05acd6d64e5670f03a9d3ab1b7faccdc.ppt

- Количество слайдов: 26

ACCOUNT OFFICER’S BASIC TRAINING How to Conduct CI/BI

Credit Investigation/ Background Investigation : An Important Tool in Client Selection

What is CIBI? • CI/BI is a tool used by the bank to gather relevant information to determine whether an applicant will qualify for a loan or not. • The CIBI is a very important step in the lending process as this helps the bank determine high-risk loan applicants or the potentially bad borrowers from getting loans. 3

The Importance of CIBI n A thorough CIBI can prevent loan delinquency problems and ensure profits. 4

A poorly done CIBI …. … “Guesstimates” “Sleeping on the job” can lead to …. . 5 Hiding information

loss of income due to non-collection of loan installments … suspension of loan operations due to slow rotation of loanable funds. 6

…. serious loan delinquency can end up meaning banks must resort to measures like small claims proceedings. 7

So, why should we conduct a CIBI? We should conduct a CIBI because we want to: § § § Verify if information provided by client in the loan application are true Determine character of the applicant, particularly reputation as a borrower Determine the applicant’s capacity to pay 8

The CIBI Steps The following steps are undertaken when doing the CIBI: 1. 2. 3. 4. Loan Application Character/Risk Analysis Cash Flow Preparation/Analysis Prepare/Finalize CIBI Report 9

Conducting the CIBI 1 st Step : Loan application n n The AO interviews the applicant and helps fill out the Loan Application form Based on the loan application, the Account Officer establishes if the applicant meets the bank’s client eligibility criteria 10

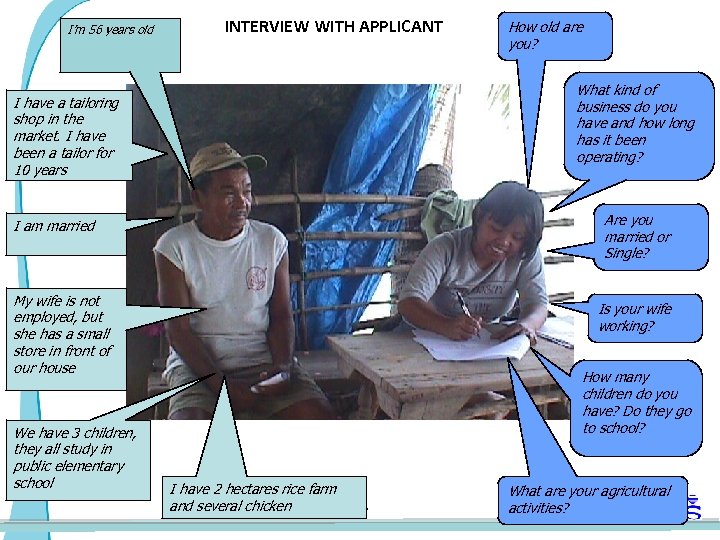

I’m 56 years old INTERVIEW WITH APPLICANT What kind of business do you have and how long has it been operating? I have a tailoring shop in the market. I have been a tailor for 10 years Are you married or Single? I am married My wife is not employed, but she has a small store in front of our house We have 3 children, they all study in public elementary school How old are you? Is your wife working? How many children do you have? Do they go to school? I have 2 hectares rice farm and several chicken 11 What are your agricultural activities?

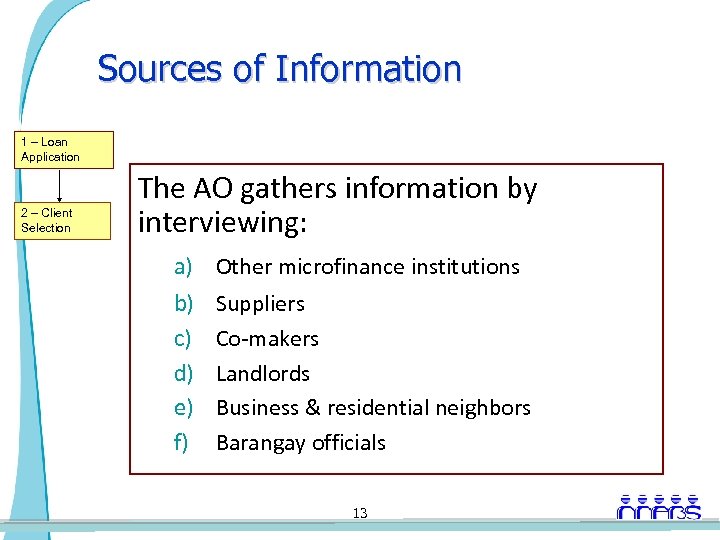

Conducting the CIBI 1 – Loan Application 2 – Client Selection 2 nd Step : Character/Risk Analysis AO gathers information from references to assess character /reputation using the four indicators of: n n Stability Entrepreneurship Reputation Repayment Behavior 12

Sources of Information 1 – Loan Application 2 – Client Selection The AO gathers information by interviewing: a) Other microfinance institutions b) c) d) e) f) Suppliers Co-makers Landlords Business & residential neighbors Barangay officials 13

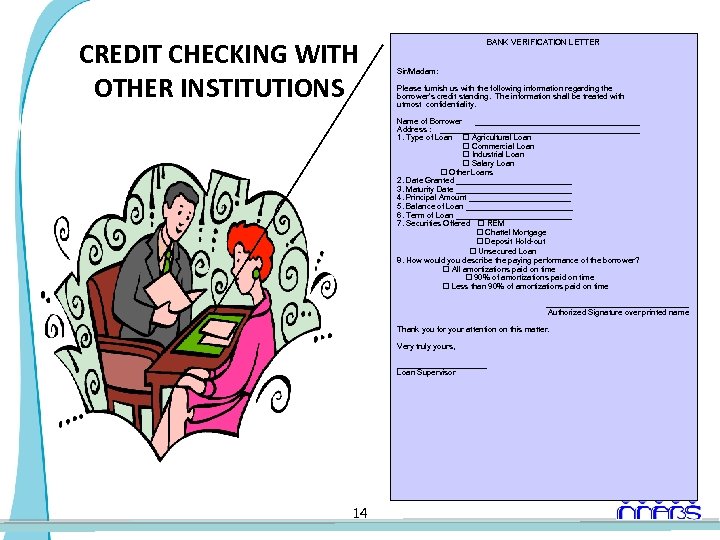

CREDIT CHECKING WITH OTHER INSTITUTIONS BANK VERIFICATION LETTER Sir/Madam: Please furnish us with the following information regarding the borrower’s credit standing. The information shall be treated with utmost confidentiality. Name of Borrower ___________________ Address : _______________________ 1. Type of Loan Agricultural Loan Commercial Loan Industrial Loan Salary Loan Other Loans 2. Date Granted _____________ 3. Maturity Date _____________ 4. Principal Amount ____________ 5. Balance of Loan ____________ 6. Term of Loan _____________ 7. Securities Offered REM Chattel Mortgage Deposit Hold-out Unsecured Loan 8. How would you describe the paying performance of the borrower? All amortizations paid on time 90% of amortizations paid on time Less than 90% of amortizations paid on time ________________ Authorized Signature over printed name Thank you for your attention on this matter. Very truly yours, __________ Loan Supervisor 14

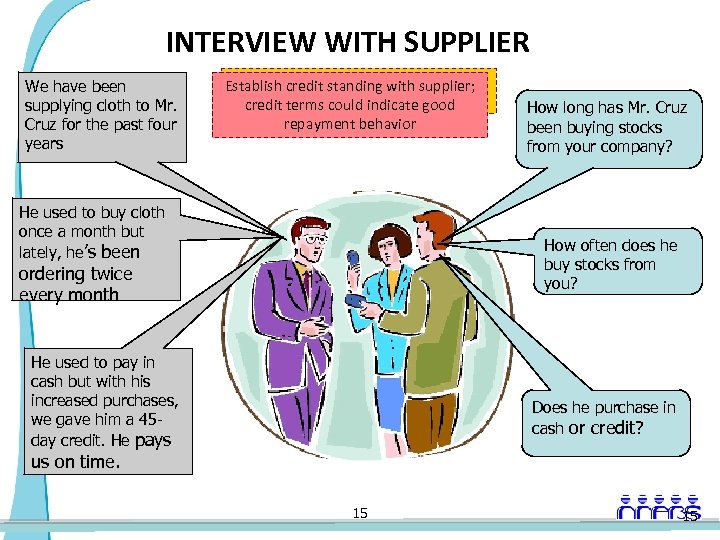

INTERVIEW WITH SUPPLIER We have been supplying cloth to Mr. Cruz for the past four years Establish if the applicant has a business of Establish frequencythe purchase credit standing with supplier; relationship with supplier (input for purchase frequency in the Cash Flow) credit terms could indicate good repayment behavior He used to buy cloth once a month but lately, he’s been How long has Mr. Cruz been buying stocks from your company? How often does he buy stocks from you? ordering twice every month He used to pay in cash but with his increased purchases, we gave him a 45 day credit. He pays Does he purchase in cash or credit? us on time. 15 15

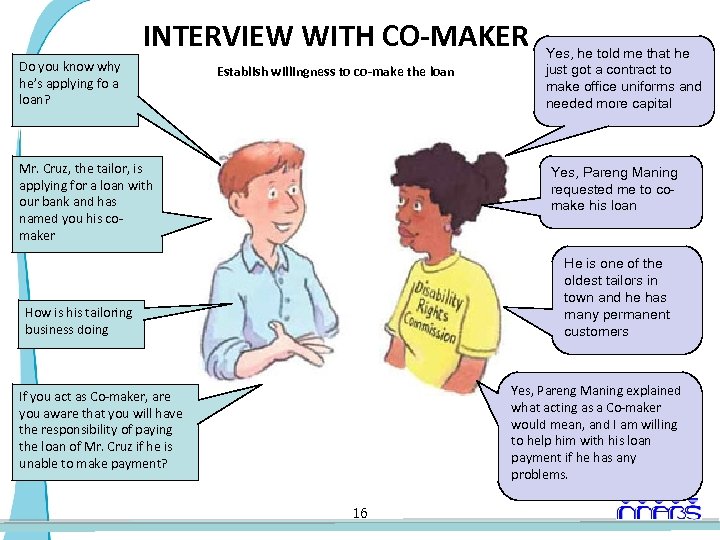

INTERVIEW WITH CO-MAKER Do you know why he’s applying fo a loan? Establish willingness to co-make the loan Mr. Cruz, the tailor, is applying for a loan with our bank and has named you his comaker Yes, he told me that he just got a contract to make office uniforms and needed more capital Yes, Pareng Maning requested me to comake his loan He is one of the oldest tailors in town and he has many permanent customers How is his tailoring business doing Yes, Pareng Maning explained what acting as a Co-maker would mean, and I am willing to help him with his loan payment if he has any problems. If you act as Co-maker, are you aware that you will have the responsibility of paying the loan of Mr. Cruz if he is unable to make payment? 16

INTERVIEW WITH RESIDENTIAL NEIGHBOR Maning is my kumpare - he is I don’t know if Maning has the godfather of my baby… he is a very generous person a loan, but I did notice a collector from an appliance store going to their house every month Maning has been our neighbor for more than 15 years. He and his family are well-liked in the neighborhood. Do you know Manuel Cruz the tailor? Would you know if Mang Maning has any loans? 17

INTERVIEW WITH BARANGAY OFFICIALS Based on our records, no complaint has been filed against Mr. Cruz with respect to collection of debts. 18

Based on the tools and procedures available, the Account Officer should decide during the loan application process – whether to recommend the applicant for a loan or not. NOTE: The CI/BI is discontinued and the loan application rejected, if at any point in the CI/BI process it is validated that the applicant does not meet the minimum loan criteria. 19

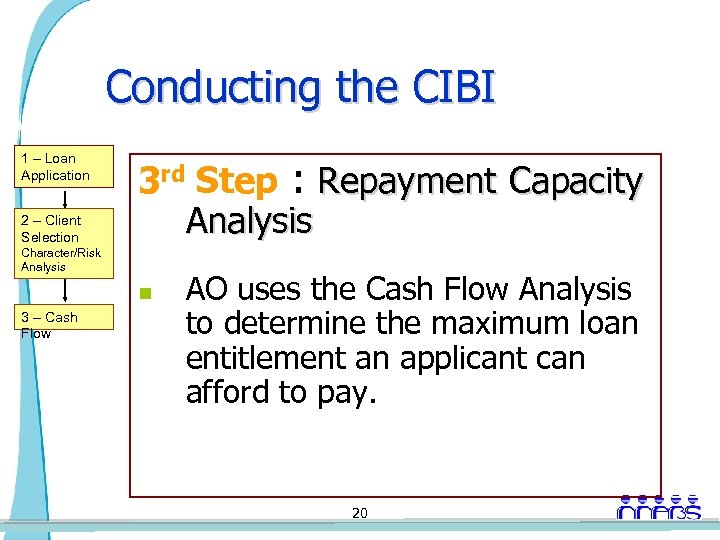

Conducting the CIBI 1 – Loan Application 2 – Client Selection 3 rd Step : Repayment Capacity Analysis Character/Risk Analysis n 3 – Cash Flow AO uses the Cash Flow Analysis to determine the maximum loan entitlement an applicant can afford to pay. 20

Is this the business approaching a lean or peak season? What is the general business condition in the area? Does the applicant have a lot of customers? What do business neighbors say about the applicant’s reputation? 21

CHECK BUSINESS AND HOUSEHOLD BILLS Electric Bill Water Bill Telephone / Cellphone Bill 22

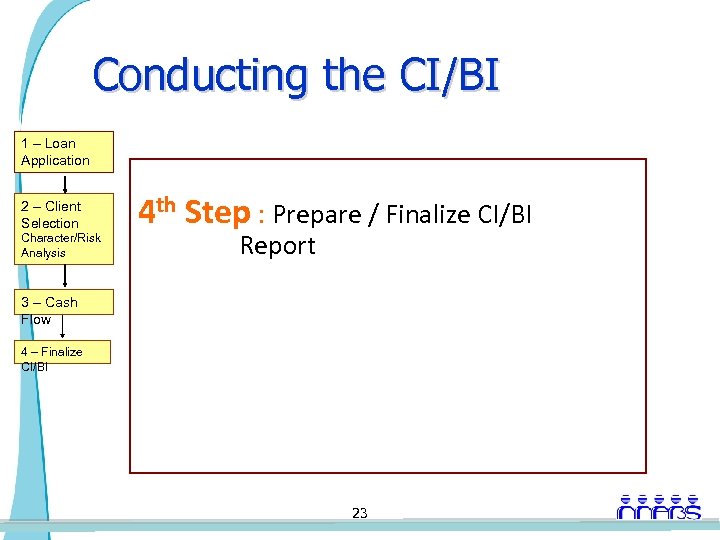

Conducting the CI/BI 1 – Loan Application 2 – Client Selection Character/Risk Analysis 4 th Step : Prepare / Finalize CI/BI Report 3 – Cash Flow 4 – Finalize CI/BI 23

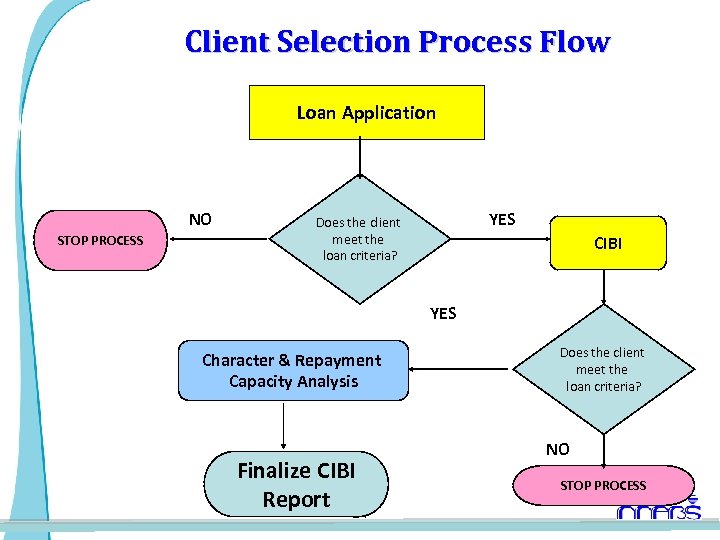

Client Selection Process Flow Loan Application NO STOP PROCESS YES Does the client meet the loan criteria? CIBI YES Character & Repayment Capacity Analysis Finalize CIBI Report 24 Does the client meet the loan criteria? NO STOP PROCESS

TO SUMMARIZE n Character is the primary basis for evaluating loan applications and establishes whether the applicant deserves a loan n Repayment Capacity establishes the maximum loan entitlement an applicant can afford to pay 25

Thank you

05acd6d64e5670f03a9d3ab1b7faccdc.ppt