7c095cb7e4b6d6d3d6935dda112b0bd6.ppt

- Количество слайдов: 13

Activity 43 Monetary and Fiscal policy

Both monetary and fiscal policy can be used to influence the inflation rate and real output For the following table • Assume an upward sloping SRAS and • Indicate the effect each specific policy has on inflation and real output in the short term (nine to twelve months)

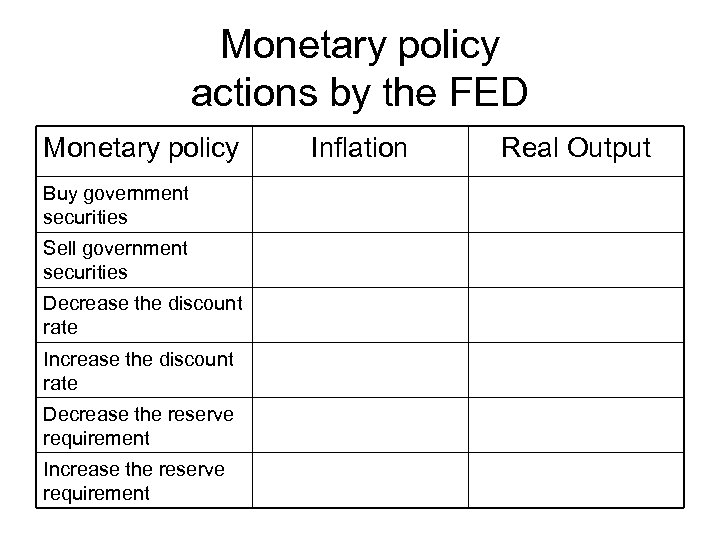

Monetary policy actions by the FED Monetary policy Buy government securities Sell government securities Decrease the discount rate Increase the discount rate Decrease the reserve requirement Inflation Real Output

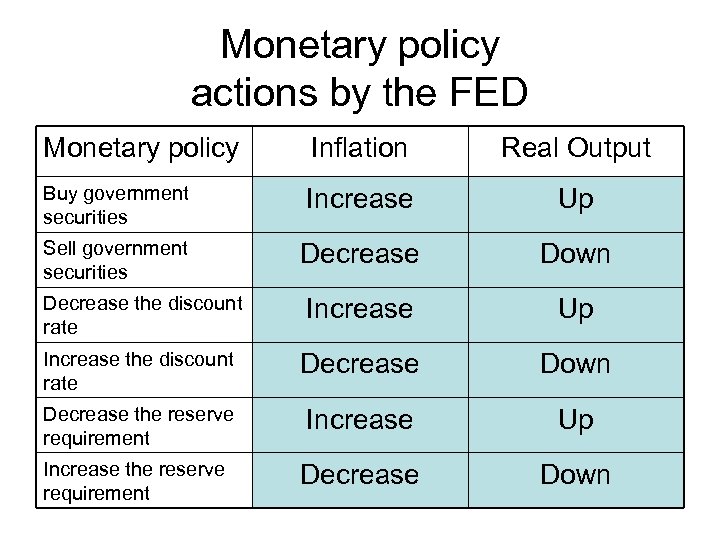

Monetary policy actions by the FED Monetary policy Inflation Real Output Buy government securities Increase Up Sell government securities Decrease Down Decrease the discount rate Increase Up Increase the discount rate Decrease Down Decrease the reserve requirement Increase Up Increase the reserve requirement Decrease Down

Fiscal policy tax and spending actions Fiscal policy Increase government spending Decrease government spending Increase taxes Decrease taxes Inflation Real Output

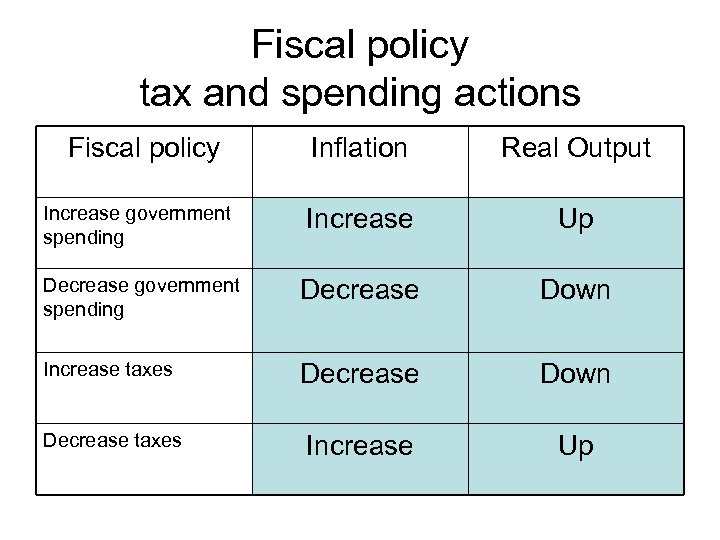

Fiscal policy tax and spending actions Fiscal policy Inflation Real Output Increase government spending Increase Up Decrease government spending Decrease Down Increase taxes Decrease Down Decrease taxes Increase Up

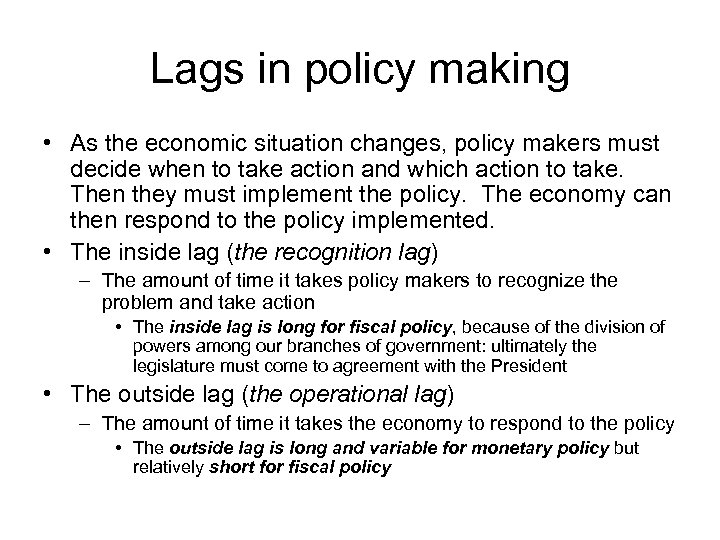

Lags in policy making • As the economic situation changes, policy makers must decide when to take action and which action to take. Then they must implement the policy. The economy can then respond to the policy implemented. • The inside lag (the recognition lag) – The amount of time it takes policy makers to recognize the problem and take action • The inside lag is long for fiscal policy, because of the division of powers among our branches of government: ultimately the legislature must come to agreement with the President • The outside lag (the operational lag) – The amount of time it takes the economy to respond to the policy • The outside lag is long and variable for monetary policy but relatively short for fiscal policy

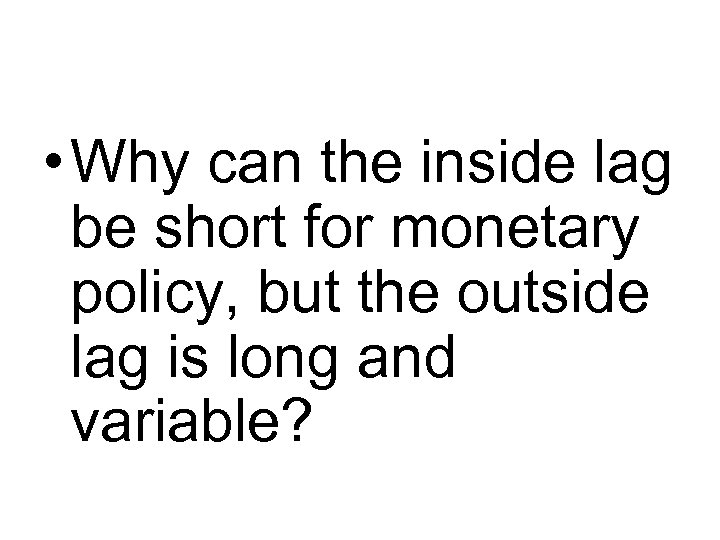

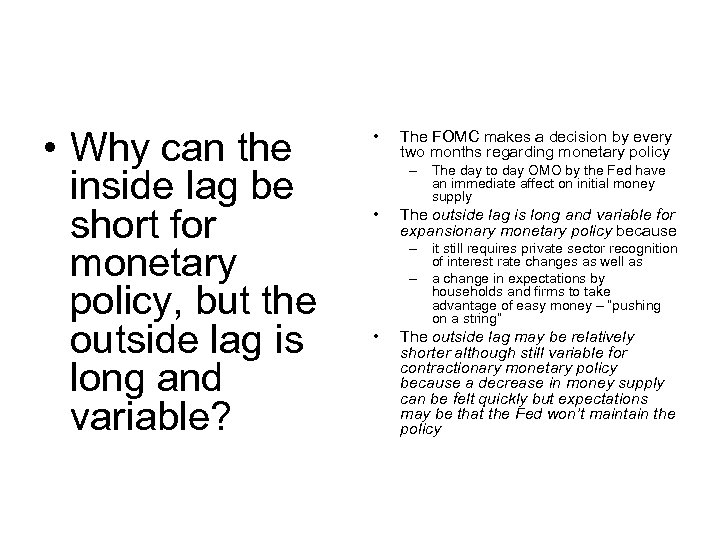

• Why can the inside lag be short for monetary policy, but the outside lag is long and variable?

• Why can the inside lag be short for monetary policy, but the outside lag is long and variable? • The FOMC makes a decision by every two months regarding monetary policy – The day to day OMO by the Fed have an immediate affect on initial money supply • The outside lag is long and variable for expansionary monetary policy because – it still requires private sector recognition of interest rate changes as well as – a change in expectations by households and firms to take advantage of easy money – “pushing on a string” • The outside lag may be relatively shorter although still variable for contractionary monetary policy because a decrease in money supply can be felt quickly but expectations may be that the Fed won’t maintain the policy

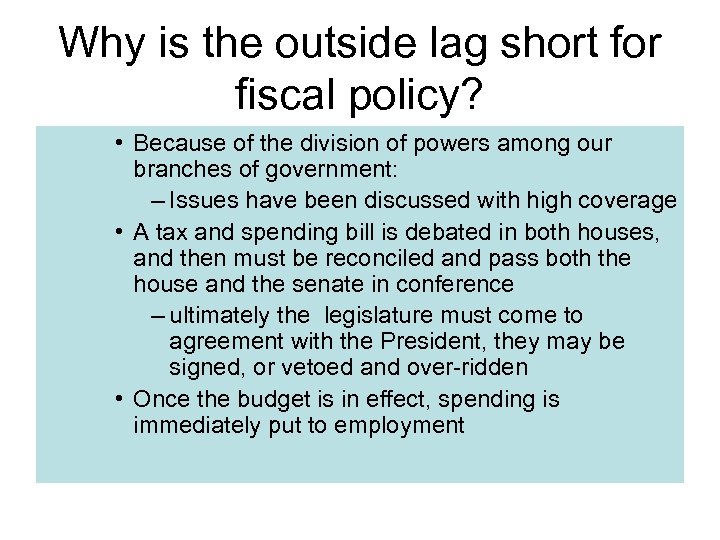

• Why is the outside lag short for fiscal policy?

Why is the outside lag short for fiscal policy? • Because of the division of powers among our branches of government: – Issues have been discussed with high coverage • A tax and spending bill is debated in both houses, and then must be reconciled and pass both the house and the senate in conference – ultimately the legislature must come to agreement with the President, they may be signed, or vetoed and over-ridden • Once the budget is in effect, spending is immediately put to employment

• Why are lags important to the discussion of stabilization policy?

Why are lags important to the discussion of stabilization policy? • The economy may be in a different place when the policy becomes effective • You can’t fine tune the economy at any given point in time – Remember the magic of markets?

7c095cb7e4b6d6d3d6935dda112b0bd6.ppt