Additional materials to Topic 2.ppt

- Количество слайдов: 23

Additional materials to Topic 2 1. Rationale for share-paid deals 2. Using Financial Modeling Techniques to Value and Structure M&As 3. Exercises

Additional materials to Topic 2 1. Rationale for share-paid deals 2. Using Financial Modeling Techniques to Value and Structure M&As 3. Exercises

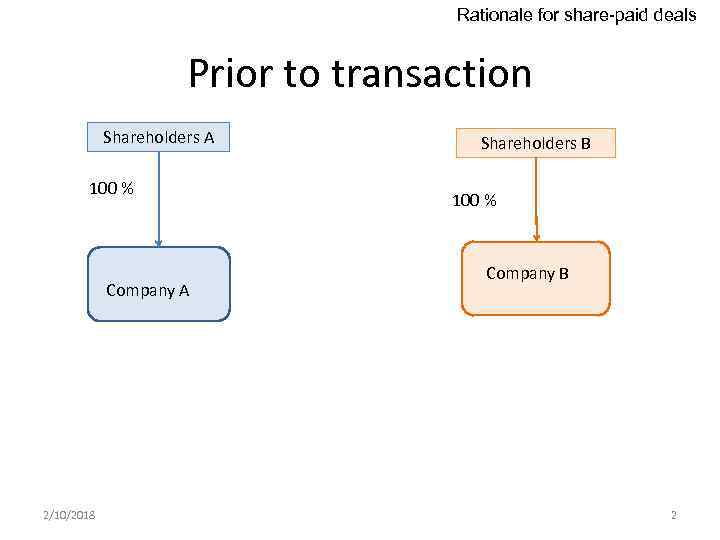

Rationale for share-paid deals Prior to transaction Shareholders A 100 % Company A 2/10/2018 Shareholders B 100 % Company B 2

Rationale for share-paid deals Prior to transaction Shareholders A 100 % Company A 2/10/2018 Shareholders B 100 % Company B 2

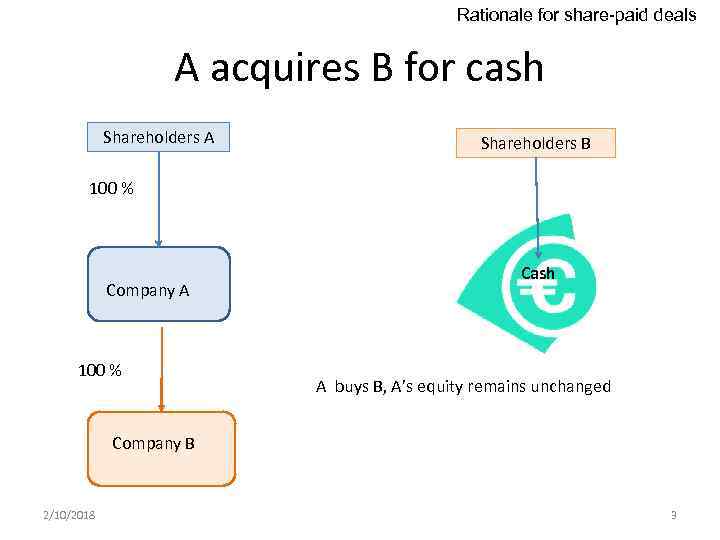

Rationale for share-paid deals A acquires B for cash Shareholders A Shareholders B 100 % Company A 100 % Cash A buys B, A’s equity remains unchanged Company B 2/10/2018 3

Rationale for share-paid deals A acquires B for cash Shareholders A Shareholders B 100 % Company A 100 % Cash A buys B, A’s equity remains unchanged Company B 2/10/2018 3

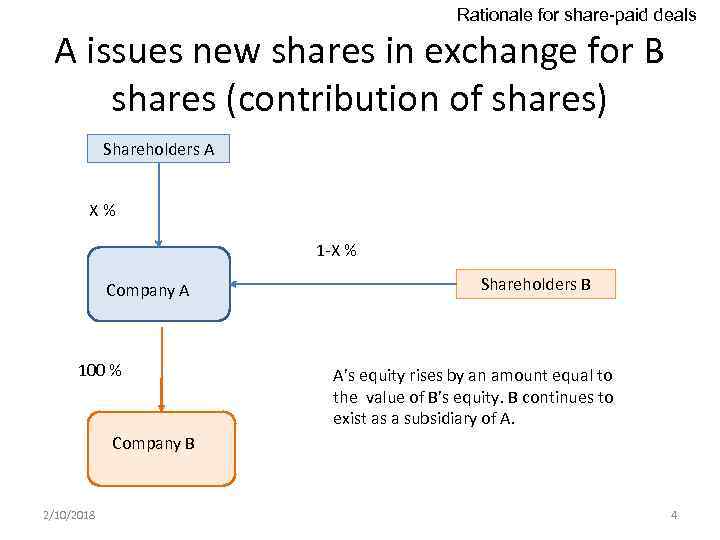

Rationale for share-paid deals A issues new shares in exchange for B shares (contribution of shares) Shareholders A X% 1 -X % Company A 100 % Shareholders B A’s equity rises by an amount equal to the value of B’s equity. B continues to exist as a subsidiary of A. Company B 2/10/2018 4

Rationale for share-paid deals A issues new shares in exchange for B shares (contribution of shares) Shareholders A X% 1 -X % Company A 100 % Shareholders B A’s equity rises by an amount equal to the value of B’s equity. B continues to exist as a subsidiary of A. Company B 2/10/2018 4

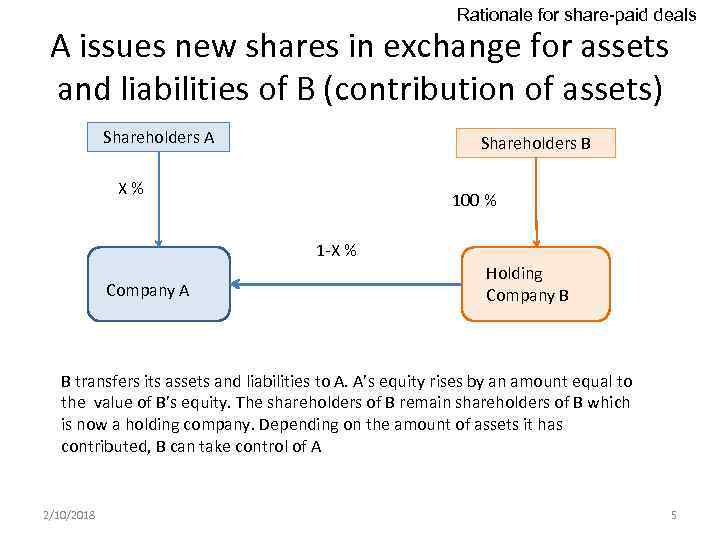

Rationale for share-paid deals A issues new shares in exchange for assets and liabilities of B (contribution of assets) Shareholders A Shareholders B X% 100 % 1 -X % Company A Holding Company B B transfers its assets and liabilities to A. A’s equity rises by an amount equal to the value of B’s equity. The shareholders of B remain shareholders of B which is now a holding company. Depending on the amount of assets it has contributed, B can take control of A 2/10/2018 5

Rationale for share-paid deals A issues new shares in exchange for assets and liabilities of B (contribution of assets) Shareholders A Shareholders B X% 100 % 1 -X % Company A Holding Company B B transfers its assets and liabilities to A. A’s equity rises by an amount equal to the value of B’s equity. The shareholders of B remain shareholders of B which is now a holding company. Depending on the amount of assets it has contributed, B can take control of A 2/10/2018 5

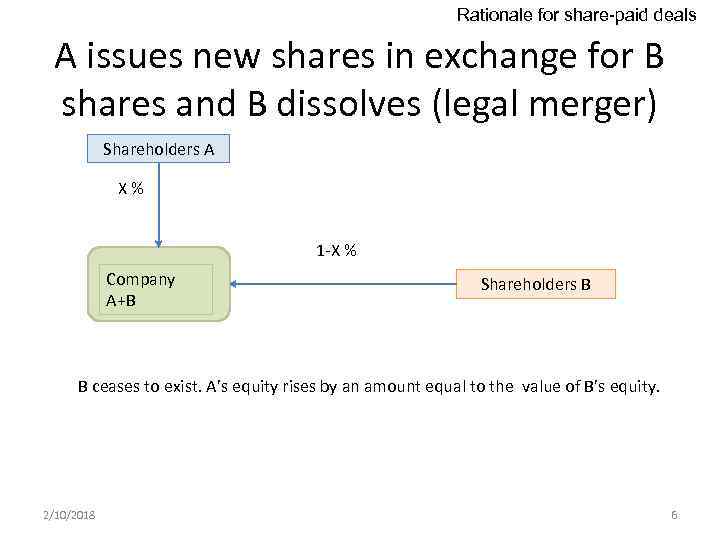

Rationale for share-paid deals A issues new shares in exchange for B shares and B dissolves (legal merger) Shareholders A X% 1 -X % Company A+B Shareholders B B ceases to exist. A’s equity rises by an amount equal to the value of B’s equity. 2/10/2018 6

Rationale for share-paid deals A issues new shares in exchange for B shares and B dissolves (legal merger) Shareholders A X% 1 -X % Company A+B Shareholders B B ceases to exist. A’s equity rises by an amount equal to the value of B’s equity. 2/10/2018 6

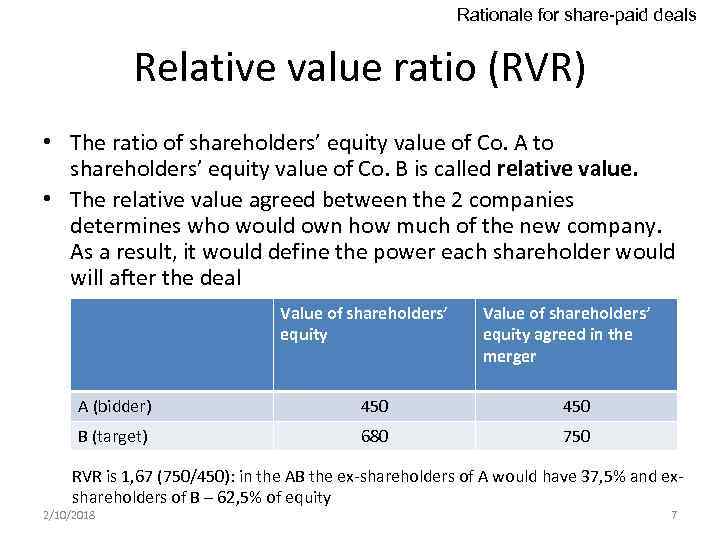

Rationale for share-paid deals Relative value ratio (RVR) • The ratio of shareholders’ equity value of Co. A to shareholders’ equity value of Co. B is called relative value. • The relative value agreed between the 2 companies determines who would own how much of the new company. As a result, it would define the power each shareholder would will after the deal Value of shareholders’ equity agreed in the merger A (bidder) 450 B (target) 680 750 RVR is 1, 67 (750/450): in the AB the ex-shareholders of A would have 37, 5% and exshareholders of B – 62, 5% of equity 2/10/2018 7

Rationale for share-paid deals Relative value ratio (RVR) • The ratio of shareholders’ equity value of Co. A to shareholders’ equity value of Co. B is called relative value. • The relative value agreed between the 2 companies determines who would own how much of the new company. As a result, it would define the power each shareholder would will after the deal Value of shareholders’ equity agreed in the merger A (bidder) 450 B (target) 680 750 RVR is 1, 67 (750/450): in the AB the ex-shareholders of A would have 37, 5% and exshareholders of B – 62, 5% of equity 2/10/2018 7

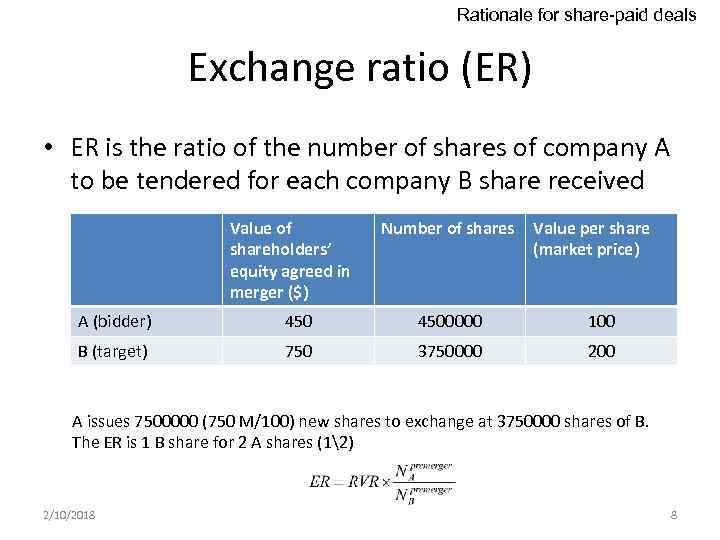

Rationale for share-paid deals Exchange ratio (ER) • ER is the ratio of the number of shares of company A to be tendered for each company B share received Value of shareholders’ equity agreed in merger ($) Number of shares Value per share (market price) A (bidder) 4500000 100 B (target) 750 3750000 200 A issues 7500000 (750 M/100) new shares to exchange at 3750000 shares of B. The ER is 1 B share for 2 A shares (12) 2/10/2018 8

Rationale for share-paid deals Exchange ratio (ER) • ER is the ratio of the number of shares of company A to be tendered for each company B share received Value of shareholders’ equity agreed in merger ($) Number of shares Value per share (market price) A (bidder) 4500000 100 B (target) 750 3750000 200 A issues 7500000 (750 M/100) new shares to exchange at 3750000 shares of B. The ER is 1 B share for 2 A shares (12) 2/10/2018 8

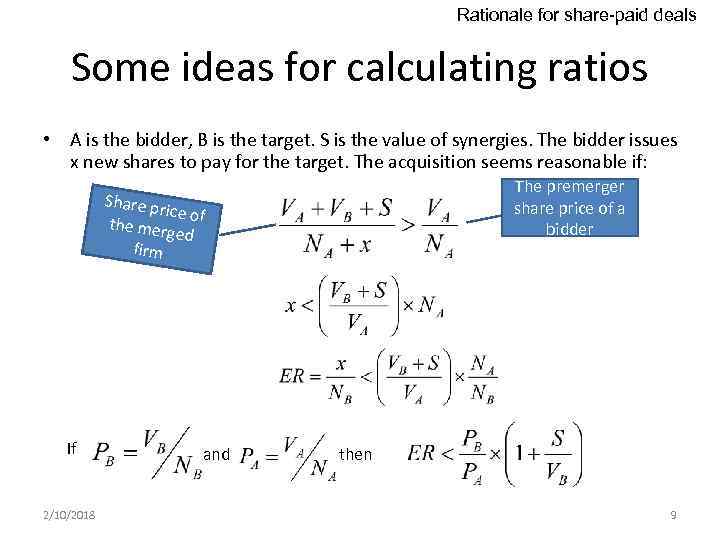

Rationale for share-paid deals Some ideas for calculating ratios • A is the bidder, B is the target. S is the value of synergies. The bidder issues x new shares to pay for the target. The acquisition seems reasonable if: The premerger share price of a bidder Share pr ice of the mer ged firm If 2/10/2018 and then 9

Rationale for share-paid deals Some ideas for calculating ratios • A is the bidder, B is the target. S is the value of synergies. The bidder issues x new shares to pay for the target. The acquisition seems reasonable if: The premerger share price of a bidder Share pr ice of the mer ged firm If 2/10/2018 and then 9

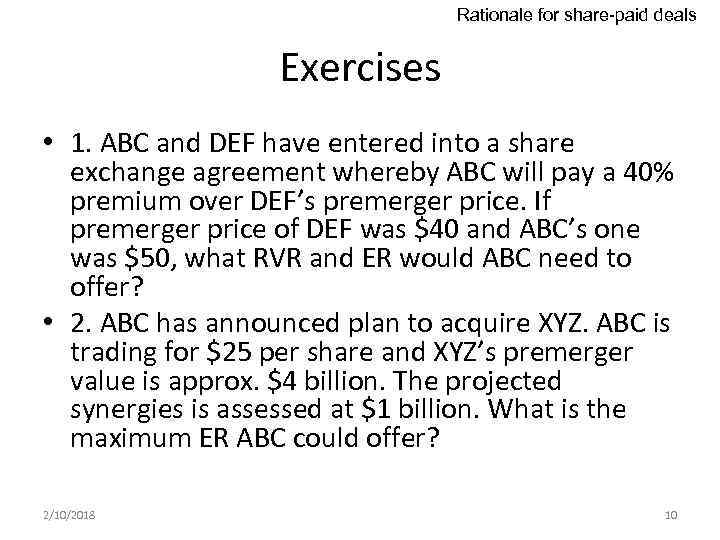

Rationale for share-paid deals Exercises • 1. ABC and DEF have entered into a share exchange agreement whereby ABC will pay a 40% premium over DEF’s premerger price. If premerger price of DEF was $40 and ABC’s one was $50, what RVR and ER would ABC need to offer? • 2. ABC has announced plan to acquire XYZ. ABC is trading for $25 per share and XYZ’s premerger value is approx. $4 billion. The projected synergies is assessed at $1 billion. What is the maximum ER ABC could offer? 2/10/2018 10

Rationale for share-paid deals Exercises • 1. ABC and DEF have entered into a share exchange agreement whereby ABC will pay a 40% premium over DEF’s premerger price. If premerger price of DEF was $40 and ABC’s one was $50, what RVR and ER would ABC need to offer? • 2. ABC has announced plan to acquire XYZ. ABC is trading for $25 per share and XYZ’s premerger value is approx. $4 billion. The projected synergies is assessed at $1 billion. What is the maximum ER ABC could offer? 2/10/2018 10

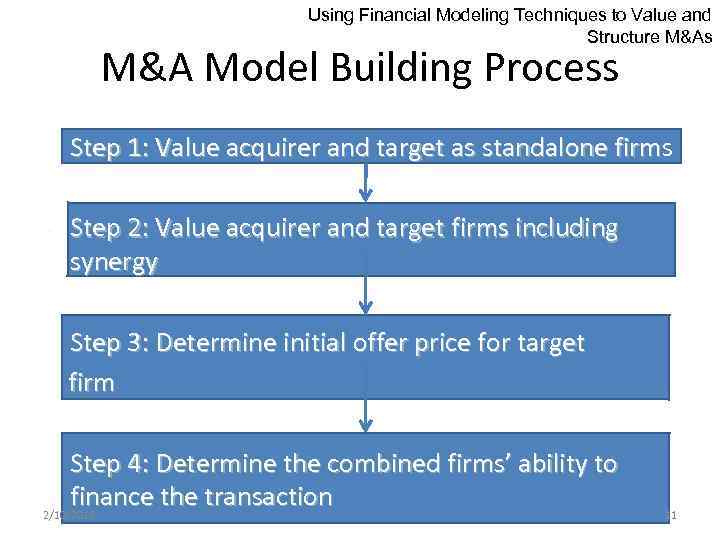

Using Financial Modeling Techniques to Value and Structure M&As M&A Model Building Process • Step 1: Value acquirer and target as standalone firms firm • Step 2: Value acquirer and target firms including synergy • Step 3: Determine initial offer price for target firm • Step 4: Determine the combined firms’ ability to finance the transaction 2/10/2018 11

Using Financial Modeling Techniques to Value and Structure M&As M&A Model Building Process • Step 1: Value acquirer and target as standalone firms firm • Step 2: Value acquirer and target firms including synergy • Step 3: Determine initial offer price for target firm • Step 4: Determine the combined firms’ ability to finance the transaction 2/10/2018 11

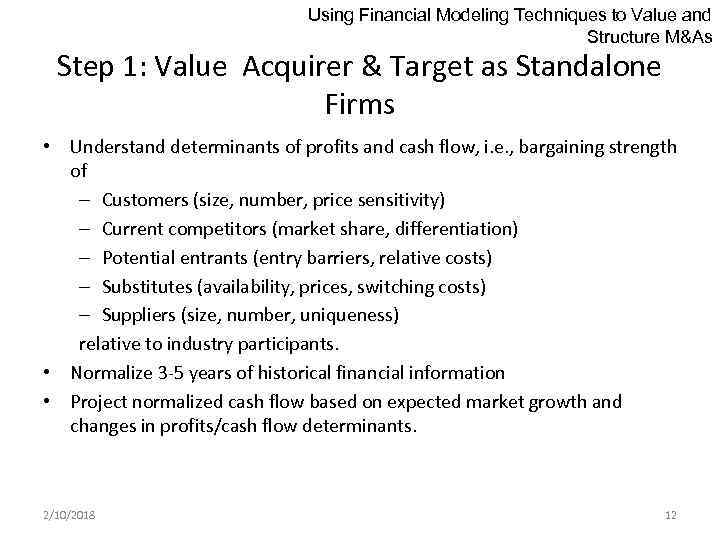

Using Financial Modeling Techniques to Value and Structure M&As Step 1: Value Acquirer & Target as Standalone Firms • Understand determinants of profits and cash flow, i. e. , bargaining strength of – Customers (size, number, price sensitivity) – Current competitors (market share, differentiation) – Potential entrants (entry barriers, relative costs) – Substitutes (availability, prices, switching costs) – Suppliers (size, number, uniqueness) relative to industry participants. • Normalize 3 -5 years of historical financial information • Project normalized cash flow based on expected market growth and changes in profits/cash flow determinants. 2/10/2018 12

Using Financial Modeling Techniques to Value and Structure M&As Step 1: Value Acquirer & Target as Standalone Firms • Understand determinants of profits and cash flow, i. e. , bargaining strength of – Customers (size, number, price sensitivity) – Current competitors (market share, differentiation) – Potential entrants (entry barriers, relative costs) – Substitutes (availability, prices, switching costs) – Suppliers (size, number, uniqueness) relative to industry participants. • Normalize 3 -5 years of historical financial information • Project normalized cash flow based on expected market growth and changes in profits/cash flow determinants. 2/10/2018 12

Using Financial Modeling Techniques to Value and Structure M&As Step 2: Value Acquirer & Target Firms Including Synergy • Estimate – Sources and destroyers of value – Implementation costs incurred to realize synergy • Consolidate acquirer and target projected financials including the effects of synergy • Estimate net synergy (consolidated firms less values of target and acquirer) 2/10/2018 13

Using Financial Modeling Techniques to Value and Structure M&As Step 2: Value Acquirer & Target Firms Including Synergy • Estimate – Sources and destroyers of value – Implementation costs incurred to realize synergy • Consolidate acquirer and target projected financials including the effects of synergy • Estimate net synergy (consolidated firms less values of target and acquirer) 2/10/2018 13

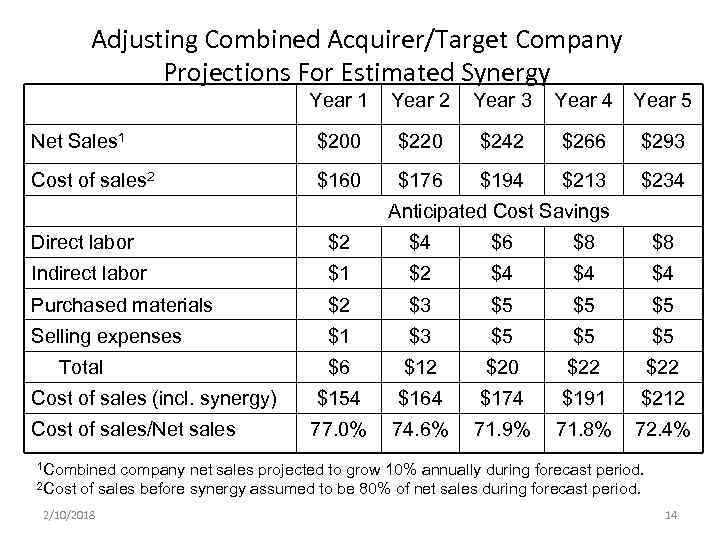

Adjusting Combined Acquirer/Target Company Projections For Estimated Synergy Year 1 Year 2 Year 3 Year 4 Year 5 Net Sales 1 $200 $220 $242 $266 $293 Cost of sales 2 $160 $176 $194 $213 $234 Anticipated Cost Savings Direct labor $2 $4 $6 $8 $8 Indirect labor $1 $2 $4 $4 $4 Purchased materials $2 $3 $5 $5 $5 Selling expenses $1 $3 $5 $5 $5 $6 $12 $20 $22 $154 $164 $174 $191 $212 77. 0% 74. 6% 71. 9% 71. 8% 72. 4% Total Cost of sales (incl. synergy) Cost of sales/Net sales 1 Combined company net sales projected to grow 10% annually during forecast period. 2 Cost of sales before synergy assumed to be 80% of net sales during forecast period. 2/10/2018 14

Adjusting Combined Acquirer/Target Company Projections For Estimated Synergy Year 1 Year 2 Year 3 Year 4 Year 5 Net Sales 1 $200 $220 $242 $266 $293 Cost of sales 2 $160 $176 $194 $213 $234 Anticipated Cost Savings Direct labor $2 $4 $6 $8 $8 Indirect labor $1 $2 $4 $4 $4 Purchased materials $2 $3 $5 $5 $5 Selling expenses $1 $3 $5 $5 $5 $6 $12 $20 $22 $154 $164 $174 $191 $212 77. 0% 74. 6% 71. 9% 71. 8% 72. 4% Total Cost of sales (incl. synergy) Cost of sales/Net sales 1 Combined company net sales projected to grow 10% annually during forecast period. 2 Cost of sales before synergy assumed to be 80% of net sales during forecast period. 2/10/2018 14

Using Financial Modeling Techniques to Value and Structure M&As Discussion Questions 1. How would you adjust the combined firm’s income statement for cost savings due to improved worker productivity? (Hint: Determine the line item most directly affected by the improvement in productivity. ) 2. How would you adjust the combined firm’s income statement for additional revenue generated from crossselling (i. e. , Acquirer selling its products to the target’s customers and vice versa)? 3. How would you reflect the expenses incurred in implementing the worker productivity improvement and cross-selling programs on the combined firm’s income statement? 2/10/2018 15

Using Financial Modeling Techniques to Value and Structure M&As Discussion Questions 1. How would you adjust the combined firm’s income statement for cost savings due to improved worker productivity? (Hint: Determine the line item most directly affected by the improvement in productivity. ) 2. How would you adjust the combined firm’s income statement for additional revenue generated from crossselling (i. e. , Acquirer selling its products to the target’s customers and vice versa)? 3. How would you reflect the expenses incurred in implementing the worker productivity improvement and cross-selling programs on the combined firm’s income statement? 2/10/2018 15

Using Financial Modeling Techniques to Value and Structure M&As Step 3: Determine Initial Offer Price for Target Firm • Estimate minimum and maximum purchase price range • Determine amount of synergy willing to share with target shareholders • Determine appropriate composition of offer price 2/10/2018 16

Using Financial Modeling Techniques to Value and Structure M&As Step 3: Determine Initial Offer Price for Target Firm • Estimate minimum and maximum purchase price range • Determine amount of synergy willing to share with target shareholders • Determine appropriate composition of offer price 2/10/2018 16

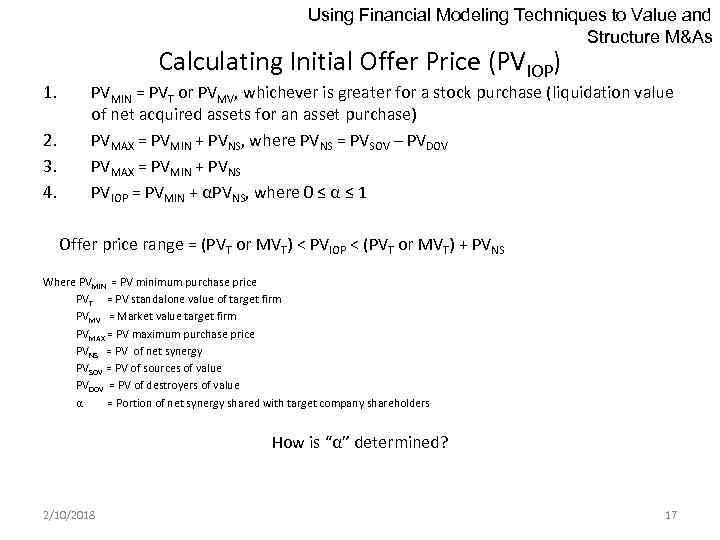

Using Financial Modeling Techniques to Value and Structure M&As 1. 2. 3. 4. Calculating Initial Offer Price (PVIOP) PVMIN = PVT or PVMV, whichever is greater for a stock purchase (liquidation value of net acquired assets for an asset purchase) PVMAX = PVMIN + PVNS, where PVNS = PVSOV – PVDOV PVMAX = PVMIN + PVNS PVIOP = PVMIN + αPVNS, where 0 ≤ α ≤ 1 Offer price range = (PVT or MVT) < PVIOP < (PVT or MVT) + PVNS Where PVMIN = PV minimum purchase price PV T = PV standalone value of target firm PV MV = Market value target firm PV MAX = PV maximum purchase price PV NS = PV of net synergy PV SOV = PV of sources of value PV DOV = PV of destroyers of value α = Portion of net synergy shared with target company shareholders How is “α” determined? 2/10/2018 17

Using Financial Modeling Techniques to Value and Structure M&As 1. 2. 3. 4. Calculating Initial Offer Price (PVIOP) PVMIN = PVT or PVMV, whichever is greater for a stock purchase (liquidation value of net acquired assets for an asset purchase) PVMAX = PVMIN + PVNS, where PVNS = PVSOV – PVDOV PVMAX = PVMIN + PVNS PVIOP = PVMIN + αPVNS, where 0 ≤ α ≤ 1 Offer price range = (PVT or MVT) < PVIOP < (PVT or MVT) + PVNS Where PVMIN = PV minimum purchase price PV T = PV standalone value of target firm PV MV = Market value target firm PV MAX = PV maximum purchase price PV NS = PV of net synergy PV SOV = PV of sources of value PV DOV = PV of destroyers of value α = Portion of net synergy shared with target company shareholders How is “α” determined? 2/10/2018 17

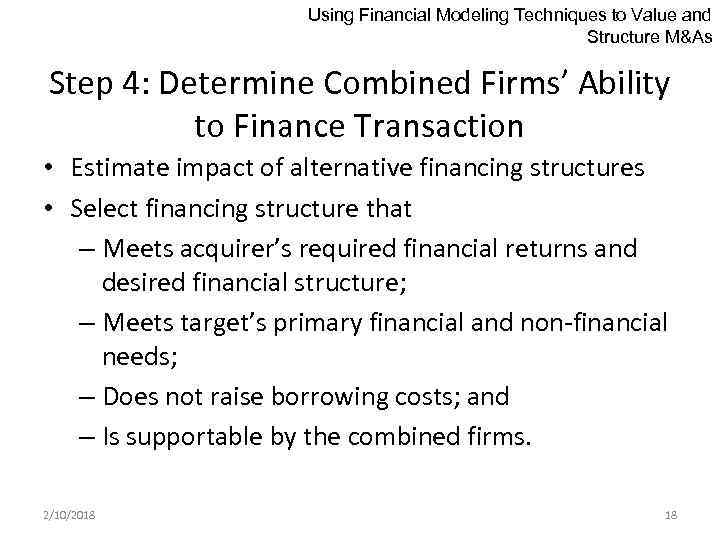

Using Financial Modeling Techniques to Value and Structure M&As Step 4: Determine Combined Firms’ Ability to Finance Transaction • Estimate impact of alternative financing structures • Select financing structure that – Meets acquirer’s required financial returns and desired financial structure; – Meets target’s primary financial and non-financial needs; – Does not raise borrowing costs; and – Is supportable by the combined firms. 2/10/2018 18

Using Financial Modeling Techniques to Value and Structure M&As Step 4: Determine Combined Firms’ Ability to Finance Transaction • Estimate impact of alternative financing structures • Select financing structure that – Meets acquirer’s required financial returns and desired financial structure; – Meets target’s primary financial and non-financial needs; – Does not raise borrowing costs; and – Is supportable by the combined firms. 2/10/2018 18

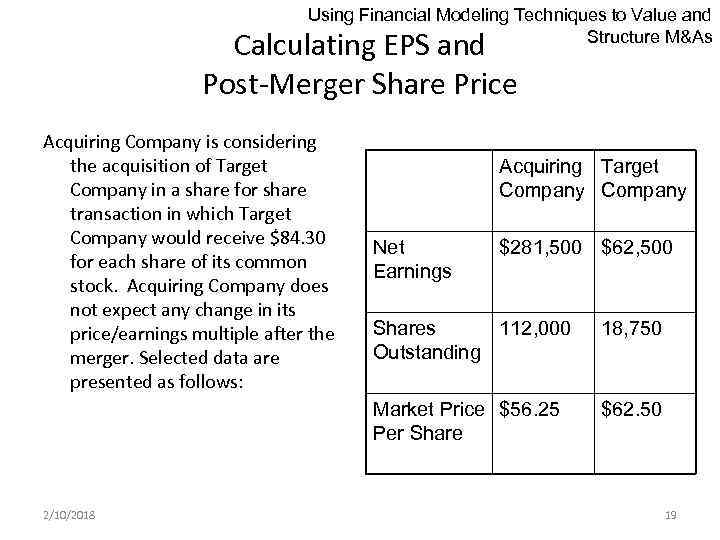

Using Financial Modeling Techniques to Value and Structure M&As Calculating EPS and Post-Merger Share Price Acquiring Company is considering the acquisition of Target Company in a share for share transaction in which Target Company would receive $84. 30 for each share of its common stock. Acquiring Company does not expect any change in its price/earnings multiple after the merger. Selected data are presented as follows: Acquiring Target Company Net Earnings $281, 500 $62, 500 18, 750 Market Price $56. 25 Per Share 2/10/2018 Shares 112, 000 Outstanding $62. 50 19

Using Financial Modeling Techniques to Value and Structure M&As Calculating EPS and Post-Merger Share Price Acquiring Company is considering the acquisition of Target Company in a share for share transaction in which Target Company would receive $84. 30 for each share of its common stock. Acquiring Company does not expect any change in its price/earnings multiple after the merger. Selected data are presented as follows: Acquiring Target Company Net Earnings $281, 500 $62, 500 18, 750 Market Price $56. 25 Per Share 2/10/2018 Shares 112, 000 Outstanding $62. 50 19

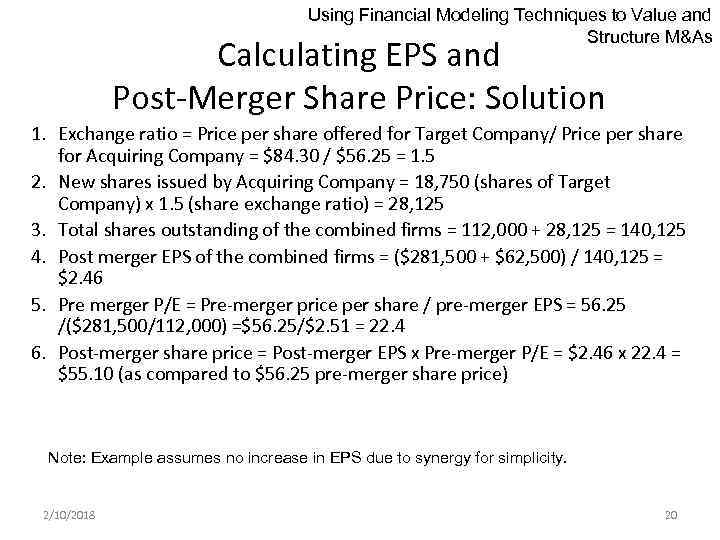

Using Financial Modeling Techniques to Value and Structure M&As Calculating EPS and Post-Merger Share Price: Solution 1. Exchange ratio = Price per share offered for Target Company/ Price per share for Acquiring Company = $84. 30 / $56. 25 = 1. 5 2. New shares issued by Acquiring Company = 18, 750 (shares of Target Company) x 1. 5 (share exchange ratio) = 28, 125 3. Total shares outstanding of the combined firms = 112, 000 + 28, 125 = 140, 125 4. Post merger EPS of the combined firms = ($281, 500 + $62, 500) / 140, 125 = $2. 46 5. Pre merger P/E = Pre-merger price per share / pre-merger EPS = 56. 25 /($281, 500/112, 000) =$56. 25/$2. 51 = 22. 4 6. Post-merger share price = Post-merger EPS x Pre-merger P/E = $2. 46 x 22. 4 = $55. 10 (as compared to $56. 25 pre-merger share price) Note: Example assumes no increase in EPS due to synergy for simplicity. 2/10/2018 20

Using Financial Modeling Techniques to Value and Structure M&As Calculating EPS and Post-Merger Share Price: Solution 1. Exchange ratio = Price per share offered for Target Company/ Price per share for Acquiring Company = $84. 30 / $56. 25 = 1. 5 2. New shares issued by Acquiring Company = 18, 750 (shares of Target Company) x 1. 5 (share exchange ratio) = 28, 125 3. Total shares outstanding of the combined firms = 112, 000 + 28, 125 = 140, 125 4. Post merger EPS of the combined firms = ($281, 500 + $62, 500) / 140, 125 = $2. 46 5. Pre merger P/E = Pre-merger price per share / pre-merger EPS = 56. 25 /($281, 500/112, 000) =$56. 25/$2. 51 = 22. 4 6. Post-merger share price = Post-merger EPS x Pre-merger P/E = $2. 46 x 22. 4 = $55. 10 (as compared to $56. 25 pre-merger share price) Note: Example assumes no increase in EPS due to synergy for simplicity. 2/10/2018 20

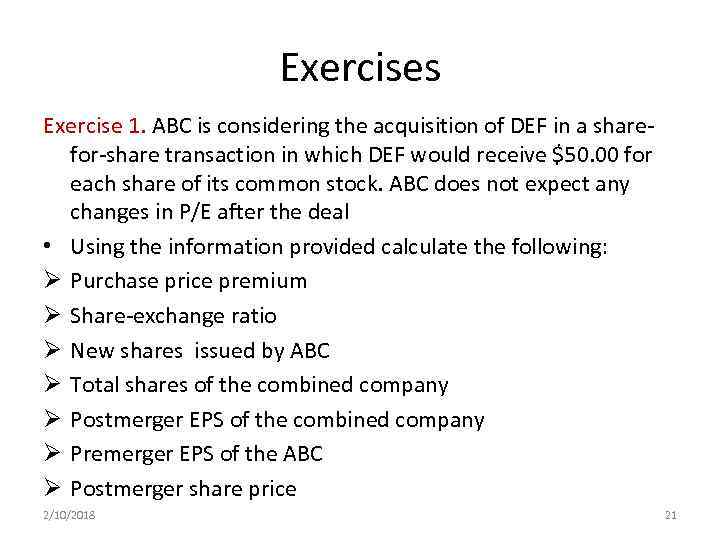

Exercises Exercise 1. ABC is considering the acquisition of DEF in a sharefor-share transaction in which DEF would receive $50. 00 for each share of its common stock. ABC does not expect any changes in P/E after the deal • Using the information provided calculate the following: Ø Purchase price premium Ø Share-exchange ratio Ø New shares issued by ABC Ø Total shares of the combined company Ø Postmerger EPS of the combined company Ø Premerger EPS of the ABC Ø Postmerger share price 2/10/2018 21

Exercises Exercise 1. ABC is considering the acquisition of DEF in a sharefor-share transaction in which DEF would receive $50. 00 for each share of its common stock. ABC does not expect any changes in P/E after the deal • Using the information provided calculate the following: Ø Purchase price premium Ø Share-exchange ratio Ø New shares issued by ABC Ø Total shares of the combined company Ø Postmerger EPS of the combined company Ø Premerger EPS of the ABC Ø Postmerger share price 2/10/2018 21

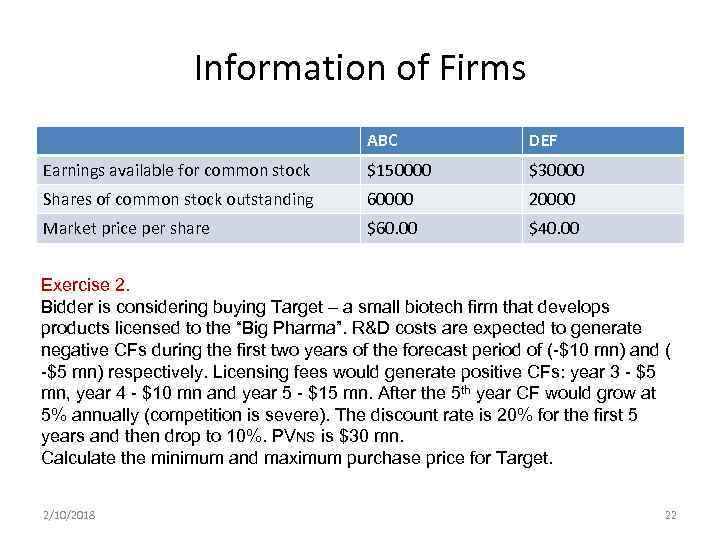

Information of Firms ABC DEF Earnings available for common stock $150000 $30000 Shares of common stock outstanding 60000 20000 Market price per share $60. 00 $40. 00 Exercise 2. Bidder is considering buying Target – a small biotech firm that develops products licensed to the “Big Pharma”. R&D costs are expected to generate negative CFs during the first two years of the forecast period of (-$10 mn) and ( -$5 mn) respectively. Licensing fees would generate positive CFs: year 3 - $5 mn, year 4 - $10 mn and year 5 - $15 mn. After the 5 th year CF would grow at 5% annually (competition is severe). The discount rate is 20% for the first 5 years and then drop to 10%. PVNS is $30 mn. Calculate the minimum and maximum purchase price for Target. 2/10/2018 22

Information of Firms ABC DEF Earnings available for common stock $150000 $30000 Shares of common stock outstanding 60000 20000 Market price per share $60. 00 $40. 00 Exercise 2. Bidder is considering buying Target – a small biotech firm that develops products licensed to the “Big Pharma”. R&D costs are expected to generate negative CFs during the first two years of the forecast period of (-$10 mn) and ( -$5 mn) respectively. Licensing fees would generate positive CFs: year 3 - $5 mn, year 4 - $10 mn and year 5 - $15 mn. After the 5 th year CF would grow at 5% annually (competition is severe). The discount rate is 20% for the first 5 years and then drop to 10%. PVNS is $30 mn. Calculate the minimum and maximum purchase price for Target. 2/10/2018 22

Exercise 3 • Using the Excel-based model, what would be the initial offer price if the amount of synergy shared with the target firm shareholders was 50%? • What is the offer price and what would the ownership distribution be if the percentage of synergy shared increased to 80% and the composition of the purchase price were all acquirer stock? 2/10/2018 23

Exercise 3 • Using the Excel-based model, what would be the initial offer price if the amount of synergy shared with the target firm shareholders was 50%? • What is the offer price and what would the ownership distribution be if the percentage of synergy shared increased to 80% and the composition of the purchase price were all acquirer stock? 2/10/2018 23