7025d208902402e087d6183c0d5ba1d1.ppt

- Количество слайдов: 28

“Active” vs. “Passive” Management Good Governance = Managing Alpha and Beta www. mcubeit. com Dr. Arun Muralidhar

“Active” vs. “Passive” Management Good Governance = Managing Alpha and Beta www. mcubeit. com Dr. Arun Muralidhar

OPERS’ Investment Philosophy § Asset allocation is the key determinant of return § Ranges will be maintained through a disciplined rebalancing program § Diversification by and within asset class is the primary risk control element § Passive alternatives to actively managed portfolios are suitable investment strategies, especially in highly efficient markets OPERS Statement of Investment Objectives and Policies, June 2003; pg 5 2

OPERS’ Investment Philosophy § Asset allocation is the key determinant of return § Ranges will be maintained through a disciplined rebalancing program § Diversification by and within asset class is the primary risk control element § Passive alternatives to actively managed portfolios are suitable investment strategies, especially in highly efficient markets OPERS Statement of Investment Objectives and Policies, June 2003; pg 5 2

Key Conclusions § Clients are separating “alpha” from “beta” - Too much alpha focus, not enough on the beta § Not enough focus on the impact versus liabilities § All portfolio decisions (including “passive” rebalancing) impact returns and risks; Must make decisions in an informed manner § Evaluate every decision in context of portfolio § The Greater Fool Theory of Asset Management 3

Key Conclusions § Clients are separating “alpha” from “beta” - Too much alpha focus, not enough on the beta § Not enough focus on the impact versus liabilities § All portfolio decisions (including “passive” rebalancing) impact returns and risks; Must make decisions in an informed manner § Evaluate every decision in context of portfolio § The Greater Fool Theory of Asset Management 3

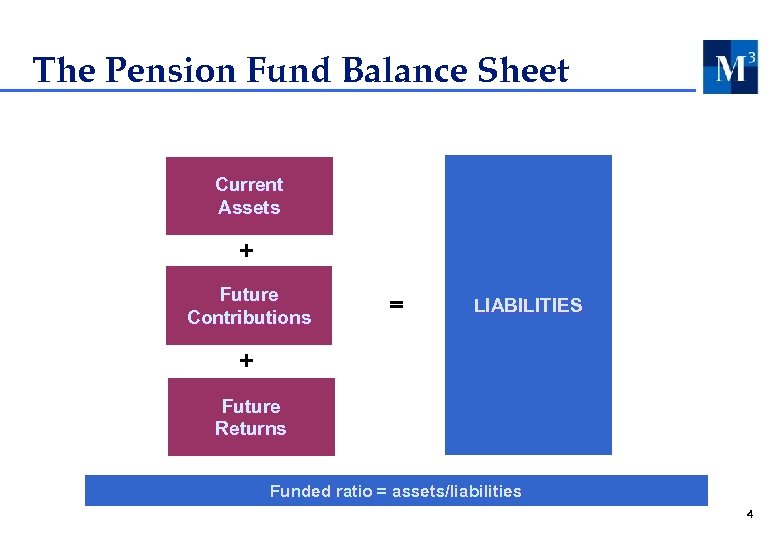

The Pension Fund Balance Sheet Current Assets + Future Contributions = = LIABILITIES + Future Returns Funded ratio = assets/liabilities 4

The Pension Fund Balance Sheet Current Assets + Future Contributions = = LIABILITIES + Future Returns Funded ratio = assets/liabilities 4

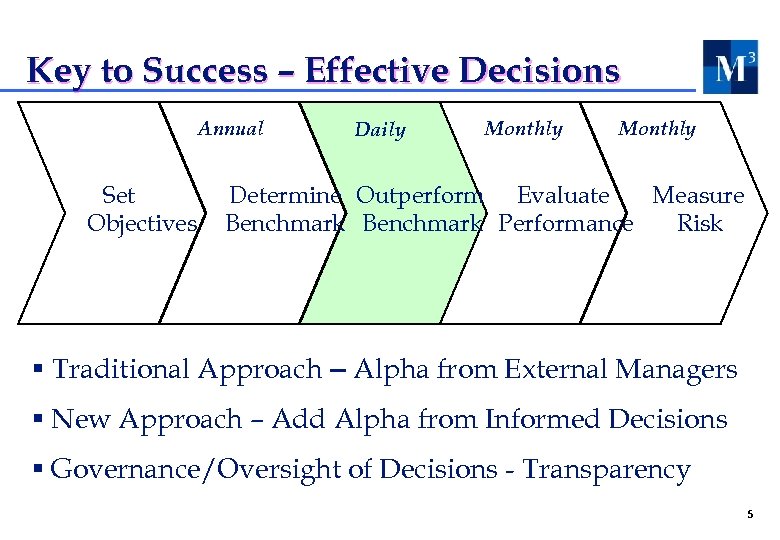

Key to Success – Effective Decisions Annual Set Objectives Daily Monthly Determine Outperform Evaluate Measure Benchmark Performance Risk § Traditional Approach – Alpha from External Managers § New Approach – Add Alpha from Informed Decisions § Governance/Oversight of Decisions - Transparency 5

Key to Success – Effective Decisions Annual Set Objectives Daily Monthly Determine Outperform Evaluate Measure Benchmark Performance Risk § Traditional Approach – Alpha from External Managers § New Approach – Add Alpha from Informed Decisions § Governance/Oversight of Decisions - Transparency 5

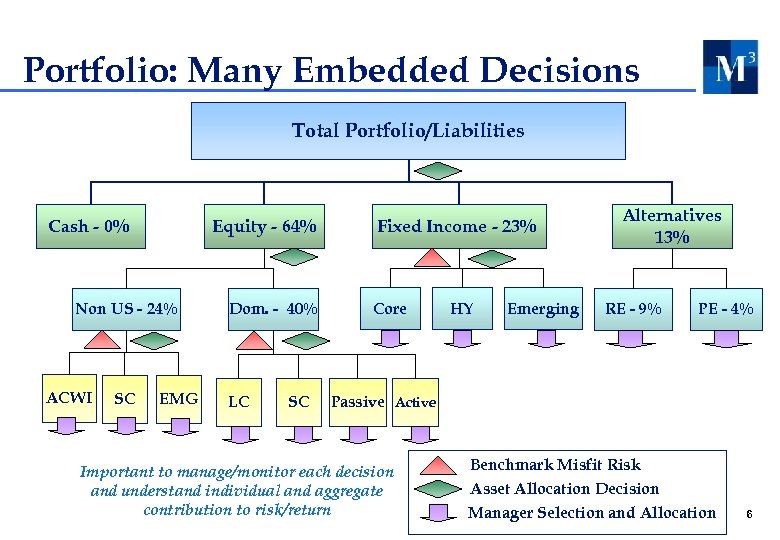

Portfolio: Many Embedded Decisions Total Portfolio/Liabilities Cash - 0% Equity - 64% Non US - 24% ACWI SC EMG Dom. - 40% LC SC Fixed Income - 23% Core HY Emerging Alternatives 13% RE - 9% PE - 4% Passive Active Important to manage/monitor each decision and understand individual and aggregate contribution to risk/return Benchmark Misfit Risk Asset Allocation Decision Manager Selection and Allocation 6

Portfolio: Many Embedded Decisions Total Portfolio/Liabilities Cash - 0% Equity - 64% Non US - 24% ACWI SC EMG Dom. - 40% LC SC Fixed Income - 23% Core HY Emerging Alternatives 13% RE - 9% PE - 4% Passive Active Important to manage/monitor each decision and understand individual and aggregate contribution to risk/return Benchmark Misfit Risk Asset Allocation Decision Manager Selection and Allocation 6

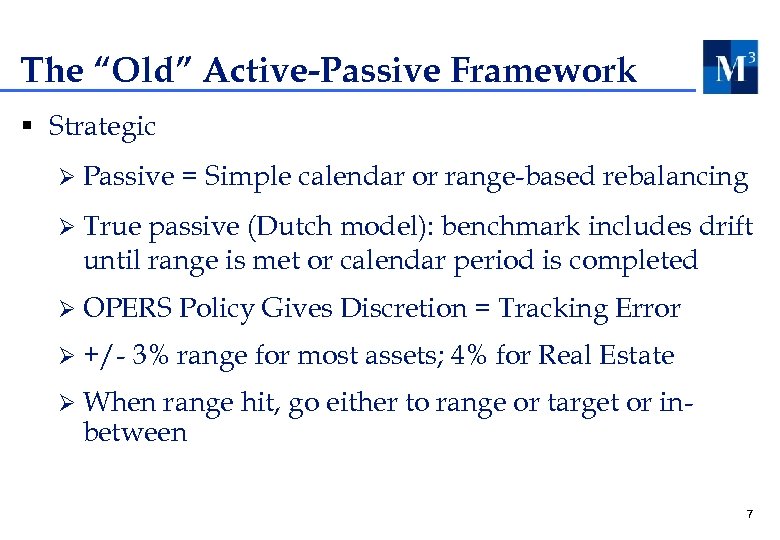

The “Old” Active-Passive Framework § Strategic Ø Passive = Simple calendar or range-based rebalancing Ø True passive (Dutch model): benchmark includes drift until range is met or calendar period is completed Ø OPERS Ø +/- Policy Gives Discretion = Tracking Error 3% range for most assets; 4% for Real Estate Ø When range hit, go either to range or target or inbetween 7

The “Old” Active-Passive Framework § Strategic Ø Passive = Simple calendar or range-based rebalancing Ø True passive (Dutch model): benchmark includes drift until range is met or calendar period is completed Ø OPERS Ø +/- Policy Gives Discretion = Tracking Error 3% range for most assets; 4% for Real Estate Ø When range hit, go either to range or target or inbetween 7

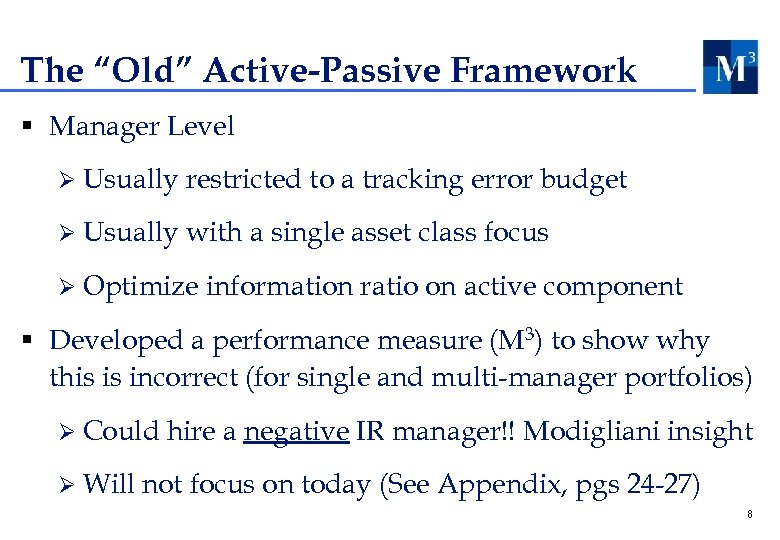

The “Old” Active-Passive Framework § Manager Level Ø Usually restricted to a tracking error budget Ø Usually with a single asset class focus Ø Optimize information ratio on active component § Developed a performance measure (M 3) to show why this is incorrect (for single and multi-manager portfolios) Ø Could Ø Will hire a negative IR manager!! Modigliani insight not focus on today (See Appendix, pgs 24 -27) 8

The “Old” Active-Passive Framework § Manager Level Ø Usually restricted to a tracking error budget Ø Usually with a single asset class focus Ø Optimize information ratio on active component § Developed a performance measure (M 3) to show why this is incorrect (for single and multi-manager portfolios) Ø Could Ø Will hire a negative IR manager!! Modigliani insight not focus on today (See Appendix, pgs 24 -27) 8

Passive Rebalancing: Can Be “Risky”* Ø OPERS Buy and Hold: 0. 16% ann. Return; 1. 09% tracking error; Worst drawdown = -2. 15% over a multi-year period Ø +/-3% range for most assets; 4% for RE** – Impact: 0. 01% annualized for 0. 21% risk – Worst drawdown: much lower at – 0. 43% (multi-year period) – No transactions cost: 0. 02% ann. (1% turnover) – On $ 60 bn = $90 mn/year impact, but lower risk! – Does not capture Asset-Liability risk or impact *Rebalancing was evaluated from 01/99 – 04/05. Only tested at the highest portfolio benchmark level. Proxied Lehman Universal with Lehman Composite and Custom Real Estate Index with NAREIT – data not provided by OPERS and hence can differ from true results. Transactions costs (one way) = 15 bps for equity; 10 bps for fixed income; 0. 5% for alternatives **Range-based rebalancing = if any asset drifts to the range limit, all assets are rebalanced to benchmark 9

Passive Rebalancing: Can Be “Risky”* Ø OPERS Buy and Hold: 0. 16% ann. Return; 1. 09% tracking error; Worst drawdown = -2. 15% over a multi-year period Ø +/-3% range for most assets; 4% for RE** – Impact: 0. 01% annualized for 0. 21% risk – Worst drawdown: much lower at – 0. 43% (multi-year period) – No transactions cost: 0. 02% ann. (1% turnover) – On $ 60 bn = $90 mn/year impact, but lower risk! – Does not capture Asset-Liability risk or impact *Rebalancing was evaluated from 01/99 – 04/05. Only tested at the highest portfolio benchmark level. Proxied Lehman Universal with Lehman Composite and Custom Real Estate Index with NAREIT – data not provided by OPERS and hence can differ from true results. Transactions costs (one way) = 15 bps for equity; 10 bps for fixed income; 0. 5% for alternatives **Range-based rebalancing = if any asset drifts to the range limit, all assets are rebalanced to benchmark 9

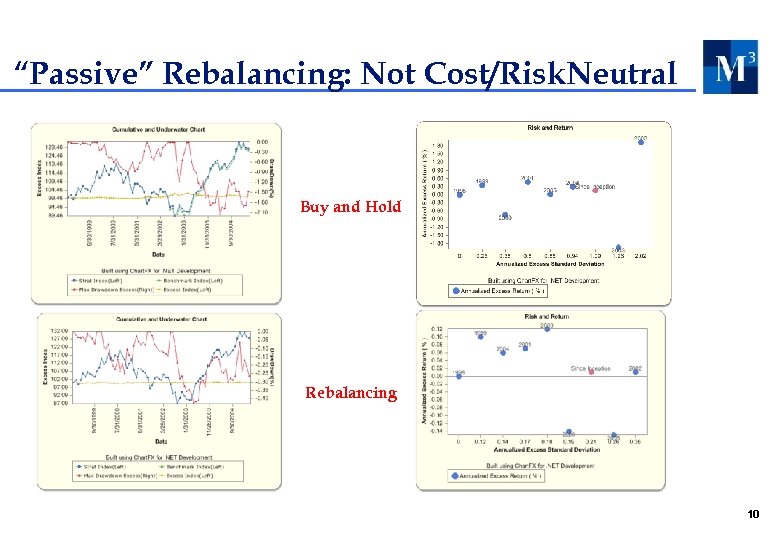

“Passive” Rebalancing: Not Cost/Risk. Neutral Buy and Hold Rebalancing 10

“Passive” Rebalancing: Not Cost/Risk. Neutral Buy and Hold Rebalancing 10

Informed Decisions within Ranges § Portfolio rebalancing is an “active” decision § Pension funds experience cash flows – use them to structure fund appropriately § Asset class structuring also creates opportunity Ø Large cap vs. Small cap (+/-2%) Ø Core vs. HY vs. EMG (+/-2%) Ø EAFE vs. EMG vs. Small (+/-2%) Can OPERS staff use discretion to create value? Key is to have a robust, transparent, consistent process 11

Informed Decisions within Ranges § Portfolio rebalancing is an “active” decision § Pension funds experience cash flows – use them to structure fund appropriately § Asset class structuring also creates opportunity Ø Large cap vs. Small cap (+/-2%) Ø Core vs. HY vs. EMG (+/-2%) Ø EAFE vs. EMG vs. Small (+/-2%) Can OPERS staff use discretion to create value? Key is to have a robust, transparent, consistent process 11

Improving the Quality of Decisions § Institute consistent evaluation and performance metrics § Test variety of rules to use for specific decisions § Many resources can be tapped Ø Internal staff – have ideas that are unused Ø Research – lots of research on when asset classes do well Ø Leverage external managers/relationships – Verizon model § Transparency and process are key for good governance “Prudence is Process” 12

Improving the Quality of Decisions § Institute consistent evaluation and performance metrics § Test variety of rules to use for specific decisions § Many resources can be tapped Ø Internal staff – have ideas that are unused Ø Research – lots of research on when asset classes do well Ø Leverage external managers/relationships – Verizon model § Transparency and process are key for good governance “Prudence is Process” 12

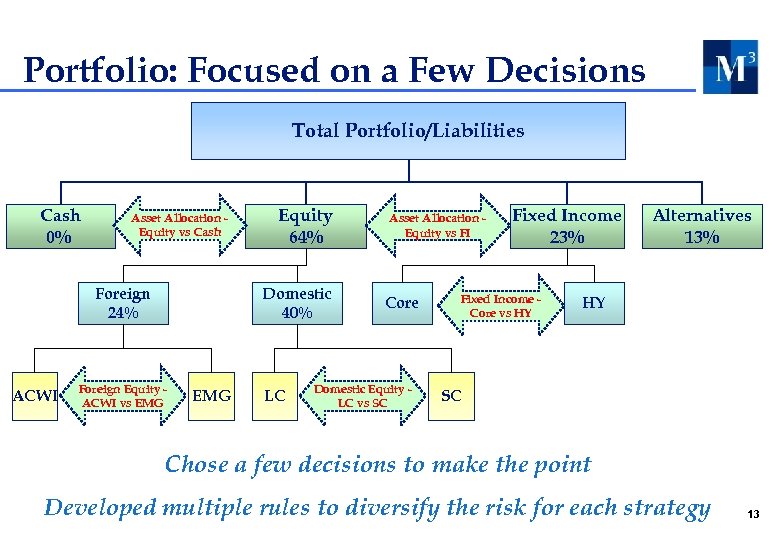

Portfolio: Focused on a Few Decisions Total Portfolio/Liabilities Cash 0% Asset Allocation Equity vs Cash Foreign 24% ACWI Equity 64% Domestic 40% Foreign Equity ACWI vs EMG LC Asset Allocation Equity vs FI Core Domestic Equity LC vs SC Fixed Income 23% Fixed Income Core vs HY Alternatives 13% HY SC Chose a few decisions to make the point Developed multiple rules to diversify the risk for each strategy 13

Portfolio: Focused on a Few Decisions Total Portfolio/Liabilities Cash 0% Asset Allocation Equity vs Cash Foreign 24% ACWI Equity 64% Domestic 40% Foreign Equity ACWI vs EMG LC Asset Allocation Equity vs FI Core Domestic Equity LC vs SC Fixed Income 23% Fixed Income Core vs HY Alternatives 13% HY SC Chose a few decisions to make the point Developed multiple rules to diversify the risk for each strategy 13

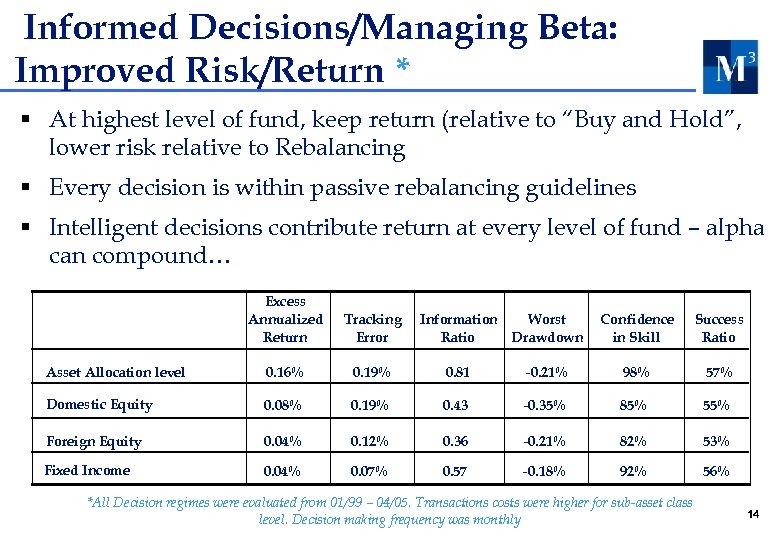

Informed Decisions/Managing Beta: Improved Risk/Return * § At highest level of fund, keep return (relative to “Buy and Hold”, lower risk relative to Rebalancing § Every decision is within passive rebalancing guidelines § Intelligent decisions contribute return at every level of fund – alpha can compound… Excess Annualized Return Tracking Error Asset Allocation level 0. 16% 0. 19% 0. 81 Domestic Equity 0. 08% 0. 19% Foreign Equity 0. 04% Fixed Income 0. 04% Information Worst Ratio Drawdown Confidence in Skill Success Ratio -0. 21% 98% 57% 0. 43 -0. 35% 85% 55% 0. 12% 0. 36 -0. 21% 82% 53% 0. 07% 0. 57 -0. 18% 92% 56% *All Decision regimes were evaluated from 01/99 – 04/05. Transactions costs were higher for sub-asset class level. Decision making frequency was monthly 14

Informed Decisions/Managing Beta: Improved Risk/Return * § At highest level of fund, keep return (relative to “Buy and Hold”, lower risk relative to Rebalancing § Every decision is within passive rebalancing guidelines § Intelligent decisions contribute return at every level of fund – alpha can compound… Excess Annualized Return Tracking Error Asset Allocation level 0. 16% 0. 19% 0. 81 Domestic Equity 0. 08% 0. 19% Foreign Equity 0. 04% Fixed Income 0. 04% Information Worst Ratio Drawdown Confidence in Skill Success Ratio -0. 21% 98% 57% 0. 43 -0. 35% 85% 55% 0. 12% 0. 36 -0. 21% 82% 53% 0. 07% 0. 57 -0. 18% 92% 56% *All Decision regimes were evaluated from 01/99 – 04/05. Transactions costs were higher for sub-asset class level. Decision making frequency was monthly 14

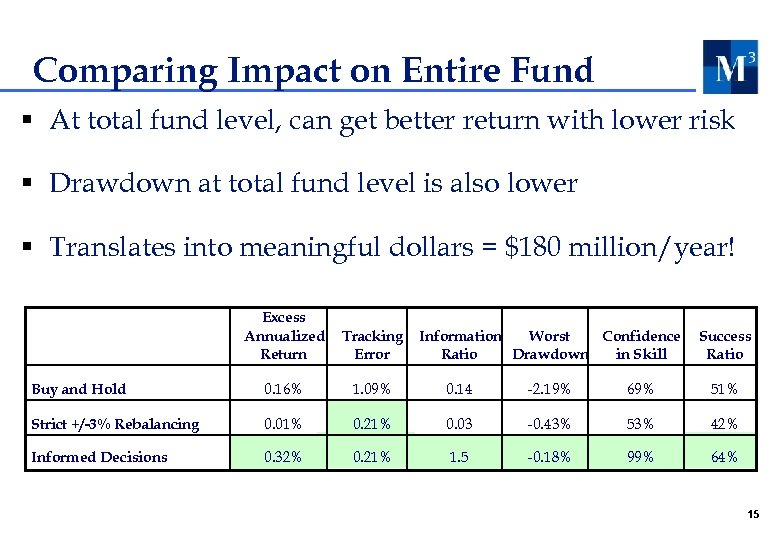

Comparing Impact on Entire Fund § At total fund level, can get better return with lower risk § Drawdown at total fund level is also lower § Translates into meaningful dollars = $180 million/year! Excess Annualized Return Tracking Error Buy and Hold 0. 16% 1. 09% 0. 14 -2. 19% 69% 51% Strict +/-3% Rebalancing 0. 01% 0. 21% 0. 03 -0. 43% 53% 42% Informed Decisions 0. 32% 0. 21% 1. 5 -0. 18% 99% 64% Information Worst Confidence Ratio Drawdown in Skill Success Ratio 15

Comparing Impact on Entire Fund § At total fund level, can get better return with lower risk § Drawdown at total fund level is also lower § Translates into meaningful dollars = $180 million/year! Excess Annualized Return Tracking Error Buy and Hold 0. 16% 1. 09% 0. 14 -2. 19% 69% 51% Strict +/-3% Rebalancing 0. 01% 0. 21% 0. 03 -0. 43% 53% 42% Informed Decisions 0. 32% 0. 21% 1. 5 -0. 18% 99% 64% Information Worst Confidence Ratio Drawdown in Skill Success Ratio 15

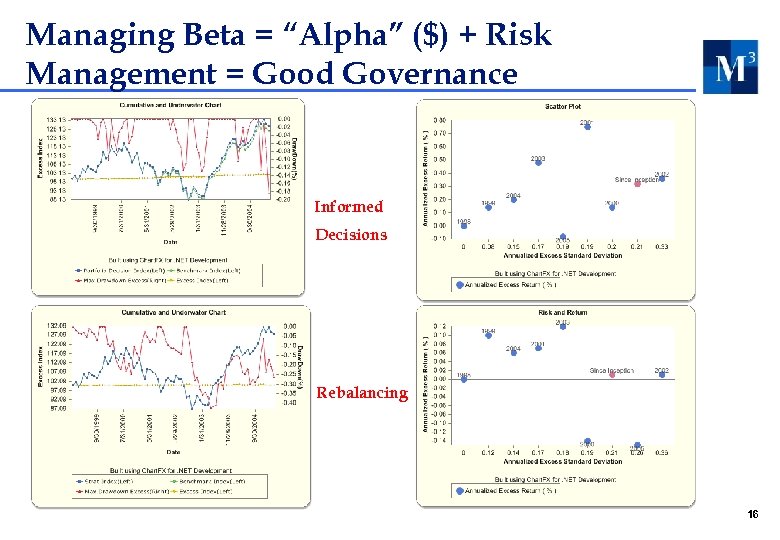

Managing Beta = “Alpha” ($) + Risk Management = Good Governance Informed Decisions Rebalancing 16

Managing Beta = “Alpha” ($) + Risk Management = Good Governance Informed Decisions Rebalancing 16

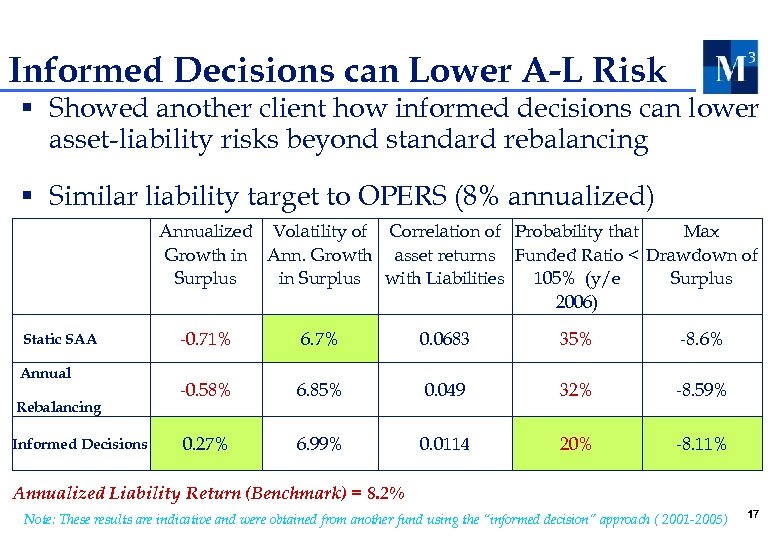

Informed Decisions can Lower A-L Risk § Showed another client how informed decisions can lower asset-liability risks beyond standard rebalancing § Similar liability target to OPERS (8% annualized) Annualized Volatility of Correlation of Probability that Max Growth in Ann. Growth asset returns Funded Ratio < Drawdown of Surplus in Surplus with Liabilities 105% (y/e Surplus 2006) Static SAA Annual Rebalancing Informed Decisions -0. 71% 6. 7% 0. 0683 35% -8. 6% -0. 58% 6. 85% 0. 049 32% -8. 59% 0. 27% 6. 99% 0. 0114 20% -8. 11% Annualized Liability Return (Benchmark) = 8. 2% Note: These results are indicative and were obtained from another fund using the “informed decision” approach ( 2001 -2005) 17

Informed Decisions can Lower A-L Risk § Showed another client how informed decisions can lower asset-liability risks beyond standard rebalancing § Similar liability target to OPERS (8% annualized) Annualized Volatility of Correlation of Probability that Max Growth in Ann. Growth asset returns Funded Ratio < Drawdown of Surplus in Surplus with Liabilities 105% (y/e Surplus 2006) Static SAA Annual Rebalancing Informed Decisions -0. 71% 6. 7% 0. 0683 35% -8. 6% -0. 58% 6. 85% 0. 049 32% -8. 59% 0. 27% 6. 99% 0. 0114 20% -8. 11% Annualized Liability Return (Benchmark) = 8. 2% Note: These results are indicative and were obtained from another fund using the “informed decision” approach ( 2001 -2005) 17

Summary § Can use current Statement of Objectives to add meaningful value from “managing beta” § Being “active” within “passive” range = good governance § Can also control risk in a meaningful way § Cheaper source of excess return at total fund return (than any other “alpha” option) § Easy to adopt by leveraging external relationships 18

Summary § Can use current Statement of Objectives to add meaningful value from “managing beta” § Being “active” within “passive” range = good governance § Can also control risk in a meaningful way § Cheaper source of excess return at total fund return (than any other “alpha” option) § Easy to adopt by leveraging external relationships 18

Appendix

Appendix

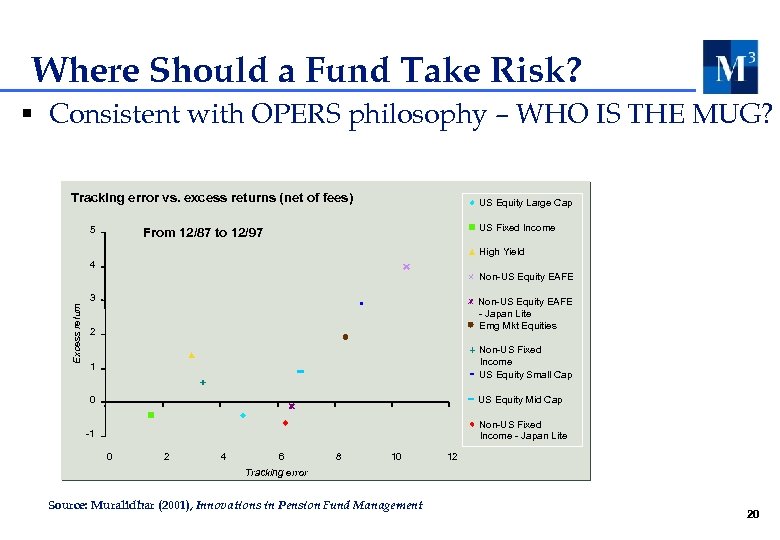

Where Should a Fund Take Risk? § Consistent with OPERS philosophy – WHO IS THE MUG? Tracking error vs. excess returns (net of fees) 5 US Equity Large Cap US Fixed Income From 12/87 to 12/97 High Yield 4 Excess return Non-US Equity EAFE 3 Non-US Equity EAFE - Japan Lite Emg Mkt Equities 2 1 Non-US Fixed Income US Equity Small Cap 0 US Equity Mid Cap -1 Non-US Fixed Income - Japan Lite 0 2 4 6 8 10 12 Tracking error Source: Muralidhar (2001), Innovations in Pension Fund Management 20

Where Should a Fund Take Risk? § Consistent with OPERS philosophy – WHO IS THE MUG? Tracking error vs. excess returns (net of fees) 5 US Equity Large Cap US Fixed Income From 12/87 to 12/97 High Yield 4 Excess return Non-US Equity EAFE 3 Non-US Equity EAFE - Japan Lite Emg Mkt Equities 2 1 Non-US Fixed Income US Equity Small Cap 0 US Equity Mid Cap -1 Non-US Fixed Income - Japan Lite 0 2 4 6 8 10 12 Tracking error Source: Muralidhar (2001), Innovations in Pension Fund Management 20

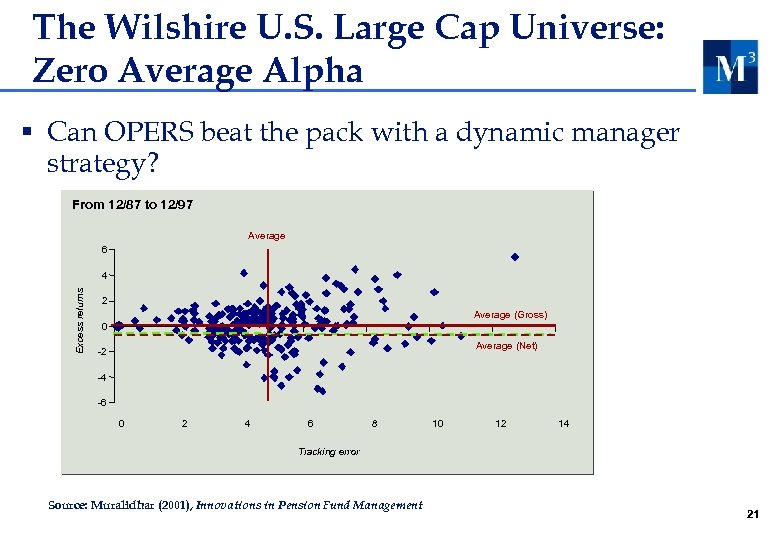

The Wilshire U. S. Large Cap Universe: Zero Average Alpha § Can OPERS beat the pack with a dynamic manager strategy? From 12/87 to 12/97 Average 6 Excess returns 4 2 Average (Gross) 0 Average (Net) -2 -4 -6 0 2 4 6 8 10 12 14 Tracking error Source: Muralidhar (2001), Innovations in Pension Fund Management 21

The Wilshire U. S. Large Cap Universe: Zero Average Alpha § Can OPERS beat the pack with a dynamic manager strategy? From 12/87 to 12/97 Average 6 Excess returns 4 2 Average (Gross) 0 Average (Net) -2 -4 -6 0 2 4 6 8 10 12 14 Tracking error Source: Muralidhar (2001), Innovations in Pension Fund Management 21

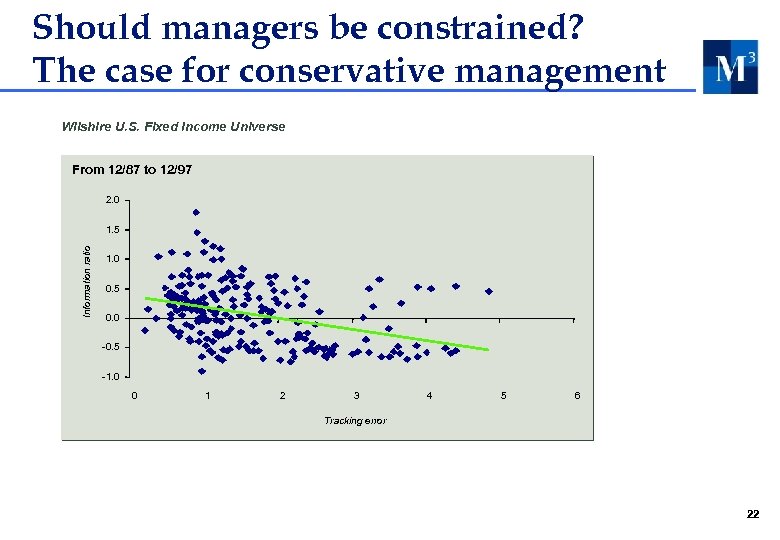

Should managers be constrained? The case for conservative management Wilshire U. S. Fixed Income Universe From 12/87 to 12/97 2. 0 Information ratio 1. 5 1. 0 0. 5 0. 0 -0. 5 -1. 0 0 1 2 3 4 5 6 Tracking error 22

Should managers be constrained? The case for conservative management Wilshire U. S. Fixed Income Universe From 12/87 to 12/97 2. 0 Information ratio 1. 5 1. 0 0. 5 0. 0 -0. 5 -1. 0 0 1 2 3 4 5 6 Tracking error 22

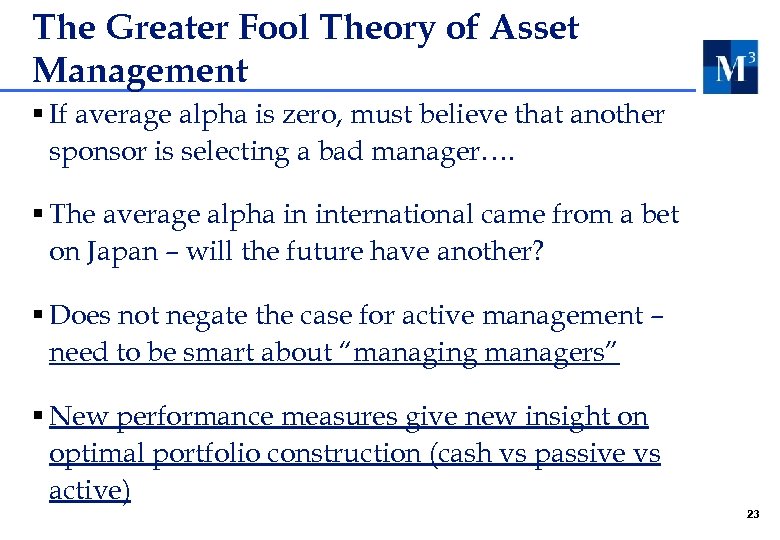

The Greater Fool Theory of Asset Management § If average alpha is zero, must believe that another sponsor is selecting a bad manager…. § The average alpha in international came from a bet on Japan – will the future have another? § Does not negate the case for active management – need to be smart about “managing managers” § New performance measures give new insight on optimal portfolio construction (cash vs passive vs active) 23

The Greater Fool Theory of Asset Management § If average alpha is zero, must believe that another sponsor is selecting a bad manager…. § The average alpha in international came from a bet on Japan – will the future have another? § Does not negate the case for active management – need to be smart about “managing managers” § New performance measures give new insight on optimal portfolio construction (cash vs passive vs active) 23

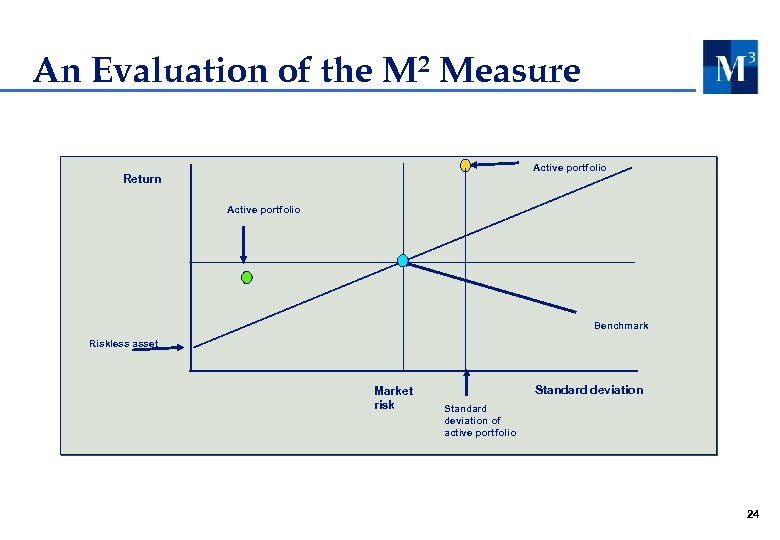

An Evaluation of the M 2 Measure Active portfolio Return Active portfolio Benchmark Riskless asset Market risk Standard deviation of active portfolio 24

An Evaluation of the M 2 Measure Active portfolio Return Active portfolio Benchmark Riskless asset Market risk Standard deviation of active portfolio 24

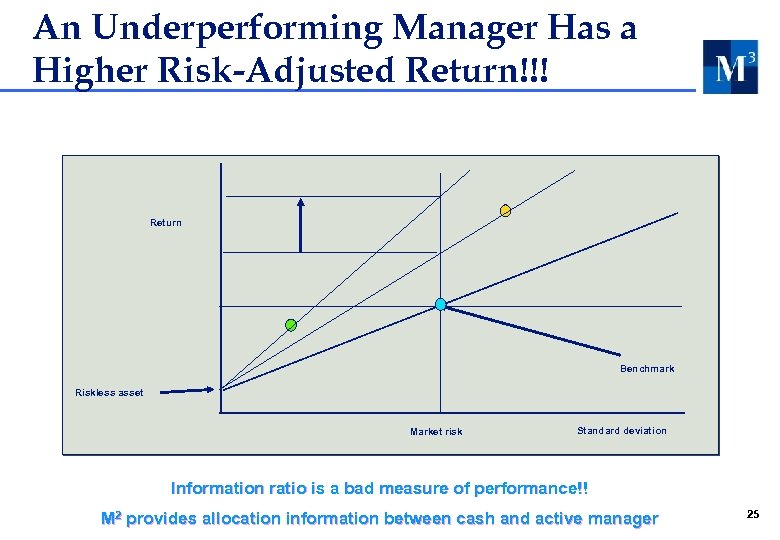

An Underperforming Manager Has a Higher Risk-Adjusted Return!!! Return Benchmark Riskless asset Market risk Standard deviation Information ratio is a bad measure of performance!! M 2 provides allocation information between cash and active manager 25

An Underperforming Manager Has a Higher Risk-Adjusted Return!!! Return Benchmark Riskless asset Market risk Standard deviation Information ratio is a bad measure of performance!! M 2 provides allocation information between cash and active manager 25

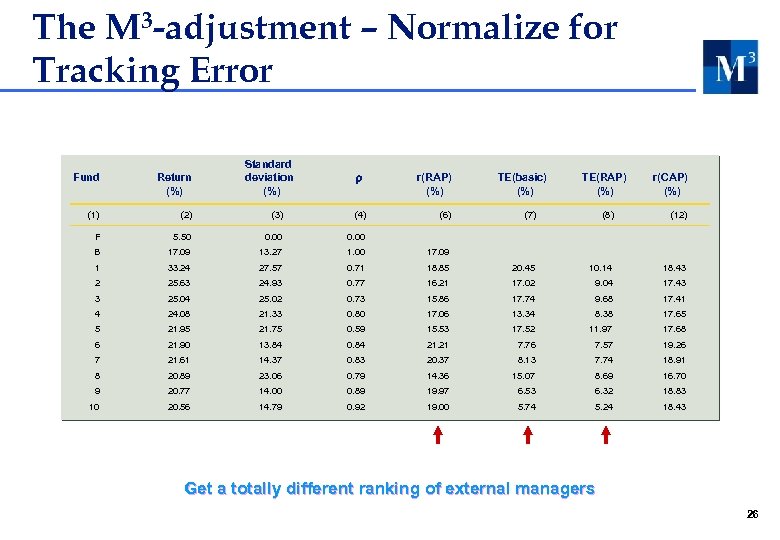

The M 3 -adjustment – Normalize for Tracking Error Standard deviation (%) Fund Return (%) r(RAP) (%) (1) (2) (3) (4) F 5. 50 0. 00 B 17. 09 13. 27 1. 00 17. 09 1 33. 24 27. 57 0. 71 2 25. 63 24. 93 3 25. 04 4 (6) TE(basic) (%) TE(RAP) (%) r(CAP) (%) (7) (8) (12) 18. 85 20. 45 10. 14 18. 43 0. 77 16. 21 17. 02 9. 04 17. 43 25. 02 0. 73 15. 86 17. 74 9. 68 17. 41 24. 08 21. 33 0. 80 17. 06 13. 34 8. 38 17. 65 5 21. 95 21. 75 0. 59 15. 53 17. 52 11. 97 17. 68 6 21. 90 13. 84 0. 84 21. 21 7. 76 7. 57 19. 26 7 21. 61 14. 37 0. 83 20. 37 8. 13 7. 74 18. 91 8 20. 89 23. 06 0. 79 14. 36 15. 07 8. 69 16. 70 9 20. 77 14. 00 0. 89 19. 97 6. 53 6. 32 18. 83 10 20. 56 14. 79 0. 92 19. 00 5. 74 5. 24 18. 43 Get a totally different ranking of external managers 26

The M 3 -adjustment – Normalize for Tracking Error Standard deviation (%) Fund Return (%) r(RAP) (%) (1) (2) (3) (4) F 5. 50 0. 00 B 17. 09 13. 27 1. 00 17. 09 1 33. 24 27. 57 0. 71 2 25. 63 24. 93 3 25. 04 4 (6) TE(basic) (%) TE(RAP) (%) r(CAP) (%) (7) (8) (12) 18. 85 20. 45 10. 14 18. 43 0. 77 16. 21 17. 02 9. 04 17. 43 25. 02 0. 73 15. 86 17. 74 9. 68 17. 41 24. 08 21. 33 0. 80 17. 06 13. 34 8. 38 17. 65 5 21. 95 21. 75 0. 59 15. 53 17. 52 11. 97 17. 68 6 21. 90 13. 84 0. 84 21. 21 7. 76 7. 57 19. 26 7 21. 61 14. 37 0. 83 20. 37 8. 13 7. 74 18. 91 8 20. 89 23. 06 0. 79 14. 36 15. 07 8. 69 16. 70 9 20. 77 14. 00 0. 89 19. 97 6. 53 6. 32 18. 83 10 20. 56 14. 79 0. 92 19. 00 5. 74 5. 24 18. 43 Get a totally different ranking of external managers 26

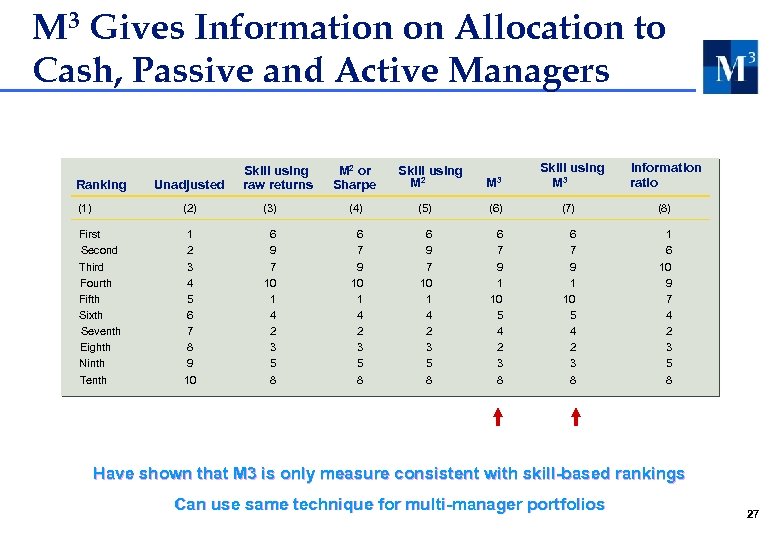

M 3 Gives Information on Allocation to Cash, Passive and Active Managers Ranking Unadjusted Skill using raw returns M 2 or Sharpe Skill using M 2 M 3 Skill using M 3 Information ratio (1) (2) (3) (4) (5) (6) (7) (8) First Second Third Fourth Fifth Sixth Seventh Eighth Ninth Tenth 1 2 3 4 5 6 7 8 9 10 6 9 7 10 1 4 2 3 5 8 6 7 9 10 1 4 2 3 5 8 6 9 7 10 1 4 2 3 5 8 6 7 9 1 10 5 4 2 3 8 1 6 10 9 7 4 2 3 5 8 Have shown that M 3 is only measure consistent with skill-based rankings Can use same technique for multi-manager portfolios 27

M 3 Gives Information on Allocation to Cash, Passive and Active Managers Ranking Unadjusted Skill using raw returns M 2 or Sharpe Skill using M 2 M 3 Skill using M 3 Information ratio (1) (2) (3) (4) (5) (6) (7) (8) First Second Third Fourth Fifth Sixth Seventh Eighth Ninth Tenth 1 2 3 4 5 6 7 8 9 10 6 9 7 10 1 4 2 3 5 8 6 7 9 10 1 4 2 3 5 8 6 9 7 10 1 4 2 3 5 8 6 7 9 1 10 5 4 2 3 8 1 6 10 9 7 4 2 3 5 8 Have shown that M 3 is only measure consistent with skill-based rankings Can use same technique for multi-manager portfolios 27

Caveats and Disclaimers § Data was not provided by OPERS – we used our own and hence actual analysis by OPERS will differ. Data was used to make a hypothetical study of the fund to show the impact of different investment options and was not meant to be an investment recommendation. § We have developed some intelligent allocation rules across various asset classes and sub-asset classes. These are purely research ideas, tapped from publicly available research, and there is no guarantee that they will generate performance in the future for OPERS. § We have attempted to use very onerous transaction costs assumptions to see if these ideas would still be beneficial. Again, OPERS’ own experience will differ because of the size of the fund and other institutional constraints. 28

Caveats and Disclaimers § Data was not provided by OPERS – we used our own and hence actual analysis by OPERS will differ. Data was used to make a hypothetical study of the fund to show the impact of different investment options and was not meant to be an investment recommendation. § We have developed some intelligent allocation rules across various asset classes and sub-asset classes. These are purely research ideas, tapped from publicly available research, and there is no guarantee that they will generate performance in the future for OPERS. § We have attempted to use very onerous transaction costs assumptions to see if these ideas would still be beneficial. Again, OPERS’ own experience will differ because of the size of the fund and other institutional constraints. 28