db5ce8696518e1d4bd5dbad65a89d76b.ppt

- Количество слайдов: 36

Acquisition Finance Market Overview Structuring The Deal Joseph V. Rizzi Amsterdam Institute of Finance 10 -12 October, 2016 Login to our free WIFI Login: AIFGUEST Password: welcome@aif Share your AIF experience @AIFknowledge #AIF

Acquisition Finance Market Overview Structuring The Deal Joseph V. Rizzi Amsterdam Institute of Finance 10 -12 October, 2016 Login to our free WIFI Login: AIFGUEST Password: welcome@aif Share your AIF experience @AIFknowledge #AIF

Sponsor Based Leveraged Acquisition Market Overview and Participants Joseph V. Rizzi Amsterdam Institute of Finance October, 2016

Sponsor Based Leveraged Acquisition Market Overview and Participants Joseph V. Rizzi Amsterdam Institute of Finance October, 2016

Acquisition/Leveraged Finance Transaction: Buyout, Acquisition or Recapitalization Leverage: Resulting in highly leveraged (i. e. , non investment grade) obligor – FD/EBITDA > 3 X Subject to market availability and pricing (function of risk appetite Deal Types: Acquisition Recapitalization Refinance PTP (Public to Private) STS (Sponsor to Sponsor, aka Pass the Parcel) PE Importance: Substantial source of investment banking revenues and M&A volume Amsterdam Institute of Finance October, 2016 3

Acquisition/Leveraged Finance Transaction: Buyout, Acquisition or Recapitalization Leverage: Resulting in highly leveraged (i. e. , non investment grade) obligor – FD/EBITDA > 3 X Subject to market availability and pricing (function of risk appetite Deal Types: Acquisition Recapitalization Refinance PTP (Public to Private) STS (Sponsor to Sponsor, aka Pass the Parcel) PE Importance: Substantial source of investment banking revenues and M&A volume Amsterdam Institute of Finance October, 2016 3

Global M&A (1 H 16) Off Record 2015 by 19% - slowest opening in 2 years Factors Cash Balances Low Rates Positive Response Confidence Volatile Stock Prices Increase in Shareholder Activism Political – Antitrust, Brexit PE: Dog that didn’t bark – Strategic Acquirers crowd-out Lowest % of M&A in years Reflects dearth of larger PTP deals Volume down 2016 v double digit M&A increase Average deal size: € 375 mln v € 600 mln + 2007 peak PPX: 14 X + Strategic; 10 X + PE Drop in cash in favor of stock/stock + cash Amsterdam Institute of Finance October, 2016 4

Global M&A (1 H 16) Off Record 2015 by 19% - slowest opening in 2 years Factors Cash Balances Low Rates Positive Response Confidence Volatile Stock Prices Increase in Shareholder Activism Political – Antitrust, Brexit PE: Dog that didn’t bark – Strategic Acquirers crowd-out Lowest % of M&A in years Reflects dearth of larger PTP deals Volume down 2016 v double digit M&A increase Average deal size: € 375 mln v € 600 mln + 2007 peak PPX: 14 X + Strategic; 10 X + PE Drop in cash in favor of stock/stock + cash Amsterdam Institute of Finance October, 2016 4

Top 10 Leveraged Loan Issuer Country 1 H 16 (Based on Volume) France UK Germany Netherlands Italy Belgium Spain Sweden Switzerland Denmark Amsterdam Institute of Finance October, 2016 22% 20% 12% 10% 6. 5% 6% 5% 3% 3% 2% 4

Top 10 Leveraged Loan Issuer Country 1 H 16 (Based on Volume) France UK Germany Netherlands Italy Belgium Spain Sweden Switzerland Denmark Amsterdam Institute of Finance October, 2016 22% 20% 12% 10% 6. 5% 6% 5% 3% 3% 2% 4

Top 10 EMEA Involvement Announced Deals 1/1/16 – 6/30/16 Target Monsanto Syngenta Johnson Credit Agricole LSE Sanofi Amral Media Medivation Supercell FCC Amsterdam Institute of Finance October, 2016 Acquirer Bayer CAAC Tyco Sacam Deutsche Boerse Roehringer Mylan Sanofi Tenent Contrel USD 61 B 46 B 27 B 20 B 12 B 10 B 8 B 8 B 8 B 6

Top 10 EMEA Involvement Announced Deals 1/1/16 – 6/30/16 Target Monsanto Syngenta Johnson Credit Agricole LSE Sanofi Amral Media Medivation Supercell FCC Amsterdam Institute of Finance October, 2016 Acquirer Bayer CAAC Tyco Sacam Deutsche Boerse Roehringer Mylan Sanofi Tenent Contrel USD 61 B 46 B 27 B 20 B 12 B 10 B 8 B 8 B 8 B 6

Impact of Market & Political Uncertainty Investor Risk Appetite Pricing Structuring Arrangers: Increased syndications risk Issuers/Acquirers: Increased deal risk Brexit Amsterdam Institute of Finance October, 2016 7

Impact of Market & Political Uncertainty Investor Risk Appetite Pricing Structuring Arrangers: Increased syndications risk Issuers/Acquirers: Increased deal risk Brexit Amsterdam Institute of Finance October, 2016 7

Success Factors Tests Amsterdam Institute of Finance October, 2016 Deal Size Timing Price Financing Consideration – Stock/Cash Buyer Execution Deal Type Best Owner Iron Law 8

Success Factors Tests Amsterdam Institute of Finance October, 2016 Deal Size Timing Price Financing Consideration – Stock/Cash Buyer Execution Deal Type Best Owner Iron Law 8

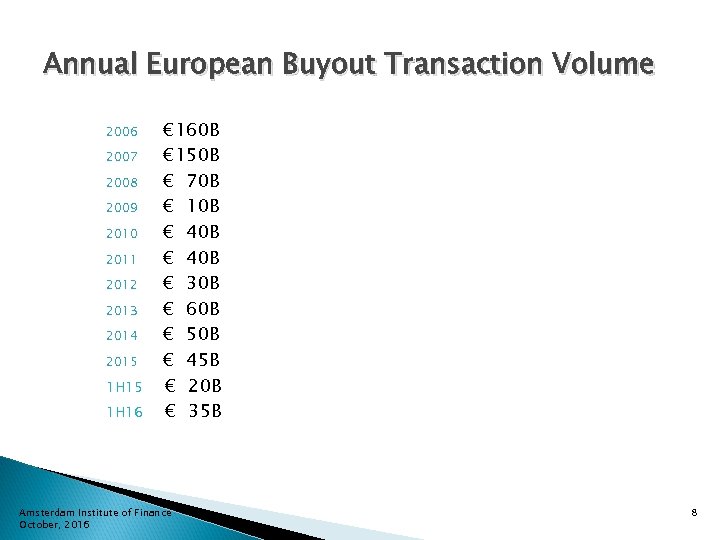

Annual European Buyout Transaction Volume 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 1 H 16 € 160 B € 150 B € 70 B € 10 B € 40 B € 30 B € 60 B € 50 B € 45 B € 20 B € 35 B Amsterdam Institute of Finance October, 2016 8

Annual European Buyout Transaction Volume 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 1 H 16 € 160 B € 150 B € 70 B € 10 B € 40 B € 30 B € 60 B € 50 B € 45 B € 20 B € 35 B Amsterdam Institute of Finance October, 2016 8

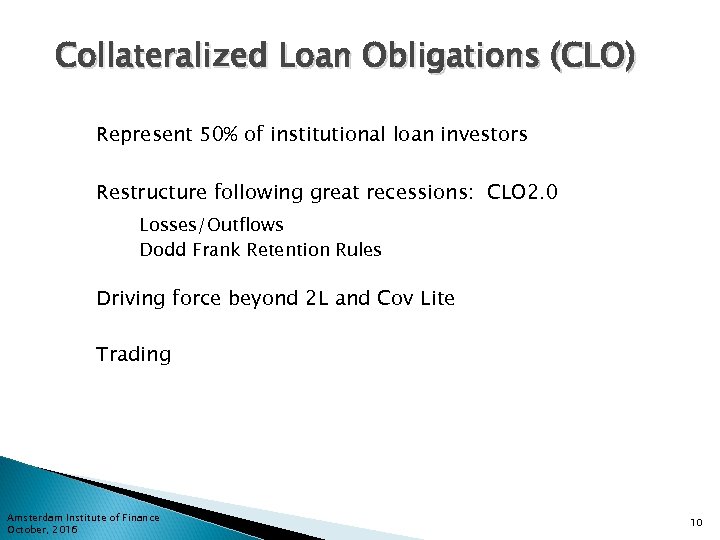

Collateralized Loan Obligations (CLO) Represent 50% of institutional loan investors Restructure following great recessions: CLO 2. 0 Losses/Outflows Dodd Frank Retention Rules Driving force beyond 2 L and Cov Lite Trading Amsterdam Institute of Finance October, 2016 10

Collateralized Loan Obligations (CLO) Represent 50% of institutional loan investors Restructure following great recessions: CLO 2. 0 Losses/Outflows Dodd Frank Retention Rules Driving force beyond 2 L and Cov Lite Trading Amsterdam Institute of Finance October, 2016 10

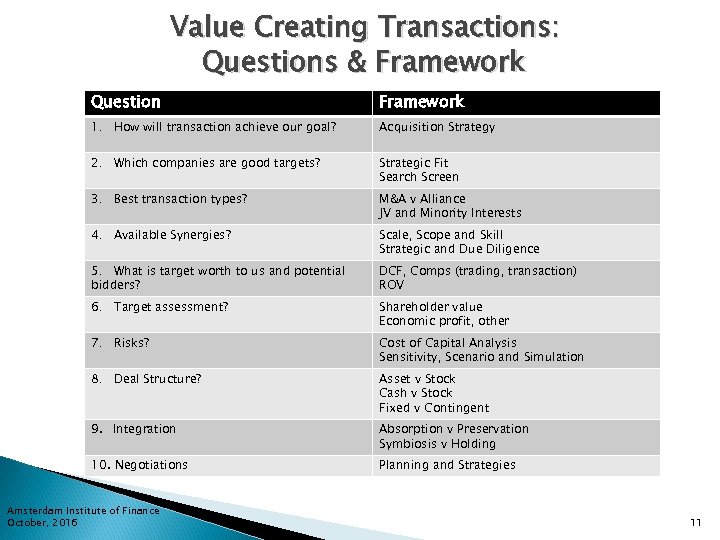

Value Creating Transactions: Questions & Framework Question Framework 1. How will transaction achieve our goal? Acquisition Strategy 2. Which companies are good targets? Strategic Fit Search Screen 3. Best transaction types? M&A v Alliance JV and Minority Interests 4. Available Synergies? Scale, Scope and Skill Strategic and Due Diligence 5. What is target worth to us and potential bidders? DCF, Comps (trading, transaction) ROV 6. Target assessment? Shareholder value Economic profit, other 7. Risks? Cost of Capital Analysis Sensitivity, Scenario and Simulation 8. Deal Structure? Asset v Stock Cash v Stock Fixed v Contingent 9. Integration Absorption v Preservation Symbiosis v Holding 10. Negotiations Planning and Strategies Amsterdam Institute of Finance October, 2016 11

Value Creating Transactions: Questions & Framework Question Framework 1. How will transaction achieve our goal? Acquisition Strategy 2. Which companies are good targets? Strategic Fit Search Screen 3. Best transaction types? M&A v Alliance JV and Minority Interests 4. Available Synergies? Scale, Scope and Skill Strategic and Due Diligence 5. What is target worth to us and potential bidders? DCF, Comps (trading, transaction) ROV 6. Target assessment? Shareholder value Economic profit, other 7. Risks? Cost of Capital Analysis Sensitivity, Scenario and Simulation 8. Deal Structure? Asset v Stock Cash v Stock Fixed v Contingent 9. Integration Absorption v Preservation Symbiosis v Holding 10. Negotiations Planning and Strategies Amsterdam Institute of Finance October, 2016 11

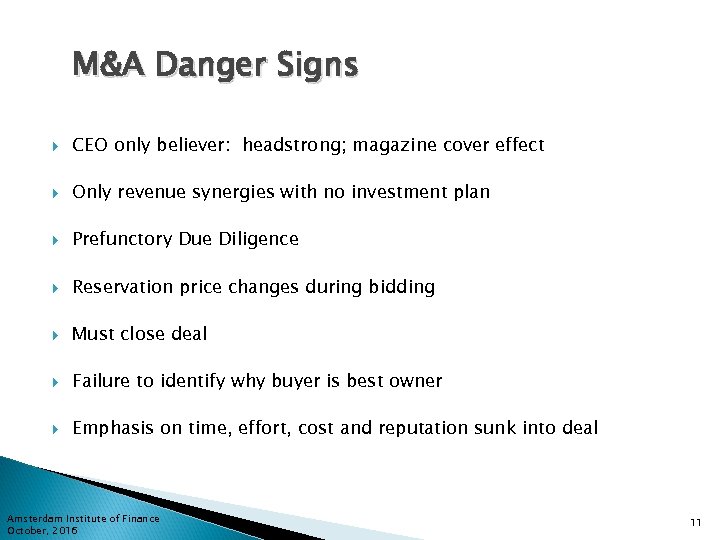

M&A Danger Signs CEO only believer: headstrong; magazine cover effect Only revenue synergies with no investment plan Prefunctory Due Diligence Reservation price changes during bidding Must close deal Failure to identify why buyer is best owner Emphasis on time, effort, cost and reputation sunk into deal Amsterdam Institute of Finance October, 2016 11

M&A Danger Signs CEO only believer: headstrong; magazine cover effect Only revenue synergies with no investment plan Prefunctory Due Diligence Reservation price changes during bidding Must close deal Failure to identify why buyer is best owner Emphasis on time, effort, cost and reputation sunk into deal Amsterdam Institute of Finance October, 2016 11

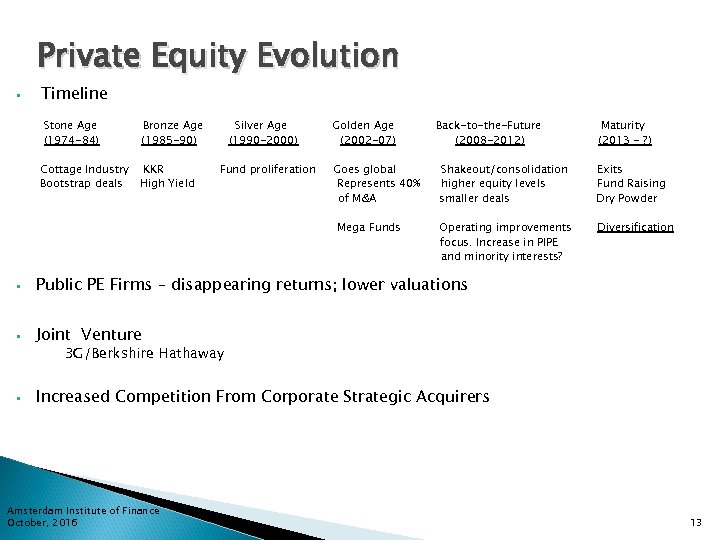

Private Equity Evolution • Timeline Stone Age (1974 -84) Cottage Industry Bootstrap deals Bronze Age (1985 -90) KKR High Yield Silver Age (1990 -2000) Fund proliferation Golden Age (2002 -07) Goes global Represents 40% of M&A Mega Funds Back-to-the-Future (2008 -2012) Maturity (2013 - ? ) Shakeout/consolidation higher equity levels smaller deals Exits Fund Raising Dry Powder Operating improvements focus. Increase in PIPE and minority interests? Diversification • Public PE Firms – disappearing returns; lower valuations • Joint Venture 3 G/Berkshire Hathaway • Increased Competition From Corporate Strategic Acquirers Amsterdam Institute of Finance October, 2016 13

Private Equity Evolution • Timeline Stone Age (1974 -84) Cottage Industry Bootstrap deals Bronze Age (1985 -90) KKR High Yield Silver Age (1990 -2000) Fund proliferation Golden Age (2002 -07) Goes global Represents 40% of M&A Mega Funds Back-to-the-Future (2008 -2012) Maturity (2013 - ? ) Shakeout/consolidation higher equity levels smaller deals Exits Fund Raising Dry Powder Operating improvements focus. Increase in PIPE and minority interests? Diversification • Public PE Firms – disappearing returns; lower valuations • Joint Venture 3 G/Berkshire Hathaway • Increased Competition From Corporate Strategic Acquirers Amsterdam Institute of Finance October, 2016 13

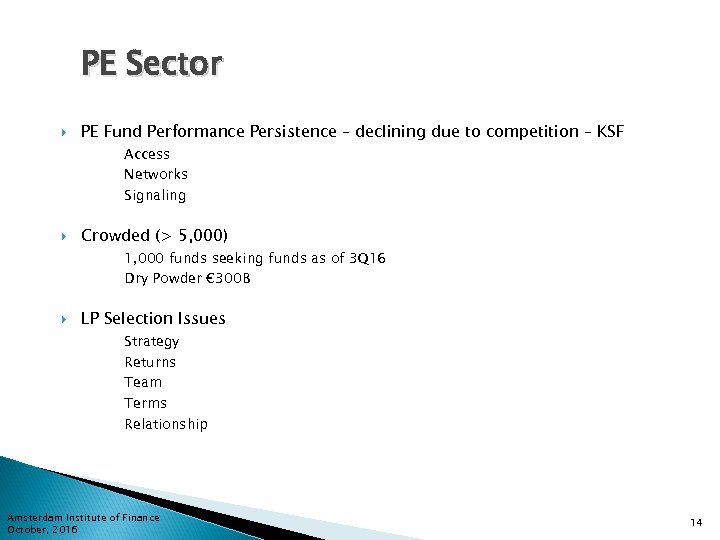

PE Sector PE Fund Performance Persistence – declining due to competition – KSF Access Networks Signaling Crowded (> 5, 000) 1, 000 funds seeking funds as of 3 Q 16 Dry Powder € 300 B LP Selection Issues Strategy Returns Team Terms Relationship Amsterdam Institute of Finance October, 2016 14

PE Sector PE Fund Performance Persistence – declining due to competition – KSF Access Networks Signaling Crowded (> 5, 000) 1, 000 funds seeking funds as of 3 Q 16 Dry Powder € 300 B LP Selection Issues Strategy Returns Team Terms Relationship Amsterdam Institute of Finance October, 2016 14

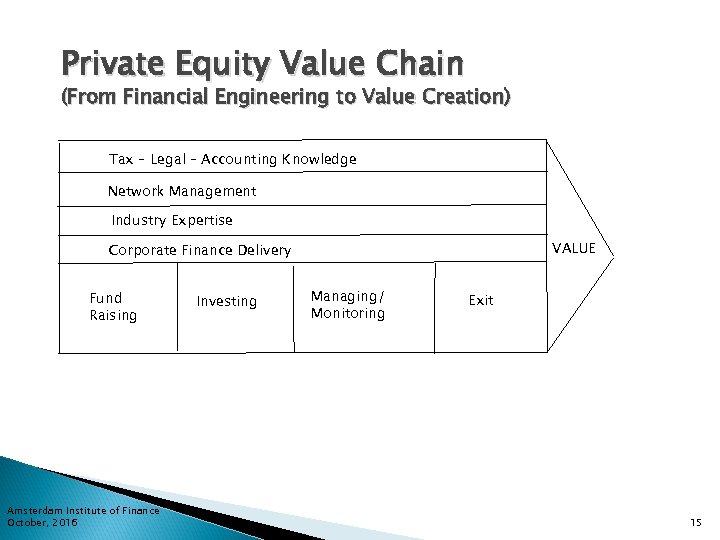

Private Equity Value Chain (From Financial Engineering to Value Creation) Tax – Legal – Accounting Knowledge Network Management Industry Expertise VALUE Corporate Finance Delivery Fund Raising Amsterdam Institute of Finance October, 2016 Investing Managing/ Monitoring Exit 15

Private Equity Value Chain (From Financial Engineering to Value Creation) Tax – Legal – Accounting Knowledge Network Management Industry Expertise VALUE Corporate Finance Delivery Fund Raising Amsterdam Institute of Finance October, 2016 Investing Managing/ Monitoring Exit 15

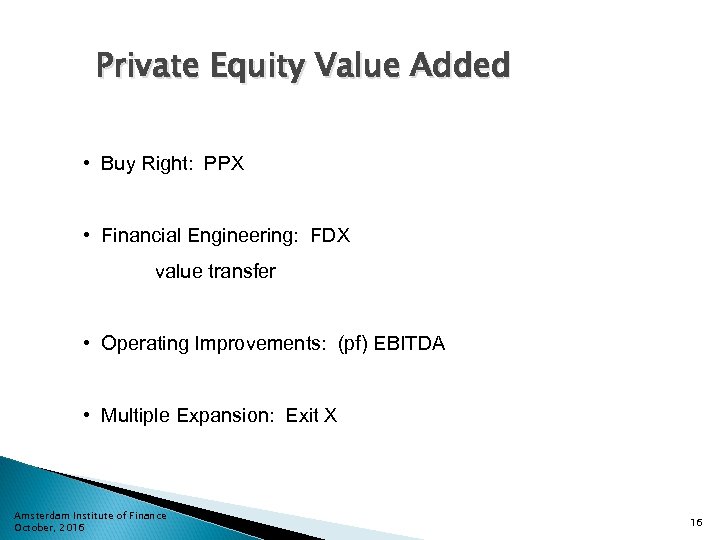

Private Equity Value Added • Buy Right: PPX • Financial Engineering: FDX value transfer • Operating Improvements: (pf) EBITDA • Multiple Expansion: Exit X Amsterdam Institute of Finance October, 2016 16

Private Equity Value Added • Buy Right: PPX • Financial Engineering: FDX value transfer • Operating Improvements: (pf) EBITDA • Multiple Expansion: Exit X Amsterdam Institute of Finance October, 2016 16

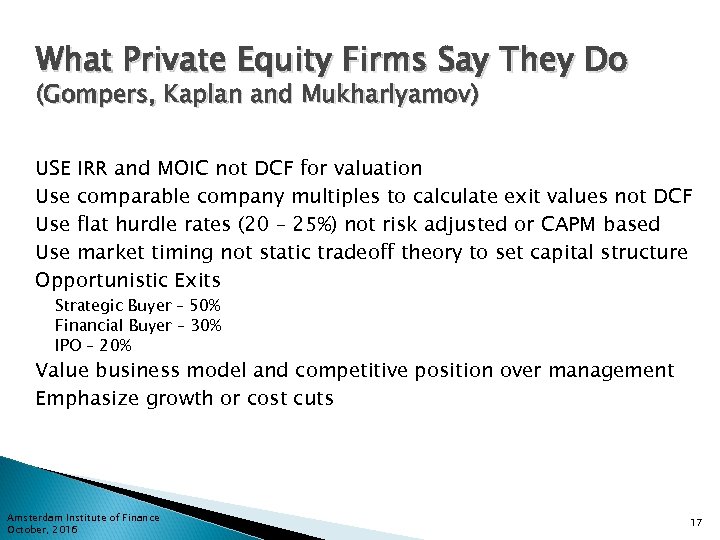

What Private Equity Firms Say They Do (Gompers, Kaplan and Mukharlyamov) USE IRR and MOIC not DCF for valuation Use comparable company multiples to calculate exit values not DCF Use flat hurdle rates (20 – 25%) not risk adjusted or CAPM based Use market timing not static tradeoff theory to set capital structure Opportunistic Exits Strategic Buyer – 50% Financial Buyer – 30% IPO – 20% Value business model and competitive position over management Emphasize growth or cost cuts Amsterdam Institute of Finance October, 2016 17

What Private Equity Firms Say They Do (Gompers, Kaplan and Mukharlyamov) USE IRR and MOIC not DCF for valuation Use comparable company multiples to calculate exit values not DCF Use flat hurdle rates (20 – 25%) not risk adjusted or CAPM based Use market timing not static tradeoff theory to set capital structure Opportunistic Exits Strategic Buyer – 50% Financial Buyer – 30% IPO – 20% Value business model and competitive position over management Emphasize growth or cost cuts Amsterdam Institute of Finance October, 2016 17

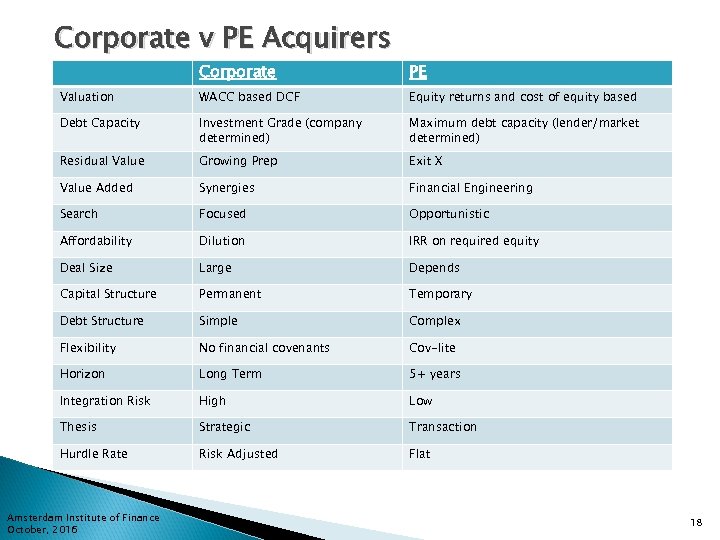

Corporate v PE Acquirers Corporate PE Valuation WACC based DCF Equity returns and cost of equity based Debt Capacity Investment Grade (company determined) Maximum debt capacity (lender/market determined) Residual Value Growing Prep Exit X Value Added Synergies Financial Engineering Search Focused Opportunistic Affordability Dilution IRR on required equity Deal Size Large Depends Capital Structure Permanent Temporary Debt Structure Simple Complex Flexibility No financial covenants Cov-lite Horizon Long Term 5+ years Integration Risk High Low Thesis Strategic Transaction Hurdle Rate Risk Adjusted Flat Amsterdam Institute of Finance October, 2016 18

Corporate v PE Acquirers Corporate PE Valuation WACC based DCF Equity returns and cost of equity based Debt Capacity Investment Grade (company determined) Maximum debt capacity (lender/market determined) Residual Value Growing Prep Exit X Value Added Synergies Financial Engineering Search Focused Opportunistic Affordability Dilution IRR on required equity Deal Size Large Depends Capital Structure Permanent Temporary Debt Structure Simple Complex Flexibility No financial covenants Cov-lite Horizon Long Term 5+ years Integration Risk High Low Thesis Strategic Transaction Hurdle Rate Risk Adjusted Flat Amsterdam Institute of Finance October, 2016 18

Most Active Sponsors – Top 20 Sponsor LTM – 1 H 16 Ardian Share 7. 29% Carlyle Group 6. 25% Bridgepoint Capital 5. 21% CVC Kohlberg, Kravis & Roberts Cinven Ltd EQT Partners PAI Management Permira Apollo Management Bain Capital BC Partners Blackstone Group Charterhouse Equity Partners Clayton, Dubilier & Rice Eurazeo FSN Capital A/S Gilde Investments Hellman & Friedman KIRKBI A/S 6. 25% 5. 21% 3. 13% 2. 08% 2. 08% Most Active Sponsors reflects activity based upon all sponsors named on a transaction. Share is based upon transaction count. Amsterdam Institute of Finance October, 2016 Source: S&P Global 19

Most Active Sponsors – Top 20 Sponsor LTM – 1 H 16 Ardian Share 7. 29% Carlyle Group 6. 25% Bridgepoint Capital 5. 21% CVC Kohlberg, Kravis & Roberts Cinven Ltd EQT Partners PAI Management Permira Apollo Management Bain Capital BC Partners Blackstone Group Charterhouse Equity Partners Clayton, Dubilier & Rice Eurazeo FSN Capital A/S Gilde Investments Hellman & Friedman KIRKBI A/S 6. 25% 5. 21% 3. 13% 2. 08% 2. 08% Most Active Sponsors reflects activity based upon all sponsors named on a transaction. Share is based upon transaction count. Amsterdam Institute of Finance October, 2016 Source: S&P Global 19

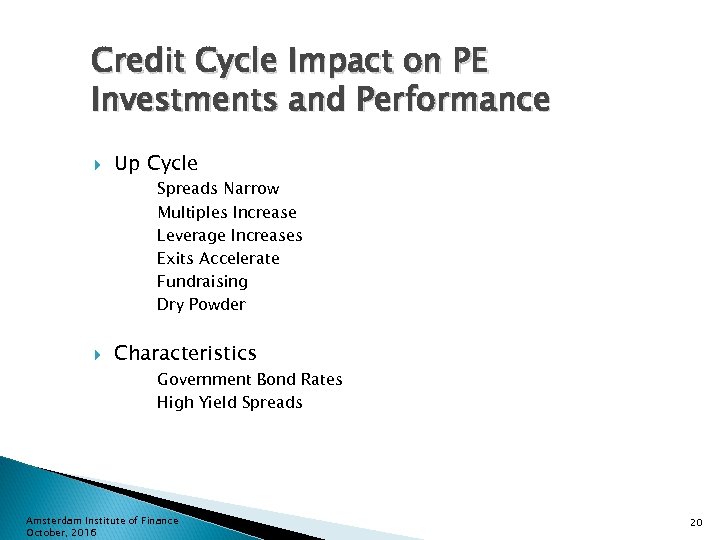

Credit Cycle Impact on PE Investments and Performance Up Cycle Spreads Narrow Multiples Increase Leverage Increases Exits Accelerate Fundraising Dry Powder Characteristics Government Bond Rates High Yield Spreads Amsterdam Institute of Finance October, 2016 20

Credit Cycle Impact on PE Investments and Performance Up Cycle Spreads Narrow Multiples Increase Leverage Increases Exits Accelerate Fundraising Dry Powder Characteristics Government Bond Rates High Yield Spreads Amsterdam Institute of Finance October, 2016 20

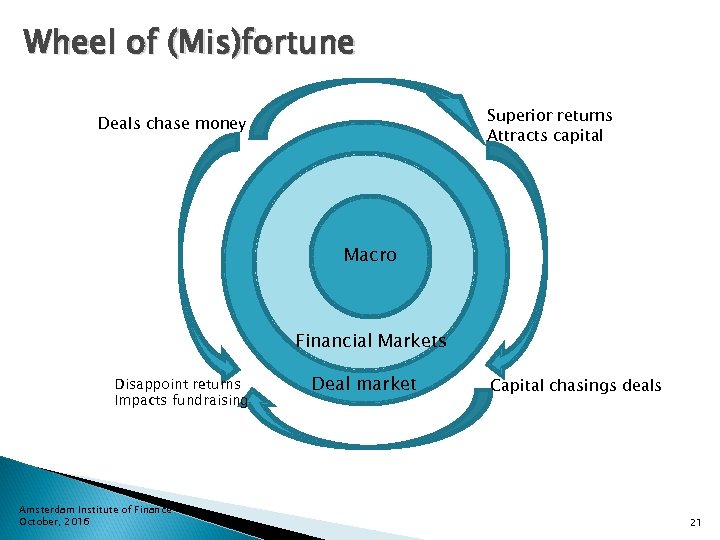

Wheel of (Mis)fortune Superior returns Attracts capital Deals chase money Macro Financial Markets Disappoint returns Impacts fundraising Amsterdam Institute of Finance October, 2016 Deal market Capital chasings deals 21

Wheel of (Mis)fortune Superior returns Attracts capital Deals chase money Macro Financial Markets Disappoint returns Impacts fundraising Amsterdam Institute of Finance October, 2016 Deal market Capital chasings deals 21

A Typical Private Equity Structure Diagram US Investors Fund manager US Exempt Investors General Carried interest LP LP LP Partner partner A B C Non-US Investors FUND Nominee Investment CLO Leverage finance Hedge funds syndicate participants Investment Bridge finance Syndicate participants Amsterdam Institute of Finance October, 2016 Investment Hold Co. Bank FLL SLL Investment High Yield Investors Hold Co. Operating Entity Mezzanine Investors 22

A Typical Private Equity Structure Diagram US Investors Fund manager US Exempt Investors General Carried interest LP LP LP Partner partner A B C Non-US Investors FUND Nominee Investment CLO Leverage finance Hedge funds syndicate participants Investment Bridge finance Syndicate participants Amsterdam Institute of Finance October, 2016 Investment Hold Co. Bank FLL SLL Investment High Yield Investors Hold Co. Operating Entity Mezzanine Investors 22

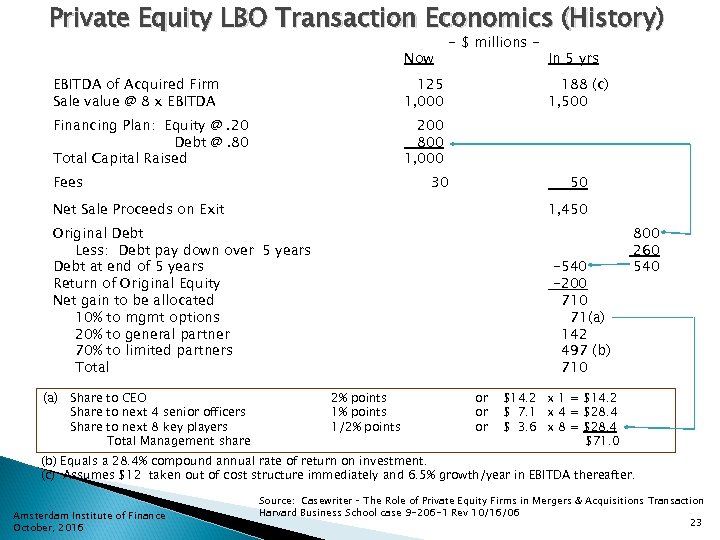

Private Equity LBO Transaction Economics (History) Now EBITDA of Acquired Firm Sale value @ 8 x EBITDA 125 1, 000 Financing Plan: Equity @. 20 Debt @. 80 Total Capital Raised - $ millions - In 5 yrs 200 800 1, 000 Fees 188 (c) 1, 500 30 50 Net Sale Proceeds on Exit 1, 450 Original Debt Less: Debt pay down over 5 years Debt at end of 5 years Return of Original Equity Net gain to be allocated 10% to mgmt options 20% to general partner 70% to limited partners Total (a) Share to CEO Share to next 4 senior officers Share to next 8 key players Total Management share -540 -200 71(a) 142 497 (b) 710 2% points 1/2% points or or or 800 260 540 $14. 2 x 1 = $14. 2 $ 7. 1 x 4 = $28. 4 $ 3. 6 x 8 = $28. 4 $71. 0 (b) Equals a 28. 4% compound annual rate of return on investment. (c) Assumes $12 taken out of cost structure immediately and 6. 5% growth/year in EBITDA thereafter. Amsterdam Institute of Finance October, 2016 Source: Casewriter – The Role of Private Equity Firms in Mergers & Acquisitions Transaction Harvard Business School case 9 -206 -1 Rev 10/16/06 23

Private Equity LBO Transaction Economics (History) Now EBITDA of Acquired Firm Sale value @ 8 x EBITDA 125 1, 000 Financing Plan: Equity @. 20 Debt @. 80 Total Capital Raised - $ millions - In 5 yrs 200 800 1, 000 Fees 188 (c) 1, 500 30 50 Net Sale Proceeds on Exit 1, 450 Original Debt Less: Debt pay down over 5 years Debt at end of 5 years Return of Original Equity Net gain to be allocated 10% to mgmt options 20% to general partner 70% to limited partners Total (a) Share to CEO Share to next 4 senior officers Share to next 8 key players Total Management share -540 -200 71(a) 142 497 (b) 710 2% points 1/2% points or or or 800 260 540 $14. 2 x 1 = $14. 2 $ 7. 1 x 4 = $28. 4 $ 3. 6 x 8 = $28. 4 $71. 0 (b) Equals a 28. 4% compound annual rate of return on investment. (c) Assumes $12 taken out of cost structure immediately and 6. 5% growth/year in EBITDA thereafter. Amsterdam Institute of Finance October, 2016 Source: Casewriter – The Role of Private Equity Firms in Mergers & Acquisitions Transaction Harvard Business School case 9 -206 -1 Rev 10/16/06 23

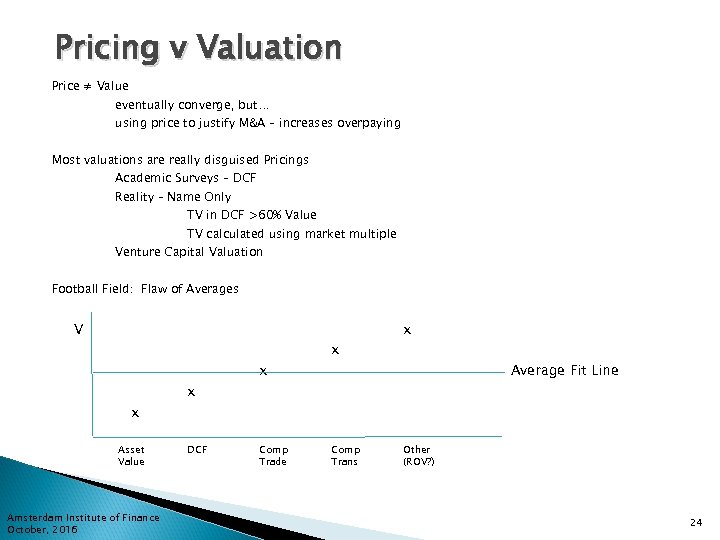

Pricing v Valuation Price ≠ Value eventually converge, but… using price to justify M&A – increases overpaying Most valuations are really disguised Pricings Academic Surveys – DCF Reality – Name Only TV in DCF >60% Value TV calculated using market multiple Venture Capital Valuation Football Field: Flaw of Averages V x Asset Value Amsterdam Institute of Finance October, 2016 x DCF x Comp Trade x Comp Trans x Average Fit Line Other (ROV? ) 24

Pricing v Valuation Price ≠ Value eventually converge, but… using price to justify M&A – increases overpaying Most valuations are really disguised Pricings Academic Surveys – DCF Reality – Name Only TV in DCF >60% Value TV calculated using market multiple Venture Capital Valuation Football Field: Flaw of Averages V x Asset Value Amsterdam Institute of Finance October, 2016 x DCF x Comp Trade x Comp Trans x Average Fit Line Other (ROV? ) 24

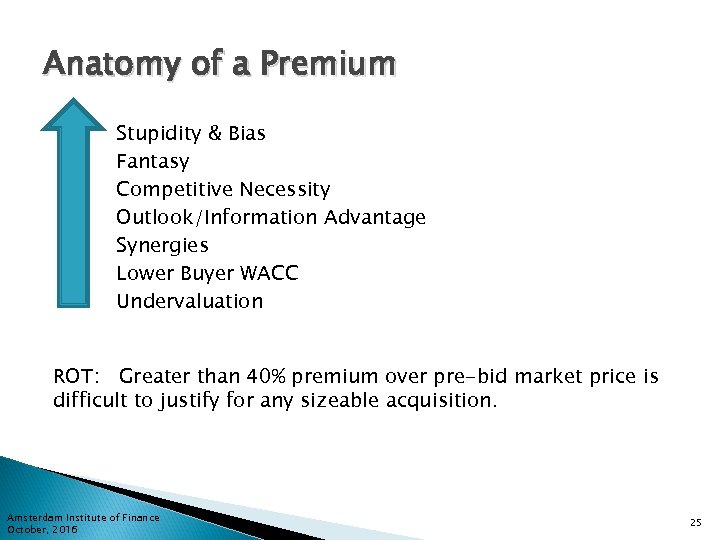

Anatomy of a Premium Stupidity & Bias Fantasy Competitive Necessity Outlook/Information Advantage Synergies Lower Buyer WACC Undervaluation ROT: Greater than 40% premium over pre-bid market price is difficult to justify for any sizeable acquisition. Amsterdam Institute of Finance October, 2016 25

Anatomy of a Premium Stupidity & Bias Fantasy Competitive Necessity Outlook/Information Advantage Synergies Lower Buyer WACC Undervaluation ROT: Greater than 40% premium over pre-bid market price is difficult to justify for any sizeable acquisition. Amsterdam Institute of Finance October, 2016 25

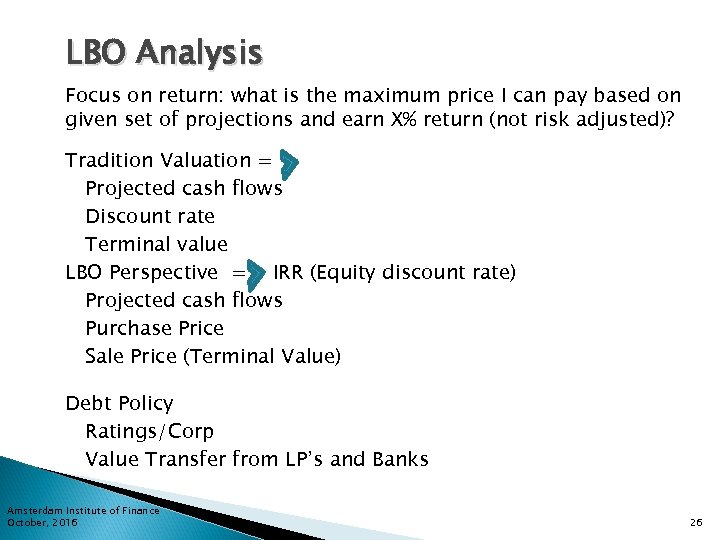

LBO Analysis Focus on return: what is the maximum price I can pay based on given set of projections and earn X% return (not risk adjusted)? Tradition Valuation = Projected cash flows Discount rate Terminal value LBO Perspective = IRR (Equity discount rate) Projected cash flows Purchase Price Sale Price (Terminal Value) Debt Policy Ratings/Corp Value Transfer from LP’s and Banks Amsterdam Institute of Finance October, 2016 26

LBO Analysis Focus on return: what is the maximum price I can pay based on given set of projections and earn X% return (not risk adjusted)? Tradition Valuation = Projected cash flows Discount rate Terminal value LBO Perspective = IRR (Equity discount rate) Projected cash flows Purchase Price Sale Price (Terminal Value) Debt Policy Ratings/Corp Value Transfer from LP’s and Banks Amsterdam Institute of Finance October, 2016 26

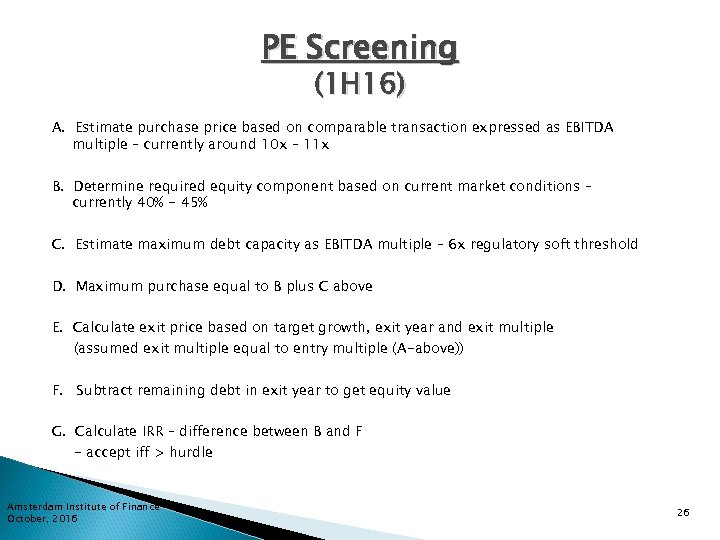

PE Screening (1 H 16) A. Estimate purchase price based on comparable transaction expressed as EBITDA multiple – currently around 10 x – 11 x B. Determine required equity component based on current market conditions – currently 40% - 45% C. Estimate maximum debt capacity as EBITDA multiple – 6 x regulatory soft threshold D. Maximum purchase equal to B plus C above E. Calculate exit price based on target growth, exit year and exit multiple (assumed exit multiple equal to entry multiple (A-above)) F. Subtract remaining debt in exit year to get equity value G. Calculate IRR – difference between B and F - accept iff > hurdle Amsterdam Institute of Finance October, 2016 26

PE Screening (1 H 16) A. Estimate purchase price based on comparable transaction expressed as EBITDA multiple – currently around 10 x – 11 x B. Determine required equity component based on current market conditions – currently 40% - 45% C. Estimate maximum debt capacity as EBITDA multiple – 6 x regulatory soft threshold D. Maximum purchase equal to B plus C above E. Calculate exit price based on target growth, exit year and exit multiple (assumed exit multiple equal to entry multiple (A-above)) F. Subtract remaining debt in exit year to get equity value G. Calculate IRR – difference between B and F - accept iff > hurdle Amsterdam Institute of Finance October, 2016 26

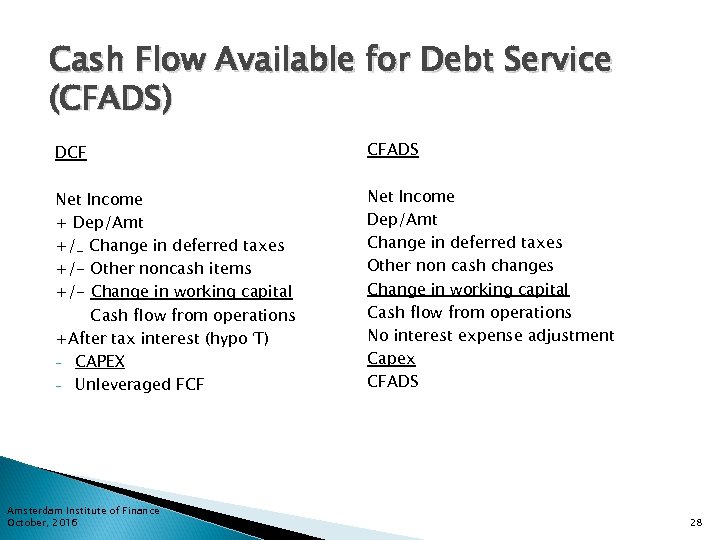

Cash Flow Available for Debt Service (CFADS) DCF CFADS Net Income + Dep/Amt +/_ Change in deferred taxes +/- Other noncash items +/- Change in working capital Cash flow from operations +After tax interest (hypo Ƭ) - CAPEX - Unleveraged FCF Net Income Dep/Amt Change in deferred taxes Other non cash changes Change in working capital Cash flow from operations No interest expense adjustment Capex CFADS Amsterdam Institute of Finance October, 2016 28

Cash Flow Available for Debt Service (CFADS) DCF CFADS Net Income + Dep/Amt +/_ Change in deferred taxes +/- Other noncash items +/- Change in working capital Cash flow from operations +After tax interest (hypo Ƭ) - CAPEX - Unleveraged FCF Net Income Dep/Amt Change in deferred taxes Other non cash changes Change in working capital Cash flow from operations No interest expense adjustment Capex CFADS Amsterdam Institute of Finance October, 2016 28

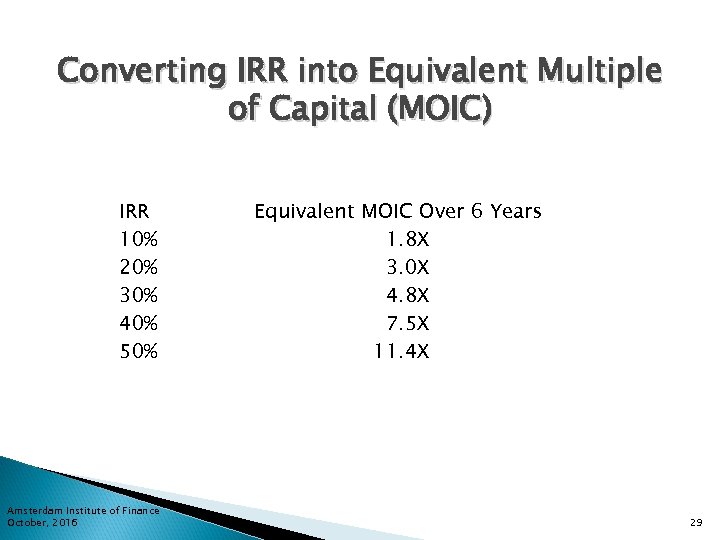

Converting IRR into Equivalent Multiple of Capital (MOIC) IRR 10% 20% 30% 40% 50% Amsterdam Institute of Finance October, 2016 Equivalent MOIC Over 6 Years 1. 8 X 3. 0 X 4. 8 X 7. 5 X 11. 4 X 29

Converting IRR into Equivalent Multiple of Capital (MOIC) IRR 10% 20% 30% 40% 50% Amsterdam Institute of Finance October, 2016 Equivalent MOIC Over 6 Years 1. 8 X 3. 0 X 4. 8 X 7. 5 X 11. 4 X 29

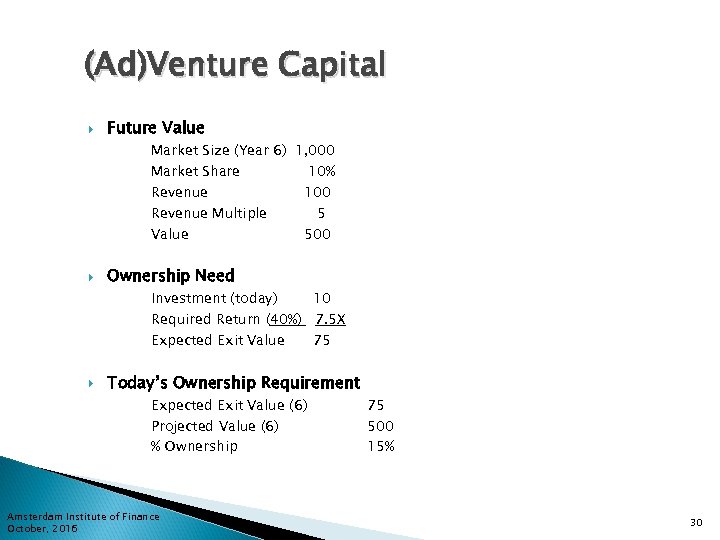

(Ad)Venture Capital Future Value Market Size (Year 6) 1, 000 Market Share 10% Revenue 100 Revenue Multiple 5 Value 500 Ownership Need Investment (today) 10 Required Return (40%) 7. 5 X Expected Exit Value 75 Today’s Ownership Requirement Expected Exit Value (6) Projected Value (6) % Ownership Amsterdam Institute of Finance October, 2016 75 500 15% 30

(Ad)Venture Capital Future Value Market Size (Year 6) 1, 000 Market Share 10% Revenue 100 Revenue Multiple 5 Value 500 Ownership Need Investment (today) 10 Required Return (40%) 7. 5 X Expected Exit Value 75 Today’s Ownership Requirement Expected Exit Value (6) Projected Value (6) % Ownership Amsterdam Institute of Finance October, 2016 75 500 15% 30

Fixing the Broken Deal – Price and Structural Flex Increase spread Original issue discount Eliminate PIK Reduce debt Add a subordinate tranche More equity Add covenants Reduce Price Seller Paper Originators Increase Hold Amsterdam Institute of Finance October, 2016 31

Fixing the Broken Deal – Price and Structural Flex Increase spread Original issue discount Eliminate PIK Reduce debt Add a subordinate tranche More equity Add covenants Reduce Price Seller Paper Originators Increase Hold Amsterdam Institute of Finance October, 2016 31

International Valuation Convert foreign cash flows into home currency using forecast FX rates; discount using the home rates Majority method due to accounting translation focus Use local cash flows and rates; spot into home currency Terminal value growth rate at local inflation rate Complications Taxes – home and foreign Political risk – Venz, Russia Inflation and FX rates (A) Forecast foreign currency cash flows (B) Discount rate - same rate for domestic home currency - convert domestic rate to foreign by multiplying risk free rate differential - IRS - local rates (C) Resulting PV is FX – convert to domestic/home using spot Amsterdam Institute of Finance October, 2016 32

International Valuation Convert foreign cash flows into home currency using forecast FX rates; discount using the home rates Majority method due to accounting translation focus Use local cash flows and rates; spot into home currency Terminal value growth rate at local inflation rate Complications Taxes – home and foreign Political risk – Venz, Russia Inflation and FX rates (A) Forecast foreign currency cash flows (B) Discount rate - same rate for domestic home currency - convert domestic rate to foreign by multiplying risk free rate differential - IRS - local rates (C) Resulting PV is FX – convert to domestic/home using spot Amsterdam Institute of Finance October, 2016 32

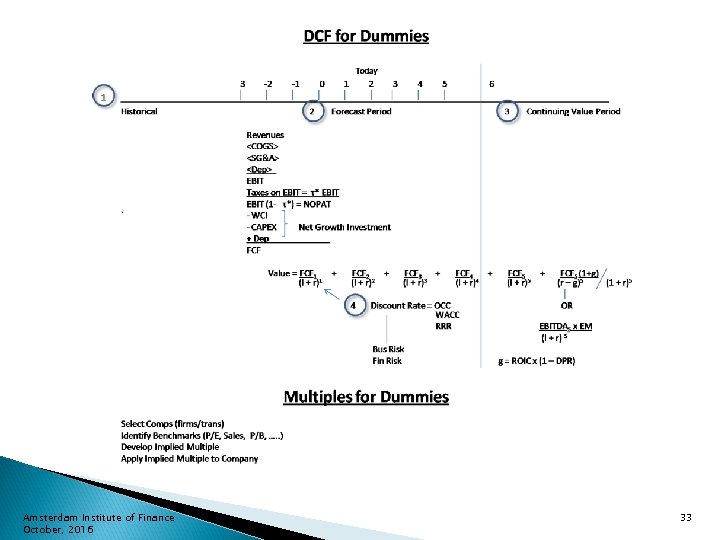

Amsterdam Institute of Finance October, 2016 33

Amsterdam Institute of Finance October, 2016 33

Special Purpose Acquisition Companies Blank Check LBO Form entity to make unidentified acquisitions within finite time period (e. g. 18 mos) Return funds / cancel commitments if no acquisition occurs Charge fees and get carried interest Conflicts abound Amsterdam Institute of Finance October, 2016 34

Special Purpose Acquisition Companies Blank Check LBO Form entity to make unidentified acquisitions within finite time period (e. g. 18 mos) Return funds / cancel commitments if no acquisition occurs Charge fees and get carried interest Conflicts abound Amsterdam Institute of Finance October, 2016 34

Exchange Rates and Cross Border M&A Does USD appreciation against Euro make Euro zone targets cheap? Pay less for Euro assets But receive less – depreciated future Euro cash flows converted back into USD Companies continue to get confused by translation accounting or are they speculating in FX Amsterdam Institute of Finance October, 2016 35

Exchange Rates and Cross Border M&A Does USD appreciation against Euro make Euro zone targets cheap? Pay less for Euro assets But receive less – depreciated future Euro cash flows converted back into USD Companies continue to get confused by translation accounting or are they speculating in FX Amsterdam Institute of Finance October, 2016 35

Foreign Currency Debt Borrowing in Foreign currency different from home currency Borrower attracted by Foreign currencies with lower rates - carry trade Borrow USD Spot into home currency Risk if home currency weakens against USD – unless hedged Taking deal risk Interest rate parity ensures no free lunch Borrow in country where assets and cash flow are located to create natural hedge Beware speculating in FX using company balance sheet Amsterdam Institute of Finance October, 2016 36

Foreign Currency Debt Borrowing in Foreign currency different from home currency Borrower attracted by Foreign currencies with lower rates - carry trade Borrow USD Spot into home currency Risk if home currency weakens against USD – unless hedged Taking deal risk Interest rate parity ensures no free lunch Borrow in country where assets and cash flow are located to create natural hedge Beware speculating in FX using company balance sheet Amsterdam Institute of Finance October, 2016 36