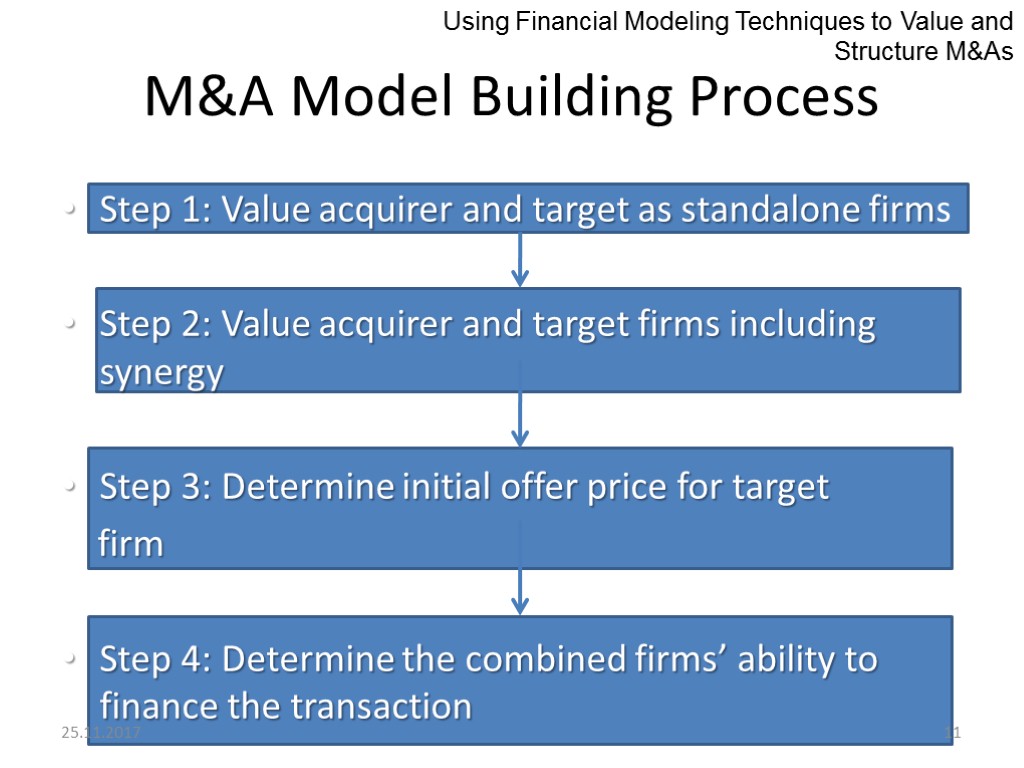

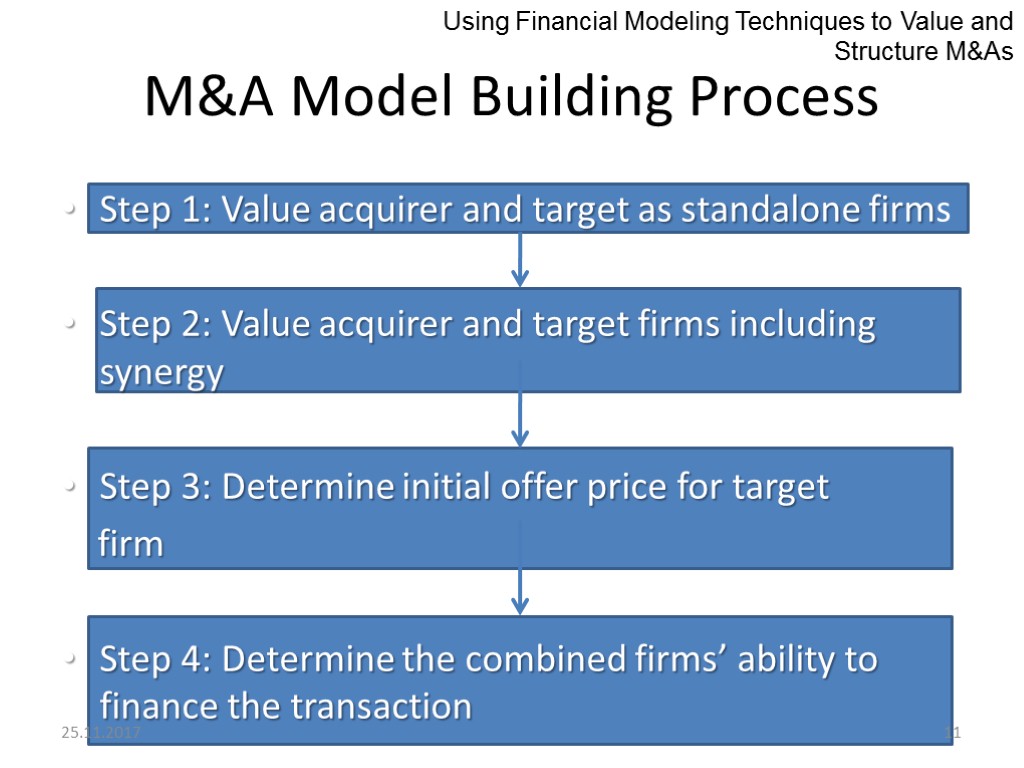

M&A Model Building Process Step 1: Value acquirer and target as standalone firms Step 2: Value acquirer and target firms including synergy Step 3: Determine initial offer price for target firm Step 4: Determine the combined firms’ ability to finance the transaction 25.11.2017 11 Using Financial Modeling Techniques to Value and Structure M&As

M&A Model Building Process Step 1: Value acquirer and target as standalone firms Step 2: Value acquirer and target firms including synergy Step 3: Determine initial offer price for target firm Step 4: Determine the combined firms’ ability to finance the transaction 25.11.2017 11 Using Financial Modeling Techniques to Value and Structure M&As

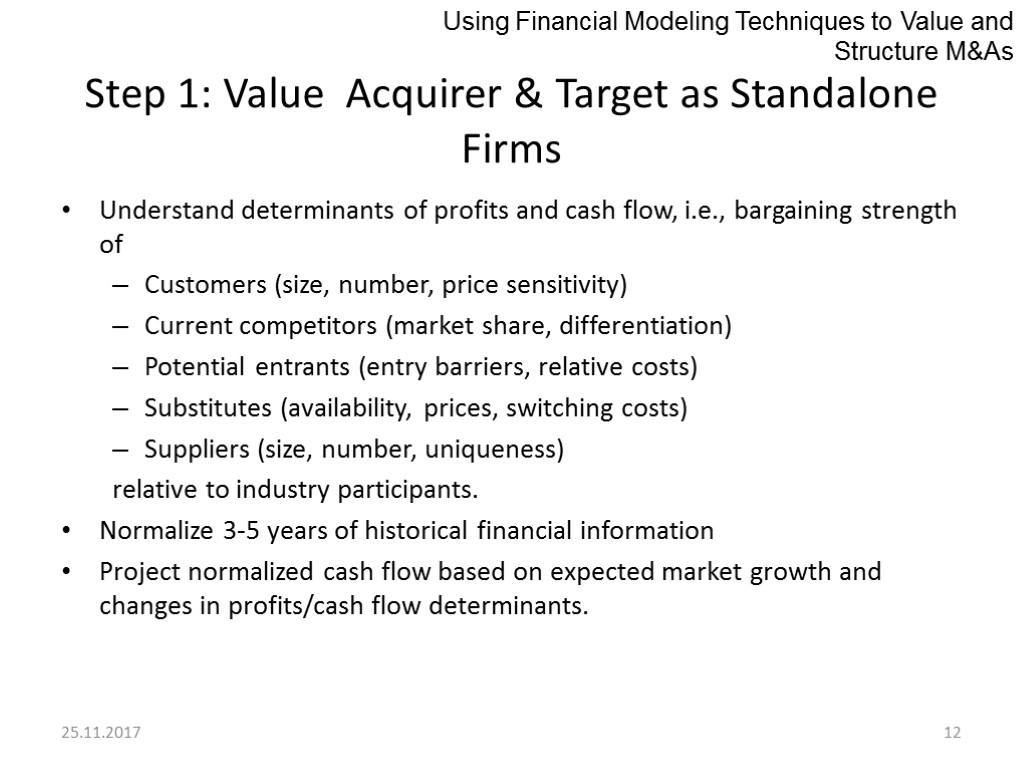

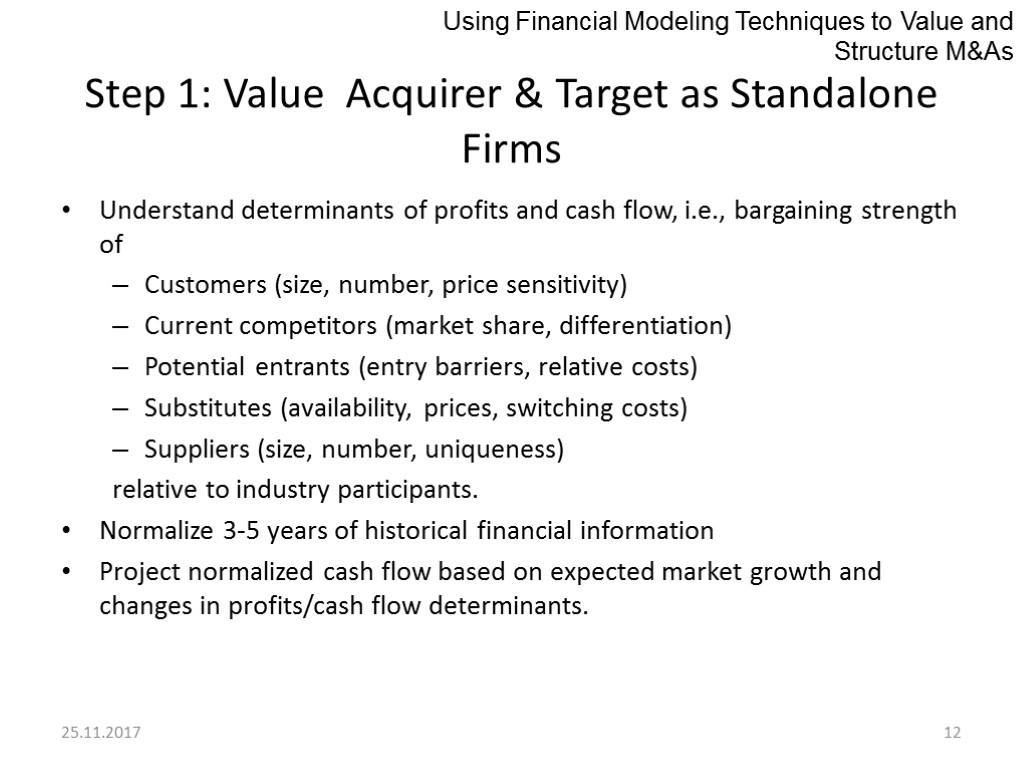

25.11.2017 12 Step 1: Value Acquirer & Target as Standalone Firms Understand determinants of profits and cash flow, i.e., bargaining strength of Customers (size, number, price sensitivity) Current competitors (market share, differentiation) Potential entrants (entry barriers, relative costs) Substitutes (availability, prices, switching costs) Suppliers (size, number, uniqueness) relative to industry participants. Normalize 3-5 years of historical financial information Project normalized cash flow based on expected market growth and changes in profits/cash flow determinants. Using Financial Modeling Techniques to Value and Structure M&As

25.11.2017 12 Step 1: Value Acquirer & Target as Standalone Firms Understand determinants of profits and cash flow, i.e., bargaining strength of Customers (size, number, price sensitivity) Current competitors (market share, differentiation) Potential entrants (entry barriers, relative costs) Substitutes (availability, prices, switching costs) Suppliers (size, number, uniqueness) relative to industry participants. Normalize 3-5 years of historical financial information Project normalized cash flow based on expected market growth and changes in profits/cash flow determinants. Using Financial Modeling Techniques to Value and Structure M&As

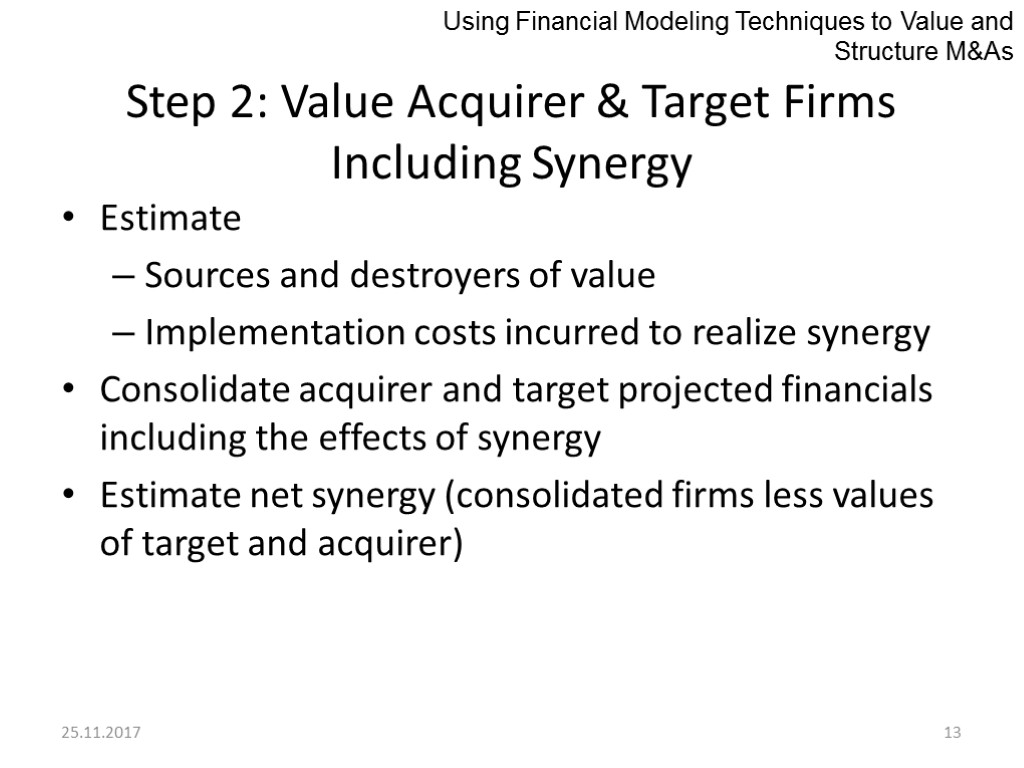

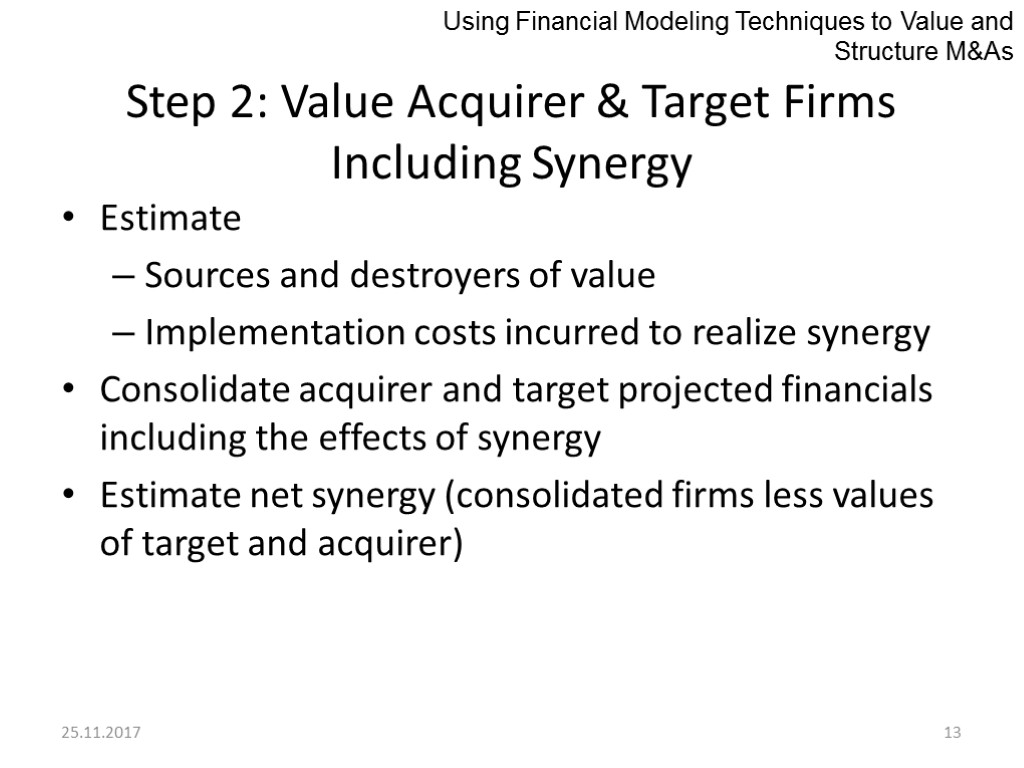

25.11.2017 13 Step 2: Value Acquirer & Target Firms Including Synergy Estimate Sources and destroyers of value Implementation costs incurred to realize synergy Consolidate acquirer and target projected financials including the effects of synergy Estimate net synergy (consolidated firms less values of target and acquirer) Using Financial Modeling Techniques to Value and Structure M&As

25.11.2017 13 Step 2: Value Acquirer & Target Firms Including Synergy Estimate Sources and destroyers of value Implementation costs incurred to realize synergy Consolidate acquirer and target projected financials including the effects of synergy Estimate net synergy (consolidated firms less values of target and acquirer) Using Financial Modeling Techniques to Value and Structure M&As

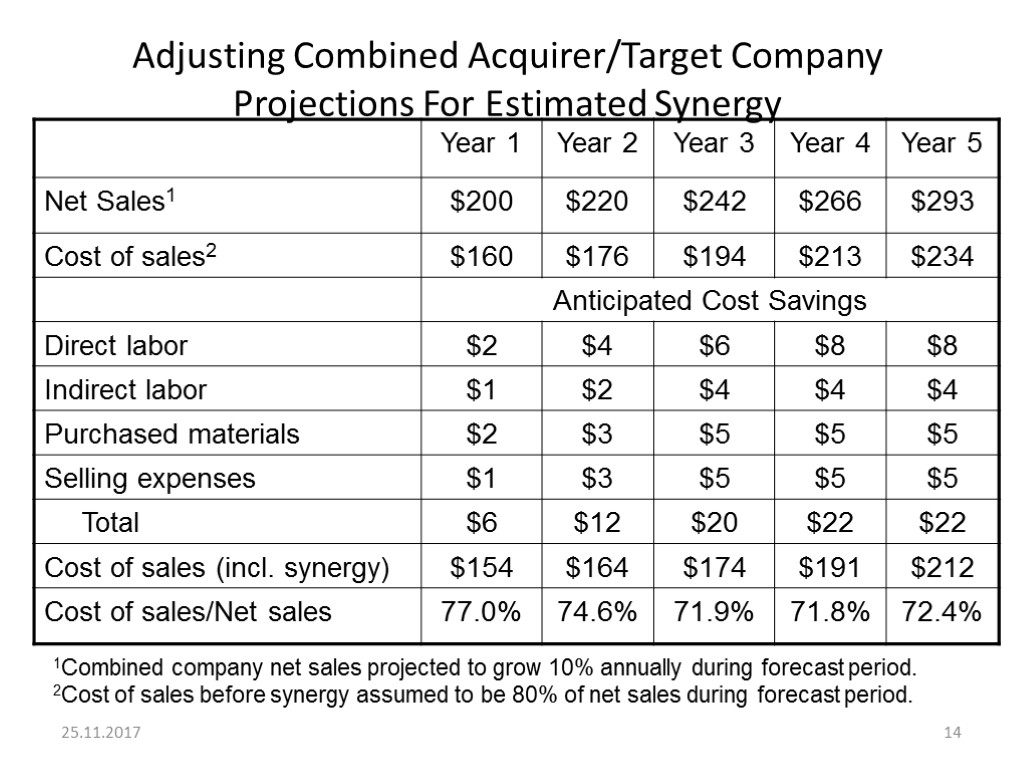

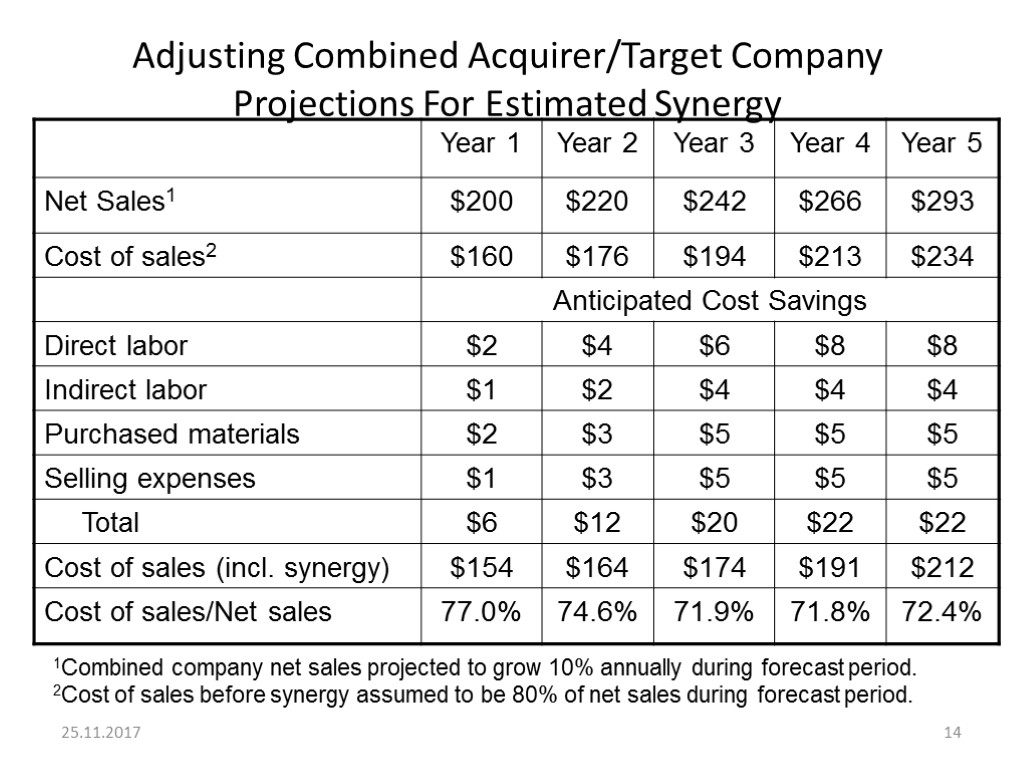

25.11.2017 14 Adjusting Combined Acquirer/Target Company Projections For Estimated Synergy 1Combined company net sales projected to grow 10% annually during forecast period. 2Cost of sales before synergy assumed to be 80% of net sales during forecast period.

25.11.2017 14 Adjusting Combined Acquirer/Target Company Projections For Estimated Synergy 1Combined company net sales projected to grow 10% annually during forecast period. 2Cost of sales before synergy assumed to be 80% of net sales during forecast period.

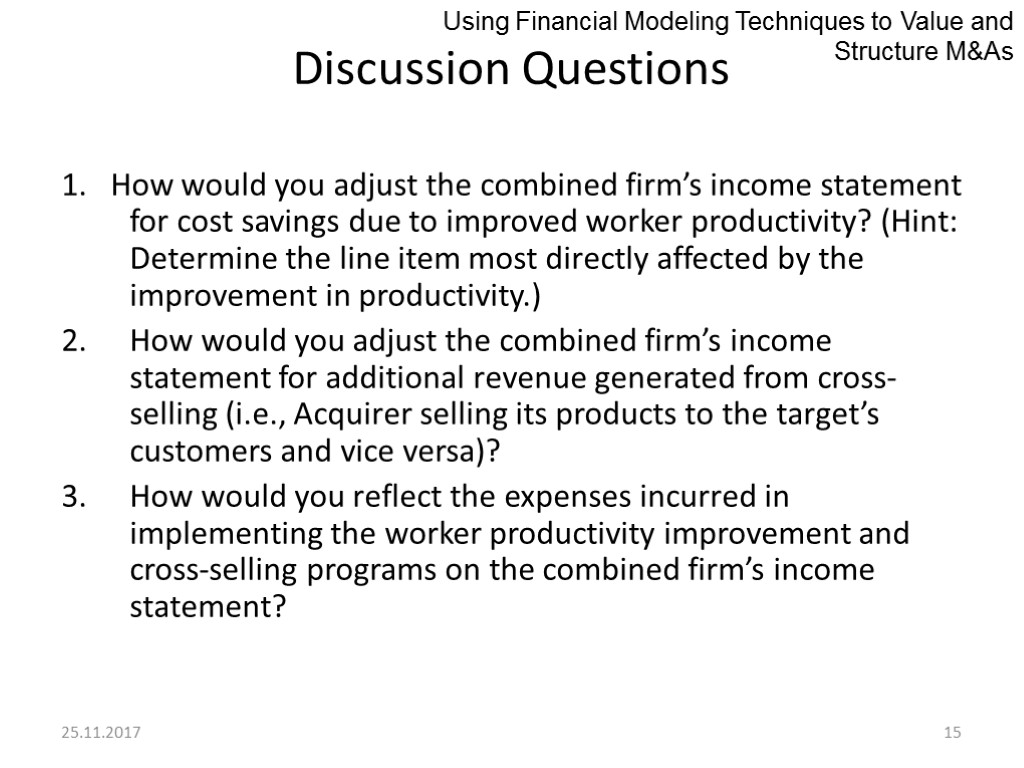

25.11.2017 15 Discussion Questions 1. How would you adjust the combined firm’s income statement for cost savings due to improved worker productivity? (Hint: Determine the line item most directly affected by the improvement in productivity.) How would you adjust the combined firm’s income statement for additional revenue generated from cross-selling (i.e., Acquirer selling its products to the target’s customers and vice versa)? How would you reflect the expenses incurred in implementing the worker productivity improvement and cross-selling programs on the combined firm’s income statement? Using Financial Modeling Techniques to Value and Structure M&As

25.11.2017 15 Discussion Questions 1. How would you adjust the combined firm’s income statement for cost savings due to improved worker productivity? (Hint: Determine the line item most directly affected by the improvement in productivity.) How would you adjust the combined firm’s income statement for additional revenue generated from cross-selling (i.e., Acquirer selling its products to the target’s customers and vice versa)? How would you reflect the expenses incurred in implementing the worker productivity improvement and cross-selling programs on the combined firm’s income statement? Using Financial Modeling Techniques to Value and Structure M&As

25.11.2017 16 Step 3: Determine Initial Offer Price for Target Firm Estimate minimum and maximum purchase price range Determine amount of synergy willing to share with target shareholders Determine appropriate composition of offer price Using Financial Modeling Techniques to Value and Structure M&As

25.11.2017 16 Step 3: Determine Initial Offer Price for Target Firm Estimate minimum and maximum purchase price range Determine amount of synergy willing to share with target shareholders Determine appropriate composition of offer price Using Financial Modeling Techniques to Value and Structure M&As

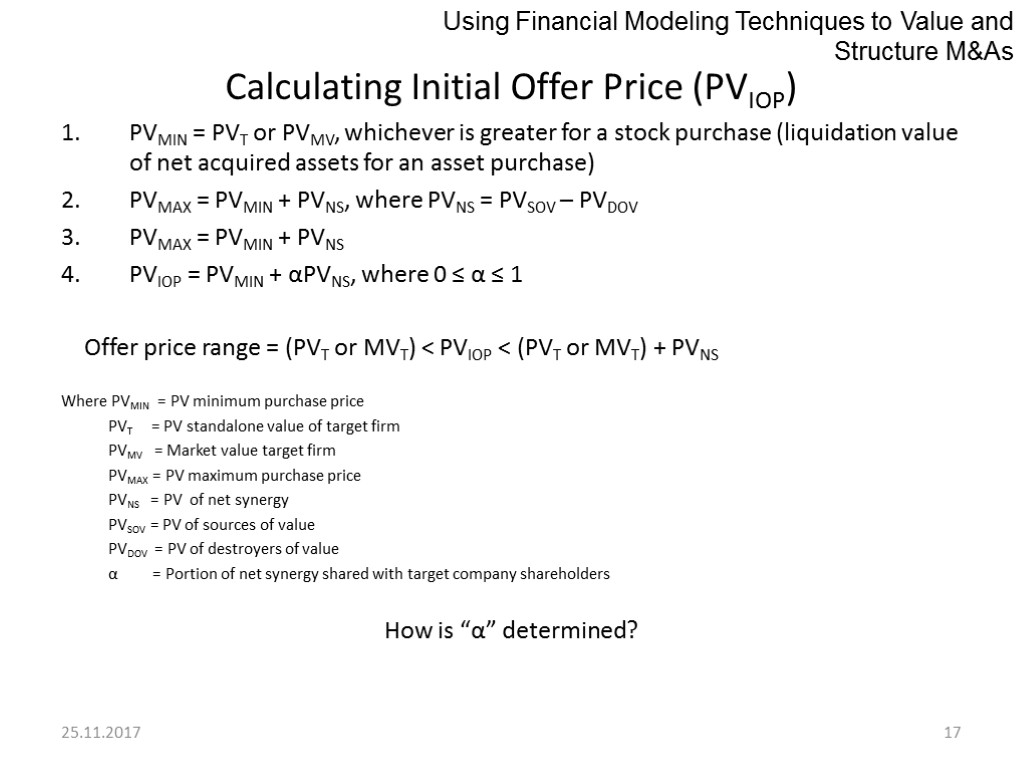

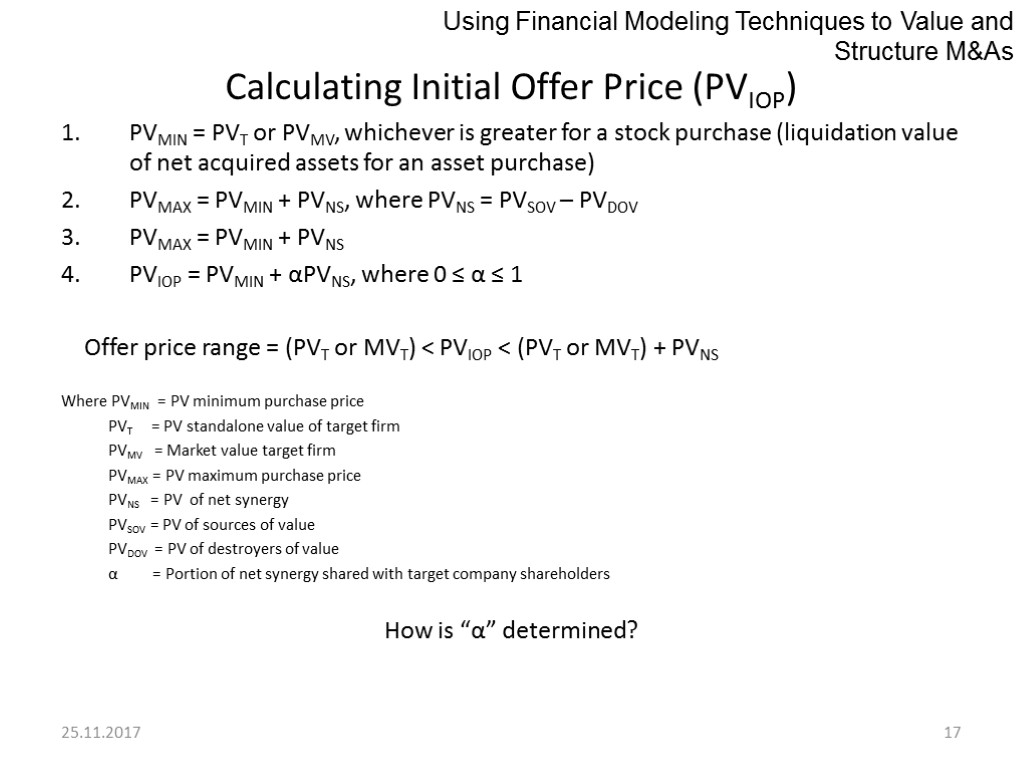

25.11.2017 17 Calculating Initial Offer Price (PVIOP) PVMIN = PVT or PVMV, whichever is greater for a stock purchase (liquidation value of net acquired assets for an asset purchase) PVMAX = PVMIN + PVNS, where PVNS = PVSOV – PVDOV PVMAX = PVMIN + PVNS PVIOP = PVMIN + αPVNS, where 0 ≤ α ≤ 1 Offer price range = (PVT or MVT) < PVIOP < (PVT or MVT) + PVNS Where PVMIN = PV minimum purchase price PVT = PV standalone value of target firm PVMV = Market value target firm PVMAX = PV maximum purchase price PVNS = PV of net synergy PVSOV = PV of sources of value PVDOV = PV of destroyers of value α = Portion of net synergy shared with target company shareholders How is “α” determined? Using Financial Modeling Techniques to Value and Structure M&As

25.11.2017 17 Calculating Initial Offer Price (PVIOP) PVMIN = PVT or PVMV, whichever is greater for a stock purchase (liquidation value of net acquired assets for an asset purchase) PVMAX = PVMIN + PVNS, where PVNS = PVSOV – PVDOV PVMAX = PVMIN + PVNS PVIOP = PVMIN + αPVNS, where 0 ≤ α ≤ 1 Offer price range = (PVT or MVT) < PVIOP < (PVT or MVT) + PVNS Where PVMIN = PV minimum purchase price PVT = PV standalone value of target firm PVMV = Market value target firm PVMAX = PV maximum purchase price PVNS = PV of net synergy PVSOV = PV of sources of value PVDOV = PV of destroyers of value α = Portion of net synergy shared with target company shareholders How is “α” determined? Using Financial Modeling Techniques to Value and Structure M&As

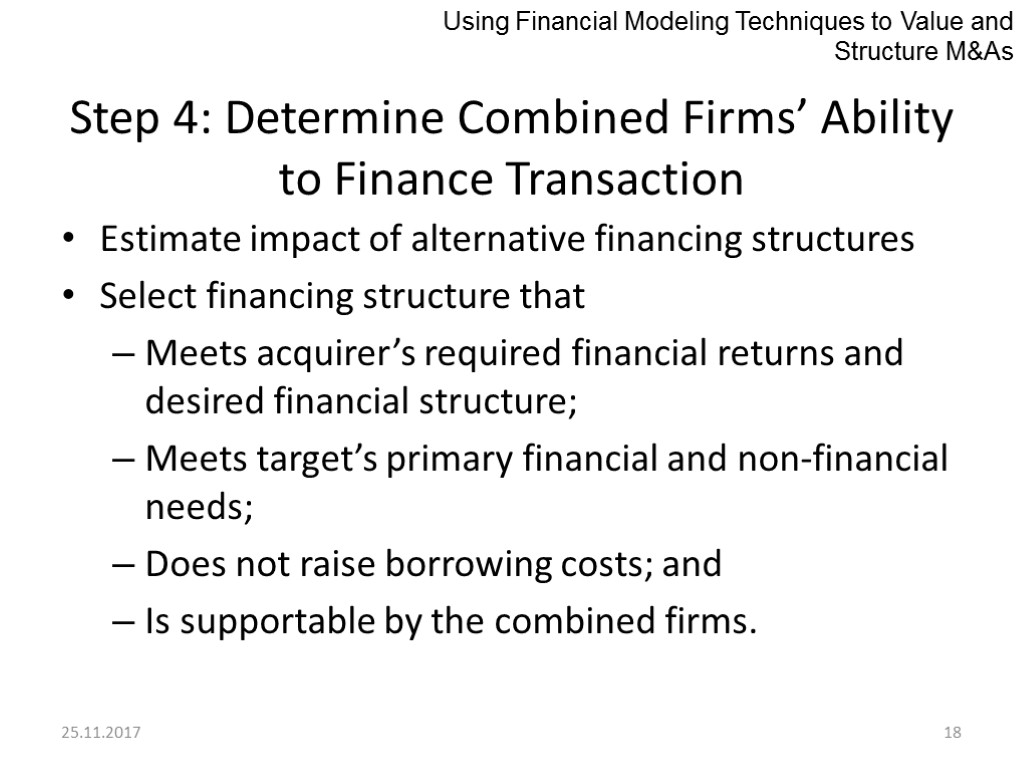

25.11.2017 18 Step 4: Determine Combined Firms’ Ability to Finance Transaction Estimate impact of alternative financing structures Select financing structure that Meets acquirer’s required financial returns and desired financial structure; Meets target’s primary financial and non-financial needs; Does not raise borrowing costs; and Is supportable by the combined firms. Using Financial Modeling Techniques to Value and Structure M&As

25.11.2017 18 Step 4: Determine Combined Firms’ Ability to Finance Transaction Estimate impact of alternative financing structures Select financing structure that Meets acquirer’s required financial returns and desired financial structure; Meets target’s primary financial and non-financial needs; Does not raise borrowing costs; and Is supportable by the combined firms. Using Financial Modeling Techniques to Value and Structure M&As

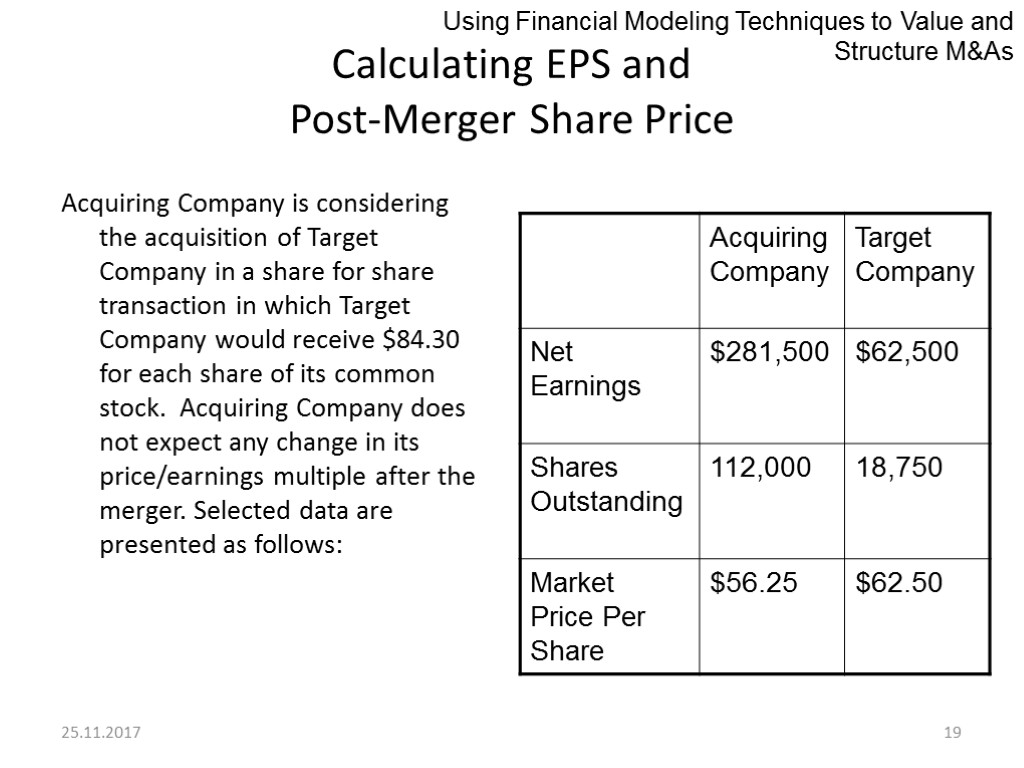

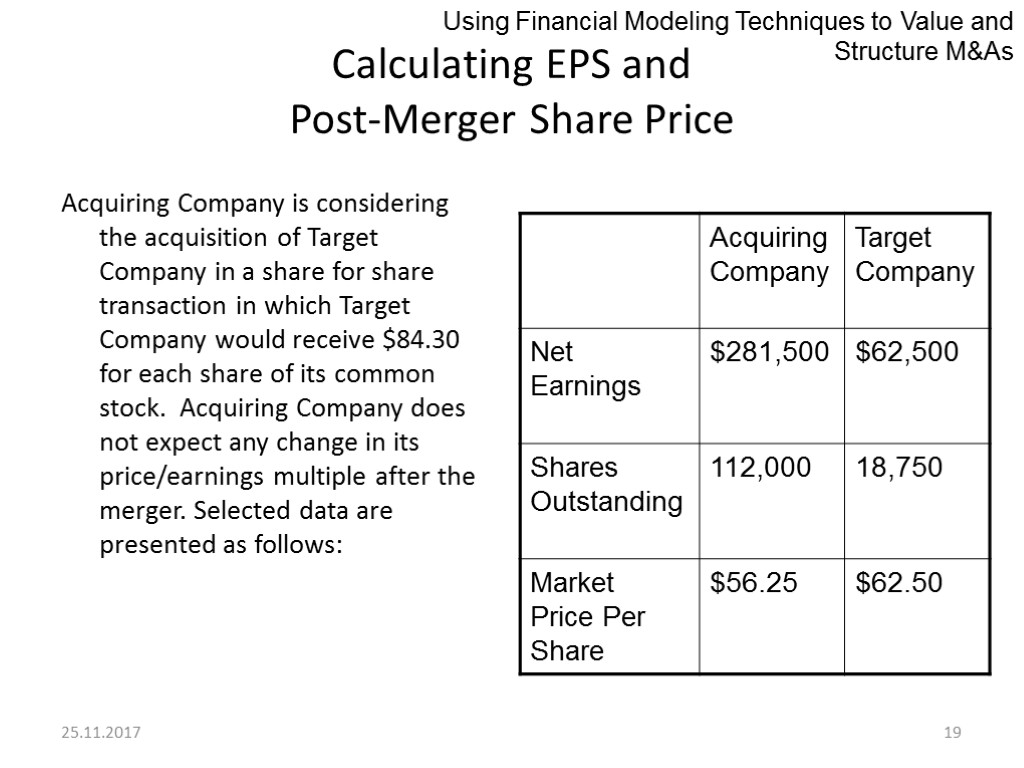

25.11.2017 19 Calculating EPS and Post-Merger Share Price Acquiring Company is considering the acquisition of Target Company in a share for share transaction in which Target Company would receive $84.30 for each share of its common stock. Acquiring Company does not expect any change in its price/earnings multiple after the merger. Selected data are presented as follows: Using Financial Modeling Techniques to Value and Structure M&As

25.11.2017 19 Calculating EPS and Post-Merger Share Price Acquiring Company is considering the acquisition of Target Company in a share for share transaction in which Target Company would receive $84.30 for each share of its common stock. Acquiring Company does not expect any change in its price/earnings multiple after the merger. Selected data are presented as follows: Using Financial Modeling Techniques to Value and Structure M&As

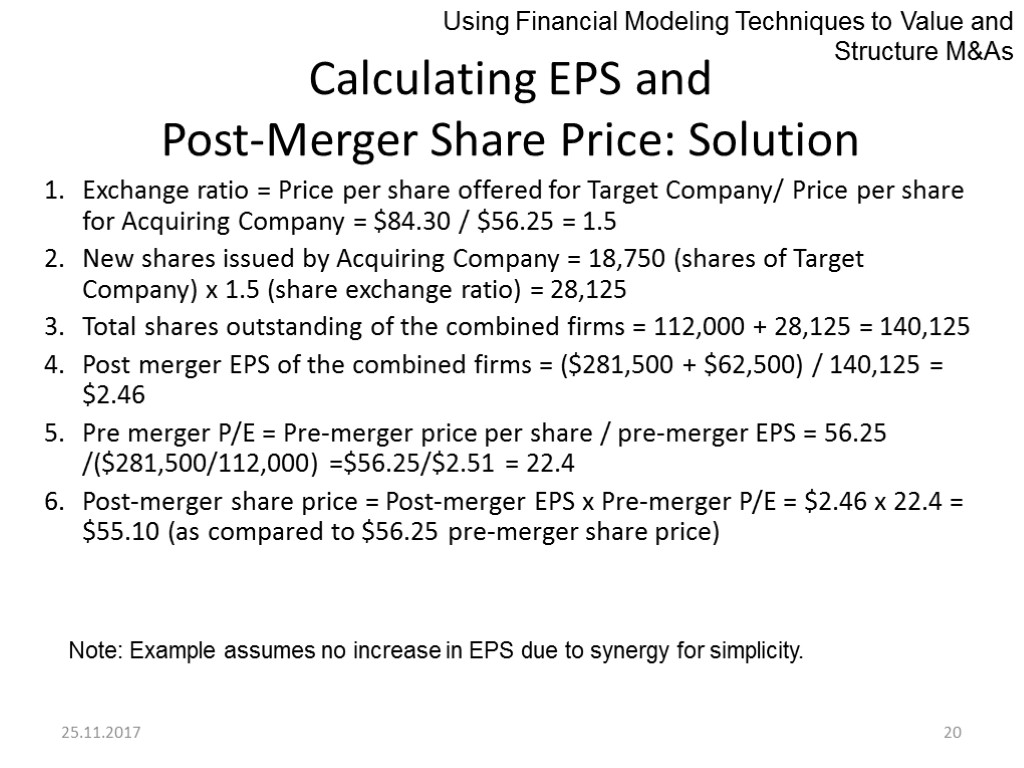

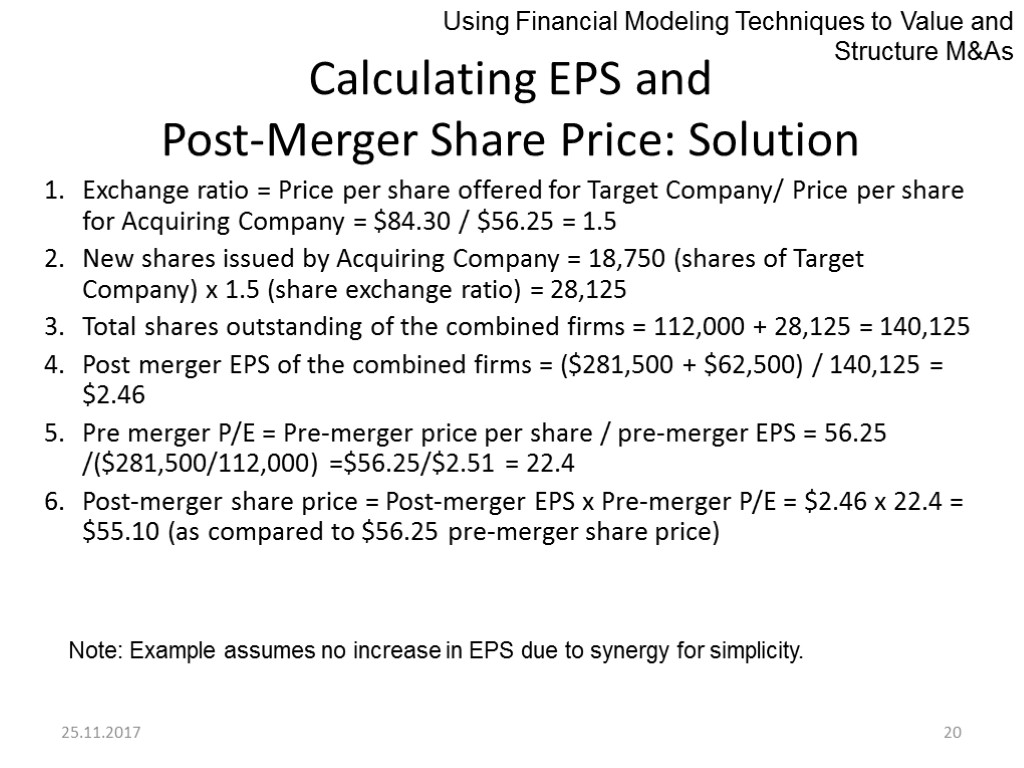

25.11.2017 20 Calculating EPS and Post-Merger Share Price: Solution 1. Exchange ratio = Price per share offered for Target Company/ Price per share for Acquiring Company = $84.30 / $56.25 = 1.5 2. New shares issued by Acquiring Company = 18,750 (shares of Target Company) x 1.5 (share exchange ratio) = 28,125 3. Total shares outstanding of the combined firms = 112,000 + 28,125 = 140,125 4. Post merger EPS of the combined firms = ($281,500 + $62,500) / 140,125 = $2.46 5. Pre merger P/E = Pre-merger price per share / pre-merger EPS = 56.25 /($281,500/112,000) =$56.25/$2.51 = 22.4 6. Post-merger share price = Post-merger EPS x Pre-merger P/E = $2.46 x 22.4 = $55.10 (as compared to $56.25 pre-merger share price) Note: Example assumes no increase in EPS due to synergy for simplicity. Using Financial Modeling Techniques to Value and Structure M&As

25.11.2017 20 Calculating EPS and Post-Merger Share Price: Solution 1. Exchange ratio = Price per share offered for Target Company/ Price per share for Acquiring Company = $84.30 / $56.25 = 1.5 2. New shares issued by Acquiring Company = 18,750 (shares of Target Company) x 1.5 (share exchange ratio) = 28,125 3. Total shares outstanding of the combined firms = 112,000 + 28,125 = 140,125 4. Post merger EPS of the combined firms = ($281,500 + $62,500) / 140,125 = $2.46 5. Pre merger P/E = Pre-merger price per share / pre-merger EPS = 56.25 /($281,500/112,000) =$56.25/$2.51 = 22.4 6. Post-merger share price = Post-merger EPS x Pre-merger P/E = $2.46 x 22.4 = $55.10 (as compared to $56.25 pre-merger share price) Note: Example assumes no increase in EPS due to synergy for simplicity. Using Financial Modeling Techniques to Value and Structure M&As

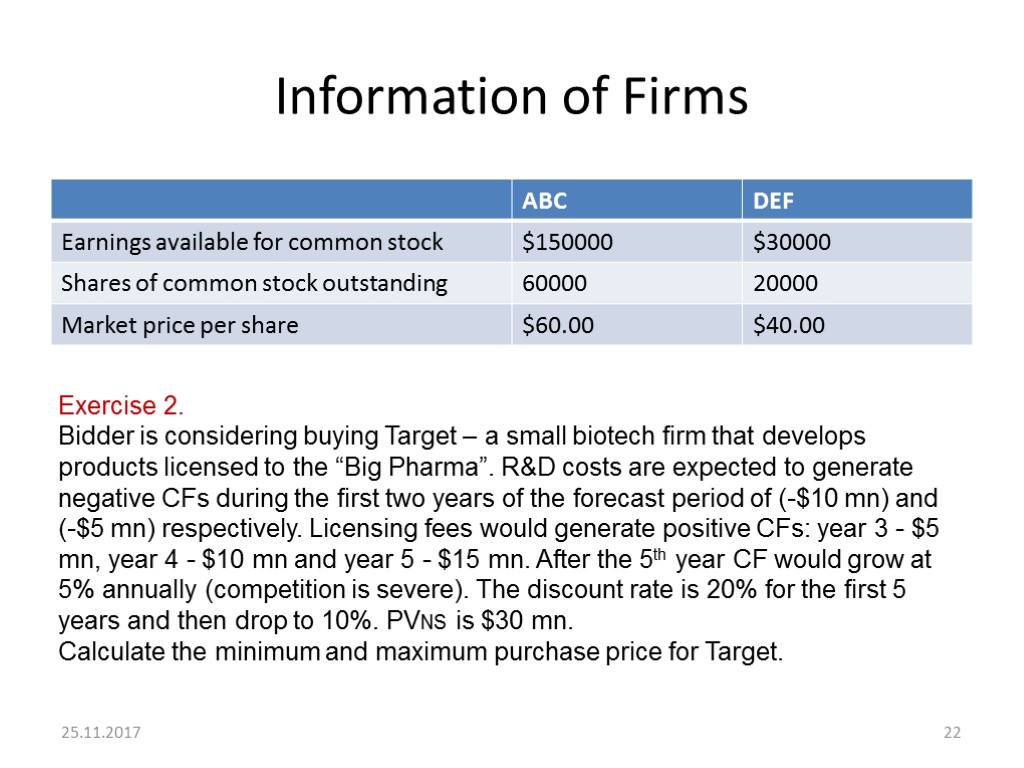

Exercises Exercise 1. ABC is considering the acquisition of DEF in a share-for-share transaction in which DEF would receive $50.00 for each share of its common stock. ABC does not expect any changes in P/E after the deal Using the information provided calculate the following: Purchase price premium Share-exchange ratio New shares issued by ABC Total shares of the combined company Postmerger EPS of the combined company Premerger EPS of the ABC Postmerger share price 25.11.2017 21

Exercises Exercise 1. ABC is considering the acquisition of DEF in a share-for-share transaction in which DEF would receive $50.00 for each share of its common stock. ABC does not expect any changes in P/E after the deal Using the information provided calculate the following: Purchase price premium Share-exchange ratio New shares issued by ABC Total shares of the combined company Postmerger EPS of the combined company Premerger EPS of the ABC Postmerger share price 25.11.2017 21

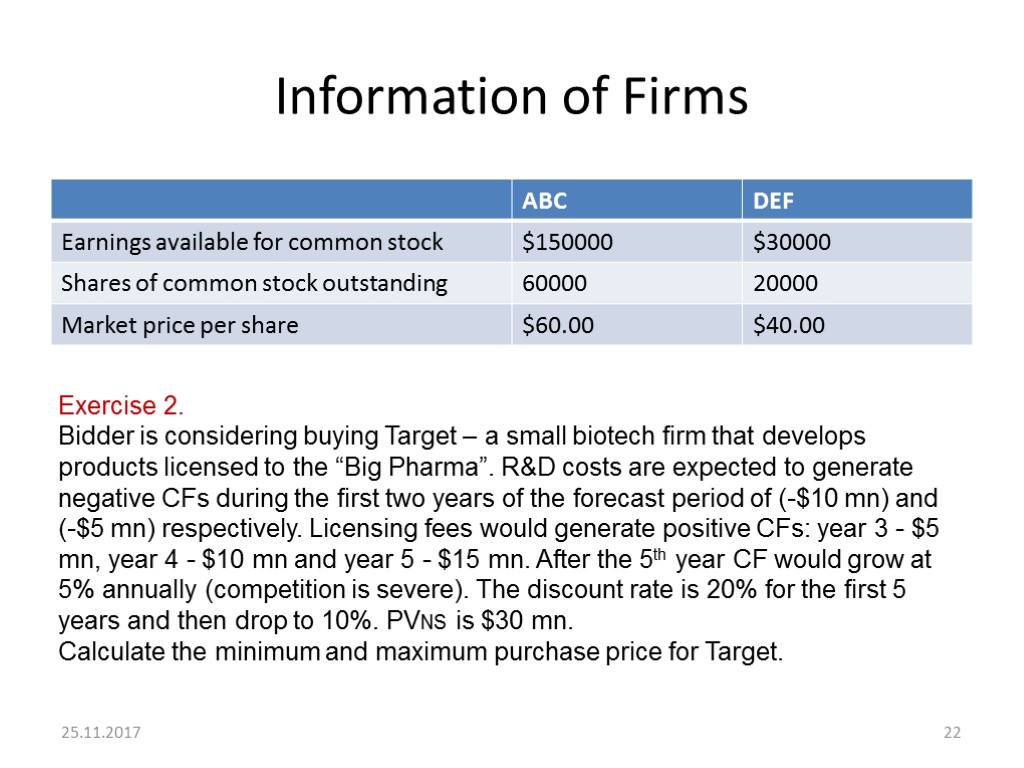

Information of Firms 25.11.2017 22 Exercise 2. Bidder is considering buying Target – a small biotech firm that develops products licensed to the “Big Pharma”. R&D costs are expected to generate negative CFs during the first two years of the forecast period of (-$10 mn) and (-$5 mn) respectively. Licensing fees would generate positive CFs: year 3 - $5 mn, year 4 - $10 mn and year 5 - $15 mn. After the 5th year CF would grow at 5% annually (competition is severe). The discount rate is 20% for the first 5 years and then drop to 10%. PVNS is $30 mn. Calculate the minimum and maximum purchase price for Target.

Information of Firms 25.11.2017 22 Exercise 2. Bidder is considering buying Target – a small biotech firm that develops products licensed to the “Big Pharma”. R&D costs are expected to generate negative CFs during the first two years of the forecast period of (-$10 mn) and (-$5 mn) respectively. Licensing fees would generate positive CFs: year 3 - $5 mn, year 4 - $10 mn and year 5 - $15 mn. After the 5th year CF would grow at 5% annually (competition is severe). The discount rate is 20% for the first 5 years and then drop to 10%. PVNS is $30 mn. Calculate the minimum and maximum purchase price for Target.

Exercise 3 Using the Excel-based model, what would be the initial offer price if the amount of synergy shared with the target firm shareholders was 50%? What is the offer price and what would the ownership distribution be if the percentage of synergy shared increased to 80% and the composition of the purchase price were all acquirer stock? 25.11.2017 23

Exercise 3 Using the Excel-based model, what would be the initial offer price if the amount of synergy shared with the target firm shareholders was 50%? What is the offer price and what would the ownership distribution be if the percentage of synergy shared increased to 80% and the composition of the purchase price were all acquirer stock? 25.11.2017 23