49c4fc792d8f0ddaaec9e3b23b1d8f6b.ppt

- Количество слайдов: 30

Accounting & Finance for Bankers Business Mathematics. Module A SPBT College

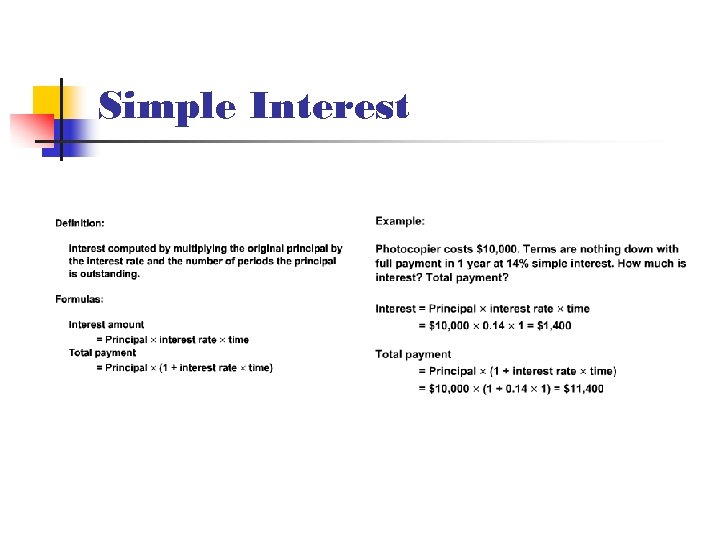

Simple Interest

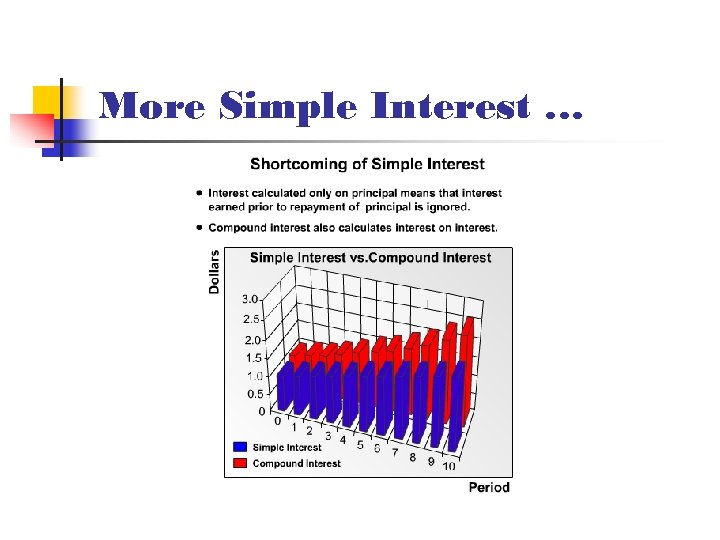

More Simple Interest …

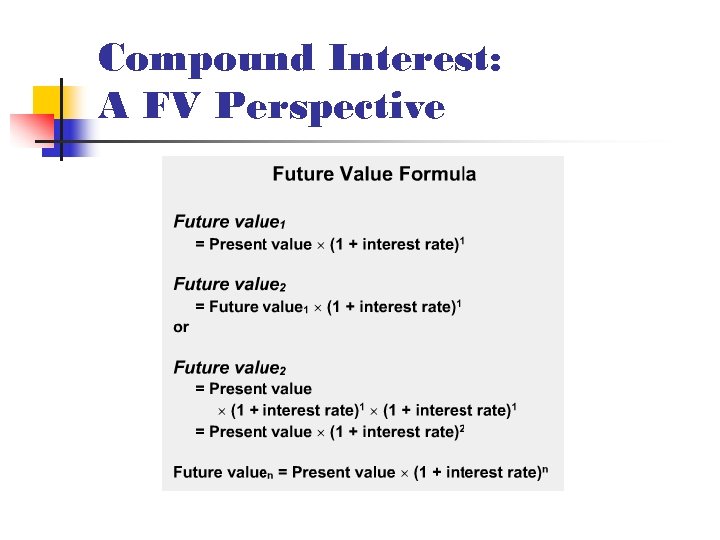

Compound Interest: A FV Perspective

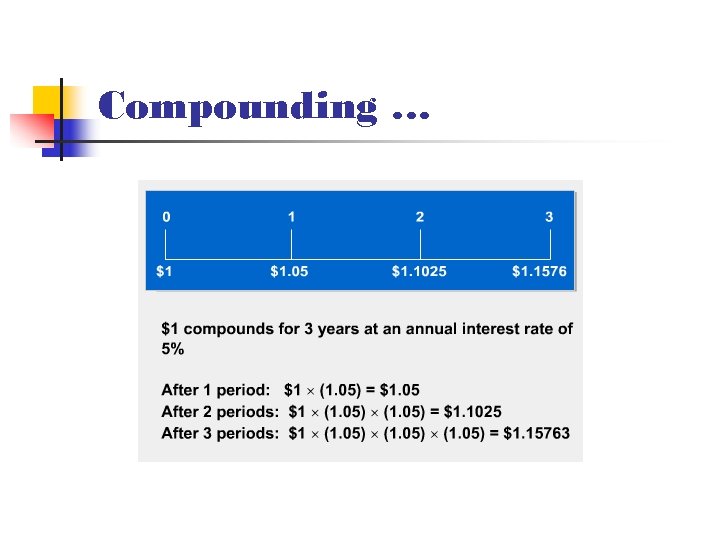

Compounding …

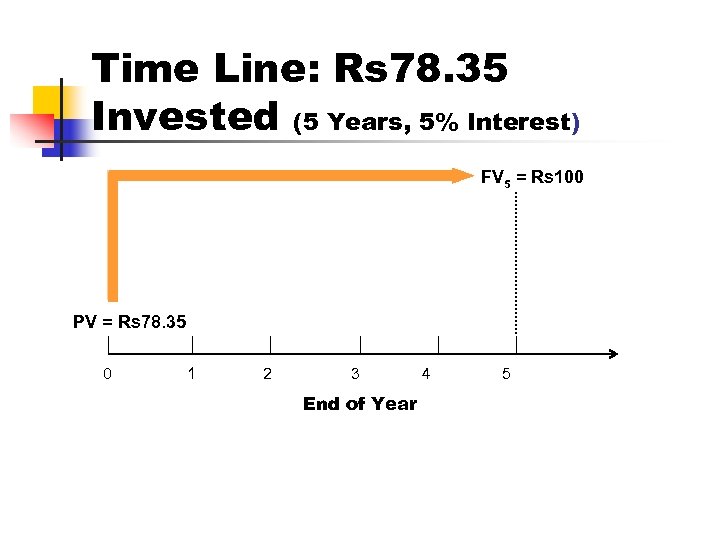

Time Line: Rs 78. 35 Invested (5 Years, 5% Interest) FV 5 = Rs 100 PV = Rs 78. 35 0 1 2 3 End of Year 4 5

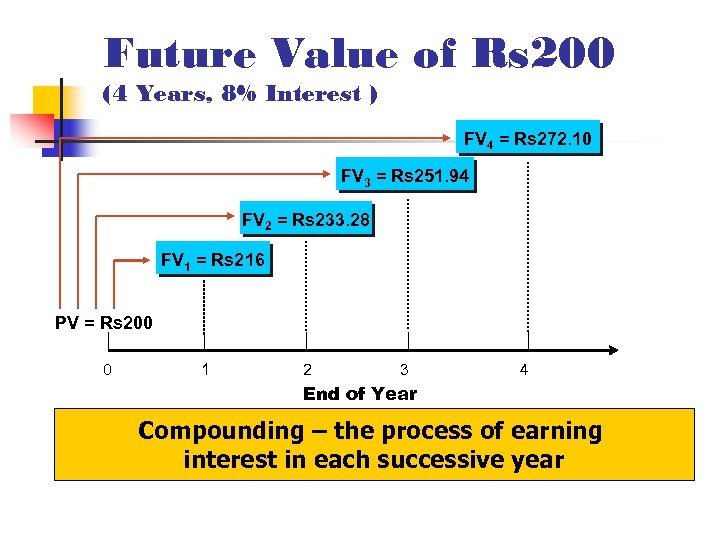

Future Value of Rs 200 (4 Years, 8% Interest ) FV 4 = Rs 272. 10 FV 3 = Rs 251. 94 FV 2 = Rs 233. 28 FV 1 = Rs 216 PV = Rs 200 0 1 2 3 4 End of Year Compounding – the process of earning interest in each successive year

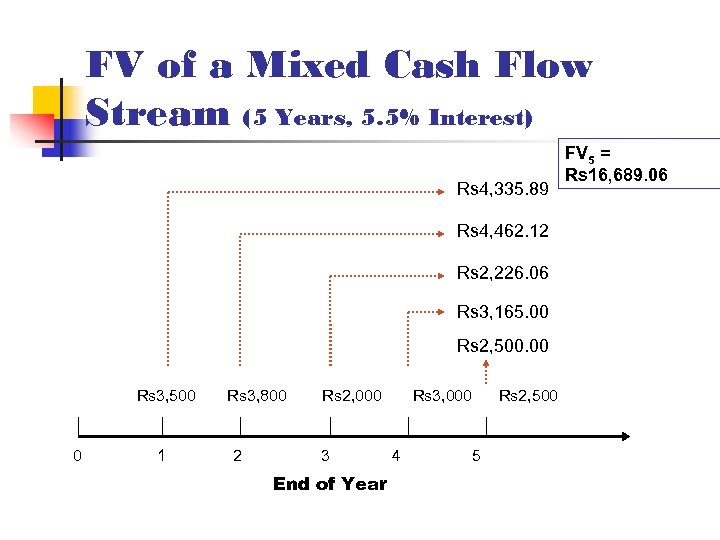

FV of a Mixed Cash Flow Stream (5 Years, 5. 5% Interest) Rs 4, 335. 89 Rs 4, 462. 12 Rs 2, 226. 06 Rs 3, 165. 00 Rs 2, 500. 00 Rs 3, 500 0 1 Rs 3, 800 2 Rs 2, 000 3 End of Year Rs 3, 000 4 5 Rs 2, 500 FV 5 = Rs 16, 689. 06

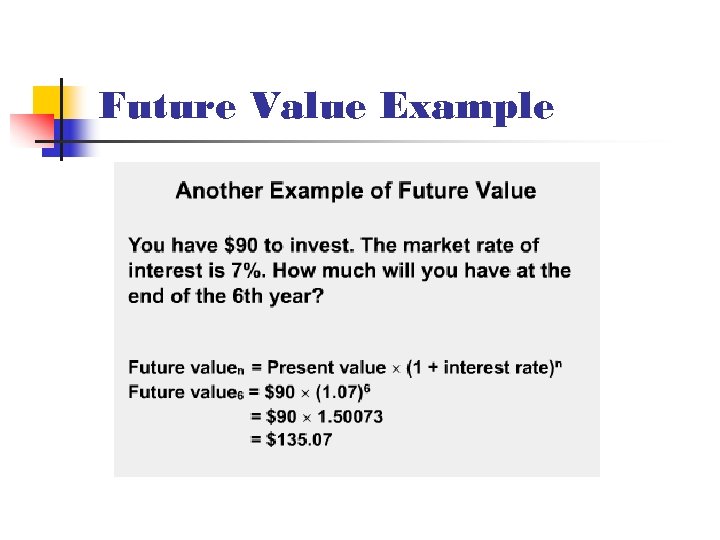

Future Value Example

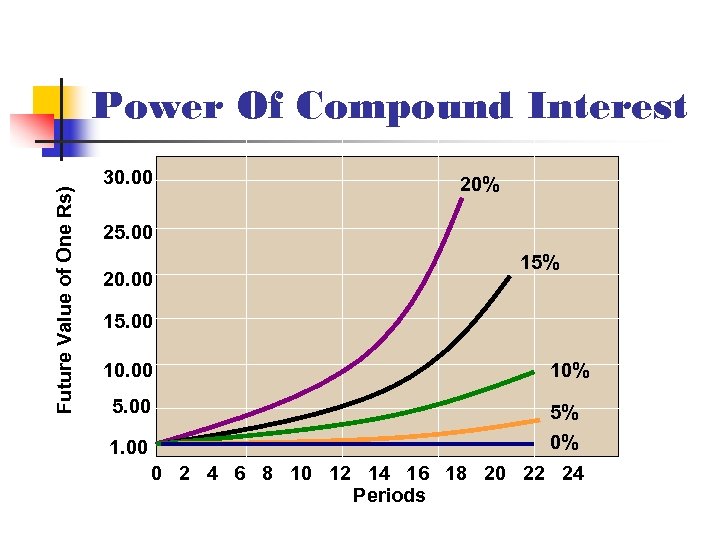

Future Value of One Rs) Power Of Compound Interest 30. 00 20% 25. 00 20. 00 15% 15. 00 10% 5. 00 5% 0% 1. 00 0 2 4 6 8 10 12 14 16 18 20 22 24 Periods

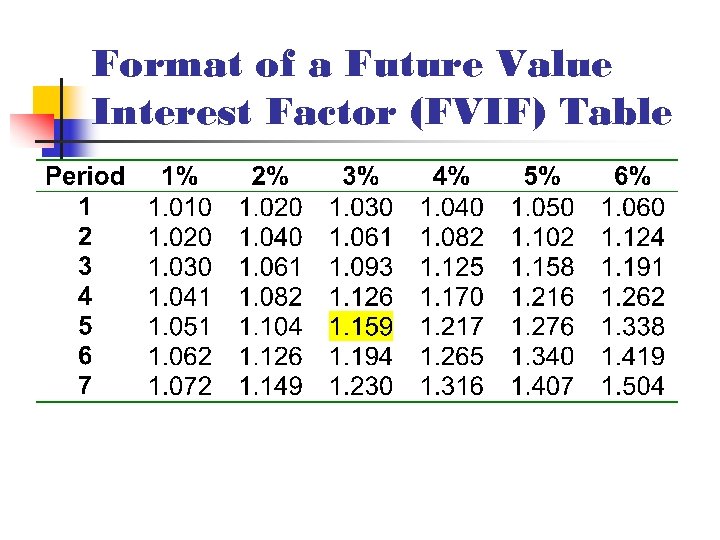

Format of a Future Value Interest Factor (FVIF) Table

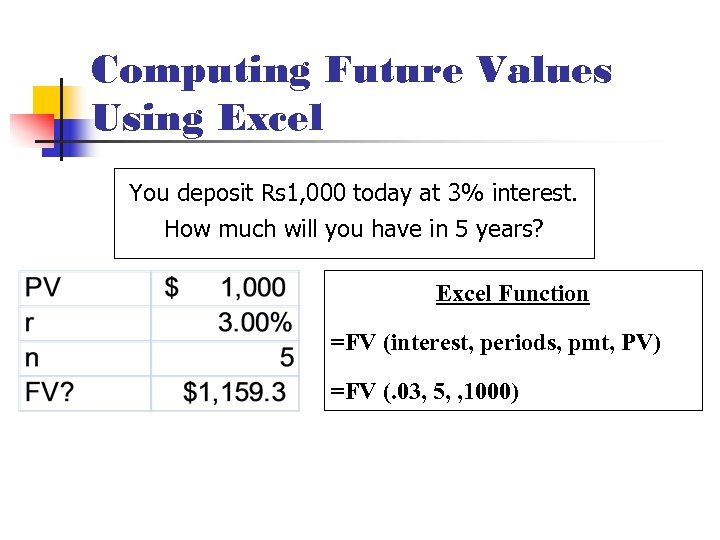

Computing Future Values Using Excel You deposit Rs 1, 000 today at 3% interest. How much will you have in 5 years? Excel Function =FV (interest, periods, pmt, PV) =FV (. 03, 5, , 1000)

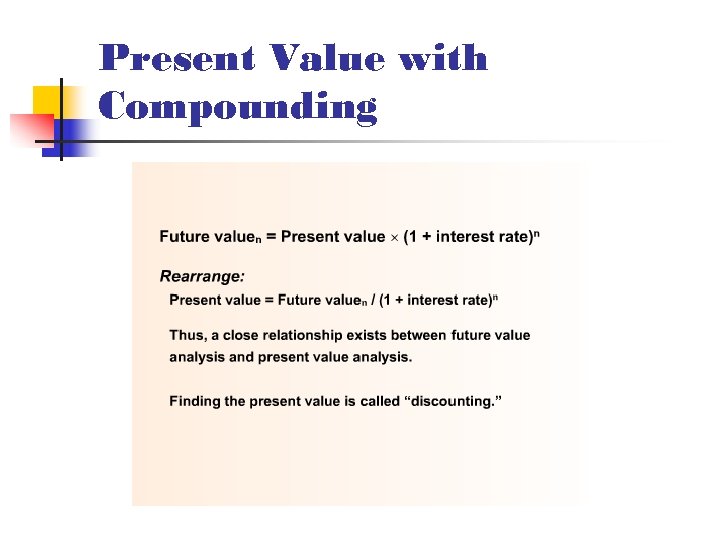

Present Value with Compounding

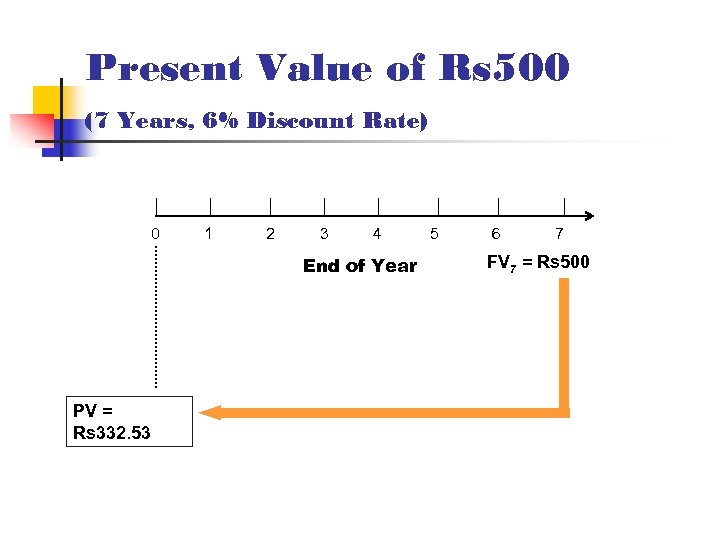

Present Value of Rs 500 (7 Years, 6% Discount Rate) 0 1 2 3 4 End of Year PV = Rs 332. 53 5 6 7 FV 7 = Rs 500

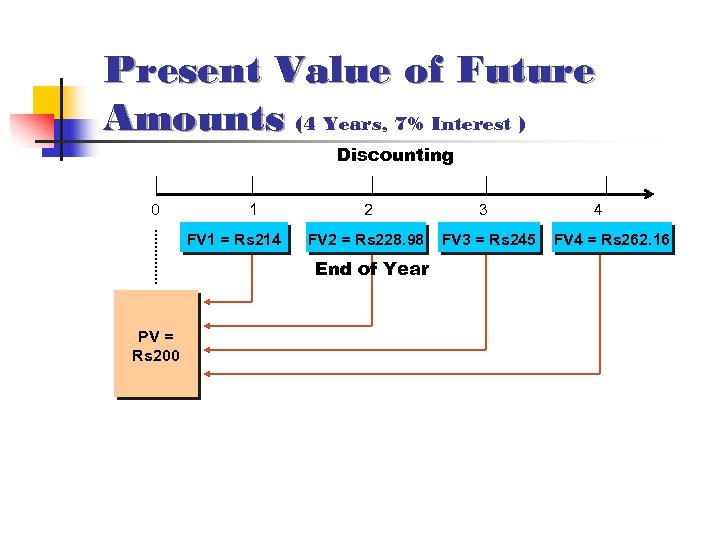

Present Value of Future Amounts (4 Years, 7% Interest ) Discounting 0 1 FV 1 = Rs 214 2 FV 2 = Rs 228. 98 End of Year PV = Rs 200 3 FV 3 = Rs 245 4 FV 4 = Rs 262. 16

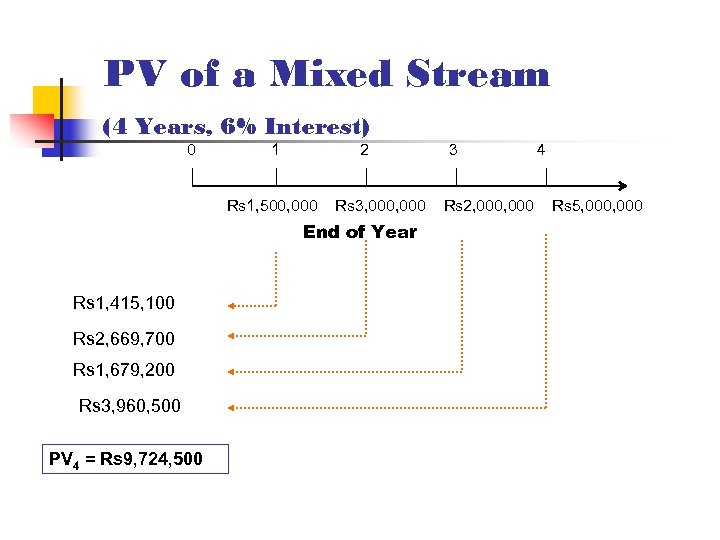

PV of a Mixed Stream (4 Years, 6% Interest) 0 1 2 Rs 1, 500, 000 Rs 3, 000 End of Year Rs 1, 415, 100 Rs 2, 669, 700 Rs 1, 679, 200 Rs 3, 960, 500 PV 4 = Rs 9, 724, 500 3 Rs 2, 000 4 Rs 5, 000

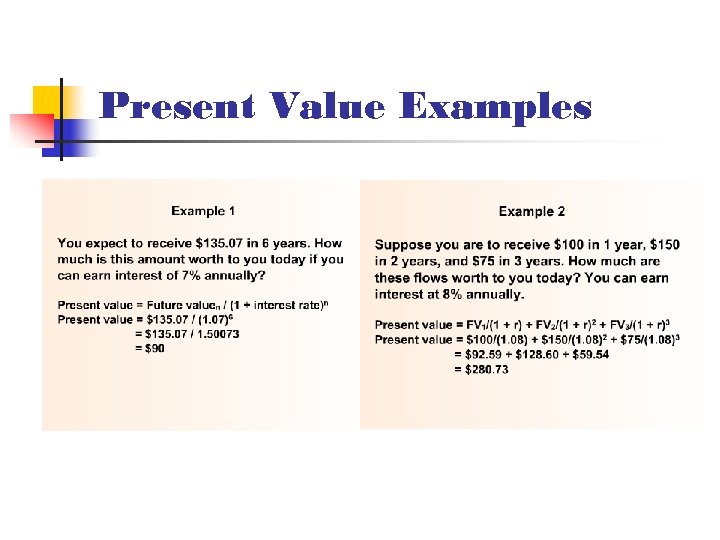

Present Value Examples

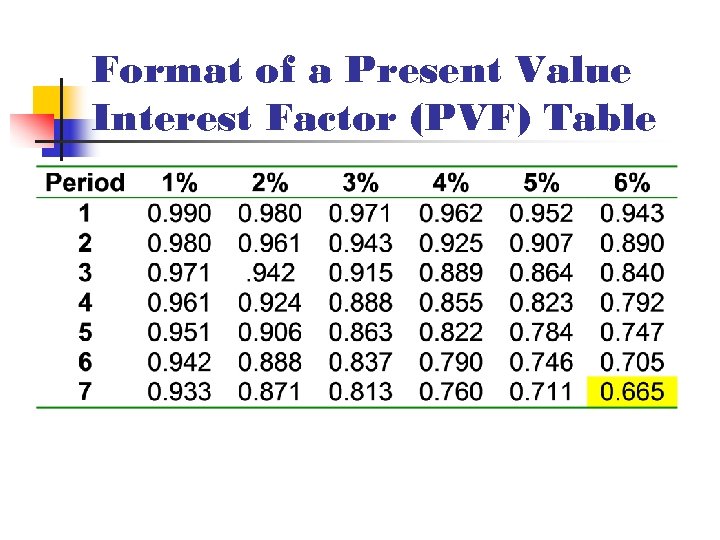

Format of a Present Value Interest Factor (PVF) Table

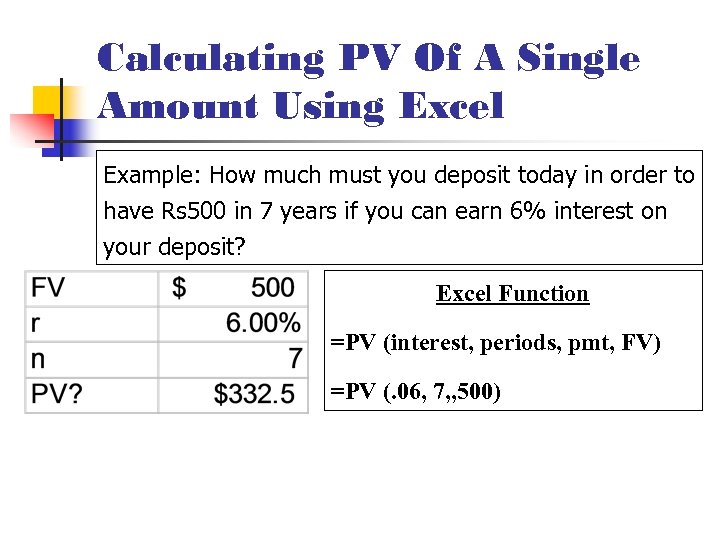

Calculating PV Of A Single Amount Using Excel Example: How much must you deposit today in order to have Rs 500 in 7 years if you can earn 6% interest on your deposit? Excel Function =PV (interest, periods, pmt, FV) =PV (. 06, 7, , 500)

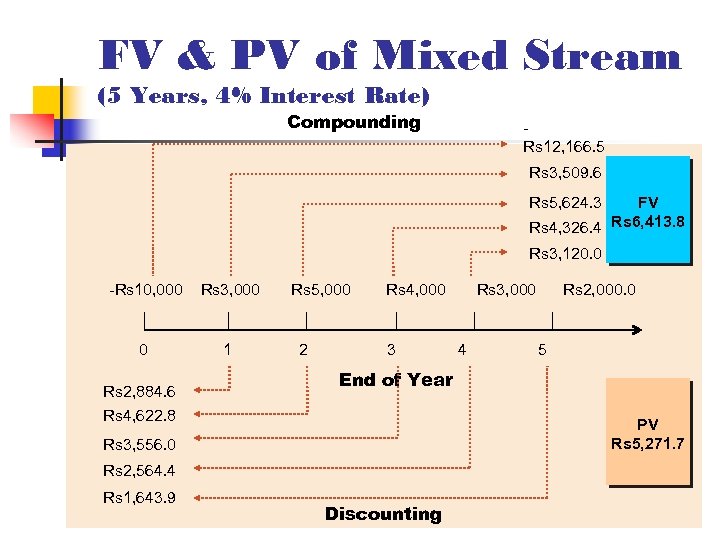

FV & PV of Mixed Stream (5 Years, 4% Interest Rate) Compounding Rs 12, 166. 5 Rs 3, 509. 6 FV Rs 4, 326. 4 Rs 6, 413. 8 Rs 5, 624. 3 Rs 3, 120. 0 -Rs 10, 000 Rs 3, 000 0 1 Rs 5, 000 2 Rs 2, 884. 6 Rs 4, 622. 8 Rs 4, 000 3 Rs 3, 000 4 Rs 2, 000. 0 5 End of Year PV Rs 5, 271. 7 Rs 3, 556. 0 Rs 2, 564. 4 Rs 1, 643. 9 W. P. Carey Executive MBA Program Discounting Slide 20

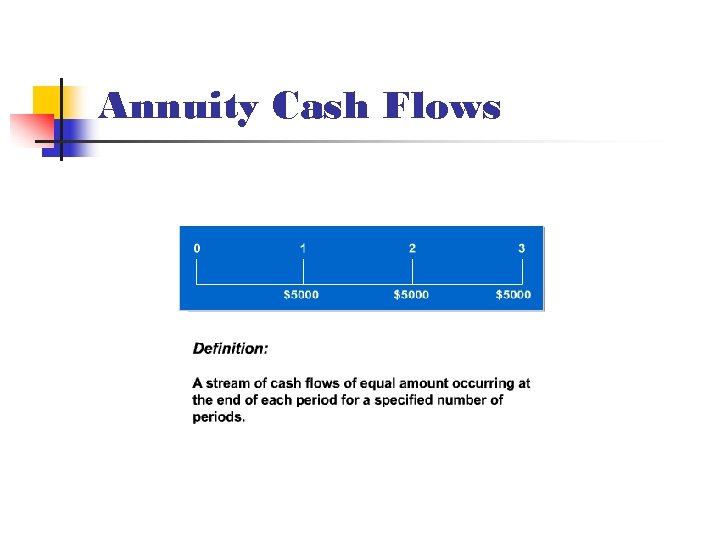

Annuity Cash Flows

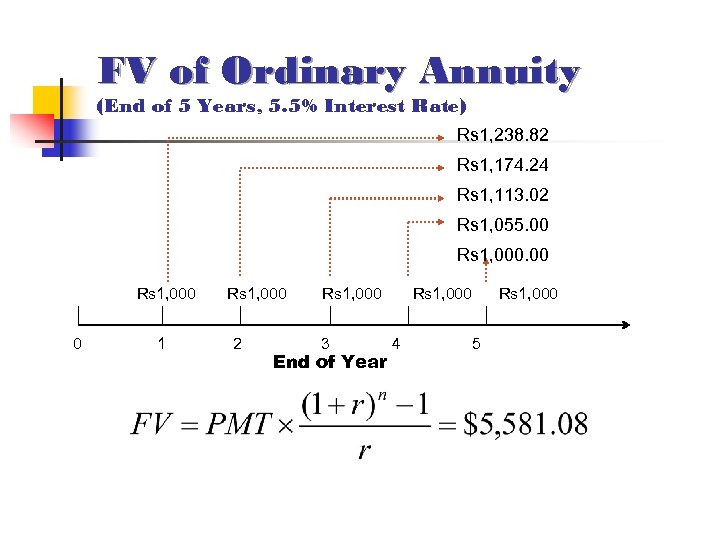

FV of Ordinary Annuity (End of 5 Years, 5. 5% Interest Rate) Rs 1, 238. 82 Rs 1, 174. 24 Rs 1, 113. 02 Rs 1, 055. 00 Rs 1, 000 0 1 Rs 1, 000 2 Rs 1, 000 3 End of Year Rs 1, 000 4 5 Rs 1, 000

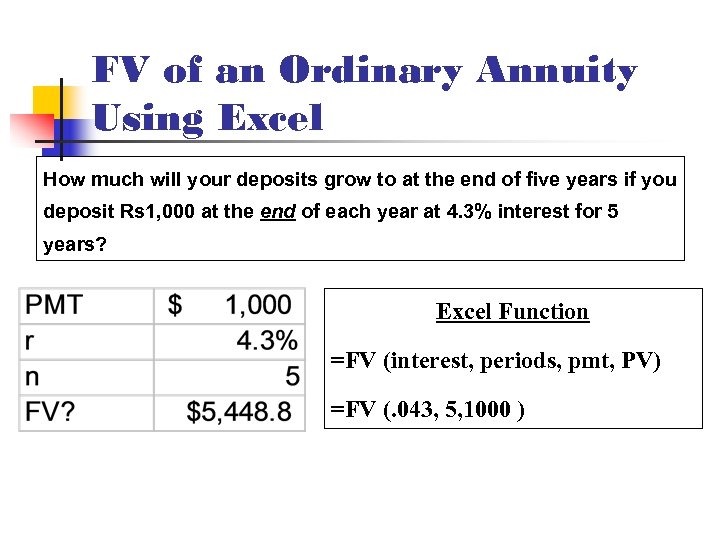

FV of an Ordinary Annuity Using Excel How much will your deposits grow to at the end of five years if you deposit Rs 1, 000 at the end of each year at 4. 3% interest for 5 years? Excel Function =FV (interest, periods, pmt, PV) =FV (. 043, 5, 1000 )

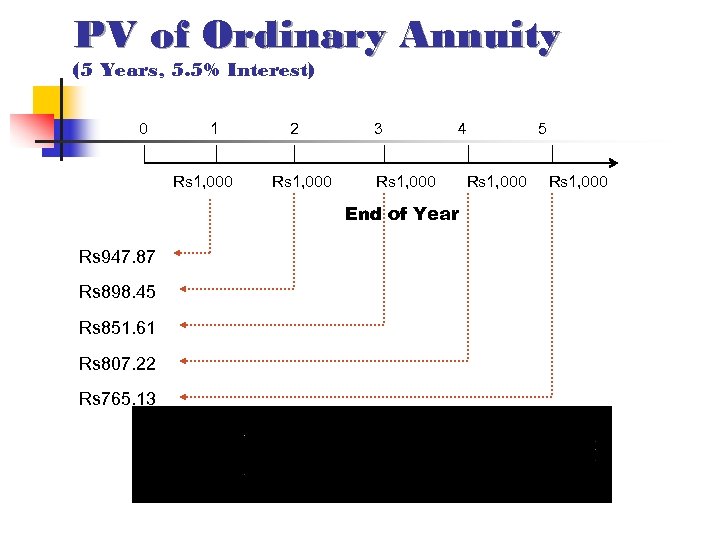

PV of Ordinary Annuity (5 Years, 5. 5% Interest) 0 1 Rs 1, 000 2 Rs 1, 000 3 4 Rs 1, 000 End of Year Rs 947. 87 Rs 898. 45 Rs 851. 61 Rs 807. 22 Rs 765. 13 Rs 1, 000 5 Rs 1, 000

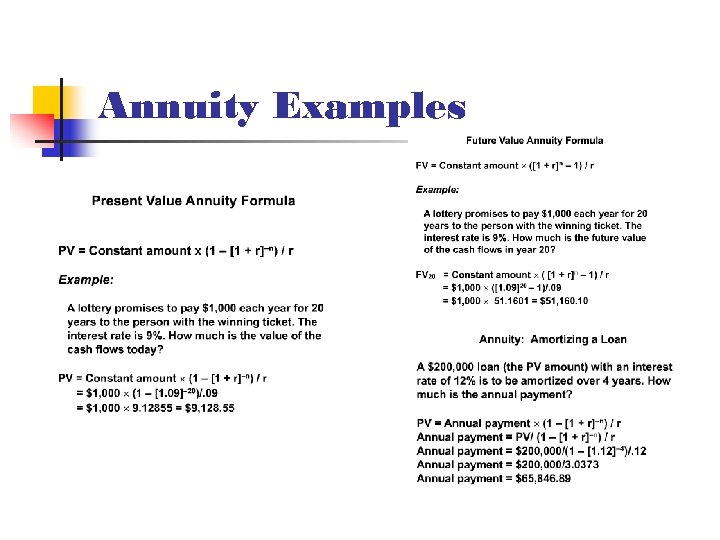

Annuity Examples

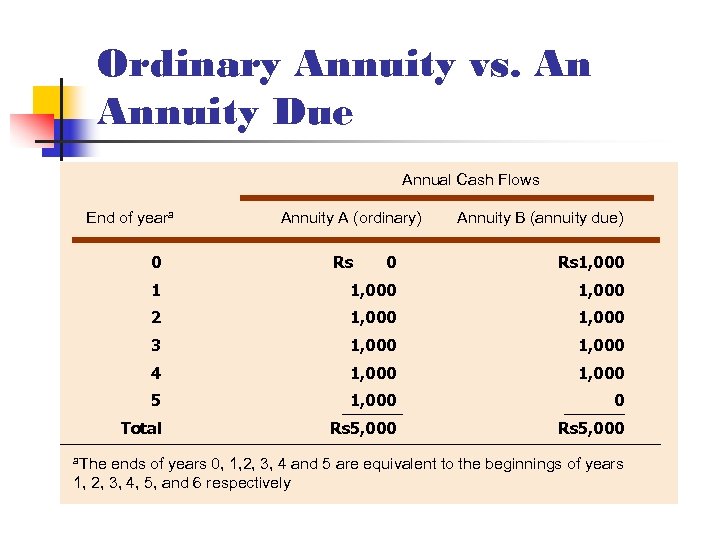

Ordinary Annuity vs. An Annuity Due Annual Cash Flows End of yeara 0 Annuity A (ordinary) 0 Rs 1, 000 2 1, 000 3 1, 000 4 1, 000 5 1, 000 0 Total a. The Rs Annuity B (annuity due) Rs 5, 000 ends of years 0, 1, 2, 3, 4 and 5 are equivalent to the beginnings of years 1, 2, 3, 4, 5, and 6 respectively

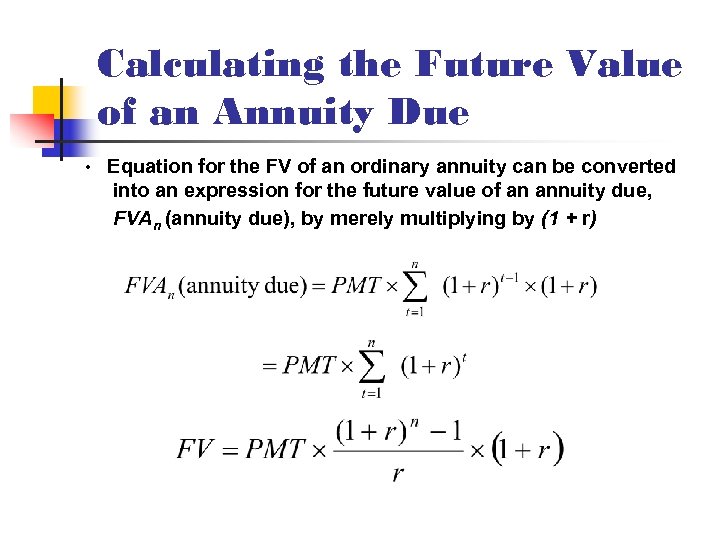

Calculating the Future Value of an Annuity Due • Equation for the FV of an ordinary annuity can be converted into an expression for the future value of an annuity due, FVAn (annuity due), by merely multiplying by (1 + r)

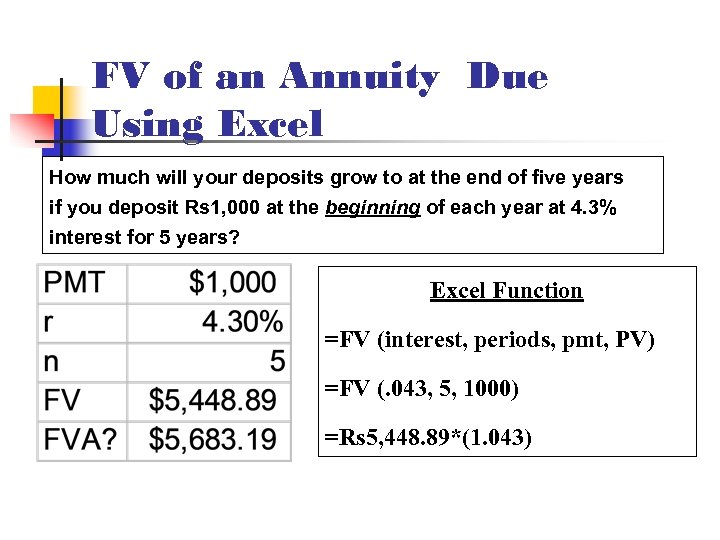

FV of an Annuity Due Using Excel How much will your deposits grow to at the end of five years if you deposit Rs 1, 000 at the beginning of each year at 4. 3% interest for 5 years? Excel Function =FV (interest, periods, pmt, PV) =FV (. 043, 5, 1000) =Rs 5, 448. 89*(1. 043)

Deposits Needed to Accumulate a Future Sum n n n A person wishes to buy a house 5 years from now and estimates an initial down payment of Rs 35, 000 will be required at that time She wishes to make equal annual end-of-year deposits in an account paying annual interest of 4 percent, so she must determine what size annuity will result in a lump sum equal to Rs 35, 000 at the end of year 5 Find the annual deposit required to accumulate FVAn dollars, given an interest rate, r, and a certain number of years, n by solving equation PMT:

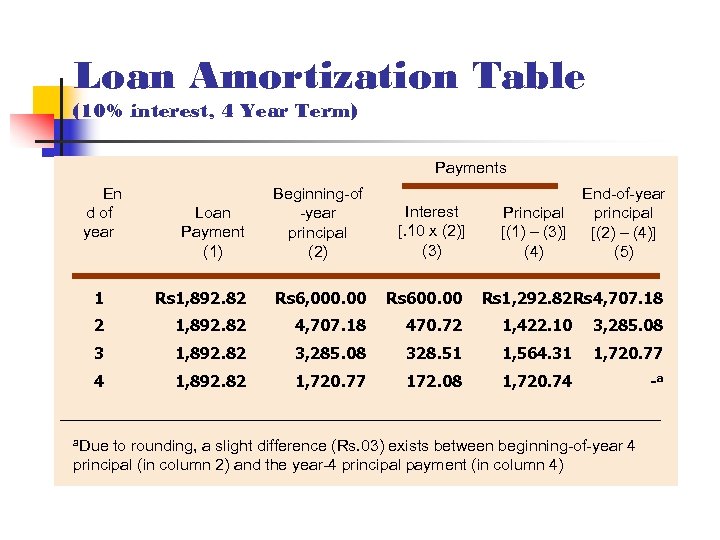

Loan Amortization Table (10% interest, 4 Year Term) Payments En d of year Loan Payment (1) Beginning-of -year principal (2) Interest [. 10 x (2)] (3) End-of-year Principal principal [(1) – (3)] [(2) – (4)] (4) (5) 1 Rs 1, 892. 82 Rs 6, 000. 00 Rs 600. 00 Rs 1, 292. 82 Rs 4, 707. 18 2 1, 892. 82 4, 707. 18 470. 72 1, 422. 10 3, 285. 08 3 1, 892. 82 3, 285. 08 328. 51 1, 564. 31 1, 720. 77 4 1, 892. 82 1, 720. 77 172. 08 1, 720. 74 -a a. Due to rounding, a slight difference (Rs. 03) exists between beginning-of-year 4 principal (in column 2) and the year-4 principal payment (in column 4)

49c4fc792d8f0ddaaec9e3b23b1d8f6b.ppt