99c0b55562ee9740d67f86188cd28bd3.ppt

- Количество слайдов: 20

Accounting for Your Investment Portfolio: Risky Business Josh Houchin

Who is Clearwater? • Launched in 2002 to provide a state-of-the-art, webbased Accounting, Compliance, Performance, and Risk reporting solution for corporate operating funds • Products focus on: – – Corporate operating funds Insurance companies Asset managers Other institutional investors • $500 billion of assets for over 6, 000 institutional investors

What we’re covering • Reporting needs for treasury • Why is investment accounting risky business? – – – Reconciliation / Verification GAAP Pronouncements IFRS Consolidator Other tidbits • Q&A

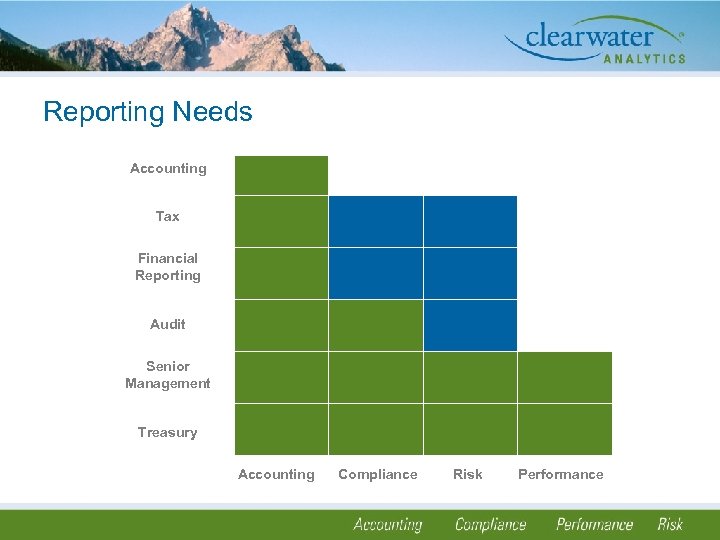

Reporting Needs Accounting Tax Financial Reporting Audit Senior Management Treasury Accounting Compliance Risk Performance

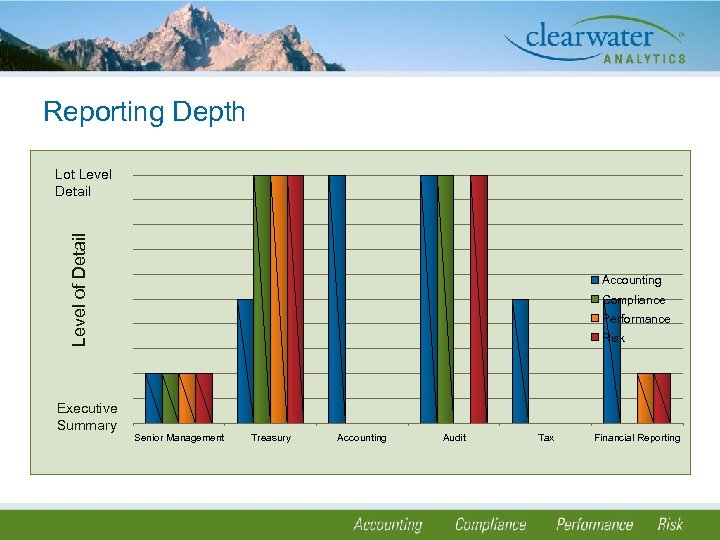

Reporting Depth Level of Detail Lot Level Detail Executive Summary Accounting Compliance Performance Risk Senior Management Treasury Accounting Constituents Audit Tax Financial Reporting

Why is Accounting ‘Risky Business’?

Reconciliation / Verification • The purpose of this process is to ensure that what should be in the bank account is in the bank account. • Core accounting data—cash, positions, transactions— must be pristine or else you risk inaccuracies. “You can’t make chicken salad out of chicken droppings” “Trust, but verify” - Ronald Reagan

Common Reconciliation/Verification Issues • • • Duplicate trades and payments Trade vs. settle data ‘Dirty prices’ Previous factors Late trades and payments Mathematical inaccuracies Improper maturity dates Improper coding of transactions Dummy data Bad pricing Transposition errors Disparate or improper accounting assumptions

Preventive and Detective Methods • Identify controls at source to catch reconciliation/verification issues (SAS 70 Type II audit) • Automated software programs to verify, reconcile, and recalculate core source of data • Monthly spot check (manual)

Proactive GAAP Interpretations General Rule: An auditor is to AUDIT your assumptions, not DEFINE your policies. • FAS 115 -2 • FAS 157

Accounting for Investments • Solution: – – Utilize a combination of resources Use your consolidator “Who are the niche players? ” Talk to people—your peers, your vendors, etc. – Read and research • Have you taken 20 minutes to read the literature? • www. clearwateranalytics. com – Make a case and present it to the auditors

FAS 157: Common Problems • Practical Expediency? – We have seen some auditors and/or companies attempt to implement FAS 157 outside the realm of practical expediency (i. e. know specifics about all inputs for all lots) – Over time and with experience this has become less common • Understanding pricing methodologies and markets – Fixed income valuation differs from equity valuation – What is the difference between a broker quote and a price received from a pricing vendor (i. e. FTID, JJ Kenny)? • Inability to track designations (i. e. audit trail) and create required disclosures

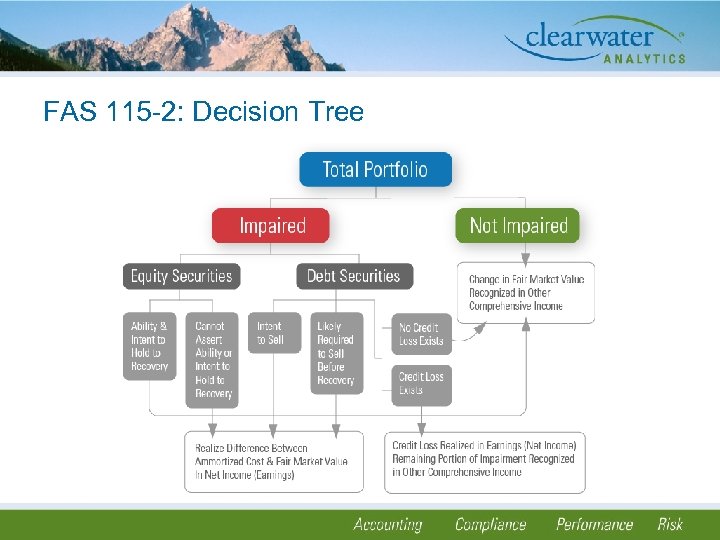

FAS 115 -2: Decision Tree

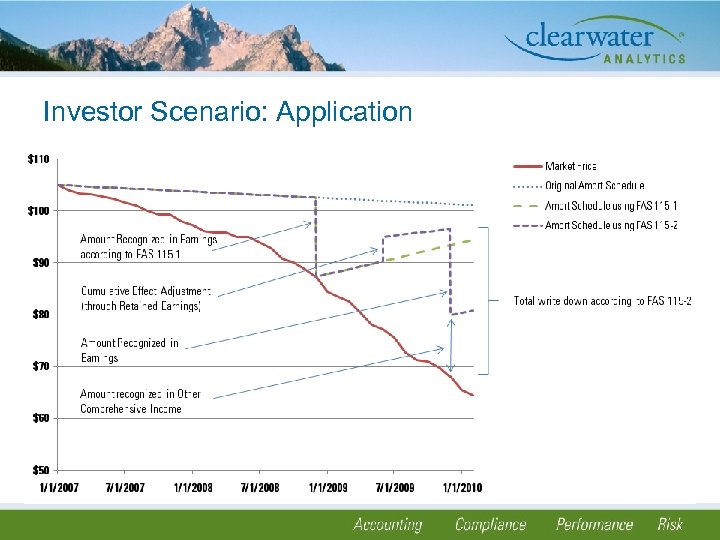

Investor Scenario: Application

IFRS a Reality • Transition from US GAAP to IFRS is a reality – Question of when not if – In our best interest? • Proponents of Adoption/Convergence – Existing global standard – Streamlined reporting for some – Comparable financial statements – Efficient capital markets • Opponents – Success of GAAP which was originally principles based – Transition a step backwards in comparability – Expense

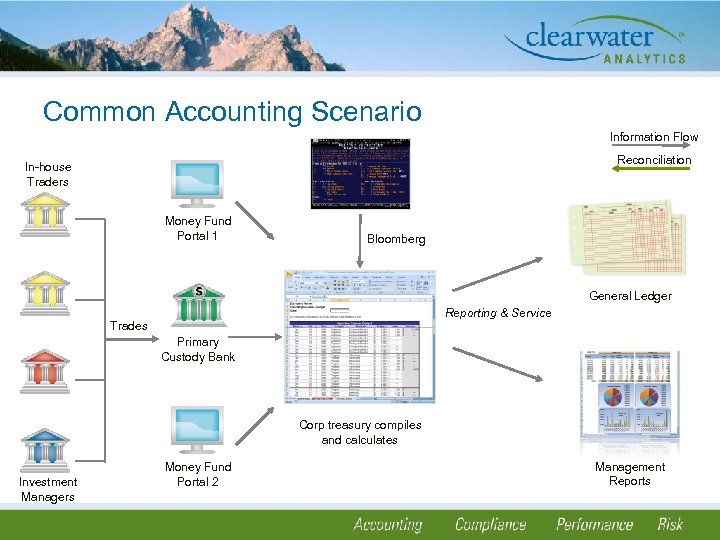

Common Accounting Scenario Information Flow Reconciliation In-house Traders Money Fund Portal 1 Trades Primary Custody Bank Bloomberg Insert Pic of Excel worksheet General Ledger Reporting & Service Corp treasury compiles and calculates Investment Managers Money Fund Portal 2 Management Reports

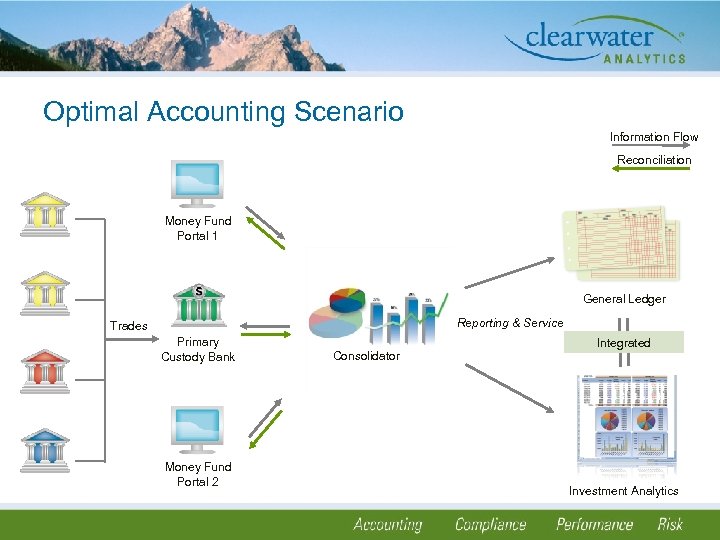

Optimal Accounting Scenario Information Flow Reconciliation Money Fund Portal 1 General Ledger Reporting & Service Trades Primary Custody Bank Money Fund Portal 2 Consolidator Integrated Investment Analytics

What’s your ‘truck factor’? How damaging would your departure be to your operations?

Q&A Josh Houchin Clearwater Analytics 208 -489 -7543 josh@clearwateranalytics. com

99c0b55562ee9740d67f86188cd28bd3.ppt