7920e8861d25c2f7f6709057da436715.ppt

- Количество слайдов: 127

Accounting From A to Z Advanced Accounting St Louis / April 2007 Presenter: Kathleen Graw

Accounting From A to Z Advanced Accounting St Louis / April 2007 Presenter: Kathleen Graw

Why do you care what I have to say? • I’ve worked in a Johnstone operation for 9 years, 11 months, 27 days… • I’ve been a Database user for 9 years, 11 months, 13 days… • I’ve been teaching DST classes for over 4 years… • I’ve been a DST consultant for accounting related jobs & issues for over 3 years…. • I have a Bachelor’s & a Master’s Degree from Texas Tech & California State Universities… • I think I am smart and I like to hear myself talk…

Why do you care what I have to say? • I’ve worked in a Johnstone operation for 9 years, 11 months, 27 days… • I’ve been a Database user for 9 years, 11 months, 13 days… • I’ve been teaching DST classes for over 4 years… • I’ve been a DST consultant for accounting related jobs & issues for over 3 years…. • I have a Bachelor’s & a Master’s Degree from Texas Tech & California State Universities… • I think I am smart and I like to hear myself talk…

Class Objectives: • To expose you to as many facets of the DST accounting package as possible. • To demonstrate as many of those features as possible. • To facilitate an exchange of ideas between users.

Class Objectives: • To expose you to as many facets of the DST accounting package as possible. • To demonstrate as many of those features as possible. • To facilitate an exchange of ideas between users.

Ground Rules: • PLEASE ask questions – I don’t mind being interrupted. • NO question is stupid. • Please keep questions relevant to the group as a whole. • “Can it be done” versus “Should it be done”? • MY way isn’t the ONLY way.

Ground Rules: • PLEASE ask questions – I don’t mind being interrupted. • NO question is stupid. • Please keep questions relevant to the group as a whole. • “Can it be done” versus “Should it be done”? • MY way isn’t the ONLY way.

Kathleen’s Silver Rule: The system is really hard to break – not much that you can do that we can’t undo with a Journal Entry, Programmer’s Magic or some fast thinking!

Kathleen’s Silver Rule: The system is really hard to break – not much that you can do that we can’t undo with a Journal Entry, Programmer’s Magic or some fast thinking!

Class Structure: -We have A LOT of ground to cover and FOUR hours just SEEMS like a long time. -Tried to give you as many screenshots as I could to cut down on your note taking. -One break at halfway point (15 minutes)

Class Structure: -We have A LOT of ground to cover and FOUR hours just SEEMS like a long time. -Tried to give you as many screenshots as I could to cut down on your note taking. -One break at halfway point (15 minutes)

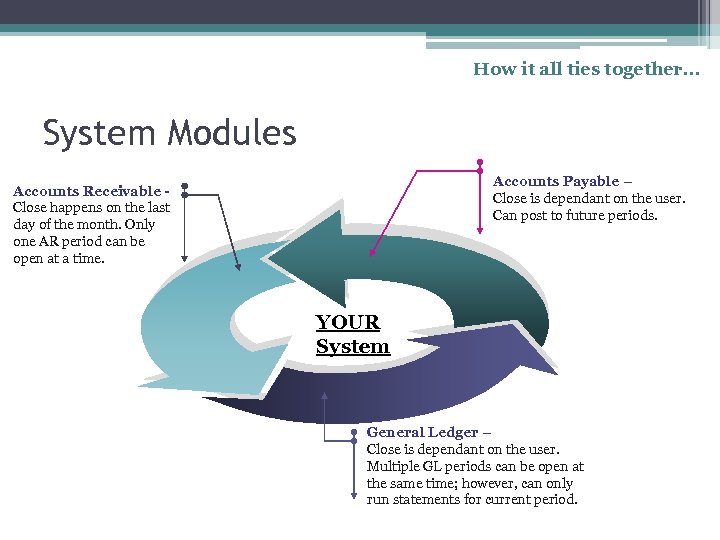

How it all ties together. . . System Modules Accounts Payable – Close is dependant on the user. Can post to future periods. Accounts Receivable Close happens on the last day of the month. Only one AR period can be open at a time. YOUR System General Ledger – Close is dependant on the user. Multiple GL periods can be open at the same time; however, can only run statements for current period.

How it all ties together. . . System Modules Accounts Payable – Close is dependant on the user. Can post to future periods. Accounts Receivable Close happens on the last day of the month. Only one AR period can be open at a time. YOUR System General Ledger – Close is dependant on the user. Multiple GL periods can be open at the same time; however, can only run statements for current period.

Helpful tidbits Men 13

Helpful tidbits Men 13

File Transfer ft Create a folder on C drive” pick Enter “ft” at any printer select prompt Will be called “ft. txt” in C: \pick Text file or convert to Excel format

File Transfer ft Create a folder on C drive” pick Enter “ft” at any printer select prompt Will be called “ft. txt” in C: \pick Text file or convert to Excel format

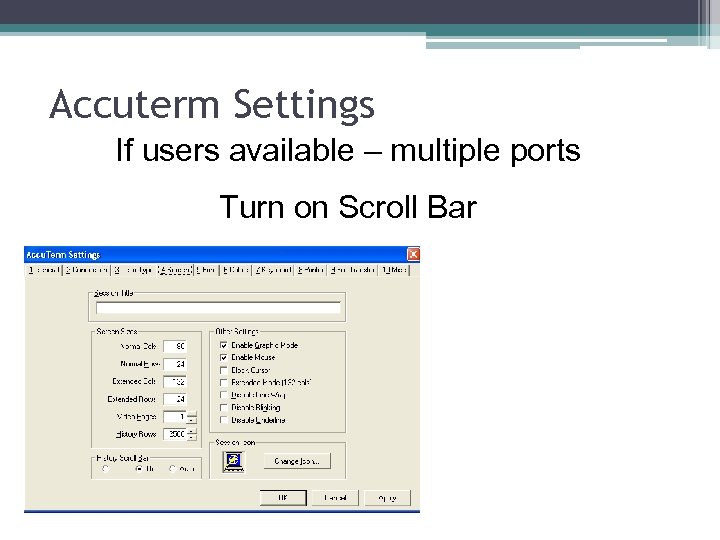

Accuterm Settings If users available – multiple ports Turn on Scroll Bar

Accuterm Settings If users available – multiple ports Turn on Scroll Bar

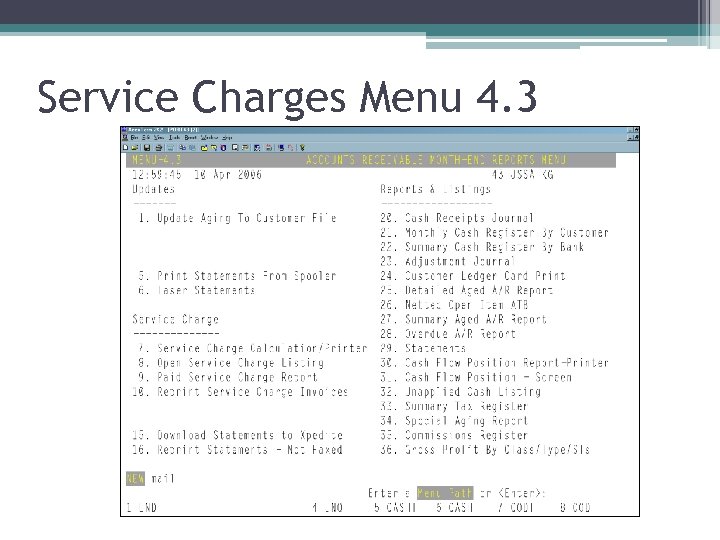

Service Charges Menu 4. 3

Service Charges Menu 4. 3

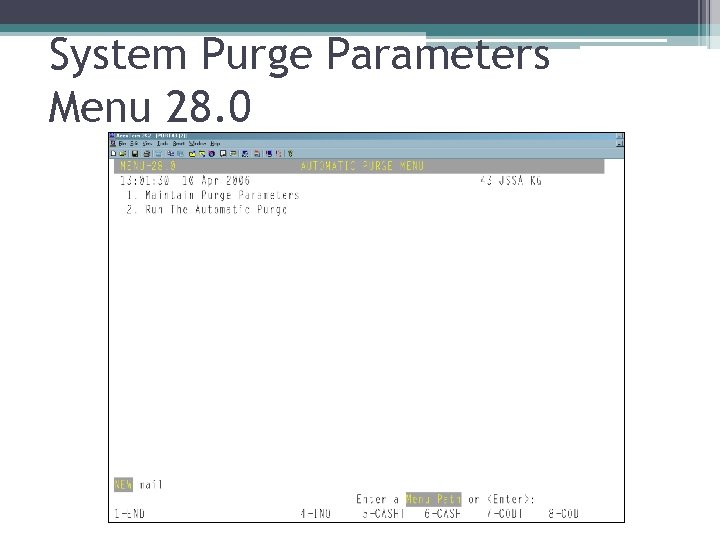

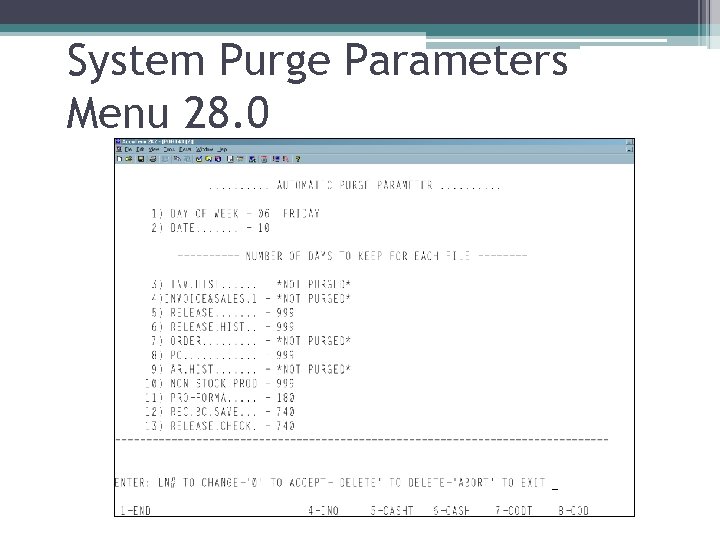

System Purge Parameters Menu 28. 0

System Purge Parameters Menu 28. 0

System Purge Parameters Menu 28. 0

System Purge Parameters Menu 28. 0

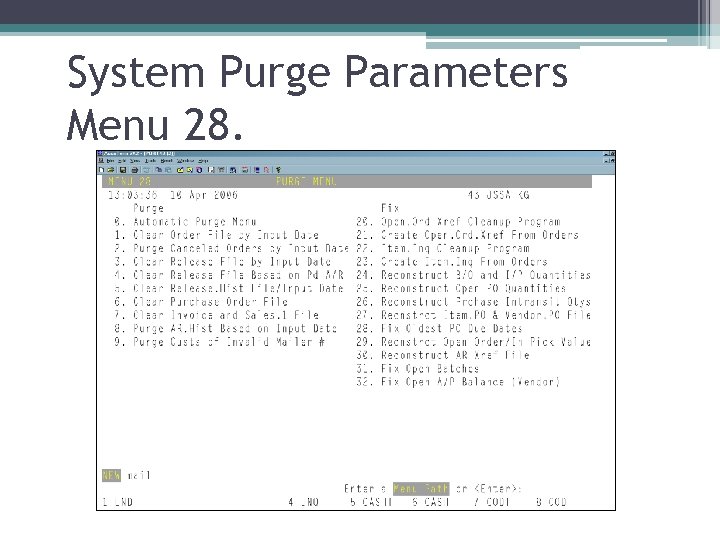

System Purge Parameters Menu 28.

System Purge Parameters Menu 28.

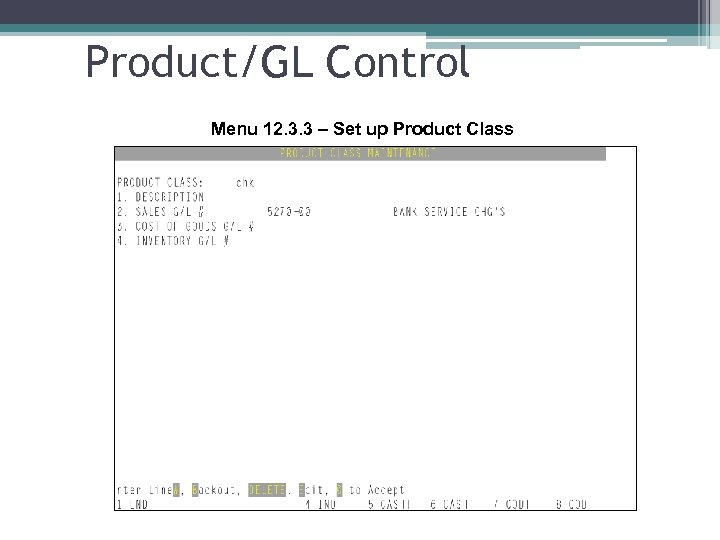

Product/GL Control Menu 12. 3. 3 – Set up Product Class

Product/GL Control Menu 12. 3. 3 – Set up Product Class

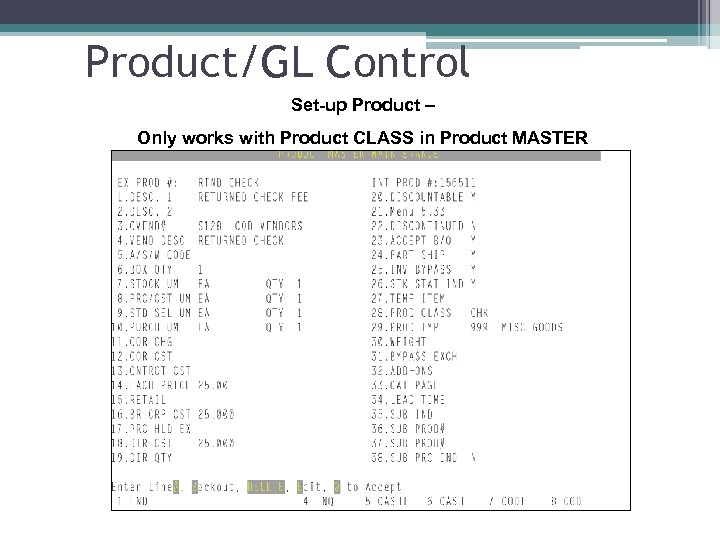

Product/GL Control Set-up Product – Only works with Product CLASS in Product MASTER

Product/GL Control Set-up Product – Only works with Product CLASS in Product MASTER

Parameters Men 13

Parameters Men 13

Menu Path Focus Menu 12

Menu Path Focus Menu 12

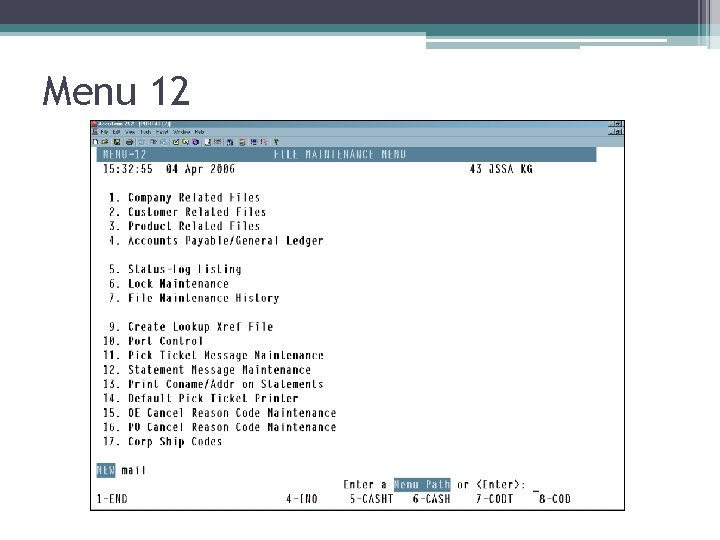

Menu 12

Menu 12

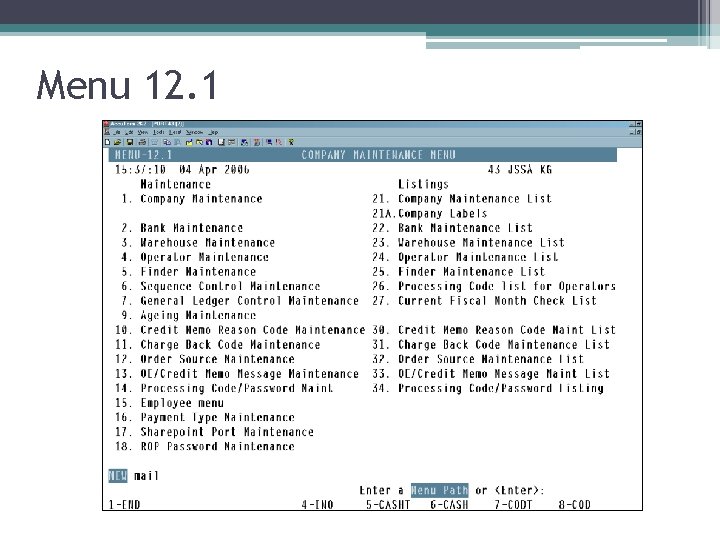

Menu 12. 1

Menu 12. 1

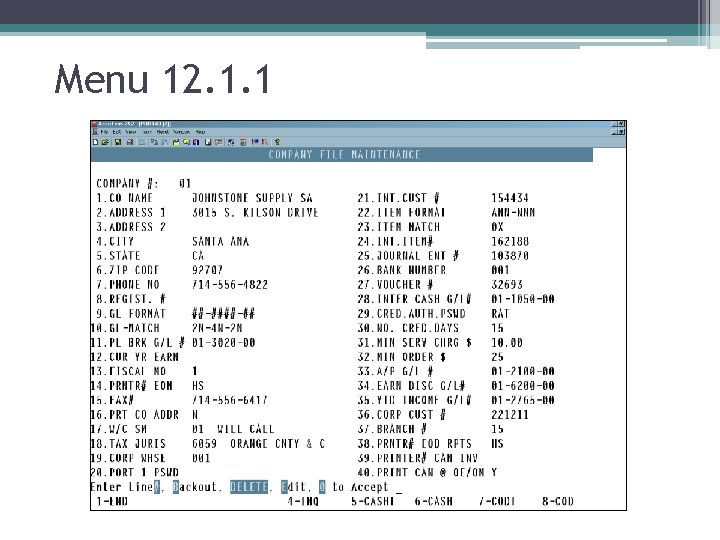

Menu 12. 1. 1

Menu 12. 1. 1

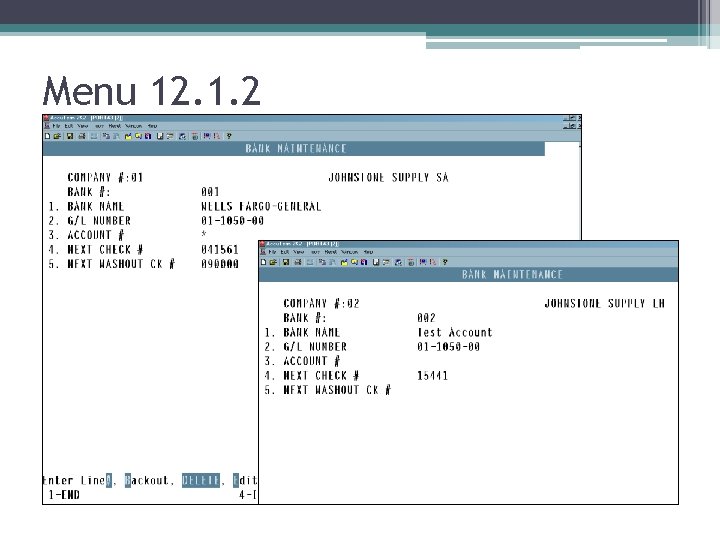

Menu 12. 1. 2

Menu 12. 1. 2

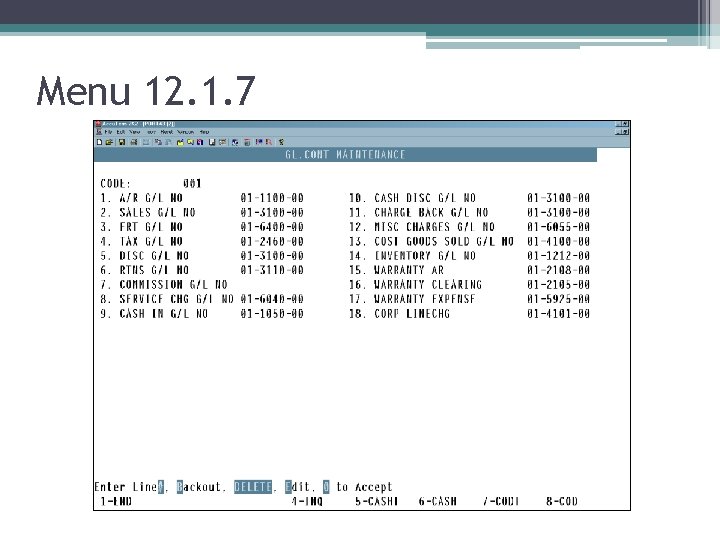

Menu 12. 1. 7

Menu 12. 1. 7

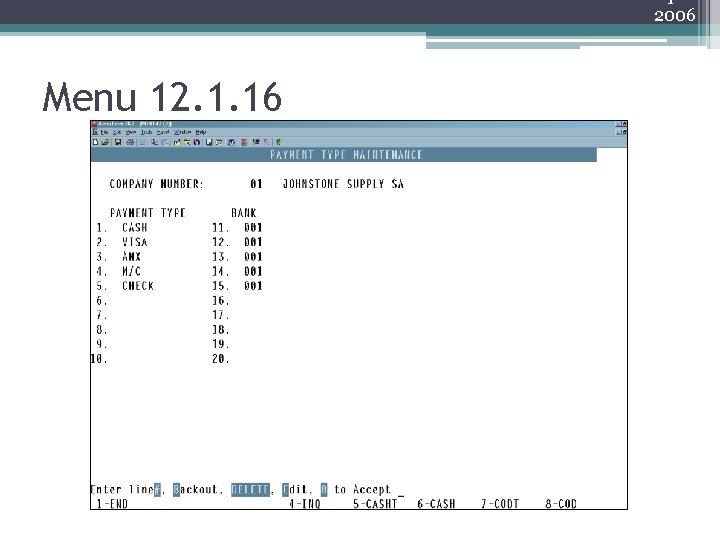

2006 Menu 12. 1. 16

2006 Menu 12. 1. 16

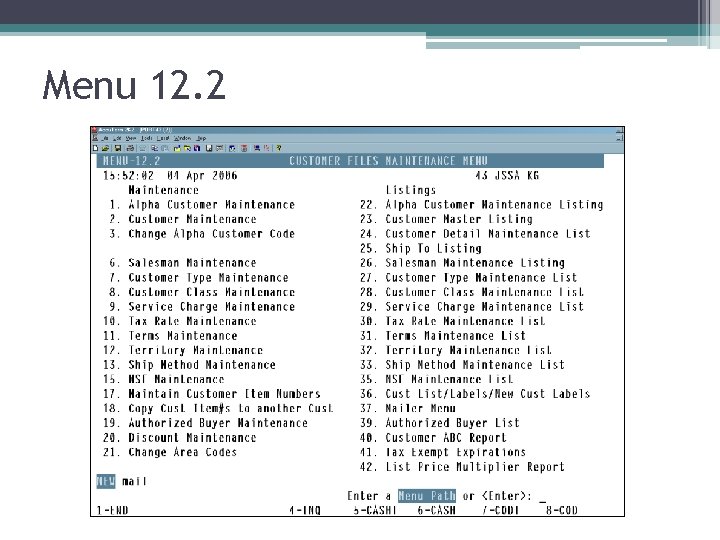

Menu 12. 2

Menu 12. 2

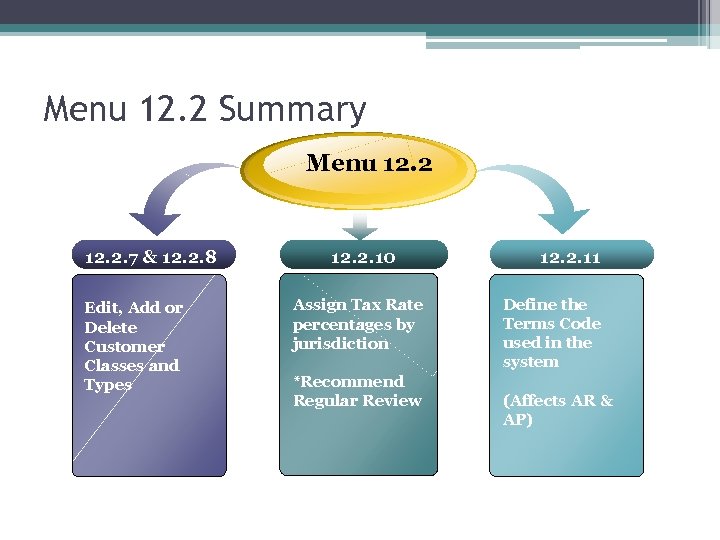

Menu 12. 2 Summary Menu 12. 2. 7 & 12. 2. 8 Edit, Add or Delete Customer Classes and Types 12. 2. 10 Assign Tax Rate percentages by jurisdiction *Recommend Regular Review 12. 2. 11 Define the Terms Code used in the system (Affects AR & AP)

Menu 12. 2 Summary Menu 12. 2. 7 & 12. 2. 8 Edit, Add or Delete Customer Classes and Types 12. 2. 10 Assign Tax Rate percentages by jurisdiction *Recommend Regular Review 12. 2. 11 Define the Terms Code used in the system (Affects AR & AP)

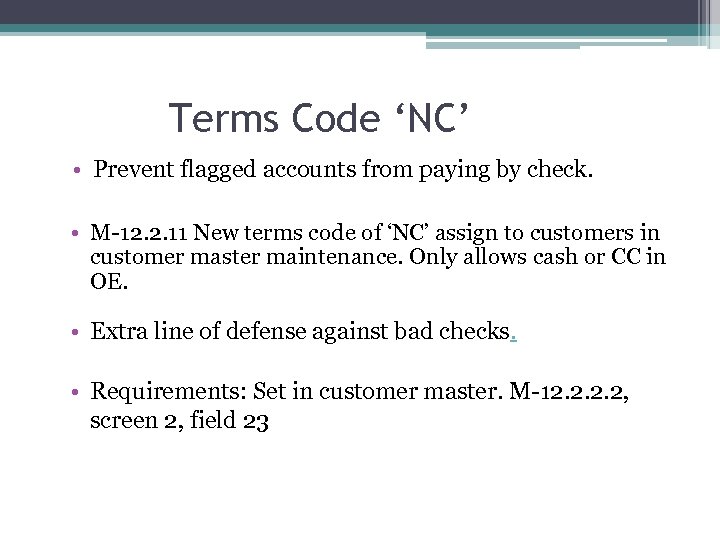

Terms Code ‘NC’ • Prevent flagged accounts from paying by check. • M-12. 2. 11 New terms code of ‘NC’ assign to customers in customer master maintenance. Only allows cash or CC in OE. • Extra line of defense against bad checks. • Requirements: Set in customer master. M-12. 2, screen 2, field 23

Terms Code ‘NC’ • Prevent flagged accounts from paying by check. • M-12. 2. 11 New terms code of ‘NC’ assign to customers in customer master maintenance. Only allows cash or CC in OE. • Extra line of defense against bad checks. • Requirements: Set in customer master. M-12. 2, screen 2, field 23

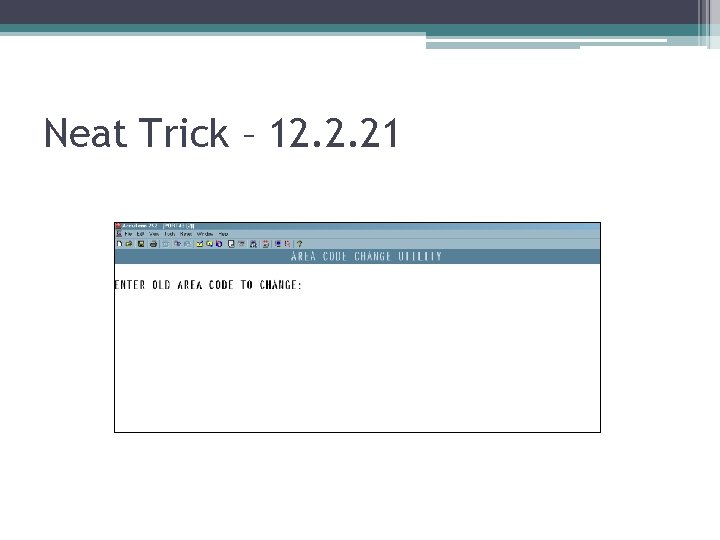

Neat Trick – 12. 2. 21

Neat Trick – 12. 2. 21

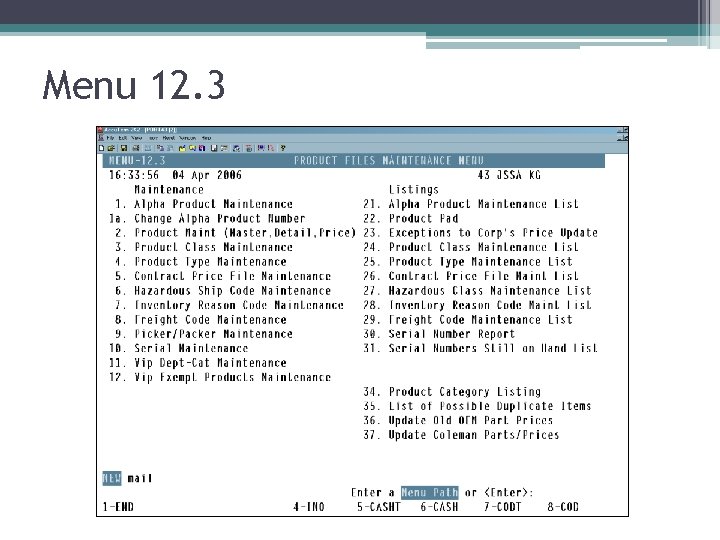

Menu 12. 3

Menu 12. 3

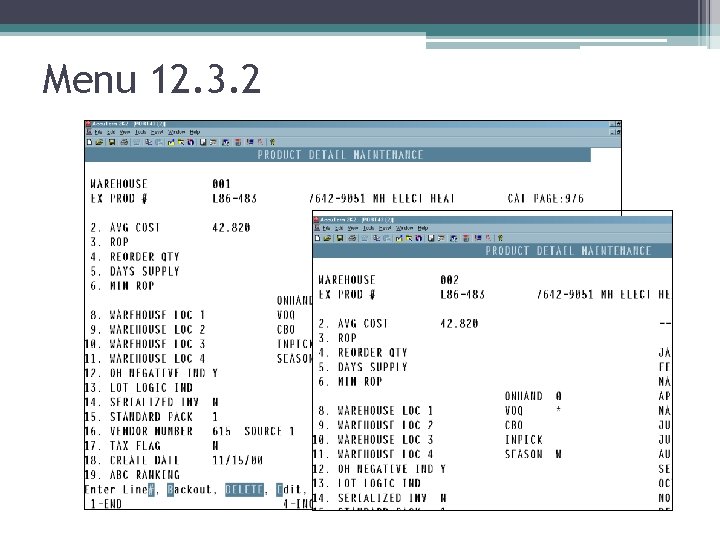

Menu 12. 3. 2

Menu 12. 3. 2

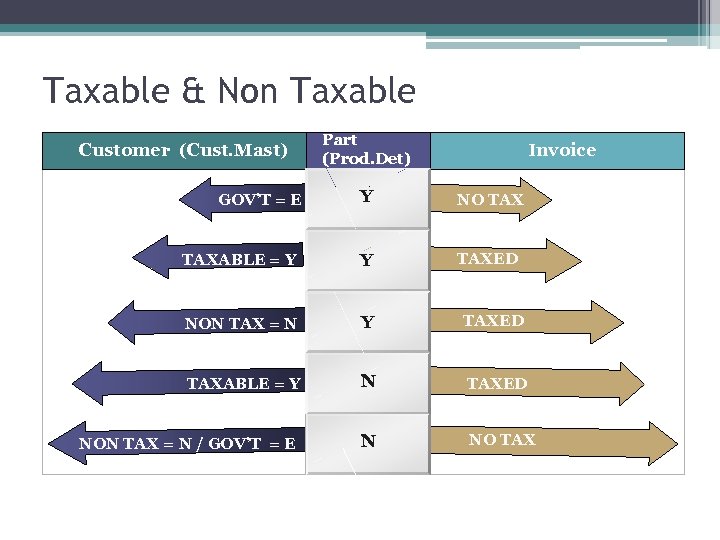

Taxable & Non Taxable Customer (Cust. Mast) Part (Prod. Det) Invoice Y NO TAXABLE = Y Y TAXED NON TAX = N Y TAXED TAXABLE = Y N TAXED N NO TAX GOV’T = E NON TAX = N / GOV’T = E

Taxable & Non Taxable Customer (Cust. Mast) Part (Prod. Det) Invoice Y NO TAXABLE = Y Y TAXED NON TAX = N Y TAXED TAXABLE = Y N TAXED N NO TAX GOV’T = E NON TAX = N / GOV’T = E

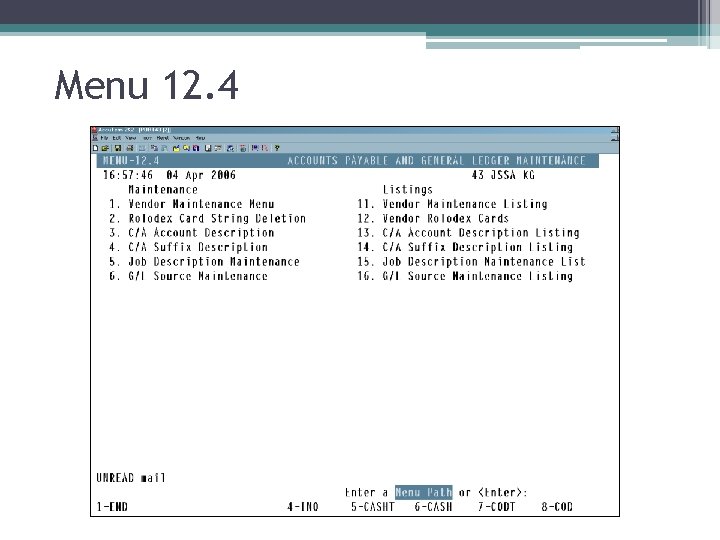

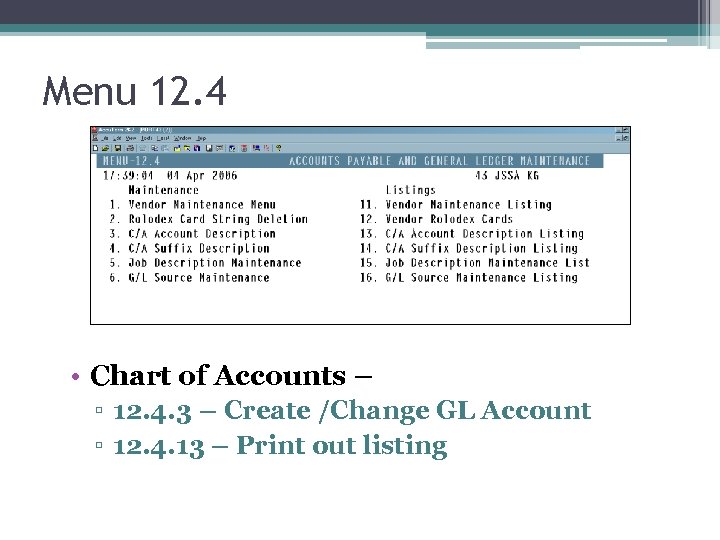

Menu 12. 4

Menu 12. 4

Menu 12. 4 • Chart of Accounts – ▫ 12. 4. 3 – Create /Change GL Account ▫ 12. 4. 13 – Print out listing

Menu 12. 4 • Chart of Accounts – ▫ 12. 4. 3 – Create /Change GL Account ▫ 12. 4. 13 – Print out listing

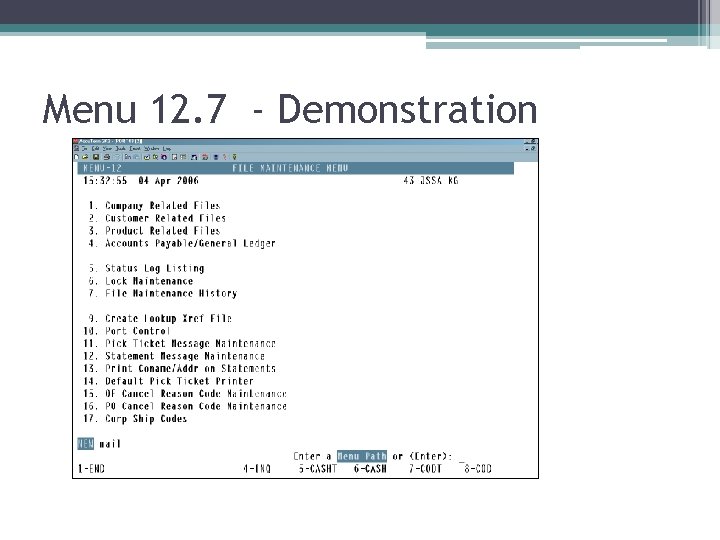

Menu 12. 7 - Demonstration

Menu 12. 7 - Demonstration

Menu Path Focus Menu 35

Menu Path Focus Menu 35

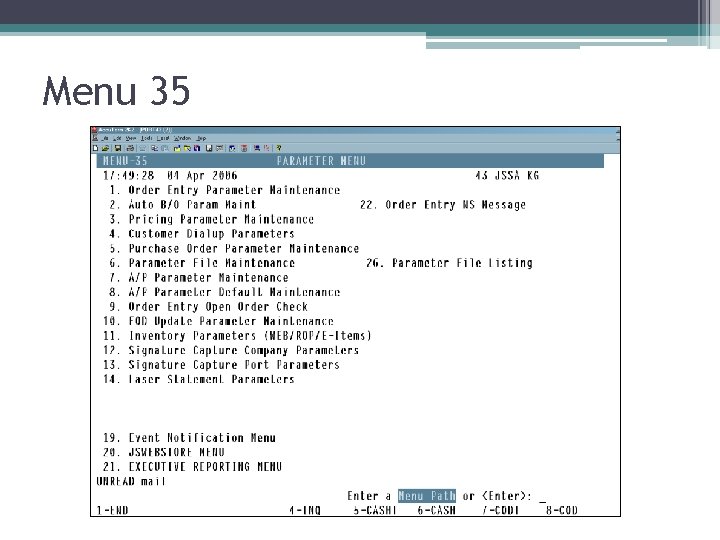

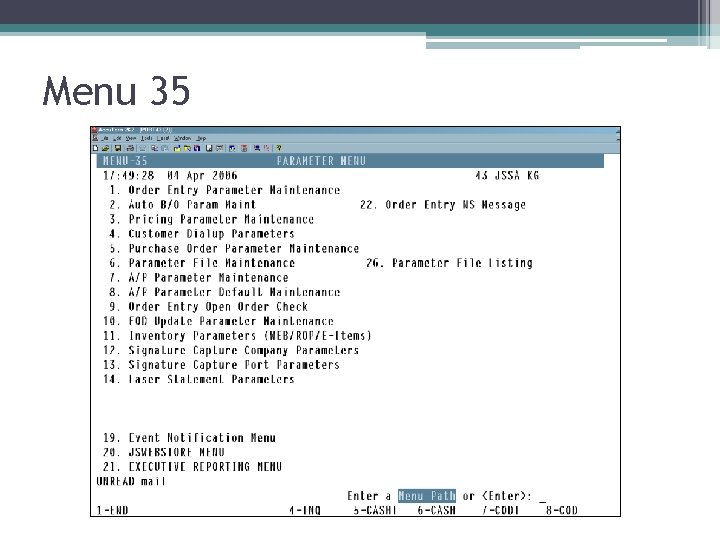

Menu 35

Menu 35

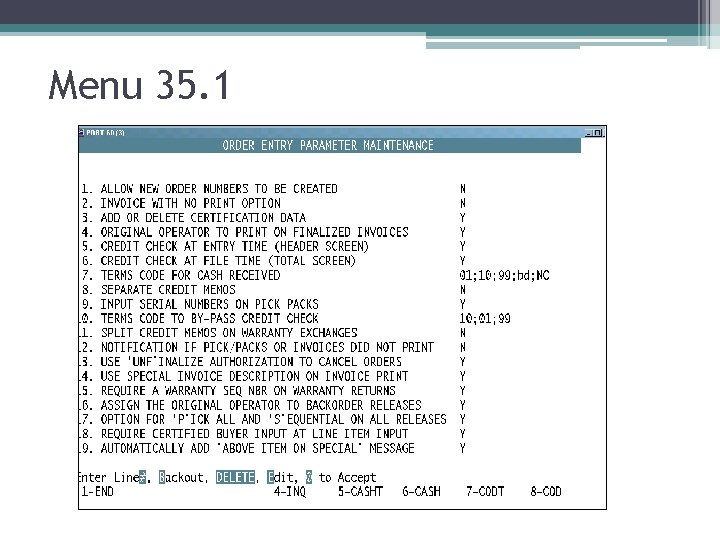

Menu 35. 1

Menu 35. 1

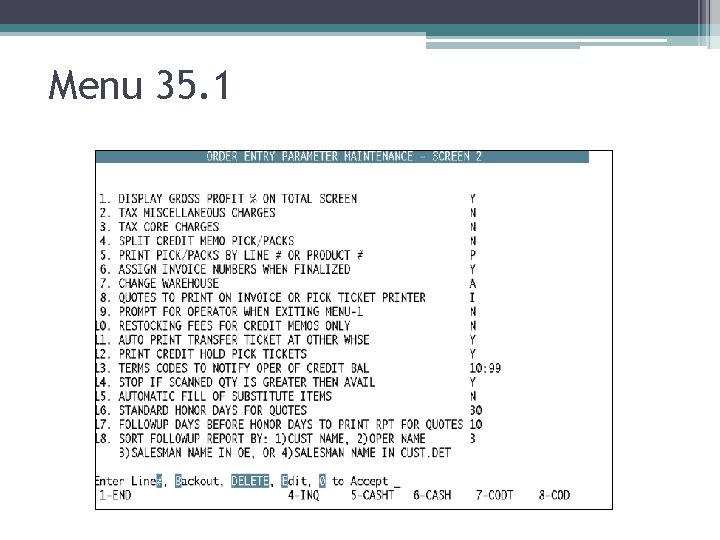

Menu 35. 1

Menu 35. 1

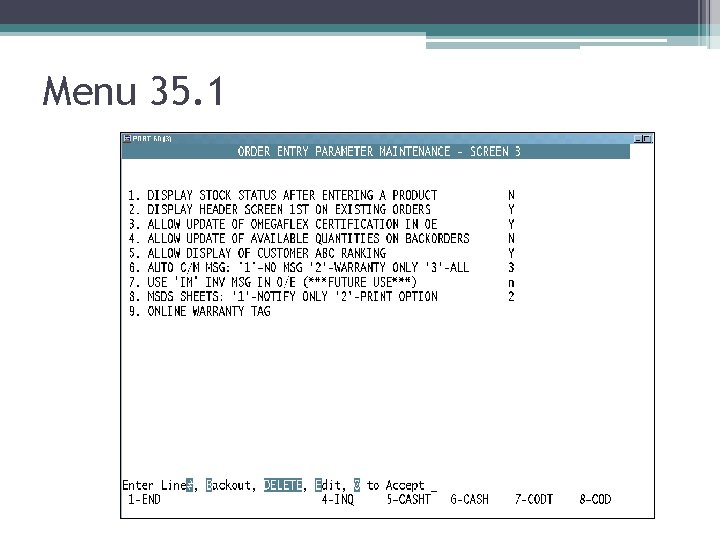

Menu 35. 1

Menu 35. 1

Menu 35

Menu 35

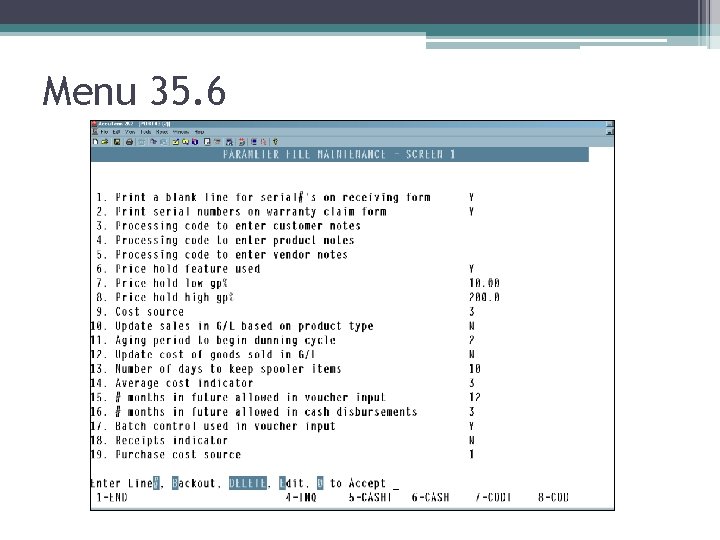

Menu 35. 6

Menu 35. 6

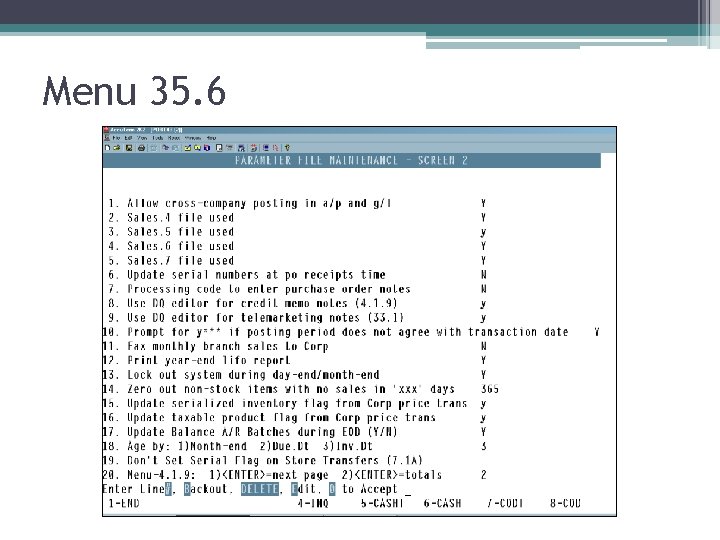

Menu 35. 6

Menu 35. 6

Aging Options • AR Aging options for system to age based on month-end, due date, or invoice date. • M-35. 6, Screen 2 field 18 Set the parameter, run through eod, see how it works. • Find the AR aging method that works best for how you do your business.

Aging Options • AR Aging options for system to age based on month-end, due date, or invoice date. • M-35. 6, Screen 2 field 18 Set the parameter, run through eod, see how it works. • Find the AR aging method that works best for how you do your business.

Aging Options cont’d: • Month-end - same aging calculation as before except that the credits will not age against overdue balances. • Due Date – invoices will age based on the number of days past the due date. • Invoice Date – Aging will be based on the number of days since the invoice was run. • Secret Option #4

Aging Options cont’d: • Month-end - same aging calculation as before except that the credits will not age against overdue balances. • Due Date – invoices will age based on the number of days past the due date. • Invoice Date – Aging will be based on the number of days since the invoice was run. • Secret Option #4

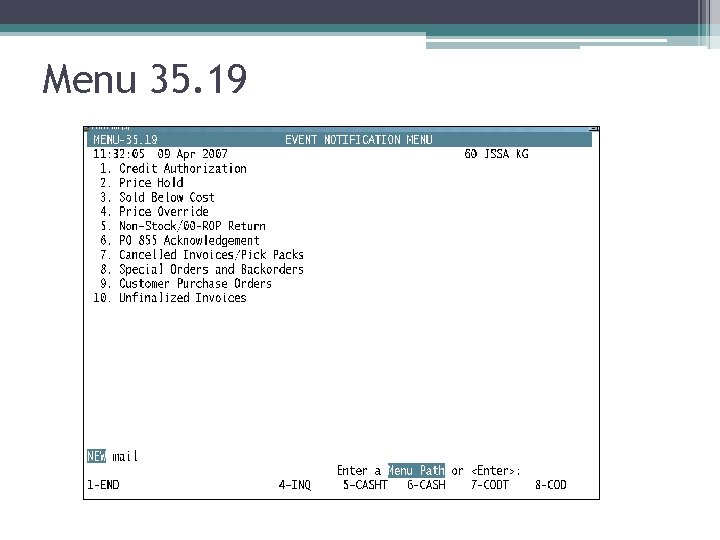

Menu 35. 19

Menu 35. 19

Demonstration

Demonstration

Questions?

Questions?

Menu Path Focus Menu 13

Menu Path Focus Menu 13

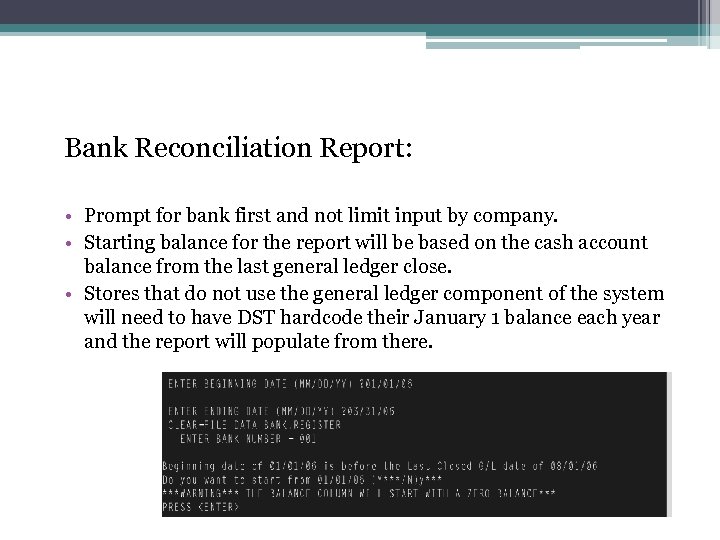

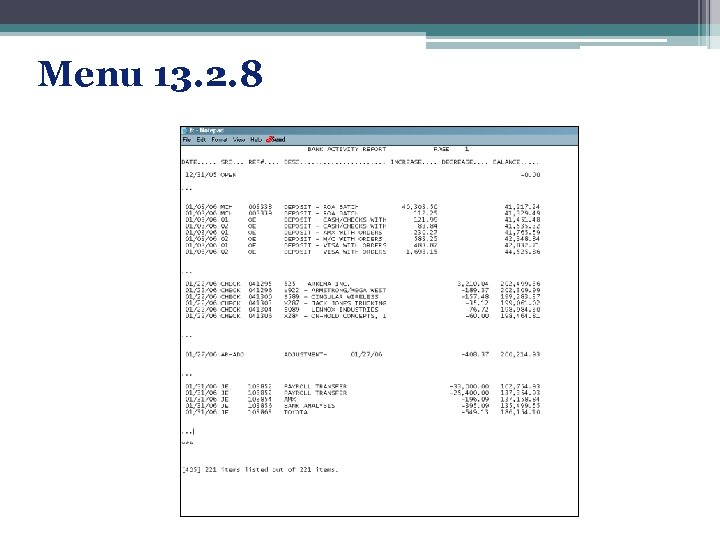

Bank Reconciliation Report: • Prompt for bank first and not limit input by company. • Starting balance for the report will be based on the cash account balance from the last general ledger close. • Stores that do not use the general ledger component of the system will need to have DST hardcode their January 1 balance each year and the report will populate from there.

Bank Reconciliation Report: • Prompt for bank first and not limit input by company. • Starting balance for the report will be based on the cash account balance from the last general ledger close. • Stores that do not use the general ledger component of the system will need to have DST hardcode their January 1 balance each year and the report will populate from there.

Demonstration

Demonstration

Menu 13. 2. 8

Menu 13. 2. 8

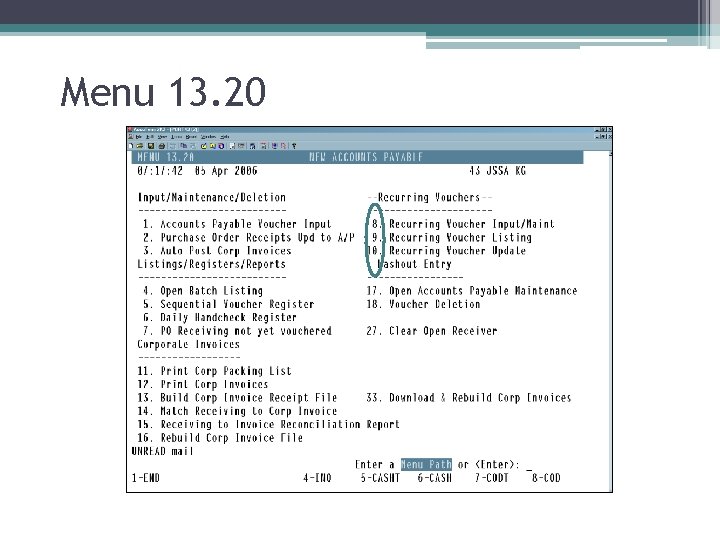

Menu 13. 20

Menu 13. 20

Demonstration

Demonstration

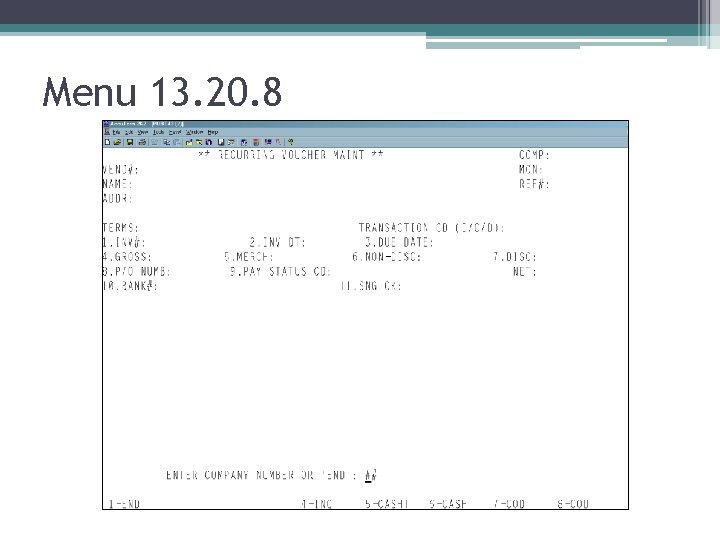

Menu 13. 20. 8

Menu 13. 20. 8

Reoccurring Vouchers Enter vouchers in 13. 20. 8 Listing 13. 20. 9 (Monthly) Update 13. 20. 10 (Monthly)

Reoccurring Vouchers Enter vouchers in 13. 20. 8 Listing 13. 20. 9 (Monthly) Update 13. 20. 10 (Monthly)

Inventory Valuation

Inventory Valuation

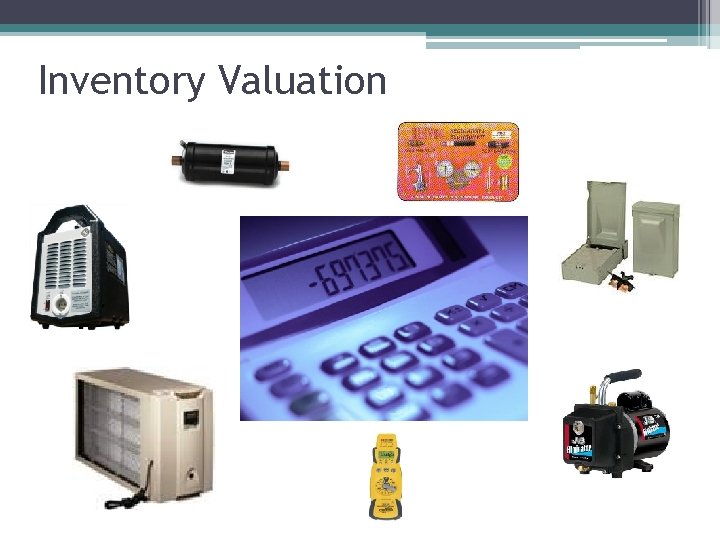

Detail vs. Summary Detail Summary

Detail vs. Summary Detail Summary

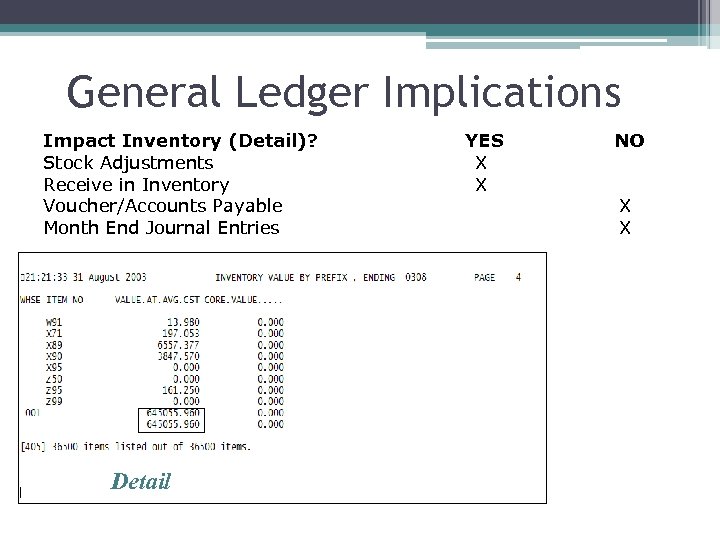

General Ledger Implications Impact Inventory (Detail)? Stock Adjustments Receive in Inventory Voucher/Accounts Payable Month End Journal Entries Detail YES X X NO X X

General Ledger Implications Impact Inventory (Detail)? Stock Adjustments Receive in Inventory Voucher/Accounts Payable Month End Journal Entries Detail YES X X NO X X

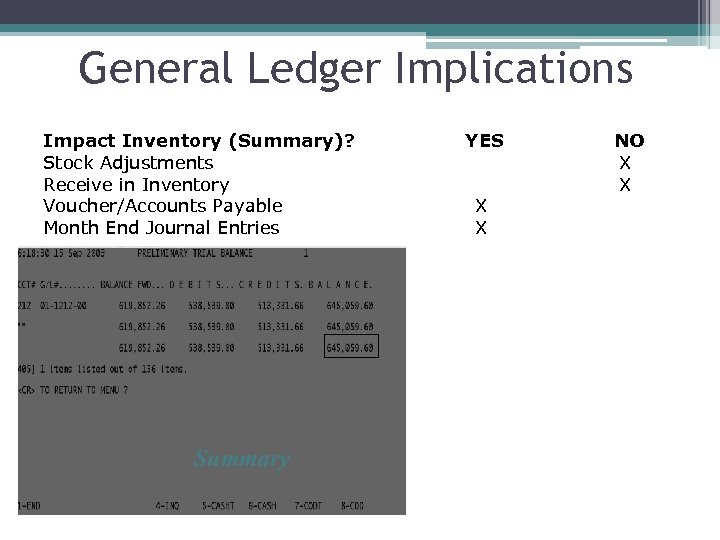

General Ledger Implications Impact Inventory (Summary)? Stock Adjustments Receive in Inventory Voucher/Accounts Payable Month End Journal Entries Summary YES X X NO X X

General Ledger Implications Impact Inventory (Summary)? Stock Adjustments Receive in Inventory Voucher/Accounts Payable Month End Journal Entries Summary YES X X NO X X

How to balance your inventory…

How to balance your inventory…

NO easy solution, but it can happen with: Time Effort Attention to detail

NO easy solution, but it can happen with: Time Effort Attention to detail

Pieces to Valuing Inventory Average Cost EOM Journal Entries Time & Effort Monthly Reconciling

Pieces to Valuing Inventory Average Cost EOM Journal Entries Time & Effort Monthly Reconciling

Potential Problems: • 1) Product has been received but not yet vouchered into the Accounts Payable system - Inventory value is updated at receiving time (i. e. as soon as the on-hand increases due to a PO receipt). However, the G/L Inventory is not updated until the vendor invoice has been vouchered and the Inventory G/L account debited for the amount of the merchandise received. • 2) Inventory adjustments have not been properly entered into the General Ledger via a Journal Entry - The Daily Inventory Transaction Audit Report that runs with each Day End lists all inventory adjustments that have been made for the day. These adjustments directly affect the product on-hand quantity and consequently the inventory value. A journal entry must be made to the Inventory G/L account for all inventory adjustments made throughout the month to properly reflect these changes in the General Ledger inventory value.

Potential Problems: • 1) Product has been received but not yet vouchered into the Accounts Payable system - Inventory value is updated at receiving time (i. e. as soon as the on-hand increases due to a PO receipt). However, the G/L Inventory is not updated until the vendor invoice has been vouchered and the Inventory G/L account debited for the amount of the merchandise received. • 2) Inventory adjustments have not been properly entered into the General Ledger via a Journal Entry - The Daily Inventory Transaction Audit Report that runs with each Day End lists all inventory adjustments that have been made for the day. These adjustments directly affect the product on-hand quantity and consequently the inventory value. A journal entry must be made to the Inventory G/L account for all inventory adjustments made throughout the month to properly reflect these changes in the General Ledger inventory value.

Potential Problems (cont’d): • 3) The difference between the PO receipt cost and the vendorinvoiced cost does not agree - It is necessary to properly record any differences between the product cost at PO receiving time and the actual cost invoiced from the vendor. • 4) Incorrect use of the Warranty System…vendor credits do not match credits issued through the warranty claim - When closing warranty claims, vouchers should be expensed only to the Warranty A/R account. Also, when issuing vendor credits, the actual credit amount from the vendor should be used. • 5) Incorrect or non-posting of the Inventory Buyback. The Buybacks (rotational or annual) reduces on-hand (and subsequently inventory value). It is therefore necessary to make a journal entry to reflect this change in the G/L inventory value.

Potential Problems (cont’d): • 3) The difference between the PO receipt cost and the vendorinvoiced cost does not agree - It is necessary to properly record any differences between the product cost at PO receiving time and the actual cost invoiced from the vendor. • 4) Incorrect use of the Warranty System…vendor credits do not match credits issued through the warranty claim - When closing warranty claims, vouchers should be expensed only to the Warranty A/R account. Also, when issuing vendor credits, the actual credit amount from the vendor should be used. • 5) Incorrect or non-posting of the Inventory Buyback. The Buybacks (rotational or annual) reduces on-hand (and subsequently inventory value). It is therefore necessary to make a journal entry to reflect this change in the G/L inventory value.

Potential Problems (cont’d): • 6) Incorrect or non-posting of the Physical Inventory variance - The Physical Inventory process updates on-hand (and subsequently inventory value) at the time the inventory is updated. It is therefore necessary to make a journal entry to reflect this change in the G/L inventory value. • 7) PO Receipts posting of items not carried as inventory - Products such as C 99 and Z 95 items should have then Inventory Bypass flag set to ‘Y’es to avoid updating their on-hand (and subsequently inventory) values. Also, these items should not be received, as their on-hand value should always remain at zero.

Potential Problems (cont’d): • 6) Incorrect or non-posting of the Physical Inventory variance - The Physical Inventory process updates on-hand (and subsequently inventory value) at the time the inventory is updated. It is therefore necessary to make a journal entry to reflect this change in the G/L inventory value. • 7) PO Receipts posting of items not carried as inventory - Products such as C 99 and Z 95 items should have then Inventory Bypass flag set to ‘Y’es to avoid updating their on-hand (and subsequently inventory) values. Also, these items should not be received, as their on-hand value should always remain at zero.

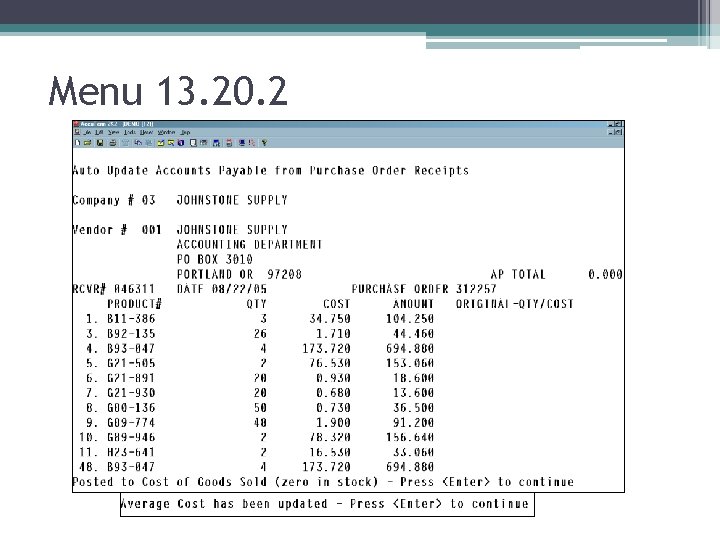

Potential Problems (cont’d): • 8) Failure to utilize 13. 20. 2 Purchase Order Receipts Update to A/P to record vendor invoices and cost changes - 13. 20. 2 is the only supported process by which stores, whose desire is to balance Inventory Value to General Inventory, can ensure that what is being entered into the inventory system via PO receipts posting matches that which is entered into the A/P system and subsequently the General Ledger. Care must be taken to match all PO receipts to vendor invoices, with reconciliation and cost discrepancies entered through the Purchase Order Receipts Update to A/P process (13. 20. 2).

Potential Problems (cont’d): • 8) Failure to utilize 13. 20. 2 Purchase Order Receipts Update to A/P to record vendor invoices and cost changes - 13. 20. 2 is the only supported process by which stores, whose desire is to balance Inventory Value to General Inventory, can ensure that what is being entered into the inventory system via PO receipts posting matches that which is entered into the A/P system and subsequently the General Ledger. Care must be taken to match all PO receipts to vendor invoices, with reconciliation and cost discrepancies entered through the Purchase Order Receipts Update to A/P process (13. 20. 2).

Average Cost Calculation

Average Cost Calculation

Menu 13. 20. 2

Menu 13. 20. 2

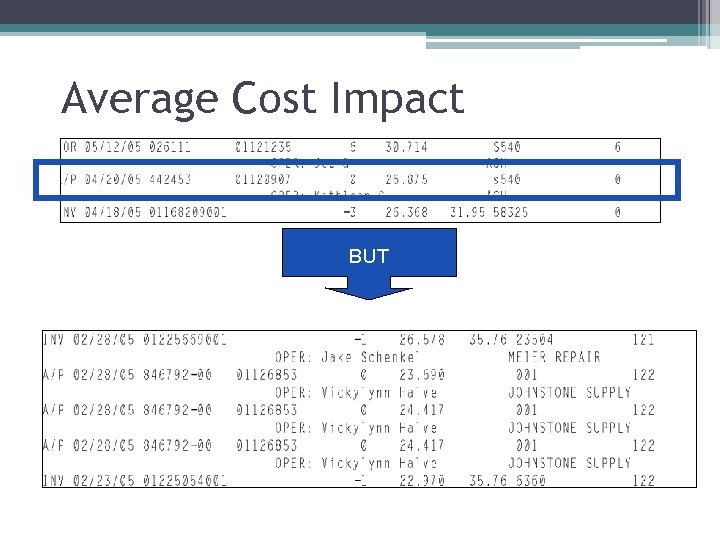

Average Cost Impact BUT

Average Cost Impact BUT

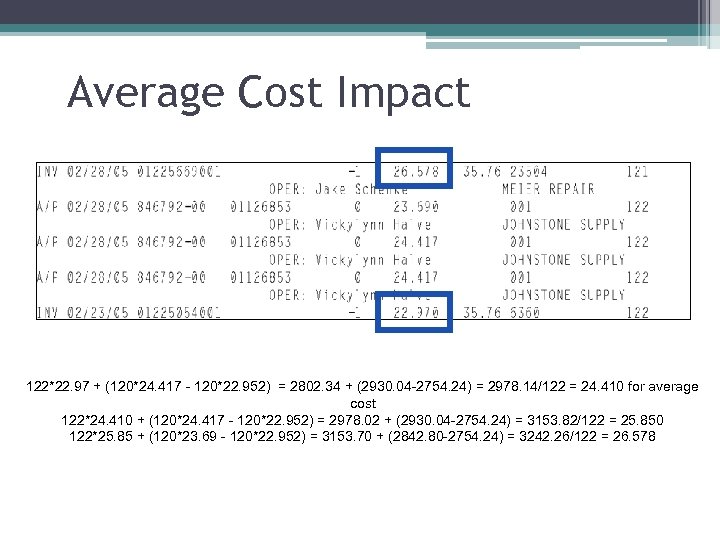

Average Cost Impact 122*22. 97 + (120*24. 417 - 120*22. 952) = 2802. 34 + (2930. 04 -2754. 24) = 2978. 14/122 = 24. 410 for average cost 122*24. 410 + (120*24. 417 - 120*22. 952) = 2978. 02 + (2930. 04 -2754. 24) = 3153. 82/122 = 25. 850 122*25. 85 + (120*23. 69 - 120*22. 952) = 3153. 70 + (2842. 80 -2754. 24) = 3242. 26/122 = 26. 578

Average Cost Impact 122*22. 97 + (120*24. 417 - 120*22. 952) = 2802. 34 + (2930. 04 -2754. 24) = 2978. 14/122 = 24. 410 for average cost 122*24. 410 + (120*24. 417 - 120*22. 952) = 2978. 02 + (2930. 04 -2754. 24) = 3153. 82/122 = 25. 850 122*25. 85 + (120*23. 69 - 120*22. 952) = 3153. 70 + (2842. 80 -2754. 24) = 3242. 26/122 = 26. 578

Questions?

Questions?

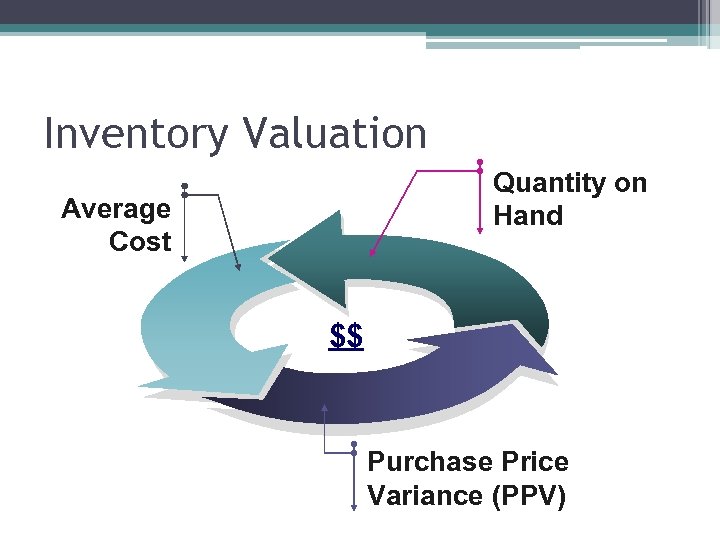

Inventory Valuation Quantity on Hand Average Cost $$ Purchase Price Variance (PPV)

Inventory Valuation Quantity on Hand Average Cost $$ Purchase Price Variance (PPV)

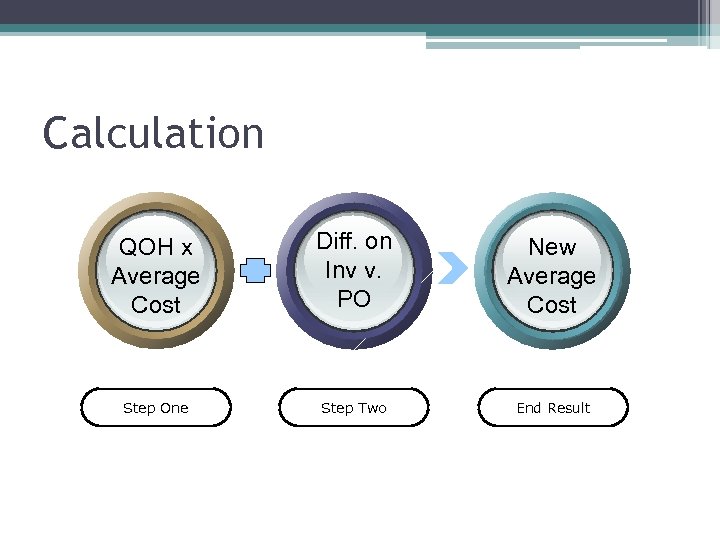

Calculation QOH x Average Cost Diff. on Inv v. PO New Average Cost Step One Step Two End Result

Calculation QOH x Average Cost Diff. on Inv v. PO New Average Cost Step One Step Two End Result

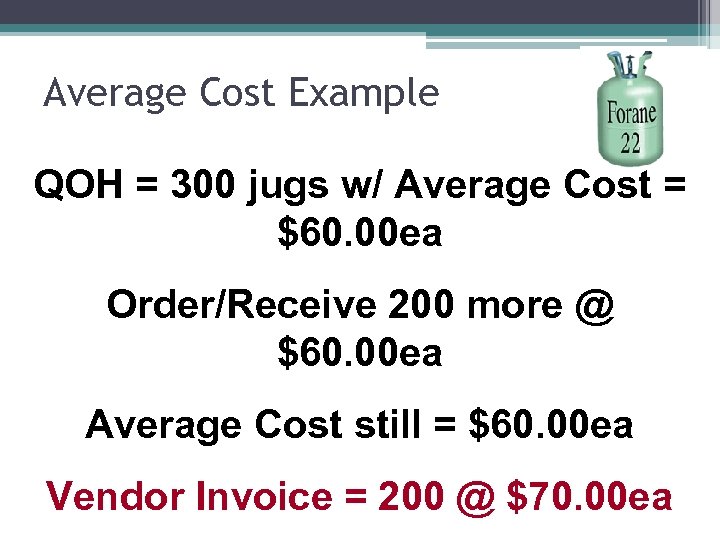

Average Cost Example QOH = 300 jugs w/ Average Cost = $60. 00 ea Order/Receive 200 more @ $60. 00 ea Average Cost still = $60. 00 ea Vendor Invoice = 200 @ $70. 00 ea

Average Cost Example QOH = 300 jugs w/ Average Cost = $60. 00 ea Order/Receive 200 more @ $60. 00 ea Average Cost still = $60. 00 ea Vendor Invoice = 200 @ $70. 00 ea

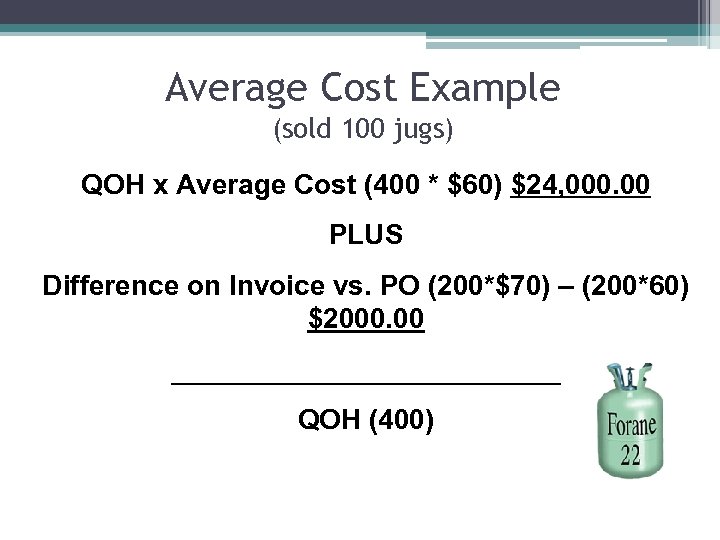

Average Cost Example (sold 100 jugs) QOH x Average Cost (400 * $60) $24, 000. 00 PLUS Difference on Invoice vs. PO (200*$70) – (200*60) $2000. 00 _____________ QOH (400)

Average Cost Example (sold 100 jugs) QOH x Average Cost (400 * $60) $24, 000. 00 PLUS Difference on Invoice vs. PO (200*$70) – (200*60) $2000. 00 _____________ QOH (400)

Average Cost Example $65. 00 New Average Cost

Average Cost Example $65. 00 New Average Cost

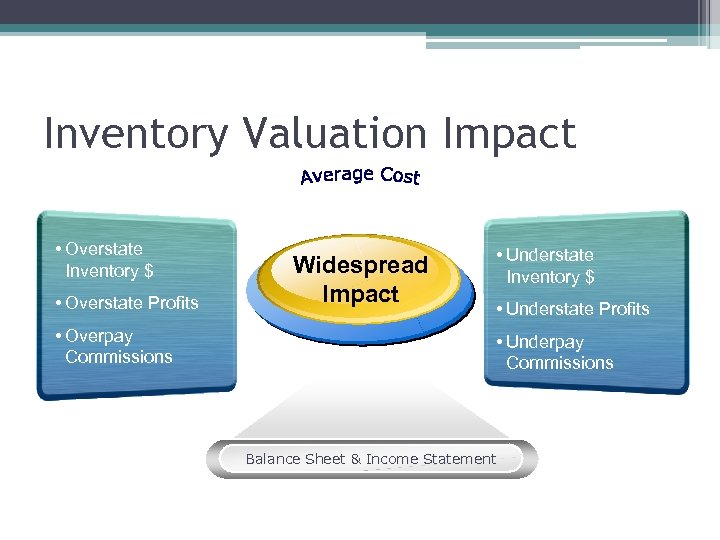

Inventory Valuation Impact • Overstate Inventory $ • Overstate Profits • Overpay Commissions Widespread Impact • Understate Inventory $ • Understate Profits • Underpay Commissions Balance Sheet & Income Statement

Inventory Valuation Impact • Overstate Inventory $ • Overstate Profits • Overpay Commissions Widespread Impact • Understate Inventory $ • Understate Profits • Underpay Commissions Balance Sheet & Income Statement

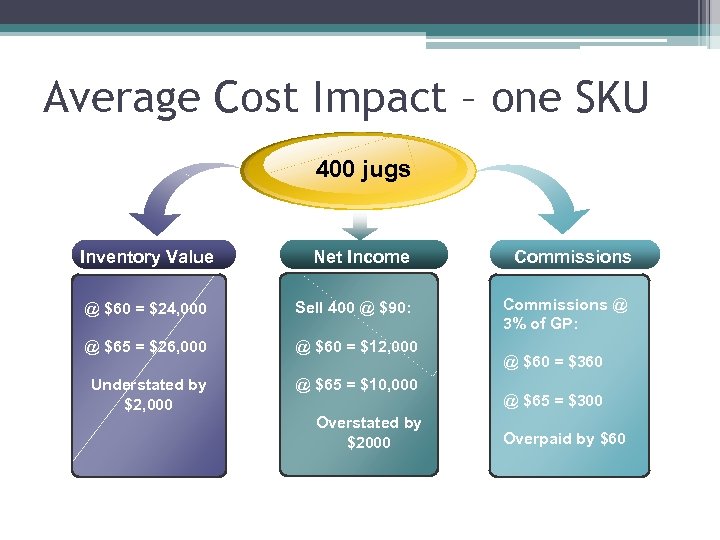

Average Cost Impact – one SKU 400 jugs Inventory Value Net Income Commissions @ $60 = $24, 000 Sell 400 @ $90: Commissions @ 3% of GP: @ $65 = $26, 000 @ $60 = $12, 000 Understated by $2, 000 @ $65 = $10, 000 Overstated by $2000 @ $60 = $360 @ $65 = $300 Overpaid by $60

Average Cost Impact – one SKU 400 jugs Inventory Value Net Income Commissions @ $60 = $24, 000 Sell 400 @ $90: Commissions @ 3% of GP: @ $65 = $26, 000 @ $60 = $12, 000 Understated by $2, 000 @ $65 = $10, 000 Overstated by $2000 @ $60 = $360 @ $65 = $300 Overpaid by $60

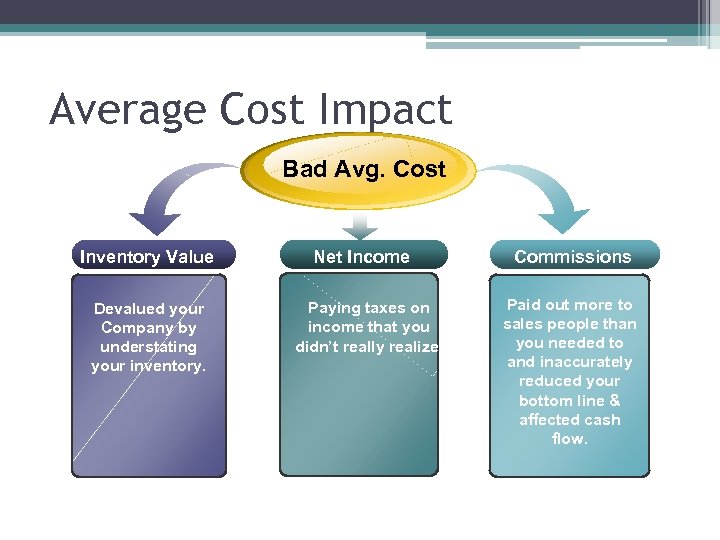

Average Cost Impact Bad Avg. Cost Inventory Value Devalued your Company by understating your inventory. Net Income Paying taxes on income that you didn’t really realize. Commissions Paid out more to sales people than you needed to and inaccurately reduced your bottom line & affected cash flow.

Average Cost Impact Bad Avg. Cost Inventory Value Devalued your Company by understating your inventory. Net Income Paying taxes on income that you didn’t really realize. Commissions Paid out more to sales people than you needed to and inaccurately reduced your bottom line & affected cash flow.

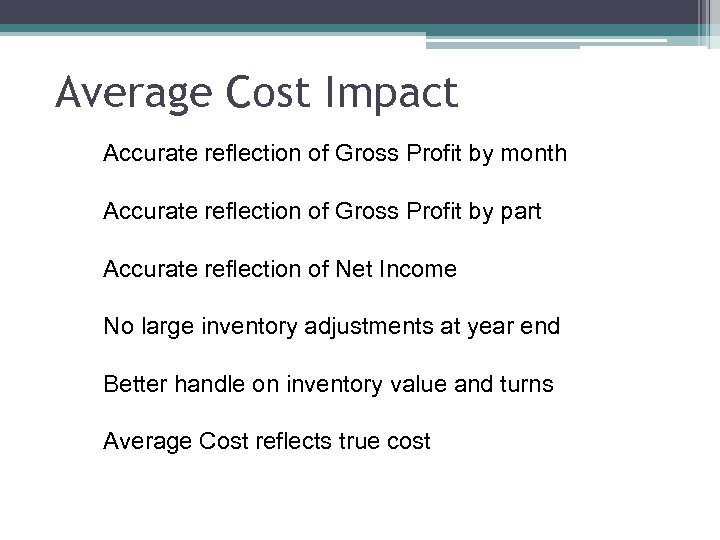

Average Cost Impact Accurate reflection of Gross Profit by month Accurate reflection of Gross Profit by part Accurate reflection of Net Income No large inventory adjustments at year end Better handle on inventory value and turns Average Cost reflects true cost

Average Cost Impact Accurate reflection of Gross Profit by month Accurate reflection of Gross Profit by part Accurate reflection of Net Income No large inventory adjustments at year end Better handle on inventory value and turns Average Cost reflects true cost

Questions?

Questions?

EOM Inventory Procedures

EOM Inventory Procedures

Inventory Journal Entry #1 Use Menu 13. 20. 2 and 13. 20. 3 Run Menu 13. 20. 7 at month end and use for reversing Journal Entry Inventory XXXXX Inv. Accr XXXXX

Inventory Journal Entry #1 Use Menu 13. 20. 2 and 13. 20. 3 Run Menu 13. 20. 7 at month end and use for reversing Journal Entry Inventory XXXXX Inv. Accr XXXXX

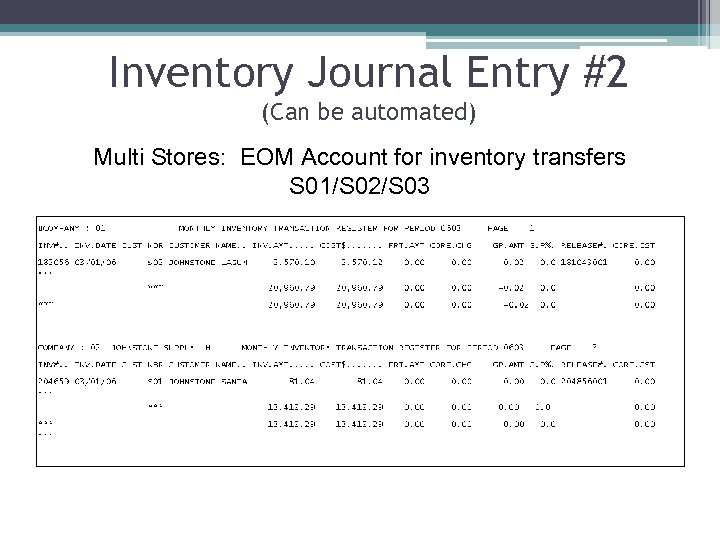

Inventory Journal Entry #2 (Can be automated) Multi Stores: EOM Account for inventory transfers S 01/S 02/S 03

Inventory Journal Entry #2 (Can be automated) Multi Stores: EOM Account for inventory transfers S 01/S 02/S 03

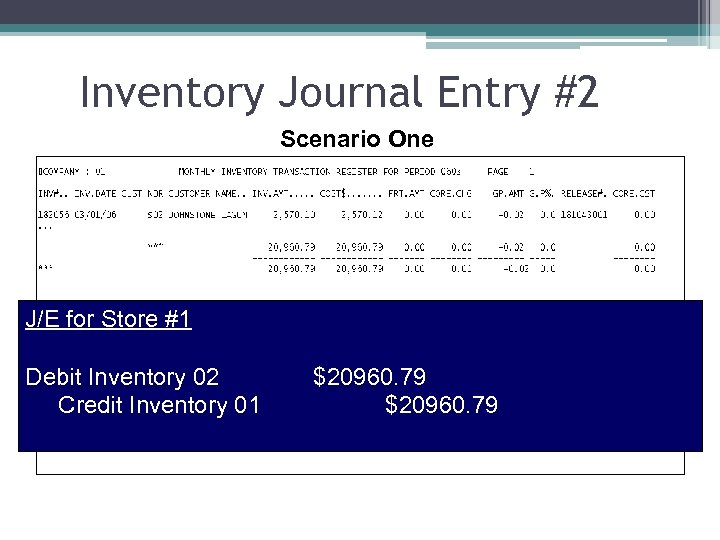

Inventory Journal Entry #2 Scenario One J/E for Store #1 Debit Inventory 02 Credit Inventory 01 $20960. 79

Inventory Journal Entry #2 Scenario One J/E for Store #1 Debit Inventory 02 Credit Inventory 01 $20960. 79

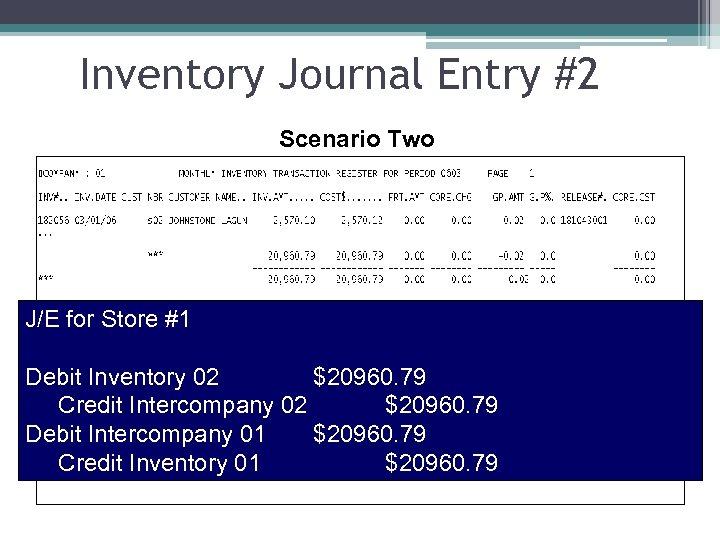

Inventory Journal Entry #2 Scenario Two J/E for Store #1 Debit Inventory 02 $20960. 79 Credit Intercompany 02 $20960. 79 Debit Intercompany 01 $20960. 79 Credit Inventory 01 $20960. 79

Inventory Journal Entry #2 Scenario Two J/E for Store #1 Debit Inventory 02 $20960. 79 Credit Intercompany 02 $20960. 79 Debit Intercompany 01 $20960. 79 Credit Inventory 01 $20960. 79

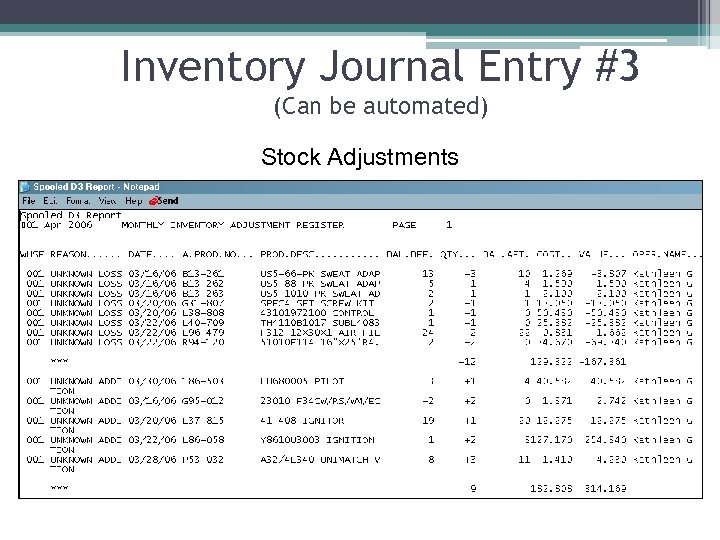

Inventory Journal Entry #3 (Can be automated) Stock Adjustments

Inventory Journal Entry #3 (Can be automated) Stock Adjustments

Questions?

Questions?

Inventory Processes Men 13

Inventory Processes Men 13

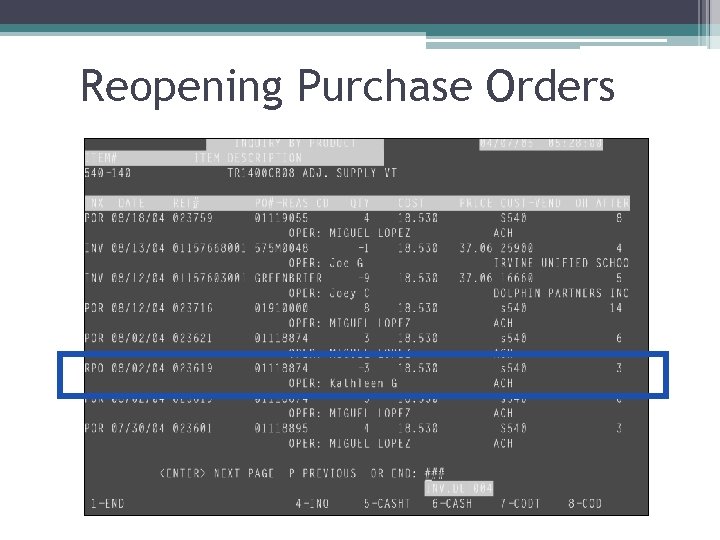

Reopening Purchase Orders Reopening Receivers If you do it – have to reopen the first & only receiver on the PO OR It can throw out your AP/GL Reconciliation ** Doesn’t work with Dropship POs

Reopening Purchase Orders Reopening Receivers If you do it – have to reopen the first & only receiver on the PO OR It can throw out your AP/GL Reconciliation ** Doesn’t work with Dropship POs

Reopening Purchase Orders

Reopening Purchase Orders

Physical Inventory Be sure to make note of the final variance amount that you update since you will need to make the journal entry on the books to balance the detail to the summary. You debit/credit inventory and an income statement account with this variance amount.

Physical Inventory Be sure to make note of the final variance amount that you update since you will need to make the journal entry on the books to balance the detail to the summary. You debit/credit inventory and an income statement account with this variance amount.

Buyback • Corp is set up as customer 00000. Field 17 (Inv. sfer) in 12. 2. 2. 3 is set to "1. " This is so that the invoices will not show on the Invoice and Credit Memo Register and will not figure in the Gross Profit Report. • Menu 19. 7 a &7 b are updated so that these transactions can be seen in the inventory history. • Also, A/R is not created and the G/L is not automatically updated. • Since the General Ledger is not automatically updated, you have to do a journal entry to relieve inventory. We credit inventory and debit “buyback expense”. Then we get the credit in from Corp, we credit buyback expense. The difference left in the account and gives us an idea of what expense we incurred (write off of dead inventory) as a result of the buyback.

Buyback • Corp is set up as customer 00000. Field 17 (Inv. sfer) in 12. 2. 2. 3 is set to "1. " This is so that the invoices will not show on the Invoice and Credit Memo Register and will not figure in the Gross Profit Report. • Menu 19. 7 a &7 b are updated so that these transactions can be seen in the inventory history. • Also, A/R is not created and the G/L is not automatically updated. • Since the General Ledger is not automatically updated, you have to do a journal entry to relieve inventory. We credit inventory and debit “buyback expense”. Then we get the credit in from Corp, we credit buyback expense. The difference left in the account and gives us an idea of what expense we incurred (write off of dead inventory) as a result of the buyback.

Buyback • The sales analysis files are not updated so they do not show up in sales. This is important since we don't want to pay 1% to Corp on the buyback sales. **An additional note along those same lines: the report that you get off at the end of the day that shows the invoices to customer 0000 at sell price. So using the report, figure out the average cost per invoice by using the sell and the GP figures. This is the number that you want to relieve inventory by (with journal entry). • There may be multiple invoices for the buyback. It usually doesn't happen on just one invoice. Usually all the invoices for the buyback are generated the same day; however, if not, just make sure to stay in contact with the warehouse so that you know whenever an invoice is generated.

Buyback • The sales analysis files are not updated so they do not show up in sales. This is important since we don't want to pay 1% to Corp on the buyback sales. **An additional note along those same lines: the report that you get off at the end of the day that shows the invoices to customer 0000 at sell price. So using the report, figure out the average cost per invoice by using the sell and the GP figures. This is the number that you want to relieve inventory by (with journal entry). • There may be multiple invoices for the buyback. It usually doesn't happen on just one invoice. Usually all the invoices for the buyback are generated the same day; however, if not, just make sure to stay in contact with the warehouse so that you know whenever an invoice is generated.

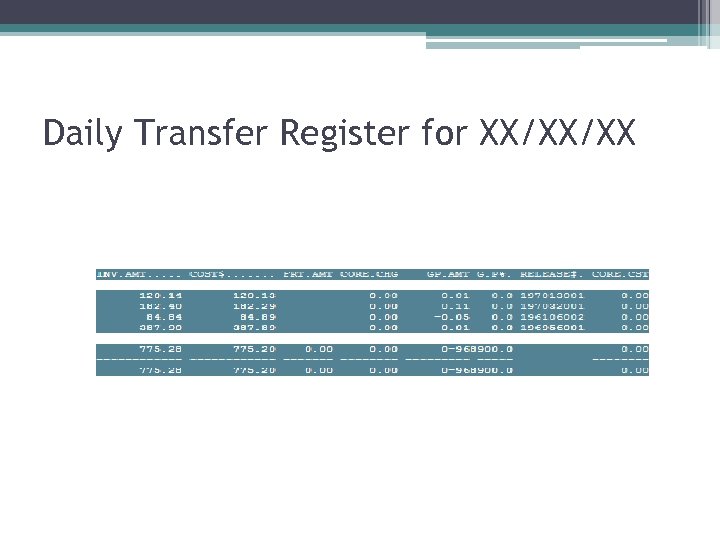

Daily Transfer Register for XX/XX/XX

Daily Transfer Register for XX/XX/XX

Warranty Men 13

Warranty Men 13

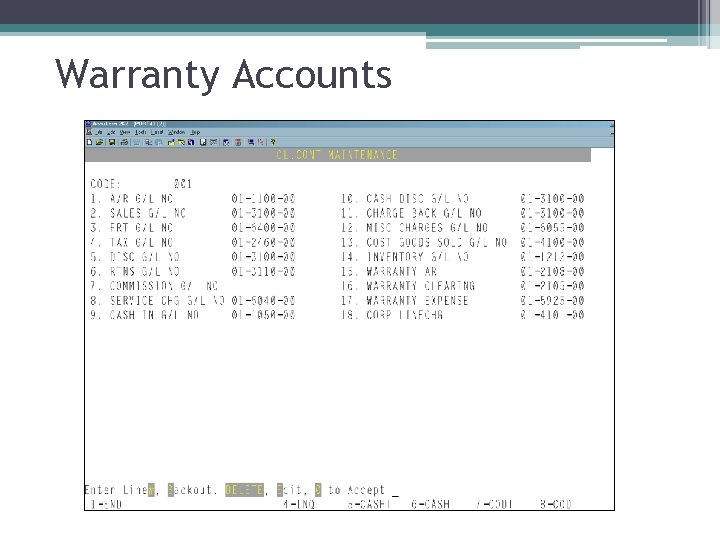

Warranty Accounts

Warranty Accounts

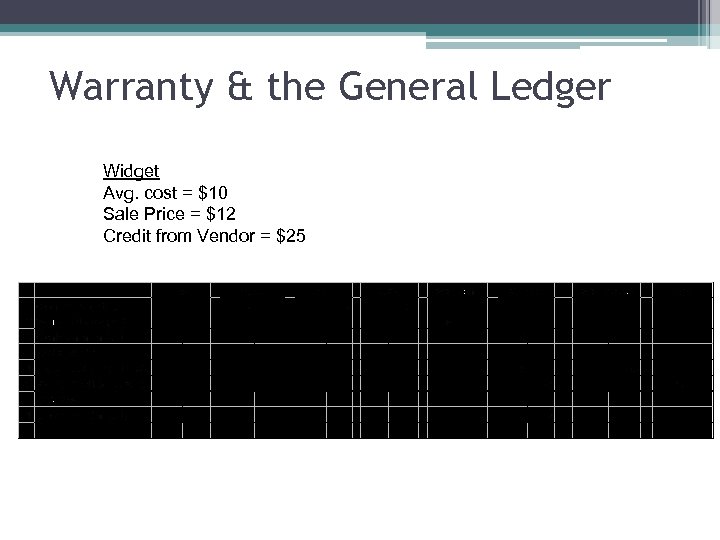

Warranty & the General Ledger Widget Avg. cost = $10 Sale Price = $12 Credit from Vendor = $25

Warranty & the General Ledger Widget Avg. cost = $10 Sale Price = $12 Credit from Vendor = $25

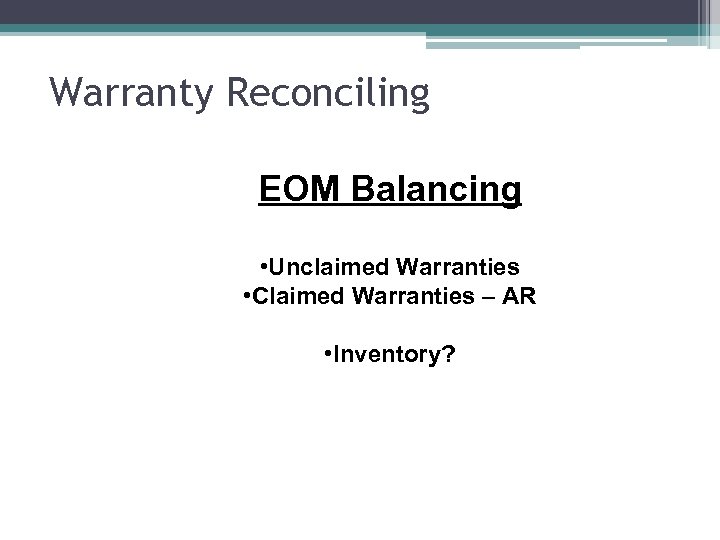

Warranty Reconciling EOM Balancing • Unclaimed Warranties • Claimed Warranties – AR • Inventory?

Warranty Reconciling EOM Balancing • Unclaimed Warranties • Claimed Warranties – AR • Inventory?

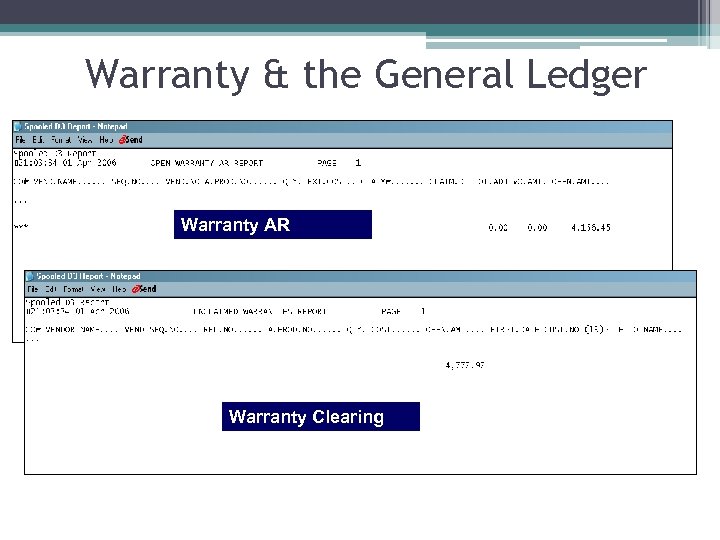

Warranty & the General Ledger Warranty AR Warranty Clearing

Warranty & the General Ledger Warranty AR Warranty Clearing

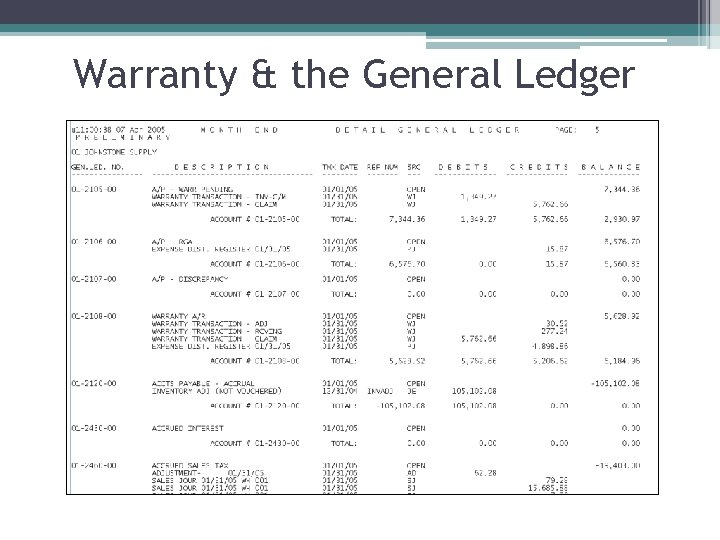

Warranty & the General Ledger

Warranty & the General Ledger

Sales Tax Men 13

Sales Tax Men 13

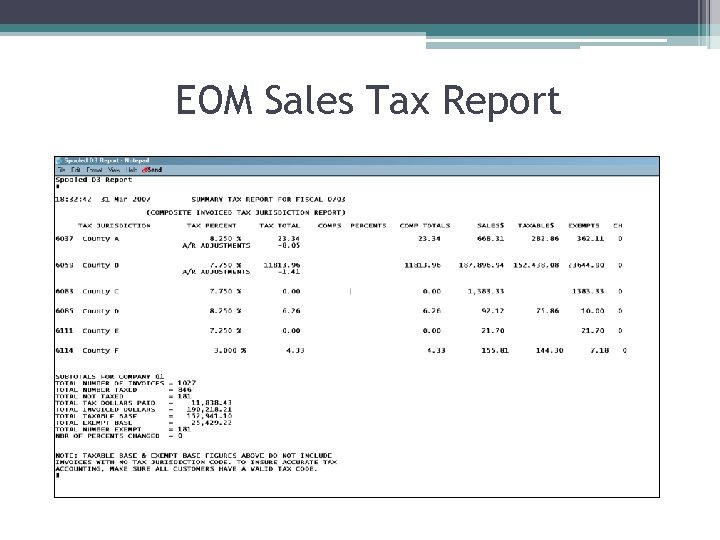

EOM Sales Tax Report

EOM Sales Tax Report

Excise Tax Men 13

Excise Tax Men 13

Discussion

Discussion

General Ledger Men 13

General Ledger Men 13

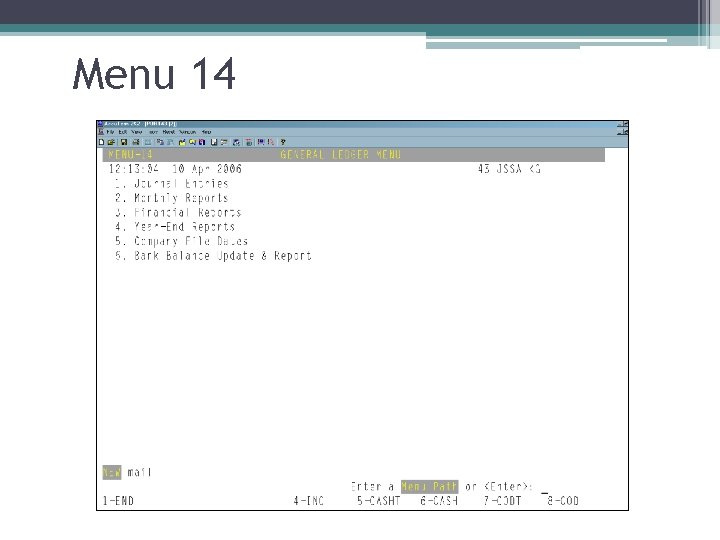

Menu 14

Menu 14

Setting up a GL account 14. 1. 1 (for each company) (Menu 12. 4. 3) Add to financial statements

Setting up a GL account 14. 1. 1 (for each company) (Menu 12. 4. 3) Add to financial statements

Demonstration

Demonstration

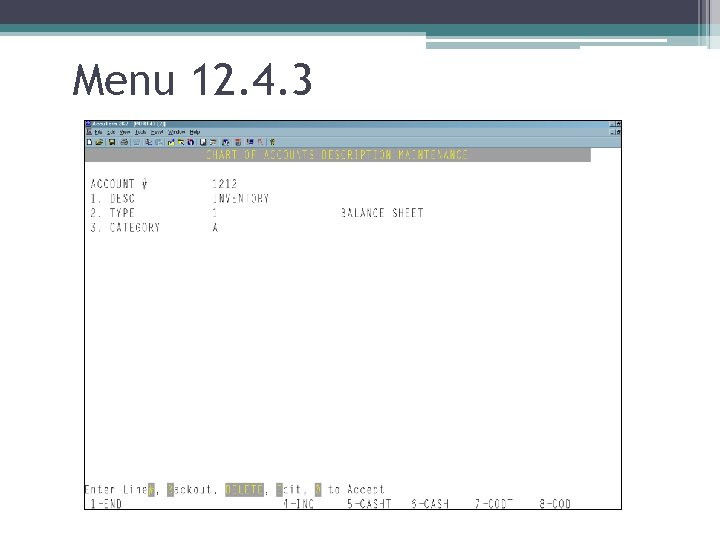

Menu 12. 4. 3

Menu 12. 4. 3

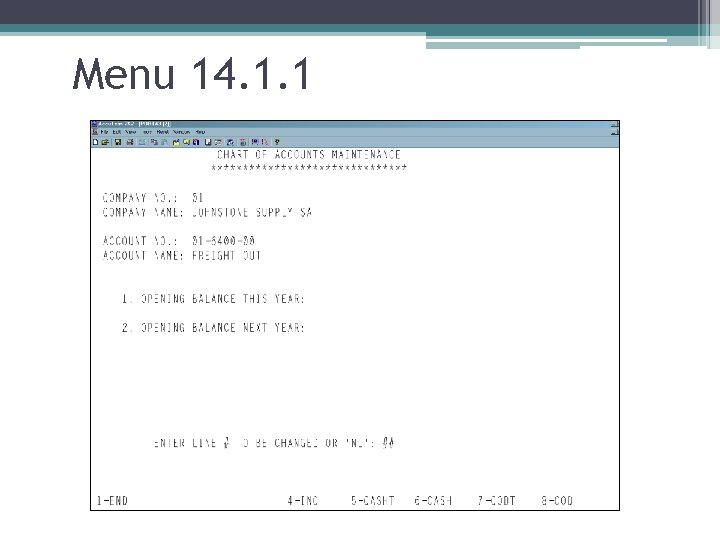

Menu 14. 1. 1

Menu 14. 1. 1

Setting up Financial Statements

Setting up Financial Statements

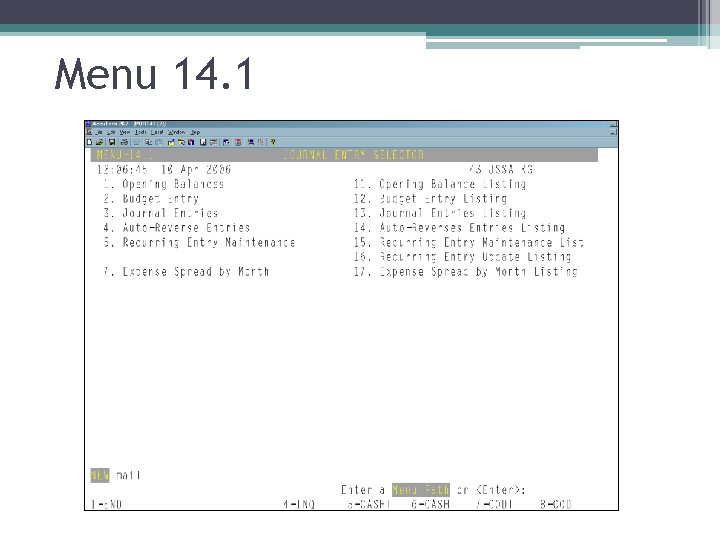

Menu 14. 1

Menu 14. 1

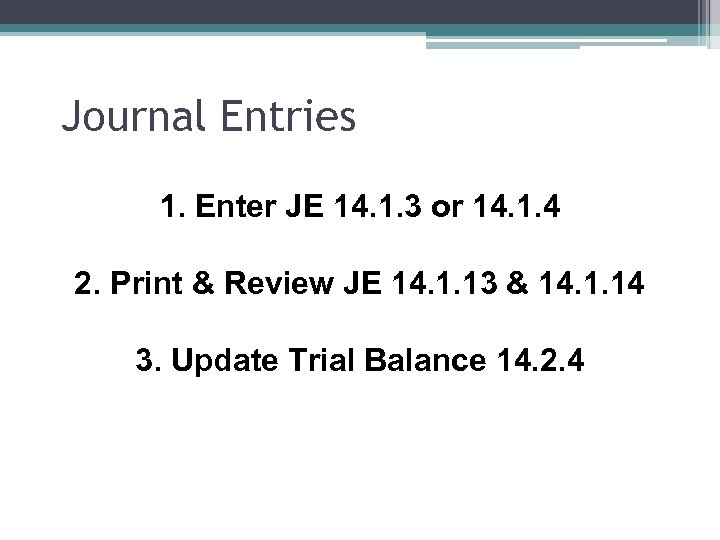

Journal Entries 1. Enter JE 14. 1. 3 or 14. 1. 4 2. Print & Review JE 14. 1. 13 & 14. 1. 14 3. Update Trial Balance 14. 2. 4

Journal Entries 1. Enter JE 14. 1. 3 or 14. 1. 4 2. Print & Review JE 14. 1. 13 & 14. 1. 14 3. Update Trial Balance 14. 2. 4

Demonstration

Demonstration

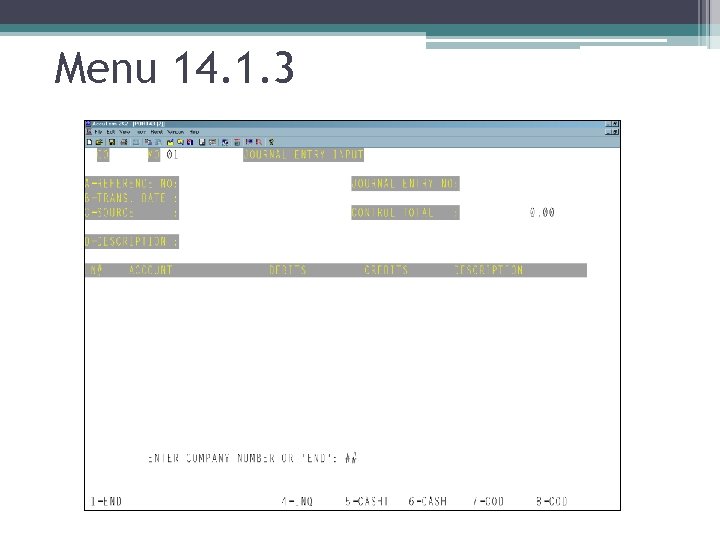

Menu 14. 1. 3

Menu 14. 1. 3

Reoccurring Journal Entries Enter JE 14. 1. 5 Review JE 14. 1. 15 Update JE 14. 1. 16 Update Trial Balance 14. 2. 4

Reoccurring Journal Entries Enter JE 14. 1. 5 Review JE 14. 1. 15 Update JE 14. 1. 16 Update Trial Balance 14. 2. 4

Demonstration

Demonstration

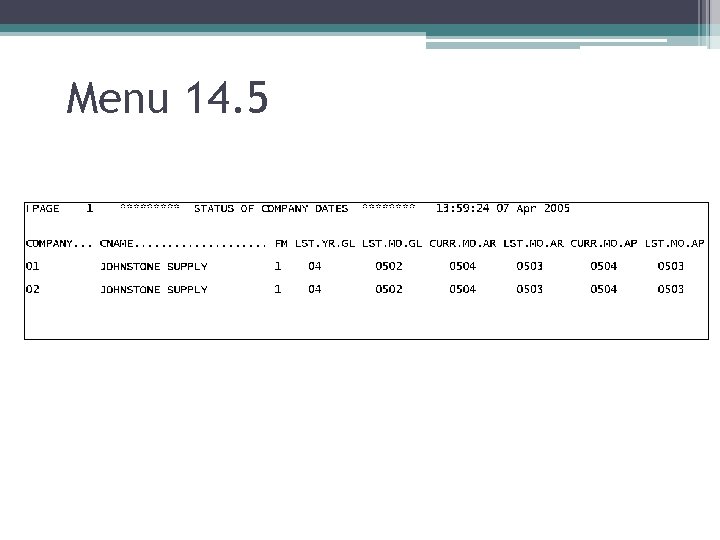

Menu 14. 5

Menu 14. 5

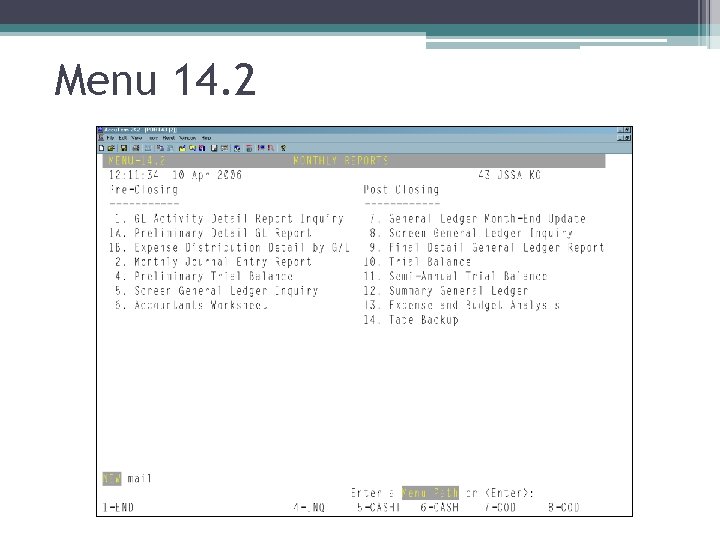

Menu 14. 2

Menu 14. 2

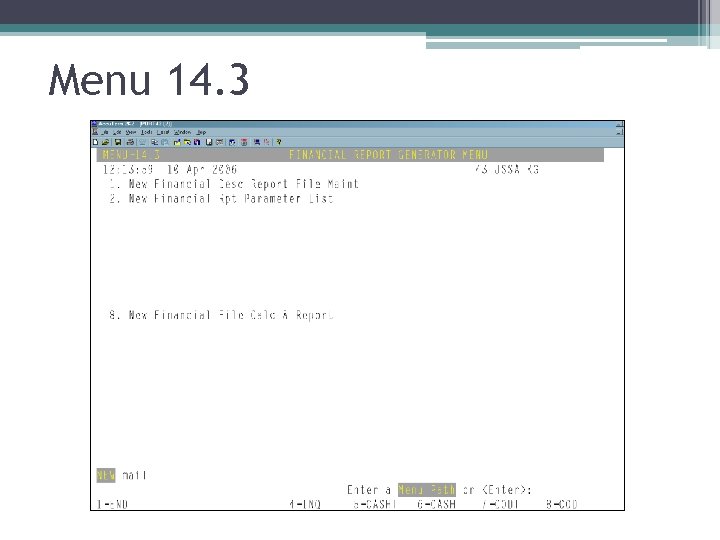

Menu 14. 3

Menu 14. 3

REAL TIME GENERAL LEDGER!!! *Have to run 14. 2. 4 first *AR & AP periods have to be current

REAL TIME GENERAL LEDGER!!! *Have to run 14. 2. 4 first *AR & AP periods have to be current

Upgrade Suggestions

Upgrade Suggestions

Discussion Topics Handling of Tanks R 22 Pricing AP process, paper trail, filing

Discussion Topics Handling of Tanks R 22 Pricing AP process, paper trail, filing

Session Evaluations

Session Evaluations