8719a75474f9c7682ea97de328d1e67d.ppt

- Количество слайдов: 34

Accounting & Finance (ACC 4004) Financial Markets-Regulations Week 10 1

Accounting & Finance (ACC 4004) Financial Markets-Regulations Week 10 1

Learning Objectives: • Why Financial Institutions need regulation? • Compelling reasons for regulation. • Theory of regulation • Arguments Against Regulation • UK Regulatory Framework 2

Learning Objectives: • Why Financial Institutions need regulation? • Compelling reasons for regulation. • Theory of regulation • Arguments Against Regulation • UK Regulatory Framework 2

Regulation • Financial regulation is the supervision and control of the financial system by a government body, to prevent abuses or failures. • Adam Smith described an “invisible hand” that direct free markets – By pursuing their own self interests, individual market participants engage in activities to benefit the whole. Smith’s image suggests that no oversight required.

Regulation • Financial regulation is the supervision and control of the financial system by a government body, to prevent abuses or failures. • Adam Smith described an “invisible hand” that direct free markets – By pursuing their own self interests, individual market participants engage in activities to benefit the whole. Smith’s image suggests that no oversight required.

The main elements of financial regulation play video disc or online right click play hyperlink ( should play all 7 ) DISCUSSION -

The main elements of financial regulation play video disc or online right click play hyperlink ( should play all 7 ) DISCUSSION -

Why Financial Industry need Regulation? • Politically sensitive industry heavily reliant on public confidence • Retail purchasers of financial services possess much less knowledge than the providers, (asymmetry of information) • Due to nature of their business (illiquid assets & short term and liquid liabilities), banks & financial firms are more prone to trouble compared to other firms/businesses • High interconnectedness of the financial institutions can cause “bank contagion” and could lead to “bank runs”. • High “systematic risk” • Consumer protection • Integrity of the financial intermediary

Why Financial Industry need Regulation? • Politically sensitive industry heavily reliant on public confidence • Retail purchasers of financial services possess much less knowledge than the providers, (asymmetry of information) • Due to nature of their business (illiquid assets & short term and liquid liabilities), banks & financial firms are more prone to trouble compared to other firms/businesses • High interconnectedness of the financial institutions can cause “bank contagion” and could lead to “bank runs”. • High “systematic risk” • Consumer protection • Integrity of the financial intermediary

Regulation- Some Terms • Bank Contagion “ The collapse of one financial institution leading to bad debts and/or a loss of confidence in other financial institutions, possibly causing their collapse- a particular problem for banks” Howells & Bain 2007: 362 • Bank runs “The situation where a large proportion of depositors withdraw their savings because they fear that the banks is unsound about to fail” Casu et al 2006: 470

Regulation- Some Terms • Bank Contagion “ The collapse of one financial institution leading to bad debts and/or a loss of confidence in other financial institutions, possibly causing their collapse- a particular problem for banks” Howells & Bain 2007: 362 • Bank runs “The situation where a large proportion of depositors withdraw their savings because they fear that the banks is unsound about to fail” Casu et al 2006: 470

Regulation- Some Terms • Systematic Risk “ The risk faced by financial system, resulting from a systematic crisis where the failure of one institution has repercussions on others, thereby threating the stability of financial markets” • Regulation Casu et al 2006: 496 The process of rule making and legislation creating the supervisory system. The rules may come from the laws of the land or from the stipulations of the regulatory agency. • Supervision Monitoring the position and behaviour of individual firms, and enforcing the regulations if required.

Regulation- Some Terms • Systematic Risk “ The risk faced by financial system, resulting from a systematic crisis where the failure of one institution has repercussions on others, thereby threating the stability of financial markets” • Regulation Casu et al 2006: 496 The process of rule making and legislation creating the supervisory system. The rules may come from the laws of the land or from the stipulations of the regulatory agency. • Supervision Monitoring the position and behaviour of individual firms, and enforcing the regulations if required.

Compelling reasons for regulating the financial services industry • To ensure systematic stability • social costs of bank failure are very high • To provide smaller, retail customers with protection • ‘caveat emptor’ not adequate in financial contracts which are often complex and opaque • To protect consumers against monopolistic exploitation • monopoly power usually in product pricing • Increase the degree of competition • Encourage small investors • Ensure capital adequacy of financial institutions • Increase the opportunities for small firms to obtain capital • Preserve the reputation of the market

Compelling reasons for regulating the financial services industry • To ensure systematic stability • social costs of bank failure are very high • To provide smaller, retail customers with protection • ‘caveat emptor’ not adequate in financial contracts which are often complex and opaque • To protect consumers against monopolistic exploitation • monopoly power usually in product pricing • Increase the degree of competition • Encourage small investors • Ensure capital adequacy of financial institutions • Increase the opportunities for small firms to obtain capital • Preserve the reputation of the market

The Theory of Regulation • The consequences of market failure • The impact of less than perfect competition caused by elements of monopoly or oligopoly • The presence of externalities • The lack of information in general or asymmetric information giving rise to a need to protect investors.

The Theory of Regulation • The consequences of market failure • The impact of less than perfect competition caused by elements of monopoly or oligopoly • The presence of externalities • The lack of information in general or asymmetric information giving rise to a need to protect investors.

Arguments Against Regulation • Regulation creates moral hazard • Regulation & particularly ‘government safety net’ creates moral hazard • Recent bailouts of British banks • Too Big To Fail (TBTF) or Too Important To Fail (TITF) • Regulation causes people to behave in a counterproductive way. • If you believe your savings are safe in any bank then there is nothing to encourage you to save with efficient, honest institutions. Neither is there anything to prevent you seeking the highest returns without being concerned about whether higher risks are being taking in order to generate those high returns. Casu et al 2006: 164 -66; Howells & Bain 2007: 365 -67

Arguments Against Regulation • Regulation creates moral hazard • Regulation & particularly ‘government safety net’ creates moral hazard • Recent bailouts of British banks • Too Big To Fail (TBTF) or Too Important To Fail (TITF) • Regulation causes people to behave in a counterproductive way. • If you believe your savings are safe in any bank then there is nothing to encourage you to save with efficient, honest institutions. Neither is there anything to prevent you seeking the highest returns without being concerned about whether higher risks are being taking in order to generate those high returns. Casu et al 2006: 164 -66; Howells & Bain 2007: 365 -67

Arguments Against Regulation • Agency capture • FIs can dominate the regulatory process and use it in their own interests instead of the interest of customers • Strong say of biggest institutions may create agency capture • Forbearance • It might not be optimal after the event (ex post) to implement regulations which could be optimal before the event (ex ante). • Not applying exit regulation in case of bank trouble to avoid systematic risk and higher political & social costs. Casu et al 2006: 164 -66; Howells & Bain 2007: 365 -67

Arguments Against Regulation • Agency capture • FIs can dominate the regulatory process and use it in their own interests instead of the interest of customers • Strong say of biggest institutions may create agency capture • Forbearance • It might not be optimal after the event (ex post) to implement regulations which could be optimal before the event (ex ante). • Not applying exit regulation in case of bank trouble to avoid systematic risk and higher political & social costs. Casu et al 2006: 164 -66; Howells & Bain 2007: 365 -67

Arguments Against Regulation • Compliance Costs • The costs of adherence to the regulation. • Institutions could pass these costs to the consumers which would result in higher costs and lower output. • Costs Entry & Exit in the markets • Regulation compliance increases the costs of entry into & exit from markets. • But this creates monopoly and cartels. Howells & Bain 2007: 365 -67

Arguments Against Regulation • Compliance Costs • The costs of adherence to the regulation. • Institutions could pass these costs to the consumers which would result in higher costs and lower output. • Costs Entry & Exit in the markets • Regulation compliance increases the costs of entry into & exit from markets. • But this creates monopoly and cartels. Howells & Bain 2007: 365 -67

The argument for deregulation • Regulation keeps out new entrants who would otherwise have been able to compete with existing firms thus keeping prices down. • Regulation prevents mergers and acquisitions and thus allows small, inefficient firms to survive. Deregulation would allow for economies of scale and the replacement of poor management. • Lower costs have to be weighed against increased risk of loss and even a possible reduction in the stability of the system.

The argument for deregulation • Regulation keeps out new entrants who would otherwise have been able to compete with existing firms thus keeping prices down. • Regulation prevents mergers and acquisitions and thus allows small, inefficient firms to survive. Deregulation would allow for economies of scale and the replacement of poor management. • Lower costs have to be weighed against increased risk of loss and even a possible reduction in the stability of the system.

Big Bang • Financial regulation went through the Big Bang in the equities markets in 1986 • The equities and bond markets were reorganised. • The Financial Services Act of 1986 and the 1987 Banking Act were introduced. Financial services advice became regulated on 29 th April 1988 changed the delivery of financial services.

Big Bang • Financial regulation went through the Big Bang in the equities markets in 1986 • The equities and bond markets were reorganised. • The Financial Services Act of 1986 and the 1987 Banking Act were introduced. Financial services advice became regulated on 29 th April 1988 changed the delivery of financial services.

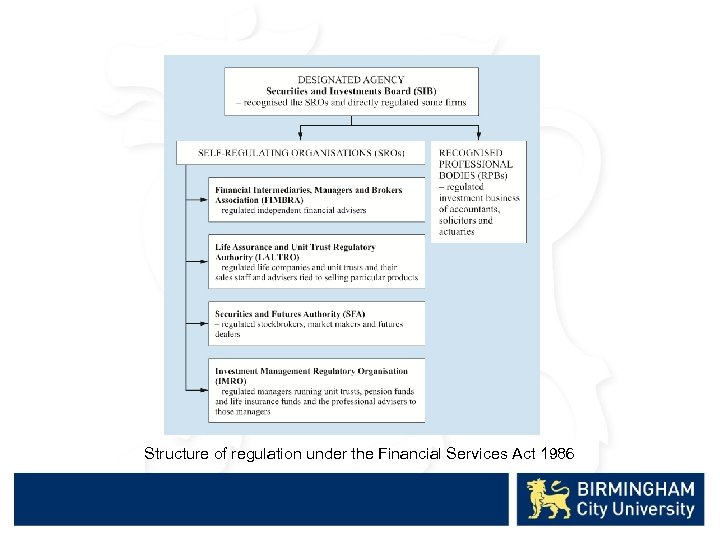

Structure of regulation under the Financial Services Act 1986

Structure of regulation under the Financial Services Act 1986

The arguments for self-regulation – A self-regulatory body would be able to react to changing circumstances more quickly than a statutory body – The involvement of practitioners in formulating and enforcing rules -encouraging high standards of conduct – Practitioners were better able to spot breaches of rules than a statutory body – Self-regulatory bodies could be set up more quickly; – Government would be kept at arm’s length from the dayto-day regulation of the markets.

The arguments for self-regulation – A self-regulatory body would be able to react to changing circumstances more quickly than a statutory body – The involvement of practitioners in formulating and enforcing rules -encouraging high standards of conduct – Practitioners were better able to spot breaches of rules than a statutory body – Self-regulatory bodies could be set up more quickly; – Government would be kept at arm’s length from the dayto-day regulation of the markets.

Problems soon arose. • There was overlapping of activities of the various SROs. Which meant the SROs had to compete for members leading to lax regulation. • The SROs were at risk of acting as trade associations. • FIMBRA (The Financial Intermediaries, Managers and Brokers Regulatory Association) kept its subscriptions low and then ran into financial difficulties. . . • These kinds of problems led to the Maxwell pension fund scandal.

Problems soon arose. • There was overlapping of activities of the various SROs. Which meant the SROs had to compete for members leading to lax regulation. • The SROs were at risk of acting as trade associations. • FIMBRA (The Financial Intermediaries, Managers and Brokers Regulatory Association) kept its subscriptions low and then ran into financial difficulties. . . • These kinds of problems led to the Maxwell pension fund scandal.

May 1997 The New Chancellor • announced his decision to merge banking supervision and investment services regulation into the Securities and Investments Board (SIB). The SIB changed its name to the Financial Services Authority in October 1997. • The first stage of the reform of financial services regulation was completed in June 1998, when responsibility for banking supervision was transferred to the FSA from the Bank of England. In May 2000 the FSA took over the role of UK Listing Authority from the London Stock Exchange. • Tripartite – Also HM Treasury ( answers to Govt) & Bank of England ( Policy Committee, Liquidity)

May 1997 The New Chancellor • announced his decision to merge banking supervision and investment services regulation into the Securities and Investments Board (SIB). The SIB changed its name to the Financial Services Authority in October 1997. • The first stage of the reform of financial services regulation was completed in June 1998, when responsibility for banking supervision was transferred to the FSA from the Bank of England. In May 2000 the FSA took over the role of UK Listing Authority from the London Stock Exchange. • Tripartite – Also HM Treasury ( answers to Govt) & Bank of England ( Policy Committee, Liquidity)

• Following the election of the Labour government in 1997, two major regulatory changes were announced. • The first was the abandonment of the self-regulatory system and the re-establishment of full statutory regulation. This was to be administered by a single regulatory authority, the Financial Services Authority (FSA). • The second major change was the transfer from the Bank of England to the FSA of responsibility for the supervision of the banking system and the wholesale money market. • The Financial Services and Markets Act (FSMA) set the FSA four objectives: market confidence, consumer awareness, consumer protection and fighting financial crime.

• Following the election of the Labour government in 1997, two major regulatory changes were announced. • The first was the abandonment of the self-regulatory system and the re-establishment of full statutory regulation. This was to be administered by a single regulatory authority, the Financial Services Authority (FSA). • The second major change was the transfer from the Bank of England to the FSA of responsibility for the supervision of the banking system and the wholesale money market. • The Financial Services and Markets Act (FSMA) set the FSA four objectives: market confidence, consumer awareness, consumer protection and fighting financial crime.

The Financial Services and Markets Act, 2000 Transferred to the FSA the responsibilities of • Building Societies Commission • Friendly Societies Commission • Investment Management Regulatory Organisation • Personal Investment Authority • Register of Friendly Societies • Securities and Futures Authority • New responsibilities – in particular taking action to prevent market abuse. • 2004/2005 Mortgage and general insurance

The Financial Services and Markets Act, 2000 Transferred to the FSA the responsibilities of • Building Societies Commission • Friendly Societies Commission • Investment Management Regulatory Organisation • Personal Investment Authority • Register of Friendly Societies • Securities and Futures Authority • New responsibilities – in particular taking action to prevent market abuse. • 2004/2005 Mortgage and general insurance

• The Financial Services and Markets Act 2000 (FSMA) http: //www. legislation. gov. uk/ukpga/2000/8/contents gives four statutory objectives: • market confidence – maintaining confidence in the UK financial system; • financial stability - contributing to the protection and enhancement of stability of the UK financial system • consumer protection - securing the appropriate degree of protection for consumers; and • the reduction of financial crime - reducing the extent to which it is possible for a regulated business to be used for a purpose connected with financial crime.

• The Financial Services and Markets Act 2000 (FSMA) http: //www. legislation. gov. uk/ukpga/2000/8/contents gives four statutory objectives: • market confidence – maintaining confidence in the UK financial system; • financial stability - contributing to the protection and enhancement of stability of the UK financial system • consumer protection - securing the appropriate degree of protection for consumers; and • the reduction of financial crime - reducing the extent to which it is possible for a regulated business to be used for a purpose connected with financial crime.

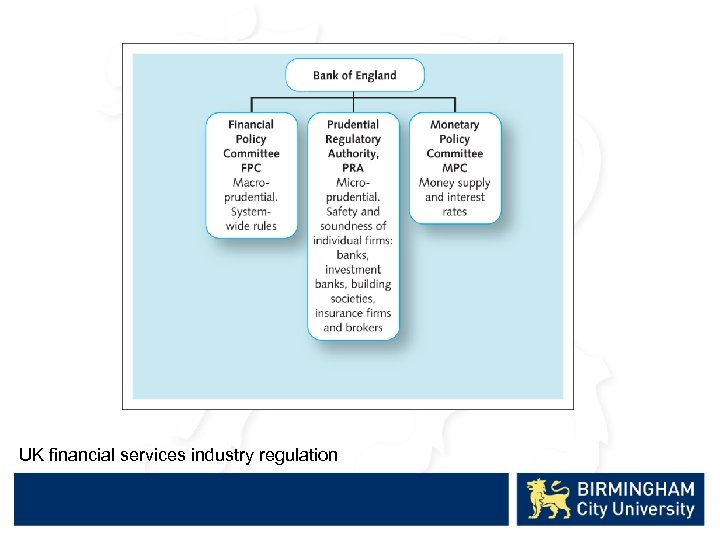

• June 2010, the new government’s intention to replace the FSA as a single financial services regulator with two new successor bodies, and restructure the UK’s financial regulatory framework. • In 2013, the FSA will be replaced by two new regulatory bodies that will carry forward our philosophy of outcomes-based regulation, intensive firm supervision and credible deterrence: • The Prudential Regulation Authority (the PRA), which will be a subsidiary of the Bank of England, will be responsible for promoting the stable and prudent operation of the financial system through regulation of all deposit-taking institutions, insurers and investment banks. • The Financial Conduct Authority (the FCA) will be responsible for regulation of conduct in retail, as well as wholesale, financial markets and the infrastructure that supports those markets. The FCA will also have responsibility for the prudential regulation of firms that do not fall under the PRA’s scope. • Bank of England to take an increased role on stability of UK financial system.

• June 2010, the new government’s intention to replace the FSA as a single financial services regulator with two new successor bodies, and restructure the UK’s financial regulatory framework. • In 2013, the FSA will be replaced by two new regulatory bodies that will carry forward our philosophy of outcomes-based regulation, intensive firm supervision and credible deterrence: • The Prudential Regulation Authority (the PRA), which will be a subsidiary of the Bank of England, will be responsible for promoting the stable and prudent operation of the financial system through regulation of all deposit-taking institutions, insurers and investment banks. • The Financial Conduct Authority (the FCA) will be responsible for regulation of conduct in retail, as well as wholesale, financial markets and the infrastructure that supports those markets. The FCA will also have responsibility for the prudential regulation of firms that do not fall under the PRA’s scope. • Bank of England to take an increased role on stability of UK financial system.

Regulation of UK financial services • Financial Services Authority • Financial Conduct Authority • Prudential Regulatory Authority (PRA) • Macro-prudential regulation

Regulation of UK financial services • Financial Services Authority • Financial Conduct Authority • Prudential Regulatory Authority (PRA) • Macro-prudential regulation

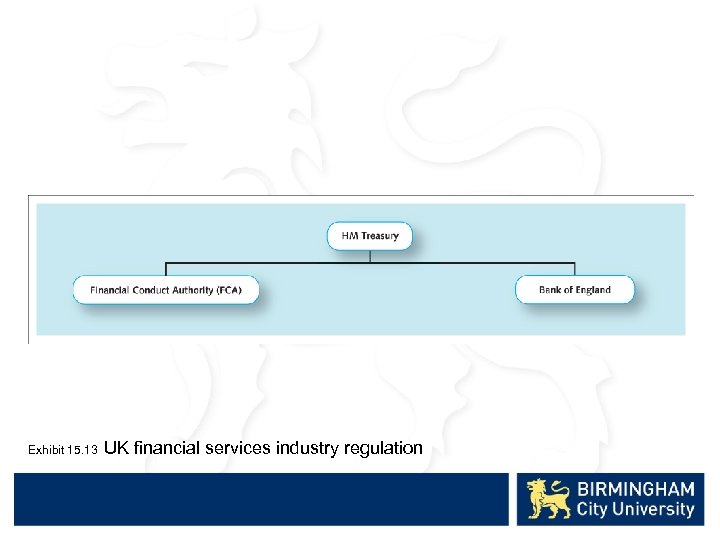

Exhibit 15. 13 UK financial services industry regulation

Exhibit 15. 13 UK financial services industry regulation

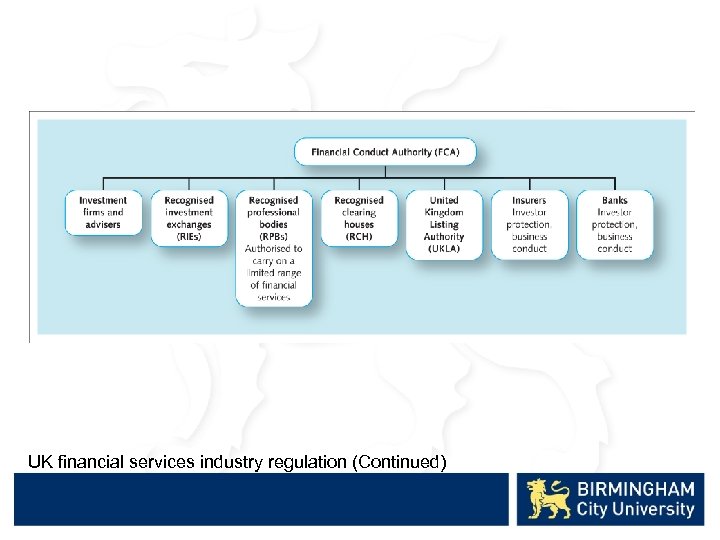

UK financial services industry regulation (Continued)

UK financial services industry regulation (Continued)

UK financial services industry regulation

UK financial services industry regulation

The Financial Conduct Authority retains responsibility for protecting consumers and preserving market integrity, covering • Investor protection, including that for bank customers • Market supervision and regulation • Business conduct of banks and financial services, including supervision of investment managers and other firms whose failure would be non-systemic (they would not cause a contagion) • Civil and criminal enforcement of market abuse rules • UK Listing Authority – supervision of initial public offerings and subsequent monitoring of listed companies.

The Financial Conduct Authority retains responsibility for protecting consumers and preserving market integrity, covering • Investor protection, including that for bank customers • Market supervision and regulation • Business conduct of banks and financial services, including supervision of investment managers and other firms whose failure would be non-systemic (they would not cause a contagion) • Civil and criminal enforcement of market abuse rules • UK Listing Authority – supervision of initial public offerings and subsequent monitoring of listed companies.

FSA/FCA • Semi-detached from government • It is financed by the industries it regulates, but its powers come from legislation • Often consults the financial services companies before deciding on principles, rules and codes of conduct, but it has basic principles approved by the government and it is answerable to the Treasury, which appoints its board, and through them Parliament The FSA/FCA tries to achieve 1. Maintaining confidence in the financial system. 2. Protecting consumers. 3. Reducing financial crime, such as money laundering, fraud and insider dealing. 4. Financial stability – contributing to the protection and enhancement of stability in the UK financial system. 5. Helping people to gain the knowledge, aptitude and skills to manage their financial affairs effectively by promoting public understanding of the financial system.

FSA/FCA • Semi-detached from government • It is financed by the industries it regulates, but its powers come from legislation • Often consults the financial services companies before deciding on principles, rules and codes of conduct, but it has basic principles approved by the government and it is answerable to the Treasury, which appoints its board, and through them Parliament The FSA/FCA tries to achieve 1. Maintaining confidence in the financial system. 2. Protecting consumers. 3. Reducing financial crime, such as money laundering, fraud and insider dealing. 4. Financial stability – contributing to the protection and enhancement of stability in the UK financial system. 5. Helping people to gain the knowledge, aptitude and skills to manage their financial affairs effectively by promoting public understanding of the financial system.

FSA/FCA (Continued) • It is not removing all risk for the investor • Tries to maintain healthy competition • Has powers over unregulated firms and persons regarding breaches of money laundering regulations and short selling • It has the power to prosecute unauthorised firms or persons carrying on regulated activities. • Has a budget of over £ 450 million per year and employs more than 3, 000 well-paid staff.

FSA/FCA (Continued) • It is not removing all risk for the investor • Tries to maintain healthy competition • Has powers over unregulated firms and persons regarding breaches of money laundering regulations and short selling • It has the power to prosecute unauthorised firms or persons carrying on regulated activities. • Has a budget of over £ 450 million per year and employs more than 3, 000 well-paid staff.

Financial Policy Committee • Decisions that apply to the entire sector to ensure system wide financial stability including the avoidance of credit and asset bubbles • Meets only four times a year to set rules • Capital requirements • May impose system-wide higher risk weights against specific classes of bank assets • May insist that banks increase their forward-looking loss provisioning when lending is growing fast • Might set nationwide borrowing limits • Identifying emerging threats to the system from the ‘shadow banking sector’.

Financial Policy Committee • Decisions that apply to the entire sector to ensure system wide financial stability including the avoidance of credit and asset bubbles • Meets only four times a year to set rules • Capital requirements • May impose system-wide higher risk weights against specific classes of bank assets • May insist that banks increase their forward-looking loss provisioning when lending is growing fast • Might set nationwide borrowing limits • Identifying emerging threats to the system from the ‘shadow banking sector’.

Capability and Exclusion • Financial Education in Schools. https: //www. moneyadviceservice. org. uk/ • Inability, reluctance or difficulty of certain groups of consumers to access mainstream financial products & services • A lack of knowledge and understanding of money issues • Common factor for most excluded = living on a low income

Capability and Exclusion • Financial Education in Schools. https: //www. moneyadviceservice. org. uk/ • Inability, reluctance or difficulty of certain groups of consumers to access mainstream financial products & services • A lack of knowledge and understanding of money issues • Common factor for most excluded = living on a low income

Financial Services Compensation Scheme (FSCS) Pays compensation if a firm is unable, or likely to be unable, to pay claims against it. • • • The FSCS protects the following: Banks and Building Societies Credit Unions Insurance Home Finance (including mortgage advice) Investments Pensions Endowments Cash deposits protected to £ 85, 000 person per institution.

Financial Services Compensation Scheme (FSCS) Pays compensation if a firm is unable, or likely to be unable, to pay claims against it. • • • The FSCS protects the following: Banks and Building Societies Credit Unions Insurance Home Finance (including mortgage advice) Investments Pensions Endowments Cash deposits protected to £ 85, 000 person per institution.

Financial Ombudsman Service FOS • Deal with complaints • Free to consumers. • Answer over a million enquiries a year and deal with more than 200, 000 disputes. • We’re completely independent and impartial. • If we decide a business has treated the consumer fairly, We don't write the rules for businesses – or fine them if rules are broken. .

Financial Ombudsman Service FOS • Deal with complaints • Free to consumers. • Answer over a million enquiries a year and deal with more than 200, 000 disputes. • We’re completely independent and impartial. • If we decide a business has treated the consumer fairly, We don't write the rules for businesses – or fine them if rules are broken. .

Bibliography Howells, P. and Bain, K. , (2007) Financial Markets and Institutions. 5 th ed. England: Pearson Howells, P. and Bain, K. , (2005) The Economics of money, banking and Finance: A European text. 3 rd ed. England: Pearson Mishkin, F. S. and Eakins, S. G. , (2009) Financial Markets and Institutions. 6 th ed. Boston: Pearson Arnold, Glen. (2013) Corporate Financial Management. 5 th ed. Pearson Arnold, Glen. (2012) Modern Financial Markets and Institutions. . Pearson Mc. Laney, Eddie. (2012) Business Finance : Theory & Practice, 9 th Edition, Pearson Education Limited http: //www. fca. org. uk/ http: //www. bankofengland. co. uk/pra/pages/default. aspx

Bibliography Howells, P. and Bain, K. , (2007) Financial Markets and Institutions. 5 th ed. England: Pearson Howells, P. and Bain, K. , (2005) The Economics of money, banking and Finance: A European text. 3 rd ed. England: Pearson Mishkin, F. S. and Eakins, S. G. , (2009) Financial Markets and Institutions. 6 th ed. Boston: Pearson Arnold, Glen. (2013) Corporate Financial Management. 5 th ed. Pearson Arnold, Glen. (2012) Modern Financial Markets and Institutions. . Pearson Mc. Laney, Eddie. (2012) Business Finance : Theory & Practice, 9 th Edition, Pearson Education Limited http: //www. fca. org. uk/ http: //www. bankofengland. co. uk/pra/pages/default. aspx