cd7321ebe3e7501a3bd7cf5c5dbca112.ppt

- Количество слайдов: 91

Activity Based Costing and Lean Accounting Superfactory Excellence Program™ www. superfactory. com © 2004 Superfactory™. All Rights Reserved. 1

Disclaimer and Approved use n Disclaimer n The files in the Superfactory Excellence Program by Superfactory Ventures LLC (“Superfactory”) are intended for use in training individuals within an organization. The handouts, tools, and presentations may be customized for each application. n THE FILES AND PRESENTATIONS ARE DISTRIBUTED ON AN "AS IS" BASIS WITHOUT WARRANTIES OF ANY KIND, EITHER EXPRESSED OR IMPLIED. n Copyright n All files in the Superfactory Excellence Program have been created by Superfactory and there are no known copyright issues. Please contact Superfactory immediately if copyright issues become apparent. Approved Use n Each copy of the Superfactory Excellence Program can be used throughout a single Customer location, such as a manufacturing plant. Multiple copies may reside on computers within that location, or on the intranet for that location. Contact Superfactory for authorization to use the Superfactory Excellence Program at multiple locations. n The presentations and files may be customized to satisfy the customer’s application. n The presentations and files, or portions or modifications thereof, may not be re-sold or redistributed without express written permission from Superfactory. n n Current contact information can be found at: www. superfactory. com © 2004 Superfactory™. All Rights Reserved. 2

Outline n n n n What is Activity Based Costing? Cost Accounting Systems Traditional Cost Systems Activity Based Costing Implementing ABC Benefits & Limitations of ABC Lean Accounting © 2004 Superfactory™. All Rights Reserved. 3

What is Cost Accounting? n n Cost Accounting involves the measuring, recording, and reporting of product costs Both the total cost and the unit cost of products are determined © 2004 Superfactory™. All Rights Reserved. 4

Objective of Cost Systems n To provide product unit cost information for product pricing, cost control, inventory valuation, and financial statement presentation © 2004 Superfactory™. All Rights Reserved. 5

What Does A Cost System Do? n Object of product costing is to: n provide inventory costs for external reporting n show consumption of resources (costs) caused by things the firm makes for decision making © 2004 Superfactory™. All Rights Reserved. 6

What Does A Cost System Do? n Object of product costing is to do what? n n n To provide inventory costs for external reporting To show consumption of resources (costs) by things the firm does (actions, choices) Which method does that “best”? n n One that does not result in material errors in external reporting One that tracks significant costs accurately to products or services as needed for decision making. © 2004 Superfactory™. All Rights Reserved. 7

Is Better Cost Allocation the Answer to Process Improvement? n One way to improve allocation is to use ABC (activity based costing) n This increases the number of cost pools used and allows the use of non unit based cost drivers as well as unit based ones © 2004 Superfactory™. All Rights Reserved. 8

Is Better Cost Allocation the Answer to Process Improvement? n An alternative approach to improved allocation through ABC is to do away with the problem (ABM or activity based management). n n n Conduct an ABC analysis. Eliminate non value added activities. Convert significant indirect costs into direct costs. Simplify the product design and manufacturing processes. Conduct another ABC analysis…. © 2004 Superfactory™. All Rights Reserved. 9

Cost Accounting Systems n n Job Order Cost System Process Cost System © 2004 Superfactory™. All Rights Reserved. 10

Job Order Costing n n n Costs are assigned to each job or batch Each job or batch has its own distinguishing characteristics and related costs Objective: To compute the cost per job © 2004 Superfactory™. All Rights Reserved. 11

Process Cost System n n n Accumulates and accounts for product-related costs for a period of time Used when a series of connected manufacturing processes produce a large volume of similar products Costs are accumulated by and assigned to departments or processes © 2004 Superfactory™. All Rights Reserved. 12

Traditional Cost Systems n n Although it may be impossible to determine the exact cost of a product or service, every effort is made to provide the best possible cost estimate The most difficult part of computing accurate unit costs is determining the proper amount of overhead cost to assign to each product, service, or job © 2004 Superfactory™. All Rights Reserved. 13

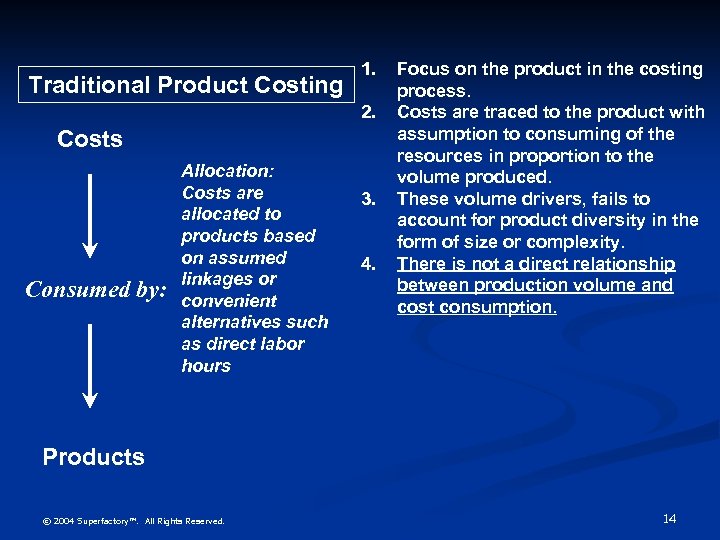

Traditional Product Costing 1. 2. Costs Consumed by: Allocation: Costs are allocated to products based on assumed linkages or convenient alternatives such as direct labor hours 3. 4. Focus on the product in the costing process. Costs are traced to the product with assumption to consuming of the resources in proportion to the volume produced. These volume drivers, fails to account for product diversity in the form of size or complexity. There is not a direct relationship between production volume and cost consumption. Products © 2004 Superfactory™. All Rights Reserved. 14

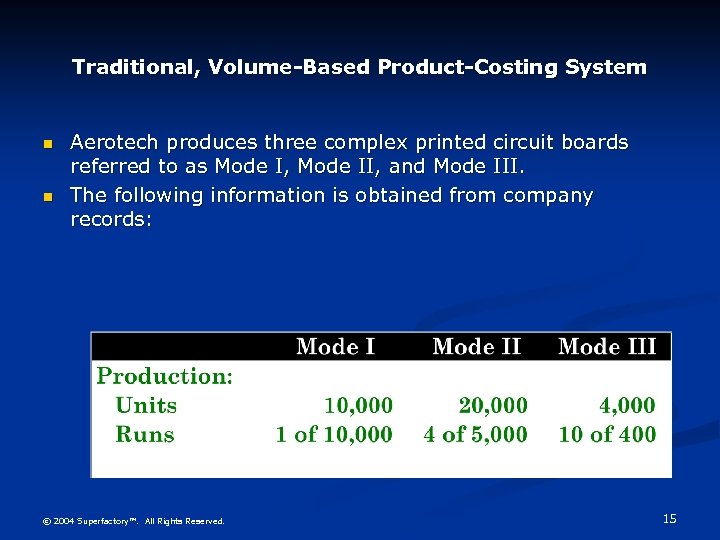

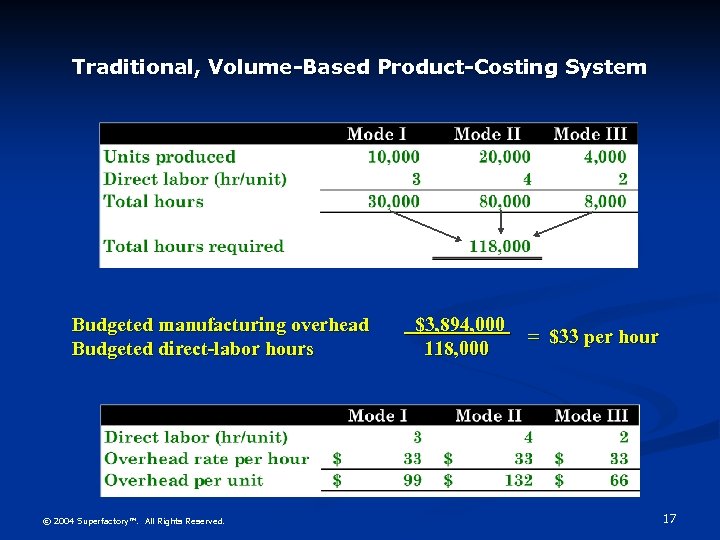

Traditional, Volume-Based Product-Costing System n n Aerotech produces three complex printed circuit boards referred to as Mode I, Mode II, and Mode III. The following information is obtained from company records: © 2004 Superfactory™. All Rights Reserved. 15

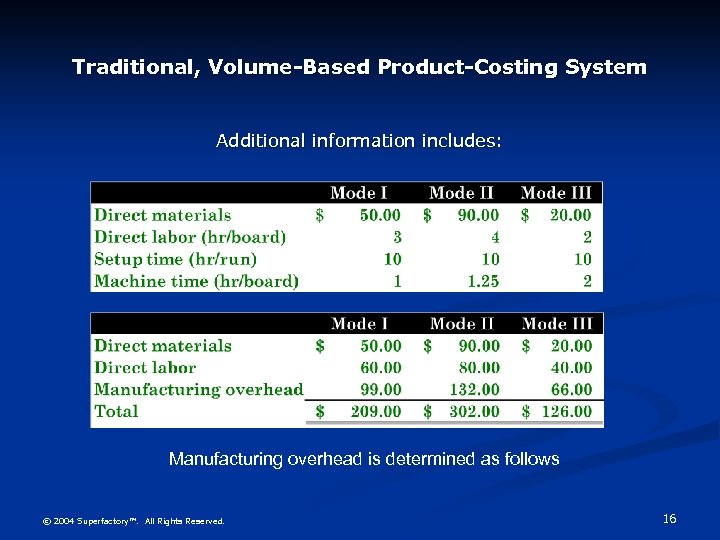

Traditional, Volume-Based Product-Costing System Additional information includes: Manufacturing overhead is determined as follows © 2004 Superfactory™. All Rights Reserved. 16

Traditional, Volume-Based Product-Costing System Budgeted manufacturing overhead Budgeted direct-labor hours © 2004 Superfactory™. All Rights Reserved. $3, 894, 000 118, 000 = $33 per hour 17

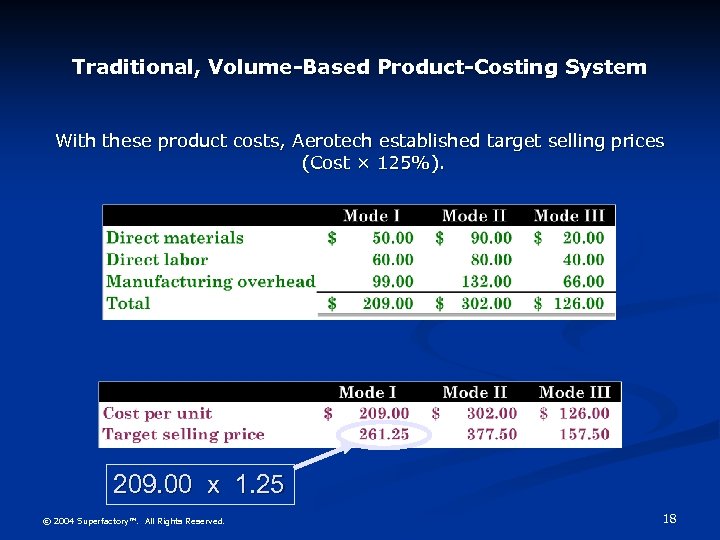

Traditional, Volume-Based Product-Costing System With these product costs, Aerotech established target selling prices (Cost × 125%). 209. 00 x 1. 25 © 2004 Superfactory™. All Rights Reserved. 18

Traditional Costing Systems n n Often the most difficult part of computing accurate unit costs is determining the proper amount of overhead cost to assign to each product, service, or job. Unlike direct materials and direct labor costs which can usually be easily traced to the product, overhead is an indirect or common cost that generally cannot be traced. © 2004 Superfactory™. All Rights Reserved. 19

The Need for a New Costing System n Companies that continue to use plantwide predetermined overhead rates based on direct labor or machine hours, where the correlation with overhead no longer exists, experience significant product cost distortions. © 2004 Superfactory™. All Rights Reserved. 20

Overhead Costs n n n A single predetermined overhead rate is used throughout the year for the entire factory operation for the assignment of overhead costs In job order costing, direct labor hours or costs are commonly used as the relevant activity base In process costing, machine hours are commonly used as the relevant activity base © 2004 Superfactory™. All Rights Reserved. 21

Activity-Based Costing n n n Allocates overhead to multiple activity cost pools and assigns the activity cost pools to products by means of cost drivers An activity is any event, action, transaction, or work sequence that causes the incurrence of cost in producing a product or providing a service A cost driver is any factor or activity that has a direct causeeffect relationship with the resources consumed © 2004 Superfactory™. All Rights Reserved. 22

Activity-Based Costing n n n Allocates costs to activities first, and then to the products, based on the product’s use of those activities Activities consume resources Products consume activities © 2004 Superfactory™. All Rights Reserved. 23

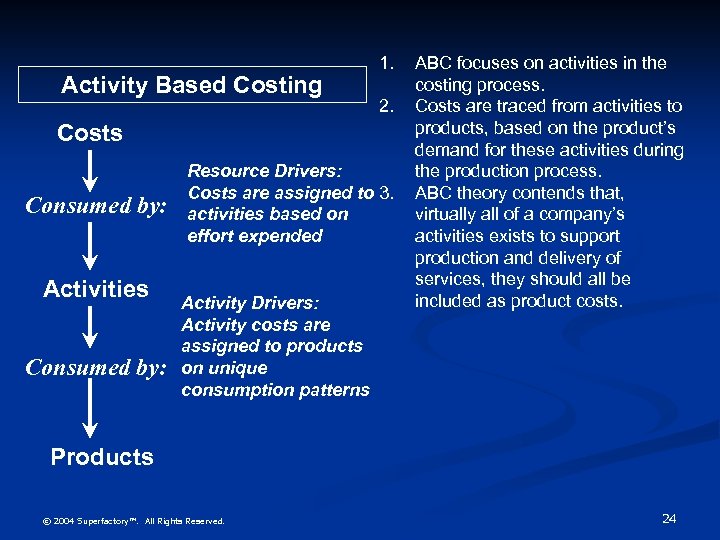

Activity Based Costing 1. 2. Costs Consumed by: Activities Consumed by: Resource Drivers: Costs are assigned to 3. activities based on effort expended Activity Drivers: Activity costs are assigned to products on unique consumption patterns ABC focuses on activities in the costing process. Costs are traced from activities to products, based on the product’s demand for these activities during the production process. ABC theory contends that, virtually all of a company’s activities exists to support production and delivery of services, they should all be included as product costs. Products © 2004 Superfactory™. All Rights Reserved. 24

Activity-Based Costing ABC is extremely valuable to an organization, because it provides information on the range, cost and consumption of operating activities. Specific benefits of and strategic use for this information are: More accurate product costs enable better strategic decisions regarding: • • • Product pricing Product mix. Make vs. Buy Investments in R&D, Process automation, etc. . Increased visibility of the activities performed enables a company to: • • • Focus more on the management of activities, such as improving the efficiency of high cost activities. Identify and reduce non-value added activities. © 2004 Superfactory™. All Rights Reserved. 25

Activity-Based Costing n ABC allocates overhead in a two-stage process: n Overhead is allocated to activity cost pools, each of which is a distinct type of activity, n Overhead in the cost pools is assigned to products using cost drivers which represent and measure the number of individual activities undertaken or performed to produce products or render services. © 2004 Superfactory™. All Rights Reserved. 26

Activity-Based Costing n n Not all products or services share equally in activities. The more complex a product’s manufacturing operation, the more activities and cost drivers it is likely to have. © 2004 Superfactory™. All Rights Reserved. 27

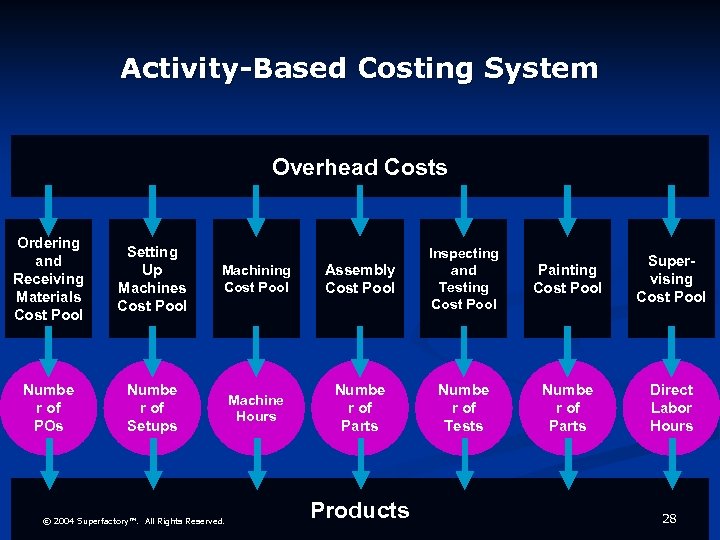

Activity-Based Costing System Overhead Costs Ordering and Receiving Materials Cost Pool Setting Up Machines Cost Pool Machining Cost Pool Numbe r of POs Numbe r of Setups Machine Hours © 2004 Superfactory™. All Rights Reserved. Assembly Cost Pool Inspecting and Testing Cost Pool Painting Cost Pool Supervising Cost Pool Numbe r of Parts Numbe r of Tests Numbe r of Parts Direct Labor Hours Products 28

Unit Costs under ABC Activity-based costing involves the following steps: 1 Identify the major activities that pertain to the manufacture of specific products and allocate manufacturing overhead costs to activity cost pools. 2 Identify the cost drivers that accurately measure each activity’s contributions to the finished product and compute the activity-based overhead rate. 3 Assign manufacturing overhead costs for each activity cost pool to products using the activity-based overhead rates (cost per driver). © 2004 Superfactory™. All Rights Reserved. 29

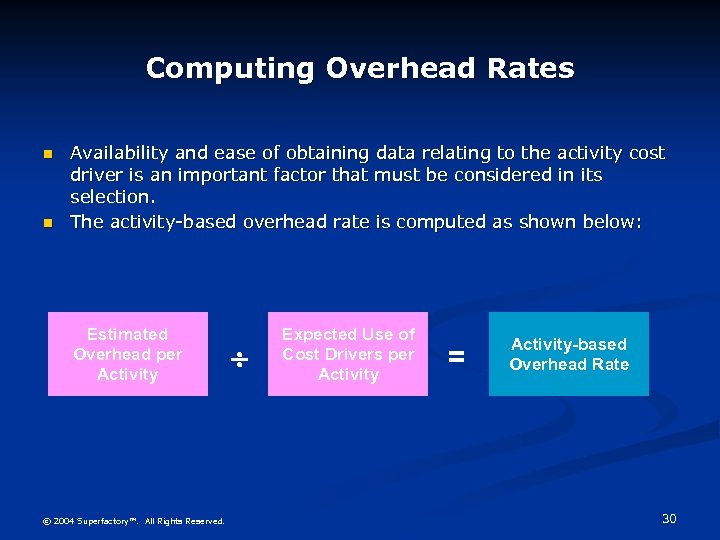

Computing Overhead Rates n n Availability and ease of obtaining data relating to the activity cost driver is an important factor that must be considered in its selection. The activity-based overhead rate is computed as shown below: Estimated Overhead per Activity © 2004 Superfactory™. All Rights Reserved. Expected Use of Cost Drivers per Activity = Activity-based Overhead Rate 30

Setting OH Rates: Choices of Level of Aggregation n Plantwide rate: simplest but most subject to distortion when products vary in their use of resources Departmental rates: more complex but subject to distortion when costs that are not unit driven are substantial and products use these costs differently Activity Based Rates: more complex and potentially more accurate © 2004 Superfactory™. All Rights Reserved. 31

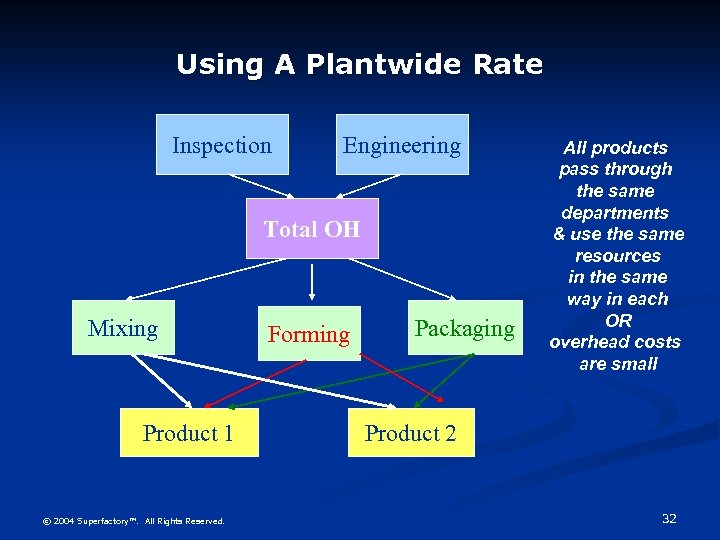

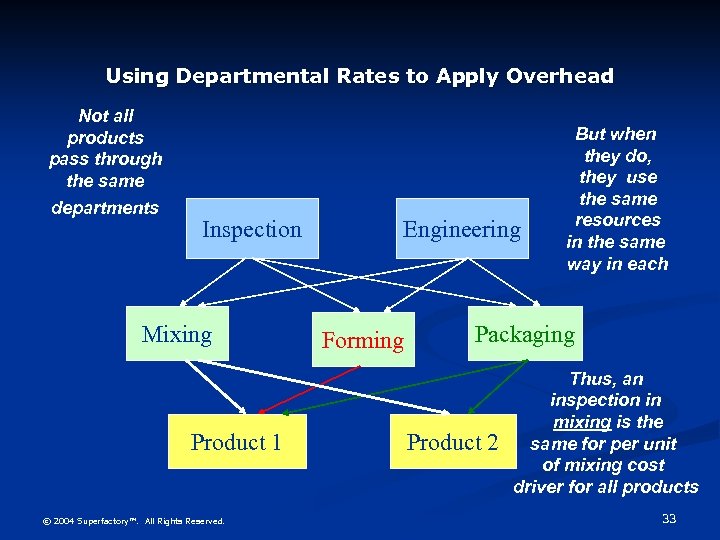

Using A Plantwide Rate Inspection Engineering Total OH Mixing Product 1 © 2004 Superfactory™. All Rights Reserved. Forming Packaging All products pass through the same departments & use the same resources in the same way in each OR overhead costs are small Product 2 32

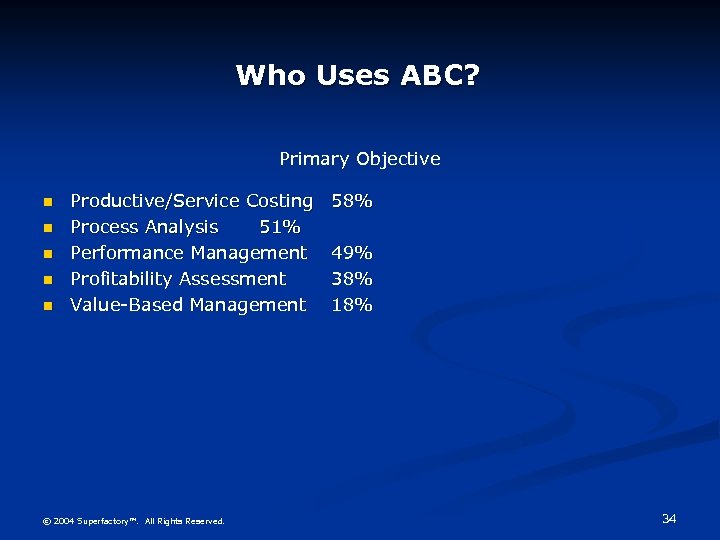

Using Departmental Rates to Apply Overhead Not all products pass through the same departments Inspection Mixing Product 1 © 2004 Superfactory™. All Rights Reserved. Engineering Forming But when they do, they use the same resources in the same way in each Packaging Product 2 Thus, an inspection in mixing is the same for per unit of mixing cost driver for all products 33

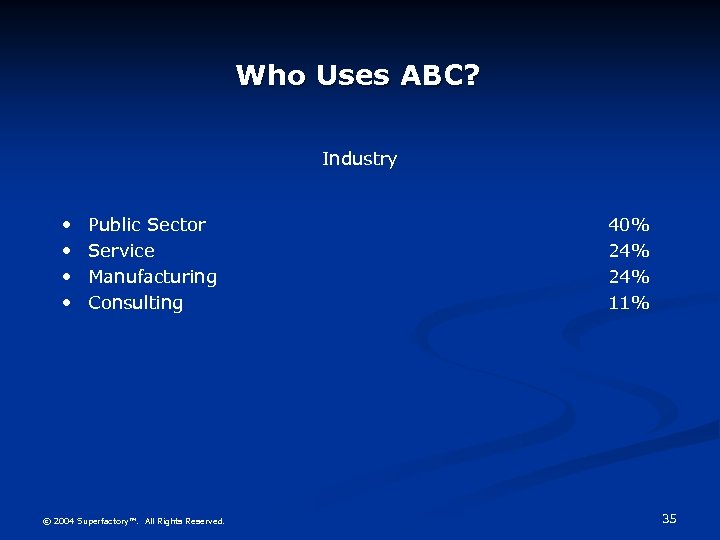

Who Uses ABC? Primary Objective n n n Productive/Service Costing Process Analysis 51% Performance Management Profitability Assessment Value-Based Management © 2004 Superfactory™. All Rights Reserved. 58% 49% 38% 18% 34

Who Uses ABC? Industry • • Public Sector Service Manufacturing Consulting © 2004 Superfactory™. All Rights Reserved. 40% 24% 11% 35

Activity-Based Costing - Step 1 n Identify the major activities that pertain to the manufacture of specific products and allocate manufacturing overhead costs to activity cost pools © 2004 Superfactory™. All Rights Reserved. 36

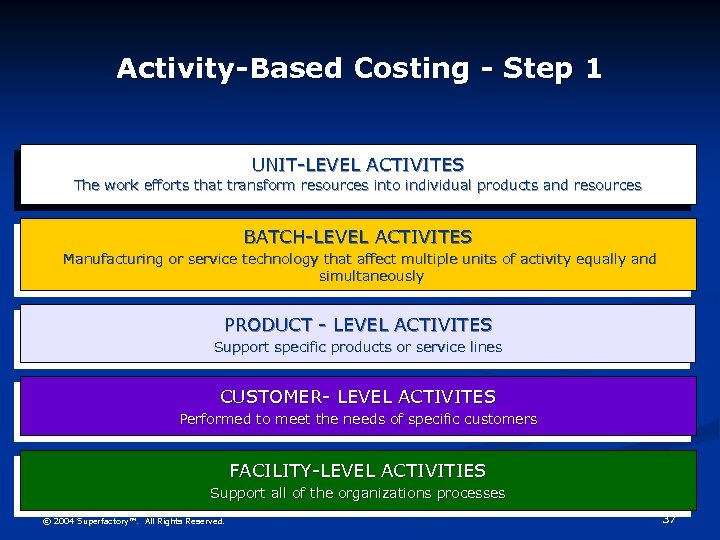

Activity-Based Costing - Step 1 UNIT-LEVEL ACTIVITES The work efforts that transform resources into individual products and resources BATCH-LEVEL ACTIVITES Manufacturing or service technology that affect multiple units of activity equally and simultaneously PRODUCT - LEVEL ACTIVITES Support specific products or service lines CUSTOMER- LEVEL ACTIVITES Performed to meet the needs of specific customers FACILITY-LEVEL ACTIVITIES Support all of the organizations processes © 2004 Superfactory™. All Rights Reserved. 37

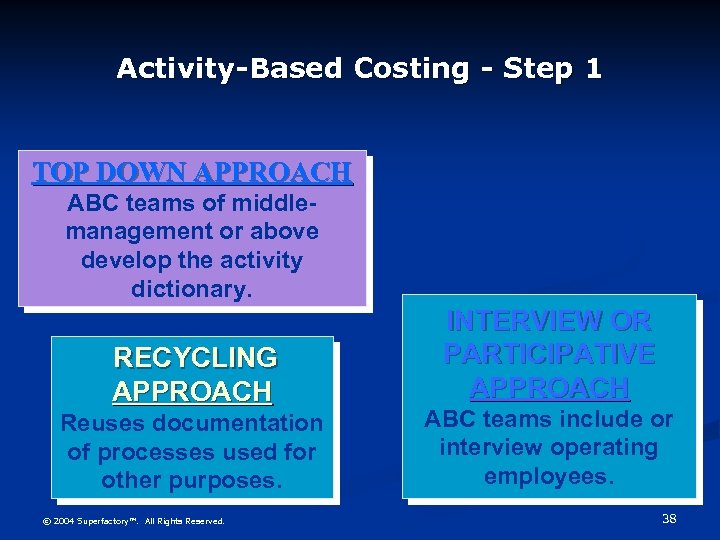

Activity-Based Costing - Step 1 TOP DOWN APPROACH ABC teams of middlemanagement or above develop the activity dictionary. RECYCLING APPROACH Reuses documentation of processes used for other purposes. © 2004 Superfactory™. All Rights Reserved. INTERVIEW OR PARTICIPATIVE APPROACH ABC teams include or interview operating employees. 38

Activity-Based Costing – Step 2 n Identify the cost drivers that accurately measure the activities consumed and compute the overhead rate © 2004 Superfactory™. All Rights Reserved. 39

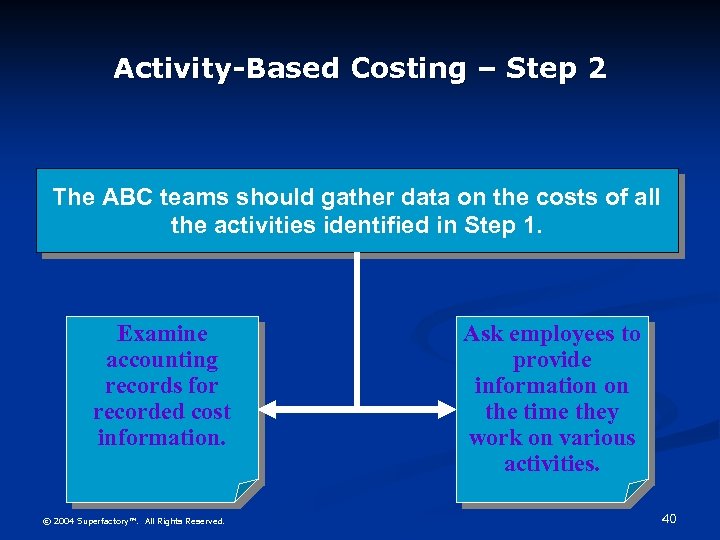

Activity-Based Costing – Step 2 The ABC teams should gather data on the costs of all the activities identified in Step 1. Examine accounting records for recorded cost information. © 2004 Superfactory™. All Rights Reserved. Ask employees to provide information on the time they work on various activities. 40

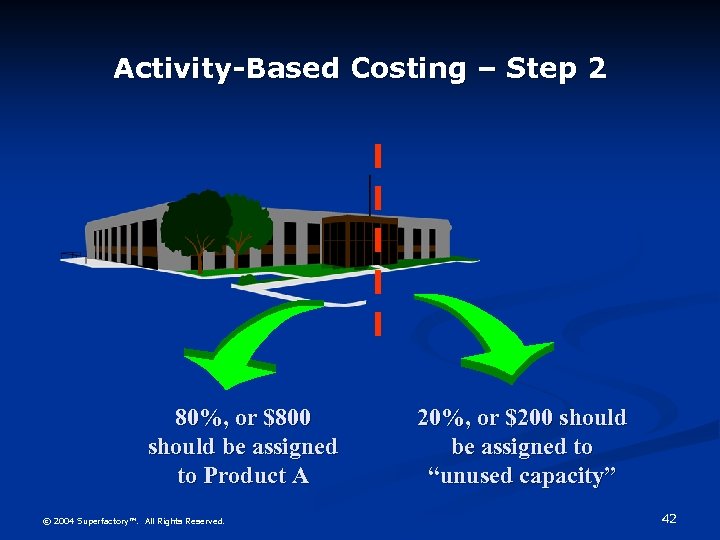

Activity-Based Costing – Step 2 When estimating the cost of an activity, only the costs associated with the product should be used (practical capacity). The cost of “unused capacity” should not be applied to products. EXAMPLE Suppose we rent a 1, 000 square foot warehouse for $1, 000 per month. Only 800 sq. ft. are used to store Product A. The rest of the warehouse is “unused”. How much rent cost should be allocated to Product A? © 2004 Superfactory™. All Rights Reserved. 41

Activity-Based Costing – Step 2 80%, or $800 should be assigned to Product A © 2004 Superfactory™. All Rights Reserved. 20%, or $200 should be assigned to “unused capacity” 42

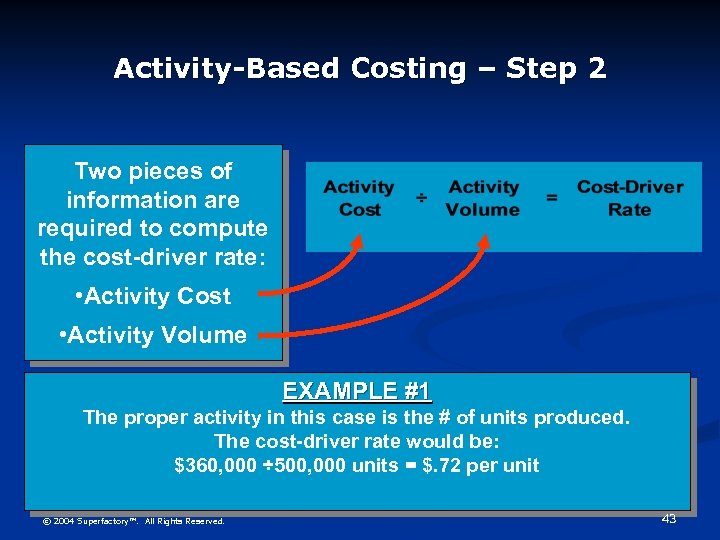

Activity-Based Costing – Step 2 Two pieces of information are required to compute the cost-driver rate: • Activity Cost • Activity Volume EXAMPLE #1 XCo has 4 employees in in this case is the #Dept. Salaries and costs The proper activity its Quality Control of units produced. for the department total $360, 000 per year. XCo produces 500, 000 The cost-driver rate would be: units of product a year. What units =appropriate activity, # of $360, 000 ÷ 500, 000 is the $. 72 per unit employees or units of product? What is the cost-driver rate? © 2004 Superfactory™. All Rights Reserved. 43

Activity-Based Costing – Step 2 EXAMPLE #2 XCo has a customer service center where Since customers are charged “per call”, customers can call to ask questions. Customers the proper activity in thisthey make to theof case is the # pay a fixed fee for each calls handled by the other XCo service center. In addition, center. departments also use the service center. It costs The cost-driver rate would be: XCo $1, 260, 000 a year to operate the center. The center receives ÷ 120, 000 units year. The center $1, 260, 000 120, 000 calls per = $10. 50 per handles 1, 000 minutes of calls. call What is the appropriate cost driver; total minutes per call or number of calls? What is the cost-driver rate? © 2004 Superfactory™. All Rights Reserved. 44

Activity-Based Costing – Step 3 n Assign overhead costs for each activity cost pool to products using the overhead rates © 2004 Superfactory™. All Rights Reserved. 45

Activity-Based Costing – Step 3 1. Identify all the activities related to a given product or service. © 2004 Superfactory™. All Rights Reserved. 2. Determine how many units of each activity are used per unit of product. 3. Assign costs to products using the costdriver rates for each activity 46

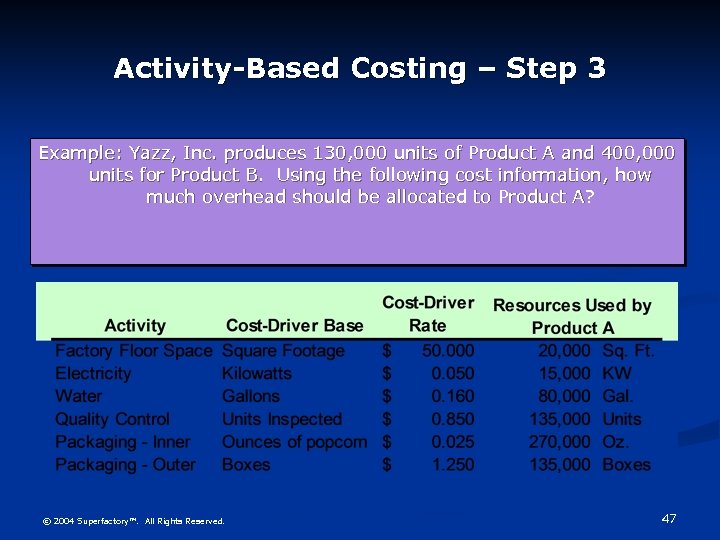

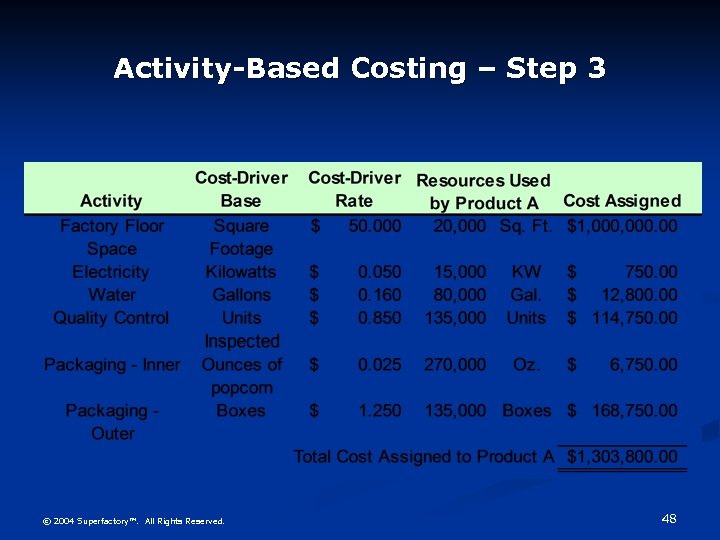

Activity-Based Costing – Step 3 Example: Yazz, Inc. produces 130, 000 units of Product A and 400, 000 units for Product B. Using the following cost information, how much overhead should be allocated to Product A? © 2004 Superfactory™. All Rights Reserved. 47

Activity-Based Costing – Step 3 © 2004 Superfactory™. All Rights Reserved. 48

Activity-Based Overhead Rate n n Estimated Overhead Cost Per Activity / Expected Use of Cost Drivers Per Activity © 2004 Superfactory™. All Rights Reserved. 49

Cost Driver A characteristic of an event or activity that results in the incurrence of costs. In selecting a cost driver, we must consider. . . Degree of Correlation with the cost Behavioral Effects of Using It Cost of Measuring the Driver © 2004 Superfactory™. All Rights Reserved. 50

Homogeneous Cost Pools A grouping of overhead costs in which each cost component is increased/decreased in roughly the same way by some causal factor (cost driver). A homogeneous cost pool can use a single cost driver and maintain accuracy in cost allocation. © 2004 Superfactory™. All Rights Reserved. 51

Identifying and Classifying Activities n n Classification = grouping into homogeneous cost pools. Is this class “homogeneous”? n Does how you classify costs matter in terms of its effect on behavior? Why or why not? n What advantage do managers get from an ABC system (beyond “more accurate costs”)? You must understand the business before you can classify costs into “like” groups. n © 2004 Superfactory™. All Rights Reserved. 52

How Do You Decide on What Belongs in Which Pool and How Many to Use? n n n In real life, how does one know what activity causes what costs? What does this imply about who should be involved in product costing? What do you do if you cannot identify a cause and effect relationship to use to assign costs? n Do all costs have to be assigned to product? n n n Externally? Internally? Benefits received? Ability to bear? The peanut butter approach? © 2004 Superfactory™. All Rights Reserved. 53

Classifying Costs into Homogeneous Groups n Arrange costs into homogeneous cost pools for assignment to product. Your goal is the smallest number of pools consistent with "homogeneous" cost pools. © 2004 Superfactory™. All Rights Reserved. 54

Costs to be Grouped n n n n Costs to reset machinery for different packaging card sizes Costs for plant security Costs for receiving raw materials and supplies and placing them in inventory. Costs for storing inventory Costs to maintain production equipment Costs for employee lunch services (subsidized cafeteria for direct labor) Costs to issue raw materials for batches Costs for purchasing raw materials and supplies © 2004 Superfactory™. All Rights Reserved. 55

Costs to be Grouped Continued n n n n Costs for engineers to design process modifications for products Depreciation on machinery Depreciation on packaging equipment Building heat, light, air conditioning, etc. Equipment power costs Inspection after forming Inspection after final packaging © 2004 Superfactory™. All Rights Reserved. 56

How big does a group of “like” costs have to be to “deserve” its own category? Does the cost of gathering the data matter? © 2004 Superfactory™. All Rights Reserved. 57

Storyboarding A procedure used to develop a detailed process flow chart, which visually represents activities and the relationships among activities. Useful in creating ABC cost pools and in tracing interrelationships for ABM. © 2004 Superfactory™. All Rights Reserved. 58

Process for Allocation of Indirect Costs n Group them into “like” pools n Use a cause and effect relationship with a cost driver for each to assign the costs to product (if possible) n ABC systems use more pools than a departmental rate system © 2004 Superfactory™. All Rights Reserved. 59

Assigning Costs to Activity Centers Assign costs to the activity centers where they are accumulated while waiting to be applied to products. © 2004 Superfactory™. All Rights Reserved. 60

Selecting Cost Drivers Assign costs from the activity center to the product (or other cost object) using appropriate cost drivers. © 2004 Superfactory™. All Rights Reserved. When selecting a cost driver consider: Ê The ease of obtaining data. Ë The degree to which the cost driver measures actual consumption by products. 61

Possible Hierarchy for Pooling Costs Into “Like” Groups n n Unit based costs n What would be included here? n What makes these change (drives these costs)? Batch based costs n What would be included here? n What makes these change (drives these costs)? Product based costs (or customer based in marketing) n What would be included here? n What makes these change (drives these costs)? Facility based costs n What would be included here? n What makes these change (drives these costs)? © 2004 Superfactory™. All Rights Reserved. 62

Benefits of Activity-Based Costing n n n ABC leads to more activity cost pools with more relevant cost drivers ABC leads to enhanced control of overhead costs since overhead costs can be more often traced directly to activities ABC leads to better management decisions by providing more accurate product costs, which contributes to setting selling prices that will achieve desired product profitability levels © 2004 Superfactory™. All Rights Reserved. 63

Benefits of ABC n n ABC leads to better management decisions. More accurate product costing helps in setting selling prices and in deciding to whether make or buy components. Activity-based costing does not, in and of itself, change the amount of overhead costs. © 2004 Superfactory™. All Rights Reserved. 64

Limitations of ABC n n ABC can be expensive to use, as a result of the higher cost of identifying multiple activities and applying numerous cost drivers Some arbitrary overhead costs will continue, even though more overhead costs can be assigned directly to products through multiple activity cost pools © 2004 Superfactory™. All Rights Reserved. 65

ABC: Some Key Issues n n The Past Small number of products which did not differ much in required manufacturing support. Labor was dominant element in the cost structure. © 2004 Superfactory™. All Rights Reserved. n n The Present Numerous products with more and complicated production requirements. Labor is becoming an ever smaller part component of total production costs. 66

When to Use ABC n n n Product lines differ greatly in volume and manufacturing complexity Product lines are numerous, diverse, and require differing degrees of support services Overhead costs constitute a significant portion of total costs The manufacturing process or the number of products has changed significantly Production or marketing managers are ignoring data provided by traditional cost systems and are using bootleg cost information to make pricing decisions © 2004 Superfactory™. All Rights Reserved. 67

ABC: Some Key Issues Leading to Increased Use n Use of ABC allows more costs to be directly traced to products n This reduces the errors in product costs generated by less-thantotally-accurate allocations © 2004 Superfactory™. All Rights Reserved. 68

When Is ABC Most Beneficial? n When products differ significantly in their use of firm resources n Does ABC have to be limited to production costs? n When these resources (overhead ) are a significant cost (thus when labor is relatively small) n What contributes to different usage of resources? n Product diversity (functions used, inspections required, batch sizes, …. ) n Production complexity n Customer diversity (order sizes, distribution requirements © 2004 Superfactory™. All Rights Reserved. 69

Both Volume and Complexity Can Affect Costs n Processing orders n Number of different forms (complexity) n Electronic or manual processing n Assembling product n Number of units n Number of unique parts n Number and type of steps (unique processes) n Can design affect this? © 2004 Superfactory™. All Rights Reserved. 70

Symptoms of the Need for a More Complex Cost System n The outcomes of bids are difficult to explain n Competitors’ prices appear unrealistically low n Products that are difficult to produce show high profits n Operational managers want to drop products that appear profitable n Departmental managers do not believe the cost reports and/or are using their own accounting system © 2004 Superfactory™. All Rights Reserved. 71

Symptoms of the Need for a Different Cost System n The firm has a highly profitable niche all to itself n Customers do not complain about price increases n Competitors send you business n Sales are increasing but profits are not n Managers don’t have the information they need to address problems n Product costs change because of changes in financial reporting regulations © 2004 Superfactory™. All Rights Reserved. 72

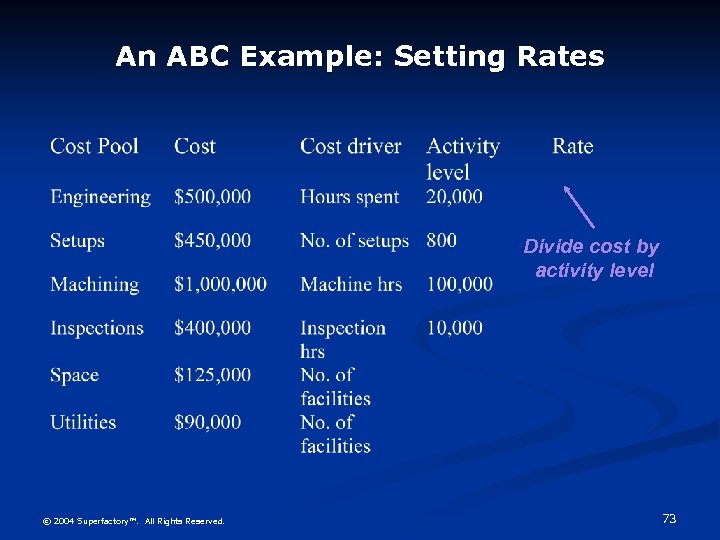

An ABC Example: Setting Rates Divide cost by activity level © 2004 Superfactory™. All Rights Reserved. 73

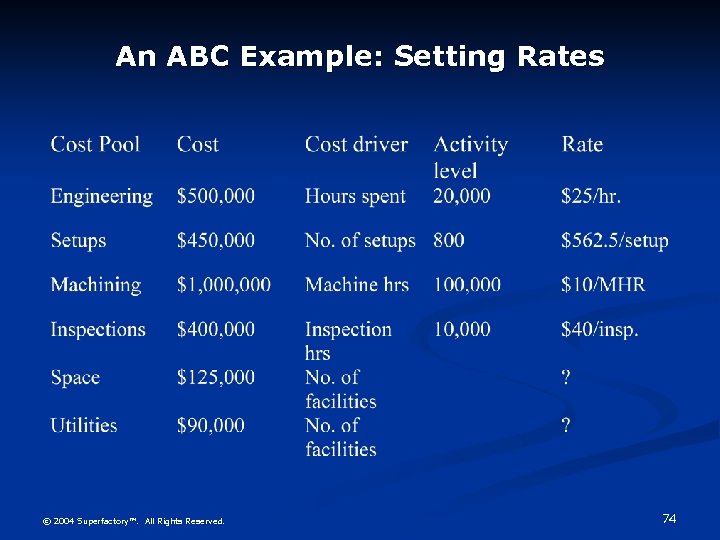

An ABC Example: Setting Rates © 2004 Superfactory™. All Rights Reserved. 74

Activity-Based Management n ABM is an extension of ABC, from a product costing system to a management function, that focuses on reducing costs and improving processes and decision making © 2004 Superfactory™. All Rights Reserved. 75

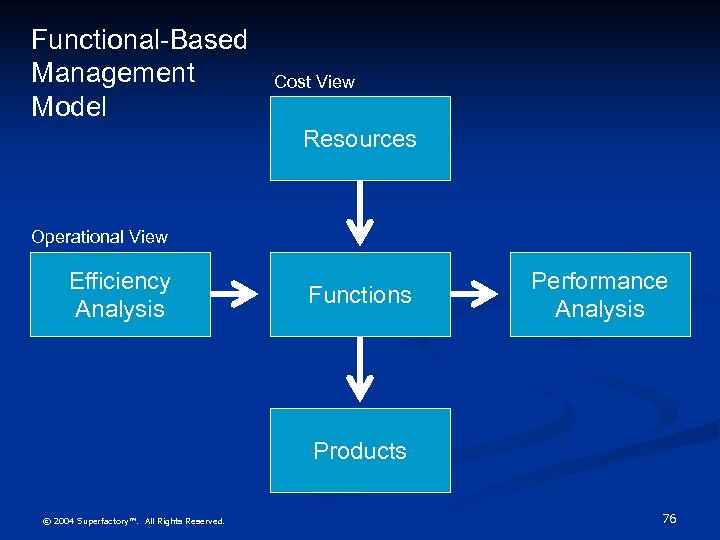

Functional-Based Management Model Cost View Resources Operational View Efficiency Analysis Functions Performance Analysis Products © 2004 Superfactory™. All Rights Reserved. 76

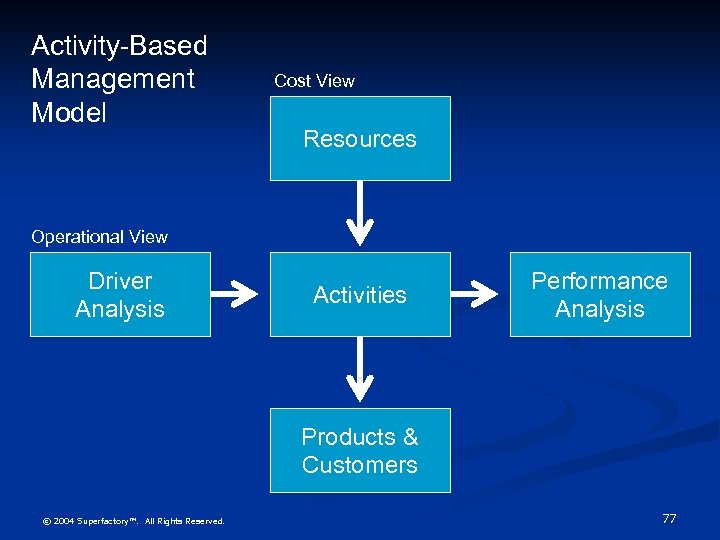

Activity-Based Management Model Cost View Resources Operational View Driver Analysis Activities Performance Analysis Products & Customers © 2004 Superfactory™. All Rights Reserved. 77

ABM: What and Why? n Activity based management = using knowledge of costs gained by ABC analysis to make pricing and product-mix decisions, to identify and select cost reduction and process improvement projects, including ones relating to product design n Knowing what costs are related to which product allows better analysis of: n which markets to emphasize n which products to consider for CIPs (cost improvement programs) n which customers to target for changes in pricing or service delivery © 2004 Superfactory™. All Rights Reserved. 78

ABC in Service Industries n n n Identifying activities, cost pools, and cost drivers are similar to manufacturing industries A larger proportion of overhead costs are facility-level costs, that cannot be directly traced to specific services rendered by the company Although initially developed and implemented by manufacturing companies that produce products, ABC has been widely adopted in service industries. The general approach to identifying activities, activity cost pools, and cost drivers is the same. Labeling activities as value-added and nonvalue-added, and trying to reduce or eliminate nonvalue-added activities is just as valid. © 2004 Superfactory™. All Rights Reserved. 79

Lean Accounting n n Lean Accounting is intended to replace traditional accounting and measurement systems; it is not intended be an additional analysis. Lean Accounting is right for companies that are well on the path toward lean manufacturing. Lean Accounting is more than a set of tools relating to measurement, capacity usage, value, and continuous improvement. Together these tools become a lean business management system that is radically different from traditional management. © 2004 Superfactory™. All Rights Reserved. 80

Lean Accounting – Element 1 n Performance measurements that motivate lean actions - at the cell level, the value stream level, and at the plant or corporation level. © 2004 Superfactory™. All Rights Reserved. 81

Lean Accounting – Element 2 n The elimination of most accounting and control transactions through the elimination of the need for them. n They (accounting transactions, shop floor control, inventory records, labor tracking, etc. ) are needed in traditional companies because processes are out of control. n In lean companies we can bring processes under control and eliminate the need for the cost accounting, inventory control, etc. Lean performance measurements become the primary control manager. © 2004 Superfactory™. All Rights Reserved. 82

Lean Accounting – Element 3 n A valid assessment of the financial impact of lean manufacturing improvement. n Many companies are looking for short-term cost cutting to come from their lean efforts. n They are usually disappointed. Lean manufacturing does not cut costs; it turns waste into available capacity. n The financial impact comes as you make decisions on how to use this capacity (and the cash flow from reduced inventory). n These are strategic decisions. Lean Accounting uses a specific tool for understanding the impact of lean changes on the company financially. © 2004 Superfactory™. All Rights Reserved. 83

Lean Accounting – Element 4 n Replacement of standard costing with costing of the value stream. n As a company seriously applies lean thinking they become less like a job shop and more like a process manufacturer. n Value stream costing becomes more relevant and "accurate" for managing the value stream. n This step (and its a big one for many companies) eliminates almost all of the wasteful transactions associated with traditional cost accounting. Plus it gives the value stream manager (and other interested parties) more valid information. © 2004 Superfactory™. All Rights Reserved. 84

Lean Accounting – Element 5 n Decisions that used to involve standard costs now use value stream profitability and contribution margin. n These decisions include pricing, profitability, make/buy, new product introduction, product and customer rationalization, etc. n This aspect is similar to throughput accounting in that it requires an understanding of flow through the bottleneck (or constraint) operations within the value stream. © 2004 Superfactory™. All Rights Reserved. 85

Lean Accounting – Element 6 n Driving the business from customer value. This is what we are striving towards. n QFD and target costing to drive our business from customer value and not from cost. n We need a profound understanding of how we create value for the customer; we need an understanding of where our costs are in the value stream; we compare where we create value with where we expend cost; and we initiate kaizens (and the like) to bring value and cost into line. n The best way to reduce cost is, of course, to increase sales. © 2004 Superfactory™. All Rights Reserved. 86

Lean Accounting – The Lean Transition n An important role for finance and accounting people in the lean organization is to actively support and participate in the transition to a lean enterprise. © 2004 Superfactory™. All Rights Reserved. 87

Lean Accounting – Management Accounting n n A cornerstone of the lean business is performance measurement. We have few measurements that are focused on the creation of customer value and the achievement of business strategy. Measurements are primarily non-financial and are established for cells, value streams, plants, and corporations. Simplified costing and financial planning methods support these measurements. © 2004 Superfactory™. All Rights Reserved. 88

Lean Accounting – Business Management n n To manage the business we need timely and valid information. Decisions are made using lean principles, not the traditional mass production mentality. Replace the department-focused structure with an organization that is focused on customer value and the value streams. Drive the business from value to the customer. © 2004 Superfactory™. All Rights Reserved. 89

Lean Accounting – Operational Accounting n n The problems of standard costing need to be addressed. Standard costing is an excellent costing method for traditional mass production; but standard costing is actively harmful to lean organizations. Replace standard costing with value stream costing. Value stream costing eliminates most transactions and does not rely on allocation and full absorption of costs. © 2004 Superfactory™. All Rights Reserved. 90

Lean Accounting – Financial Accounting n n While the majority of Lean Accounting affects internal processes, Lean principles are applied equally to the company’s financial accounting. There is much waste to be eliminated. Finance and accounting people in the average American company spend more than 70% of their time on bookkeeping and very little time on analysis and improvement. © 2004 Superfactory™. All Rights Reserved. 91

cd7321ebe3e7501a3bd7cf5c5dbca112.ppt