784e4c826b4aac84de69b4a2c240c771.ppt

- Количество слайдов: 32

Acct 414 – Fall 2008 – Prof. Teresa Gordon Leases PV Computations Classification of Leases Under US GAAP & IFRS

Acct 414 – Fall 2008 – Prof. Teresa Gordon Leases PV Computations Classification of Leases Under US GAAP & IFRS

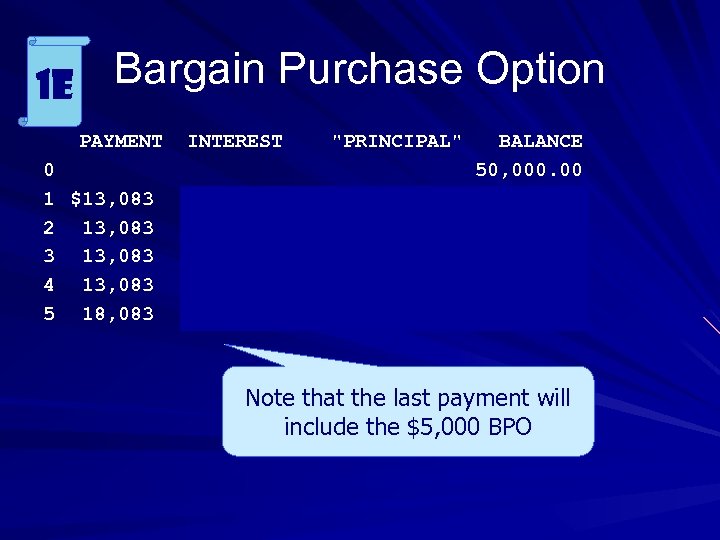

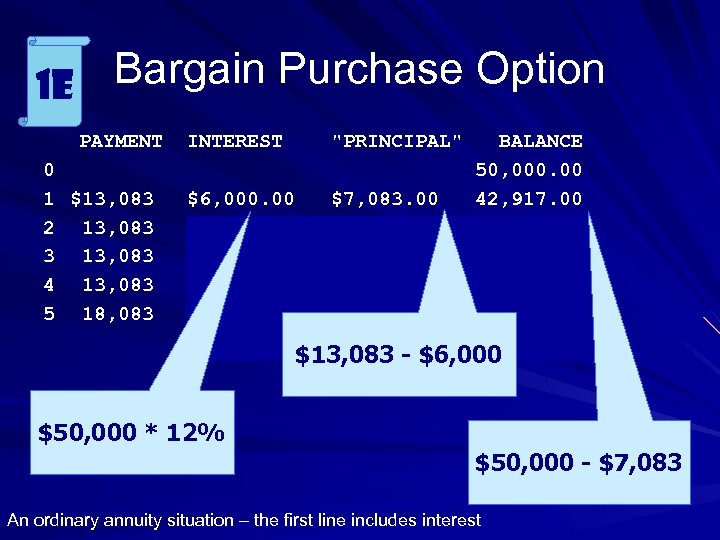

1 e BPO - Lease 1 E 1. Inception date: 1/1/12 2. Lessor: Troy Tractors 3. 4. 5. 6. Inc. Fair value of combine at 1/1/02: $50, 000 Cost to manufacture combine: $40, 000 Estimated fair value at end of lease is $10, 000 Fixed non-cancelable lease term: 5 years. 7. First payment due on 12/31/12 8. Lessee: Farview Farms 9. Incremental borrowing rate (lessee): 12% 10. Implicit interest rate (known to lessee): 12% 11. Option to buy at end of lease term for $5, 000 12. Estimated useful life of combine: 8 years

1 e BPO - Lease 1 E 1. Inception date: 1/1/12 2. Lessor: Troy Tractors 3. 4. 5. 6. Inc. Fair value of combine at 1/1/02: $50, 000 Cost to manufacture combine: $40, 000 Estimated fair value at end of lease is $10, 000 Fixed non-cancelable lease term: 5 years. 7. First payment due on 12/31/12 8. Lessee: Farview Farms 9. Incremental borrowing rate (lessee): 12% 10. Implicit interest rate (known to lessee): 12% 11. Option to buy at end of lease term for $5, 000 12. Estimated useful life of combine: 8 years

Bargain Purchase Option 1 e PAYMENT 0 1 $13, 083 2 13, 083 3 13, 083 4 13, 083 5 18, 083 INTEREST "PRINCIPAL" $6, 000. 00 5, 180. 04 4, 198. 08 3, 131. 89 1, 934. 99 $7, 083. 00 7, 932. 96 8, 884. 92 9, 951. 11 16, 148. 01 BALANCE 50, 000. 00 42, 917. 00 34, 984. 04 26, 099. 12 16, 148. 01 0. 00 Note that the last payment will include the $5, 000 BPO

Bargain Purchase Option 1 e PAYMENT 0 1 $13, 083 2 13, 083 3 13, 083 4 13, 083 5 18, 083 INTEREST "PRINCIPAL" $6, 000. 00 5, 180. 04 4, 198. 08 3, 131. 89 1, 934. 99 $7, 083. 00 7, 932. 96 8, 884. 92 9, 951. 11 16, 148. 01 BALANCE 50, 000. 00 42, 917. 00 34, 984. 04 26, 099. 12 16, 148. 01 0. 00 Note that the last payment will include the $5, 000 BPO

Bargain Purchase Option 1 e PAYMENT 0 1 $13, 083 2 13, 083 3 13, 083 4 13, 083 5 18, 083 INTEREST "PRINCIPAL" $6, 000. 00 5, 150. 04 4, 198. 08 3, 131. 89 1, 934. 99 $7, 083. 00 7, 932. 96 8, 884. 92 9, 951. 11 16, 148. 01 BALANCE 50, 000. 00 42, 917. 00 34, 984. 04 26, 099. 12 16, 148. 01 0. 00 $13, 083 - $6, 000 $50, 000 * 12% $50, 000 - $7, 083 An ordinary annuity situation – the first line includes interest

Bargain Purchase Option 1 e PAYMENT 0 1 $13, 083 2 13, 083 3 13, 083 4 13, 083 5 18, 083 INTEREST "PRINCIPAL" $6, 000. 00 5, 150. 04 4, 198. 08 3, 131. 89 1, 934. 99 $7, 083. 00 7, 932. 96 8, 884. 92 9, 951. 11 16, 148. 01 BALANCE 50, 000. 00 42, 917. 00 34, 984. 04 26, 099. 12 16, 148. 01 0. 00 $13, 083 - $6, 000 $50, 000 * 12% $50, 000 - $7, 083 An ordinary annuity situation – the first line includes interest

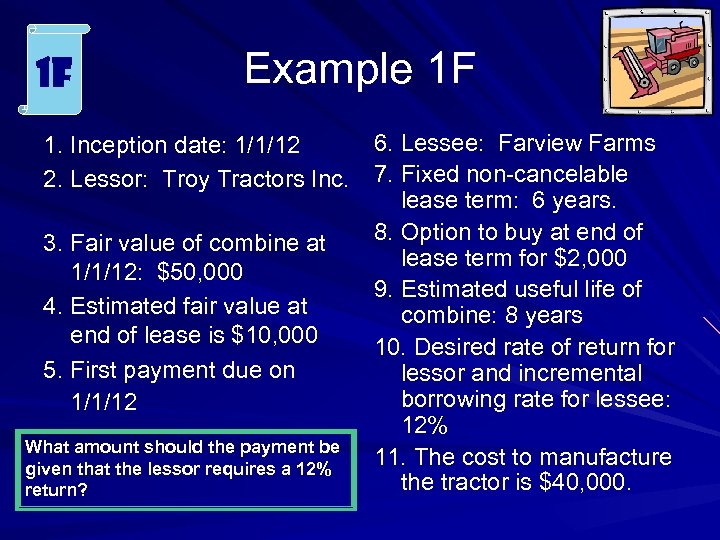

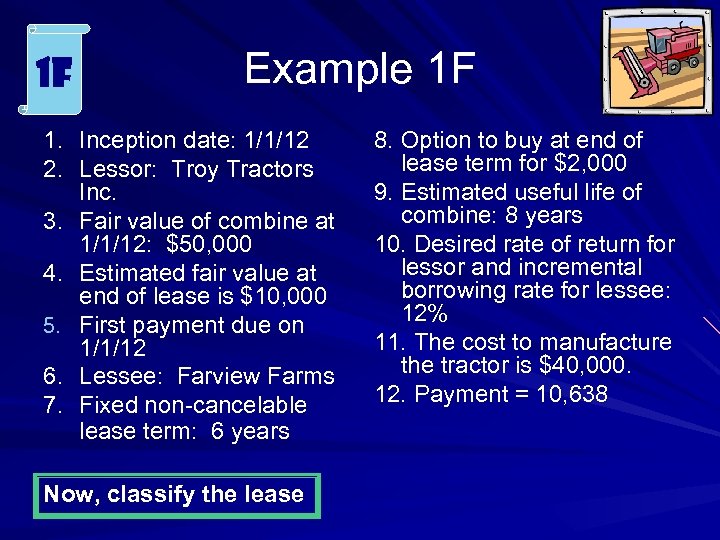

1 f Example 1 F 6. Lessee: Farview Farms 1. Inception date: 1/1/12 2. Lessor: Troy Tractors Inc. 7. Fixed non-cancelable lease term: 6 years. 8. Option to buy at end of 3. Fair value of combine at lease term for $2, 000 1/1/12: $50, 000 9. Estimated useful life of 4. Estimated fair value at combine: 8 years end of lease is $10, 000 10. Desired rate of return for 5. First payment due on lessor and incremental borrowing rate for lessee: 1/1/12 12% What amount should the payment be 11. The cost to manufacture given that the lessor requires a 12% the tractor is $40, 000. return?

1 f Example 1 F 6. Lessee: Farview Farms 1. Inception date: 1/1/12 2. Lessor: Troy Tractors Inc. 7. Fixed non-cancelable lease term: 6 years. 8. Option to buy at end of 3. Fair value of combine at lease term for $2, 000 1/1/12: $50, 000 9. Estimated useful life of 4. Estimated fair value at combine: 8 years end of lease is $10, 000 10. Desired rate of return for 5. First payment due on lessor and incremental borrowing rate for lessee: 1/1/12 12% What amount should the payment be 11. The cost to manufacture given that the lessor requires a 12% the tractor is $40, 000. return?

1 f Example 1 F 1. Inception date: 1/1/12 2. Lessor: Troy Tractors Inc. 3. Fair value of combine at 1/1/12: $50, 000 4. Estimated fair value at end of lease is $10, 000 5. First payment due on 1/1/12 6. Lessee: Farview Farms 7. Fixed non-cancelable lease term: 6 years Now, classify the lease 8. Option to buy at end of lease term for $2, 000 9. Estimated useful life of combine: 8 years 10. Desired rate of return for lessor and incremental borrowing rate for lessee: 12% 11. The cost to manufacture the tractor is $40, 000. 12. Payment = 10, 638

1 f Example 1 F 1. Inception date: 1/1/12 2. Lessor: Troy Tractors Inc. 3. Fair value of combine at 1/1/12: $50, 000 4. Estimated fair value at end of lease is $10, 000 5. First payment due on 1/1/12 6. Lessee: Farview Farms 7. Fixed non-cancelable lease term: 6 years Now, classify the lease 8. Option to buy at end of lease term for $2, 000 9. Estimated useful life of combine: 8 years 10. Desired rate of return for lessor and incremental borrowing rate for lessee: 12% 11. The cost to manufacture the tractor is $40, 000. 12. Payment = 10, 638

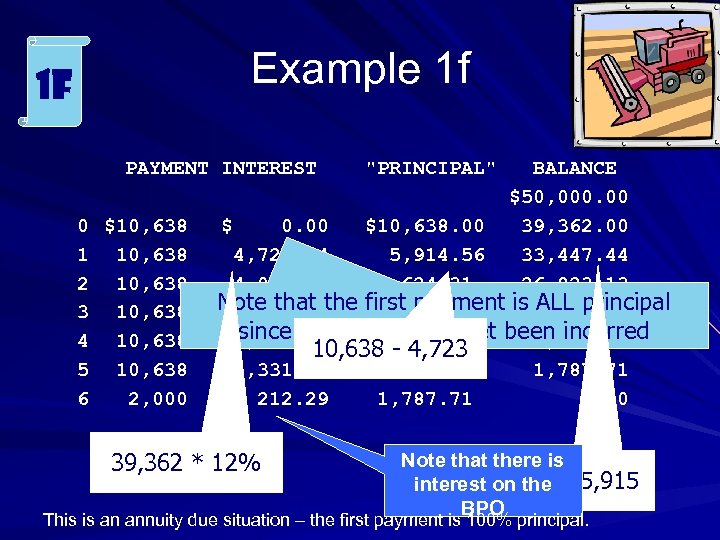

Example 1 f 1 f PAYMENT INTEREST 0 $10, 638 1 10, 638 2 10, 638 3 10, 638 4 10, 638 5 10, 638 6 2, 000 BALANCE $50, 000. 00 $10, 638. 00 39, 362. 00 4, 723. 44 5, 914. 56 33, 447. 44 4, 013. 69 6, 624. 31 26, 823. 13 Note that the first payment is ALL principal 3, 218. 78 7, 419. 22 19, 403. 91 since no 2, 328. 47 interest has yet been incurred 8, 309. 53 11, 094. 38 10, 638 - 4, 723 1, 33 9, 306. 67 1, 787. 71 212. 29 1, 787. 71 0. 00 39, 362 * 12% "PRINCIPAL" Note that there is 39, 362 interest on the BPO 5, 915 This is an annuity due situation – the first payment is 100% principal.

Example 1 f 1 f PAYMENT INTEREST 0 $10, 638 1 10, 638 2 10, 638 3 10, 638 4 10, 638 5 10, 638 6 2, 000 BALANCE $50, 000. 00 $10, 638. 00 39, 362. 00 4, 723. 44 5, 914. 56 33, 447. 44 4, 013. 69 6, 624. 31 26, 823. 13 Note that the first payment is ALL principal 3, 218. 78 7, 419. 22 19, 403. 91 since no 2, 328. 47 interest has yet been incurred 8, 309. 53 11, 094. 38 10, 638 - 4, 723 1, 33 9, 306. 67 1, 787. 71 212. 29 1, 787. 71 0. 00 39, 362 * 12% "PRINCIPAL" Note that there is 39, 362 interest on the BPO 5, 915 This is an annuity due situation – the first payment is 100% principal.

A quick comparison IFRS vs. US GAAP IAS 17 vs. FAS 13 as amended many times

A quick comparison IFRS vs. US GAAP IAS 17 vs. FAS 13 as amended many times

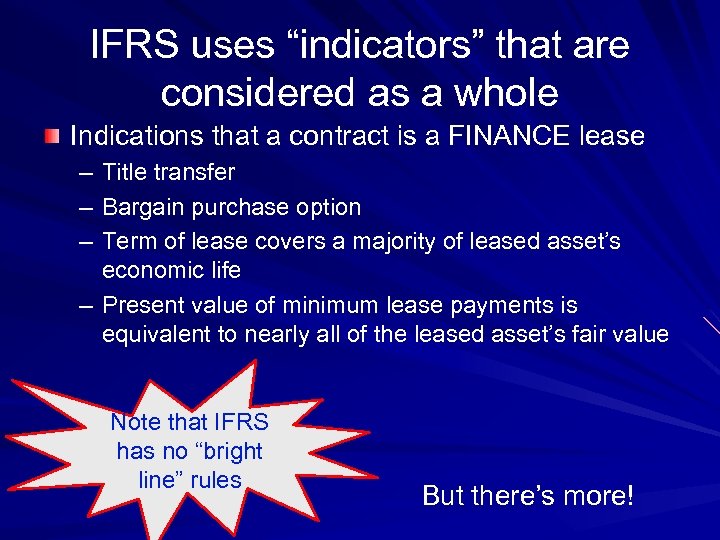

IFRS uses “indicators” that are considered as a whole Indications that a contract is a FINANCE lease – Title transfer – Bargain purchase option – Term of lease covers a majority of leased asset’s economic life – Present value of minimum lease payments is equivalent to nearly all of the leased asset’s fair value Note that IFRS has no “bright line” rules But there’s more!

IFRS uses “indicators” that are considered as a whole Indications that a contract is a FINANCE lease – Title transfer – Bargain purchase option – Term of lease covers a majority of leased asset’s economic life – Present value of minimum lease payments is equivalent to nearly all of the leased asset’s fair value Note that IFRS has no “bright line” rules But there’s more!

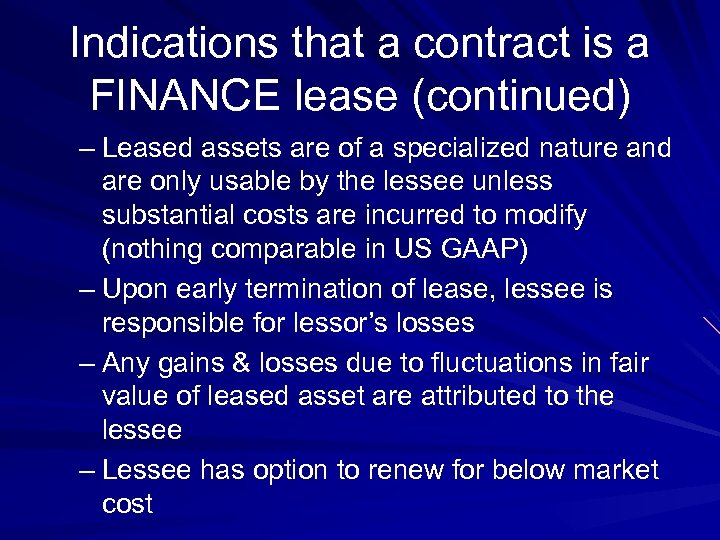

Indications that a contract is a FINANCE lease (continued) – Leased assets are of a specialized nature and are only usable by the lessee unless substantial costs are incurred to modify (nothing comparable in US GAAP) – Upon early termination of lease, lessee is responsible for lessor’s losses – Any gains & losses due to fluctuations in fair value of leased asset are attributed to the lessee – Lessee has option to renew for below market cost

Indications that a contract is a FINANCE lease (continued) – Leased assets are of a specialized nature and are only usable by the lessee unless substantial costs are incurred to modify (nothing comparable in US GAAP) – Upon early termination of lease, lessee is responsible for lessor’s losses – Any gains & losses due to fluctuations in fair value of leased asset are attributed to the lessee – Lessee has option to renew for below market cost

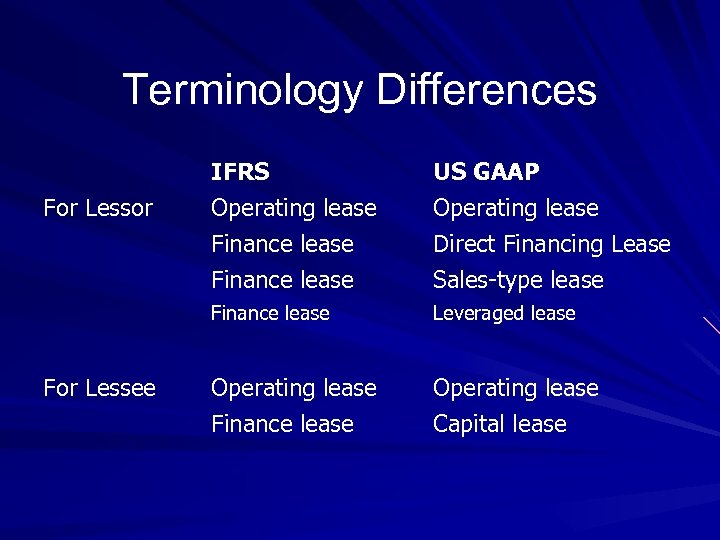

Terminology Differences For Lessee US GAAP Operating lease Direct Financing Lease Sales-type lease Finance lease For Lessor IFRS Operating lease Finance lease Leveraged lease Operating lease Finance lease Operating lease Capital lease

Terminology Differences For Lessee US GAAP Operating lease Direct Financing Lease Sales-type lease Finance lease For Lessor IFRS Operating lease Finance lease Leveraged lease Operating lease Finance lease Operating lease Capital lease

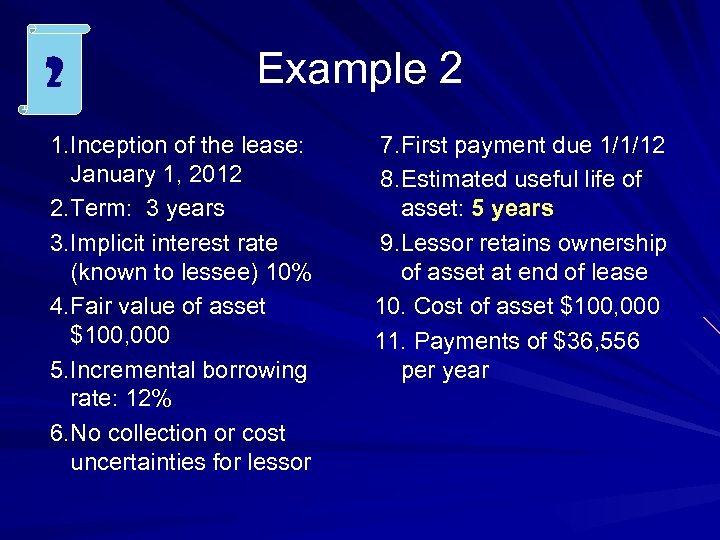

2 Example 2 1. Inception of the lease: January 1, 2012 2. Term: 3 years 3. Implicit interest rate (known to lessee) 10% 4. Fair value of asset $100, 000 5. Incremental borrowing rate: 12% 6. No collection or cost uncertainties for lessor 7. First payment due 1/1/12 8. Estimated useful life of asset: 5 years 9. Lessor retains ownership of asset at end of lease 10. Cost of asset $100, 000 11. Payments of $36, 556 per year

2 Example 2 1. Inception of the lease: January 1, 2012 2. Term: 3 years 3. Implicit interest rate (known to lessee) 10% 4. Fair value of asset $100, 000 5. Incremental borrowing rate: 12% 6. No collection or cost uncertainties for lessor 7. First payment due 1/1/12 8. Estimated useful life of asset: 5 years 9. Lessor retains ownership of asset at end of lease 10. Cost of asset $100, 000 11. Payments of $36, 556 per year

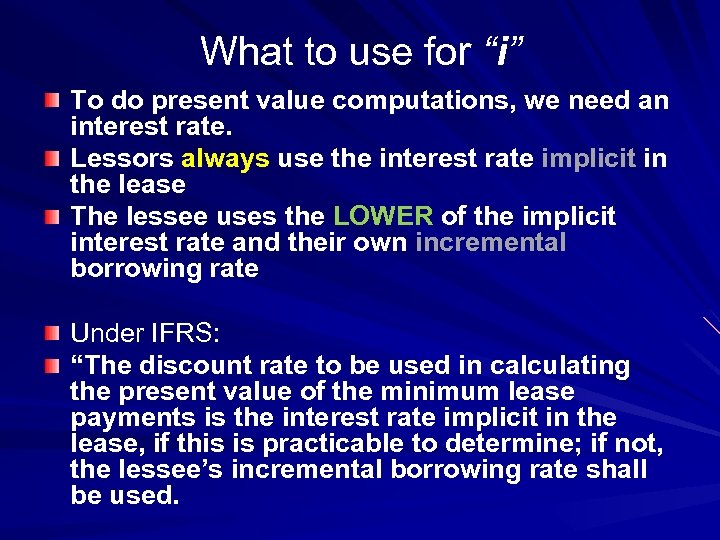

What to use for “i” To do present value computations, we need an interest rate. Lessors always use the interest rate implicit in the lease The lessee uses the LOWER of the implicit interest rate and their own incremental borrowing rate Under IFRS: “The discount rate to be used in calculating the present value of the minimum lease payments is the interest rate implicit in the lease, if this is practicable to determine; if not, the lessee’s incremental borrowing rate shall be used.

What to use for “i” To do present value computations, we need an interest rate. Lessors always use the interest rate implicit in the lease The lessee uses the LOWER of the implicit interest rate and their own incremental borrowing rate Under IFRS: “The discount rate to be used in calculating the present value of the minimum lease payments is the interest rate implicit in the lease, if this is practicable to determine; if not, the lessee’s incremental borrowing rate shall be used.

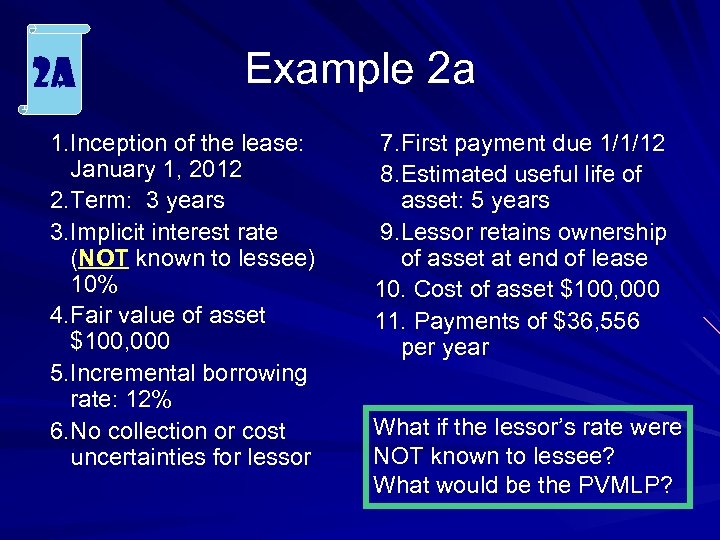

2 a Example 2 a 1. Inception of the lease: January 1, 2012 2. Term: 3 years 3. Implicit interest rate (NOT known to lessee) 10% 4. Fair value of asset $100, 000 5. Incremental borrowing rate: 12% 6. No collection or cost uncertainties for lessor 7. First payment due 1/1/12 8. Estimated useful life of asset: 5 years 9. Lessor retains ownership of asset at end of lease 10. Cost of asset $100, 000 11. Payments of $36, 556 per year What if the lessor’s rate were NOT known to lessee? What would be the PVMLP?

2 a Example 2 a 1. Inception of the lease: January 1, 2012 2. Term: 3 years 3. Implicit interest rate (NOT known to lessee) 10% 4. Fair value of asset $100, 000 5. Incremental borrowing rate: 12% 6. No collection or cost uncertainties for lessor 7. First payment due 1/1/12 8. Estimated useful life of asset: 5 years 9. Lessor retains ownership of asset at end of lease 10. Cost of asset $100, 000 11. Payments of $36, 556 per year What if the lessor’s rate were NOT known to lessee? What would be the PVMLP?

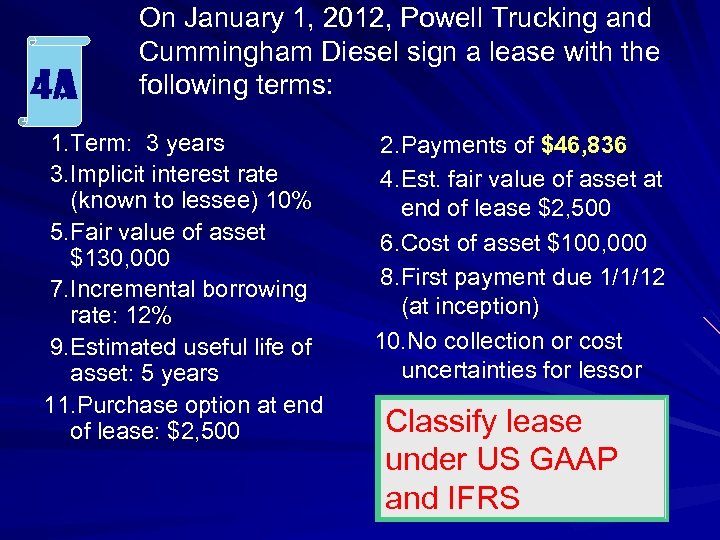

4 a On January 1, 2012, Powell Trucking and Cummingham Diesel sign a lease with the following terms: 1. Term: 3 years 3. Implicit interest rate (known to lessee) 10% 5. Fair value of asset $130, 000 7. Incremental borrowing rate: 12% 9. Estimated useful life of asset: 5 years 11. Purchase option at end of lease: $2, 500 2. Payments of $46, 836 4. Est. fair value of asset at end of lease $2, 500 6. Cost of asset $100, 000 8. First payment due 1/1/12 (at inception) 10. No collection or cost uncertainties for lessor Classify lease under US GAAP and IFRS

4 a On January 1, 2012, Powell Trucking and Cummingham Diesel sign a lease with the following terms: 1. Term: 3 years 3. Implicit interest rate (known to lessee) 10% 5. Fair value of asset $130, 000 7. Incremental borrowing rate: 12% 9. Estimated useful life of asset: 5 years 11. Purchase option at end of lease: $2, 500 2. Payments of $46, 836 4. Est. fair value of asset at end of lease $2, 500 6. Cost of asset $100, 000 8. First payment due 1/1/12 (at inception) 10. No collection or cost uncertainties for lessor Classify lease under US GAAP and IFRS

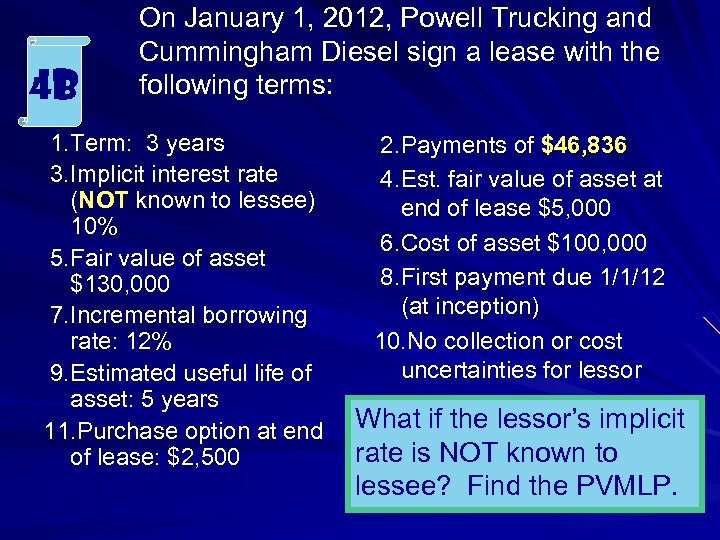

4 b On January 1, 2012, Powell Trucking and Cummingham Diesel sign a lease with the following terms: 1. Term: 3 years 3. Implicit interest rate (NOT known to lessee) 10% 5. Fair value of asset $130, 000 7. Incremental borrowing rate: 12% 9. Estimated useful life of asset: 5 years 11. Purchase option at end of lease: $2, 500 2. Payments of $46, 836 4. Est. fair value of asset at end of lease $5, 000 6. Cost of asset $100, 000 8. First payment due 1/1/12 (at inception) 10. No collection or cost uncertainties for lessor What if the lessor’s implicit rate is NOT known to lessee? Find the PVMLP.

4 b On January 1, 2012, Powell Trucking and Cummingham Diesel sign a lease with the following terms: 1. Term: 3 years 3. Implicit interest rate (NOT known to lessee) 10% 5. Fair value of asset $130, 000 7. Incremental borrowing rate: 12% 9. Estimated useful life of asset: 5 years 11. Purchase option at end of lease: $2, 500 2. Payments of $46, 836 4. Est. fair value of asset at end of lease $5, 000 6. Cost of asset $100, 000 8. First payment due 1/1/12 (at inception) 10. No collection or cost uncertainties for lessor What if the lessor’s implicit rate is NOT known to lessee? Find the PVMLP.

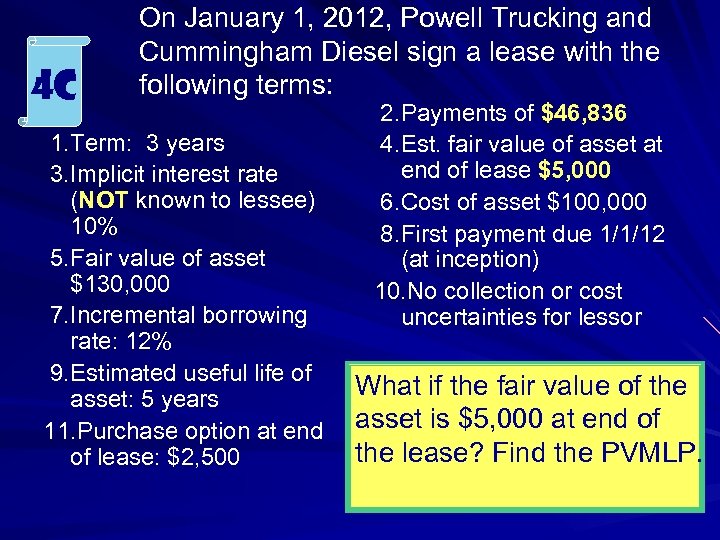

4 c On January 1, 2012, Powell Trucking and Cummingham Diesel sign a lease with the following terms: 1. Term: 3 years 3. Implicit interest rate (NOT known to lessee) 10% 5. Fair value of asset $130, 000 7. Incremental borrowing rate: 12% 9. Estimated useful life of asset: 5 years 11. Purchase option at end of lease: $2, 500 2. Payments of $46, 836 4. Est. fair value of asset at end of lease $5, 000 6. Cost of asset $100, 000 8. First payment due 1/1/12 (at inception) 10. No collection or cost uncertainties for lessor What if the fair value of the asset is $5, 000 at end of the lease? Find the PVMLP.

4 c On January 1, 2012, Powell Trucking and Cummingham Diesel sign a lease with the following terms: 1. Term: 3 years 3. Implicit interest rate (NOT known to lessee) 10% 5. Fair value of asset $130, 000 7. Incremental borrowing rate: 12% 9. Estimated useful life of asset: 5 years 11. Purchase option at end of lease: $2, 500 2. Payments of $46, 836 4. Est. fair value of asset at end of lease $5, 000 6. Cost of asset $100, 000 8. First payment due 1/1/12 (at inception) 10. No collection or cost uncertainties for lessor What if the fair value of the asset is $5, 000 at end of the lease? Find the PVMLP.

Complications Initial Direct Costs Residual Values

Complications Initial Direct Costs Residual Values

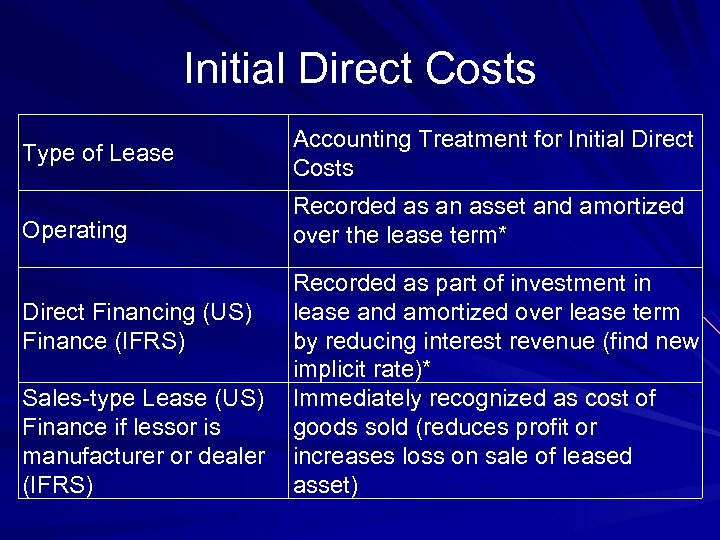

Initial Direct Costs Type of Lease Accounting Treatment for Initial Direct Costs Operating Recorded as an asset and amortized over the lease term* Direct Financing (US) Finance (IFRS) Sales-type Lease (US) Finance if lessor is manufacturer or dealer (IFRS) Recorded as part of investment in lease and amortized over lease term by reducing interest revenue (find new implicit rate)* Immediately recognized as cost of goods sold (reduces profit or increases loss on sale of leased asset)

Initial Direct Costs Type of Lease Accounting Treatment for Initial Direct Costs Operating Recorded as an asset and amortized over the lease term* Direct Financing (US) Finance (IFRS) Sales-type Lease (US) Finance if lessor is manufacturer or dealer (IFRS) Recorded as part of investment in lease and amortized over lease term by reducing interest revenue (find new implicit rate)* Immediately recognized as cost of goods sold (reduces profit or increases loss on sale of leased asset)

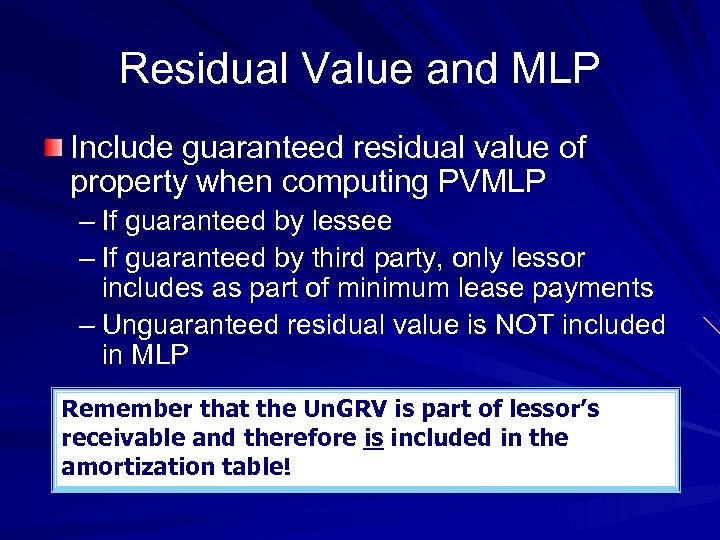

Residual Value and MLP Include guaranteed residual value of property when computing PVMLP – If guaranteed by lessee – If guaranteed by third party, only lessor includes as part of minimum lease payments – Unguaranteed residual value is NOT included in MLP Remember that the Un. GRV is part of lessor’s receivable and therefore is included in the amortization table!

Residual Value and MLP Include guaranteed residual value of property when computing PVMLP – If guaranteed by lessee – If guaranteed by third party, only lessor includes as part of minimum lease payments – Unguaranteed residual value is NOT included in MLP Remember that the Un. GRV is part of lessor’s receivable and therefore is included in the amortization table!

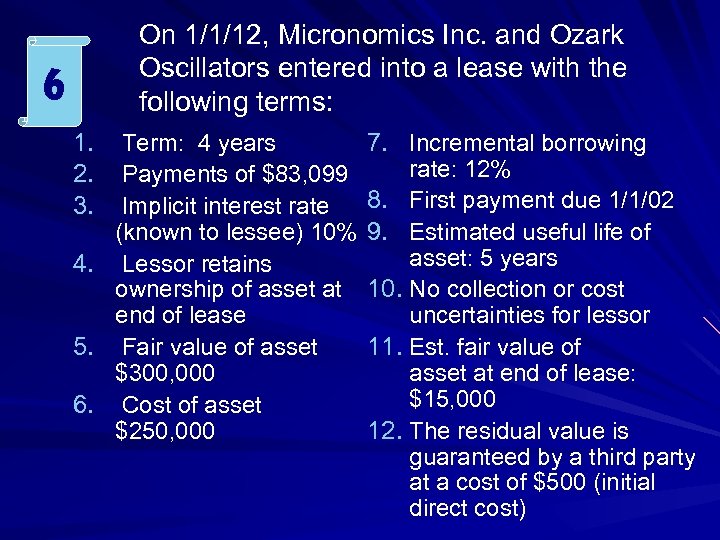

On 1/1/12, Micronomics Inc. and Ozark Oscillators entered into a lease with the following terms: 6 1. 2. 3. 4. 5. 6. Term: 4 years Payments of $83, 099 Implicit interest rate (known to lessee) 10% Lessor retains ownership of asset at end of lease Fair value of asset $300, 000 Cost of asset $250, 000 7. Incremental borrowing rate: 12% 8. First payment due 1/1/02 9. Estimated useful life of asset: 5 years 10. No collection or cost uncertainties for lessor 11. Est. fair value of asset at end of lease: $15, 000 12. The residual value is guaranteed by a third party at a cost of $500 (initial direct cost)

On 1/1/12, Micronomics Inc. and Ozark Oscillators entered into a lease with the following terms: 6 1. 2. 3. 4. 5. 6. Term: 4 years Payments of $83, 099 Implicit interest rate (known to lessee) 10% Lessor retains ownership of asset at end of lease Fair value of asset $300, 000 Cost of asset $250, 000 7. Incremental borrowing rate: 12% 8. First payment due 1/1/02 9. Estimated useful life of asset: 5 years 10. No collection or cost uncertainties for lessor 11. Est. fair value of asset at end of lease: $15, 000 12. The residual value is guaranteed by a third party at a cost of $500 (initial direct cost)

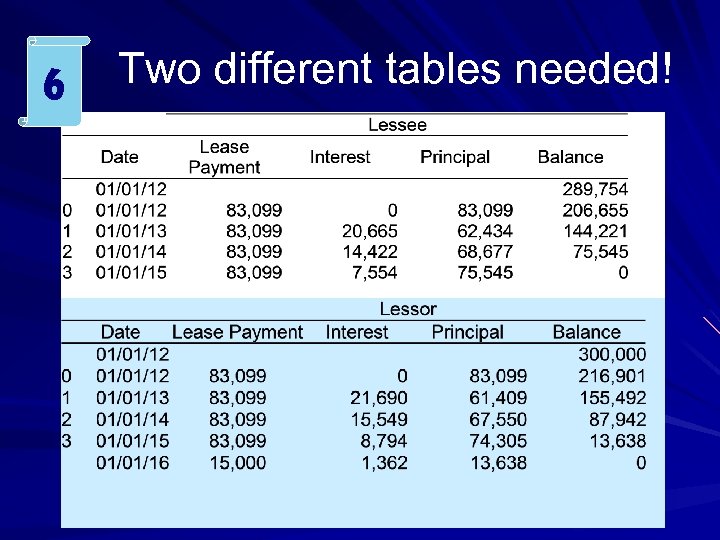

6 Two different tables needed!

6 Two different tables needed!

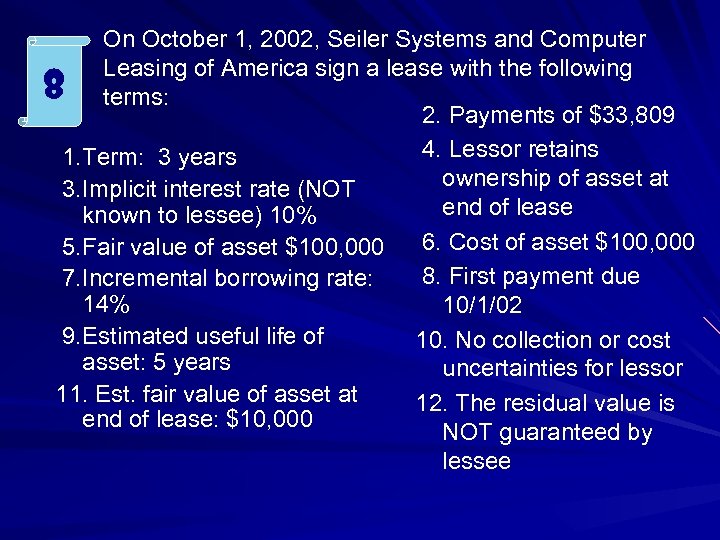

On October 1, 2002, Seiler Systems and Computer Leasing of America sign a lease with the following terms: 2. Payments of $33, 809 4. Lessor retains 1. Term: 3 years ownership of asset at 3. Implicit interest rate (NOT end of lease known to lessee) 10% 6. Cost of asset $100, 000 5. Fair value of asset $100, 000 8. First payment due 7. Incremental borrowing rate: 14% 10/1/02 9. Estimated useful life of 10. No collection or cost asset: 5 years uncertainties for lessor 11. Est. fair value of asset at 12. The residual value is end of lease: $10, 000 NOT guaranteed by lessee 8

On October 1, 2002, Seiler Systems and Computer Leasing of America sign a lease with the following terms: 2. Payments of $33, 809 4. Lessor retains 1. Term: 3 years ownership of asset at 3. Implicit interest rate (NOT end of lease known to lessee) 10% 6. Cost of asset $100, 000 5. Fair value of asset $100, 000 8. First payment due 7. Incremental borrowing rate: 14% 10/1/02 9. Estimated useful life of 10. No collection or cost asset: 5 years uncertainties for lessor 11. Est. fair value of asset at 12. The residual value is end of lease: $10, 000 NOT guaranteed by lessee 8

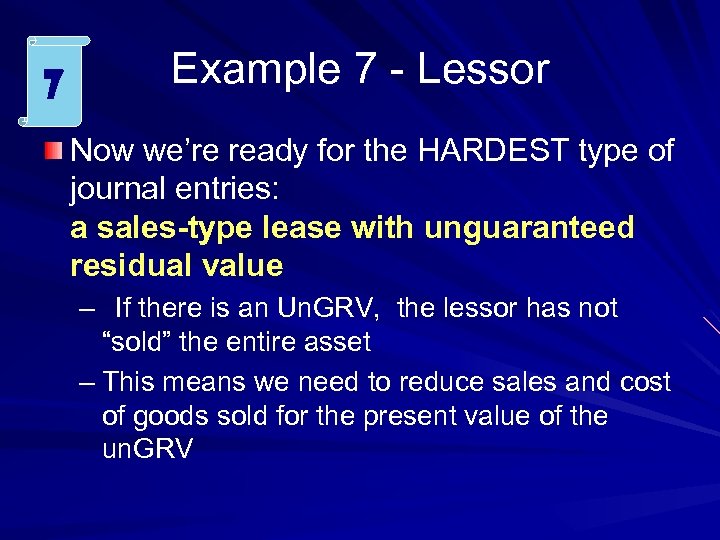

7 Example 7 - Lessor Now we’re ready for the HARDEST type of journal entries: a sales-type lease with unguaranteed residual value – If there is an Un. GRV, the lessor has not “sold” the entire asset – This means we need to reduce sales and cost of goods sold for the present value of the un. GRV

7 Example 7 - Lessor Now we’re ready for the HARDEST type of journal entries: a sales-type lease with unguaranteed residual value – If there is an Un. GRV, the lessor has not “sold” the entire asset – This means we need to reduce sales and cost of goods sold for the present value of the un. GRV

More complications. . . Lease Term Renewal Periods Executory Costs

More complications. . . Lease Term Renewal Periods Executory Costs

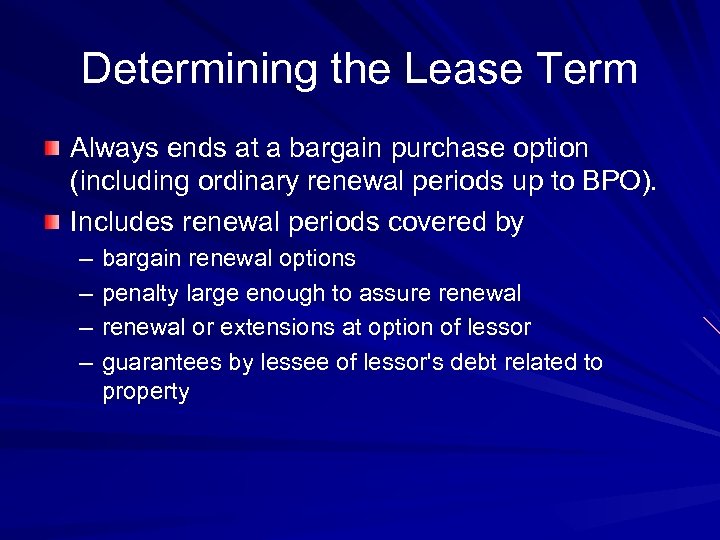

Determining the Lease Term Always ends at a bargain purchase option (including ordinary renewal periods up to BPO). Includes renewal periods covered by – – bargain renewal options penalty large enough to assure renewal or extensions at option of lessor guarantees by lessee of lessor's debt related to property

Determining the Lease Term Always ends at a bargain purchase option (including ordinary renewal periods up to BPO). Includes renewal periods covered by – – bargain renewal options penalty large enough to assure renewal or extensions at option of lessor guarantees by lessee of lessor's debt related to property

Excluded from MLP Exclude contingent rentals Exclude all rental payments past date of bargain purchase option Exclude renewal penalty big enough to assure renewal Exclude executory costs paid by lessor: – maintenance – property taxes – insurance

Excluded from MLP Exclude contingent rentals Exclude all rental payments past date of bargain purchase option Exclude renewal penalty big enough to assure renewal Exclude executory costs paid by lessor: – maintenance – property taxes – insurance

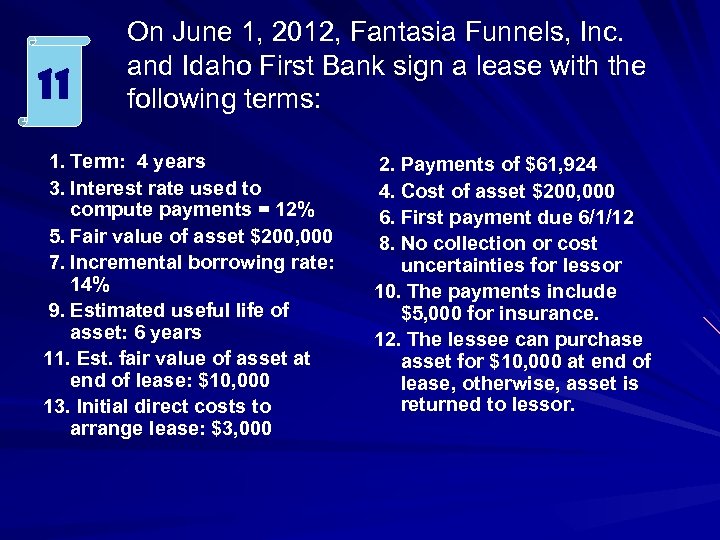

11 On June 1, 2012, Fantasia Funnels, Inc. and Idaho First Bank sign a lease with the following terms: 1. Term: 4 years 3. Interest rate used to compute payments = 12% 5. Fair value of asset $200, 000 7. Incremental borrowing rate: 14% 9. Estimated useful life of asset: 6 years 11. Est. fair value of asset at end of lease: $10, 000 13. Initial direct costs to arrange lease: $3, 000 2. Payments of $61, 924 4. Cost of asset $200, 000 6. First payment due 6/1/12 8. No collection or cost uncertainties for lessor 10. The payments include $5, 000 for insurance. 12. The lessee can purchase asset for $10, 000 at end of lease, otherwise, asset is returned to lessor.

11 On June 1, 2012, Fantasia Funnels, Inc. and Idaho First Bank sign a lease with the following terms: 1. Term: 4 years 3. Interest rate used to compute payments = 12% 5. Fair value of asset $200, 000 7. Incremental borrowing rate: 14% 9. Estimated useful life of asset: 6 years 11. Est. fair value of asset at end of lease: $10, 000 13. Initial direct costs to arrange lease: $3, 000 2. Payments of $61, 924 4. Cost of asset $200, 000 6. First payment due 6/1/12 8. No collection or cost uncertainties for lessor 10. The payments include $5, 000 for insurance. 12. The lessee can purchase asset for $10, 000 at end of lease, otherwise, asset is returned to lessor.

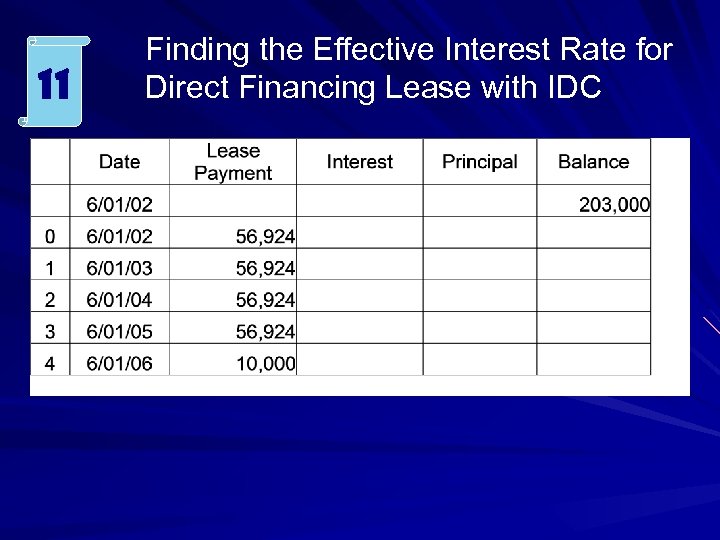

11 Finding the Effective Interest Rate for Direct Financing Lease with IDC

11 Finding the Effective Interest Rate for Direct Financing Lease with IDC

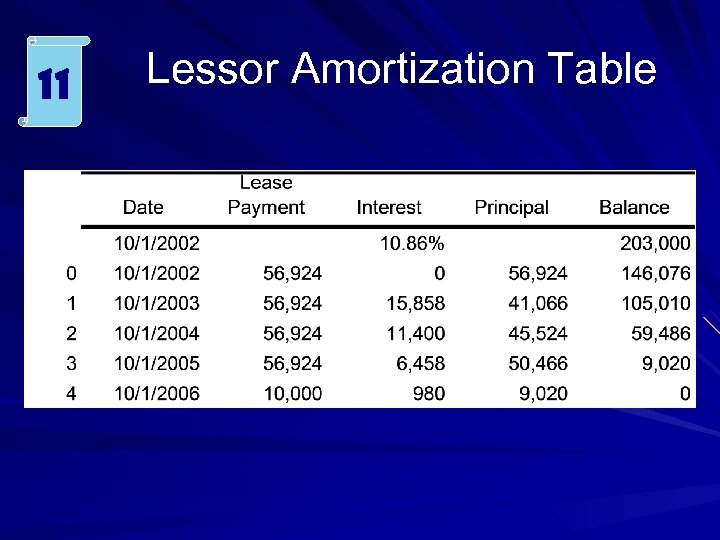

11 Lessor Amortization Table

11 Lessor Amortization Table

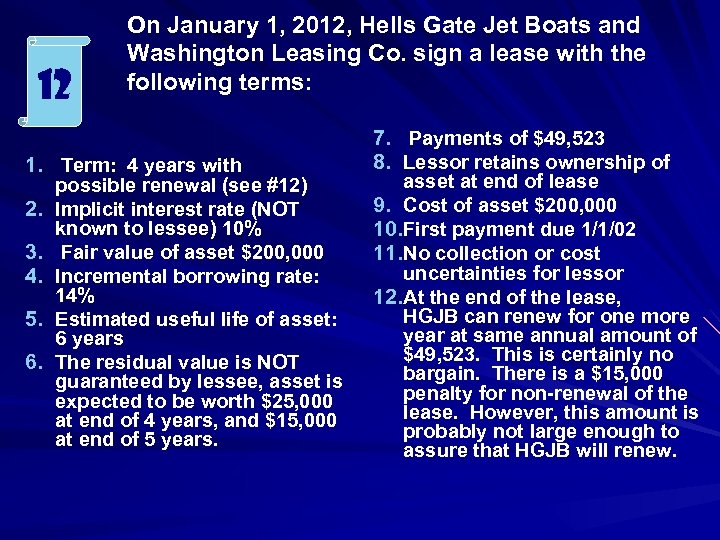

12 On January 1, 2012, Hells Gate Jet Boats and Washington Leasing Co. sign a lease with the following terms: 1. Term: 4 years with 2. 3. 4. 5. 6. possible renewal (see #12) Implicit interest rate (NOT known to lessee) 10% Fair value of asset $200, 000 Incremental borrowing rate: 14% Estimated useful life of asset: 6 years The residual value is NOT guaranteed by lessee, asset is expected to be worth $25, 000 at end of 4 years, and $15, 000 at end of 5 years. 7. Payments of $49, 523 8. Lessor retains ownership of asset at end of lease 9. Cost of asset $200, 000 10. First payment due 1/1/02 11. No collection or cost uncertainties for lessor 12. At the end of the lease, HGJB can renew for one more year at same annual amount of $49, 523. This is certainly no bargain. There is a $15, 000 penalty for non-renewal of the lease. However, this amount is probably not large enough to assure that HGJB will renew.

12 On January 1, 2012, Hells Gate Jet Boats and Washington Leasing Co. sign a lease with the following terms: 1. Term: 4 years with 2. 3. 4. 5. 6. possible renewal (see #12) Implicit interest rate (NOT known to lessee) 10% Fair value of asset $200, 000 Incremental borrowing rate: 14% Estimated useful life of asset: 6 years The residual value is NOT guaranteed by lessee, asset is expected to be worth $25, 000 at end of 4 years, and $15, 000 at end of 5 years. 7. Payments of $49, 523 8. Lessor retains ownership of asset at end of lease 9. Cost of asset $200, 000 10. First payment due 1/1/02 11. No collection or cost uncertainties for lessor 12. At the end of the lease, HGJB can renew for one more year at same annual amount of $49, 523. This is certainly no bargain. There is a $15, 000 penalty for non-renewal of the lease. However, this amount is probably not large enough to assure that HGJB will renew.

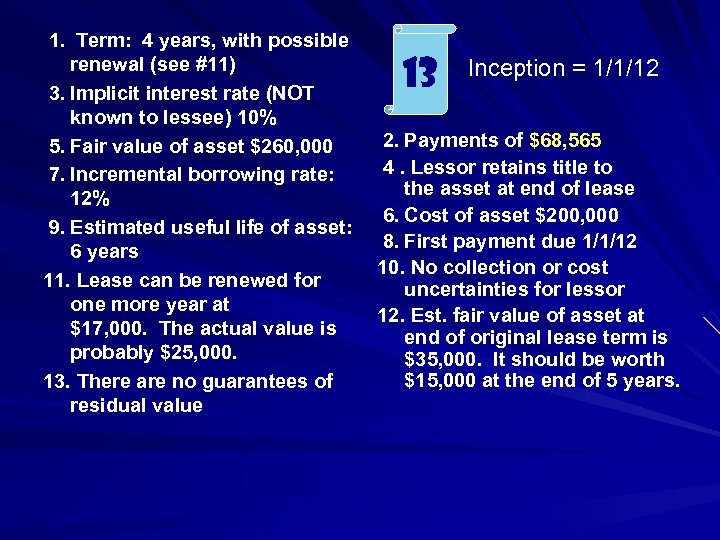

1. Term: 4 years, with possible renewal (see #11) 3. Implicit interest rate (NOT known to lessee) 10% 5. Fair value of asset $260, 000 7. Incremental borrowing rate: 12% 9. Estimated useful life of asset: 6 years 11. Lease can be renewed for one more year at $17, 000. The actual value is probably $25, 000. 13. There are no guarantees of residual value 13 Inception = 1/1/12 2. Payments of $68, 565 4. Lessor retains title to the asset at end of lease 6. Cost of asset $200, 000 8. First payment due 1/1/12 10. No collection or cost uncertainties for lessor 12. Est. fair value of asset at end of original lease term is $35, 000. It should be worth $15, 000 at the end of 5 years.

1. Term: 4 years, with possible renewal (see #11) 3. Implicit interest rate (NOT known to lessee) 10% 5. Fair value of asset $260, 000 7. Incremental borrowing rate: 12% 9. Estimated useful life of asset: 6 years 11. Lease can be renewed for one more year at $17, 000. The actual value is probably $25, 000. 13. There are no guarantees of residual value 13 Inception = 1/1/12 2. Payments of $68, 565 4. Lessor retains title to the asset at end of lease 6. Cost of asset $200, 000 8. First payment due 1/1/12 10. No collection or cost uncertainties for lessor 12. Est. fair value of asset at end of original lease term is $35, 000. It should be worth $15, 000 at the end of 5 years.