a9c99855a8fcb40820d4cae7d9c57f33.ppt

- Количество слайдов: 17

Adding Inflation To Our Model: Macro Aggregate Demand Macro Aggregate Supply Lecture 19 Jennifer P. Wissink © 2017 Jennifer P. Wissink, all rights reserved. October 31, 2017

Adding Inflation To Our Model: Macro Aggregate Demand Macro Aggregate Supply Lecture 19 Jennifer P. Wissink © 2017 Jennifer P. Wissink, all rights reserved. October 31, 2017

Announcements: MACRO Fall 2017 u Upcoming MEL Quiz Due Dates – please take note. – Quiz#09 due 11/2 at 10 am (1 attempt) » this one you can only do once, and you can review immediately once you submit » It is a review of chapters 8 -10. Everyone is welcomed to do it and grab more points towards the magic number of 600. u All Wissink 1120 Fall 2017 Prelim 2 TESTING LOCATIONS – Early people on Thursday (11/2) report to Uris 262 by 5: 00 pm. – Extended Time people on Thursday (11/2) report to Uris 202 by 5: 00 pm. – Regular Time people on Thursday (11/2) report no later than 7: 15 pm to rooms as follows: » WRNB 25 – Last names starting with the letter A thru K » WRN 175 – Last names starting with the letter L thru R » WRN 151 – Last names starting with the letter S thru Z – Makeup People on Friday (11/3) report to GSH 142 no later than 3: 00 pm. – Extended Time people on Friday (11/3) report to Uris 438 by 1: 30 pm.

Announcements: MACRO Fall 2017 u Upcoming MEL Quiz Due Dates – please take note. – Quiz#09 due 11/2 at 10 am (1 attempt) » this one you can only do once, and you can review immediately once you submit » It is a review of chapters 8 -10. Everyone is welcomed to do it and grab more points towards the magic number of 600. u All Wissink 1120 Fall 2017 Prelim 2 TESTING LOCATIONS – Early people on Thursday (11/2) report to Uris 262 by 5: 00 pm. – Extended Time people on Thursday (11/2) report to Uris 202 by 5: 00 pm. – Regular Time people on Thursday (11/2) report no later than 7: 15 pm to rooms as follows: » WRNB 25 – Last names starting with the letter A thru K » WRN 175 – Last names starting with the letter L thru R » WRN 151 – Last names starting with the letter S thru Z – Makeup People on Friday (11/3) report to GSH 142 no later than 3: 00 pm. – Extended Time people on Friday (11/3) report to Uris 438 by 1: 30 pm.

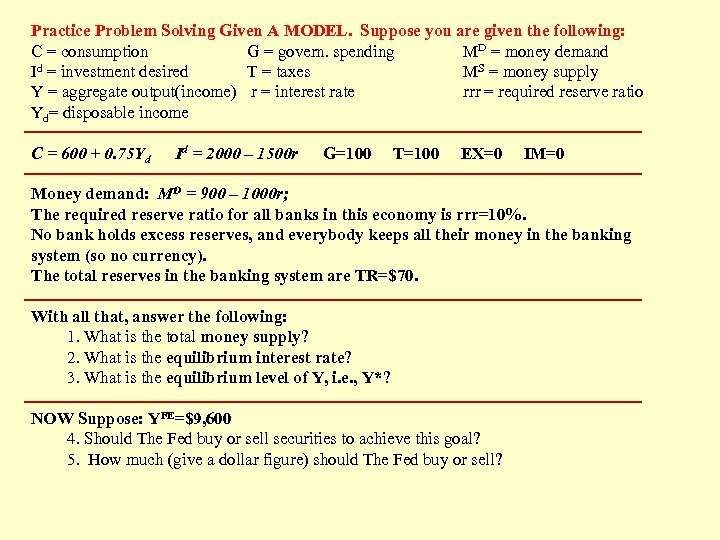

Practice Problem Solving Given A MODEL. Suppose you are given the following: C = consumption G = govern. spending MD = money demand Id = investment desired T = taxes MS = money supply Y = aggregate output(income) r = interest rate rrr = required reserve ratio Yd= disposable income C = 600 + 0. 75 Yd Id = 2000 – 1500 r G=100 T=100 EX=0 IM=0 Money demand: MD = 900 – 1000 r; The required reserve ratio for all banks in this economy is rrr=10%. No bank holds excess reserves, and everybody keeps all their money in the banking system (so no currency). The total reserves in the banking system are TR=$70. With all that, answer the following: 1. What is the total money supply? 2. What is the equilibrium interest rate? 3. What is the equilibrium level of Y, i. e. , Y*? NOW Suppose: YFE=$9, 600 4. Should The Fed buy or sell securities to achieve this goal? 5. How much (give a dollar figure) should The Fed buy or sell?

Practice Problem Solving Given A MODEL. Suppose you are given the following: C = consumption G = govern. spending MD = money demand Id = investment desired T = taxes MS = money supply Y = aggregate output(income) r = interest rate rrr = required reserve ratio Yd= disposable income C = 600 + 0. 75 Yd Id = 2000 – 1500 r G=100 T=100 EX=0 IM=0 Money demand: MD = 900 – 1000 r; The required reserve ratio for all banks in this economy is rrr=10%. No bank holds excess reserves, and everybody keeps all their money in the banking system (so no currency). The total reserves in the banking system are TR=$70. With all that, answer the following: 1. What is the total money supply? 2. What is the equilibrium interest rate? 3. What is the equilibrium level of Y, i. e. , Y*? NOW Suppose: YFE=$9, 600 4. Should The Fed buy or sell securities to achieve this goal? 5. How much (give a dollar figure) should The Fed buy or sell?

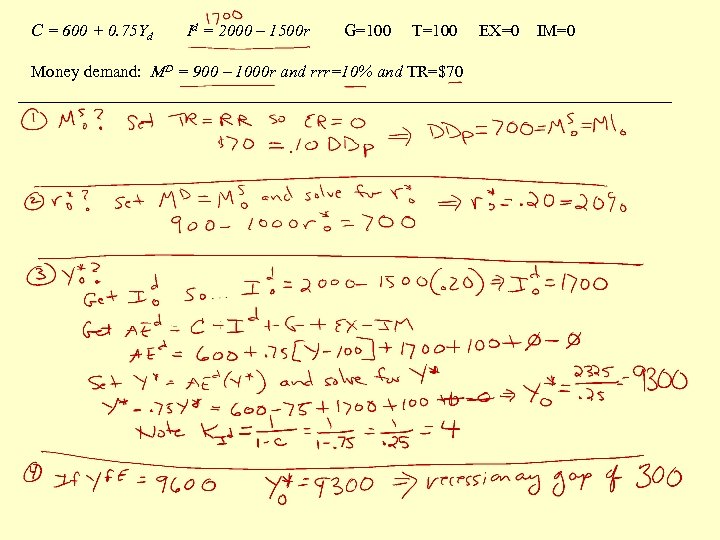

C = 600 + 0. 75 Yd Id = 2000 – 1500 r G=100 T=100 Money demand: MD = 900 – 1000 r and rrr=10% and TR=$70 EX=0 IM=0

C = 600 + 0. 75 Yd Id = 2000 – 1500 r G=100 T=100 Money demand: MD = 900 – 1000 r and rrr=10% and TR=$70 EX=0 IM=0

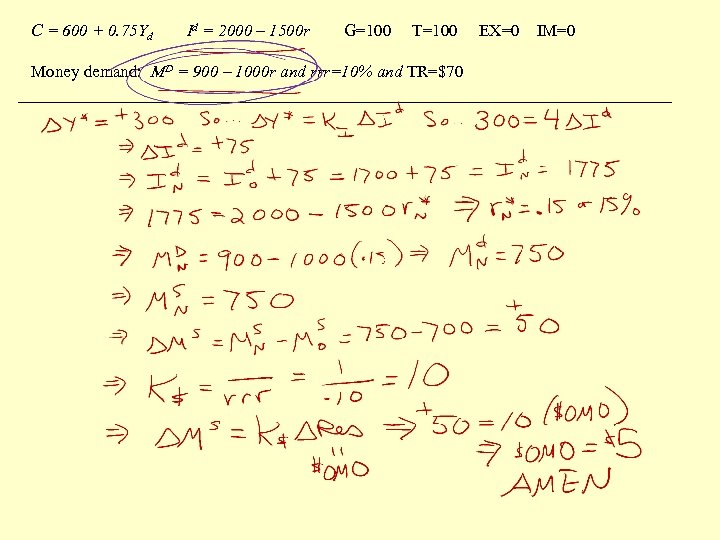

C = 600 + 0. 75 Yd Id = 2000 – 1500 r G=100 T=100 Money demand: MD = 900 – 1000 r and rrr=10% and TR=$70 EX=0 IM=0

C = 600 + 0. 75 Yd Id = 2000 – 1500 r G=100 T=100 Money demand: MD = 900 – 1000 r and rrr=10% and TR=$70 EX=0 IM=0

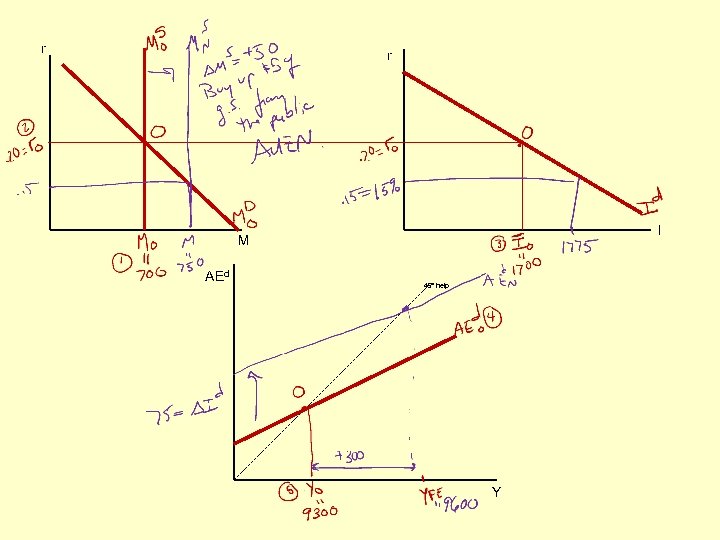

r r I M AEd 45° help Y

r r I M AEd 45° help Y

Try MORE! u Same set up, but now assume YFE=$9, 000 u Add an import function. . . and do the problem over. u Make the tax function more interesting. . . and do the problem over. u How about FISCAL policy instead of monetary. . . and do the problem over.

Try MORE! u Same set up, but now assume YFE=$9, 000 u Add an import function. . . and do the problem over. u Make the tax function more interesting. . . and do the problem over. u How about FISCAL policy instead of monetary. . . and do the problem over.

END OF MATERIAL FOR PRELIM 2 Thank goodness!

END OF MATERIAL FOR PRELIM 2 Thank goodness!

Newest Wrinkle – The Price Level u u u Up to now we’ve pretty much (not completely) ignored the overall price level - now we want to reintroduce it. How will it alter our understanding of the model and fiscal and monetary policy? Where does the price level appear in the model? – In the Money Demand Function! – Recall, MD depends on r, Y and PL where PL is the aggregate price level » HOW? u It’s time to introduce two new notions: – (Macro) Aggregate Demand = AD – (Macro) Aggregate Supply = AS, both SR-AS and LR-AS

Newest Wrinkle – The Price Level u u u Up to now we’ve pretty much (not completely) ignored the overall price level - now we want to reintroduce it. How will it alter our understanding of the model and fiscal and monetary policy? Where does the price level appear in the model? – In the Money Demand Function! – Recall, MD depends on r, Y and PL where PL is the aggregate price level » HOW? u It’s time to introduce two new notions: – (Macro) Aggregate Demand = AD – (Macro) Aggregate Supply = AS, both SR-AS and LR-AS

The Aggregate Demand Curve - AD u The Aggregate Demand (AD) curve is a curve that shows the relationship between aggregate output/income (Y) and the price level (PL) when the money market and goods market are both in equilibrium. u The Aggregate Demand (AD) curve is negatively sloped. u To derive the Aggregate Demand Curve, we examine what happens to aggregate output/income (Y) when the price level (PL) changes, assuming no changes in government spending (G), net taxes (T), or the monetary policy variable (Ms). – And no changes in exports and imports, which we are ignoring for now anyway.

The Aggregate Demand Curve - AD u The Aggregate Demand (AD) curve is a curve that shows the relationship between aggregate output/income (Y) and the price level (PL) when the money market and goods market are both in equilibrium. u The Aggregate Demand (AD) curve is negatively sloped. u To derive the Aggregate Demand Curve, we examine what happens to aggregate output/income (Y) when the price level (PL) changes, assuming no changes in government spending (G), net taxes (T), or the monetary policy variable (Ms). – And no changes in exports and imports, which we are ignoring for now anyway.

The Aggregate Demand Curve: A Warning u The AD curve is not a market demand curve like in microeconomics. It’s a more complex concept. – It’s an equilibrium locus, really. u Remember: A higher price level causes the demand for money to rise, which causes the interest rate to rise. – Then, the higher interest rate causes aggregate output to fall. – At all points along the AD curve, both the goods market and the money market are in equilibrium.

The Aggregate Demand Curve: A Warning u The AD curve is not a market demand curve like in microeconomics. It’s a more complex concept. – It’s an equilibrium locus, really. u Remember: A higher price level causes the demand for money to rise, which causes the interest rate to rise. – Then, the higher interest rate causes aggregate output to fall. – At all points along the AD curve, both the goods market and the money market are in equilibrium.

Additional Reasons for a “Negative” AD Curve u The consumption link: There might be a decrease in consumption brought about by the increase in the interest rate brought about by a higher price level – this would contribute to the overall decrease in aggregate output (Y). u The real wealth effect, or real balance effect: There might be a decrease in consumption brought about by the decrease in real wealth that results from an increase in the price level – this would contribute to the overall decrease in aggregate output (Y). u Note: These are not directly in the model we’ve constructed. . . but you will see them later if you take more macro.

Additional Reasons for a “Negative” AD Curve u The consumption link: There might be a decrease in consumption brought about by the increase in the interest rate brought about by a higher price level – this would contribute to the overall decrease in aggregate output (Y). u The real wealth effect, or real balance effect: There might be a decrease in consumption brought about by the decrease in real wealth that results from an increase in the price level – this would contribute to the overall decrease in aggregate output (Y). u Note: These are not directly in the model we’ve constructed. . . but you will see them later if you take more macro.

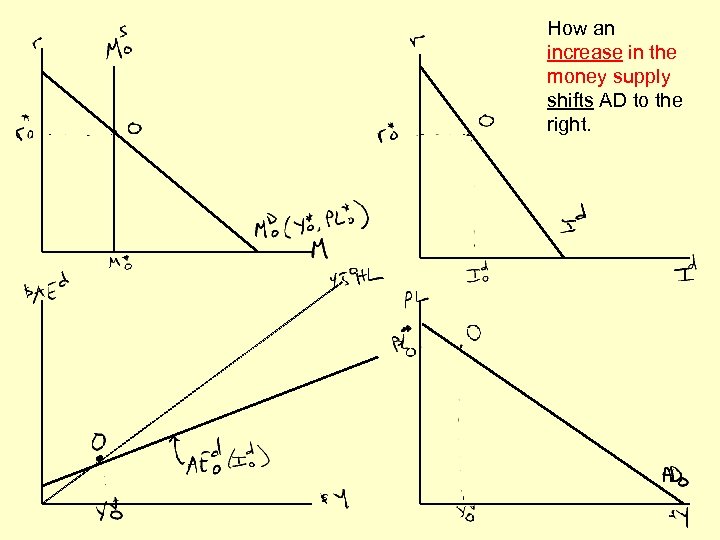

Shifts in Aggregate Demand via Monetary Policy u An increase in Ms at a given price level shifts the aggregate demand curve to the right. u A decrease in Ms at a given price level shifts the aggregate demand curve to the left.

Shifts in Aggregate Demand via Monetary Policy u An increase in Ms at a given price level shifts the aggregate demand curve to the right. u A decrease in Ms at a given price level shifts the aggregate demand curve to the left.

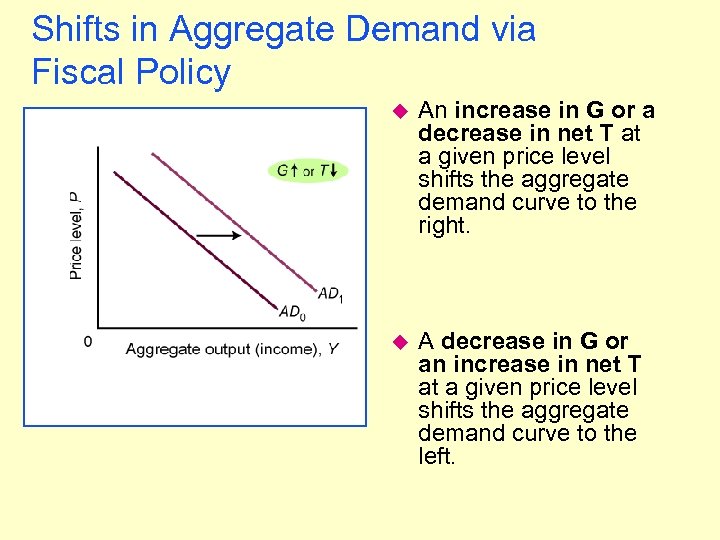

Shifts in Aggregate Demand via Fiscal Policy u An increase in G or a decrease in net T at a given price level shifts the aggregate demand curve to the right. u A decrease in G or an increase in net T at a given price level shifts the aggregate demand curve to the left.

Shifts in Aggregate Demand via Fiscal Policy u An increase in G or a decrease in net T at a given price level shifts the aggregate demand curve to the right. u A decrease in G or an increase in net T at a given price level shifts the aggregate demand curve to the left.

How an increase in the money supply shifts AD to the right.

How an increase in the money supply shifts AD to the right.