ddd7b094e6c8d51fa82f826cdcf03a99.ppt

- Количество слайдов: 31

Activity-Based Costing Key Concepts 3/16/2018 rd 1

Costs Life cycle First Operating & Maintenance Disposal Sunk Future Opportunity Direct Indirect Overhead Fixed Variable 3/16/2018 rd 2

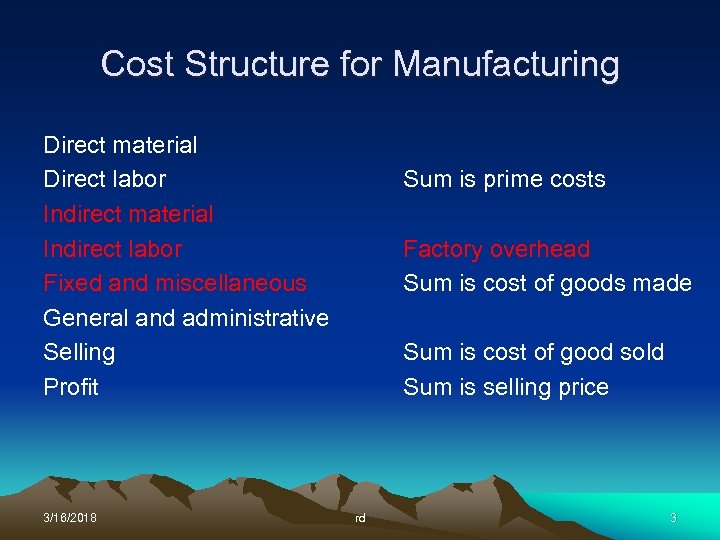

Cost Structure for Manufacturing Direct material Direct labor Indirect material Indirect labor Fixed and miscellaneous General and administrative Selling Profit 3/16/2018 Sum is prime costs Factory overhead Sum is cost of goods made Sum is cost of good sold Sum is selling price rd 3

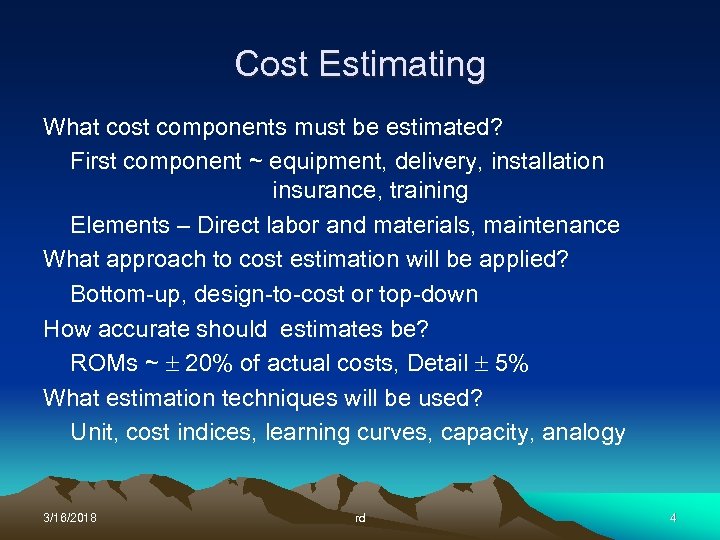

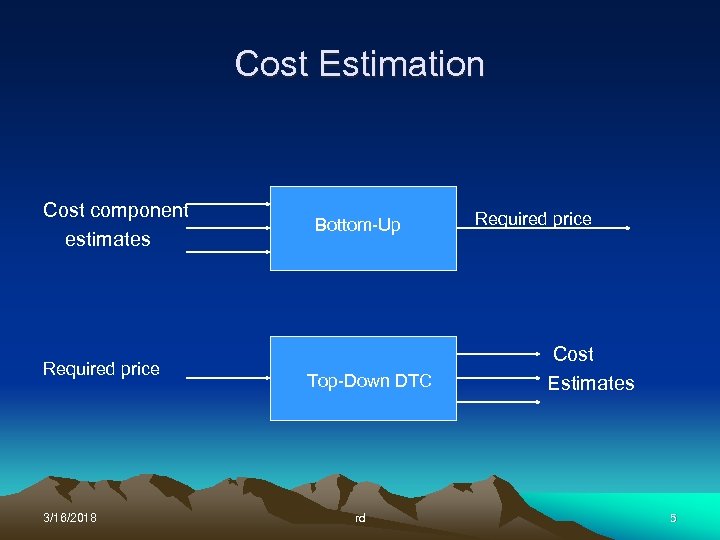

Cost Estimating What cost components must be estimated? First component ~ equipment, delivery, installation insurance, training Elements – Direct labor and materials, maintenance What approach to cost estimation will be applied? Bottom-up, design-to-cost or top-down How accurate should estimates be? ROMs ~ 20% of actual costs, Detail 5% What estimation techniques will be used? Unit, cost indices, learning curves, capacity, analogy 3/16/2018 rd 4

Cost Estimation Cost component estimates Required price 3/16/2018 Bottom-Up Top-Down DTC rd Required price Cost Estimates 5

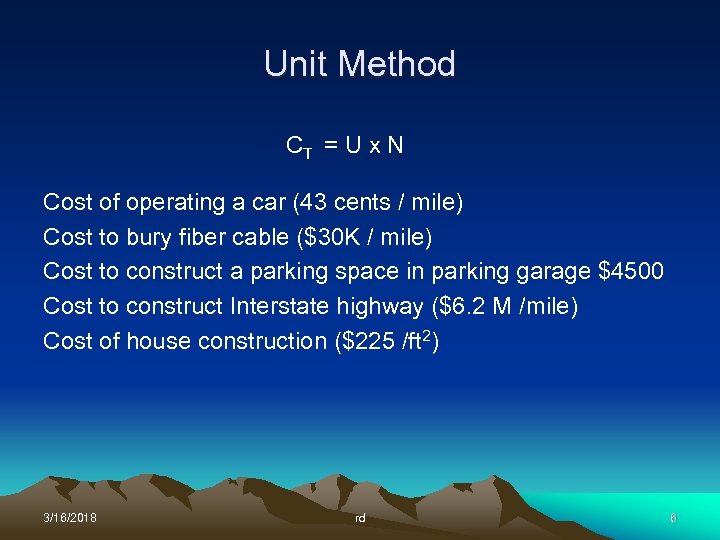

Unit Method CT = U x N Cost of operating a car (43 cents / mile) Cost to bury fiber cable ($30 K / mile) Cost to construct a parking space in parking garage $4500 Cost to construct Interstate highway ($6. 2 M /mile) Cost of house construction ($225 /ft 2) 3/16/2018 rd 6

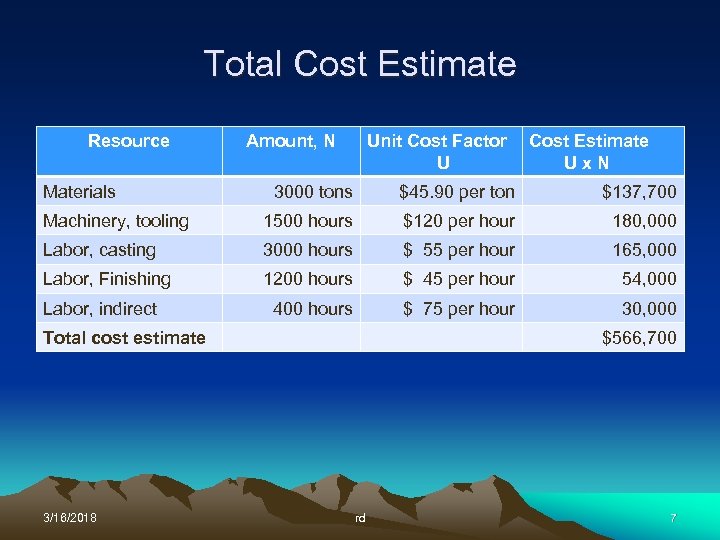

Total Cost Estimate Resource Materials Amount, N Unit Cost Factor U Cost Estimate Ux. N 3000 tons $45. 90 per ton $137, 700 Machinery, tooling 1500 hours $120 per hour 180, 000 Labor, casting 3000 hours $ 55 per hour 165, 000 Labor, Finishing 1200 hours $ 45 per hour 54, 000 400 hours $ 75 per hour 30, 000 Labor, indirect Total cost estimate 3/16/2018 $566, 700 rd 7

Cost Indexes Cost index is a ratio of the cost of something today to its cost sometime in the past. CPI ~ Consumer Price Index 3/16/2018 rd 8

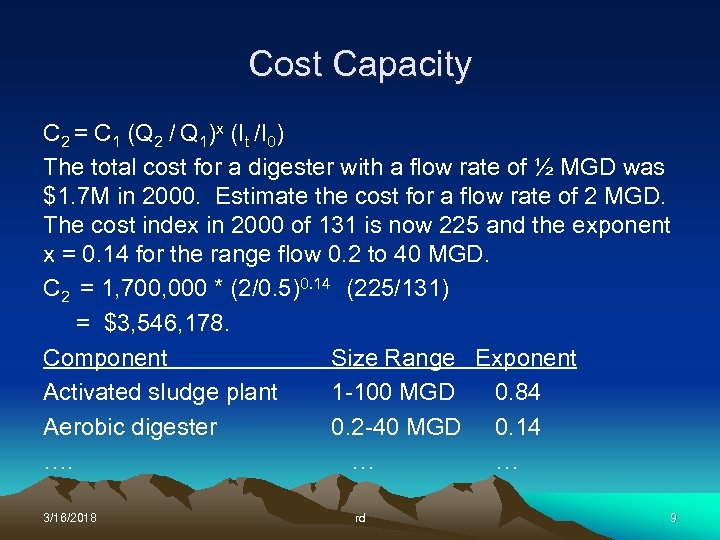

Cost Capacity C 2 = C 1 (Q 2 / Q 1)x (It /I 0) The total cost for a digester with a flow rate of ½ MGD was $1. 7 M in 2000. Estimate the cost for a flow rate of 2 MGD. The cost index in 2000 of 131 is now 225 and the exponent x = 0. 14 for the range flow 0. 2 to 40 MGD. C 2 = 1, 700, 000 * (2/0. 5)0. 14 (225/131) = $3, 546, 178. Component Size Range Exponent Activated sludge plant 1 -100 MGD 0. 84 Aerobic digester 0. 2 -40 MGD 0. 14 …. … … 3/16/2018 rd 9

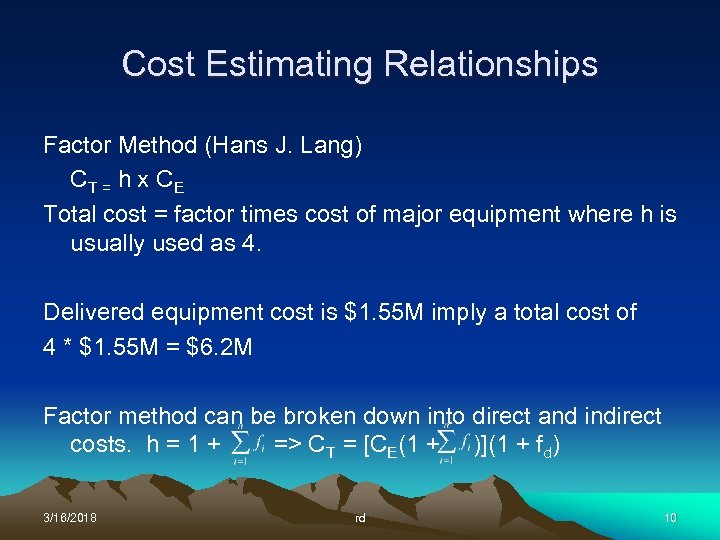

Cost Estimating Relationships Factor Method (Hans J. Lang) CT = h x C E Total cost = factor times cost of major equipment where h is usually used as 4. Delivered equipment cost is $1. 55 M imply a total cost of 4 * $1. 55 M = $6. 2 M Factor method can be broken down into direct and indirect costs. h = 1 + => CT = [CE(1 + )](1 + fd) 3/16/2018 rd 10

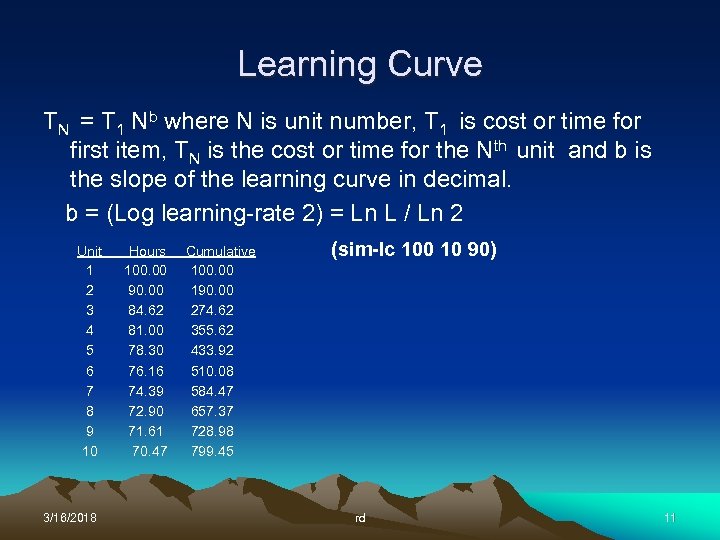

Learning Curve TN = T 1 Nb where N is unit number, T 1 is cost or time for first item, TN is the cost or time for the Nth unit and b is the slope of the learning curve in decimal. b = (Log learning-rate 2) = Ln L / Ln 2 Unit 1 2 3 4 5 6 7 8 9 10 3/16/2018 Hours 100. 00 90. 00 84. 62 81. 00 78. 30 76. 16 74. 39 72. 90 71. 61 70. 47 Cumulative 100. 00 190. 00 274. 62 355. 62 433. 92 510. 08 584. 47 657. 37 728. 98 799. 45 (sim-lc 100 10 90) rd 11

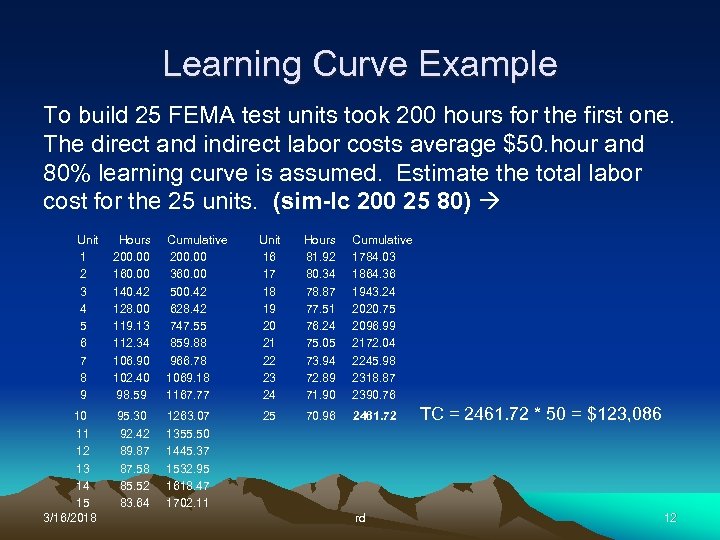

Learning Curve Example To build 25 FEMA test units took 200 hours for the first one. The direct and indirect labor costs average $50. hour and 80% learning curve is assumed. Estimate the total labor cost for the 25 units. (sim-lc 200 25 80) Unit 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 3/16/2018 Hours 200. 00 160. 00 140. 42 128. 00 119. 13 112. 34 106. 90 102. 40 98. 59 Cumulative 200. 00 360. 00 500. 42 628. 42 747. 55 859. 88 966. 78 1069. 18 1167. 77 Unit 16 17 18 19 20 21 22 23 24 Hours 81. 92 80. 34 78. 87 77. 51 76. 24 75. 05 73. 94 72. 89 71. 90 Cumulative 1784. 03 1864. 36 1943. 24 2020. 75 2096. 99 2172. 04 2245. 98 2318. 87 2390. 76 95. 30 1263. 07 25 70. 96 2461. 72 92. 42 89. 87 87. 58 85. 52 83. 64 1355. 50 1445. 37 1532. 95 1618. 47 1702. 11 rd TC = 2461. 72 * 50 = $123, 086 12

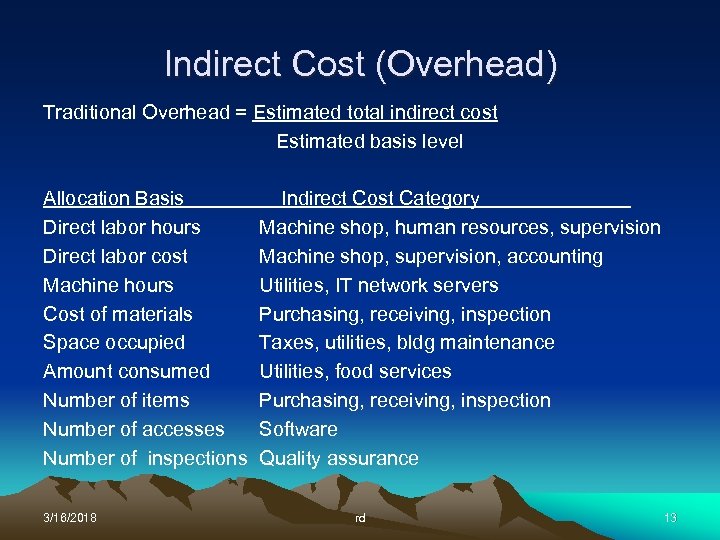

Indirect Cost (Overhead) Traditional Overhead = Estimated total indirect cost Estimated basis level Allocation Basis Direct labor hours Direct labor cost Machine hours Cost of materials Space occupied Amount consumed Number of items Number of accesses Number of inspections 3/16/2018 Indirect Cost Category Machine shop, human resources, supervision Machine shop, supervision, accounting Utilities, IT network servers Purchasing, receiving, inspection Taxes, utilities, bldg maintenance Utilities, food services Purchasing, receiving, inspection Software Quality assurance rd 13

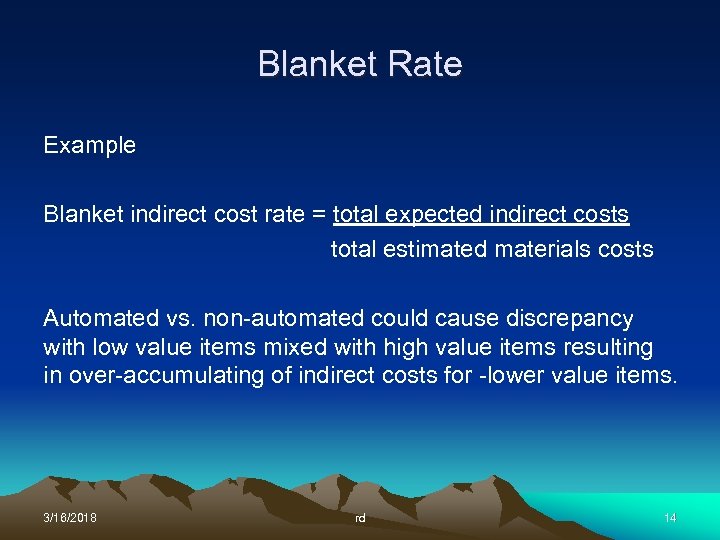

Blanket Rate Example Blanket indirect cost rate = total expected indirect costs total estimated materials costs Automated vs. non-automated could cause discrepancy with low value items mixed with high value items resulting in over-accumulating of indirect costs for -lower value items. 3/16/2018 rd 14

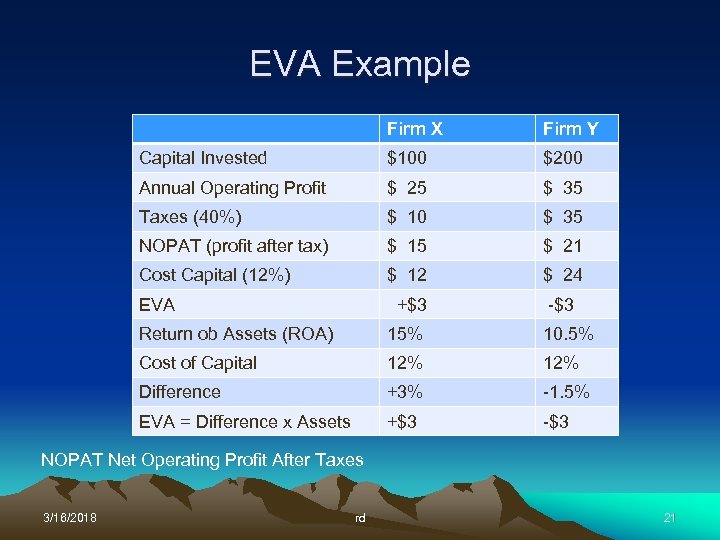

Economic Value Added (EVA) EVA ~ adding value to the shareholders looks at the difference between net operating profit and the cost of capital. 3/16/2018 rd 15

Activity Based Cost (ABC) Accounting Rate sensitive to value added is a production hour rate method. Using more than one basis led to the ABC method. Factory costs are the sum of the costs of goods. Automation advances result in decreased direct hours. Once 35% to 45% of final cost due to labor; now 5 to 15% Indirect cost comprise as much as 35% to 45% of total cost 3/16/2018 rd 16

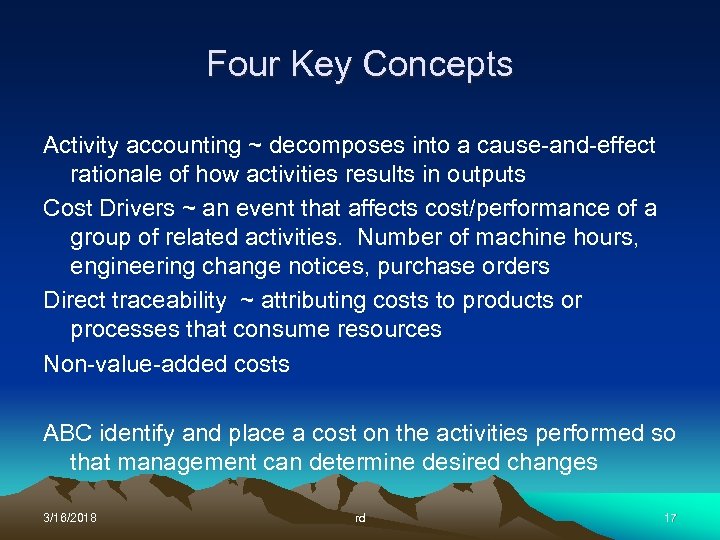

Four Key Concepts Activity accounting ~ decomposes into a cause-and-effect rationale of how activities results in outputs Cost Drivers ~ an event that affects cost/performance of a group of related activities. Number of machine hours, engineering change notices, purchase orders Direct traceability ~ attributing costs to products or processes that consume resources Non-value-added costs ABC identify and place a cost on the activities performed so that management can determine desired changes 3/16/2018 rd 17

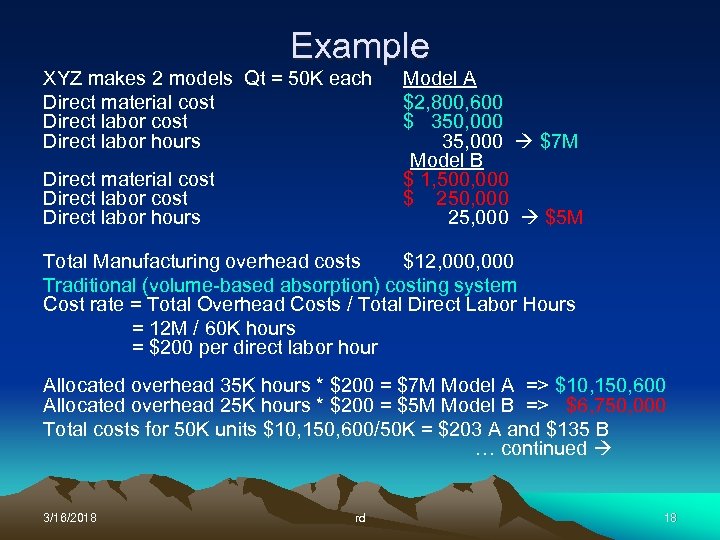

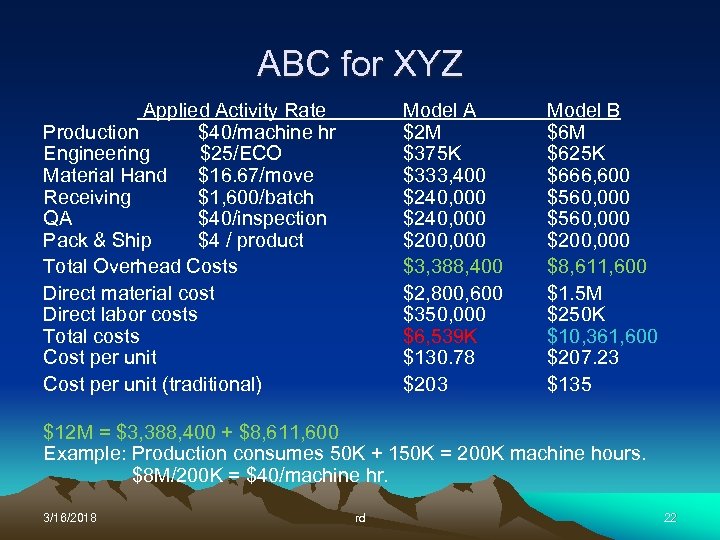

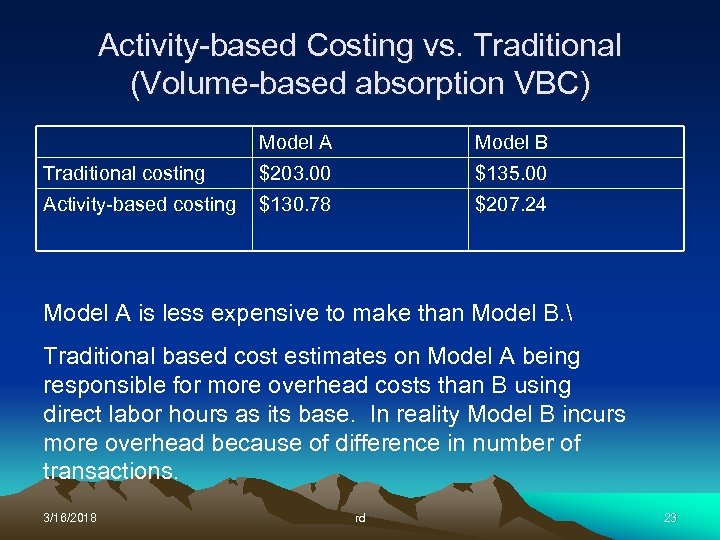

Example XYZ makes 2 models Qt = 50 K each Direct material cost Direct labor hours Model A $2, 800, 600 $ 350, 000 35, 000 $7 M Model B $ 1, 500, 000 $ 250, 000 25, 000 $5 M Total Manufacturing overhead costs $12, 000 Traditional (volume-based absorption) costing system Cost rate = Total Overhead Costs / Total Direct Labor Hours = 12 M / 60 K hours = $200 per direct labor hour Allocated overhead 35 K hours * $200 = $7 M Model A => $10, 150, 600 Allocated overhead 25 K hours * $200 = $5 M Model B => $6, 750, 000 Total costs for 50 K units $10, 150, 600/50 K = $203 A and $135 B … continued 3/16/2018 rd 18

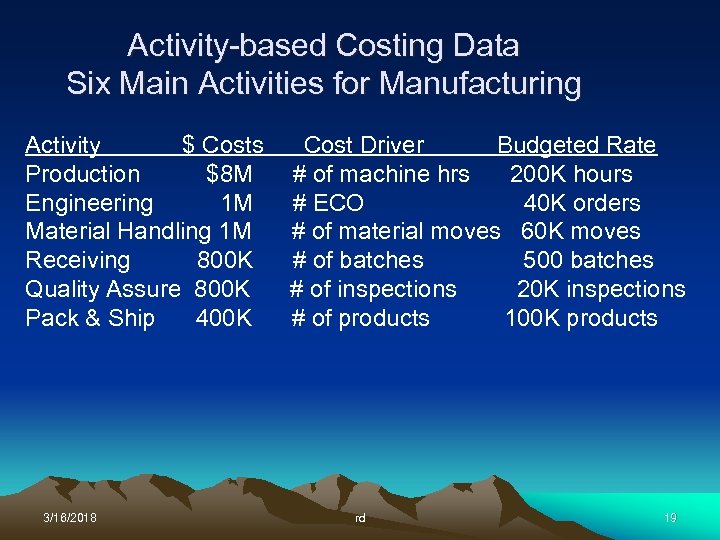

Activity-based Costing Data Six Main Activities for Manufacturing Activity $ Costs Production $8 M Engineering 1 M Material Handling 1 M Receiving 800 K Quality Assure 800 K Pack & Ship 400 K 3/16/2018 Cost Driver Budgeted Rate # of machine hrs 200 K hours # ECO 40 K orders # of material moves 60 K moves # of batches 500 batches # of inspections 20 K inspections # of products 100 K products rd 19

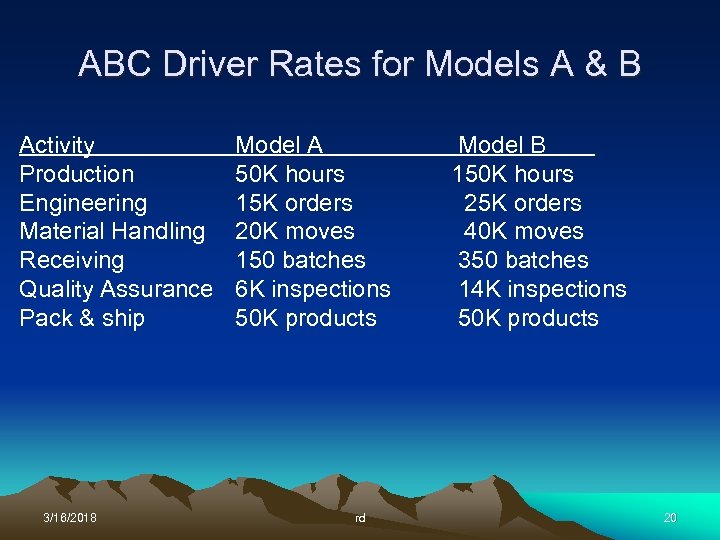

ABC Driver Rates for Models A & B Activity Production Engineering Material Handling Receiving Quality Assurance Pack & ship 3/16/2018 Model A 50 K hours 15 K orders 20 K moves 150 batches 6 K inspections 50 K products rd Model B 150 K hours 25 K orders 40 K moves 350 batches 14 K inspections 50 K products 20

EVA Example Firm X Firm Y Capital Invested $100 $200 Annual Operating Profit $ 25 $ 35 Taxes (40%) $ 10 $ 35 NOPAT (profit after tax) $ 15 $ 21 Cost Capital (12%) $ 12 $ 24 +$3 -$3 EVA Return ob Assets (ROA) 15% 10. 5% Cost of Capital 12% Difference +3% -1. 5% EVA = Difference x Assets +$3 -$3 NOPAT Net Operating Profit After Taxes 3/16/2018 rd 21

ABC for XYZ Applied Activity Rate Production $40/machine hr Engineering $25/ECO Material Hand $16. 67/move Receiving $1, 600/batch QA $40/inspection Pack & Ship $4 / product Total Overhead Costs Direct material cost Direct labor costs Total costs Cost per unit (traditional) Model A $2 M $375 K $333, 400 $240, 000 $200, 000 $3, 388, 400 $2, 800, 600 $350, 000 $6, 539 K $130. 78 $203 Model B $6 M $625 K $666, 600 $560, 000 $200, 000 $8, 611, 600 $1. 5 M $250 K $10, 361, 600 $207. 23 $135 $12 M = $3, 388, 400 + $8, 611, 600 Example: Production consumes 50 K + 150 K = 200 K machine hours. $8 M/200 K = $40/machine hr. 3/16/2018 rd 22

Activity-based Costing vs. Traditional (Volume-based absorption VBC) Model A Model B Traditional costing $203. 00 $135. 00 Activity-based costing $130. 78 $207. 24 Model A is less expensive to make than Model B. Traditional based cost estimates on Model A being responsible for more overhead costs than B using direct labor hours as its base. In reality Model B incurs more overhead because of difference in number of transactions. 3/16/2018 rd 23

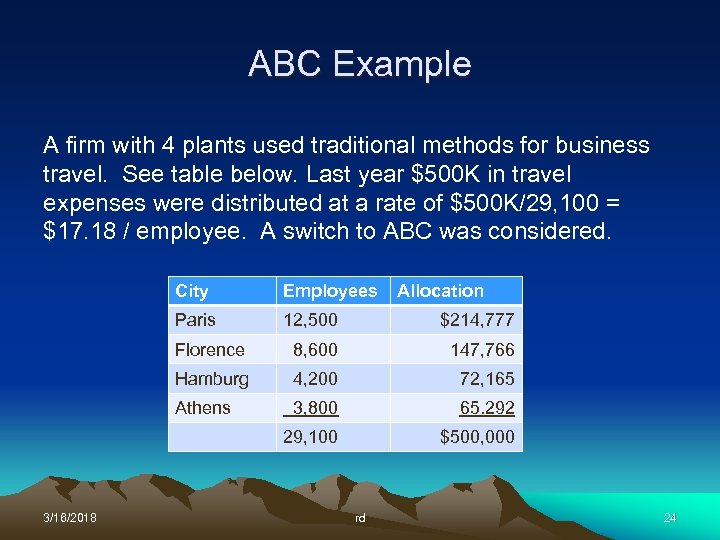

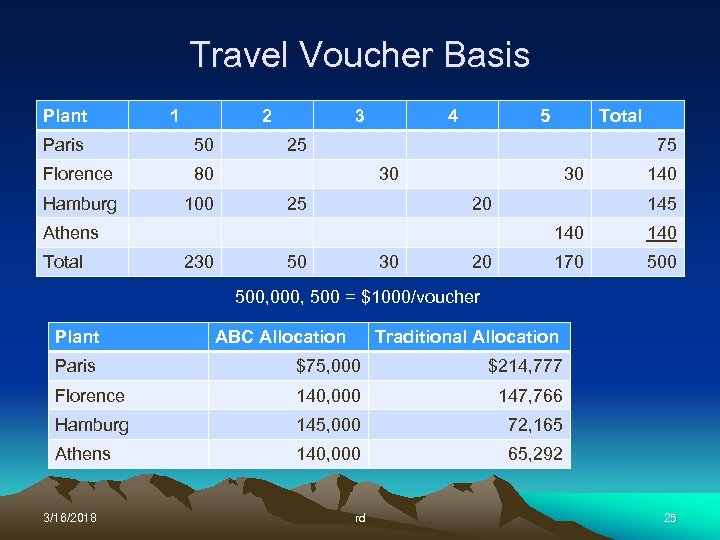

ABC Example A firm with 4 plants used traditional methods for business travel. See table below. Last year $500 K in travel expenses were distributed at a rate of $500 K/29, 100 = $17. 18 / employee. A switch to ABC was considered. City Paris 12, 500 $214, 777 Florence 8, 600 147, 766 Hamburg 4, 200 72, 165 Athens 3, 800 65. 292 29, 100 3/16/2018 Employees $500, 000 rd Allocation 24

Travel Voucher Basis Plant 1 2 Paris 50 Florence 80 Hamburg 100 3 4 5 25 75 30 20 Athens Total 140 145 140 230 50 30 20 140 170 500, 000, 500 = $1000/voucher Plant ABC Allocation Traditional Allocation Paris $75, 000 $214, 777 Florence 140, 000 147, 766 Hamburg 145, 000 72, 165 Athens 140, 000 65, 292 3/16/2018 rd 25

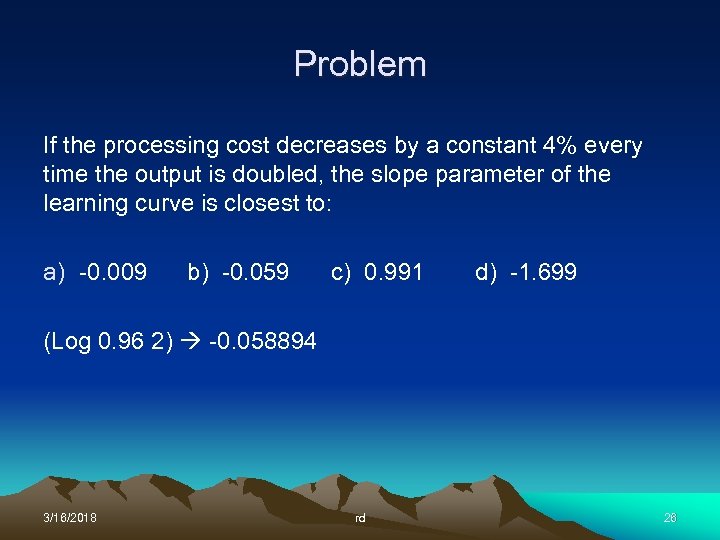

Problem If the processing cost decreases by a constant 4% every time the output is doubled, the slope parameter of the learning curve is closest to: a) -0. 009 b) -0. 059 c) 0. 991 d) -1. 699 (Log 0. 96 2) -0. 058894 3/16/2018 rd 26

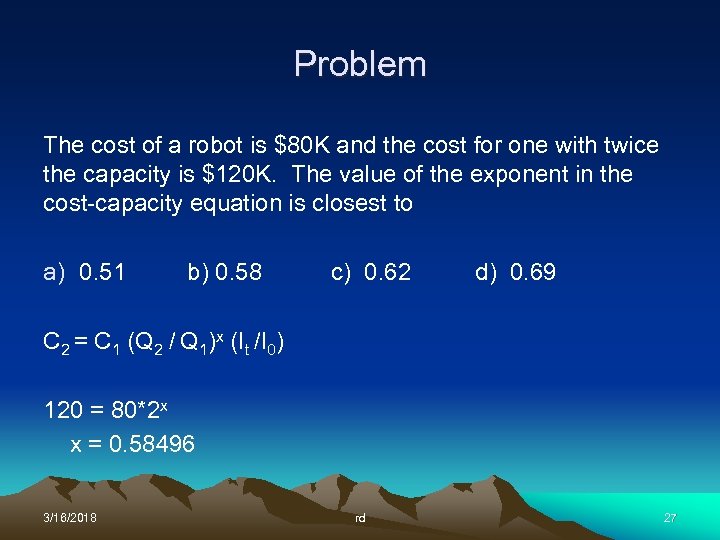

Problem The cost of a robot is $80 K and the cost for one with twice the capacity is $120 K. The value of the exponent in the cost-capacity equation is closest to a) 0. 51 b) 0. 58 c) 0. 62 d) 0. 69 C 2 = C 1 (Q 2 / Q 1)x (It /I 0) 120 = 80*2 x x = 0. 58496 3/16/2018 rd 27

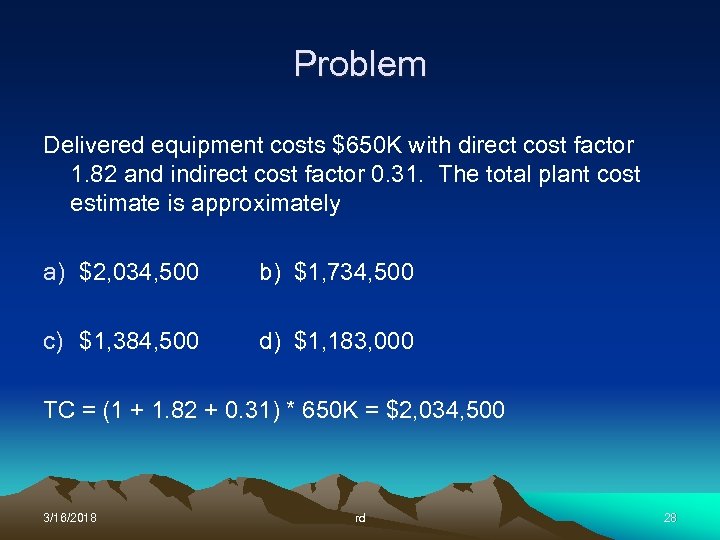

Problem Delivered equipment costs $650 K with direct cost factor 1. 82 and indirect cost factor 0. 31. The total plant cost estimate is approximately a) $2, 034, 500 b) $1, 734, 500 c) $1, 384, 500 d) $1, 183, 000 TC = (1 + 1. 82 + 0. 31) * 650 K = $2, 034, 500 3/16/2018 rd 28

Problem Police want to allocate indirect cost for speed monitoring of 3 toll roads. An allocation basis that may not be reasonable is a) b) c) d) Miles of toll road monitored Average number of cars patrolling per hours Amount of car traffic per section of toll road Cost to operate a car. 3/16/2018 rd 29

Problem First one took 24. 5 seconds to paint with a 95% learning rate. How long to paint the 10 th one? a) 20. 7 seconds c) 2. 75 seconds b) 0. 46 seconds d) 15. 5 seconds T 10 = 24. 5 * 10 (Log 0. 95 2) = 20. 66 sec. 3/16/2018 rd 30

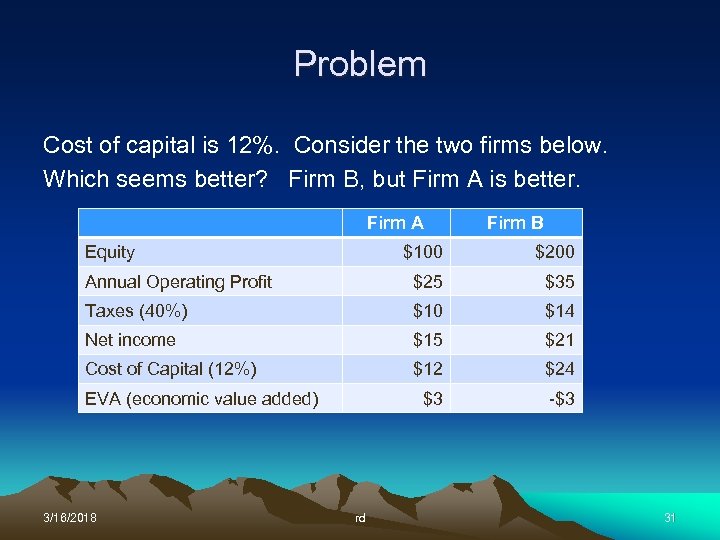

Problem Cost of capital is 12%. Consider the two firms below. Which seems better? Firm B, but Firm A is better. Firm A Equity Firm B $100 $200 Annual Operating Profit $25 $35 Taxes (40%) $10 $14 Net income $15 $21 Cost of Capital (12%) $12 $24 $3 -$3 EVA (economic value added) 3/16/2018 rd 31

ddd7b094e6c8d51fa82f826cdcf03a99.ppt