AD

AD

AD

AD

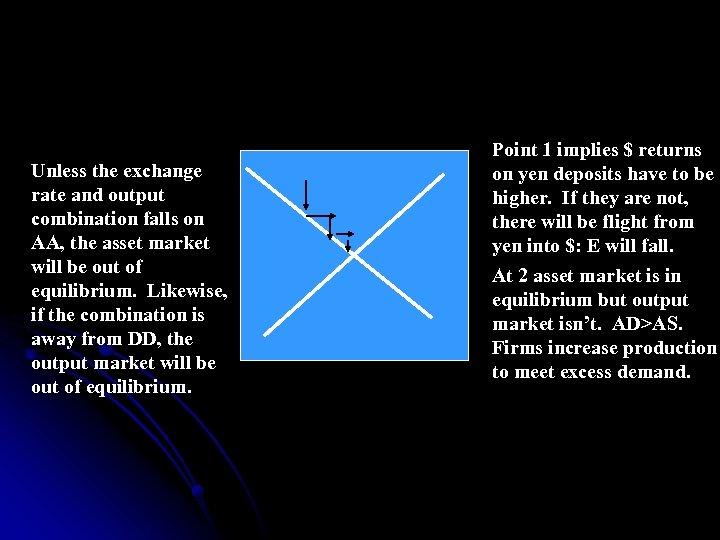

Unless the exchange rate and output combination falls on AA, the asset market will be out of equilibrium. Likewise, if the combination is away from DD, the output market will be out of equilibrium. Point 1 implies $ returns on yen deposits have to be higher. If they are not, there will be flight from yen into $: E will fall. At 2 asset market is in equilibrium but output market isn’t. AD>AS. Firms increase production to meet excess demand.

Unless the exchange rate and output combination falls on AA, the asset market will be out of equilibrium. Likewise, if the combination is away from DD, the output market will be out of equilibrium. Point 1 implies $ returns on yen deposits have to be higher. If they are not, there will be flight from yen into $: E will fall. At 2 asset market is in equilibrium but output market isn’t. AD>AS. Firms increase production to meet excess demand.

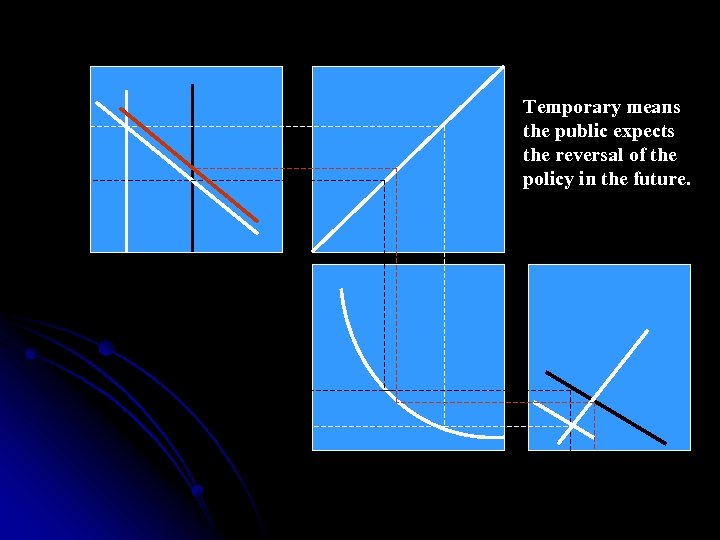

Temporary means the public expects the reversal of the policy in the future.

Temporary means the public expects the reversal of the policy in the future.

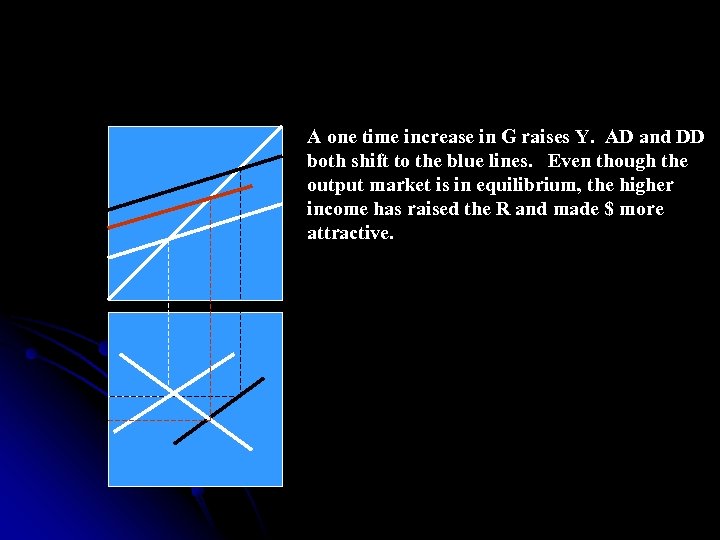

A one time increase in G raises Y. AD and DD both shift to the blue lines. Even though the output market is in equilibrium, the higher income has raised the R and made $ more attractive.

A one time increase in G raises Y. AD and DD both shift to the blue lines. Even though the output market is in equilibrium, the higher income has raised the R and made $ more attractive.

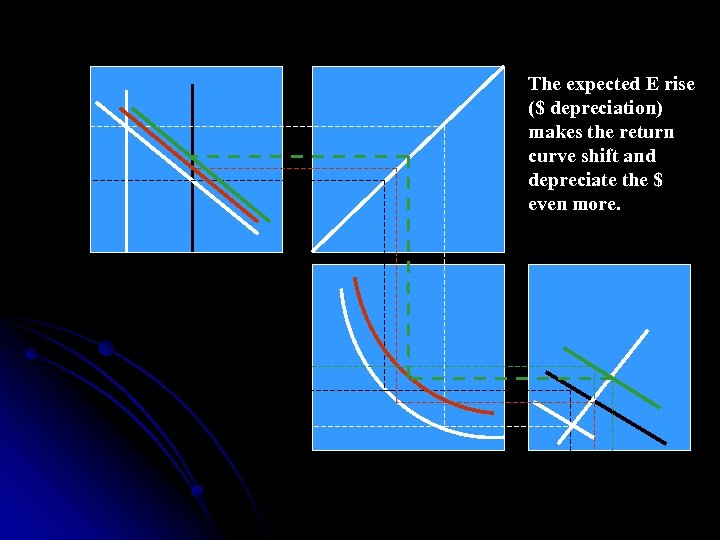

The expected E rise ($ depreciation) makes the return curve shift and depreciate the $ even more.

The expected E rise ($ depreciation) makes the return curve shift and depreciate the $ even more.

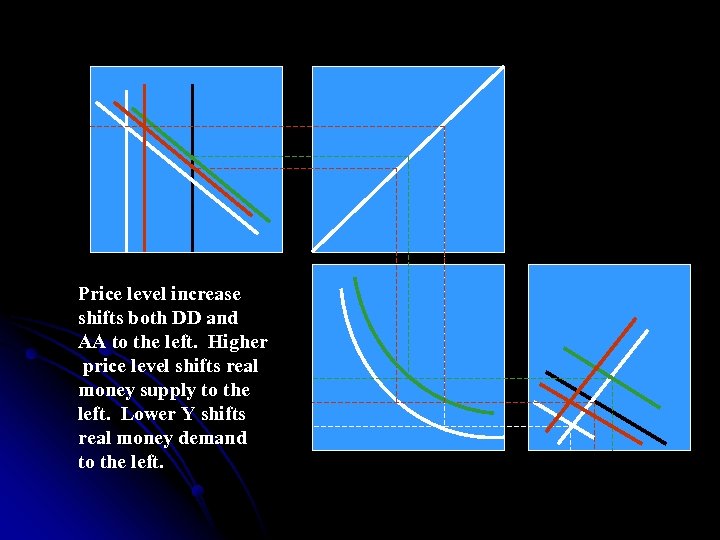

Price level increase shifts both DD and AA to the left. Higher price level shifts real money supply to the left. Lower Y shifts real money demand to the left.

Price level increase shifts both DD and AA to the left. Higher price level shifts real money supply to the left. Lower Y shifts real money demand to the left.

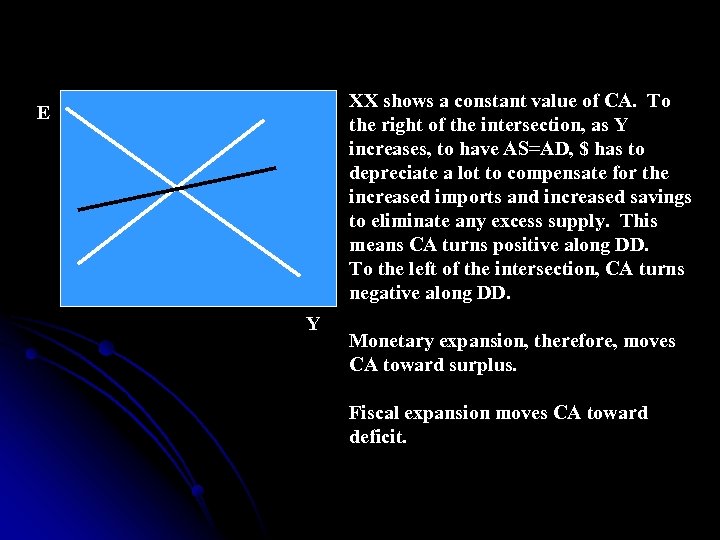

XX shows a constant value of CA. To the right of the intersection, as Y increases, to have AS=AD, $ has to depreciate a lot to compensate for the increased imports and increased savings to eliminate any excess supply. This means CA turns positive along DD. To the left of the intersection, CA turns negative along DD. E Y Monetary expansion, therefore, moves CA toward surplus. Fiscal expansion moves CA toward deficit.

XX shows a constant value of CA. To the right of the intersection, as Y increases, to have AS=AD, $ has to depreciate a lot to compensate for the increased imports and increased savings to eliminate any excess supply. This means CA turns positive along DD. To the left of the intersection, CA turns negative along DD. E Y Monetary expansion, therefore, moves CA toward surplus. Fiscal expansion moves CA toward deficit.