72f8344c29f01d3196d2b4fe0d4f9b32.ppt

- Количество слайдов: 22

Active vs. Passive Strategies Using ETFs C. Michael Carty Principal & CIO New Millennium Advisors, LLC July 20, 2010 QWAFAFEW/NYC Presentation Patrick Conway’s New York, NY

Active vs. Passive Strategies Using ETFs C. Michael Carty Principal & CIO New Millennium Advisors, LLC July 20, 2010 QWAFAFEW/NYC Presentation Patrick Conway’s New York, NY

Our Purpose n To review the pros and cons of using active vs. passive strategies using ETFs and their tax consequences. New Millennium Advisors

Our Purpose n To review the pros and cons of using active vs. passive strategies using ETFs and their tax consequences. New Millennium Advisors

Is Buy and Hold Dead? n Indexing works for investors as a group Individuals have unique characteristics Examples of characteristics changing Identify the instruments of change Passively active or actively passive? Are indexes purely passive? n n n New Millennium Advisors

Is Buy and Hold Dead? n Indexing works for investors as a group Individuals have unique characteristics Examples of characteristics changing Identify the instruments of change Passively active or actively passive? Are indexes purely passive? n n n New Millennium Advisors

As a Group Investors Can Buy & Hold n n Individual stocks, bonds and cash Actively managed portfolios (stocks, bonds & cash) Mutual funds (stocks, bonds & cash) Passive funds (ETFs, ETNs, & ETCs) New Millennium Advisors

As a Group Investors Can Buy & Hold n n Individual stocks, bonds and cash Actively managed portfolios (stocks, bonds & cash) Mutual funds (stocks, bonds & cash) Passive funds (ETFs, ETNs, & ETCs) New Millennium Advisors

Individuals Have Unique Characteristics n n n Risk preferences Financial goals Personal circumstances Asset endowments Time horizons New Millennium Advisors

Individuals Have Unique Characteristics n n n Risk preferences Financial goals Personal circumstances Asset endowments Time horizons New Millennium Advisors

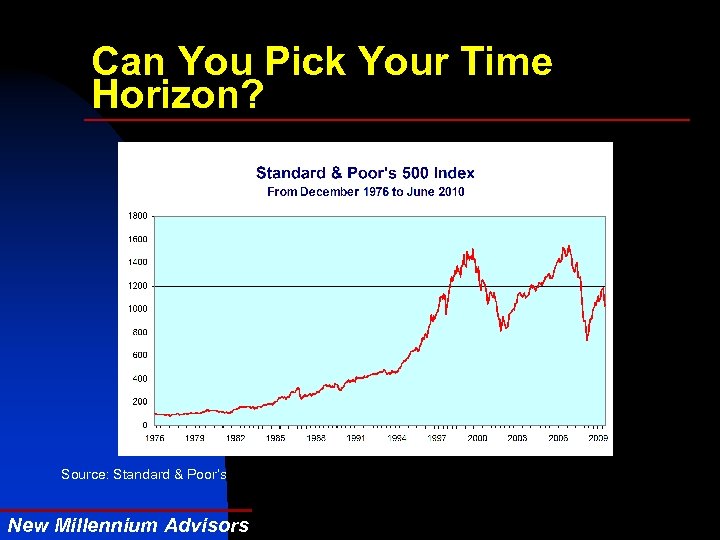

Can You Pick Your Time Horizon? Source: Standard & Poor’s New Millennium Advisors

Can You Pick Your Time Horizon? Source: Standard & Poor’s New Millennium Advisors

Characteristics Change with Time n n n Sell at the bottom & buy at the top Beat the market & absolute returns Marriage/divorce and disabilities Lotto, housing bubble/bust, & jobs Life, retirement & death New Millennium Advisors

Characteristics Change with Time n n n Sell at the bottom & buy at the top Beat the market & absolute returns Marriage/divorce and disabilities Lotto, housing bubble/bust, & jobs Life, retirement & death New Millennium Advisors

Instruments of Change n n n Economic cycles Inflation Government polices Fed monetary policy Regulatory environment Environmental factors New Millennium Advisors

Instruments of Change n n n Economic cycles Inflation Government polices Fed monetary policy Regulatory environment Environmental factors New Millennium Advisors

Passively Active or Actively Passive? n n Passive until change requires action (changes in strategic allocations) Actively using passive funds (tactical changes in strategic allocations) New Millennium Advisors

Passively Active or Actively Passive? n n Passive until change requires action (changes in strategic allocations) Actively using passive funds (tactical changes in strategic allocations) New Millennium Advisors

Are Passive Indexes Truly Passive? n n Changing market definitions Percent of market capitalization Market cap or float-weighted Market segmentation vs. diversification New Millennium Advisors

Are Passive Indexes Truly Passive? n n Changing market definitions Percent of market capitalization Market cap or float-weighted Market segmentation vs. diversification New Millennium Advisors

Global Industry Classification Standard n n n n n Energy Materials Industrials Consumer Discretionary Consumer Staples Health Care Financials Information Technology Telecom Services Utilities New Millennium Advisors

Global Industry Classification Standard n n n n n Energy Materials Industrials Consumer Discretionary Consumer Staples Health Care Financials Information Technology Telecom Services Utilities New Millennium Advisors

Some Actively Passive ETP Pairs Possibilities n n n Large cap growth (IWF) vs. value (IWD) ETFs Large cap (IWB) vs. small cap (IWM) ETFs Domestic (IVV) vs. Foreign (EAF) ETFs Developed (EAF) vs. emerging markets (EEM) Two Chinas: FTSE (FXI) vs. Halter (PGJ) Gold (GLD) vs. Silver (SLV) New Millennium Advisors

Some Actively Passive ETP Pairs Possibilities n n n Large cap growth (IWF) vs. value (IWD) ETFs Large cap (IWB) vs. small cap (IWM) ETFs Domestic (IVV) vs. Foreign (EAF) ETFs Developed (EAF) vs. emerging markets (EEM) Two Chinas: FTSE (FXI) vs. Halter (PGJ) Gold (GLD) vs. Silver (SLV) New Millennium Advisors

Actively Managing Growth & Value n Strategy: Invest in the index that outperformed in the trailing two months Indexes: Russell 1000 Growth & Value n Range: January 1988 to June 2010 n New Millennium Advisors

Actively Managing Growth & Value n Strategy: Invest in the index that outperformed in the trailing two months Indexes: Russell 1000 Growth & Value n Range: January 1988 to June 2010 n New Millennium Advisors

Active Growth/Value Strategy Sources: New Millennium Advisors and Standard & Poor’s New Millennium Advisors

Active Growth/Value Strategy Sources: New Millennium Advisors and Standard & Poor’s New Millennium Advisors

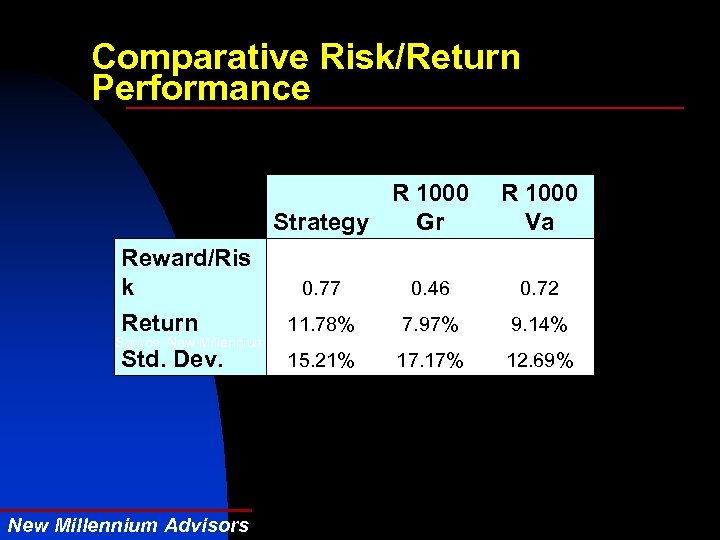

Comparative Risk/Return Performance R 1000 Strategy Gr Reward/Ris k 0. 77 Return 11. 78% Source: New Millennium Advisors Std. Dev. 15. 21% New Millennium Advisors R 1000 Va 0. 46 0. 72 7. 97% 9. 14% 17. 17% 12. 69%

Comparative Risk/Return Performance R 1000 Strategy Gr Reward/Ris k 0. 77 Return 11. 78% Source: New Millennium Advisors Std. Dev. 15. 21% New Millennium Advisors R 1000 Va 0. 46 0. 72 7. 97% 9. 14% 17. 17% 12. 69%

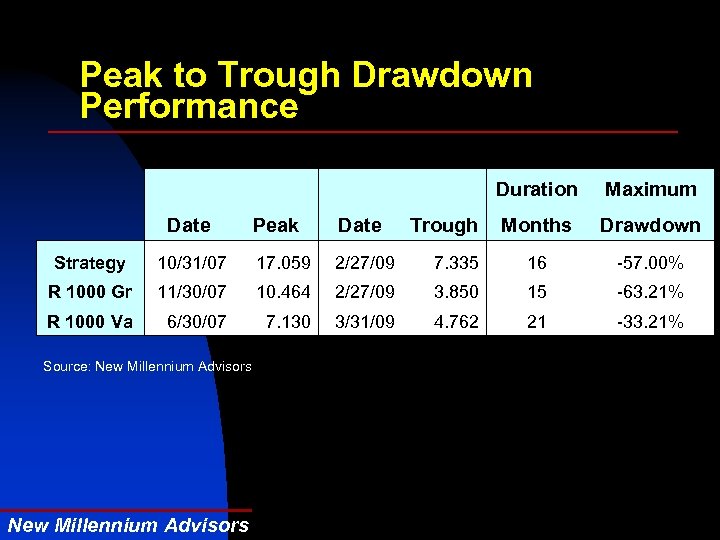

Peak to Trough Drawdown Performance Date Peak Date Duration Maximum Trough Months Drawdown Strategy 10/31/07 17. 059 2/27/09 7. 335 16 -57. 00% R 1000 Gr 11/30/07 10. 464 2/27/09 3. 850 15 -63. 21% R 1000 Va 6/30/07 7. 130 3/31/09 4. 762 21 -33. 21% Source: New Millennium Advisors

Peak to Trough Drawdown Performance Date Peak Date Duration Maximum Trough Months Drawdown Strategy 10/31/07 17. 059 2/27/09 7. 335 16 -57. 00% R 1000 Gr 11/30/07 10. 464 2/27/09 3. 850 15 -63. 21% R 1000 Va 6/30/07 7. 130 3/31/09 4. 762 21 -33. 21% Source: New Millennium Advisors

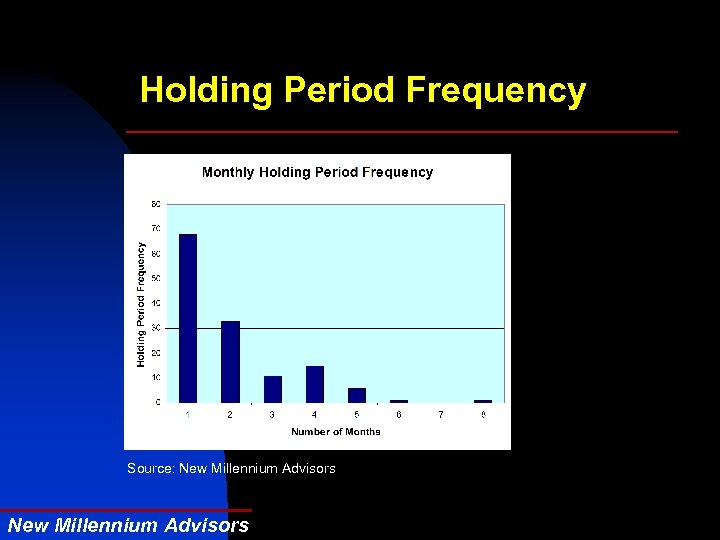

Holding Period Frequency Source: New Millennium Advisors

Holding Period Frequency Source: New Millennium Advisors

How Should Tax Issues Be Managed? n n Distinguish between qualified and non-qualified accounts Consider the tax implications for long- and short-term investors, and equity and fixed income holdings New Millennium Advisors

How Should Tax Issues Be Managed? n n Distinguish between qualified and non-qualified accounts Consider the tax implications for long- and short-term investors, and equity and fixed income holdings New Millennium Advisors

Qualified and Non-Qualified Accounts n n Non-qualified accounts can defer long-term capital gains indefinitely and withdraw funds at long-term capital gains rates Retirement accounts defer taxes but are taxed at the ordinary income rate when funds are withdrawn New Millennium Advisors

Qualified and Non-Qualified Accounts n n Non-qualified accounts can defer long-term capital gains indefinitely and withdraw funds at long-term capital gains rates Retirement accounts defer taxes but are taxed at the ordinary income rate when funds are withdrawn New Millennium Advisors

Long-Term Investors Who Rarely Trade n n Equity ETFs should be held in non-qualified accounts to get a favorable tax treatment Fixed income investments should be held in taxdeferred accounts so income can compound tax free New Millennium Advisors

Long-Term Investors Who Rarely Trade n n Equity ETFs should be held in non-qualified accounts to get a favorable tax treatment Fixed income investments should be held in taxdeferred accounts so income can compound tax free New Millennium Advisors

Summary and Conclusions n n n Buy & hold strategies relates to the entire market and only investors in the aggregate can hold it indefinitely. An individual’s buy & hold choices are limited by their risk preferences, financial goals, personal circumstances, assets and their forms, and time horizons. These characteristics change over time, so their strategic allocation must be actively managed. As events cause changes, it is prudent and reasonable to adapt to them rather than be victimized by them. Managing tax consequences is simplified using tax efficient ETPs in non-qualified accounts as surrogates for qualified accounts. New Millennium Advisors

Summary and Conclusions n n n Buy & hold strategies relates to the entire market and only investors in the aggregate can hold it indefinitely. An individual’s buy & hold choices are limited by their risk preferences, financial goals, personal circumstances, assets and their forms, and time horizons. These characteristics change over time, so their strategic allocation must be actively managed. As events cause changes, it is prudent and reasonable to adapt to them rather than be victimized by them. Managing tax consequences is simplified using tax efficient ETPs in non-qualified accounts as surrogates for qualified accounts. New Millennium Advisors

Thank you! C. Michael Carty New Millennium Advisors, LLC Two Rector Street, 15 th Floor New York, NY 10006 Tel. (917) 697 -9464 Fax (212) 386 -7590 mcarty@qwafafew. org New Millennium Advisors

Thank you! C. Michael Carty New Millennium Advisors, LLC Two Rector Street, 15 th Floor New York, NY 10006 Tel. (917) 697 -9464 Fax (212) 386 -7590 mcarty@qwafafew. org New Millennium Advisors