f1d4a1ca211b1e2e4b42c61427de2cf2.ppt

- Количество слайдов: 19

Act No. 98/2004 Coll. on the Excise Duty on Mineral Oil

Act No. 98/2004 Coll. on the Excise Duty on Mineral Oil

Legislation background • The Act entered into force on 1. 5. 2004 • 18 amendments up to now • The last amendment – Act No. 323/2014 Coll. – entered into force on 1. 12. 2014, on 1. 1. 2015 and on 1. 2. 2015 • Replaced Act No. 239/2001 Coll.

Legislation background • The Act entered into force on 1. 5. 2004 • 18 amendments up to now • The last amendment – Act No. 323/2014 Coll. – entered into force on 1. 12. 2014, on 1. 1. 2015 and on 1. 2. 2015 • Replaced Act No. 239/2001 Coll.

Excise administration is represented by the competent customs offices since 1. 1. 2002.

Excise administration is represented by the competent customs offices since 1. 1. 2002.

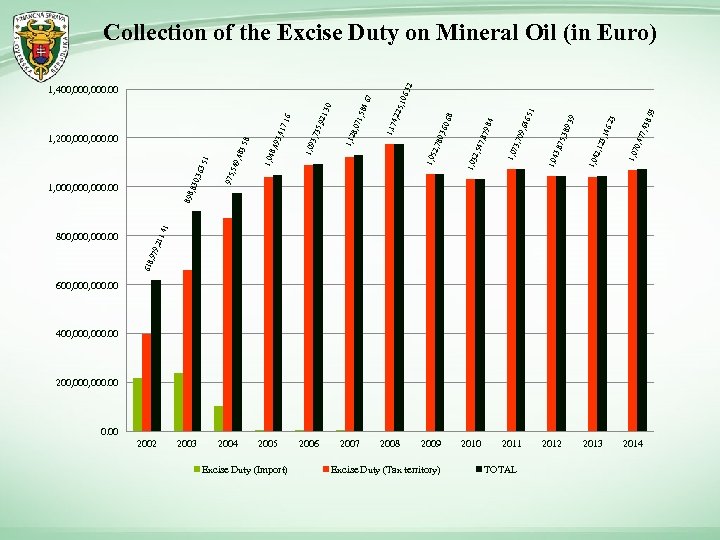

Collection of the Excise Duty on Mineral Oil (in Euro) 7, 43 0, 47 1, 07 6. 23 2, 12 1, 04 3, 14 3, 87 1, 04 5, 38 9. 39 6. 51 9, 64 3, 70 1, 07 1, 03 2, 54 7, 87 9. 84 0. 68 0, 36 2, 78 1, 05 2013 8. 93 6. 32 5, 10 4, 22 1, 17 4. 67 1, 58 1, 12 8, 07 1. 30 5, 92 3, 73 1, 09 8, 49 1, 04 , 483 , 549 2012 . 41 , 211 618 , 979 800, 000. 00 898 1, 000, 000. 00 975 , 830 , 363. 51 . 58 1, 200, 000. 00 3, 41 7. 16 1, 400, 000. 00 600, 000. 00 400, 000. 00 200, 000. 00 2002 2003 2004 2005 Excise Duty (Import) 2006 2007 2008 2009 Excise Duty (Tax territory) 2010 2011 TOTAL 2014

Collection of the Excise Duty on Mineral Oil (in Euro) 7, 43 0, 47 1, 07 6. 23 2, 12 1, 04 3, 14 3, 87 1, 04 5, 38 9. 39 6. 51 9, 64 3, 70 1, 07 1, 03 2, 54 7, 87 9. 84 0. 68 0, 36 2, 78 1, 05 2013 8. 93 6. 32 5, 10 4, 22 1, 17 4. 67 1, 58 1, 12 8, 07 1. 30 5, 92 3, 73 1, 09 8, 49 1, 04 , 483 , 549 2012 . 41 , 211 618 , 979 800, 000. 00 898 1, 000, 000. 00 975 , 830 , 363. 51 . 58 1, 200, 000. 00 3, 41 7. 16 1, 400, 000. 00 600, 000. 00 400, 000. 00 200, 000. 00 2002 2003 2004 2005 Excise Duty (Import) 2006 2007 2008 2009 Excise Duty (Tax territory) 2010 2011 TOTAL 2014

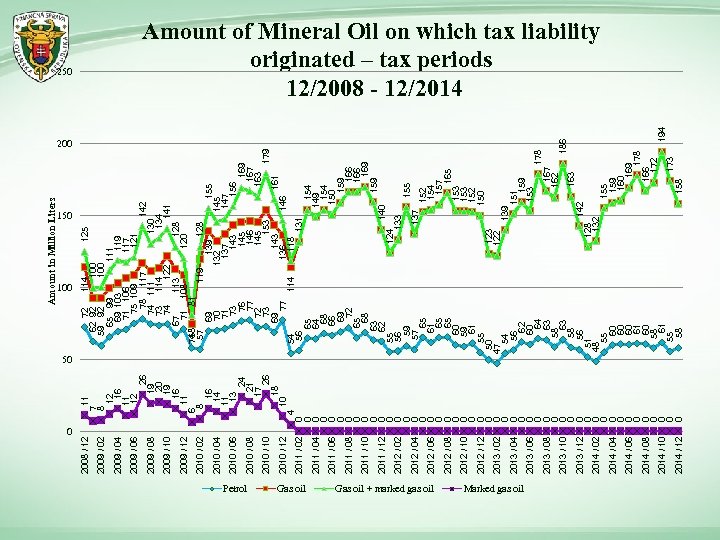

0 Petrol Gas oil + marked gas oil Marked gas oil 2014 / 12 2014 / 10 2014 / 08 2014 / 06 2014 / 04 2014 / 02 2013 / 10 2013 / 08 2013 / 06 2013 / 04 2013 / 02 2012 / 10 2012 / 08 2012 / 06 2012 / 04 2012 / 02 2011 / 10 2011 / 08 2011 / 06 2011 / 04 2011 / 02 2010 / 10 2010 / 08 2010 / 06 2010 / 04 2010 / 02 2009 / 10 2009 / 08 2009 / 06 0 0 0 0 0 0 0 0 0 0 0 0 4 24 21 17 26 18 10 16 14 11 13 6 8 26 19 20 19 16 11 50 2009 / 04 100 72 114 125 62 92 100 59 92 100 65 99 111 69 103 119 117 71 106 75 109 121 78 117 142 74 111 130 73 114 134 74 122 141 67 113 128 71 108 120 74 58 81 57 119 128 69 139 155 70 132 145 71 137 147 73 143 156 76 145 169 77 146 167 72 145 163 73 153 179 69 143 161 77 136 146 54 118 56 131 65 154 64 149 68 154 66 150 69 159 72 166 65 166 68 169 63 159 62 140 55 124 56 133 59 155 57 137 65 152 61 154 65 157 65 165 60 153 59 153 61 152 55 150 50 123 47 122 54 139 56 151 62 159 60 153 64 178 63 167 58 162 63 186 58 163 56 142 51 128 48 132 55 155 60 159 60 160 60 169 61 178 60 166 58 172 61 194 55 173 58 150 2009 / 02 11 7 8 12 16 11 12 2008 / 12 Amount in Million Liters 250 Amount of Mineral Oil on which tax liability originated – tax periods 12/2008 - 12/2014

0 Petrol Gas oil + marked gas oil Marked gas oil 2014 / 12 2014 / 10 2014 / 08 2014 / 06 2014 / 04 2014 / 02 2013 / 10 2013 / 08 2013 / 06 2013 / 04 2013 / 02 2012 / 10 2012 / 08 2012 / 06 2012 / 04 2012 / 02 2011 / 10 2011 / 08 2011 / 06 2011 / 04 2011 / 02 2010 / 10 2010 / 08 2010 / 06 2010 / 04 2010 / 02 2009 / 10 2009 / 08 2009 / 06 0 0 0 0 0 0 0 0 0 0 0 0 4 24 21 17 26 18 10 16 14 11 13 6 8 26 19 20 19 16 11 50 2009 / 04 100 72 114 125 62 92 100 59 92 100 65 99 111 69 103 119 117 71 106 75 109 121 78 117 142 74 111 130 73 114 134 74 122 141 67 113 128 71 108 120 74 58 81 57 119 128 69 139 155 70 132 145 71 137 147 73 143 156 76 145 169 77 146 167 72 145 163 73 153 179 69 143 161 77 136 146 54 118 56 131 65 154 64 149 68 154 66 150 69 159 72 166 65 166 68 169 63 159 62 140 55 124 56 133 59 155 57 137 65 152 61 154 65 157 65 165 60 153 59 153 61 152 55 150 50 123 47 122 54 139 56 151 62 159 60 153 64 178 63 167 58 162 63 186 58 163 56 142 51 128 48 132 55 155 60 159 60 160 60 169 61 178 60 166 58 172 61 194 55 173 58 150 2009 / 02 11 7 8 12 16 11 12 2008 / 12 Amount in Million Liters 250 Amount of Mineral Oil on which tax liability originated – tax periods 12/2008 - 12/2014

Measures of the Financial Administration to combat fraud in motor fuel • Legislation and legislative changes • Active support - a change of the Article 20 Section 1 of the Council Directive 2003/96/ES of 27 October 2003 restructuring the Community framework for the taxation of energy products and electricity • Operative Information Exchange about movements of mineral oils within V 4 countries and regular workshops • Establishment of Working Group on Mineral Oils (2012) • Movements monitoring • Petrol stations control (sampling) • Memorandum of cooperation between the Financial Administration and SAPPO (2013)

Measures of the Financial Administration to combat fraud in motor fuel • Legislation and legislative changes • Active support - a change of the Article 20 Section 1 of the Council Directive 2003/96/ES of 27 October 2003 restructuring the Community framework for the taxation of energy products and electricity • Operative Information Exchange about movements of mineral oils within V 4 countries and regular workshops • Establishment of Working Group on Mineral Oils (2012) • Movements monitoring • Petrol stations control (sampling) • Memorandum of cooperation between the Financial Administration and SAPPO (2013)

Marked gas oil (1. 1. 2002 – 31. 12. 2010) If the gas oil (diesel) was used as a) fuel, b) motor fuel for propulsion in rail transport, c) motor fuel for propulsion of machines used exclusively in the area of agricultural and forestry production, d) motor fuel for propulsion of engines of stationary equipment aimed at the electricity production, could be tax favored = reduced tax rate was used.

Marked gas oil (1. 1. 2002 – 31. 12. 2010) If the gas oil (diesel) was used as a) fuel, b) motor fuel for propulsion in rail transport, c) motor fuel for propulsion of machines used exclusively in the area of agricultural and forestry production, d) motor fuel for propulsion of engines of stationary equipment aimed at the electricity production, could be tax favored = reduced tax rate was used.

Conditions of tax relief: a) mineral oil was marked by indication substance and red color, b) mineral oil could be marked by registered warehousekeeper only in tax territory on the basis of permission issued by customs office, c) only registered user enterprise could receive a tax favored mineral oil on the basis of an exemption certificate and was obliged to prove a using of tax favored mineral oil on stated purpose to the customs office, d) within the tax supervision, customs office established and controlled also a storage method of tax favored mineral oil (verified storage tanks).

Conditions of tax relief: a) mineral oil was marked by indication substance and red color, b) mineral oil could be marked by registered warehousekeeper only in tax territory on the basis of permission issued by customs office, c) only registered user enterprise could receive a tax favored mineral oil on the basis of an exemption certificate and was obliged to prove a using of tax favored mineral oil on stated purpose to the customs office, d) within the tax supervision, customs office established and controlled also a storage method of tax favored mineral oil (verified storage tanks).

Some figures: a) Number of registered user enterprises entitled to use marked gas oil (diesel) – about 5, 800 b) Average monthly consumption amount of marked gas oil (diesel) – 15 million liters Nevertheless, a review of the use and storage of motor fuel (gas oil and petrol) used for other purposes (for example cargo transport, building activities, mining activities, etc. ) absents, respectively of the other mineral oils which could be used as fuel or motor fuel or mixed with the fuel and motor fuel.

Some figures: a) Number of registered user enterprises entitled to use marked gas oil (diesel) – about 5, 800 b) Average monthly consumption amount of marked gas oil (diesel) – 15 million liters Nevertheless, a review of the use and storage of motor fuel (gas oil and petrol) used for other purposes (for example cargo transport, building activities, mining activities, etc. ) absents, respectively of the other mineral oils which could be used as fuel or motor fuel or mixed with the fuel and motor fuel.

Trader with selected mineral oil (since 1. 5. 2006 to the present) Since 1. 5. 2006 – trader who traded in tax territory with: a) marked mineral oil, b) mineral oil without a specified tax rate subjects to control and the movement procedure (for example naphtha), c) biogenic substance, d) heating oil.

Trader with selected mineral oil (since 1. 5. 2006 to the present) Since 1. 5. 2006 – trader who traded in tax territory with: a) marked mineral oil, b) mineral oil without a specified tax rate subjects to control and the movement procedure (for example naphtha), c) biogenic substance, d) heating oil.

Since 1. 4. 2012 – the group of mineral oils whose trading is subject to the registration (if they are in containers larger than 210 liters) extended, namely: a) lubricating oils and other mineral oils within CN codes 2710 19 91 to 2710 19 99, b) Mineral oil that could be used as fuel, motor fuel, additive to motor fuel or be offered to these purposes.

Since 1. 4. 2012 – the group of mineral oils whose trading is subject to the registration (if they are in containers larger than 210 liters) extended, namely: a) lubricating oils and other mineral oils within CN codes 2710 19 91 to 2710 19 99, b) Mineral oil that could be used as fuel, motor fuel, additive to motor fuel or be offered to these purposes.

Since 1. 3. 2013 – the group of mineral oils whose trading is subject to registration (if they are in containers larger than 210 liters) extended more, namely: lubricating and other mineral oils within CN codes 2710 19 71 to 2710 19 83, 2710 19 87 a 3403 19 10 (for example motor oils. . . ). Since 1. 11. 2013 – packaging volume was modified follows: 150 liters, respectively 230 liters for some mineral oils. Mineral oils within CN codes 2710 19 71 to 2710 19 83, 2710 19 87 to 2710 19 99 are subject to the control and movement procedure in tax territory and trader with selected mineral oil is obliged to notify the customs office of each dispatch to another Member State and receipt from another Member State, import and export of these selected mineral oils in advance. Number of traders with selected mineral oil – 734

Since 1. 3. 2013 – the group of mineral oils whose trading is subject to registration (if they are in containers larger than 210 liters) extended more, namely: lubricating and other mineral oils within CN codes 2710 19 71 to 2710 19 83, 2710 19 87 a 3403 19 10 (for example motor oils. . . ). Since 1. 11. 2013 – packaging volume was modified follows: 150 liters, respectively 230 liters for some mineral oils. Mineral oils within CN codes 2710 19 71 to 2710 19 83, 2710 19 87 to 2710 19 99 are subject to the control and movement procedure in tax territory and trader with selected mineral oil is obliged to notify the customs office of each dispatch to another Member State and receipt from another Member State, import and export of these selected mineral oils in advance. Number of traders with selected mineral oil – 734

Seller of motor fuel (since 1. 4. 2012 to 28. 2. 2013) Seller of motor fuel is registered since 1. 4. 2012 and means a person who wants, within the business, to sell in free circulation in the tax territory for a final consumption a) petrol, b) gas oil (diesel) or c) liquefied gaseous hydrocarbons (LPG).

Seller of motor fuel (since 1. 4. 2012 to 28. 2. 2013) Seller of motor fuel is registered since 1. 4. 2012 and means a person who wants, within the business, to sell in free circulation in the tax territory for a final consumption a) petrol, b) gas oil (diesel) or c) liquefied gaseous hydrocarbons (LPG).

Seller, Distributor and Consumer of Motor Fuel (since 1. 3. 2013 to the present) Since 1. 3. 2013 – new types of tax subjects are registered: Distributor and Consumer of Motor Fuel Distributor of Motor Fuel = person who wants to distribute, within the business, in tax territory in free circulation (wholesale) a) petrol, b) gas oil (diesel) or c) liquefied gaseous hydrocarbons (LPG).

Seller, Distributor and Consumer of Motor Fuel (since 1. 3. 2013 to the present) Since 1. 3. 2013 – new types of tax subjects are registered: Distributor and Consumer of Motor Fuel Distributor of Motor Fuel = person who wants to distribute, within the business, in tax territory in free circulation (wholesale) a) petrol, b) gas oil (diesel) or c) liquefied gaseous hydrocarbons (LPG).

Consumer of Motor Fuel = person who buys in tax territory in free circulation for own consumption a) petrol, b) gas oil (diesel) or c) liquefied gaseous hydrocarbons and these storages in storage facility with a capacity 15, 000 liters and more.

Consumer of Motor Fuel = person who buys in tax territory in free circulation for own consumption a) petrol, b) gas oil (diesel) or c) liquefied gaseous hydrocarbons and these storages in storage facility with a capacity 15, 000 liters and more.

Requirements for a storage facility (for all three types of tax subjects) a) has to satisfy conditions of fire safety and environmental protection, b) is provided with a suitable certified measuring equipment allowing demonstrably to measure a received, issued and stored quantity of motor fuel flowing in and out.

Requirements for a storage facility (for all three types of tax subjects) a) has to satisfy conditions of fire safety and environmental protection, b) is provided with a suitable certified measuring equipment allowing demonstrably to measure a received, issued and stored quantity of motor fuel flowing in and out.

Since 1. 2. 2015 – the last conditions update for trading with motor fuel yet. New conditions for: § Seller of Motor Fuel – is obliged to sell motor fuel for final consumption only by dispensers with certified measuring equipment, § Consumer of Motor Fuel = person who wants to buy motor fuel within its business in tax territory in free circulation for own consumption. If this person storages a motor fuel, has to meet continue all conditions for storage facility, independent of the volume of the storage facility. (exception: consumer packaging for final consumption). Consumer of Motor Fuel may buy motor fuel by Distributor of Motor Fuel only.

Since 1. 2. 2015 – the last conditions update for trading with motor fuel yet. New conditions for: § Seller of Motor Fuel – is obliged to sell motor fuel for final consumption only by dispensers with certified measuring equipment, § Consumer of Motor Fuel = person who wants to buy motor fuel within its business in tax territory in free circulation for own consumption. If this person storages a motor fuel, has to meet continue all conditions for storage facility, independent of the volume of the storage facility. (exception: consumer packaging for final consumption). Consumer of Motor Fuel may buy motor fuel by Distributor of Motor Fuel only.

Number of tax subjects • Distributor of Motor Fuel: 315 • Seller of Motor Fuel: 641 • Consumer of Motor Fuel: 1 398

Number of tax subjects • Distributor of Motor Fuel: 315 • Seller of Motor Fuel: 641 • Consumer of Motor Fuel: 1 398

Thank you for your attention

Thank you for your attention