27e8d658e2362b8d4dc36e116f90b775.ppt

- Количество слайдов: 32

Access to Equity Markets, Corporate Investments and Stock Returns: International Evidence By Sheridan Titman: UT-Austin K. C. John Wei: HKUST Feixue Xie: UT-El Paso 2010 NTU Conference, Taipei December 10, 2010

Access to Equity Markets, Corporate Investments and Stock Returns: International Evidence By Sheridan Titman: UT-Austin K. C. John Wei: HKUST Feixue Xie: UT-El Paso 2010 NTU Conference, Taipei December 10, 2010

Introduction • Capital investment or asset growth anomaly – More investment -> lower subsequent stock returns – Cannot be explained by CAPM or Fama-French factor models • • • Baker, Stein, and Wurgler (2003), Titman, Wei, and Xie (2004), Anderson and Garcia-Feijoo (2006), Fama and French (2008), Cooper, Gulen, and Schill (2008), Polk and Sapienza (2009), etc. – Exception: Japan (Titman, Wei, and Xie (2009)) 3/18/2018 2

Introduction • Capital investment or asset growth anomaly – More investment -> lower subsequent stock returns – Cannot be explained by CAPM or Fama-French factor models • • • Baker, Stein, and Wurgler (2003), Titman, Wei, and Xie (2004), Anderson and Garcia-Feijoo (2006), Fama and French (2008), Cooper, Gulen, and Schill (2008), Polk and Sapienza (2009), etc. – Exception: Japan (Titman, Wei, and Xie (2009)) 3/18/2018 2

Behavioral Explanations: Overinvestment • Titman, Wei, and Xie (2004): Agency-based explanation – Management empire building tendency (expropriation, compensation, ego) – Jensen’s (1986) agency cost of free cash flow: Too much free cash flow too much CAPX overinvest – Market mis-reaction to overinvestment: initially underreacts, subsequently corrects its reaction to negative information on overinvestment, resulting in lower stock returns 3/18/2018 3

Behavioral Explanations: Overinvestment • Titman, Wei, and Xie (2004): Agency-based explanation – Management empire building tendency (expropriation, compensation, ego) – Jensen’s (1986) agency cost of free cash flow: Too much free cash flow too much CAPX overinvest – Market mis-reaction to overinvestment: initially underreacts, subsequently corrects its reaction to negative information on overinvestment, resulting in lower stock returns 3/18/2018 3

Behavioral Explanations • Overconfidence explanation – Heaton (2002): managers overestimate return on investment -> overinvestment – Implication: cultures that promote overconfidence are likely to exhibit a stronger asset growth effect • Corporate governance – Good corporate governance may mitigate overinvestment • Implications: factors that affect corporate overinvestment should also influence the asset growth effect – If firms find it somewhat easier to overinvest in countries with easier access to equity markets, there may be a stronger asset growth effect in countries with better developed capital markets 3/18/2018 4

Behavioral Explanations • Overconfidence explanation – Heaton (2002): managers overestimate return on investment -> overinvestment – Implication: cultures that promote overconfidence are likely to exhibit a stronger asset growth effect • Corporate governance – Good corporate governance may mitigate overinvestment • Implications: factors that affect corporate overinvestment should also influence the asset growth effect – If firms find it somewhat easier to overinvest in countries with easier access to equity markets, there may be a stronger asset growth effect in countries with better developed capital markets 3/18/2018 4

Behavioral Explanations • Equity mispricing-based explanation (The catering theory of investment or the market timing theory) – Stein (1996) and Baker, Stein, and Wurgler (2003) – Firms overvalued or undervalued from time to time and firms tend to invest more when overvalued and less when undervalued. Empirical support: Polk and Sapienza (2009) – mispricing proxy: discretionary accruals (DAC) • negatively associated with future stock returns. – higher DAC firms invest more 3/18/2018 5

Behavioral Explanations • Equity mispricing-based explanation (The catering theory of investment or the market timing theory) – Stein (1996) and Baker, Stein, and Wurgler (2003) – Firms overvalued or undervalued from time to time and firms tend to invest more when overvalued and less when undervalued. Empirical support: Polk and Sapienza (2009) – mispricing proxy: discretionary accruals (DAC) • negatively associated with future stock returns. – higher DAC firms invest more 3/18/2018 5

Rational explanations • The q-theory explanation – Cochrane (1991, 1996), Livdan, Zhang (2009), Liu, Whited, and Zhang (2009), and others – Rrequired rate of returns are time-varying and firms investment more when their required rates of return (expected returns) are lower (assuming that firms invest optimally): ROIC = Co. C – The extended q-theory with investment frictions (Li and Zhang (2010)): the investment effect is stronger when frictions associated with increasing investment are stronger. – Implication: the asset growth effect is expected to be higher in countries with higher investment frictions 3/18/2018 6

Rational explanations • The q-theory explanation – Cochrane (1991, 1996), Livdan, Zhang (2009), Liu, Whited, and Zhang (2009), and others – Rrequired rate of returns are time-varying and firms investment more when their required rates of return (expected returns) are lower (assuming that firms invest optimally): ROIC = Co. C – The extended q-theory with investment frictions (Li and Zhang (2010)): the investment effect is stronger when frictions associated with increasing investment are stronger. – Implication: the asset growth effect is expected to be higher in countries with higher investment frictions 3/18/2018 6

Rational explanations • Option-theory explanation – Berk, Green, and Naik (1999): after growth options are exercised (increased investment), risk is reduced, -> expected returns are lower 3/18/2018 7

Rational explanations • Option-theory explanation – Berk, Green, and Naik (1999): after growth options are exercised (increased investment), risk is reduced, -> expected returns are lower 3/18/2018 7

Main objectives • Overinvestment can be caused by – the agency cost of free cash flow, – managerial overconfidence, or – equity overvaluation • Objectives: 1. To examine the asset growth effect in an international setting 2. To examine the extent to which the cross-country variation in the asset growth effect is generated by cross-country differences in country characteristics such as the development of local equity markets, managerial overconfidence, and legal protection 3/18/2018 8

Main objectives • Overinvestment can be caused by – the agency cost of free cash flow, – managerial overconfidence, or – equity overvaluation • Objectives: 1. To examine the asset growth effect in an international setting 2. To examine the extent to which the cross-country variation in the asset growth effect is generated by cross-country differences in country characteristics such as the development of local equity markets, managerial overconfidence, and legal protection 3/18/2018 8

Main Findings • Using data from over 13, 300 firms across 40 countries during 1981 -2005, there exists the investment effect outside the United States • With a few exceptions, most countries exhibit a negative relation between asset growth and subsequent stock returns • As a whole, the asset growth effect is highly significant among developed countries, but is very weak and insignificant among developing countries • The asset growth effect in developed markets is very persistent and lasts for at least five years after portfolio formation 3/18/2018 9

Main Findings • Using data from over 13, 300 firms across 40 countries during 1981 -2005, there exists the investment effect outside the United States • With a few exceptions, most countries exhibit a negative relation between asset growth and subsequent stock returns • As a whole, the asset growth effect is highly significant among developed countries, but is very weak and insignificant among developing countries • The asset growth effect in developed markets is very persistent and lasts for at least five years after portfolio formation 3/18/2018 9

Main Findings • Among developed countries, the difference in the asset growth effect can be explained by the cross-country difference in the ease of access to equity markets or equity market development – the asset growth effect is 0. 58% per month (or about 7% per year) higher in countries in the top 30% than in the bottom 30% of all developed countries in the access-to-equity market index • The asset growth effect is also stronger in countries with more overconfidence, and strong legal protection • The inclusion of these country variables does not materially affect the significant influence of the access to equity markets on the asset growth effect 3/18/2018 10

Main Findings • Among developed countries, the difference in the asset growth effect can be explained by the cross-country difference in the ease of access to equity markets or equity market development – the asset growth effect is 0. 58% per month (or about 7% per year) higher in countries in the top 30% than in the bottom 30% of all developed countries in the access-to-equity market index • The asset growth effect is also stronger in countries with more overconfidence, and strong legal protection • The inclusion of these country variables does not materially affect the significant influence of the access to equity markets on the asset growth effect 3/18/2018 10

Data: Country-level variables • The ease of access to external markets – the index of access-to-equity market: Global Competitiveness Report from 1999 to 2006 surveyed by World Economic Forum – the ratio of stock market capitalization to gross domestic product (GDP) scaled by the fraction of stock market held by outside investors – Both are used by La Porta, Lopez-de-Silanes, and Shleifer (2006) • Overconfidence – The individualism index: from Hofstede (1980, 2001) – Used by Chui, Titman, and Wei (2010) 3/18/2018 11

Data: Country-level variables • The ease of access to external markets – the index of access-to-equity market: Global Competitiveness Report from 1999 to 2006 surveyed by World Economic Forum – the ratio of stock market capitalization to gross domestic product (GDP) scaled by the fraction of stock market held by outside investors – Both are used by La Porta, Lopez-de-Silanes, and Shleifer (2006) • Overconfidence – The individualism index: from Hofstede (1980, 2001) – Used by Chui, Titman, and Wei (2010) 3/18/2018 11

Data: Country-level variables • Corporate governance (Legal protection of investors) – the anti-self-dealing index – It is from Djankov, La Porta, Lopez-de-Silanes, and Shleifer (2008) • Firm-level data: Financial and market data – The US: CRSP and Compustat – Other countries: Datastream 3/18/2018 12

Data: Country-level variables • Corporate governance (Legal protection of investors) – the anti-self-dealing index – It is from Djankov, La Porta, Lopez-de-Silanes, and Shleifer (2008) • Firm-level data: Financial and market data – The US: CRSP and Compustat – Other countries: Datastream 3/18/2018 12

Measurement of firm-level variables • Total asset growth rate (TAG) – TAGit = (TAit – TAit-1)/TAit-1 • Alternative measures – Capx divided by net fixed assets and its variants • • Firm size (SZ) Book-to-market ratio (BM) Momentum (MOM) Equity issuance (Issue) 3/18/2018 13

Measurement of firm-level variables • Total asset growth rate (TAG) – TAGit = (TAit – TAit-1)/TAit-1 • Alternative measures – Capx divided by net fixed assets and its variants • • Firm size (SZ) Book-to-market ratio (BM) Momentum (MOM) Equity issuance (Issue) 3/18/2018 13

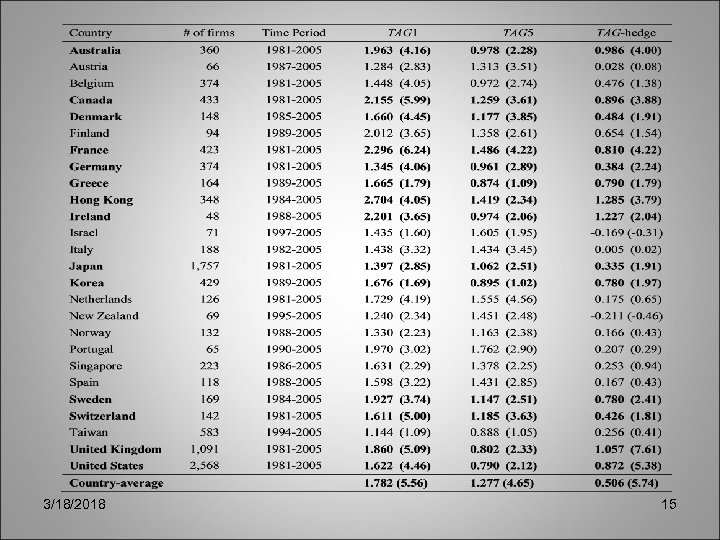

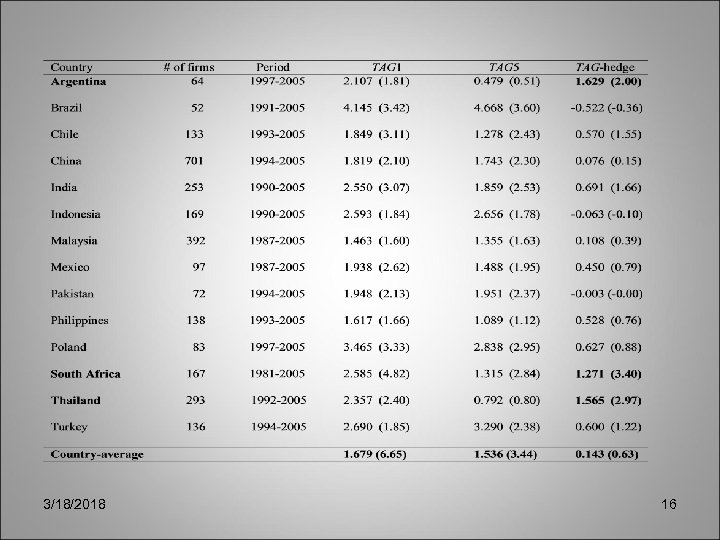

Preliminary Results: Country by country • Stocks are sorted into TAG quintiles for each country • Table 1: The country-by-country asset growth effects – Among developed countries, only 2 countries exhibit a reversed asset growth effect (Israel and New Zealand) and both are insignificant – 14 out of the 26 developed countries have a significant asset growth effect – The asset growth effect is very weak in developing countries – Only 3 out of the 14 developing countries have a significant asset growth effect – a considerable variation in the investment effect across countries – the developed countries as a whole show a strong and significant global investment effect, but not among developing countries 3/18/2018 14

Preliminary Results: Country by country • Stocks are sorted into TAG quintiles for each country • Table 1: The country-by-country asset growth effects – Among developed countries, only 2 countries exhibit a reversed asset growth effect (Israel and New Zealand) and both are insignificant – 14 out of the 26 developed countries have a significant asset growth effect – The asset growth effect is very weak in developing countries – Only 3 out of the 14 developing countries have a significant asset growth effect – a considerable variation in the investment effect across countries – the developed countries as a whole show a strong and significant global investment effect, but not among developing countries 3/18/2018 14

3/18/2018 15

3/18/2018 15

3/18/2018 16

3/18/2018 16

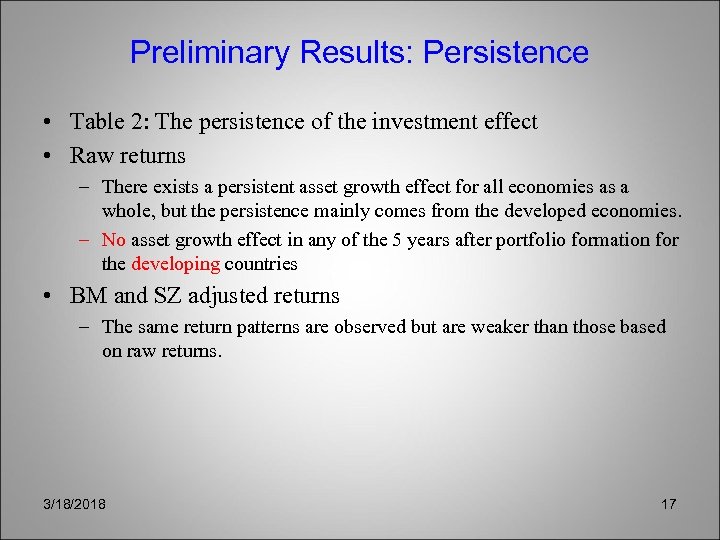

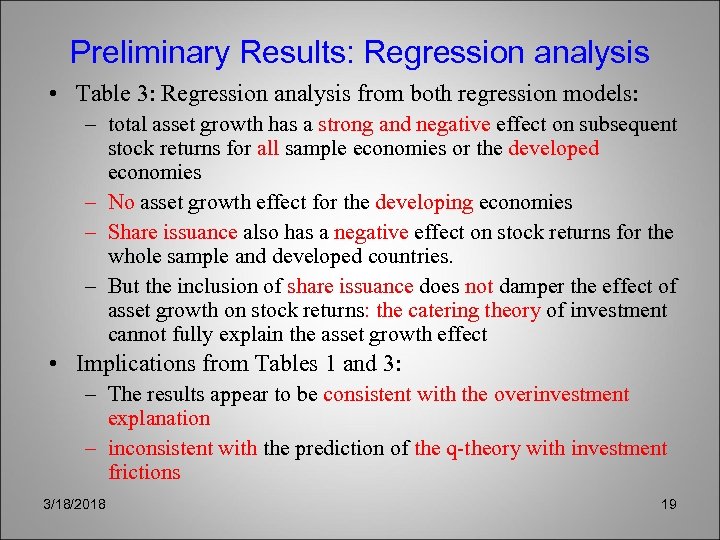

Preliminary Results: Persistence • Table 2: The persistence of the investment effect • Raw returns – There exists a persistent asset growth effect for all economies as a whole, but the persistence mainly comes from the developed economies. – No asset growth effect in any of the 5 years after portfolio formation for the developing countries • BM and SZ adjusted returns – The same return patterns are observed but are weaker than those based on raw returns. 3/18/2018 17

Preliminary Results: Persistence • Table 2: The persistence of the investment effect • Raw returns – There exists a persistent asset growth effect for all economies as a whole, but the persistence mainly comes from the developed economies. – No asset growth effect in any of the 5 years after portfolio formation for the developing countries • BM and SZ adjusted returns – The same return patterns are observed but are weaker than those based on raw returns. 3/18/2018 17

Persistence analysis 3/18/2018 18

Persistence analysis 3/18/2018 18

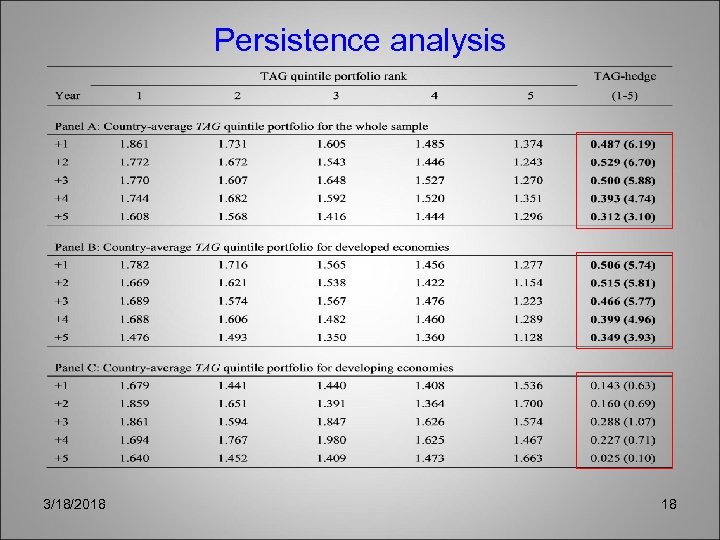

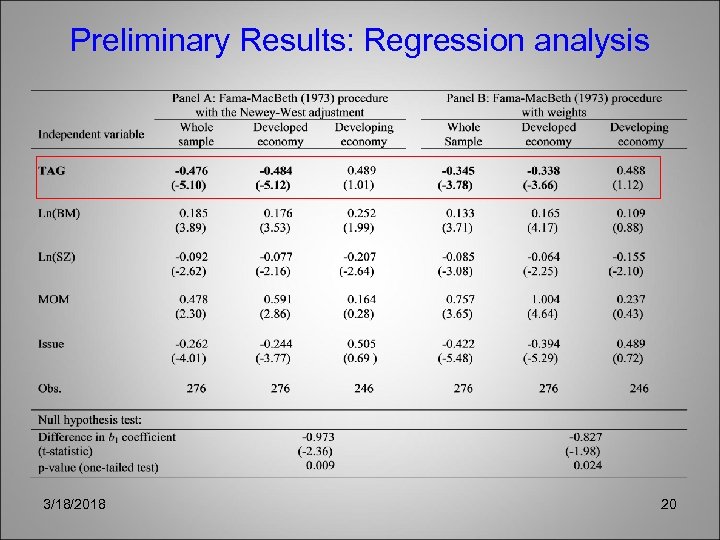

Preliminary Results: Regression analysis • Table 3: Regression analysis from both regression models: – total asset growth has a strong and negative effect on subsequent stock returns for all sample economies or the developed economies – No asset growth effect for the developing economies – Share issuance also has a negative effect on stock returns for the whole sample and developed countries. – But the inclusion of share issuance does not damper the effect of asset growth on stock returns: the catering theory of investment cannot fully explain the asset growth effect • Implications from Tables 1 and 3: – The results appear to be consistent with the overinvestment explanation – inconsistent with the prediction of the q-theory with investment frictions 3/18/2018 19

Preliminary Results: Regression analysis • Table 3: Regression analysis from both regression models: – total asset growth has a strong and negative effect on subsequent stock returns for all sample economies or the developed economies – No asset growth effect for the developing economies – Share issuance also has a negative effect on stock returns for the whole sample and developed countries. – But the inclusion of share issuance does not damper the effect of asset growth on stock returns: the catering theory of investment cannot fully explain the asset growth effect • Implications from Tables 1 and 3: – The results appear to be consistent with the overinvestment explanation – inconsistent with the prediction of the q-theory with investment frictions 3/18/2018 19

Preliminary Results: Regression analysis 3/18/2018 20

Preliminary Results: Regression analysis 3/18/2018 20

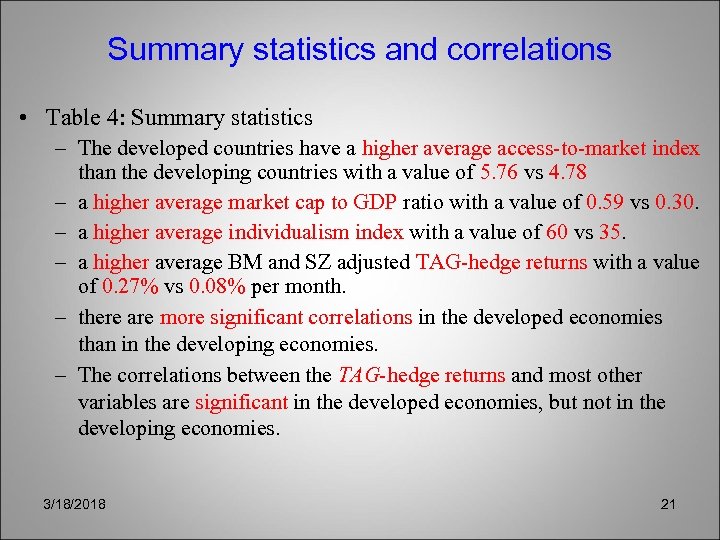

Summary statistics and correlations • Table 4: Summary statistics – The developed countries have a higher average access-to-market index than the developing countries with a value of 5. 76 vs 4. 78 – a higher average market cap to GDP ratio with a value of 0. 59 vs 0. 30. – a higher average individualism index with a value of 60 vs 35. – a higher average BM and SZ adjusted TAG-hedge returns with a value of 0. 27% vs 0. 08% per month. – there are more significant correlations in the developed economies than in the developing economies. – The correlations between the TAG-hedge returns and most other variables are significant in the developed economies, but not in the developing economies. 3/18/2018 21

Summary statistics and correlations • Table 4: Summary statistics – The developed countries have a higher average access-to-market index than the developing countries with a value of 5. 76 vs 4. 78 – a higher average market cap to GDP ratio with a value of 0. 59 vs 0. 30. – a higher average individualism index with a value of 60 vs 35. – a higher average BM and SZ adjusted TAG-hedge returns with a value of 0. 27% vs 0. 08% per month. – there are more significant correlations in the developed economies than in the developing economies. – The correlations between the TAG-hedge returns and most other variables are significant in the developed economies, but not in the developing economies. 3/18/2018 21

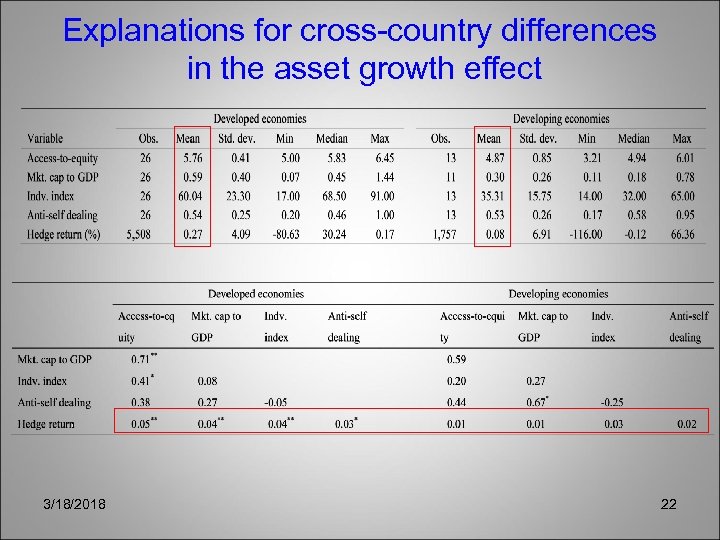

Explanations for cross-country differences in the asset growth effect 3/18/2018 22

Explanations for cross-country differences in the asset growth effect 3/18/2018 22

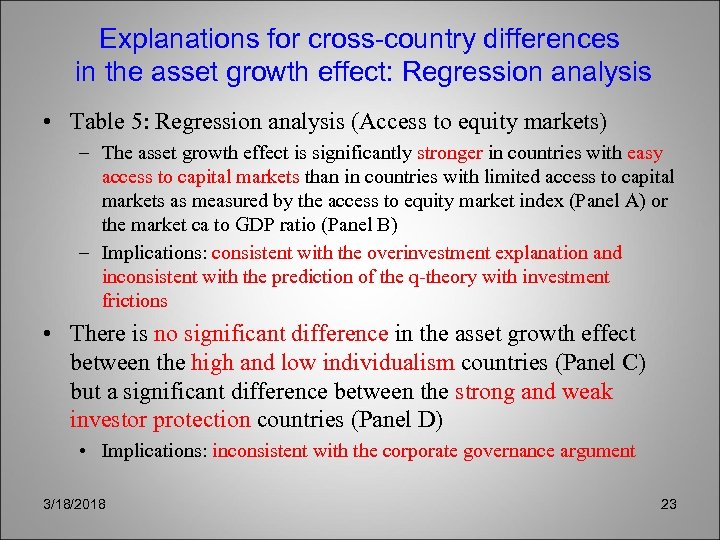

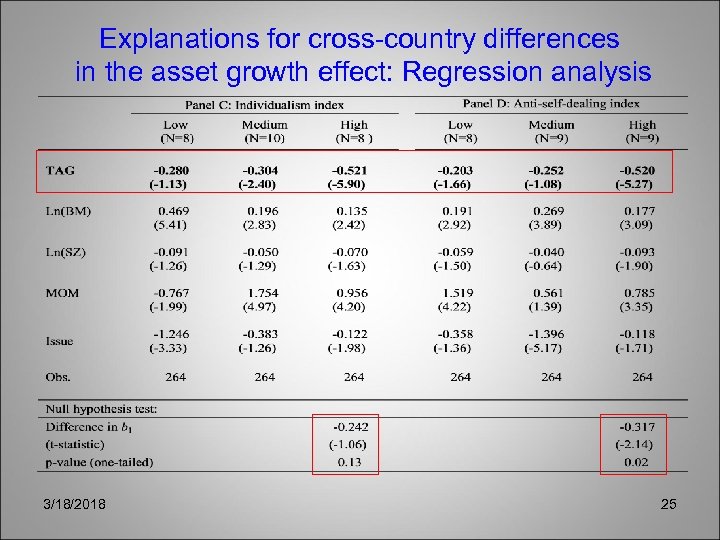

Explanations for cross-country differences in the asset growth effect: Regression analysis • Table 5: Regression analysis (Access to equity markets) – The asset growth effect is significantly stronger in countries with easy access to capital markets than in countries with limited access to capital markets as measured by the access to equity market index (Panel A) or the market ca to GDP ratio (Panel B) – Implications: consistent with the overinvestment explanation and inconsistent with the prediction of the q-theory with investment frictions • There is no significant difference in the asset growth effect between the high and low individualism countries (Panel C) but a significant difference between the strong and weak investor protection countries (Panel D) • Implications: inconsistent with the corporate governance argument 3/18/2018 23

Explanations for cross-country differences in the asset growth effect: Regression analysis • Table 5: Regression analysis (Access to equity markets) – The asset growth effect is significantly stronger in countries with easy access to capital markets than in countries with limited access to capital markets as measured by the access to equity market index (Panel A) or the market ca to GDP ratio (Panel B) – Implications: consistent with the overinvestment explanation and inconsistent with the prediction of the q-theory with investment frictions • There is no significant difference in the asset growth effect between the high and low individualism countries (Panel C) but a significant difference between the strong and weak investor protection countries (Panel D) • Implications: inconsistent with the corporate governance argument 3/18/2018 23

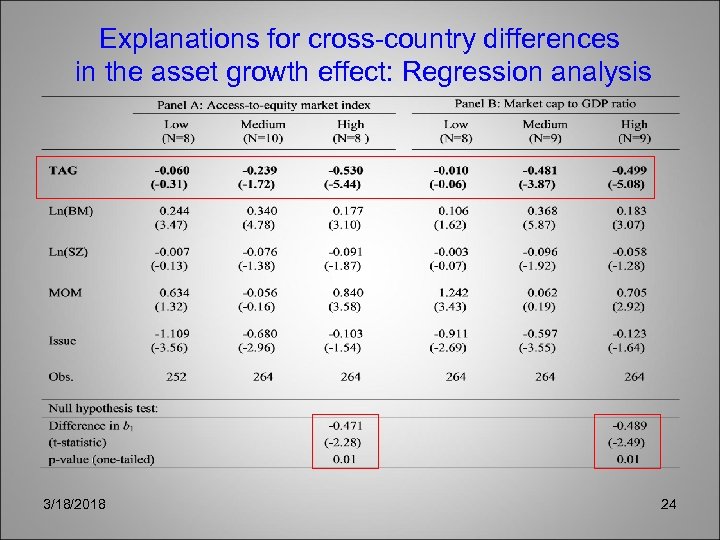

Explanations for cross-country differences in the asset growth effect: Regression analysis 3/18/2018 24

Explanations for cross-country differences in the asset growth effect: Regression analysis 3/18/2018 24

Explanations for cross-country differences in the asset growth effect: Regression analysis 3/18/2018 25

Explanations for cross-country differences in the asset growth effect: Regression analysis 3/18/2018 25

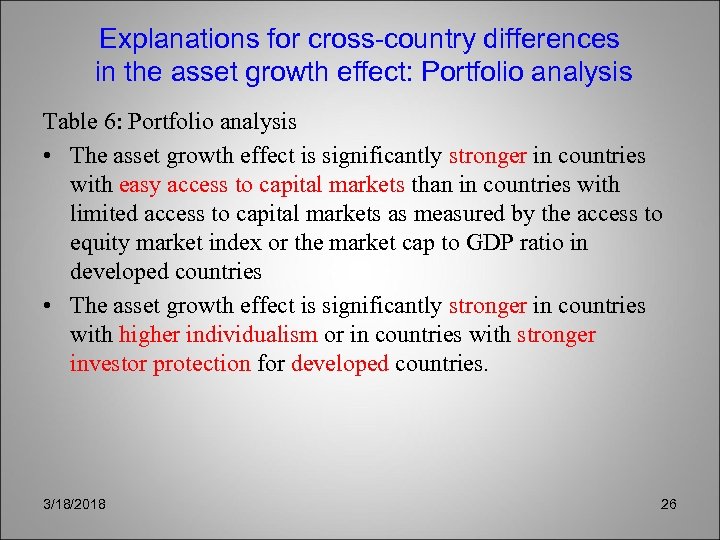

Explanations for cross-country differences in the asset growth effect: Portfolio analysis Table 6: Portfolio analysis • The asset growth effect is significantly stronger in countries with easy access to capital markets than in countries with limited access to capital markets as measured by the access to equity market index or the market cap to GDP ratio in developed countries • The asset growth effect is significantly stronger in countries with higher individualism or in countries with stronger investor protection for developed countries. 3/18/2018 26

Explanations for cross-country differences in the asset growth effect: Portfolio analysis Table 6: Portfolio analysis • The asset growth effect is significantly stronger in countries with easy access to capital markets than in countries with limited access to capital markets as measured by the access to equity market index or the market cap to GDP ratio in developed countries • The asset growth effect is significantly stronger in countries with higher individualism or in countries with stronger investor protection for developed countries. 3/18/2018 26

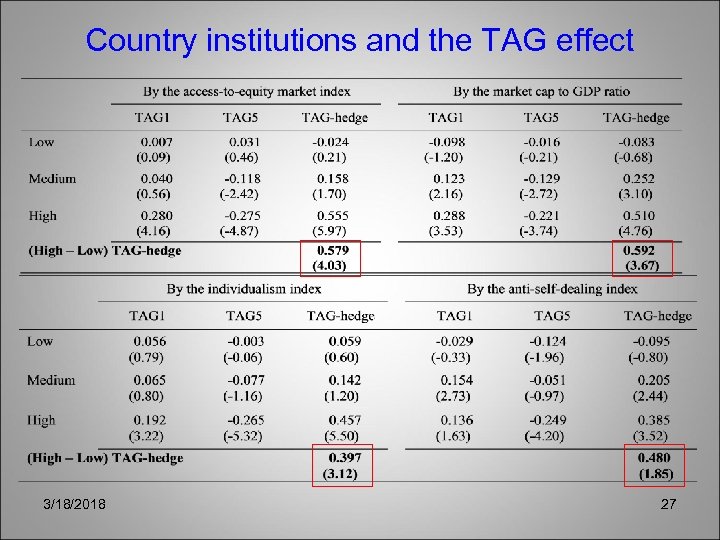

Country institutions and the TAG effect 3/18/2018 27

Country institutions and the TAG effect 3/18/2018 27

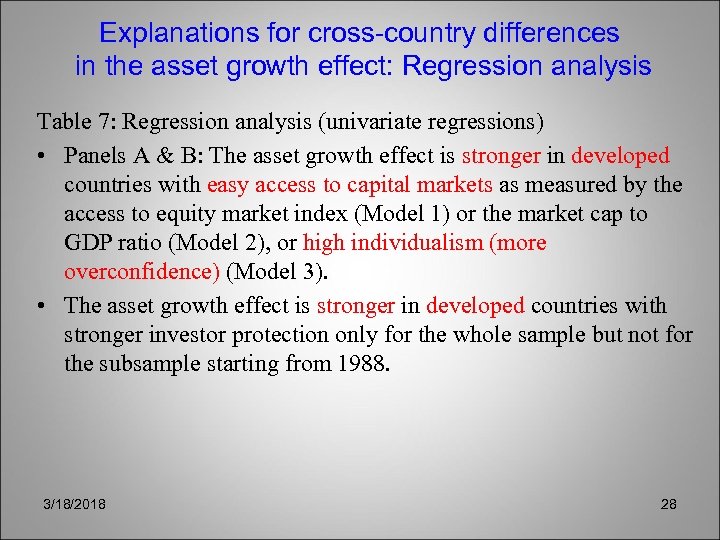

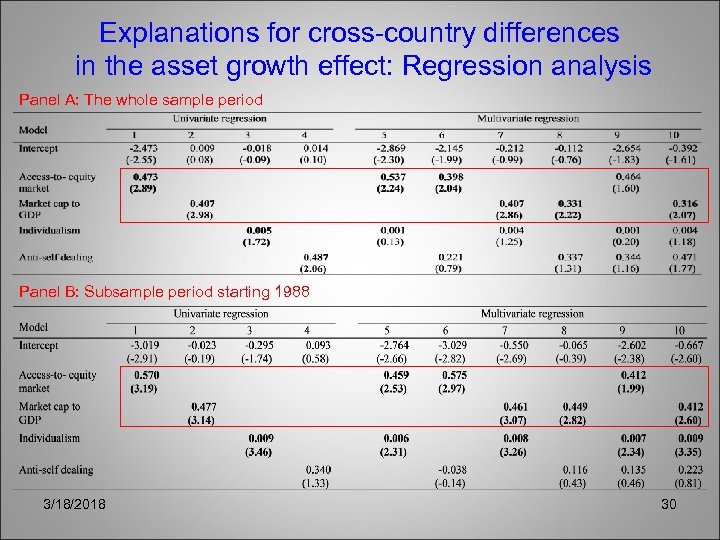

Explanations for cross-country differences in the asset growth effect: Regression analysis Table 7: Regression analysis (univariate regressions) • Panels A & B: The asset growth effect is stronger in developed countries with easy access to capital markets as measured by the access to equity market index (Model 1) or the market cap to GDP ratio (Model 2), or high individualism (more overconfidence) (Model 3). • The asset growth effect is stronger in developed countries with stronger investor protection only for the whole sample but not for the subsample starting from 1988. 3/18/2018 28

Explanations for cross-country differences in the asset growth effect: Regression analysis Table 7: Regression analysis (univariate regressions) • Panels A & B: The asset growth effect is stronger in developed countries with easy access to capital markets as measured by the access to equity market index (Model 1) or the market cap to GDP ratio (Model 2), or high individualism (more overconfidence) (Model 3). • The asset growth effect is stronger in developed countries with stronger investor protection only for the whole sample but not for the subsample starting from 1988. 3/18/2018 28

Explanations for cross-country differences in the asset growth effect: Regression analysis Table 7: Regression analysis (multivariate regressions) • The inclusion of individualism, and legal protection does not damper the influence of access to capital markets on the asset growth effect in developed markets • In addition, individualism is also significant • Implications from Tables 6 and 7: confirm the previous results. – Consistent with the overinvestment explanation and inconsistent with the prediction of the q-theory with investment frictions 3/18/2018 29

Explanations for cross-country differences in the asset growth effect: Regression analysis Table 7: Regression analysis (multivariate regressions) • The inclusion of individualism, and legal protection does not damper the influence of access to capital markets on the asset growth effect in developed markets • In addition, individualism is also significant • Implications from Tables 6 and 7: confirm the previous results. – Consistent with the overinvestment explanation and inconsistent with the prediction of the q-theory with investment frictions 3/18/2018 29

Explanations for cross-country differences in the asset growth effect: Regression analysis Panel A: The whole sample period Panel B: Subsample period starting 1988 3/18/2018 30

Explanations for cross-country differences in the asset growth effect: Regression analysis Panel A: The whole sample period Panel B: Subsample period starting 1988 3/18/2018 30

Conclusion • There is the asset growth effect outside the United States. • We find a strong asset growth effect among developed economies but not among developing economies. • Developed countries with easy access to equity markets and more overconfidence cultures show a stronger asset growth effect, possibly through a propensity-to-overinvest channel. • But the inclusion of these country institutional variables does not damper the effect of the ease of access to equity markets. • Our results appear to be generally consistent with an overinvestment explanation by Titman, Wei, and Xie (2004) and to be inconsistent with the prediction by the q-theory with investment frictions suggested by Li and Zhang (2010). 3/18/2018 31

Conclusion • There is the asset growth effect outside the United States. • We find a strong asset growth effect among developed economies but not among developing economies. • Developed countries with easy access to equity markets and more overconfidence cultures show a stronger asset growth effect, possibly through a propensity-to-overinvest channel. • But the inclusion of these country institutional variables does not damper the effect of the ease of access to equity markets. • Our results appear to be generally consistent with an overinvestment explanation by Titman, Wei, and Xie (2004) and to be inconsistent with the prediction by the q-theory with investment frictions suggested by Li and Zhang (2010). 3/18/2018 31

Conclusion • In sum, we provide evidence that cross-country differences in access to equity markets and cultures can affect cross-country differences in the asset growth effect. • Our results provide a challenge to market efficient hypothesis and behavioral as well as the traditional risk-based theories. – Risk-based: Why asset growth portfolios are risky in developed countries but not in developing markets? – Behavior based: why managers have a tendency to overinvest and at the same time investors tend to underreact to the negative information contained in overinvestment in developed markets, but it is in developing markets? 3/18/2018 32

Conclusion • In sum, we provide evidence that cross-country differences in access to equity markets and cultures can affect cross-country differences in the asset growth effect. • Our results provide a challenge to market efficient hypothesis and behavioral as well as the traditional risk-based theories. – Risk-based: Why asset growth portfolios are risky in developed countries but not in developing markets? – Behavior based: why managers have a tendency to overinvest and at the same time investors tend to underreact to the negative information contained in overinvestment in developed markets, but it is in developing markets? 3/18/2018 32